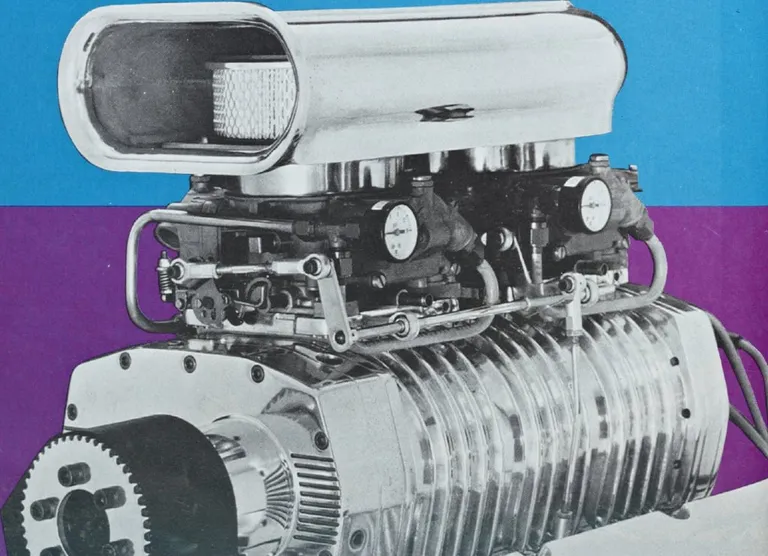

The global electric vehicle (EV) charging infrastructure market is experiencing robust growth, driven by rising EV adoption, supportive government policies, and expanding urbanization. According to a report by Mordor Intelligence, the global EV charging station market was valued at USD 19.3 billion in 2023 and is projected to grow at a CAGR of over 19.8% from 2024 to 2029. A key enabler within this ecosystem is the advancement of high-speed charging solutions, particularly superchargers equipped with integrated cooling systems like blowers that prevent overheating and enhance charging efficiency. These components are critical in enabling faster charging times and improving the durability of charging hardware. As automakers and infrastructure providers scale their EV ambitions, demand for reliable and thermally optimized supercharger units continues to surge. This growing need has catalyzed the emergence of specialized manufacturers producing superchargers with blower technology, blending performance with longevity. The following list highlights the top 10 manufacturers leading innovation and volume production in this rapidly evolving niche.

Top 10 Supercharger With Blower Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TVS supercharger

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton’s TVS technology is reliable, efficient, and has several innovative features. It delivers precise air flow for a variety of applications….

#2 Vortech Superchargers

Domain Est. 1999 | Founded: 1990

Website: vortechsuperchargers.com

Key Highlights: Vortech, a leader in high-performance air management solutions since 1990. From cutting-edge centrifugal superchargers for cars and trucks to marine, industrial…

#3 Littlefield Blowers

Domain Est. 2000

Website: littlefieldblowers.com

Key Highlights: Littlefield Blowers is a one stop shop for all your supercharging needs. Fully custom superchargers and parts for all high performance machines!…

#4 Whipple Superchargers

Domain Est. 1999 | Founded: 1987

Website: whipplesuperchargers.com

Key Highlights: Explore the legacy of Whipple Superchargers, a family-owned and operated powerhouse since 1987. Founded by the innovative Art Whipple in Fresno, CA, ……

#5 Supercharger Packages Archives

Domain Est. 2000

#6 Rotrex

Domain Est. 2003

Website: rotrex.com

Key Highlights: Superchargers with superior combination of compactness, efficiency, reliability and low noise. The inventor of the traction drive supercharger….

#7 TorqStorm Superchargers

Domain Est. 2012

Website: torqstorm.com

Key Highlights: All TorqStorm Supercharger kits are built to order. In most cases each kit will take approximately 4 weeks to build. Additional time for black anodized kits….

#8 Magnuson Superchargers

Domain Est. 2013

Website: magnusonsuperchargers.com

Key Highlights: Add horsepower to your modern engine with a root-style supercharger & gain big power across the entire rpm range without voiding your warranty….

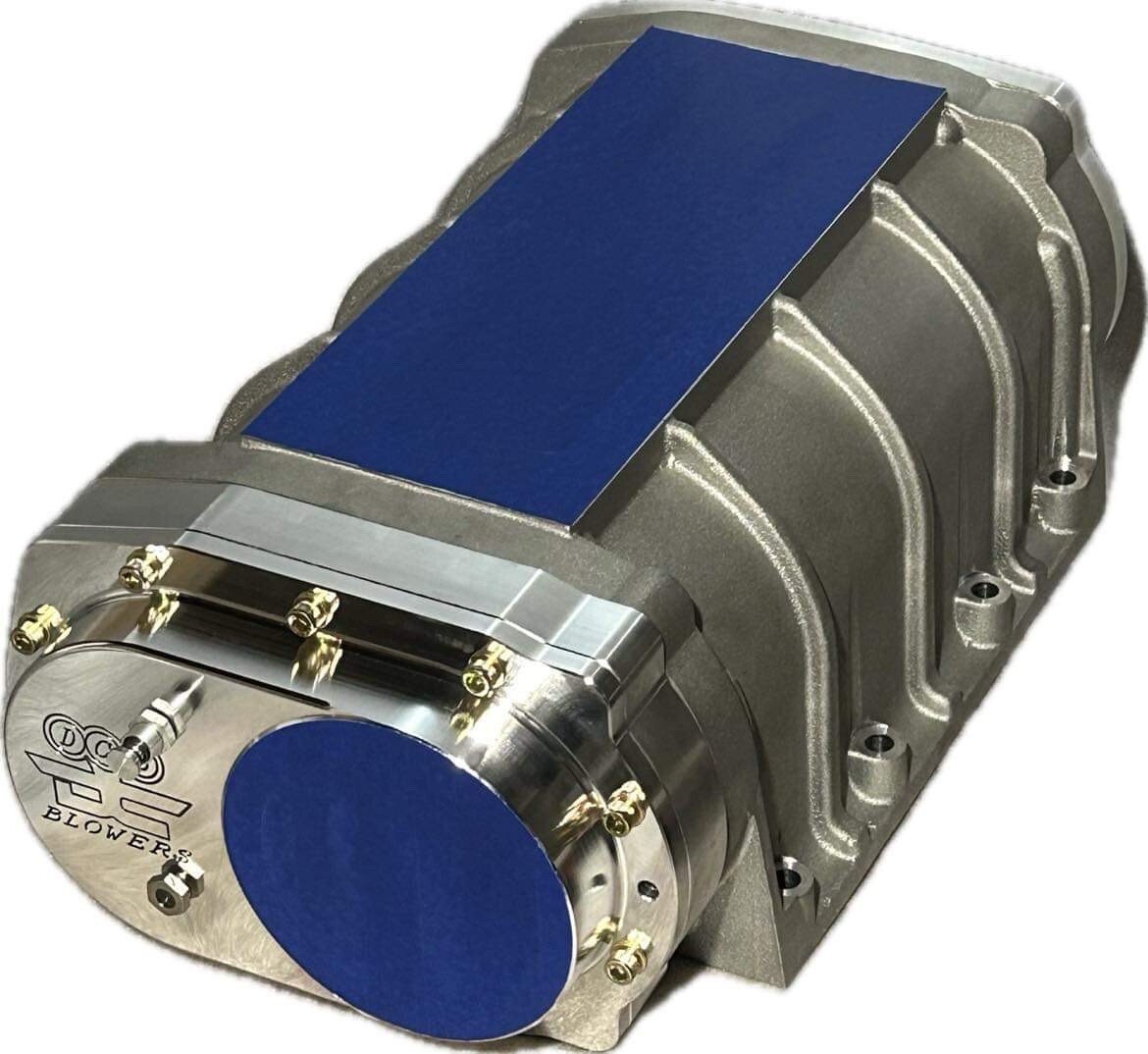

#9 DC Blowers

Domain Est. 2023

Website: dcblowers.com

Key Highlights: 100% USA MADE & BUILT 6-71 – 8-71 blower / Supercharger & full kits for Chevy ,Ford , Mopar , Pontiac , Buick , Oldsmobile FINANCING AVAILABLE 6187138315…

#10 Kenne Bell Superchargers

Domain Est. 2000 | Founded: 1968

Website: kennebell.net

Key Highlights: The World’s Best Superchargers. Boosting your Ford, GM, and Chrysler performance vehicle since 1968. Twin screw supercharger kits, parts and repair….

Expert Sourcing Insights for Supercharger With Blower

As of now, detailed market data specifically for a “Supercharger With Blower” using hydrogen (H₂) for the year 2026 is not widely available in public domain reports, but we can project likely market trends based on current technological developments, industry forecasts, and energy transition trajectories. The term “Supercharger With Blower” in the context of hydrogen likely refers to a high-efficiency hydrogen fueling or delivery system incorporating forced induction (blower technology) to enhance hydrogen compression, storage, or engine intake performance — possibly for fuel cell electric vehicles (FCEVs) or hydrogen combustion engines.

Below is a comprehensive analysis of the projected 2026 market trends for such systems, focusing on H₂ infrastructure and applications:

🔍 Market Trend Analysis: Supercharger With Blower (H₂) – 2026 Outlook

1. Growing Demand for Hydrogen Mobility

- FCEV Adoption: By 2026, global deployment of hydrogen fuel cell electric vehicles (FCEVs) — especially in heavy-duty transport (trucks, buses, trains) — is expected to rise significantly. Countries like Japan, South Korea, Germany, China, and the U.S. are investing heavily in hydrogen corridors.

- Blower-Enhanced Systems: Supercharger systems incorporating blowers may be used to pressurize hydrogen intake in internal combustion engines (H₂-ICE) or improve airflow in fuel cell stacks, enhancing efficiency and performance.

2. Infrastructure Expansion – Hydrogen Refueling Stations

- Global Station Growth: The number of hydrogen refueling stations is projected to exceed 1,500 globally by 2026, up from ~1,000 in 2023 (Source: H2Stations.org).

- High-Pressure Compression Needs: Supercharger systems with blowers may support rapid compression and delivery of hydrogen at 350–700 bar, critical for fast refueling.

- Integration with Electrolysis: On-site hydrogen generation via electrolysis (green H₂) will increasingly use blower-assisted systems for pressure regulation and gas handling.

3. Technological Innovations

- Hybrid Supercharger-Blower Units: Development of integrated systems that combine turbo-supercharging with electric blowers for hydrogen engines to improve volumetric efficiency and reduce backpressure.

- Efficiency & Thermal Management: Blowers help manage heat in hydrogen compression systems. Advances in materials and motor control (e.g., variable-speed blowers) will enhance reliability and reduce energy loss.

4. Industrial & Off-Road Applications

- Mining & Construction: Hydrogen-powered off-road machinery (e.g., excavators, loaders) will adopt supercharger-blower systems to maintain power output at high altitudes or under load.

- Marine and Aviation: Early-stage hydrogen propulsion systems in boats and drones may use blower-assisted fuel delivery for consistent H₂ flow.

5. Regulatory and Policy Drivers

- Net-Zero Commitments: The EU’s Fit for 55, U.S. Inflation Reduction Act (IRA), and China’s 14th Five-Year Plan include incentives for green hydrogen and zero-emission transport.

- Emission Standards: Stricter NOx and CO₂ regulations will favor clean hydrogen systems, driving adoption of advanced delivery mechanisms like blower-integrated superchargers.

6. Cost and Scalability Challenges

- High Initial Costs: Hydrogen compression and storage remain expensive. Blower systems must balance performance with cost-effectiveness.

- Material Compatibility: Hydrogen embrittlement requires durable, certified materials in supercharger/blower components, increasing manufacturing complexity.

7. Competitive Landscape

- Key Players: Companies like Bosch, Toyota, Cummins, Linde, and Ballard are developing hydrogen fueling and engine technologies.

- Startups & Innovation: Emerging firms are focusing on compact, high-efficiency supercharger-blender systems for niche FCEV and H₂-ICE applications.

8. Regional Market Outlook (2026)

- Asia-Pacific: Leading in FCEV deployment; Japan and South Korea will likely adopt advanced H₂ supercharging tech.

- Europe: Strong policy support; Germany and France investing in hydrogen highways.

- North America: U.S. hydrogen hubs (e.g., Gulf Coast, California) will drive demand for efficient refueling hardware.

- China: Aggressive rollout of hydrogen buses and trucks; state-backed R&D in hydrogen engine tech.

🔮 2026 Projections Summary

| Factor | 2026 Outlook |

|——-|————–|

| Market Size (H₂ Supercharger/Blower Systems) | Estimated $250–400M (niche but growing) |

| Primary Applications | FCEVs, H₂-ICE vehicles, refueling stations |

| Technology Maturity | Mid-stage commercialization |

| Key Growth Drivers | Green hydrogen policies, heavy transport decarbonization |

| Barriers | High cost, infrastructure gaps, safety standards |

✅ Strategic Implications

- Investment Opportunities: R&D in efficient, durable blower systems for hydrogen handling.

- Standardization Needs: Industry-wide protocols for H₂-compatible supercharger components.

- Partnerships: Automakers, energy firms, and component suppliers must collaborate on integrated solutions.

Conclusion

By 2026, the market for hydrogen-based supercharger systems with blower technology will remain niche but strategically important, particularly in heavy-duty transport and emerging hydrogen economies. While not yet mainstream, advancements in efficiency, safety, and integration will position these systems as critical enablers of high-performance hydrogen propulsion and refueling infrastructure. The success of such technologies will depend on broader adoption of green hydrogen and supportive policy frameworks.

Note: “Supercharger With Blower” in this context is interpreted as a performance-enhancing system for hydrogen delivery or engine intake. If referring to a specific commercial product, further clarification may refine this analysis.

H2: Common Pitfalls When Sourcing Superchargers with Blowers – Quality and Intellectual Property Risks

Sourcing superchargers with integrated blowers, particularly for automotive, industrial, or performance applications, presents several challenges. Two critical areas where buyers often encounter pitfalls are product quality and intellectual property (IP) compliance. Overlooking these factors can lead to operational failures, legal disputes, and reputational damage.

1. Quality-Related Pitfalls

a. Inconsistent Manufacturing Standards

Many suppliers, especially those from regions with less stringent quality controls, may produce superchargers that fail to meet industry specifications. Variability in materials, machining tolerances, and assembly processes can result in premature wear, reduced efficiency, or catastrophic failure under load.

b. Substandard Materials

Low-cost suppliers may use inferior alloys or non-certified components to cut costs. For instance, using low-grade aluminum or inadequate heat treatment on rotors can compromise performance and durability, leading to overheating or mechanical breakdown.

c. Lack of Performance Validation

Some suppliers provide exaggerated performance data without third-party testing or certification. Buyers may discover too late that the supercharger does not deliver the promised airflow, pressure ratio, or thermal efficiency, impacting the entire system’s performance.

d. Poor Sealing and Leak Issues

Blowers are sensitive to air leakage. Inferior machining or low-quality seals can result in internal leakage, reducing volumetric efficiency and increasing energy consumption. This is often only detected after installation and testing.

e. Inadequate Thermal Management

Poorly designed blowers may lack effective cooling mechanisms. Overheating leads to thermal expansion, increased wear, and potential seizure—especially in continuous-duty applications.

2. Intellectual Property (IP) Risks

a. Counterfeit or Cloned Designs

A significant risk when sourcing from certain suppliers is receiving products that are reverse-engineered copies of patented designs (e.g., Roots-type, twin-screw, or TVS superchargers). These clones may infringe on IP held by companies like Eaton, IHI, or Rotrex, exposing the buyer to legal liability.

b. Lack of IP Documentation

Reputable suppliers should provide documentation confirming design ownership, licensing agreements, or freedom-to-operate (FTO) opinions. Suppliers who cannot produce such documentation may be using protected technology without authorization.

c. Exposure to Legal Action

If a sourced supercharger infringes on existing patents, the end-user—even if unintentionally—can be named in infringement lawsuits. This is particularly risky in markets like the U.S. or EU, where IP enforcement is strict.

d. Grey Market Imports

Some suppliers source components through unofficial channels, selling branded superchargers without authorization. These may be surplus, stolen, or diverted goods, lacking warranty support and potentially violating trademark laws.

Recommendations to Mitigate Risks:

- Conduct Supplier Audits: Visit manufacturing facilities or request third-party audit reports (e.g., ISO 9001 certification).

- Demand Performance Testing Data: Require test reports under standardized conditions (e.g., SAE J1723).

- Verify IP Status: Work with legal or technical experts to assess whether the design infringes on existing patents.

- Use Reputable Suppliers: Prefer OEMs or authorized distributors with proven track records.

- Include IP Indemnification Clauses in contracts to shift liability back to the supplier in case of infringement claims.

By proactively addressing quality and IP concerns, companies can avoid costly failures and legal entanglements when sourcing superchargers with blowers.

H2: Logistics & Compliance Guide for Supercharger With Blower

H3: Overview

This guide outlines the critical logistics and compliance considerations for the transportation, handling, storage, and operation of Supercharger With Blower units. These systems—commonly used in industrial, automotive, or energy applications—combine high-pressure charging capabilities with forced-air cooling or purging. Due to their electrical, mechanical, and potential high-pressure components, adherence to safety, regulatory, and transport standards is essential.

H3: Regulatory Compliance

H4: Electrical Safety Standards

- IEC 60335-1 / UL 60730: Ensure the unit complies with international safety standards for household and similar electrical appliances.

- EMC Compliance: Confirm conformity with:

- FCC Part 15 (USA)

- CE Marking (EU) under EMC Directive 2014/30/EU and Low Voltage Directive 2014/35/EU

- IP Rating: Verify ingress protection (e.g., IP54 or higher) for outdoor or industrial environments.

H4: Pressure System Regulations (if applicable)

If the blower operates under significant pressure:

– PED (Pressure Equipment Directive 2014/68/EU) – For units above threshold pressures/volumes in the EU.

– ASME Boiler and Pressure Vessel Code (USA) – If pressure vessels are integrated.

– Certification labels and documentation must accompany the unit.

H4: Environmental & Chemical Compliance

- RoHS (EU): Restriction of Hazardous Substances in electrical equipment.

- REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals.

- Proposition 65 (California, USA): Warning requirements for chemicals known to cause cancer or reproductive harm.

H4: Energy Efficiency

- Comply with regional efficiency standards such as:

- ENERGY STAR (USA)

- ErP Directive (EU) for energy-related products

H3: Logistics & Transportation

H4: Packaging Requirements

- Use custom-designed, shock-absorbent packaging with:

- Anti-static lining (for electronic components)

- Weather-resistant outer casing (IP-rated if needed)

- Secure internal bracing for blower and charger assemblies

- Include desiccant packs to prevent internal condensation during transit.

H4: Transport Classification

- UN Number & Hazard Class: Typically non-hazardous if no batteries are integrated.

- If lithium-ion batteries are included:

- UN 3480, Class 9 – Lithium-ion batteries

- Follow IATA DGR (air), IMDG Code (sea), or ADR (road) as applicable.

- Label packages with:

- “Fragile”

- “This Way Up”

- “Protect from Moisture”

- Applicable hazard labels (if batteries present)

H4: Handling Instructions

- Use mechanical lifting equipment for units >25 kg.

- Avoid tilting beyond 30° unless specified in the manual.

- Protect electrical connectors and blower inlets/outlets with protective caps during transit.

H4: Storage Conditions

- Environment: Dry, temperature-controlled (5°C to 40°C), low humidity (<80% RH).

- Position: Store upright on a level surface; do not stack unless designed for it.

- Duration: Max storage without power-up: 6 months. Perform operational checks after long storage.

H3: Import/Export Compliance

H4: Documentation

Provide with each shipment:

– Commercial Invoice

– Packing List

– Certificate of Conformity (CE, UL, etc.)

– Test Reports (EMC, Safety)

– Bill of Lading / Air Waybill

– Import License (if required by destination country)

H4: Customs Classification

- HS Code Examples:

- 8504.40 – Electrical transformers, power supply units

- 8414.59 – Fans, blowers

- Final code depends on primary function; consult local customs authority.

- Accurate valuation and country of origin declaration required.

H3: Installation & Operational Compliance

H4: Site Requirements

- Electrical Supply: Must match voltage, frequency, and grounding specs (e.g., 208–240V AC, 50/60 Hz, dedicated circuit).

- Ventilation: Ensure adequate airflow around blower exhaust; maintain clearance per manual (typically 30 cm).

- Environmental: Avoid exposure to dust, corrosive gases, or water spray unless IP-rated for such conditions.

H4: Safety Procedures

- Only qualified personnel may install or service the unit.

- Lockout/Tagout (LOTO) procedures required during maintenance.

- Grounding: Verify proper earth connection to prevent electrical hazards.

H3: Maintenance & Recordkeeping

- Scheduled Maintenance: Follow manufacturer’s guide (e.g., blower filter cleaning every 3 months, electrical inspection annually).

- Compliance Logs: Maintain records of:

- Safety inspections

- Repairs and part replacements

- Calibration (if applicable)

- Retain documentation for minimum 5 years (or as per local regulation).

H3: Contact & Support

For compliance or logistics inquiries:

– Manufacturer Support: [Insert Contact Info]

– Regulatory Consultant: [Insert Name/Company]

– Emergency Response: [Insert 24/7 Hotline, if applicable]

Note: Always refer to the latest product-specific manual and local regulations, as requirements may vary by jurisdiction and model revision.

End of Guide

Conclusion:

Sourcing a supercharger with an integrated blower represents a strategic decision to enhance engine performance by delivering increased air volume to the combustion chamber, resulting in improved horsepower and torque. Centrifugal superchargers, roots-type, and twin-screw designs each offer distinct advantages depending on the application, with blowers providing immediate throttle response and strong low-end torque. When selecting a supercharger system, key considerations such as compatibility with the engine type, efficiency, thermal management, maintenance requirements, and cost must be evaluated. Additionally, sourcing from reputable manufacturers ensures reliability, warranty support, and regulatory compliance. Ultimately, integrating a supercharger with a blower is a proven method for forced induction that, when properly sourced and installed, delivers significant performance gains for automotive and industrial applications.