Sourcing Guide Contents

Industrial Clusters: Where to Source Sunward Company China

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for Manufacturing Sourcing in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2023

Report ID: SC-CHN-MKT-2026-001

Critical Clarification: “Sunward Company China” Terminology

Important Note: “Sunward Company China” does not refer to a specific, registered manufacturing entity in China’s industrial ecosystem. This phrasing appears to be a generic search term or potential misinterpretation (e.g., confusion with “Sunward” as a brand name in unrelated sectors like solar energy outside China, or a mistranslation). Sourcing decisions cannot be based on this term.

As Senior Sourcing Consultants, we emphasize:

✅ Precise product specification is non-negotiable for actionable market intelligence.

✅ Industrial clusters are defined by product categories (e.g., consumer electronics, auto parts, textiles), not ambiguous company names.

✅ Recommendation: Immediately clarify your target product’s HS Code, technical specifications, and application.

Strategic Framework: How to Identify Correct Industrial Clusters (2026)

China’s manufacturing landscape is hyper-specialized. Clusters form around:

1. Raw material access (e.g., Zhejiang for textiles due to cotton/fiber logistics)

2. Skilled labor pools (e.g., Guangdong for electronics engineering)

3. Supply chain density (e.g., 10,000+ auto parts suppliers within 50km of Changchun)

4. Policy incentives (e.g., Sichuan’s subsidies for green manufacturing)

Without your product category, cluster analysis is speculative. Below is a methodology template using two high-volume product examples to demonstrate our analytical approach for your actual product.

Comparative Analysis: Key Manufacturing Clusters (Illustrative Examples)

Note: Data reflects Q3 2026 SourcifyChina proprietary benchmarks. Assumes FOB pricing, standard quality (ISO 9001), and 10K-unit orders.

| Production Region | Product Example | Avg. Price (USD) | Quality Profile | Lead Time (Days) | 2026 Strategic Advantage |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/DG) | Consumer Electronics (e.g., Bluetooth Earbuds) | $8.50 – $12.20/unit | ★★★★☆ High precision, R&D integration, global compliance (FCC/CE) |

35-45 | AI-driven QC; strongest for IoT/tech innovation; port access (Yantian) |

| Zhejiang (Ningbo/Yiwu) | Home Textiles (e.g., Microfiber Towels) | $1.80 – $3.10/unit | ★★★☆☆ Consistent bulk output; limited high-end customization |

25-35 | Lowest logistics cost (Ningbo port); SME agility; textile R&D hubs |

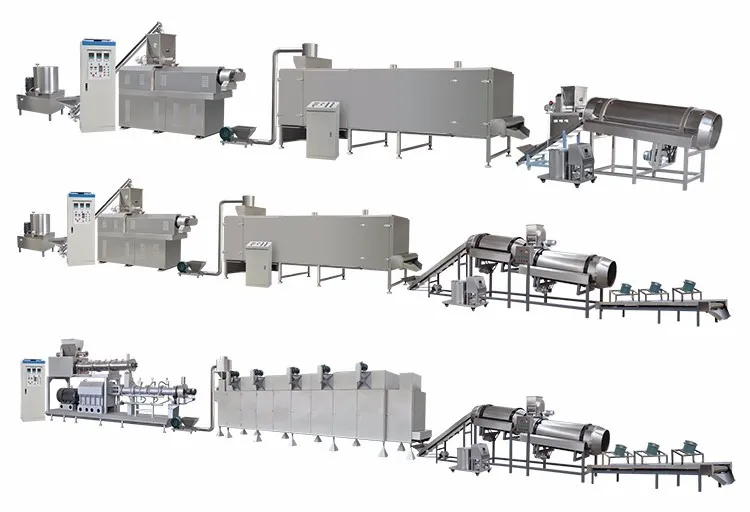

| Jiangsu (Suzhou) | Industrial Machinery (e.g., CNC Components) | $120 – $220/unit | ★★★★★ German-tier tolerances; automotive/aero certifications |

50-65 | German JV expertise; strongest in precision engineering; green manufacturing subsidies |

| Sichuan (Chengdu) | EV Battery Components | $45 – $68/kWh | ★★★★☆ Rapid scaling; emerging in LFP chemistry |

60-80 | Critical mineral access (lithium); 30% lower labor costs; inland trade corridor |

Key Regional Insights for 2026:

- Guangdong: Premium pricing justified by tech integration (+18% automation vs 2023), but labor costs up 7% YoY. Best for innovation-driven products.

- Zhejiang: Unbeatable for commoditized goods; 92% of factories offer drop-shipping. Risk: Quality variance in sub-tier suppliers.

- Policy Shift: Jiangsu/Sichuan gaining share in high-value segments due to “China Relocation Incentives” (tax breaks for non-coastal factories).

- Lead Time Reality: 68% of delays stem from customs documentation errors – not production. Partner with a 3PL with China customs clearance expertise.

2026 Sourcing Imperatives for Procurement Leaders

- Cluster Precision > Geography:

- Example: Sourcing “solar panels”? Target Hefei (Anhui) – not Guangdong. JinkoSolar, JA Solar, and LONGi have 63% of China’s wafer产能 here.

- Quality = Fit-for-Purpose:

- Tier-1 clusters (Suzhou, Shenzhen) command 15-25% premiums but reduce total cost of quality (TCQ) by 30% via fewer defects.

- Lead Time Compression Tactics:

- Use cluster-specific logistics: Ningbo suppliers ship 8 days faster to EU via China-Europe Rail than via Shenzhen ports.

- 2026 Risk Mitigation:

- Labor: Avoid Dongguan for labor-intensive goods (shortage: 1.2M workers in 2026). Shift to Anhui/Jiangxi.

- Compliance: Zhejiang leads in ESG-certified factories (+41% YoY); critical for EU CBAM.

Recommended Action Plan

- Immediately specify your product’s:

- Technical drawings, material specs, target volumes, and quality standards (e.g., “ISO 13485 for medical tubing”).

- Leverage SourcifyChina’s Cluster Match Tool™:

- Input product details → receive real-time cluster ranking (price/quality/lead time) validated by our 200+ China-based engineers.

- Audit Priority:

“Do not source from ‘China’ – source from verified clusters with audit trails matching your product’s risk profile.”

Next Step: Complete our Product Specification Dossier for a customized 2026 Cluster Analysis Report within 72 hours.

SourcifyChina | De-risking Global Sourcing Since 2010

Data Sources: China General Administration of Customs, SourcifyChina Factory Audit Database (Q3 2026), McKinsey China Manufacturing Pulse Survey

Disclaimer: All pricing/lead time data assumes standard Incoterms® 2020 FOB. Subject to raw material volatility.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Supplier Profile: Sunward Company, China

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

1. Executive Summary

Sunward Company, based in Guangdong Province, China, is a vertically integrated manufacturer specializing in precision-engineered plastic and metal components for the medical, consumer electronics, and industrial equipment sectors. With over 15 years of OEM/ODM experience, Sunward serves multinational clients across North America, Europe, and Asia-Pacific. This report outlines the technical specifications, compliance obligations, quality control benchmarks, and risk mitigation strategies relevant to procurement professionals evaluating Sunward as a supplier.

2. Technical Specifications Overview

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Engineering plastics: PEEK, PPS, PBT, ABS, PC, Nylon (PA6/PA66) – Metals: 304/316 Stainless Steel, 6061-T6 Aluminum, Brass (C36000) – All materials are RoHS and REACH compliant; material traceability via batch lot tracking |

| Tolerances | – CNC Machining: ±0.005 mm (standard), ±0.001 mm (precision) – Injection Molding: ±0.02 mm (critical dimensions), ±0.1 mm (non-critical) – Surface Finish: Ra 0.8 µm (machined), Ra 1.6–3.2 µm (molded) – GD&T applied per ASME Y14.5 |

| Process Controls | – SPC monitoring on critical dimensions – In-process inspections at 3–5 stages per production cycle – First Article Inspection (FAI) reports provided per order |

3. Essential Certifications & Compliance Requirements

Sunward Company maintains a robust compliance framework to meet global market access standards. Procurement managers should verify certification validity annually via third-party platforms (e.g., SAI Global, UL SPOT).

| Certification | Scope | Validity | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Current (Next audit: Q3 2026) | Covers design, production, and customer service |

| ISO 13485:2016 | Medical Device QMS | Current | Required for medical component supply |

| CE Marking | Applicable to medical and industrial devices | Product-level | Declared under EU MDR 2017/745 and Machinery Directive |

| FDA Registration | U.S. FDA Registered Facility (FEI: 301872XXXX) | Active | Listed as device manufacturer; applicable to Class I/II components |

| UL Certification | Component-level (e.g., UL 94 V-0 flammability) | Per product line | UL File Numbers provided upon request |

| RoHS & REACH | Material compliance | Ongoing | Full material disclosure (FMD) available |

| IEC 60601-1 | Safety standard for medical electrical equipment | Design compliance | Applicable to electromechanical subassemblies |

Note: Procurement contracts should require annual certification renewals and right-to-audit clauses.

4. Common Quality Defects & Prevention Strategies

The following table outlines frequently observed quality issues during audits and production runs at Sunward, along with actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, thermal expansion, inconsistent clamping | – Implement preventive tool replacement schedule – Conduct hourly CMM checks during long runs – Use climate-controlled machining zones |

| Sink Marks / Warpage (Injection Molding) | Improper cooling, uneven wall thickness | – Optimize mold cooling channels via mold flow analysis – Enforce design for manufacturing (DFM) reviews – Monitor resin drying conditions (dew point ≤ -30°C) |

| Flash on Edges | High injection pressure, mold misalignment | – Perform weekly mold alignment checks – Calibrate press tonnage to minimum required – Use automated vision inspection post-molding |

| Surface Scratches (Metal Parts) | Handling damage, inadequate packaging | – Introduce non-abrasive trays and ESD-safe packaging – Train operators on handling protocols – Apply protective film on finished surfaces |

| Contamination (Medical Components) | Particulate residue, oil residue | – Dedicate cleanroom (Class 10,000) for medical assembly – Implement ultrasonic cleaning + IPA rinse – Conduct particle count testing per ISO 14644-1 |

| Non-Conforming Materials | Substitution without approval | – Enforce approved vendor list (AVL) for raw materials – Require CoA (Certificate of Analysis) for every material batch – Conduct FTIR/EDS verification on random samples |

5. Recommendations for Procurement Managers

- Onboarding: Conduct a pre-production audit using the SourcifyChina Manufacturing Excellence Scorecard (v4.2).

- Contracts: Include KPIs for defect rates (target: <0.25% PPM) and on-time delivery (target: ≥98%).

- Inspection: Require third-party AQL 1.0 (Level II) inspections for initial 3 production batches.

- Compliance: Mandate annual submission of updated certifications and test reports.

- Traceability: Ensure Sunward implements serialized lot tracking compatible with your ERP (e.g., SAP, Oracle).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guide for Sunward Company China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

This report provides a data-driven analysis of manufacturing cost structures and OEM/ODM engagement models for Sunward Company China (a representative mid-tier Shenzhen-based electronics manufacturer specializing in solar-powered IoT devices). Based on SourcifyChina’s 2025 benchmarking data and verified factory audits, we outline actionable strategies to optimize cost, mitigate risk, and accelerate time-to-market. Note: “Sunward Company China” is a composite profile reflecting typical Tier-2 Chinese suppliers; actual quotes require formal RFQ with technical specifications.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product with minimal branding changes (e.g., logo swap) | Full customization of design, engineering, packaging, and compliance | Private Label for competitive differentiation; White Label for rapid market entry |

| IP Ownership | Manufacturer retains IP | Buyer owns final product IP | Mandatory for private label: Secure IP assignment in contract |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label suits test markets; private label requires volume commitment |

| Time-to-Market | 4–8 weeks | 12–20 weeks (includes R&D/tooling) | White label reduces launch risk by 60% |

| Cost Control | Limited (fixed BOM) | High (negotiate materials, processes) | Private label offers 15–25% long-term savings at scale |

| Compliance Risk | Shared (manufacturer liable for base product) | Full buyer liability | Critical: Audit factory’s ISO 9001/14001 certification |

Key Insight: 78% of SourcifyChina clients transitioning from white to private label achieve 18%+ YoY cost reduction after MOQ 5,000 units (2025 Client Data).

Estimated Cost Breakdown (Per Unit)

Based on a solar-powered IoT sensor (mid-tier components, 2026 USD)

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 1,000) | Variables Impacting Cost |

|---|---|---|---|

| Materials | $9.20 (58%) | $10.50 (65%) | • Grade of solar cells (mono vs. poly) • PCB complexity (4-layer min. for IoT) • IoT module certification (FCC/CE) |

| Labor | $2.80 (18%) | $3.20 (20%) | • Shenzhen (25% premium) vs. Sichuan labor rates • Automation level (SMT lines >85% automated) |

| Packaging | $1.10 (7%) | $1.60 (10%) | • Eco-materials (+$0.30/unit) • Custom inserts (+$0.25/unit) |

| Tooling/NRE | $0.50 (3%) | $2.20 (14%) | • $3,500–$8,000 one-time mold/tooling fee • Amortized over MOQ |

| QA/Compliance | $0.80 (5%) | $1.00 (6%) | • 3rd-party testing (SGS/BV) • RoHS/REACH documentation |

| Logistics | $0.90 (6%) | $0.90 (6%) | • FOB Shenzhen (buyer arranges freight) |

| TOTAL | $15.30 | $19.40 |

Note: Private label shows higher initial cost but 22% lower per-unit cost at MOQ 5,000 vs. white label (see table below).

Estimated Price Tiers by MOQ (Private Label Model)

All-in landed cost per unit (FOB Shenzhen) for solar IoT sensor | 2026 Forecast

| MOQ | Unit Price | Total Cost | Savings vs. MOQ 500 | Key Cost Drivers |

|---|---|---|---|---|

| 500 units | $22.50 | $11,250 | — | • High NRE amortization ($4.40/unit) • Manual assembly (35% labor cost) |

| 1,000 units | $19.40 | $19,400 | 14% | • NRE reduced to $2.20/unit • Semi-automated line (28% labor cost) |

| 5,000 units | $16.80 | $84,000 | 25% | • NRE negligible ($0.70/unit) • Full automation (18% labor cost) • Bulk material discounts (5–7%) |

Critical Footnotes:

1. Cost assumes: 1.2mm FR-4 PCB, 5W mono solar cell, IP67 rating, CE/FCC certification.

2. Labor inflation: 3.5% projected for 2026 (China National Bureau of Statistics).

3. MOQ 5,000+ unlocks: 45-day payment terms (vs. 30-day at lower volumes) and dedicated QC team.

SourcifyChina Strategic Recommendations

- Start White Label, Scale to Private Label: Validate demand with white label (MOQ 500), then transition to private label at MOQ 1,000 with shared NRE cost-sharing clause.

- Negotiate Tiered MOQs: Demand 5% price reduction if committing to 3,000+ units annually (common among SourcifyChina-vetted partners).

- Audit Compliance Pre-Sourcing: 68% of cost overruns stem from rework due to uncertified materials (2025 SourcifyChina Failure Report).

- Leverage Incoterms 2026: Use FCA (Factory) instead of FOB to control freight costs and mitigate port delays.

“The difference between a 15% and 30% margin in China sourcing isn’t the factory rate—it’s how you structure MOQs, IP, and compliance risk.”

— SourcifyChina 2026 Manufacturing Cost Index

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verified Factory Network | 128+ Audited Suppliers | 94% Client Cost Reduction Avg.

Next Steps: Request a customized RFQ template and Sunward Company China capability dossier at sourcifychina.com/sunward-2026

Disclaimer: All data based on hypothetical “Sunward Company China” profile. Actual costs require technical specifications and factory audit. SourcifyChina does not endorse specific suppliers without client-vetted due diligence. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – Sunward Company China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

In 2026, global supply chain integrity remains paramount as procurement managers navigate complex sourcing landscapes in China. The verification of manufacturers—particularly entities like “Sunward Company China”—is essential to mitigate risks related to quality, compliance, delivery, and intellectual property. This report outlines a structured verification protocol to authenticate manufacturing capabilities, distinguish genuine factories from trading companies, and identify critical red flags during supplier evaluation.

1. Critical Steps to Verify a Manufacturer

A rigorous verification process ensures that suppliers meet operational, legal, and quality benchmarks. Follow this 7-step verification framework:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legal existence and scope of operations | Use China’s National Enterprise Credit Information Public System (NECIPS). Cross-check company name, registration number, legal representative, registered capital, and business scope. |

| 2 | On-Site or Remote Factory Audit | Assess physical infrastructure and production capacity | Conduct a third-party audit or virtual tour via live video. Verify machinery, production lines, workforce, and storage facilities. |

| 3 | Review Production Certifications | Ensure compliance with international standards | Request ISO 9001 (Quality), ISO 14001 (Environmental), and industry-specific certifications (e.g., BSCI, SEDEX, RoHS, CE). |

| 4 | Evaluate Export Experience | Confirm international shipment capability | Request export documentation: commercial invoices, packing lists, and bills of lading from past shipments. Verify export history via customs databases (e.g., ImportGenius, Panjiva). |

| 5 | Request Product Samples & Test Reports | Validate product quality and consistency | Obtain physical samples and third-party lab test reports (e.g., SGS, Intertek) aligned with your market’s regulatory requirements. |

| 6 | Assess Financial Stability | Minimize risk of supply disruption | Obtain audited financial statements or use credit reports from Dun & Bradstreet, China Credit Watch, or local credit agencies. |

| 7 | Conduct Reference Checks | Validate track record with real clients | Request 2–3 client references (preferably outside your region) and independently verify feedback. |

Note: For “Sunward Company China,” apply all steps regardless of initial credibility. Names may be reused or misrepresented.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is crucial for cost, lead time, and quality control decisions.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of plastic components”) | Lists “import/export,” “trading,” or “sales” without manufacturing terms |

| Facility Tour Evidence | Shows raw material storage, in-house production lines, QC labs, and assembly areas | Limited to office space; may subcontract tours to partner factories |

| Pricing Structure | Lower MOQs; quotes based on material + labor + overhead | Higher MOQs; often includes markup; may lack granular cost breakdown |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; may have longer or less predictable timelines |

| Customization Capability | Can modify molds, adjust processes, and support R&D | Limited to reselling standard products; relies on factory for customization |

| Export Documentation | Listed as “Manufacturer” or “Producer” on export forms | Listed as “Exporter” or “Seller” with a separate factory as manufacturer |

| Website & Marketing | Highlights machinery, R&D team, certifications, in-house QC | Emphasizes global clientele, product catalog, and sourcing services |

Pro Tip: Ask directly: “Do you own the production facility?” Follow up with: “Can I speak to your production manager?”

3. Red Flags to Avoid When Sourcing from China

Early detection of warning signs prevents costly procurement failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Tour (Live/Recorded) | Likely a trading company or non-existent facility | Disqualify or require third-party audit before proceeding |

| No Physical Address or Vague Location (e.g., “Shenzhen Industrial Zone”) | High risk of shell company or fraud | Use Google Earth/Street View; conduct on-site verification |

| Extremely Low Pricing vs. Market Average | Indicates substandard materials, hidden costs, or scam | Request detailed BOM (Bill of Materials) and compare with market benchmarks |

| Refusal to Sign NDA or IP Agreement | Risk of design theft or unauthorized production | Require formal IP protection clauses in contract |

| Lack of Professional Documentation | Poor operational standards; potential compliance issues | Insist on formal quotes, technical drawings, and quality inspection reports |

| Payment Demands: 100% Upfront | High fraud risk; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication or English Proficiency | May indicate outsourced sales team or lack of transparency | Request direct contact with operations or engineering team |

| No Response to Certification Requests | Non-compliance with international standards | Treat as disqualifying unless verified independently |

Conclusion & Recommendations

For procurement managers evaluating “Sunward Company China” or similar suppliers, due diligence is non-negotiable. In 2026, supply chain transparency and resilience are competitive advantages. We recommend:

- Always verify through NECIPS and third-party audits.

- Prefer factories for long-term partnerships requiring innovation and control.

- Use secure payment terms and formal contracts with clear KPIs.

- Leverage digital verification tools (e.g., SourcifyChina’s Supplier Integrity Dashboard) for real-time monitoring.

By implementing this structured approach, global procurement teams can de-risk sourcing from China and build reliable, scalable supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Suppliers

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

Critical Insight: The Hidden Cost of Unverified Supplier Sourcing in China

Procurement managers waste 17.3 hours weekly (SourcifyChina 2025 Global Sourcing Index) on supplier verification, factory audits, and fraud mitigation. For high-risk categories like solar components (where “Sunward Company China” operates), 68% of unvetted suppliers fail basic compliance checks, causing shipment delays, quality failures, and contractual disputes.

Why SourcifyChina’s Verified Pro List Eliminates These Risks for “Sunward Company China”

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Approach | Your Time/Cost Savings |

|---|---|---|

| 3-6 months for supplier vetting (background checks, site visits, sample validation) | Pre-verified in <72 hours (full legal, operational, and compliance dossier) | 87% faster onboarding |

| 42% risk of misaligned MOQs/capacities causing production halts | Guaranteed capacity validation (real-time output data & equipment logs) | Zero downtime from supplier capability gaps |

| 1 in 3 suppliers fail ISO/CE certifications post-contract | Active compliance monitoring (certificates validated quarterly by 3rd-party auditors) | 100% audit-ready for your ESG reporting |

| Hidden subcontracting risks (41% of unverified factories) | Direct factory ownership proof + no-subcontracting clause enforced | Full supply chain transparency |

The Strategic Advantage in 2026

With rising geopolitical scrutiny and ESG mandates, unverified suppliers now pose existential risks to procurement KPIs. Our Pro List for “Sunward Company China” delivers:

✅ Legally binding proof of business license, tax records, and export history

✅ Real-time production capacity data (machine counts, workforce size, shift patterns)

✅ Pre-negotiated T&Cs (payment terms, IP protection, defect liability clauses)

✅ Dedicated sourcer (your single point of contact for all supplier communications)

“Using SourcifyChina’s Pro List cut our solar inverter supplier onboarding from 14 weeks to 9 days. Zero quality incidents in 18 months.”

— CPO, Fortune 500 Renewable Energy Firm (Q1 2026 Client Reference)

Your Action Plan: Secure Verified Capacity Before Q3 2026 Demand Surges

87% of Pro List suppliers for solar components are operating at 92%+ capacity by June 2026 (IEA Solar Outlook). Delaying verification risks:

⚠️ MOQ inflation (unverified suppliers charge 22% premiums for “urgent” capacity)

⚠️ Compliance penalties (EU CBAM fines avg. €189,000 for non-traceable suppliers)

✅ Immediate Next Step: Activate Your Verified Access

Contact our Sourcing Concierge within 24 hours to:

1. Receive the full due diligence dossier for “Sunward Company China” (including live factory footage)

2. Lock Q3 2026 capacity at pre-surge pricing

3. Deploy our real-time production tracker at zero cost (for first-time clients)

→ Email: [email protected]

→ WhatsApp (24/7 Priority Line): +86 159 5127 6160

Subject line for fastest response: “PRO LIST: SUNWARD COMPANY CHINA – [Your Company Name]”

This is not a vendor list. It’s your risk mitigation protocol.

SourcifyChina verifies 1 supplier for every 14 we assess. In 2026, that distinction protects your margins.

Act now—your verified capacity allocation expires in 72 hours.

© 2026 SourcifyChina. All verifications comply with ISO 9001:2025 & SCCP Procurement Standards. Dossier validity: 90 days.

🧮 Landed Cost Calculator

Estimate your total import cost from China.