The global sunflower oil powder market is experiencing robust growth, driven by rising consumer demand for plant-based, non-dairy, and allergen-friendly ingredients in the food and beverage industry. According to Grand View Research, the global edible oil powder market size was valued at USD 1.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Sunflower oil powder, in particular, is gaining traction due to its high oxidative stability, clean flavor profile, and non-GMO status compared to other vegetable oil powders. Its use in powdered coffee creamers, infant formula, bakery mixes, and dietary supplements has expanded its footprint across both conventional and health-focused product lines. With health consciousness and clean-label trends on the rise, manufacturers are increasingly turning to sunflower oil powder as a sustainable and functional lipid alternative. As the market becomes more competitive, identifying leading producers with strong technical capabilities, quality certifications, and global supply chain reach is crucial for sourcing professionals and brand developers alike.

Top 10 Sunflower Oil Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High Oleic Sunflower Oil Powder

Domain Est. 2016

Website: hsfbiotech.com

Key Highlights: Leading manufacturer of high oleic sunflower oil powder with annual capacity of 600mts, KOSHER, HALAL Certificates available. HSF Biotech is the key factory ……

#2 Connoils

Domain Est. 2007

Website: connoils.com

Key Highlights: Connoils By Kraft is a leading international supplement manufacturer, distributor and wholesale supplier of bulk oil ingredients. We create oil and oil powders ……

#3 Maverik Oils

Domain Est. 2015

Website: maverikoils.com

Key Highlights: Maverik Oils offers a vast selection of the finest organic and non-GMO specialty oils and ingredients to food, cosmetic, and pharmaceutical manufacturers….

#4 Sigma Oil Seeds

Website: sigmaoilseeds.eu

Key Highlights: Sigma Oil Seeds, your plant-based supplier. We offer a wide range of plant-based specialty oils for food, cosmetic and petfood application….

#5 Better sourcing of rapeseed and sunflower

Domain Est. 1996

Website: aak.com

Key Highlights: Rapeseed and sunflower are key soft oils for food production that bring important health benefits. Learn more about how we are engaging with suppliers and ……

#6

Domain Est. 1997 | Founded: 1930

Website: aristaindustries.com

Key Highlights: Since 1930, Arista Industries has grown into one of the nation’s leading specialty Vegetable and Marine oil suppliers….

#7 Oils & Fats

Domain Est. 1999

Website: ciranda.com

Key Highlights: Sunflower Oil High-Oleic. Organic high oleic sunflower oil is a stable, neutral-flavored oil containing a high percentage of oleic fatty acids….

#8 Sunflower Oil

Domain Est. 2004

#9 HOSO Fat Powder

Domain Est. 2007

Website: zeonlifesciences.com

Key Highlights: Zeopure offers High Oleic Sunflower 70% Fat Powder, a free flowing powder with no lumps or foreign material. It has uniform and homogeneous particles size….

#10 O&3

Domain Est. 2014

Website: oand3.com

Key Highlights: At O&3 we are the oil experts. With over 40 years’ experience we provide a range of innovative, organic, natural and essential oils for the wholesale ……

Expert Sourcing Insights for Sunflower Oil Powder

H2: 2026 Market Trends for Sunflower Oil Powder

The global sunflower oil powder market is poised for significant transformation and growth by 2026, driven by shifting consumer preferences, advancements in food technology, and rising demand for convenient and healthier fat alternatives. Several key trends are expected to shape the market landscape:

-

Rising Demand for Clean-Label and Plant-Based Ingredients

Consumers are increasingly favoring clean-label, non-GMO, and plant-based food products. Sunflower oil powder—naturally rich in vitamin E and low in saturated fats—aligns with these health-conscious preferences. As a dairy- and trans-fat-free ingredient, it is gaining traction in plant-based formulations for snacks, dairy alternatives, and ready-to-eat meals. -

Expansion in Food and Beverage Applications

Sunflower oil powder is being adopted across a broad spectrum of food products, including instant soups, sauces, bakery items, infant nutrition, and sports nutrition bars. Its powder form improves shelf life, enhances texture, and enables easier handling in industrial processing. By 2026, innovation in functional foods will likely accelerate its integration into fortified and meal replacement products. -

Growth in Convenience and Shelf-Stable Products

The ongoing demand for long-lasting, lightweight, and easy-to-transport food solutions—especially in urban markets and emergency food supplies—supports the adoption of oil powders. Sunflower oil powder offers a stable, non-perishable alternative to liquid oils, making it ideal for ready-to-mix products and military or outdoor rations. -

Technological Advancements in Encapsulation

Improved encapsulation techniques, such as spray drying and liposome encapsulation, are enhancing the stability, solubility, and controlled release of sunflower oil powders. These innovations are expected to expand applications in pharmaceuticals and nutraceuticals, particularly in fat-soluble vitamin delivery systems. -

Sustainability and Supply Chain Transparency

With greater emphasis on sustainable sourcing, manufacturers are investing in traceable and eco-friendly sunflower oil supply chains. Regions such as Eastern Europe and Russia, major sunflower oil producers, are likely to play a pivotal role in meeting global demand while adhering to environmental and ethical standards. -

Regional Market Expansion

While North America and Europe lead in early adoption due to high health awareness, the Asia-Pacific region is anticipated to witness the fastest growth by 2026. Rising urbanization, increasing disposable incomes, and a growing middle class are driving demand for processed and functional foods in countries like China, India, and Southeast Asia. -

Regulatory and Labeling Support

Favorable regulatory developments, including GRAS (Generally Recognized As Safe) status in the U.S. and EFSA approvals in Europe, bolster market confidence. Clear labeling of sunflower oil powder as a healthy, natural ingredient further enhances consumer trust and product appeal.

In conclusion, the sunflower oil powder market is set for robust growth by 2026, underpinned by health trends, technical innovation, and expanding applications. Stakeholders who invest in sustainable sourcing, product diversification, and consumer education will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Sunflower Oil Powder (Quality & Intellectual Property)

Sourcing sunflower oil powder can be advantageous for various food and supplement applications due to its stability and ease of use. However, buyers often encounter significant pitfalls related to quality inconsistencies and intellectual property (IP) risks. Being aware of these challenges is crucial for ensuring a reliable, safe, and legally compliant supply chain.

Quality-Related Pitfalls

Inconsistent Oil Content and Carrier Ratios

Sunflower oil powder is typically produced by spray-drying or drum-drying sunflower oil onto a carrier (commonly maltodextrin, gum arabic, or modified starch). A major pitfall is variability in the actual oil-to-carrier ratio. Suppliers may advertise a certain oil content (e.g., 50%), but batch-to-batch inconsistencies can lead to lower effective oil delivery, affecting product functionality and cost-efficiency. Always request and verify Certificates of Analysis (CoA) with every shipment.

Poor Oxidative Stability and Rancidity

Despite being powdered, sunflower oil remains susceptible to oxidation, especially if not properly protected during processing and storage. Low-quality powders may lack sufficient antioxidants (e.g., tocopherols, rosemary extract) or be processed at high temperatures, leading to off-flavors, reduced shelf life, and potential health concerns. Insist on peroxide value (PV), anisidine value (AV), and TOTOX specifications in quality agreements.

Inadequate Particle Size and Solubility

Improper particle size distribution can result in poor dispersibility, clumping, or sedimentation in final products. Some suppliers may not control particle size (e.g., median diameter, D50), leading to formulation issues. Additionally, low solubility or wettability can hinder performance in beverages or instant mixes. Request particle size data and conduct in-house solubility testing.

Contamination and Purity Issues

Cross-contamination with allergens (e.g., soy, gluten if carriers are not carefully sourced) or residual solvents (from extraction processes) is a serious concern. Ensure suppliers follow GMP and have allergen control plans. Also, verify non-GMO and allergen-free claims with documentation, especially if making such claims on your final product.

Moisture Content and Caking

High moisture content (>5%) can promote microbial growth and caking during storage. This affects flowability and usability in automated production lines. Define strict moisture specifications and ensure packaging includes moisture barriers (e.g., aluminum-lined bags with desiccants).

Intellectual Property (IP)-Related Pitfalls

Infringement of Encapsulation Technology Patents

Many sunflower oil powders are produced using proprietary encapsulation techniques protected by patents (e.g., specific emulsification methods, wall material compositions, or drying parameters). Sourcing from a supplier using patented technology without proper licensing exposes your company to IP litigation. Conduct due diligence: ask suppliers to disclose the basis of their technology and confirm freedom-to-operate.

Unclear Ownership of Formulation IP

If you co-develop a custom sunflower oil powder formulation with a supplier, IP ownership may be ambiguous. Without a clear agreement, the supplier could claim rights to the formulation or sell it to competitors. Always establish IP ownership, confidentiality, and exclusivity terms in a formal development agreement.

Misrepresentation of “Natural” or “Clean Label” Claims

Some suppliers may market their powders as “natural” or “non-chemical,” but the encapsulation process or carrier materials might involve synthetic additives or processing aids not compliant with clean label standards. Verify ingredient sources and processing methods to avoid misleading claims and potential regulatory scrutiny.

Counterfeit or Gray Market Products

In regions with weak IP enforcement, counterfeit or diverted sunflower oil powder may enter the supply chain. These products can lack quality controls and infringe on legitimate patents. Source only from reputable, audited suppliers and verify batch traceability.

Mitigation Strategies

- Request full technical documentation, including CoA, specifications, process descriptions, and IP disclosures.

- Audit suppliers—conduct on-site audits to assess GMP compliance and IP practices.

- Use legal agreements—include quality specifications, IP indemnification clauses, and confidentiality in contracts.

- Test incoming materials—perform independent lab testing for key quality parameters and contaminant screening.

By proactively addressing these quality and IP pitfalls, companies can secure a reliable, high-performing, and legally sound supply of sunflower oil powder.

Logistics & Compliance Guide for Sunflower Oil Powder

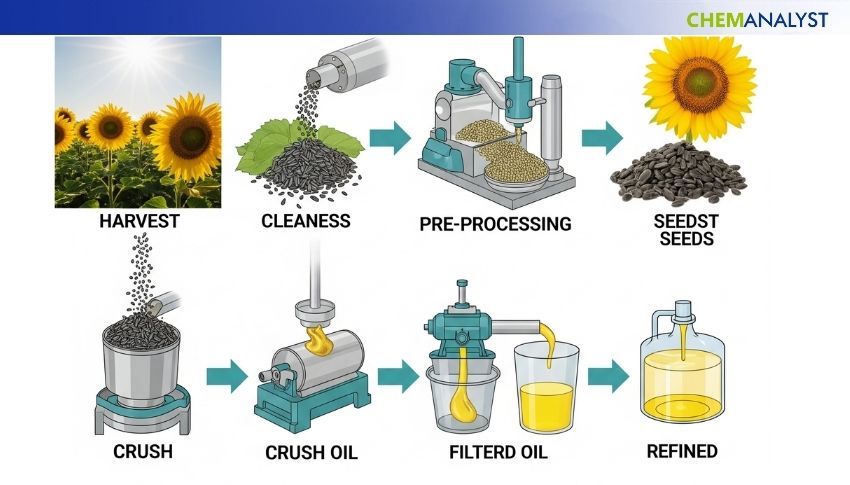

Product Overview

Sunflower Oil Powder is a spray-dried or encapsulated form of sunflower oil, typically combined with a carrier (such as maltodextrin or modified starch) to create a free-flowing powder. It is widely used in food manufacturing, including bakery, dairy alternatives, instant beverages, and dry mixes, due to its ease of handling, extended shelf life, and oxidative stability.

H2: Regulatory Compliance & Food Safety

1. International Food Safety Standards

- Codex Alimentarius: Sunflower Oil Powder must comply with general standards for food additives and contaminants (e.g., Codex Stan 19-1973). Adherence to Codex guidelines supports global market access.

- General Standard for Contaminants and Toxins in Food (Codex Stan 193-1995): Monitor limits for heavy metals (e.g., lead, arsenic), pesticide residues, and mycotoxins (e.g., aflatoxins).

2. Key Regional Regulations

- United States (FDA):

- Must comply with the Food Safety Modernization Act (FSMA).

- Generally Recognized as Safe (GRAS) status should be confirmed for all ingredients (oil, carrier, emulsifiers).

- Labeling must follow 21 CFR Part 101, including allergen disclosure if applicable.

-

Facilities must be registered with the FDA, and a Foreign Supplier Verification Program (FSVP) is required for importers.

-

European Union (EU):

- Subject to Regulation (EC) No 178/2002 (General Food Law).

- Must comply with Regulation (EC) No 852/2004 on food hygiene.

- If the carrier is maltodextrin from GMO sources, EU GMO labeling regulations (Regulation (EC) No 1829/2003) apply.

- Allergen labeling under Directive 2000/13/EC and Regulation (EU) No 1169/2011—sunflower oil is not a listed allergen, but carriers (e.g., milk-derived ingredients) may be.

-

Novel Food assessment may be required if the encapsulation process significantly alters bioavailability (Regulation (EU) 2015/2283).

-

Other Markets:

- Canada: Comply with the Safe Food for Canadians Regulations (SFCR) and CFIA requirements.

- Australia/New Zealand: Must meet standards under FSANZ (Food Standards Code, Standard 1.2.4 – Labelling of Ingredients).

- GCC Countries: Subject to Gulf Standardization Organization (GSO) regulations, including halal certification if marketed as such.

3. Additives & Labeling

- Emulsifiers (e.g., soy lecithin, mono- and diglycerides) must be approved in the target market.

- Carriers (e.g., maltodextrin) must be food-grade and declared on the label.

- Nutrition labeling (fat, calories, fatty acid profile) must be accurate and region-compliant.

- Claims such as “source of vitamin E” or “unsaturated fat” must comply with local health claim regulations.

4. Food Defense & Traceability

- Implement a HACCP-based food safety plan.

- Maintain full traceability (batch-level tracking from raw materials to finished goods).

- Adhere to GS1 standards for barcoding and supply chain visibility.

H2: Logistics & Transportation Requirements

1. Storage Conditions

- Temperature: Store in a cool, dry place. Ideal range: 15–25°C (59–77°F). Avoid exposure to high heat.

- Humidity: Keep relative humidity below 65% to prevent caking and microbial growth.

- Light: Protect from direct sunlight to minimize oxidation.

- Packaging Integrity: Use moisture-resistant, sealed packaging (e.g., multi-wall foil-lined bags inside fiber drums or bulk totes).

2. Shelf Life & Stability

- Typical shelf life: 12–24 months when stored properly.

- Monitor for off-odors, color changes, or clumping as signs of degradation.

- Conduct periodic stability testing (peroxide value, free fatty acids).

3. Packaging Specifications

- Primary Packaging: Food-grade, oxygen and moisture barrier materials (e.g., aluminum laminate bags).

- Secondary Packaging: Fiber drums (25 kg), bulk bags (500–1000 kg), or cartons with liners.

- Labeling: Include product name, batch number, best-before date, storage instructions, net weight, allergen information, and manufacturer details.

4. Transportation

- Mode: Suitable for road, sea, and air freight (subject to IATA/IMDG regulations if air or sea).

- Conditions:

- Avoid temperature extremes; use climate-controlled (reefer) containers if ambient conditions exceed limits.

- Prevent moisture ingress—ensure containers are dry and sealed.

- Protect from physical damage; palletize securely.

- Documentation: Include commercial invoice, packing list, bill of lading, certificate of analysis (CoA), and certificate of origin.

5. Import/Export Requirements

- HS Code: Typically 1518.00.00 (powders of animal or vegetable fats and oils) or 1901.90 (maltodextrin-based powders). Confirm with local customs.

- Phytosanitary Certificate: Not usually required unless mandated by the importing country.

- Customs Clearance: Provide full ingredient disclosure, country of origin, and compliance certificates (e.g., FDA registration, EU health certificate if applicable).

H2: Certifications & Documentation

1. Required Certifications

- Certificate of Analysis (CoA): Includes moisture, oil content, peroxide value, microbial counts (total plate count, E. coli, Salmonella), and heavy metals.

- Certificate of Origin: Required for tariff classification and trade agreements.

- Free Sale Certificate: May be needed for export to certain countries (e.g., China, Russia).

- Halal or Kosher Certification: If targeting religious or specialty markets.

- Non-GMO Project Verification or EU GMO Compliance: If applicable.

- Organic Certification: If marketed as organic (e.g., USDA Organic, EU Organic).

2. Sustainability & Ethical Compliance

- RSPO (Roundtable on Sustainable Palm Oil): Not applicable to sunflower, but relevant if palm-based emulsifiers are used.

- Deforestation-Free Sourcing: Increasingly important for ESG reporting.

- Supplier Audits: Conduct regular audits of raw material suppliers for quality and ethical practices.

H2: Risk Management & Contingency Planning

- Supply Chain Risks: Monitor geopolitical and climatic factors affecting sunflower oil supply (e.g., Ukraine production disruptions).

- Recall Preparedness: Maintain a product recall plan aligned with local regulations (e.g., FDA Reportable Food Registry).

- Insurance: Ensure cargo, product liability, and contamination insurance are in place.

- Dual Sourcing: Establish backup suppliers to mitigate supply disruption risks.

This guide provides a comprehensive framework for ensuring the safe, compliant, and efficient handling of Sunflower Oil Powder across global supply chains. Always consult local regulatory bodies and legal counsel to ensure up-to-date compliance.

Conclusion for Sourcing Sunflower Oil Powder

Sourcing sunflower oil powder requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. As a versatile and increasingly popular ingredient in food manufacturing, dietary supplements, and functional foods, sunflower oil powder offers benefits such as improved shelf life, ease of handling, and oxidative stability compared to liquid oil.

Key considerations in the sourcing process include selecting suppliers with strong manufacturing capabilities—particularly those utilizing spray drying or encapsulation technologies with high-quality emulsifiers like maltodextrin or modified starches. It is essential to verify certifications (e.g., non-GMO, organic, ISO, FSSC 22000) and ensure compliance with food safety and regulatory standards in both the country of origin and destination markets.

Additionally, assessing the product’s nutritional profile, fat content, solubility, and stability under various conditions will ensure it meets application-specific requirements. Building long-term relationships with transparent, reliable suppliers, conducting regular quality audits, and considering logistical factors such as lead times and packaging will further mitigate risks and support consistent product performance.

In conclusion, successful sourcing of sunflower oil powder hinges on due diligence, clear specifications, and proactive supply chain management. With rising demand for plant-based and shelf-stable fat alternatives, investing in a robust sourcing strategy positions companies to meet market needs efficiently and sustainably.