The global loudspeaker market, fueled by rising consumer demand for premium audio experiences in home entertainment, automotive, and portable devices, is witnessing robust growth. According to Grand View Research, the global loudspeaker market size was valued at USD 8.7 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. A critical component driving audio performance—especially in subwoofers—is the voice coil, responsible for converting electrical signals into mechanical motion to produce deep bass frequencies. As the demand for high-fidelity sound increases across consumer electronics and automotive sectors, the need for high-performance, thermally efficient, and durable voice coils has become paramount. This growing demand has elevated the importance of specialized manufacturers capable of innovating in materials, winding techniques, and thermal management. The following analysis highlights the top 8 subwoofer voice coil manufacturers shaping innovation and reliability in this expanding niche of the audio components industry.

Top 8 Subwoofer Voice Coil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Precision Econowind Custom Coils

Domain Est. 1999

Website: precisioneconowind.com

Key Highlights: They specialize in custom coils such as voice coils, precision layered coils, freestanding coils, and coils wound with flat wire….

#2 Subwoofer Speaker Parts

Domain Est. 2015

Website: thelordofbass.com

Key Highlights: 3–9 day delivery 14-day returnsLord of Bass is the largest subwoofer speaker parts supplier in the world, specializing in OEM loudspeaker design for car audio, home audio and pro a…

#3 B&C Speakers

Domain Est. 1999

Website: bcspeakers.com

Key Highlights: Featuring aluminum voice coils, these new woofers are a perfect fit for low-cost line array or point-source applications. The new 12SW115, a 12″ woofer with a ……

#4 Ciare

Domain Est. 1999

Website: ciare.com

Key Highlights: For over 70 years, Ciare has brought “Made in Italy” sound quality to the world. Recent Additions. HSG200-4. Low Frequency Driver8 Inches. 4Ω. Voice Coil ……

#5 Sound Town

Domain Est. 2000

Website: soundtown.com

Key Highlights: Free delivery 30-day returnsA larger voice coil is equivalent to better control over the speaker cone, improved damping and enhanced linearity. While it makes the subwoofer more di…

#6 Voice Coil Suppliers

Domain Est. 2009

Website: electriccoils.net

Key Highlights: Conveniently locate the leading voice coil suppliers that manufacture their products domestically, and offer fast shipping throughout the United States….

#7 Speaker and Subwoofer Voice Coils

Domain Est. 2010

#8 Voice

Domain Est. 2013

Website: uscotronics.com

Key Highlights: US Cotronics manufactures electromagnetic voice coil windings for voice coil actuators (VCAs) found in a wide variety of today’s electronics products….

Expert Sourcing Insights for Subwoofer Voice Coil

H2: 2026 Market Trends for Subwoofer Voice Coil

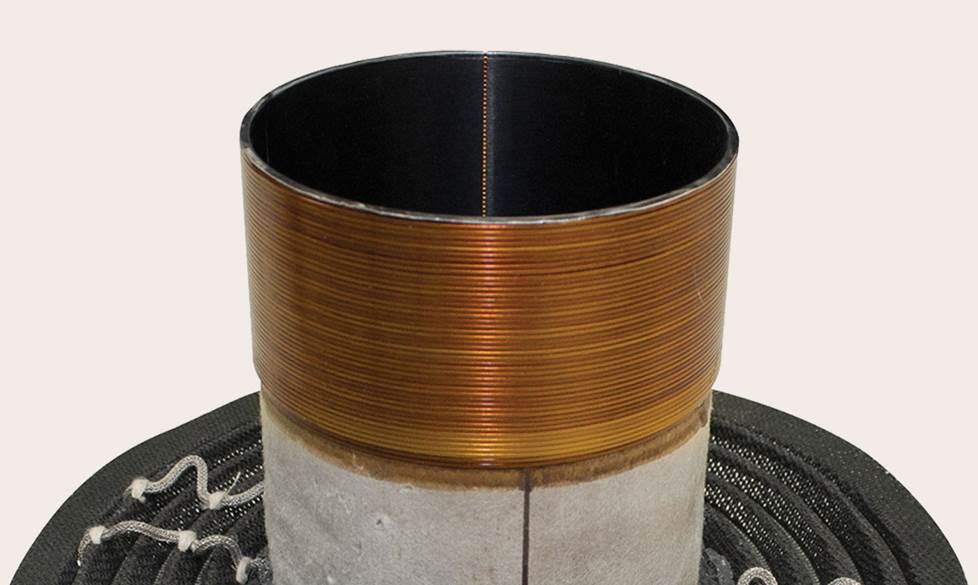

The global subwoofer voice coil market is poised for significant evolution by 2026, driven by advancements in audio technology, rising consumer demand for high-fidelity sound systems, and the expansion of smart audio devices. Voice coils—critical components in subwoofers responsible for converting electrical signals into mechanical motion—are undergoing material and design innovations to meet performance, durability, and efficiency demands.

Increasing Demand from Consumer Electronics

One of the primary drivers shaping the 2026 landscape is the growing appetite for premium audio experiences in consumer electronics. With the proliferation of home theater systems, soundbars, and high-end headphones, manufacturers are investing in superior voice coil materials such as copper-clad aluminum wire (CCAW) and advanced high-temperature formable (HTF) adhesives. These materials improve thermal management and power handling—key factors in voice coil reliability and sound quality.

Additionally, the integration of subwoofers into smart speakers and portable audio devices is creating new opportunities. As voice assistants like Alexa and Google Assistant become standard in homes, audio fidelity has become a competitive differentiator, pushing brands to incorporate better subwoofer components, including high-performance voice coils.

Automotive Audio Innovations

The automotive sector is another major contributor to subwoofer voice coil demand. By 2026, luxury and electric vehicles (EVs) are expected to feature advanced in-cabin audio systems as a standard offering. EV manufacturers, in particular, are leveraging high-end sound systems to enhance the driving experience in quieter electric cabins. This trend is increasing the need for robust, lightweight, and thermally efficient voice coils capable of delivering deep bass without distortion under variable power loads.

Automotive-grade voice coils are seeing increased use of aluminum and high-purity copper windings, along with improved cooling mechanisms such as vented pole pieces and ferrofluid cooling—technologies expected to gain further traction by 2026.

Material and Manufacturing Advancements

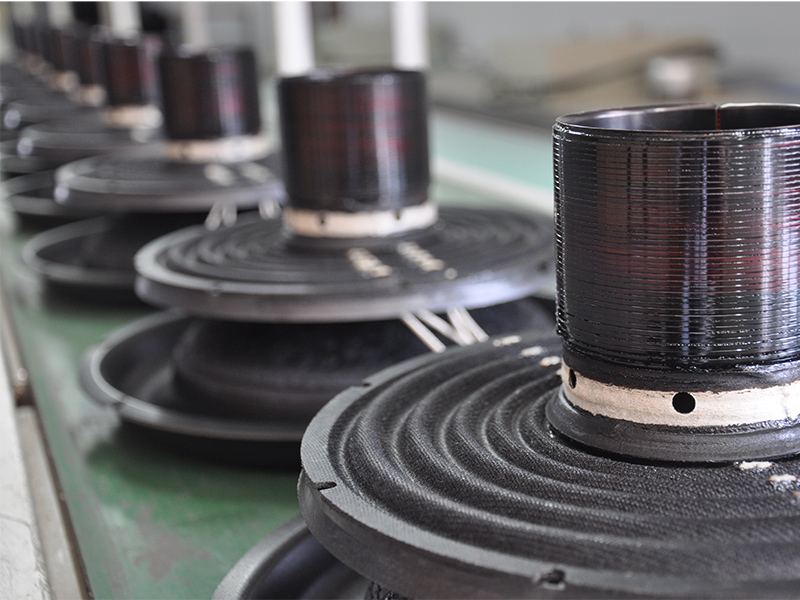

Material science is playing a pivotal role in shaping future voice coil performance. Innovations in coil former materials—such as composite polymers and aluminum—help reduce weight while improving heat dissipation. Furthermore, automated precision winding techniques and 3D coil designs are enhancing consistency and efficiency in production, reducing failure rates and enabling tighter tolerances.

Manufacturers are also focusing on sustainability, with initiatives to recycle copper and reduce waste in coil production. These efforts align with broader industry trends toward greener electronics manufacturing, which could influence regulatory standards and consumer preferences by 2026.

Regional Market Dynamics

Asia-Pacific is expected to dominate the subwoofer voice coil market by 2026, fueled by robust electronics manufacturing in China, Japan, and South Korea. These regions are home to leading audio component suppliers and OEMs, supporting local and global supply chains. Meanwhile, North America and Europe maintain strong demand due to high consumer spending on premium audio equipment and home automation systems.

Emerging markets in Latin America and Southeast Asia are also showing growth potential, driven by rising disposable incomes and expanding access to high-quality audio products.

Competitive Landscape

The market is witnessing increased consolidation among key players such as Tymphany, Monacor, and SB Acoustics, who are investing in R&D to differentiate through patented coil technologies and proprietary materials. Smaller suppliers are focusing on niche applications, including professional audio and custom installations, where high power handling and long-term durability are paramount.

Conclusion

By 2026, the subwoofer voice coil market will be shaped by technological innovation, evolving consumer preferences, and industry-specific demands—particularly in automotive and smart audio. H2 highlights a period of accelerated growth and transformation, with material improvements, manufacturing precision, and regional expansion driving the next generation of voice coil performance and market penetration.

Common Pitfalls When Sourcing Subwoofer Voice Coil (Quality, IP)

Sourcing high-quality subwoofer voice coils is critical to ensuring optimal audio performance, durability, and reliability. However, several pitfalls—especially concerning quality inconsistencies and intellectual property (IP) issues—can compromise product integrity and expose companies to legal and financial risks. Being aware of these common challenges helps in making informed procurement decisions.

Quality Inconsistencies and Material Deficiencies

One of the most frequent issues when sourcing subwoofer voice coils is inconsistent quality across batches. Suppliers, particularly in low-cost manufacturing regions, may use substandard materials such as lower-grade copper wire, inferior adhesives, or weak former materials (e.g., aluminum vs. high-temp composites). These compromises can lead to voice coil deformation, reduced power handling, or thermal failure under prolonged use. Additionally, poor winding precision or misalignment affects motor symmetry and increases distortion. Inadequate quality control processes often result in higher rejection rates during speaker assembly, increasing production costs and delays.

Lack of IP Protection and Risk of Infringement

Another critical pitfall involves intellectual property (IP) risks. Some suppliers may offer voice coils that mimic patented designs—such as specific winding patterns, cooling technologies, or former geometries—without proper licensing. Purchasing such components exposes the buyer to potential IP infringement claims, especially when entering regulated markets like the U.S. or EU. Reverse-engineered or cloned voice coils may appear cost-effective but can damage brand reputation and result in costly litigation. Always verify that suppliers respect IP rights and can provide documentation proving the legitimacy of their designs and manufacturing processes.

Inadequate Environmental and Performance Certification (e.g., IP Ratings)

While “IP” often refers to Intellectual Property, in hardware contexts it may also denote Ingress Protection ratings—though less common for internal components like voice coils. However, confusion can arise. More importantly, suppliers may falsely claim performance certifications (e.g., high-temperature tolerance, humidity resistance) without proper testing. Voice coils used in outdoor or high-humidity environments must withstand thermal cycling and oxidation. Sourcing from vendors without verifiable test data or third-party certifications increases the risk of premature failure in demanding applications.

Supply Chain Transparency and Traceability Gaps

Many subwoofer voice coil suppliers operate through complex subcontracting networks, making it difficult to trace material origins or enforce quality standards. Lack of transparency increases the risk of counterfeit components, recycled materials, or unethical labor practices entering the supply chain. Without clear traceability, it becomes challenging to address quality issues or respond to compliance audits, especially under regulations like RoHS or REACH.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence on suppliers: request material specifications, quality control reports, and IP compliance documentation. Perform on-site audits when possible, and consider working with established manufacturers that invest in R&D and hold relevant certifications. Prototyping and rigorous testing before mass production are essential to validate both performance and IP safety.

Logistics & Compliance Guide for Subwoofer Voice Coil

Overview

Subwoofer voice coils are critical electromechanical components used in audio systems to convert electrical signals into mechanical motion, producing low-frequency sound. Due to their composition and function, specific logistics and regulatory compliance considerations must be observed during international shipping, storage, and handling.

Material Composition and Handling

Voice coils are typically constructed from copper or aluminum wire wound around a former made of materials such as aluminum, Kapton, or fiberglass. These materials are generally non-hazardous but sensitive to environmental factors.

– Temperature Sensitivity: Avoid exposure to extreme heat (>80°C) which may degrade insulation or deform the coil former.

– Moisture Protection: Store in dry conditions (relative humidity <60%) to prevent oxidation of conductive windings.

– Electrostatic Discharge (ESD): Use ESD-safe packaging and handling procedures to protect sensitive electronic components during assembly.

Packaging Requirements

Proper packaging ensures product integrity during transit:

– Use anti-static bags or shielded packaging for individual coils.

– Cushioning materials (e.g., foam inserts) must prevent movement within the container.

– Seal in moisture-barrier bags with desiccants if shipping to humid climates or for long-term storage.

– Label packages with “Fragile,” “Handle with Care,” and “Do Not Stack” as appropriate.

Shipping and Transportation

Voice coils are generally non-regulated for hazardous transport under IATA, IMDG, or ADR when shipped standalone.

– Classification: Typically classified under HS Code 8503.00.00 (parts of loudspeakers) or 8544.42.00 (insulated winding wire). Confirm with local customs authority.

– Documentation: Include commercial invoice, packing list, and bill of lading.

– Export Controls: No ITAR or EAR restrictions apply in most cases, but verify if coils are designed for military or aerospace applications.

– Marking: Clearly label with product name, part number, batch/lot number, and country of origin.

Regulatory Compliance

Ensure adherence to regional and international standards:

– RoHS (EU): Voice coils must comply with Restriction of Hazardous Substances Directive 2011/65/EU. Confirm absence of lead, cadmium, mercury, hexavalent chromium, PBB, and PBDE above permitted levels.

– REACH (EU): Register and communicate substances of very high concern (SVHC) if present above threshold.

– Proposition 65 (California, USA): If components contain listed chemicals (e.g., lead in solder), provide appropriate warnings.

– WEEE (EU): Although voice coils are components, ensure end-product compliance if supplied as part of an assembly.

Import Considerations

- Customs Duties: Duty rates vary by destination; check HTS code classification in the importing country.

- Product Certification: No standalone safety certification (e.g., UL, CE) is required for voice coils, but end-products (e.g., subwoofers) may require full compliance.

- Labeling: Include manufacturer details, voltage/current ratings (if applicable), and compliance marks (e.g., CE, RoHS) on packaging or product if required by downstream integration.

Storage and Inventory Management

- Store in a clean, climate-controlled warehouse.

- Implement FIFO (First In, First Out) to minimize aging effects.

- Monitor shelf life—insulation materials may degrade after prolonged storage (typically >24 months).

End-of-Life and Recycling

- Copper and aluminum content makes voice coils recyclable.

- Segregate from electronic waste streams for proper recovery.

- Comply with local e-waste regulations when disposing of defective or obsolete units.

Summary

Subwoofer voice coils require careful handling and documentation to ensure logistics efficiency and regulatory compliance. While not classified as hazardous goods, attention to electrostatic protection, moisture control, and material compliance (RoHS, REACH) is essential. Always coordinate with suppliers and customers to meet destination-specific import and environmental standards.

In conclusion, sourcing subwoofer voice coils requires careful consideration of several key factors including material quality, compatibility with existing speaker designs, power handling capacity, thermal durability, and cost-efficiency. Whether sourcing locally or internationally, it is essential to partner with reliable suppliers who adhere to industry standards and can provide consistent quality and timely delivery. Evaluating parameters such as voice coil diameter, winding material (copper or aluminum), former type (e.g., Kapton, aluminum, or fiberglass), and adhesion to heat-resistant practices ensures optimal performance and longevity of the subwoofer. Additionally, conducting thorough supplier assessments, requesting samples, and performing performance testing can significantly reduce risks and enhance product reliability. Ultimately, a strategic and informed sourcing approach will support superior audio performance, operational efficiency, and competitiveness in the audio equipment market.