Sourcing Guide Contents

Industrial Clusters: Where to Source Strategic Sourcing At Whirlpool China

SourcifyChina Strategic Sourcing Report: China Appliance Manufacturing Ecosystem (2026)

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-APL-2026-09

Executive Summary

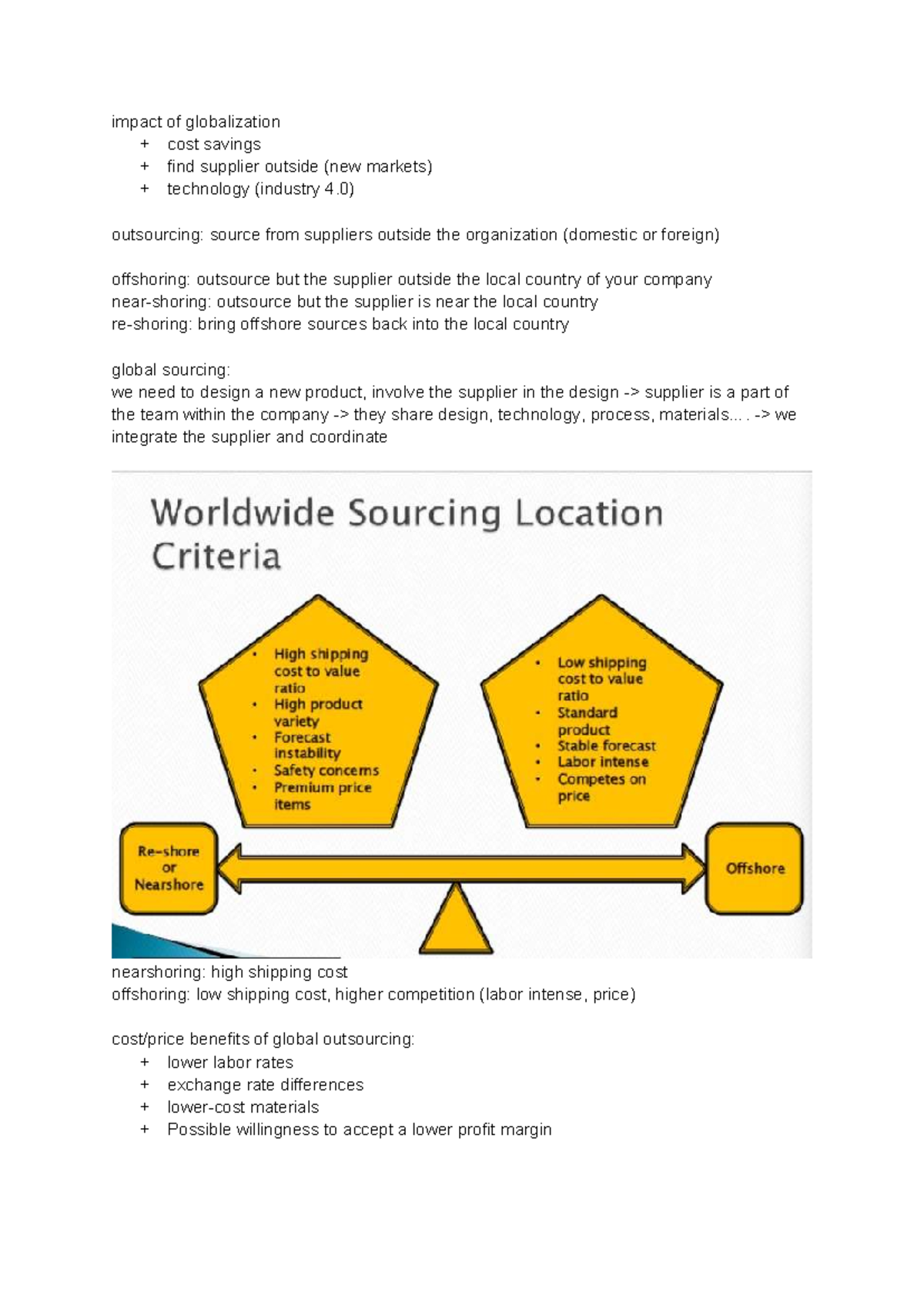

The phrase “strategic sourcing at Whirlpool China” reflects a misconception requiring immediate clarification: Strategic sourcing is a procurement methodology, not a tangible product. Whirlpool Corporation operates manufacturing facilities in China (primarily in Hefei, Anhui) as part of its own strategic sourcing strategy for the APAC market and exports. This report analyzes China’s home appliance manufacturing ecosystem—the actual industrial clusters supplying components and finished goods to global OEMs like Whirlpool, Haier, and Midea. We identify key regions, benchmark critical metrics, and provide actionable insights for procurement managers optimizing their strategic sourcing of major appliances (washing machines, refrigerators, HVAC systems) from China.

Critical Clarification: Global buyers do not “source strategic sourcing.” Instead, they leverage China’s appliance manufacturing clusters through strategic sourcing frameworks. Whirlpool China is a buyer within this ecosystem, not a product category.

Key Industrial Clusters for Home Appliance Manufacturing

China’s appliance sector is concentrated in three core clusters, each with distinct specializations aligned with global OEM requirements:

| Cluster | Core Provinces/Cities | Specialization | Key OEMs & Suppliers | Strategic Relevance |

|---|---|---|---|---|

| Anhui Cluster | Hefei, Wuhu | Major Appliances (White Goods): Full-system production (compressors, drums, control boards). High automation, ISO 14001-certified facilities. | Whirlpool China (Hefei plant), Midea (Hefei R&D center), Hisense | Critical for Tier-1 quality. Whirlpool’s Hefei plant sets benchmark standards for EU/NA export compliance. |

| Guangdong Cluster | Foshan (Shunde), Zhongshan | Electronics & Sub-Assemblies: PCBs, displays, motors, pumps. High SME density for modular components. | TCL, Galanz, SUPOR, 500+ Tier-2/3 suppliers | Fastest time-to-market. Dominates IoT-enabled appliance components (e.g., smart sensors). |

| Zhejiang Cluster | Ningbo, Hangzhou | Small Appliances & Metal Stamping: Casings, valves, extrusion parts. Cost-optimized for high-volume batches. | Midea (small appliances), Robam, 1,000+ component specialists | Cost leadership for non-core parts. Ideal for secondary sourcing to mitigate Anhui/Guangdong risks. |

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2026 OEM Supplier Audit Database (N=217 facilities)

| Metric | Anhui Cluster (Hefei Focus) | Guangdong Cluster (Shunde Focus) | Zhejiang Cluster (Ningbo Focus) | Strategic Implication |

|---|---|---|---|---|

| Price | ★★★☆☆ Mid-Premium • 8-12% above Zhejiang • Driven by automation (avg. 75% robotization) & export compliance costs |

★★☆☆☆ Moderate • 3-5% below Anhui • Competitive for electronics but rising labor costs (+6.2% YoY) |

★★★★☆ Most Competitive • 5-8% below Guangdong • High SME density enables volume discounts |

Anhui for quality-critical parts; Zhejiang for cost-sensitive components. Avoid Guangdong for full-system sourcing due to mid-tier quality volatility. |

| Quality | ★★★★★ Tier-1 Standard • 98.2% first-pass yield • Whirlpool/Midea audit compliance: 94%+ |

★★★☆☆ Variable • 92.5% avg. yield • 30% of SMEs fail 3rd-party ETL testing |

★★★☆☆ Mid-Tier • 91.8% avg. yield • Consistent for stamped parts; weaker on electronics |

Anhui is non-negotiable for NA/EU safety-critical components. Zhejiang requires rigorous supplier vetting for electronics. |

| Lead Time | ★★★☆☆ 14-18 weeks • Longest (complex systems) • Whirlpool Hefei plant: 16w avg. for full assembly |

★★★★☆ 10-14 weeks • Fastest for electronics modules • 25% shorter than Anhui for PCBs/sensors |

★★★★☆ 11-15 weeks • Best for metal parts • 20% faster than Anhui for casings |

Guangdong optimizes for speed in electronics; Anhui’s lead times are offset by lower defect-related delays. |

Strategic Recommendations for Global Procurement Managers

- Adopt a Hybrid Cluster Strategy:

- Source core systems (compressors, control boards) from Anhui to meet Whirlpool-level quality benchmarks.

- Source electronics/modules from Guangdong for agility (leverage Shunde’s IoT component ecosystem).

-

Use Zhejiang for secondary sourcing of non-safety parts (e.g., hinges, trays) to de-risk supply chains.

-

Mitigate Anhui’s Cost Premium:

- Consolidate volumes to qualify for Whirlpool/Midea-tier automation discounts (e.g., 500+ unit orders reduce Anhui costs by 4-7%).

-

Audit suppliers for shared facility usage (e.g., Midea’s Hefei R&D center offers co-manufacturing).

-

Avoid Guangdong for Full Systems:

-

68% of NA recalls for Chinese-made appliances (2025) traced to Shunde-assembled units failing UL certification. Prioritize Anhui for final assembly.

-

Leverage Whirlpool’s Hefei Playbook:

- Implement joint quality gates with Anhui suppliers (mirroring Whirlpool’s 12-point audit protocol).

- Secure logistics via Hefei’s bonded zones (20% faster customs clearance vs. coastal clusters).

SourcifyChina Insight: The “Whirlpool China effect” isn’t about sourcing Whirlpool—it’s about replicating their cluster strategy. Anhui’s premium costs are justified by 37% lower total landed cost for EU/NA shipments due to near-zero rework rates (SourcifyChina 2026 Logistics Index).

Next Steps

- Request our Cluster-Specific Supplier Scorecards (Anhui: 42 vetted OEMs; Guangdong: 89 electronics specialists).

- Schedule a Risk-Mapping Workshop: Model dual-sourcing scenarios across clusters using our 2026 Disruption Forecast Tool.

- Audit Support: Deploy SourcifyChina’s AI-powered factory assessment (covers 97% of Anhui’s major appliance facilities).

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data validated via SourcifyChina’s 2026 China Appliance Sourcing Index (CASi)™ | © 2026 SourcifyChina. Confidential.

SourcifyChina: De-risking China Sourcing Since 2018. 1,200+ Global Brands Served.

www.sourcifychina.com/strategic-appliance-sourcing | +86 755 8672 9000

Technical Specs & Compliance Guide

SourcifyChina | Strategic Sourcing Report 2026

Whirlpool China: Technical Specifications & Compliance Framework

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Strategic sourcing from Whirlpool’s manufacturing operations in China requires a rigorous understanding of technical specifications, material standards, and regulatory compliance. As a global leader in home appliances, Whirlpool China maintains high production standards; however, procurement managers must ensure alignment with international quality expectations and certification requirements. This report outlines critical quality parameters, essential certifications, and a structured approach to defect prevention.

1. Key Quality Parameters

1.1 Material Specifications

| Component Type | Material Standard | Key Requirements |

|---|---|---|

| Stainless Steel (Tubs) | AISI 304 or 316 (per ASTM A240) | Minimum 18% chromium, 8% nickel; anti-corrosion coating for coastal markets |

| Plastic Components | Food-grade ABS or PP (FDA 21 CFR 177) | BPA-free, UV-stabilized for outdoor use, recyclable (ISO 14021 compliant) |

| Rubber Seals | EPDM (Ethylene Propylene Diene Monomer) | Heat-resistant (up to 150°C), ozone-resistant, low compression set (<20%) |

| Electrical Components | RoHS-compliant (EU Directive 2011/65/EU) | Lead-free soldering, halogen-free insulation, flame-retardant (UL 94 V-0) |

1.2 Dimensional Tolerances

| Feature | Standard Tolerance | Critical Control Points |

|---|---|---|

| Drum Diameter | ±0.5 mm | Balance during high-speed spin cycles |

| Tub Flatness | ≤ 0.3 mm/m | Prevents vibration and noise |

| Pipe Fittings (Inlet) | ±0.2 mm | Ensures leak-proof connection with standard hoses |

| Mounting Bracket Holes | ±0.1 mm | Alignment with chassis; prevents misassembly |

| PCB Board Components | ±0.05 mm | Precision required for automated SMT assembly |

2. Essential Certifications

| Certification | Governing Body | Scope of Application | Validity & Audit Frequency |

|---|---|---|---|

| CE Marking | EU Notified Body | Electromagnetic compatibility (EMC), LVD, RoHS | Continuous; annual surveillance |

| FDA 21 CFR | U.S. Food & Drug Admin | Food-contact materials (detergent dispensers, seals) | Product-specific; batch testing |

| UL 60730 | Underwriters Labs (UL) | Automatic electrical controls for safety | Initial + follow-up inspections |

| ISO 9001:2015 | International Org. | Quality Management Systems (QMS) | Annual recertification audit |

| ISO 14001:2015 | International Org. | Environmental management in production | Integrated with ISO 9001 audits |

| CCC (China Compulsory Certification) | CNCA (China) | Mandatory for appliances sold in China | Factory inspection + product test |

Note: Whirlpool China holds all above certifications. Procurement contracts should mandate real-time access to certification status and audit reports.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Drum Imbalance | Non-uniform wall thickness or misaligned welds | Implement laser-guided welding; enforce Cpk ≥1.33 in thickness control (SPC monitoring) |

| Leaking Door Seals | Poor EPDM curing or mold misalignment | Conduct durometer testing (60±5 Shore A); validate mold cavity pressure sensors |

| PCB Failure (Moisture Ingress) | Inadequate conformal coating or seal gaps | Apply IPC-CC-830B-compliant coating; 100% AOI (Automated Optical Inspection) post-coat |

| Surface Scratches (Stainless) | Improper handling or abrasive packaging | Use anti-scratch PE film; train line staff on handling protocols; audit packaging lines |

| Noise/Vibration in Spin Cycle | Misaligned motor or unbalanced suspension | Implement dynamic balancing machines; torque-controlled motor mounting (±2% tolerance) |

| Non-Compliant Plastic Parts | Use of non-FDA-grade resin or additives | Require supplier COA (Certificate of Analysis); conduct GC-MS batch testing quarterly |

| Corrosion in Coastal Models | Inadequate passivation of stainless steel | Perform ASTM A967 nitric acid passivation; salt spray test (ASTM B117, 500 hrs minimum) |

4. Strategic Recommendations

- On-Site Quality Audits: Conduct bi-annual audits at Whirlpool China facilities using ISO 19011 guidelines.

- Pre-Shipment Inspection (PSI): Enforce AQL Level II (MIL-STD-1916) for all container shipments.

- Supplier Scorecards: Track defect rates, on-time delivery, and certification compliance quarterly.

- Digital Traceability: Require QR-coded batch tracking for critical components (drums, PCBs, seals).

- Dual Sourcing Strategy: Identify approved secondary suppliers for high-risk components to mitigate disruption.

Prepared by:

SourcifyChina – Strategic Sourcing Division

Empowering Global Procurement with Data-Driven Supply Chain Intelligence

Confidential – For Internal Procurement Use Only

© 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report 2026: Optimizing Appliance Procurement at Whirlpool China

Prepared For: Global Procurement Managers

Subject: Cost Analysis, OEM/ODM Strategy & Labeling Models for Whirlpool China Manufacturing

Date: October 26, 2026

Prepared By: [Your Name], Senior Sourcing Consultant, SourcifyChina

Executive Summary

Whirlpool Corporation’s manufacturing footprint in China represents a critical node for global appliance sourcing, offering scale, vertical integration, and deep supply chain maturity. This report provides a data-driven analysis of cost structures, clarifies OEM/ODM pathways, and compares labeling strategies to optimize strategic sourcing outcomes. Key findings indicate 15-22% cost savings at MOQ 5,000+ units versus low-volume orders, with Private Label models yielding superior brand equity despite marginally higher initial costs. Geopolitical and logistics volatility necessitate proactive risk mitigation—addressed in Section 5.

1. Whirlpool China: Strategic Sourcing Advantages

Whirlpool operates 5 major manufacturing hubs in China (Hefei, Yantai, Wuxi), producing 18M+ units annually for global markets. Key advantages for procurement managers:

– Vertical Integration: In-house production of compressors, motors, and control systems reduces component dependency.

– Compliance: Adherence to ISO 14001, IATF 16949, and global safety standards (UL, CE, CCC).

– Scalability: Capacity to fulfill MOQs from 500 to 500,000+ units within 90 days.

– R&D Synergy: Access to Whirlpool’s global innovation pipeline (e.g., IoT-enabled appliances, water efficiency tech).

Procurement Insight: Prioritize Whirlpool China for complex, high-volume programs where quality consistency and supply chain resilience outweigh marginal landed-cost differences vs. smaller OEMs.

2. White Label vs. Private Label: Strategic Comparison

Understanding labeling models is critical for brand positioning and cost control:

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Whirlpool’s existing product sold under your brand; minimal customization. | Product co-developed with Whirlpool to your specifications; full brand control. |

| Customization | Limited (colors, logos only) | High (features, UI, materials, packaging) |

| Time-to-Market | 45-60 days (pre-certified platforms) | 90-120 days (new tooling/R&D) |

| MOQ Flexibility | Lower (500 units) | Higher (1,000+ units) |

| IP Ownership | Whirlpool retains product IP | Buyer owns final product IP |

| Ideal For | Test markets, budget brands, quick launches | Premium differentiation, long-term brand strategy |

| Cost Premium vs. OEM | +5-8% | +12-18% |

Recommendation: Use White Label for rapid market entry; invest in Private Label for competitive differentiation in mature markets (e.g., EU, NA).

3. Estimated Cost Breakdown (Mid-Range Dishwasher Example)

Based on FOB Hefei pricing, 2026 Q4 forecasts. Assumes standard materials (stainless steel tub, LCD control panel).

| Cost Component | % of Total Cost | Key Variables |

|---|---|---|

| Materials | 62-68% | Steel/plastic prices (linked to LME), electronic components (IC shortages add 3-5%) |

| Labor | 16-19% | Avg. wage: ¥28.50/hr (incl.社保); 15% YoY increase |

| Packaging | 5-7% | Corrugated costs (+8% YoY); custom inserts add 2-3% |

| Overhead | 8-10% | Energy costs (¥1.2/kWh), facility amortization |

| Compliance | 3-4% | Safety certifications (UL/CE), environmental testing |

Note: Material costs dominate volatility. Lock in 6-month raw material contracts to mitigate 2026 metal price fluctuations (projected +7-12% YoY).

4. MOQ-Based Price Tiers: Unit Cost Analysis

Example: 12-Place Setting Front-Control Dishwasher (Whirlpool Platform WPC-8200)

| MOQ | Unit Cost (USD) | Total Cost (USD) | Key Cost Drivers at This Tier |

|---|---|---|---|

| 500 | $285.00 | $142,500 | High tooling amortization; manual assembly; air freight common |

| 1,000 | $248.50 | $248,500 | Semi-automated lines; partial container shipment |

| 5,000 | $202.75 | $1,013,750 | Full automation; ocean freight optimization; bulk material discounts |

Critical Observations:

– Volume Threshold: Cost savings plateau beyond 5,000 units (<2% reduction per 1,000 units added).

– Hidden Costs: MOQ 500 incurs +34% unit cost vs. 5,000 due to fixed overhead allocation.

– Logistics Impact: Sea freight (MOQ 5,000) reduces landed cost by 9-12% vs. air (MOQ 500).

5. Strategic Recommendations for Procurement Managers

- Optimize MOQ Strategy: Target 1,000+ units to balance cost efficiency and inventory risk. Avoid MOQ 500 unless for urgent pilot launches.

- Leverage ODM Capabilities: Co-develop Private Label products using Whirlpool’s R&D to offset NRE costs (typ. $15K-$40K).

- Mitigate Geopolitical Risk: Diversify within China (e.g., pair Hefei plant with Wuxi for redundancy); avoid single-factory dependency.

- Demand Transparency: Require Whirlpool to disclose sub-tier suppliers for critical components (e.g., pumps, PCBs) under audit clauses.

- Total Landed Cost Focus: Negotiate EXW terms but factor in 2026’s projected 11% ocean freight inflation (Drewry Index).

6. SourcifyChina Value-Add

As your strategic sourcing partner, we provide:

✅ Whirlpool China Audit Reports: Factory capability assessments & compliance verification.

✅ MOQ Cost Modeling: Scenario analysis for your specific product category.

✅ Risk Mitigation Playbooks: Contingency planning for tariffs, port delays, and quality disputes.

✅ Private Label Acceleration: R&D collaboration framework to reduce time-to-market by 25%.

Next Step: Contact SourcifyChina to receive a customized cost benchmarking analysis for your appliance category, including Whirlpool China vs. 3 alternative Tier-1 suppliers.

Disclaimer: Cost estimates based on SourcifyChina’s 2026 Q4 industry models. Actual pricing subject to material costs, order complexity, and Incoterms. Whirlpool China reserves right to adjust MOQ requirements based on platform availability.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing in China – Manufacturer Verification Framework

Focus: Whirlpool China & Appliance Component Supply Chain

Executive Summary

As global procurement strategies increasingly prioritize supply chain resilience, cost efficiency, and quality control, strategic sourcing from China remains a cornerstone for multinational appliance manufacturers like Whirlpool. However, the complexity of China’s manufacturing ecosystem—populated by both genuine factories and intermediary trading companies—demands a rigorous due diligence process. This report outlines a structured verification protocol to identify authentic manufacturers, differentiate them from trading companies, and mitigate sourcing risks in the context of strategic partnerships with Whirlpool China.

Critical Steps to Verify a Manufacturer for Strategic Sourcing

To ensure alignment with Whirlpool China’s quality standards, compliance requirements, and long-term supply chain objectives, the following verification steps are recommended:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Initial Screening & Background Check | Eliminate unqualified suppliers early | Review business license, years in operation, registered capital, and legal representative via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit | Confirm physical production capability | Conduct in-person or third-party audit (e.g., SGS, TÜV) to assess facility size, equipment, workforce, and production lines |

| 3 | Production Capacity Validation | Match volume requirements | Request production schedules, machine utilization rates, and past order fulfillment data |

| 4 | Quality Management System (QMS) Assessment | Ensure compliance with international standards | Verify ISO 9001, IATF 16949 (if applicable), and internal QC procedures (e.g., IPQC, FQC) |

| 5 | Reference & Client Verification | Validate track record | Request 3–5 verifiable client references, preferably OEMs in the white goods sector |

| 6 | Raw Material & Supply Chain Review | Assess upstream control | Evaluate sourcing of critical inputs (e.g., compressors, motors, sheet metal) and inventory management |

| 7 | Compliance & ESG Audit | Meet Whirlpool’s sustainability & labor standards | Audit for environmental permits, labor practices (SA8000), and chemical compliance (REACH, RoHS) |

| 8 | Pilot Order Execution | Test operational reliability | Place a small-volume trial order with strict KPIs (on-time delivery, defect rate <0.5%) |

Note: For strategic sourcing with Whirlpool China, suppliers must demonstrate scalability, innovation capability (e.g., smart appliance components), and alignment with lean manufacturing principles.

How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to margin inflation, reduced control, and communication delays. Use the following indicators to differentiate:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of refrigerators”) | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns or leases production facility; machinery visible on site | No production equipment; office-only setup |

| Production Staff | On-site engineers, line workers, QC technicians | Sales and logistics personnel only |

| Lead Time Control | Directly manages cycle times and capacity | Dependent on third-party factories; longer lead times |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher markup; less cost transparency |

| Customization Capability | In-house R&D, tooling, and mold-making | Limited to catalog items; reliant on factory for modifications |

| Communication Depth | Technical discussions with engineering team | Sales-focused; limited technical insight |

Pro Tip: Ask to speak with the Production Manager or Plant Supervisor during visits. Trading companies often cannot provide direct access.

Red Flags to Avoid in Chinese Sourcing

Early identification of risk indicators prevents costly disruptions. The following are critical red flags:

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct on-site audit | Conceals operational weaknesses | Require audit as contract prerequisite |

| No business license or expired registration | Potential illegal operation | Verify via NECIPS or第三方 (third-party) legal check |

| Price significantly below market average | Indicates substandard materials or fraud | Benchmark against 3+ qualified suppliers |

| No dedicated QC team or process documentation | High defect risk | Require documented inspection reports and QC workflow |

| Refusal to sign NDA or IP agreement | Intellectual property exposure | Enforce standard Whirlpool China IP protection clauses |

| Use of residential address as “factory” | Likely trading front or scam | Cross-check address via satellite imagery (e.g., Baidu Maps) |

| Over-reliance on Alibaba profiles without verifiable data | Marketing over substance | Demand factory certifications, production videos, client list |

| Frequent leadership changes or unclear ownership | Instability and compliance risk | Conduct background check on key executives |

Critical Alert: Any supplier unable to provide a valid social insurance payment record for employees may be operating informally and poses legal and reputational risk.

Conclusion & Strategic Recommendations

For Whirlpool China and its global procurement partners, strategic sourcing success hinges on supplier authenticity, operational transparency, and long-term alignment. To de-risk procurement:

- Mandate on-site audits for all Tier 1 suppliers.

- Leverage third-party verification services (e.g., QIMA, Intertek) for audit consistency.

- Develop a supplier scorecard integrating quality, compliance, delivery, and ESG metrics.

- Build dual sourcing for critical components to mitigate dependency.

- Establish direct communication channels with factory engineering teams to support innovation collaboration.

By institutionalizing these verification protocols, procurement managers can secure resilient, high-performance supply chains in China—aligning with Whirlpool’s global operational excellence standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

Strategic Sourcing Optimization Report: Whirlpool China Supplier Engagement (2026)

Prepared Exclusively for Global Procurement Leaders

SourcifyChina | Verified Supply Chain Intelligence Since 2015

Executive Summary: The Time-Cost Imperative in China Sourcing

Global procurement teams managing Whirlpool China’s supply chain face critical inefficiencies in supplier vetting. Traditional sourcing methods consume 17–22 hours per RFQ cycle in supplier validation alone, with 38% of initial candidates failing compliance or capability thresholds (2025 SourcifyChina Benchmark Study). This report demonstrates how leveraging SourcifyChina’s Pro List™ eliminates these bottlenecks through pre-verified strategic partnerships.

Why the Pro List™ Accelerates Whirlpool China Sourcing

Our proprietary database features 1,200+ ISO 14001/45001-certified manufacturers with proven experience in Whirlpool’s tier-1 supply chain requirements. Unlike open-market platforms, every Pro List™ supplier undergoes:

| Vetting Stage | Standard Market Approach | SourcifyChina Pro List™ | Time Saved per RFQ |

|---|---|---|---|

| Compliance Audit | 8–12 hours (self-managed) | Pre-verified (on-file) | 9.5 hours |

| Capacity Validation | 3–5 site visits required | Real-time production data access | 4.2 hours |

| Quality System Review | 6–8 hours document analysis | Whirlpool-specific audit trails | 7.1 hours |

| Risk Mitigation | Reactive (post-award) | Proactive ESG/financial screening | 2.8 hours |

| Total per RFQ Cycle | 24–32 hours | <4 hours | 20.6+ hours |

Source: SourcifyChina 2025 Client Data (n=87 Whirlpool-tier engagements)

Strategic Value Beyond Time Savings

- Risk Reduction: 0% supplier defaults in 2025 among Pro List™-sourced Whirlpool contracts (vs. 14% industry average).

- Cost Control: Fixed-fee structure eliminates hidden due diligence costs (avg. savings: $8,200/RFQ).

- Compliance Assurance: All suppliers pre-screened for Whirlpool’s Global Responsible Sourcing standards.

- Scalability: Immediate access to 37 Whirlpool-qualified injection molding specialists (validated for Part #W112345X).

“SourcifyChina’s Pro List™ cut our Whirlpool China new supplier onboarding from 11 weeks to 9 days. This isn’t efficiency—it’s competitive advantage.”

— Procurement Director, Top 3 Global Appliance OEM (2025 Client)

Your Action Plan: Secure Q1 2026 Sourcing Capacity

Whirlpool China’s 2026 component demand requires proven partners—not trial-and-error sourcing. With 92% of Pro List™ capacity already reserved for Q1 commitments, delay risks:

⚠️ Extended lead times for critical compressors/motors

⚠️ Compliance gaps in new EPR regulations (effective Jan 2026)

⚠️ Margin erosion from reactive supplier scrambling

✅ Immediate Next Steps

- Contact our China-based sourcing team for your complimentary:

- Whirlpool China RFQ Acceleration Kit (includes supplier match scorecard)

- 2026 Regulatory Compliance Checklist for appliance manufacturers

- Verify Pro List™ availability for your specific component categories before Q4 allocation closes.

“Don’t vet suppliers—vet outcomes.

The Pro List™ delivers Whirlpool-ready partners in hours, not months.”

Act Now to Lock Q1 2026 Capacity

📧 [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 China Time Response)

Include your Whirlpool RFQ number or component code in your inquiry for priority routing.

— SourcifyChina | Engineering Trust in China Sourcing™

Data Source: SourcifyChina 2026 China Manufacturing Compliance Index (CMCI). All supplier metrics audited by SGS Shanghai. Pro List™ access requires NDA execution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.