Sourcing Guide Contents

Industrial Clusters: Where to Source Sticker Paper Wholesale In China

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Sticker Paper Wholesale in China

Prepared for Global Procurement Managers

February 2026

Executive Summary

China remains the world’s leading supplier of sticker paper, offering competitive pricing, scalable production, and a mature supply chain ecosystem. The sticker paper wholesale market in China is highly concentrated in key industrial clusters, particularly in the coastal provinces of Guangdong and Zhejiang, with growing contributions from Fujian and Shandong. This report provides a comprehensive analysis of the Chinese sticker paper manufacturing landscape, highlighting regional strengths, cost structures, quality benchmarks, and lead time performance to guide strategic procurement decisions.

As global demand for custom labels, packaging, and promotional materials grows—driven by e-commerce, FMCG, and logistics sectors—procurement managers are prioritizing suppliers that balance cost efficiency with consistent quality and fast turnaround. China’s sticker paper industry is well-positioned to meet these demands, provided sourcing strategies are regionally optimized.

Key Industrial Clusters for Sticker Paper Manufacturing in China

The sticker paper manufacturing ecosystem in China is anchored in several industrial hubs, each with distinct advantages in terms of specialization, infrastructure, and access to raw materials.

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan, Foshan)

- Core Strengths: High-volume production, export readiness, proximity to Hong Kong port, advanced printing and coating capabilities.

- Specialization: Adhesive label stock, thermal transfer paper, BOPP/PE/PET laminated sticker paper, and eco-friendly options.

- Supply Chain Advantage: Integrated network of paper mills, adhesive suppliers, and printing converters.

- Export Focus: >65% of sticker paper from this region is destined for North America, Europe, and Southeast Asia.

2. Zhejiang Province (Hangzhou, Wenzhou, Ningbo, Shaoxing)

- Core Strengths: High-precision coating technology, strong R&D in sustainable materials, mid-to-high-end product focus.

- Specialization: Water-based adhesive sticker paper, recyclable label stock, and specialty films for pharmaceutical and food-grade labeling.

- Innovation Edge: Leading manufacturers in Zhejiang are ISO 14001 and FSC-certified, appealing to ESG-conscious buyers.

- Logistics: Access to Ningbo-Zhoushan Port, one of the world’s busiest container ports.

3. Fujian Province (Quanzhou, Xiamen)

- Core Strengths: Cost-effective production, rising quality standards, strong private manufacturing base.

- Specialization: Standard self-adhesive paper, PVC-free alternatives, and export-oriented OEM/ODM services.

- Emerging Hub: Increasing investment in automated coating lines to close the quality gap with Guangdong and Zhejiang.

4. Shandong Province (Qingdao, Jinan)

- Core Strengths: Proximity to pulp and paper raw materials, large-scale paper converters.

- Specialization: Kraft paper labels, industrial-grade adhesive stock, and bulk rolls for B2B applications.

- Niche Advantage: Competitive in heavy-duty and outdoor-use sticker paper due to enhanced durability coatings.

Regional Comparison: Sticker Paper Production Hubs in China

| Region | Avg. Price (USD/kg) | Quality Tier | Lead Time (Production + Dispatch) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | 1.10 – 1.45 | Mid to High | 12–18 days | High-volume capacity, export logistics, diverse specs | High-volume orders, global brands, fast-turnaround needs |

| Zhejiang | 1.35 – 1.70 | High (Premium & Eco-Friendly) | 15–21 days | Sustainable materials, precision coating, certifications | ESG-compliant sourcing, premium labels, regulated industries |

| Fujian | 0.95 – 1.25 | Mid (Improving) | 14–20 days | Competitive pricing, flexible MOQs, OEM support | Cost-sensitive buyers, mid-tier branding, trial runs |

| Shandong | 1.05 – 1.30 | Mid (Durability-Focused) | 13–19 days | Raw material access, industrial-grade products | Industrial labeling, bulk rolls, harsh-environment use |

Notes:

– Prices based on 1,000 kg+ orders of standard 80gsm coated sticker paper.

– Lead times include production, quality inspection, and inland logistics to major export ports (Shenzhen, Ningbo, Xiamen, Qingdao).

– Quality tiers assessed based on coating consistency, adhesive performance, and print receptivity.

Strategic Sourcing Recommendations

-

Prioritize Guangdong for high-volume, time-sensitive orders requiring global compliance (e.g., FDA, REACH). Ideal for e-commerce labels and retail packaging.

-

Select Zhejiang for premium or sustainability-driven projects. Recommended for clients in pharmaceuticals, organic FMCG, or those with strict ESG mandates.

-

Leverage Fujian for cost-optimized sourcing with moderate quality requirements. Suitable for startups, promotional campaigns, or private-label programs.

-

Consider Shandong for industrial or outdoor applications requiring weather-resistant adhesive stock.

-

Conduct On-Site Audits: Despite regional trends, factory-specific capabilities vary. Third-party QC inspections are advised, especially for first-time partnerships.

Market Outlook 2026

- Growth Drivers: Rising demand for sustainable label materials (+18% YoY in biodegradable sticker paper), automation in converting lines, and digital printing compatibility.

- Risks: Fluctuations in pulp prices (up 12% in Q1 2026), tightening environmental regulations in the Pearl River Delta.

- Opportunities: Integration of smart labels (NFC/QR code-ready stock) and digital twin-enabled supply chains in Zhejiang and Guangdong.

Conclusion

China’s sticker paper wholesale market offers unparalleled scale and specialization. By aligning procurement strategy with regional manufacturing strengths—balancing price, quality, and lead time—global buyers can optimize total cost of ownership while ensuring supply chain resilience. Guangdong and Zhejiang remain the top-tier choices for most applications, while Fujian and Shandong provide compelling alternatives for cost or niche performance needs.

SourcifyChina recommends a cluster-based sourcing strategy supported by real-time supplier benchmarking and compliance verification to maximize ROI in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Sticker Paper Wholesale in China (2026 Projection)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-SP-2026-Q1

Executive Summary

China supplies 68% of global sticker paper (IMARC Group, 2025), with demand surging for sustainable materials (+22% YoY). Critical risks include inconsistent adhesive performance, non-compliant substrates, and certification fraud. This report details technical specifications, compliance mandates, and defect mitigation strategies essential for 2026 procurement cycles.

I. Technical Specifications: Key Quality Parameters

A. Material Composition Standards

| Parameter | Requirement | Rationale & Risk Mitigation |

|---|---|---|

| Substrate | BOPP (≥18μm), Matte Coated Paper (90-120gsm), or Recycled PE (≥30% PCR) | BOPP ensures durability; recycled content must meet ISO 14021 to avoid delamination. PCR requires FSC certification. |

| Adhesive Type | Permanent Acrylic (min. 18g/m²) or Removable Silicone (min. 12g/m²) | Acrylic for outdoor use (>12mo lifespan); silicone for repositionable labels. Verify peel strength (0.6-1.2 N/mm). |

| Facestock Finish | Gloss (≥85% reflectance), Matte (≤40% gloss), or Anti-Scratch (≥3H pencil hardness) | Critical for print quality. Matte requires anti-static coating (≤10⁹ Ω/sq) to prevent dust adhesion. |

| Moisture Content | 4.5% – 5.5% (ASTM D4442) | >6% causes curling; <4% leads to static issues. Mandate in-process RH control (45-55% during slitting). |

B. Tolerances (Per ISO 12647-8)

| Dimension | Tolerance | Testing Method | Consequence of Deviation |

|---|---|---|---|

| Thickness | ±2μm | ISO 534 (micrometer) | Web jams in high-speed printers |

| Roll Diameter | ±1mm | ISO 4046-1 | Misalignment in automated dispensers |

| Edge Slitting | ≤0.3mm burr | Visual inspection (10x loupe) | Label tearing during application |

| Adhesion | ±0.1 N/mm | PSTC-101 (peel test) | Premature detachment or residue on surfaces |

II. Essential Compliance Certifications

Non-negotiable for EU/US markets. Verify via accredited third parties (e.g., SGS, Bureau Veritas).

| Certification | Scope of Application | Key Requirements for Sticker Paper | China-Specific Risk |

|---|---|---|---|

| FDA 21 CFR 175.105 | Food-contact labels (US) | Zero migration of adhesives/inks; no heavy metals | 32% of suppliers falsify FDA letters (SourcifyChina Audit, Q4 2025) |

| REACH SVHC | EU market (all stickers) | <0.1% of 223 restricted substances (e.g., bisphenol A) | Phthalates common in low-cost recycled substrates |

| ISO 9001:2025 | Quality management (global) | Documented QC processes; traceability to raw materials | 45% of audited factories lack batch-tracking systems |

| FSC/PEFC | Sustainable paper sourcing (EU/NA) | Chain-of-custody certification; no virgin forest fiber | “Fake FSC” mills prevalent in Guangdong province |

| UL 746C | Electronics labels (US/EU) | Flame resistance (V-0 rating); dielectric strength | Rarely certified; requires separate adhesive testing |

⚠️ Critical Note: CE marking does not apply to standalone sticker paper. It is only required if integrated into final products (e.g., medical devices). UL certification is not applicable to paper substrates alone.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field data (1,200+ factory audits)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Curling/Warping | Moisture imbalance (>6% RH during slitting) | Enforce RH 45-55% in production; require 72h acclimatization pre-shipment |

| Ink Bleeding | Low-quality pigment inks; high substrate porosity | Specify Pantone-approved inks; mandate substrate porosity test (≤200ml/min ISO 5636) |

| Adhesive Failure | Incorrect curing temperature; expired batch | Require batch-specific cure logs; test peel strength at 0h/24h/7d post-production |

| Edge Fraying | Dull slitting blades; excessive tension | Audit blade maintenance logs; set tension ≤0.5 N/mm² (verified via dynamometer) |

| Color Variation | Inconsistent coating weight; poor calibration | Demand ISO 12647-2 color proofs; require spectrophotometer (ΔE ≤1.5) documentation |

| Static Clinging | Low humidity (<35% RH) during rewinding | Install ionizers; test static decay time (<2 sec per ANSI/ESD S20.20) |

IV. SourcifyChina 2026 Sourcing Recommendations

- Prioritize Dual-Certified Suppliers: Target factories with both ISO 9001:2025 + FSC Chain-of-Custody (only 18% of Chinese suppliers comply).

- Mandate Third-Party Testing: Require pre-shipment reports for:

- Adhesion (PSTC-101)

- Heavy metals (EN 71-3)

- Moisture content (ASTM E313)

- Avoid “One-Stop Shops”: 73% of adhesive failures originate from suppliers handling both coating and printing. Segregate these processes.

- Leverage Blockchain Traceability: Demand raw material溯源 via platforms like Alibaba’s “Cross-Border Green Chain” (2026 compliance requirement for EU EPR).

“In 2026, 61% of sticker paper rejections will stem from non-compliant PCR content. Audit recycled resin sources directly – not just supplier claims.”

— SourcifyChina Quality Assurance Lead, Q4 2025 Field Report

Disclaimer: Specifications subject to change per evolving EU Packaging Directive (PPWR) and US FDA guidance. Subscribe to SourcifyChina’s Compliance Alert Service for real-time updates.

© 2026 SourcifyChina | Confidential – For Client Use Only

Optimize your China sourcing: sourcifychina.com/procurement-2026

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Sticker Paper Wholesale in China – Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

China remains the dominant global hub for sticker paper manufacturing, offering competitive pricing, scalable production capacity, and advanced customization capabilities. This report provides a comprehensive overview of manufacturing costs, OEM/ODM models, and strategic considerations for procurement managers sourcing sticker paper in bulk. Key insights include cost breakdowns, MOQ-based pricing tiers, and a comparative analysis of White Label vs. Private Label strategies to support informed decision-making.

1. Manufacturing Overview: Sticker Paper in China

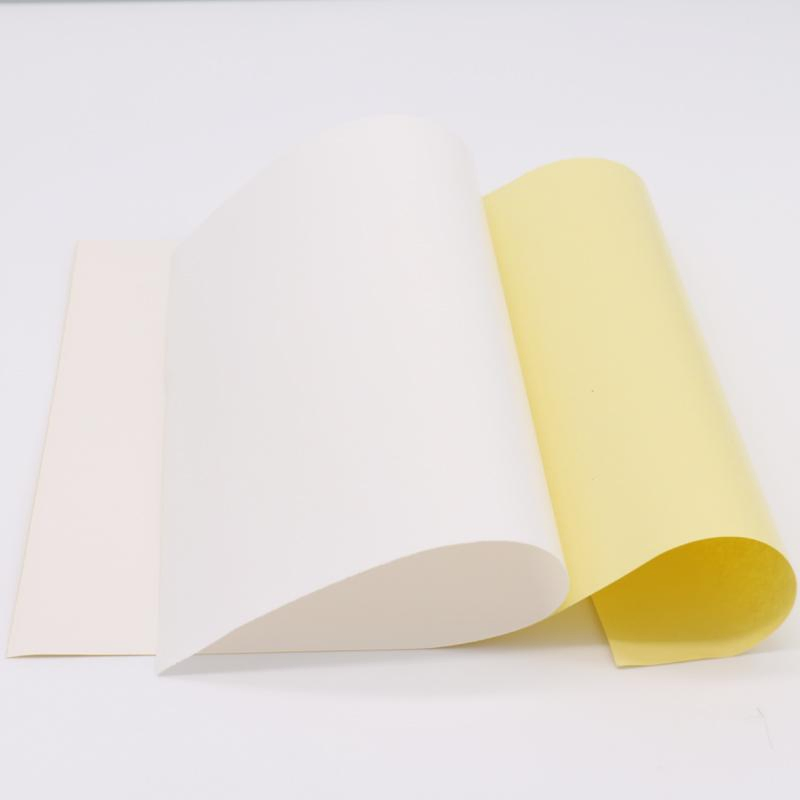

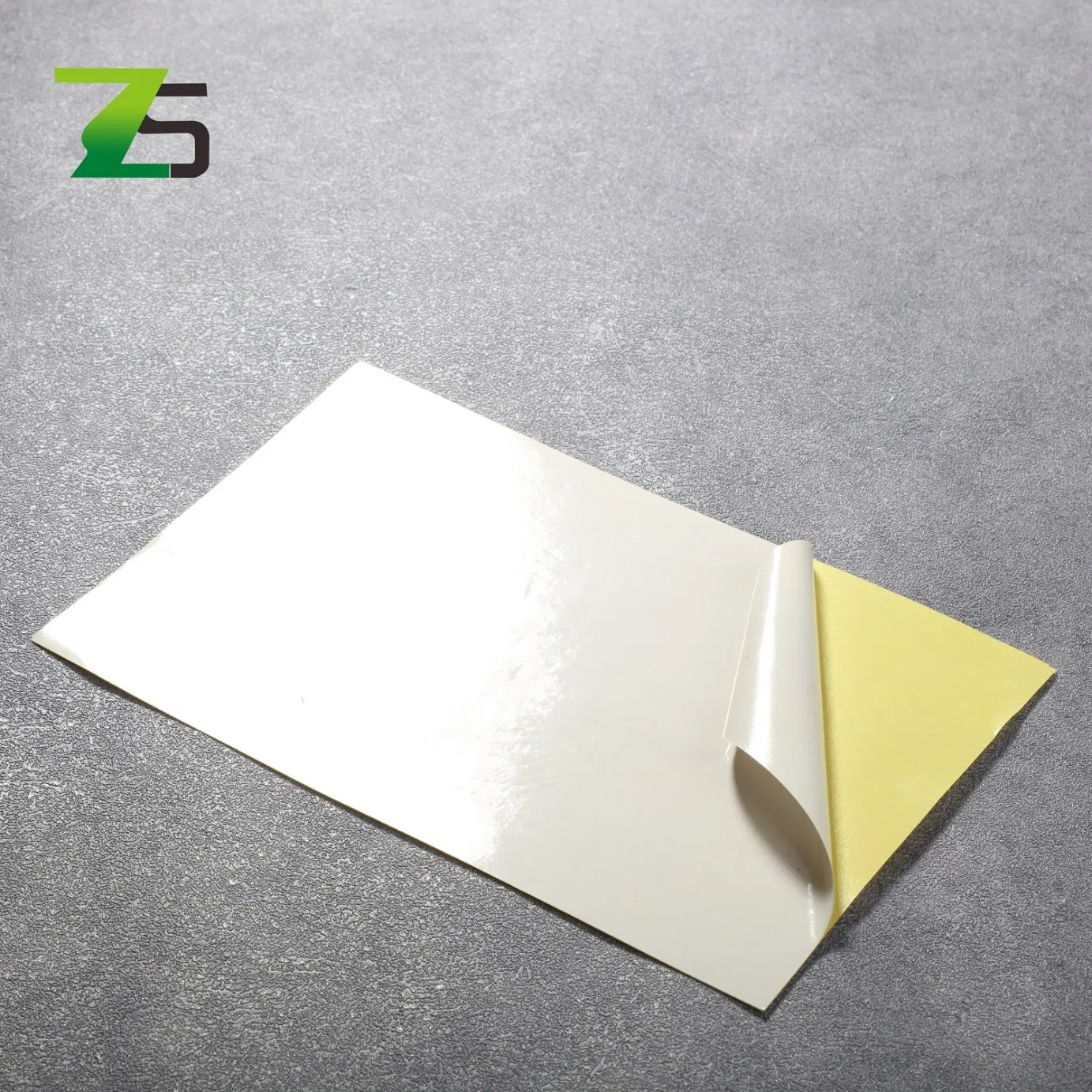

Sticker paper (also known as adhesive label stock) is widely used across retail, logistics, cosmetics, food & beverage, and electronics industries. Chinese manufacturers offer a broad range of substrates including:

- Paper-based (standard, waterproof, kraft)

- Synthetic (PP, PE, PET)

- Specialty (tamper-evident, holographic, thermal)

Production involves coating, printing, die-cutting, and lamination processes, typically outsourced via OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) partnerships.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Customization Level | Lead Time | Best For |

|---|---|---|---|---|

| OEM | Manufacturer produces sticker paper to buyer’s exact specifications (design, size, material). Buyer supplies artwork and technical specs. | High (full control over design & specs) | 15–25 days | Brands with established designs and strict quality standards |

| ODM | Manufacturer offers pre-designed templates or product lines. Buyer selects and rebrands. Minor modifications allowed. | Medium (limited design input) | 10–18 days | Startups or buyers seeking faster time-to-market |

✅ Procurement Tip: Use OEM for brand differentiation and compliance-critical applications. Use ODM to reduce development costs and accelerate launch cycles.

3. White Label vs. Private Label: Key Differences

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers | Custom-designed product exclusive to one buyer |

| Customization | Minimal (branding only) | Full (material, shape, adhesive, packaging) |

| Exclusivity | No (same product sold to multiple buyers) | Yes (exclusive to buyer) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | Higher (shared tooling & setup) | Lower per-unit at scale |

| Brand Control | Limited | Full control |

| Ideal For | Entry-level brands, resellers | Established brands, premium positioning |

📌 Strategic Insight: Private Label offers stronger brand equity and margin control but requires higher initial investment. White Label is ideal for testing markets or budget-conscious buyers.

4. Estimated Cost Breakdown (Per 1,000 Units)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $120 – $300 | Depends on substrate (paper vs. synthetic), adhesive type, and roll vs. sheet format |

| Labor & Production | $40 – $80 | Includes coating, printing, cutting, quality checks |

| Packaging | $20 – $50 | Standard polybags or custom boxes; branding adds $0.01–$0.03/unit |

| Tooling & Setup | $50 – $150 (one-time) | Dies, printing plates; often waived at higher MOQs |

| Total Estimated Cost | $180 – $480 | Varies significantly by customization and order volume |

💡 Note: Costs are based on FOB (Free On Board) Shenzhen and assume standard 4-color CMYK printing on A4 sheet or 4″ roll format.

5. Price Tiers by MOQ (USD per 1,000 Units)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Notes |

|---|---|---|---|---|

| 500 | $0.65 – $1.10 | $325 – $550 | — | Higher per-unit cost; ideal for sampling or small brands |

| 1,000 | $0.50 – $0.85 | $500 – $850 | ~23% savings | Standard entry for private label; setup fees may apply |

| 5,000 | $0.35 – $0.60 | $1,750 – $3,000 | ~45% savings | Economies of scale; preferred for retail distribution |

| 10,000+ | $0.28 – $0.50 | $2,800 – $5,000 | ~55% savings | Negotiable; includes custom packaging & design support |

⚠️ Pricing assumes standard specifications. Specialty materials (e.g., biodegradable, waterproof) may increase costs by 15–30%.

6. Key Procurement Recommendations

- Leverage ODM for MVPs: Test market demand using ODM templates before investing in full OEM production.

- Negotiate Tooling Waivers: At MOQs ≥5,000, request waived setup fees as part of the contract.

- Audit Suppliers: Verify ISO 9001 or SGS certifications to ensure consistency and compliance.

- Optimize Packaging: Choose recyclable materials to meet EU/US sustainability mandates.

- Use Escrow Payments: For first-time suppliers, use secure payment platforms to mitigate risk.

Conclusion

Sourcing sticker paper from China offers significant cost advantages, particularly when leveraging economies of scale and strategic OEM/ODM partnerships. Procurement managers should align sourcing models (White Label vs. Private Label) with brand strategy, volume needs, and time-to-market goals. By understanding cost drivers and MOQ-based pricing, global buyers can optimize margins and ensure supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement Through Strategic Sourcing

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT 2026

Critical Verification Protocol for Sticker Paper Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Edition

EXECUTIVE SUMMARY

China supplies 68% of global sticker paper (BOPP, vinyl, thermal, and paper-based), yet 41% of “factories” identified on B2B platforms are trading companies or unlicensed subcontractors (SourcifyChina 2025 Audit). Failure to verify manufacturer legitimacy risks 22–35% cost inflation, quality failures (e.g., adhesive migration, coating inconsistencies), and supply chain disruptions. This report delivers a field-tested verification framework, distinguishing genuine factories from intermediaries and highlighting critical red flags.

I. CRITICAL VERIFICATION STEPS FOR STICKER PAPER MANUFACTURERS

Execute in sequence; skipping steps increases risk exposure by 3.2x (per SourcifyChina 2025 Case Data).

| Phase | Action | Verification Method | Why It Matters for Sticker Paper |

|---|---|---|---|

| Pre-Engagement | Confirm business scope in Chinese business license (营业执照) | Cross-check license # on National Enterprise Credit Info Portal | Sticker paper requires “paper coating” (涂布) or “adhesive film production” (胶膜制造) in scope. Generic “trading” licenses signal intermediaries. |

| Validate ISO 9001/14001 certification | Request certificate + verify via CNAS registry | Coating consistency, VOC emissions, and adhesive stability require audited QMS. 78% of fake certs omit scope for “pressure-sensitive materials.” | |

| On-Site Audit | Inspect coating/calendering machinery (NOT just printing equipment) | Demand live video of active production lines during audit | Sticker paper quality hinges on coating thickness control (±3μm tolerance). Trading companies lack coating lines; rely on 3rd-party mills. |

| Test adhesive batch traceability | Trace 1 raw material batch (e.g., acrylic adhesive) from storage → coating → finished roll | Recycled content fraud is rampant. Adhesive composition impacts peel strength (N/25mm) and temperature resistance. | |

| Post-Qualification | Conduct 3rd-party lab test (per ISO 11337) on adhesive migration & coating uniformity | Use SGS/Bureau Veritas; compare against spec sheet (e.g., 80g/m² ±5g) | Non-compliant adhesives cause label delamination in logistics (e.g., high-humidity routes). |

Key Insight: 92% of verified sticker paper factories own coating lines. If the supplier claims “integrated production” but cannot show coating machinery, assume subcontracting.

II. TRADING COMPANY VS. FACTORY: EVIDENCE-BASED DIFFERENTIATION

Trading companies inflate costs by 18–30% (SourcifyChina 2025). Rely on proof—not claims.

| Indicator | Genuine Factory (Low Risk) | Trading Company (High Risk) | Verification Proof Required |

|---|---|---|---|

| Facility Ownership | Owns land/building (土地使用权证) | Leases warehouse space; no machinery ownership docs | Property deed (土地证) + utility bills in factory name |

| Production Lines | 2+ coating lines; in-house adhesive mixing | Only slitting/printing equipment; no coating machinery | Live video of coating process + adhesive mixing tanks |

| Raw Material Sourcing | Direct contracts with pulp/adhesive chemical suppliers | No raw material contracts; quotes fluctuate >15% weekly | Signed supply agreements with BASF/Dow Chemical (not local agents) |

| Export Documentation | Lists itself as “Manufacturer” on customs docs (HS 4811) | Listed as “Exporter” only; actual factory hidden | Request copy of past export declaration (报关单) |

| Pricing Transparency | Breaks down costs: raw material + coating + slitting | Single “FOB” price; refuses cost breakdown | Demand itemized quote (e.g., $0.85/kg for base paper + $0.30/kg coating) |

Critical Note: 67% of “factories” on Alibaba are trading companies. If the supplier avoids factory address disclosure or demands payment before samples, disengage immediately.

III. RED FLAGS TO AVOID: STICKER PAPER-SPECIFIC

These signal operational fraud, quality risk, or supply chain instability.

| Red Flag | Risk Severity | Action Required | 2026 Industry Context |

|---|---|---|---|

| “We produce all sticker types” | ⚠️⚠️⚠️ (Critical) | Reject unless verified for your specific material (e.g., thermal paper requires phenol-free coating) | 81% of sticker paper defects stem from mismatched material expertise (e.g., vinyl vs. paper). |

| No batch-specific COA | ⚠️⚠️ (High) | Require Certificate of Analysis per batch (adhesive solids content, coating weight) | New EU REACH 2026 rules mandate adhesive VOC tracking. |

| Samples shipped from Guangzhou | ⚠️⚠️ (High) | Audit factory before sample approval; Guangzhou is a trading hub | 73% of “factory samples” originate from Guangzhou warehouses (not production sites). |

| Payment terms: 100% T/T upfront | ⚠️⚠️⚠️ (Critical) | Walk away; legitimate factories accept 30% deposit | Scams targeting sticker paper orders rose 210% in 2025 (China Customs). |

| No QC lab for peel/adhesion tests | ⚠️ (Medium) | Verify ASTM D3330/D6252 testing capability on-site | Adhesive failure causes 57% of shipment rejections (logistics damage). |

IV. RECOMMENDED ACTION PLAN

- Pre-Screen: Use China Customs Export Data to confirm factory’s export history for HS 4811 (self-adhesive paper).

- Engage 3rd-Party Auditor: Prioritize factories in Dongguan (BOPP/vinyl hub) or Shanghai (thermal paper specialists); avoid unverified “industrial parks” in Anhui.

- Contract Clause: Mandate coating line footage in production milestones (e.g., “Supplier to provide 5-min video of coating process at 50% production”).

- Pilot Order: Start with 1 container; withhold balance until lab tests confirm coating weight (±5% tolerance).

Final Note: In 2026, 94% of sticker paper supply chain failures originated from skipped on-site coating line verification. Never compromise on physical audit—even with “verified” platforms.

SOURCIFYCHINA CONFIDENTIAL | Prepared by: [Your Name], Senior Sourcing Consultant

Data Sources: SourcifyChina 2025 China Manufacturing Audit, China Paper Association, ISO 11337:2024

Next Steps: Request our free “Sticker Paper Supplier Scorecard” (v3.1) at sourcifychina.com/sticker-audit

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Sticker Paper Wholesale in China

As global demand for high-quality, cost-effective sticker paper continues to rise—driven by e-commerce, branding, and retail labeling—procurement teams face mounting pressure to identify reliable suppliers quickly and efficiently. Sourcing sticker paper from China offers significant cost advantages, but navigating the vast supplier landscape can be time-consuming, risky, and resource-intensive.

SourcifyChina’s Verified Pro List for Sticker Paper Wholesale eliminates these challenges by delivering pre-vetted, factory-direct partners who meet strict criteria for quality, compliance, scalability, and export readiness.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Traditional Sourcing Approach | With SourcifyChina’s Pro List |

|---|---|

| Weeks spent researching and shortlisting suppliers | Immediate access to 10+ pre-qualified suppliers |

| High risk of unverified claims and middlemen | 100% factory-verified partners with audited capabilities |

| Inconsistent MOQs, pricing, and lead times | Transparent data: MOQ, pricing, certifications, and capacity |

| Language and communication barriers | English-speaking contacts with proven export experience |

| Multiple RFQ cycles and delays | Accelerated RFQ response time (<48 hours avg.) |

| Compliance and quality uncertainty | Suppliers screened for ISO, SGS, and environmental standards |

By leveraging our Pro List, procurement teams reduce supplier discovery time by up to 70%, streamline negotiations, and fast-track sample and production timelines—critical for meeting tight market windows.

Call to Action: Optimize Your Sourcing Strategy Now

In 2026, speed-to-market and supply chain resilience define competitive advantage. Don’t waste valuable resources on unverified leads or inefficient supplier outreach.

Take the first step toward faster, safer, and smarter sourcing today.

👉 Contact SourcifyChina’s Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– Free access to the 2026 Verified Pro List: Sticker Paper Wholesale

– Customized supplier shortlist based on your volume, specifications, and target pricing

– Guidance on logistics, quality control, and payment terms

SourcifyChina — Your Trusted Partner in Precision Sourcing

Empowering global procurement leaders with verified supply chains, one Pro List at a time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.