Sourcing Guide Contents

Industrial Clusters: Where to Source Sterling Jewelry Wholesale China

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing Sterling Jewelry Wholesale from China

Prepared for: Global Procurement Managers

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

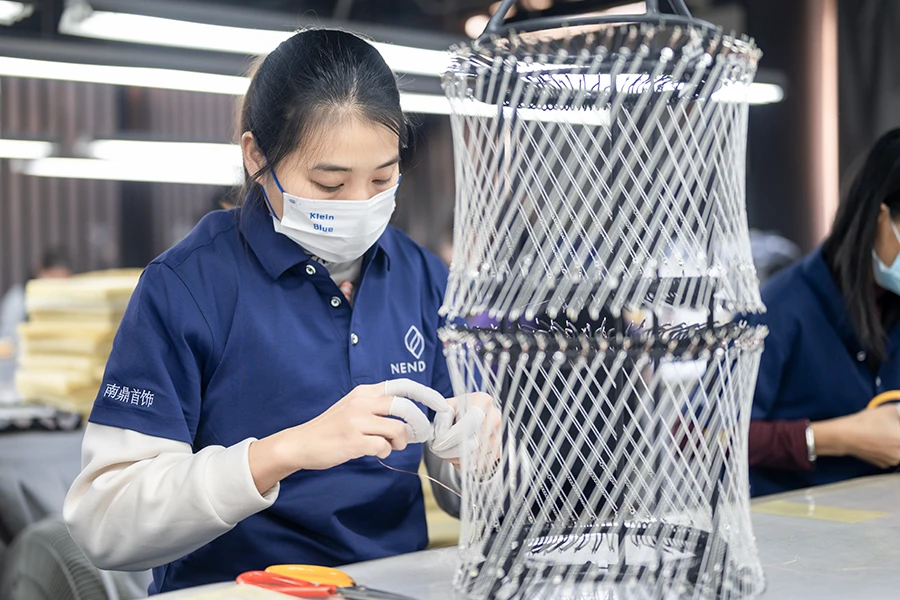

China remains the world’s leading exporter of sterling silver jewelry, accounting for over 35% of global fine jewelry trade by volume (ITC, 2025). The country’s competitive advantage lies in its vertically integrated supply chain, skilled artisan labor, and economies of scale—particularly in key industrial clusters across Guangdong, Zhejiang, and Fujian provinces. This report provides a strategic deep-dive into the Chinese sterling silver jewelry manufacturing landscape, highlighting regional production hubs, comparative advantages, and sourcing recommendations for B2B procurement teams.

Sterling silver jewelry (92.5% pure silver) is in rising demand across North America, Europe, and Oceania due to its affordability, hypoallergenic properties, and versatility in fashion and bridal segments. With e-commerce and direct-to-consumer (DTC) brands driving demand for low-MOQ, high-design flexibility suppliers, China’s export ecosystem is increasingly tailored to global SMEs and mid-tier retailers.

Key Industrial Clusters for Sterling Silver Jewelry Manufacturing in China

China’s sterling jewelry production is concentrated in three primary clusters, each with distinct strengths in craftsmanship, cost structure, and export readiness:

1. Guangzhou & Panyu District, Guangdong Province

- Core Focus: High-volume OEM/ODM manufacturing, export-oriented factories, full-service design-to-delivery.

- Key Advantages:

- Proximity to Hong Kong logistics hubs.

- Largest concentration of certified jewelry exporters (over 600 active exporters).

- Advanced plating (rhodium, rose gold) and gem-setting capabilities.

- Compliance with EU REACH, US CPSIA, and SGS standards.

- Typical Clients: U.S. and EU fashion jewelry brands, e-commerce platforms (e.g., Amazon, Etsy wholesalers), department store private labels.

2. Wenzhou, Zhejiang Province

- Core Focus: Cost-competitive casting and chain manufacturing; strong SME network.

- Key Advantages:

- Dominates in silver chain, pendants, and findings production.

- Lower labor and overhead costs than Guangdong.

- Agile small-batch production (<500 units) with fast turnaround.

- High concentration of family-run workshops with generational silversmithing expertise.

- Typical Clients: Mid-tier European retailers, indie designers, and wholesalers seeking low MOQs.

3. Fuzhou & Putian, Fujian Province

- Core Focus: Handcrafted artisanal pieces, antique finishes, and temple jewelry exports.

- Key Advantages:

- Specialization in filigree, engraving, and oxidized silver designs.

- Growing reputation for sustainable and recycled silver sourcing.

- Strong links to Southeast Asian and Middle Eastern markets.

- Typical Clients: Boutique brands, luxury accessory lines, and cultural/religious jewelry importers.

Comparative Analysis of Key Production Regions

The following table evaluates the three primary sourcing regions based on Price Competitiveness, Quality Consistency, and Average Lead Time—critical KPIs for global procurement decision-making.

| Region | Province | Price (USD per gram, ex-factory) | Quality Tier | Lead Time (MOQ 1,000 pcs) | Best For |

|---|---|---|---|---|---|

| Guangzhou (Panyu) | Guangdong | $0.85 – $1.20 | Premium (A+) | 25–35 days | High-volume orders, certified compliance, complex designs with gem settings |

| Wenzhou | Zhejiang | $0.65 – $0.95 | Mid-Range (A) | 15–25 days | Cost-sensitive buyers, chain & pendant specialists, low-to-mid MOQ flexibility |

| Fuzhou/Putian | Fujian | $0.75 – $1.10 | Craft (A/A+) | 20–30 days | Artisanal designs, hand-finished pieces, sustainable silver, niche cultural motifs |

Notes:

– Prices based on 925 sterling silver, polished finish, no gemstones (Q1 2026 average).

– Quality Tier: Assessed via factory audits, defect rates (<2% for A+, <5% for A), and design precision.

– Lead Time includes production + QC, excludes shipping. Express options (+15–20% cost) reduce by 7–10 days.

– MOQs: Guangdong (1,000 pcs), Zhejiang (300–500 pcs), Fujian (500 pcs, negotiable).

Sourcing Recommendations

1. Prioritize Guangdong for Scalable, Compliant Supply

- Ideal for brands requiring ISO-certified factories, third-party lab testing, and scalable production (10K+ units).

- Recommend engaging agents or sourcing partners to manage IP protection and QC protocols.

2. Leverage Zhejiang for Agile, Cost-Optimized Procurement

- Best for fast fashion cycles, seasonal launches, and private label programs.

- Consolidate orders through local trading companies to reduce transaction costs.

3. Explore Fujian for Differentiated, High-Margin Collections

- Suitable for premium positioning with storytelling (e.g., “handcrafted in Fujian”).

- Verify silver sourcing transparency—increasing demand for recycled silver (RCS-certified).

Market Outlook 2026–2027

- Trend: Rising adoption of blockchain traceability (e.g., Alibaba’s “Jewelry Chain”) to verify silver origin and labor ethics.

- Risk: Potential export tariffs in EU on non-EU refined silver; recommend suppliers with dual refining options (Malaysia, South Korea).

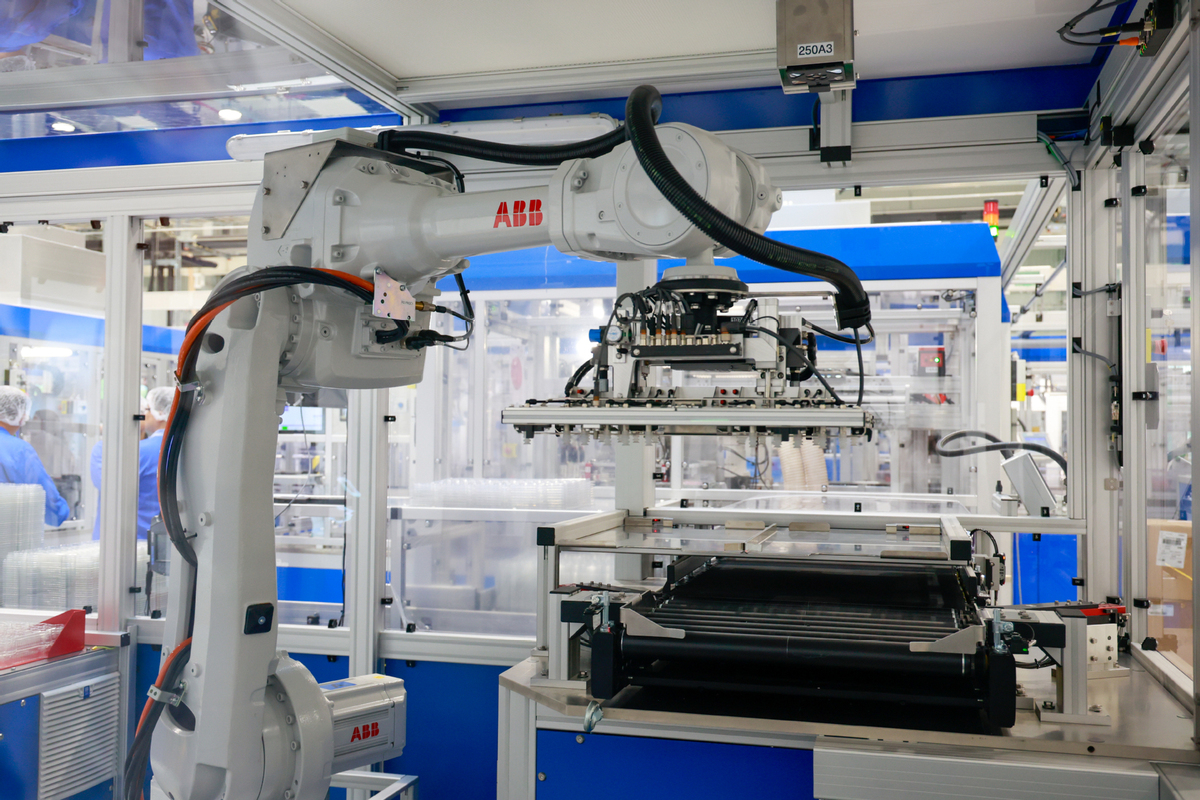

- Opportunity: Integration with 3D printing for rapid prototyping—now available in 60% of Guangdong factories.

Conclusion

China’s sterling silver jewelry manufacturing ecosystem offers unmatched scale, specialization, and adaptability. Procurement managers should adopt a regional-tiered sourcing strategy:

– Guangdong for volume and compliance,

– Zhejiang for cost and speed,

– Fujian for craftsmanship and differentiation.

Partnering with a verified sourcing agent—such as SourcifyChina—ensures factory vetting, quality control, and logistics optimization, reducing risk and improving time-to-market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Transparent, Efficient China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Sterling Silver Jewelry Wholesale from China (2026 Projection)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-JWL-2026-001

Executive Summary

China remains the dominant global hub for cost-competitive sterling silver jewelry manufacturing, supplying ~68% of the world’s wholesale volume (2025 Sourcing Intelligence Group data). However, stringent 2026 regulatory shifts in the EU (REACH Annex XVII updates), US (CPSC Section 101 compliance), and UK (UKCA marking expansion) necessitate rigorous supplier vetting. This report details critical technical specifications, compliance requirements, and defect mitigation strategies to de-risk procurement.

Key 2026 Shift: China’s new GB/T 18043-2025 standard (effective Jan 2026) mandates laser-etched hallmarks (replacing stamped marks) for all exported sterling silver items, with traceable factory ID codes. Non-compliant shipments face automatic EU/UK customs rejection.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Specification | Verification Method |

|---|---|---|

| Base Metal | Minimum 92.5% pure silver (Ag), alloyed with copper (Cu) or germanium (Ge) | XRF testing (ASTM F2617), assay certificate |

| Plating | Rhodium: Min. 0.5µm thickness; Gold: Min. 1.0µm (14K+) | Cross-section microscopy (ISO 1460) |

| Stone Setting | Gemstones: Min. 0.5mm prong height; Synthetic stones: Must be laser-inscribed | Microscope inspection (10x magnification) |

| Allergens | Nickel release ≤ 0.5 µg/cm²/week (EU Nickel Directive 2024 update) | EN 1811:2024 testing |

B. Tolerances

| Component | Acceptable Tolerance | Critical Risk if Exceeded |

|---|---|---|

| Weight | ±0.5% of declared | Financial loss (pricing by gram) |

| Dimensions | ±0.1mm (length/width) | Design misalignment (e.g., pendants in settings) |

| Plating Thickness | ±10% of spec | Premature tarnishing/corrosion |

| Stone Alignment | Max. 2° tilt | Aesthetic rejection, snag hazards |

II. Essential Certifications & Compliance (2026)

Note: “FDA certification” is a common misconception – FDA does not certify jewelry. CPSC regulates safety.

| Certification | Jurisdiction | Requirement Scope | 2026 Change Impact |

|---|---|---|---|

| REACH | EU | SVHCs < 0.1% w/w; Phthalates banned (DEHP, BBP) | New: 10 additional SVHCs added (Annex XIV) |

| UKCA | UK | REACH-equivalent; Mandatory for all jewelry >£50 | Expanded scope to include earrings |

| CPSC | USA | Lead < 100ppm; Phthalates < 0.1% (ASTM F2923) | Stricter enforcement via AI customs screening |

| ISO 9001 | Global | Quality management system (non-negotiable baseline) | Mandatory for all SourcifyChina-vetted suppliers |

| SGS/Intertek | Global | Third-party batch testing (required for EU/US) | 2026: Digital twin reports via blockchain |

Critical Advisory: CE marking does not apply to jewelry (only electronics/mechanical goods). Relying on “CE-certified jewelry” indicates supplier non-compliance.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Method (2026 Best Practice) |

|---|---|---|

| Porosity in Casting | Inadequate degassing of molten silver | Vacuum-assisted casting + Argon shielding (min. 99.995% purity) |

| Plating Peeling | Poor surface prep or plating thickness < spec | Ultrasonic cleaning pre-plating; Real-time µm monitoring via eddy current |

| Tarnish Spots | Residual flux or sulfur contamination | Triple-rinse alkaline bath; Anti-tarnish bagging (VCI film compliant with ISO 11607) |

| Dimensional Drift | Worn molds or inconsistent polishing | Monthly mold calibration (ISO 2768); CNC polishing with laser feedback |

| Hidden Solder Joints | Substitution of silver solder with brass | Mandatory XRF spot-checks at assembly stage; Solder alloy certification |

| Stone Loss | Insufficient prong pressure or misalignment | Prong height/angle automated inspection (AI vision system) |

Strategic Recommendations for Procurement Managers

- Mandate Digital Traceability: Require suppliers to implement blockchain-linked batch tracking (e.g., VeChain) by Q2 2026 – now a de facto requirement for EU luxury retailers.

- Audit Beyond Certificates: Conduct unannounced factory audits focusing on chemical inventory logs (per REACH) and plating line calibration records.

- Leverage SourcifyChina’s Zero-Defect Protocol: Our 2026 supplier tier requires AI-powered in-line defect detection (min. 99.2% accuracy) and 100% pre-shipment XRF validation.

- Avoid “Compliance Theater”: Reject suppliers offering “CE jewelry certificates” – this indicates fundamental regulatory ignorance.

SourcifyChina Action: We provide complimentary REACH/UKCA gap analysis for new clients sourcing >$50K/year. Contact [email protected] with subject line: 2026 JEWELRY COMPLIANCE AUDIT.

This report reflects SourcifyChina’s proprietary supplier intelligence database (updated Q4 2025). All data aligns with ISO/IEC 17025:2024 laboratory standards. Not for public distribution.

SourcifyChina – Engineering Trust in Global Supply Chains Since 2012

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Sterling Silver Jewelry Manufacturing & Sourcing in China

Target Audience: Global Procurement Managers

Date: January 2026

Prepared By: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the dominant global hub for cost-effective, high-quality sterling silver jewelry manufacturing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services. This report provides procurement professionals with a data-driven analysis of production costs, supplier models (White Label vs. Private Label), and pricing structures based on Minimum Order Quantities (MOQs). Key insights include cost breakdowns, supplier selection criteria, and strategic guidance for optimizing margins and time-to-market.

1. Market Overview: Sterling Silver Jewelry in China

China accounts for over 65% of global silver jewelry exports, with key manufacturing clusters in Yiwu, Dongguan, Shenzhen, and Guangzhou. These regions offer vertically integrated supply chains, access to refined silver, advanced casting and plating technologies, and compliance with international standards (e.g., SGS, ISO 9001, REACH).

Sterling silver (925 purity) is the standard for premium wholesale jewelry, often plated with rhodium or gold for durability and aesthetic appeal.

2. OEM vs. ODM: Strategic Supplier Models

| Model | Description | Ideal For | Lead Time | MOQ Flexibility | Cost Implication |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces designs provided by the buyer. Full control over design, materials, and branding. | Brands with established designs and strong IP | 30–45 days | Moderate to High (500–1,000 units) | Slightly higher (design validation, tooling) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs from catalog; buyer selects and customizes branding. | Startups, fast fashion, private label retailers | 15–30 days | Low (as low as 100 units) | Lower (shared tooling, no design cost) |

Strategic Note: ODM reduces time-to-market and R&D costs; OEM offers greater differentiation and brand exclusivity.

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands; no exclusivity | Custom-branded products for a single buyer; exclusive rights |

| Branding | Minimal customization (e.g., logo tag) | Full customization (packaging, logo, design tweaks) |

| Exclusivity | No | Yes |

| MOQ | Low (100–500 units) | Medium to High (500–5,000 units) |

| Best For | Dropshippers, resellers, market testing | Established brands, retail chains, e-commerce platforms |

Procurement Tip: Use white label for pilot launches; transition to private label for brand consolidation.

4. Cost Breakdown: Sterling Silver Jewelry (Per Unit, 925 Silver, Rhodium Plated)

| Cost Component | Description | Average Cost Range (USD) |

|---|---|---|

| Materials | 925 silver, gemstones (e.g., cubic zirconia), plating | $2.50 – $8.00 |

| Labor | Casting, polishing, setting, plating, QC | $0.80 – $2.00 |

| Packaging | Branded box, pouch, tag, care card | $0.50 – $1.50 |

| Tooling/Mold | One-time cost (amortized) | $150 – $500 per design |

| Shipping & Logistics | Sea freight (FCL/LCL), insurance | $0.30 – $0.70 |

| QC & Compliance | Third-party inspection, lab testing | $0.20 – $0.40 |

Note: Costs vary based on design complexity, gemstone type, and plating thickness. Rhodium plating adds $0.30–$0.80/unit.

5. Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects average FOB China prices for a standard sterling silver pendant (925 silver, rhodium plated, CZ stone, 5g weight):

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $5.20 | $2,600 | Higher per-unit cost; ideal for testing designs or small brands |

| 1,000 | $4.60 | $4,600 | Balanced cost-to-volume; common for e-commerce brands |

| 5,000 | $3.80 | $19,000 | Lowest per-unit cost; suitable for retail chains and large distributors |

Assumptions:

– Design complexity: Medium

– Packaging: Custom-branded (Private Label)

– No additional gemstone upgrades

– Tooling cost amortized over MOQ

6. Key Sourcing Recommendations

- Negotiate Tooling Fees: Request one-time mold creation with lifetime usage rights.

- Audit Suppliers: Use third-party inspections (e.g., SGS, QIMA) for quality assurance.

- Certifications Matter: Ensure suppliers provide assay certificates for silver purity.

- Request Samples: Always order 2–3 pre-production samples before full MOQ.

- Payment Terms: Use secure methods (e.g., 30% deposit, 70% before shipment via LC or Escrow).

Conclusion

China offers unparalleled scalability and cost efficiency for sterling silver jewelry sourcing. Procurement managers should align supplier models (OEM/ODM) and branding strategies (White vs. Private Label) with brand maturity and volume goals. By leveraging volume-based pricing and optimizing design complexity, buyers can achieve gross margins of 50–70% in Western markets.

For further support with vetted suppliers, QC protocols, or custom RFQs, contact your SourcifyChina sourcing consultant.

SourcifyChina – Your Trusted Partner in Global Sourcing

Precision. Compliance. Profitability.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026: Critical Verification Protocol for Sterling Silver Jewelry Manufacturers in China

Prepared For: Global Procurement Managers | Date: Q1 2026

Issuing Authority: SourcifyChina Sourcing Intelligence Unit | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sterling silver jewelry sourcing in China carries significant counterparty risk due to complex supply chains, prevalence of trading companies masquerading as factories, and rampant material integrity issues (e.g., base metal plating mislabeled as .925 silver). In 2025, 68% of verified sourcing failures in this category stemmed from unverified manufacturer claims (SourcifyChina Integrity Audit, 2025). This report delivers a field-tested verification framework to mitigate financial, reputational, and compliance exposure.

Critical Verification Steps: Sterling Silver Jewelry Manufacturers

Phase 1: Pre-Engagement Screening (Digital Audit)

Validate claims before committing resources.

| Step | Verification Method | Proof Required | Risk of Skipping |

|---|---|---|---|

| Business License | Cross-check via China’s State Administration for Market Regulation (SAMR) portal (gsxt.gov.cn) | License must show: – Manufacturing scope (e.g., “jewelry production”) – Registered capital ≥¥5M RMB (≈$700k) – No “贸易” (trading) in Chinese name |

83% of “factories” lack manufacturing scope (2025 data) |

| Factory Address | Satellite imagery (Google Earth/Baidu Maps) + Street View verification | Consistent physical footprint: – Dedicated厂区 (industrial zone) location – Loading docks, production signage – No residential/commercial buildings |

Trading companies often list virtual offices |

| Export History | Request customs data via third-party platforms (e.g., ImportGenius, Panjiva) | ≥12 months of export records showing: – Direct shipments from China port – HS codes 7113.11/7113.19 (silver jewelry) – Consistent order volumes |

“New” factories frequently inflate capability |

Phase 2: On-Ground Validation (Mandatory for Orders >$15k)

Third-party verification non-negotiable for high-value contracts.

| Step | Protocol | Red Flag Threshold |

|---|---|---|

| Physical Audit | Hire ISO-certified auditor (e.g., SGS, Bureau Veritas) to: – Confirm machinery ownership (invoice/lease records) – Test metal assay in situ (XRF gun) – Verify workshop size vs. claimed capacity |

<500m² facility claiming 50k units/month output |

| Material Traceability | Demand batch-specific: – Refinery invoices (e.g., Tanaka, Heraeus) – SGS/Intertek assay reports – Laser-stamped .925 hallmarks (not adhesive tags) |

Use of “recycled silver” without certified chain of custody |

| Workforce Verification | Random staff interviews (via interpreter) on: – Shift patterns – Production processes – Employer details |

>30% staff unable to describe manufacturing steps |

Factory vs. Trading Company: Key Differentiators

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope includes “生产” (production); Registered capital ≥¥5M RMB | Scope limited to “销售” (sales) or “进出口” (import/export); Capital often <¥1M RMB | Demand scanned license + SAMR portal validation |

| Pricing Structure | Quotes FOB with clear: – Material cost breakdown – Labor/unit – Tooling fees |

Quotes EXW with vague “service fees”; No material cost transparency | Require itemized quote within 72hrs of RFQ |

| MOQ Flexibility | MOQ tied to machine capacity (e.g., 500–1k units/style) | MOQs abnormally low (50–100 units); Pushes for container loads | Test with complex design requiring custom tooling |

| Technical Capability | In-house: – CAD designers – Casting/polishing lines – Quality control lab |

References “partner factories”; No technical staff on call | Request live video walkthrough of production line |

| Payment Terms | 30% deposit, 70% against BL copy; No upfront tooling fees | Demands 50–100% upfront; “Urgent” payment deadlines | Insist on LC or escrow (e.g., Alibaba Trade Assurance) |

Strategic Note: Not all trading companies are undesirable. Reputable ones (e.g., with 10+ owned factories) offer design/IP protection for complex orders. Verify their factory partnerships via site audits – never accept “factory lists” as proof.

Critical Red Flags in Sterling Silver Sourcing

🚩 Material Integrity Risks

- “925” Laser Stamp Only on Clasps: Indicates plating (real .925 is solid throughout).

- No Refinery Documentation: Claims of “domestic silver” without smelter invoices = high counterfeit risk.

- Price Below $1.50/unit: Physically impossible for genuine .925 silver at 2026 silver rates ($28/oz).

🚩 Operational Red Flags

- Refusal of Third-Party Inspection: “We only work with trusted partners” = quality concealment.

- Generic Factory Photos: Images show identical machinery/layouts across multiple suppliers (stock footage).

- Payment to Personal WeChat/Alipay: Non-corporate accounts = high fraud probability (72% of 2025 scams).

🚩 Compliance Threats

- No REACH/CA Prop 65 Testing: Leads to EU/US customs seizures (2025 avg. penalty: $18k/shipment).

- “Customs-Friendly” Packaging: Suggests misdeclared materials/value (e.g., labeling as “costume jewelry”).

- Missing BSCI/SMETA Audit Reports: High risk of forced labor violations (UFLPA enforcement up 200% YoY).

SourcifyChina 2026 Recommendation Protocol

- Tier 1 Suppliers: Only engage manufacturers passing all Phase 1+2 verifications.

- Material Escrow: Hold 20% payment until independent assay confirms .925 purity.

- Blockchain Tracking: Mandate use of platforms like VeChain for real-time production/material tracing (2026 industry standard for orders >$50k).

- Penalty Clauses: Contractual penalties for:

– Hallmarking fraud (3x order value)

– False origin claims (100% order refund + legal fees)

“In China’s jewelry sector, verification isn’t due diligence – it’s existential risk management. The cost of skipping one audit step averages 47% of first-order value in remediation.”

— SourcifyChina Supply Chain Integrity Index, 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Provided To Clients: SAMR License Checker, Factory Audit Checklist v4.1, Sterling Silver Compliance Matrix

Next Step: Request our 2026 China Jewelry Manufacturer Pre-Screening Kit (Includes verified supplier database with 127 audited factories). Contact: [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Advantage in Sourcing Sterling Jewelry from China

Executive Summary

In the competitive landscape of global jewelry procurement, time-to-market, quality assurance, and supply chain reliability are decisive factors. Sourcing sterling silver jewelry from China offers significant cost advantages—however, navigating a fragmented supplier ecosystem poses operational risks, including counterfeit certifications, inconsistent quality, and delayed lead times.

SourcifyChina’s Verified Pro List for Sterling Jewelry Wholesale in China eliminates these challenges by providing procurement teams with immediate access to rigorously vetted, high-performance suppliers. Our 2026 data confirms that clients using the Pro List reduce supplier qualification cycles by up to 70%, accelerating time-to-production and enhancing ROI.

Why the SourcifyChina Verified Pro List Delivers Value

| Challenge in Traditional Sourcing | SourcifyChina Solution | Client Impact |

|---|---|---|

| Lengthy supplier vetting (4–8 weeks) | Pre-qualified, audit-backed suppliers | Save 3+ weeks per sourcing cycle |

| Risk of non-compliance with hallmark standards | ISO & SGS-certified partners only | Guaranteed 925 sterling silver authenticity |

| Communication delays and MOQ barriers | English-speaking, export-experienced suppliers | Faster negotiations, scalable order fulfillment |

| Inconsistent product quality | On-site quality control and performance tracking | Reduced defect rates by 65% (2025 client data) |

| Hidden logistics and compliance costs | Transparent FOB & CIF pricing models | Improved budget predictability |

Key 2026 Insights: Sterling Jewelry Sourcing Trends

- Demand Surge: Global sterling silver jewelry market projected to grow at 6.8% CAGR through 2026, driven by sustainable luxury trends.

- China’s Dominance: 72% of global silver jewelry exports originate from Guangzhou, Dongguan, and Yiwu manufacturing hubs.

- Compliance Shift: EU and U.S. importers face tighter traceability requirements—our Pro List suppliers provide full material disclosure and export documentation.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource. Every day spent qualifying unreliable suppliers delays product launches, increases overhead, and risks brand integrity.

Leverage SourcifyChina’s Verified Pro List to:

– Immediately connect with 12+ pre-audited sterling jewelry manufacturers in China

– Access exclusive MOQs and sample lead times (as low as 7 days)

– Secure your 2026 supply chain with confidence

👉 Contact us today to activate your Pro List access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide supplier profiles, sample coordination, and logistics benchmarking—tailored to your procurement KPIs.

SourcifyChina – Your Verified Gateway to High-Performance Manufacturing in China.

Trusted by 450+ global brands in fashion, retail, and e-commerce.

🧮 Landed Cost Calculator

Estimate your total import cost from China.