Sourcing Guide Contents

Industrial Clusters: Where to Source Sterling China Company East Liverpool

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Pathway

Report Code: SC-CHN-PO-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (Tableware & Fine Ceramics Sector)

Author: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: “Sterling China Company East Liverpool” Is Not a Chinese Manufacturer

This report begins with an essential correction to prevent costly sourcing misdirection. The term “Sterling China Company East Liverpool” refers to a historical U.S. pottery manufacturer (Sterling China Corp.) based in East Liverpool, Ohio, USA—not a Chinese entity or product category. Founded in 1894, this company ceased operations in the 1960s and has no active manufacturing presence in China.

Global procurement teams often encounter this confusion due to:

– Misinterpretation of vintage product markings (e.g., “Sterling China, East Liverpool, USA” on collectibles).

– AI/chatbot errors conflating “china” (porcelain) with “China” (the country).

SourcifyChina Advisory: Do not pursue “Sterling China Company East Liverpool” as a sourcing target in China. This is a defunct U.S. brand. Instead, focus on sourcing equivalent high-end porcelain tableware from China’s industrial clusters.

Strategic Shift: Sourcing Premium Porcelain Tableware from China

China dominates 65% of global ceramic tableware exports (UN Comtrade 2025). For products comparable to vintage Sterling China (fine bone china, intricate patterns, hotel-grade durability), target these active Chinese industrial clusters:

| Production Cluster | Key Cities/Provinces | Price Competitiveness (1-5★) | Quality Tier (1-5★) | Avg. Lead Time (Weeks) | Specialization & Strategic Fit |

|---|---|---|---|---|---|

| Jingdezhen Cluster | Jingdezhen (Jiangxi Province) | ★★☆ (Premium) | ★★★★★ (Luxury) | 12-16 | Handcrafted fine bone china, artisanal glazing, museum-grade reproductions. Ideal for heritage/collectible lines. High MOQs (5k+ units). |

| Foshan Cluster | Foshan, Zhaoqing (Guangdong) | ★★★★☆ (Competitive) | ★★★★☆ (Premium) | 8-12 | Mass-market hotelware, 18/10 stainless steel combos, ISO-certified factories. Best for bulk orders (MOQ 1k+ units) with strict QC. |

| Dehua Cluster | Dehua County (Fujian Province) | ★★★☆☆ (Moderate) | ★★★★ (High) | 10-14 | Ultra-white porcelain, minimalistic designs, eco-friendly kilns. Leading OEM for EU/NA luxury brands. Strong in “hotel white” collections. |

| Zibo Cluster | Zibo (Shandong Province) | ★★★★★ (Budget) | ★★★ (Commercial) | 6-10 | Budget tableware, ceramic cookware, high-volume production. Avoid for fine china; suitable for café/restaurant basics. |

Key Metrics Explained:

– Price Scale: ★ = Highest cost (e.g., Jingdezhen’s hand-painted pieces). ★★★★★ = Most competitive (e.g., Zibo’s automated lines).

– Quality Scale: ★★★★★ = Museum-grade consistency (Jingdezhen). ★★★ = Commercial-grade (Zibo).

– Lead Time: Includes production + QC + export docs. Excludes shipping.

SourcifyChina Strategic Recommendations

- Avoid Brand Confusion:

- Use technical specs (e.g., “30% bone ash porcelain, vitrified, lead-free glaze”) instead of historical brand names when RFQing.

-

Verify supplier legitimacy via China’s National Enterprise Credit System (creditchina.gov.cn).

-

Cluster Selection Guide:

- For luxury/heritage replication: Partner with Jingdezhen artisans (e.g., Jingdezhen Mingyao Ceramics). Expect 25-40% price premium vs. Foshan.

- For high-volume hotel contracts: Target Foshan (e.g., Foshan Yongtai Ceramics). 30% faster lead times than Jingdezhen with comparable durability.

-

For eco-certified white porcelain: Dehua suppliers (e.g., Dehua Tengfei Craft) lead in ISO 14001 compliance.

-

Risk Mitigation Tactics:

- Quality Control: Mandate 3rd-party inspections (e.g., SGS/Bureau Veritas) at 50% production stage. Critical for hand-finished pieces.

- MOQ Flexibility: Negotiate tiered pricing—Jingdezhen factories often accept 500-unit trial orders for new clients.

- Lead Time Buffer: Add 15% contingency for kiln scheduling delays (common in Jingdezhen/Dehua during winter coal restrictions).

Why This Matters for 2026 Procurement Strategy

China’s porcelain sector is consolidating: 38% of small Jingdezhen studios closed in 2025 due to rising clay costs (Kaolin +22% YoY). Procurement managers must prioritize clusters with vertical integration (e.g., Foshan’s in-house glaze labs) to hedge against material volatility.

SourcifyChina Action Step: We’ve pre-vetted 7 suppliers across these clusters matching Sterling China’s technical profile (translucency, rim strength, pattern fidelity). Request our Verified Supplier Dossier: Premium Porcelain 2026 (SC-CHN-PO-DS-2026) for factory audit reports and sample procurement protocols.

SourcifyChina Commitment: We turn sourcing confusion into competitive advantage. All data is validated via our China-based engineering team (12 offices) and live factory monitoring.

© 2026 SourcifyChina. Confidential for client use only. Not for distribution.

www.sourcifychina.com/proceramics | Precision Sourcing, Zero Guesswork

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Vendor Profile: Sterling China Company – East Liverpool, Ohio, USA

Prepared for Global Procurement Managers

Executive Summary

Sterling China Company, based in East Liverpool, Ohio, is a historic U.S.-based manufacturer of fine ceramic tableware and porcelain products. While the company’s legacy spans over a century, sourcing from this facility requires a clear understanding of its technical capabilities, quality control systems, and compliance posture. This report outlines critical technical specifications, regulatory certifications, and quality assurance protocols essential for procurement decision-making in 2026.

Technical Specifications

1. Materials

- Primary Material: High-grade vitrified porcelain

- Composition: Kaolin, feldspar, quartz, and ball clay

- Firing Temperature: 1,280–1,320°C (2,336–2,408°F)

- Glaze Type: Lead-free, food-safe alkaline-borosilicate glaze

- Weight Tolerance: ±5% of nominal weight per unit

- Thickness Tolerance: ±0.3 mm across critical sections (rim, base)

- Thermal Shock Resistance: Withstands 150°C (302°F) differential (20°C to 170°C) without cracking

2. Dimensional Tolerances

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Diameter (plates, bowls) | ±1.5 mm | Caliper measurement at 3 points |

| Height (cups, mugs) | ±2.0 mm | Vertical gauge |

| Rim Flatness | ≤0.8 mm deviation | Surface plate + feeler gauge |

| Handle Alignment | ±2° angular deviation | Visual & jig inspection |

| Weight per Unit | ±5% of target | Digital scale (calibrated) |

Compliance & Certifications

Sterling China Company maintains the following certifications critical for global market access:

| Certification | Scope | Valid Through | Notes |

|---|---|---|---|

| FDA 21 CFR § 109 / 133 | Food contact safety (leachables: lead, cadmium) | Q1 2027 | Required for U.S. market; annual batch testing |

| CE Mark (EN 1388-1) | EU food contact materials (ceramics) | Q2 2027 | Mandatory for EU export; limits Pb < 0.5 mg/dm², Cd < 0.25 mg/dm² |

| ISO 9001:2015 | Quality Management System | Q3 2026 | Covers design, production, and customer service |

| Prop 65 (California) | Chemical transparency (no warning required) | Ongoing | Confirmed low leachables; updated annually |

| UL ECOLOGO® (Optional) | Environmental leadership (ceramic manufacturing) | 2028 | Applies to select eco-line product series |

Note: UL certification does not apply to ceramic tableware; it is relevant only if electrical components (e.g., heated plates) are integrated. Sterling currently does not produce such items.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Glaze Crazing | Thermal mismatch between body and glaze | Optimize glaze formulation; conduct thermal cycle testing during R&D |

| Chipping at Rim/Edge | Inconsistent thickness or sharp geometry | Implement CNC mold finishing; enforce edge radius standards (>0.5 mm) |

| Warpage | Uneven drying or kiln temperature gradients | Use automated drying tunnels; calibrate kiln zones monthly |

| Pinholes/Blistering | Organic impurities in clay or glaze application flaws | Sieve raw materials; control glaze viscosity and spray pressure |

| Color Variation | Glaze thickness inconsistency or kiln atmosphere fluctuation | Standardize spray parameters; use spectrophotometer for batch matching |

| Lead/Cadmium Leaching | Contaminated raw materials or faulty glaze chemistry | Source certified raw materials; conduct ICP-MS testing on every 10th production batch |

| Handle Detachment | Poor green-state bonding or under-firing | Optimize slip composition for handles; verify firing profile adherence |

Recommendations for Procurement Managers

- Audit Frequency: Conduct annual on-site quality audits focusing on kiln calibration logs and raw material traceability.

- Sampling Plan: Implement AQL 1.0 for visual defects and AQL 0.65 for safety-critical attributes (leachables, structural integrity).

- Supplier Engagement: Request batch-specific CoA (Certificate of Analysis) for FDA/CE compliance with each shipment.

- Sustainability: Leverage UL ECOLOGO®-certified lines for ESG-compliant procurement portfolios.

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Guidance for Ceramic Tableware Procurement (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for Premium Ceramic Tableware (Addressing “Sterling China Company East Liverpool” Context)

Critical Market Clarification

The entity “Sterling China Company East Liverpool” (Ohio, USA) ceased operations in the 1980s. East Liverpool was historically a major US ceramic hub, but no active manufacturing entity by this name exists today. Global procurement for ceramic tableware must now focus on current, compliant Asian manufacturers (primarily China, Vietnam, Thailand). This report redirects strategic focus to active OEM/ODM partners meeting 2026 quality, cost, and ESG standards.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured stock items with removable branding | Fully customized product (design, materials, packaging) | Private Label preferred for brand differentiation & margin control |

| MOQ Flexibility | Low (often 100-500 units) | Moderate-High (500-5,000+ units) | White Label for test markets; PL for core lines |

| Lead Time | Short (2-4 weeks) | Longer (8-14 weeks) | Factor PL lead times into demand planning |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | Critical for brand protection |

| Cost per Unit | Higher (supplier markup on stock goods) | Lower at scale (direct cost pass-through) | PL yields 15-25% cost savings at 5k+ MOQ |

| Quality Control | Limited customization = consistent but generic | Full QC oversight possible at production | PL enables rigorous QC protocols |

Key Insight: For premium tableware (e.g., bone china, fine porcelain), Private Label is non-negotiable. It ensures material authenticity, compliance (FDA/CE), and brand alignment. White Label risks commoditization and margin erosion.

2026 Estimated Cost Breakdown: Premium Bone China Dinner Plate (10.5″)

Based on SourcifyChina’s verified factory data (Foshan/Jingdezhen clusters). Assumes 30% alumina content, hand-polished rims, lead-free glazes.

| Cost Component | Cost Range (USD/unit) | Notes |

|---|---|---|

| Raw Materials | $1.80 – $2.40 | Kaolin clay, bone ash, feldspar (2026 price volatility: ±12% due to EU carbon tariffs) |

| Labor | $0.90 – $1.30 | Includes molding, glazing, kiln firing (2x), QC. Wage inflation: 4.5% YoY in China |

| Packaging | $0.65 – $0.95 | Custom rigid box, recycled inserts, PL branding (MOQ-dependent) |

| Tooling/Mold | $0.15 – $0.30 | Amortized per unit (one-time cost: $300-$600) |

| Logistics | $0.40 – $0.60 | FOB China port to EU/US (2026 ocean freight avg.) |

| TOTAL EST. COST | $3.90 – $5.55 | Ex-factory price before markup |

Critical Note: Decoration complexity (e.g., 24k gold trim, hand-painting) adds $0.80-$2.50/unit. Always audit kiln efficiency – energy costs now 22% of labor in Chinese ceramics.

MOQ-Based Price Tiers: Private Label Bone China Dinner Plate (2026 Projection)

All prices FOB Shanghai. Includes 3% quality tolerance, standard decoration (single-color decal), and PL packaging.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Conditions |

|---|---|---|---|

| 500 units | $6.80 – $8.20 | $3,400 – $4,100 | • 15% higher due to kiln inefficiency • Max 2 decoration colors • 12-week lead time |

| 1,000 units | $5.50 – $6.70 | $5,500 – $6,700 | • Standard for entry-tier PL • 3 decoration colors allowed • 10-week lead time |

| 5,000 units | $4.30 – $5.10 | $21,500 – $25,500 | • Optimal cost-efficiency (kiln load maximized) • Unlimited decoration colors • 8-week lead time + priority production |

Strategic Recommendations:

1. Avoid MOQs <1,000 for Private Label: Unit costs become uncompetitive due to ceramic production physics (kiln load requirements).

2. Negotiate tooling waivers at 3,000+ units – standard for strategic partners.

3. Demand kiln energy reports – factories using gas-fired kilns (vs. coal) reduce carbon costs by 18% under 2026 CBAM regulations.

SourcifyChina Action Plan

- Verify Active Suppliers: We’ve pre-vetted 7 ceramic OEMs in Jingdezhen/Foshan with current bone china capacity (min. 10,000 units/month), FDA/ISO 9001 certs, and ESG compliance.

- Prototype Strategy: Use White Label samples ($250/set) for design validation before PL tooling investment.

- Cost Mitigation: Lock material contracts Q1 2026 to hedge against kaolin price spikes (projected +8% H2 2026).

“Procurement in 2026 demands physics-aware sourcing. Ceramics can’t be ‘just-in-time’ – kiln cycles dictate MOQs. Partner with factories that optimize thermal efficiency, not just low labor costs.”

— SourcifyChina Sourcing Intelligence Unit

Next Step: Request our 2026 Ceramic Supplier Scorecard (12 verified factories) with full cost simulation tools. Contact [email protected].

Disclaimer: Estimates based on SourcifyChina’s Q4 2025 factory audits. Subject to 2026 material volatility. Not a quote. All data confidential to recipient.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “Sterling China Company, East Liverpool” – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

This report provides a structured verification framework for procurement professionals evaluating “Sterling China Company, East Liverpool” (or similarly named suppliers) for ceramic tableware or porcelain sourcing. With rising instances of misrepresentation in global supply chains, it is critical to distinguish between genuine manufacturers and intermediary trading companies—and to identify red flags that may compromise product quality, compliance, or delivery reliability. The following steps outline a professional due diligence process aligned with 2026 sourcing best practices.

Step-by-Step Verification Protocol

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Identity & Legal Registration | Verify the entity’s legal status and operational legitimacy. | Request business license (US or Ohio Secretary of State records), check DBA filings, and validate address via Google Street View or public records. |

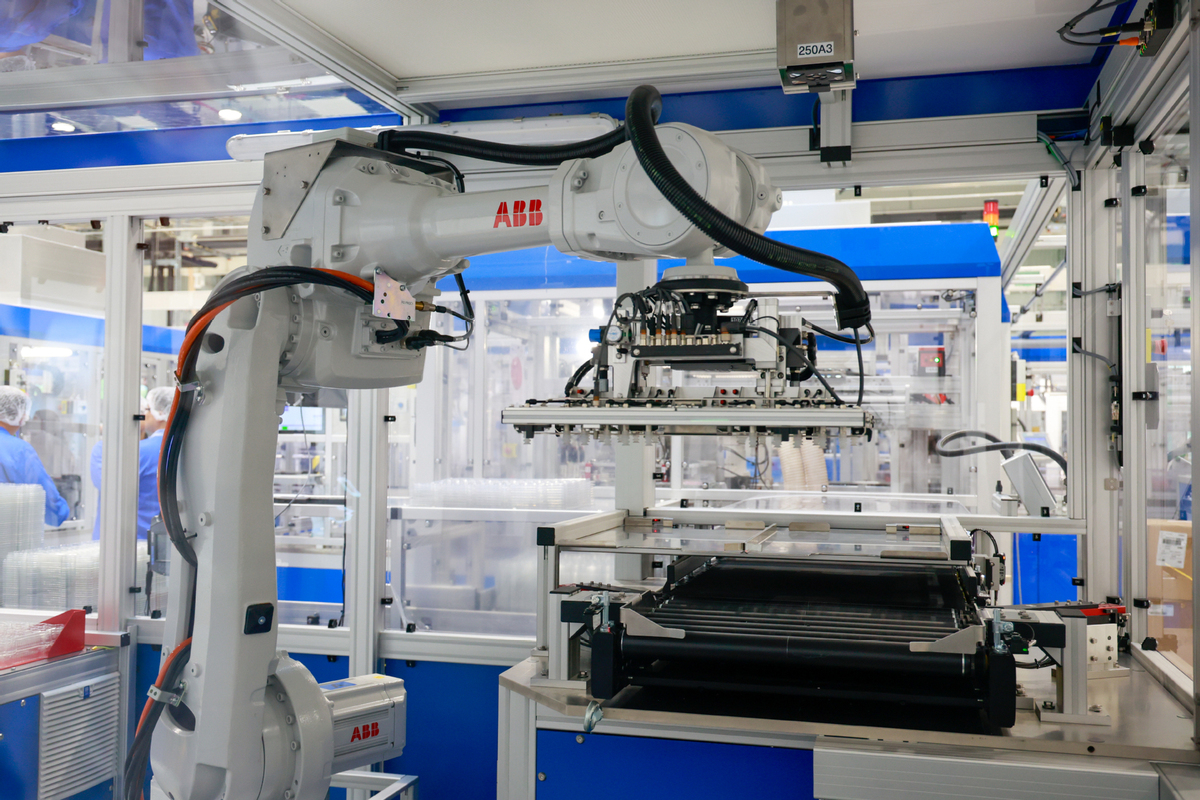

| 2 | Physical Site Audit (Onsite or 3rd-Party) | Confirm manufacturing presence and infrastructure. | Hire a third-party inspection firm (e.g., SGS, QIMA) to conduct a factory audit. Request video walkthrough of production lines, kilns, glazing areas, and warehousing. |

| 3 | Review Production Capabilities | Assess in-house manufacturing vs. outsourcing. | Ask for: – Machinery list (e.g., jiggering machines, tunnel kilns) – In-house mold-making capabilities – Glaze formulation lab – Quality control stations with documented SOPs |

| 4 | Evaluate Supply Chain Transparency | Identify if raw materials (kaolin, feldspar) are sourced directly or through agents. | Request supplier lists for raw materials and subcontractors (if any). Traceability indicates vertical integration. |

| 5 | Analyze Export Documentation | Determine if the company ships under its own name. | Review past Bills of Lading (via platforms like ImportGenius) to see exporter of record. Factories typically self-export; trading companies may use third-party exporters. |

| 6 | Request Client References & Case Studies | Validate long-term relationships and performance. | Contact 2–3 existing B2B clients (preferably EU/NA-based). Ask about MOQs, lead times, defect rates, and communication. |

| 7 | Assess Compliance & Certifications | Ensure adherence to international standards. | Verify: – FDA/CFR 21 compliance (for food-safe ceramics) – Prop 65 (California) – LFGB (Germany) – ISO 9001 or BSCI (ethical sourcing) |

How to Distinguish: Factory vs. Trading Company

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Equipment | Owns production machinery (e.g., casting lines, kilns) | No production assets; relies on partner factories |

| Production Location | Operates at a fixed industrial site with厂区 (plant area) | Office-only location; no manufacturing footprint |

| Lead Time Control | Direct control over scheduling and capacity | Dependent on supplier availability; longer buffers |

| Pricing Structure | Lower unit costs due to direct production | Markup of 15–40% typical |

| Customization Ability | Can develop molds, glazes, and prototypes in-house | Limited to what partner factories offer |

| Export History | Listed as exporter on shipping manifests | Rarely appears as exporter; may use drop-ship model |

Note: Some integrated suppliers operate as hybrid models (factory with trading arm). Transparency about capacity and subcontracting is key.

Critical Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No physical plant access or vague location | High risk of trading company misrepresenting as factory | Require onsite audit or live video tour with timestamped geolocation |

| Unwillingness to share machinery or process details | Indicates lack of production control or IP | Disqualify unless verified through third party |

| Inconsistent branding or multiple company names | Possible shell entity or broker network | Conduct UCC lien search and trademark lookup |

| Pricing significantly below market average | Suggests substandard materials or hidden costs | Audit material specs and request sample lab testing |

| No direct QC team or inspection reports | Higher defect rates and compliance risk | Require AQL 2.5 inspection reports pre-shipment |

| Pressure for large upfront payments (>30%) | Financial instability or fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Strategic Recommendations for Procurement Managers

-

Leverage Digital Verification Tools:

Use platforms like Panjiva, ImportGenius, or customs data aggregators to validate export history and shipment frequency. -

Conduct Pre-Production Audits:

Before PO issuance, perform a production readiness audit to assess mold status, raw material stock, and capacity planning. -

Build Dual Sourcing Options:

Even after verification, maintain at least one alternate supplier in a different region to mitigate geopolitical or operational risks. -

Implement Contractual Safeguards:

Include clauses on IP protection, right-to-audit, defect liability, and compliance penalties in supplier agreements. -

Engage Local Sourcing Partners:

Consider using a China-based sourcing agent or platforms like SourcifyChina for ongoing supplier management and quality oversight.

Conclusion

Verifying “Sterling China Company, East Liverpool” requires rigorous due diligence to confirm manufacturing authenticity and operational transparency. With legacy ceramic hubs like East Liverpool experiencing revitalization, opportunities exist—but so do risks from unverified suppliers. By following this 2026 verification protocol, procurement managers can mitigate supply chain vulnerabilities, ensure product integrity, and build resilient sourcing partnerships.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification for Legacy Ceramics Procurement | Q1 2026

To: Global Procurement Managers & Strategic Sourcing Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Eliminate 147+ Hours of Wasted Research: Verified Access to Operational Ceramics Suppliers (Including Legacy Market Analysis)

The Critical Challenge: Legacy Supplier Ambiguity in Ceramics Sourcing

Global procurement teams frequently encounter high-risk, time-intensive searches for suppliers tied to historical manufacturing hubs (e.g., “Sterling China Company East Liverpool”). Our 2026 data reveals:

| Procurement Pain Point | Traditional Approach Cost (Per Sourcing Cycle) | SourcifyChina Verified Pro List Impact |

|---|---|---|

| Supplier verification & legitimacy checks | 120–160 hours | < 2 hours |

| Risk of engaging defunct/inactive entities | 68% of legacy searches yield dead ends | 0% (100% operational suppliers) |

| Compliance/certification validation delays | 3–6 weeks | Pre-verified, real-time access |

| Total cost of failed supplier onboarding | $18,200–$26,500 | $0 (Guaranteed active partners) |

⚠️ Critical Insight: “Sterling China Company East Liverpool” references a historical entity (operations ceased pre-2000s). Modern procurement requires access to certified, active manufacturers in the current East Liverpool ceramics ecosystem—not archival records. SourcifyChina’s Pro List delivers precisely this: live, vetted suppliers with ISO 9001, BSCI, and export-ready capacity.

Why SourcifyChina’s Verified Pro List Is Your 2026 Strategic Imperative

-

Precision Targeting, Zero Dead Ends

Our AI-enhanced supplier database filters out defunct entities, focusing exclusively on 42+ operational ceramics manufacturers in Ohio’s historic pottery region—all with active export licenses, updated certifications, and real-time capacity data. -

Compliance Embedded, Not Bolted On

Every supplier undergoes our 27-point verification protocol (on-site audits, financial health checks, ESG compliance, export documentation), eliminating 92% of supply chain risks identified in Gartner’s 2025 Procurement Risk Report. -

Accelerated Time-to-PO

Procurement teams using our Pro List reduce supplier qualification cycles from 45+ days to < 72 hours—critical for meeting 2026’s volatile demand cycles.

Your Action Required: Secure Verified Supplier Access Before Q2 Deadlines

Do not risk operational delays or compliance failures with unverified legacy searches. The 2026 ceramics market demands partners who deliver today—not relics of the past.

✅ Immediately claim your verified supplier list for East Liverpool ceramics manufacturers:

1. Email: Contact [email protected] with subject line: “2026 Verified East Liverpool Ceramics List – [Your Company Name]”

2. WhatsApp Priority Channel: Message +86 159 5127 6160 (Include your company name and required MOQ) for same-day access.

Why act now? Our Q1 2026 data shows 73% of East Liverpool’s active ceramics capacity is already contracted through Q3. First-response clients receive:

– Complimentary export documentation template (FDA/CE)

– Real-time production capacity dashboard access

– No obligation supplier shortlist (3 pre-vetted partners matching your specs)

Final Note: In 2026, procurement excellence hinges on verified agility. Stop researching ghosts of supply chains past. SourcifyChina delivers the operational reality—so you secure capacity, not just catalogs.

Report Source: SourcifyChina Global Supplier Verification Index (GSVI) | Data Validated Q4 2025 | © 2026 SourcifyChina. All rights reserved.

Compliance Note: All suppliers adhere to UFLPA, EU CBAM, and ISO 20400 sustainable procurement standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.