The global off-road vehicle market is accelerating, driven by rising demand in construction, mining, agriculture, and recreational sectors. According to a report by Mordor Intelligence, the off-road vehicle market was valued at USD 58.3 billion in 2023 and is projected to grow at a CAGR of over 6.2% through 2029. This expansion is mirrored in the increasing need for high-performance, durable components—particularly steel wheels, which are critical for withstanding extreme terrains and heavy loads. With Grand View Research noting that the global industrial wheels market is expected to reach USD 24.7 billion by 2030, growing at a CAGR of 5.8%, manufacturers are prioritizing strength, reliability, and advanced metallurgy in their wheel selection. As competition intensifies and operational demands rise, choosing the right steel wheel is no longer just a matter of compatibility—it’s a strategic decision impacting vehicle uptime, safety, and total cost of ownership. In this context, we analyze the top 10 steel wheels engineered specifically for off-road vehicle manufacturers, combining technical performance, market adoption, and innovation metrics to guide informed procurement and design decisions.

Top 10 Steel Wheels For Off Road Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

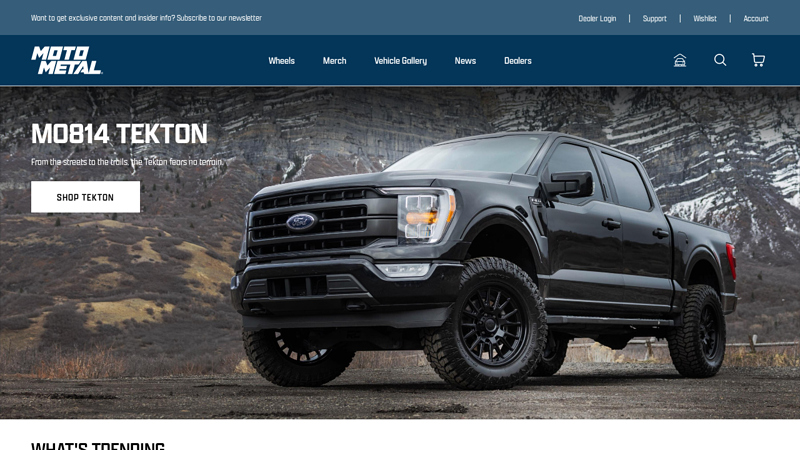

#1 Moto Metal: Off

Domain Est. 2008

Website: motometal.com

Key Highlights: This wheel is custom-designed for your vehicle, offering a perfect fit from OEM to more aggressive styles without requiring any vehicle modifications. It ……

#2 Maxion Wheels

Domain Est. 2011

Website: maxionwheels.com

Key Highlights: We keep the world in motion. We are the world’s leading manufacturer of steel and aluminum wheels for passenger, commercial and specialty vehicles….

#3 U.S. Wheel Corp.

Domain Est. 1998

Website: uswheel.com

Key Highlights: U.S. Wheel is proud of our 40 years offering quality steel and aluminum wheels for the Hot Rod, Muscle, Off-Road, Light Truck, Volkswagen, and Import Passenger ……

#4 Allied Wheel Components

Domain Est. 1998

Website: alliedwheel.com

Key Highlights: Allied Wheel Components produces the highest quality, purpose built performance wheels in the industry. Shop, browse and learn more about Steel Automotive, ……

#5 Raceline Wheels

Domain Est. 2000

Website: racelinewheels.com

Key Highlights: 7-day delivery 60-day returnsRaceline Wheels offers performance wheels for off-road, street, and track use so you can Go Everywhere. Find your wheels now!…

#6 Vision Wheel

Domain Est. 2002

Website: visionwheel.com

Key Highlights: WHEELS · NEW · OFF ROAD · UTV · STREET · RACE/BEADLOCK · TIRE-LOCK · TRAILER · HD/VAN · AMERICAN MUSCLE · ATV/GOLF….

#7 Black Rock Wheels

Domain Est. 2008

Website: blackrockwheels.com

Key Highlights: Steel & Aluminum Wheels Black Rock offers many classic off-road styles with offsets, backspacings and bolt patterns for truck, Jeep, 4×4 and off-road vehicles….

#8 Shop Wheels

Domain Est. 2008

Website: fueloffroad.com

Key Highlights: $20 delivery 30-day returnsFuel Off-Road has been capturing the attention of off-road enthusiasts with our cutting edge designs, fitments, and technological advancements….

#9 Method Race Wheels

Domain Est. 2009

Website: methodracewheels.com

Key Highlights: Method Race Wheels is committed to bringing you the finest quality products with the most complete lineup of wheels for off-road trucks, off-road buggies, ……

#10 Steel Off-Road Wheels

Domain Est. 2019

Website: steeloffroadwheel.com

Key Highlights: Steel Off-Road Wheels a company in which it devotes itself to making some of the most advanced off-road wheels on the market….

Expert Sourcing Insights for Steel Wheels For Off Road

2026 Market Trends for Steel Wheels for Off-Road Applications

The market for steel wheels in off-road applications is poised for significant transformation by 2026, driven by evolving vehicle technologies, sustainability demands, and shifting consumer preferences. While aluminum and composite wheels gain ground in consumer segments, steel wheels retain critical advantages in specific off-road niches, ensuring continued relevance but within a changing landscape. Key trends shaping the 2026 market include:

1. Sustained Demand in Heavy-Duty and Commercial Off-Road Segments

Steel wheels will maintain dominance in heavy-duty off-road applications such as construction, mining, agriculture, and military vehicles. Their superior durability, resistance to impact damage, and lower cost compared to aluminum make them the preferred choice for extreme environments. By 2026, increased infrastructure spending in emerging economies and ongoing demand for rugged commercial fleets will sustain steady growth in this segment. Manufacturers will focus on advanced steel alloys and reinforced designs to improve load capacity and fatigue resistance without sacrificing weight efficiency.

2. Electrification Driving Design and Performance Innovations

The rise of electric off-road vehicles (e-ORVs), including electric UTVs, ATVs, and emerging electric pickup trucks, will influence steel wheel design. Electric drivetrains deliver instant torque and often increase vehicle weight due to batteries, placing higher stress on wheels. Steel wheels will be engineered with optimized spoke patterns and thicker rims to handle increased loads and torque. Additionally, thermal management considerations may influence wheel design, as steel’s thermal conductivity differs from aluminum, requiring adaptations in brake and hub integration.

3. Sustainability and Circular Economy Pressures

Environmental regulations and corporate sustainability goals will push the steel wheel industry toward greener practices by 2026. Steel’s high recyclability (up to 90% recycled content possible) will become a key competitive advantage over aluminum, particularly as carbon footprint labeling gains traction. Manufacturers will invest in energy-efficient production processes, such as electric arc furnaces powered by renewable energy, and promote closed-loop recycling programs. Demand for wheels made from low-carbon or “green” steel is expected to rise, especially in regulated markets like Europe.

4. Niche Resurgence in Enthusiast and Aftermarket Communities

While aluminum dominates the consumer off-road aftermarket for aesthetics and weight savings, steel wheels are experiencing a niche resurgence among hardcore off-road enthusiasts. Their unmatched ability to withstand rock crawling, trail abuse, and repair in remote conditions makes them ideal for expedition and overlanding builds. By 2026, aftermarket brands will expand offerings with modern finishes (powder coating, textured paints), improved designs for better tire bead retention, and compatibility with advanced TPMS systems, appealing to performance-focused buyers.

5. Competitive Pressure from Lightweight Alternatives

Steel wheels will face intensified competition from advanced aluminum alloys, forged composites, and hybrid materials that offer better strength-to-weight ratios. As off-road vehicles prioritize fuel efficiency and performance, lighter wheels improve handling, acceleration, and range—especially critical for electric models. To remain competitive, steel wheel manufacturers will focus on weight reduction through optimized geometry, high-strength microalloyed steels, and hybrid construction (e.g., steel rims with aluminum centers), targeting applications where cost and durability outweigh marginal weight gains.

In summary, the 2026 steel wheel market for off-road use will be characterized by resilience in heavy-duty sectors, adaptation to electrification, and a strategic emphasis on sustainability. While facing competition from lighter materials, steel’s inherent toughness and recyclability will secure its role in demanding applications, with innovation focused on performance enhancement and environmental responsibility.

Common Pitfalls When Sourcing Steel Wheels for Off-Road Use

Sourcing steel wheels for off-road applications demands careful attention to both quality and intellectual property (IP) considerations. Cutting corners can lead to safety risks, product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Construction

One of the most frequent issues is sourcing wheels made from substandard steel or with weak structural designs. Off-road wheels endure extreme stress, impacts, and torsional forces. Wheels made from low-grade steel or with inadequate thickness are prone to cracking, warping, or catastrophic failure. Always verify material specifications (e.g., ASTM or ISO standards), demand mill test reports, and conduct third-party testing if necessary.

Inadequate Manufacturing Processes

Even with good raw materials, poor manufacturing—such as inconsistent welding, improper heat treatment, or flawed forming techniques—can compromise wheel integrity. Off-road wheels should undergo rigorous quality control, including X-ray or ultrasonic testing for welds and dimensional inspections. Avoid suppliers who skip these steps or provide limited traceability.

Lack of Certification and Compliance

Many off-road wheels are marketed without proper certifications (e.g., DOT, ISO, JWL, or VIA). These standards ensure the wheel has passed load, impact, and fatigue tests relevant to off-road conditions. Sourcing uncertified wheels increases liability risks and may void vehicle warranties or insurance coverage.

Counterfeit or IP-Infringing Products

A major IP pitfall is inadvertently sourcing wheels that copy protected designs, logos, or patented technologies from established brands (e.g., ARB, Pro Comp, or Method). These counterfeit wheels may look identical but lack performance validation. Purchasing such products exposes your business to legal action, customs seizures, and brand damage. Always verify design ownership and request proof of IP clearance from suppliers.

Weak or Missing Documentation

Reliable suppliers provide detailed technical documentation, including load ratings, bolt patterns, offset specifications, and compliance certificates. Vague or missing documentation is a red flag and may indicate non-compliance or generic replication without engineering rigor.

Overlooking Aftermarket Fitment and Compatibility

Not all steel wheels are created equal in terms of fitment. Off-road vehicles vary significantly in hub bore, backspacing, and suspension clearance. Sourcing wheels without verifying compatibility can lead to customer dissatisfaction, returns, and safety issues such as rubbing or improper alignment.

Focusing Only on Price

The lowest-cost wheels often sacrifice durability, safety, and legality. While cost is important, prioritizing price over proven quality and IP compliance can result in higher long-term costs due to failures, recalls, or legal fees.

By addressing these pitfalls proactively—through due diligence, supplier vetting, and adherence to standards—you can source reliable, compliant steel off-road wheels that meet both performance and legal requirements.

Logistics & Compliance Guide for Steel Wheels For Off-Road Use

Overview

This guide outlines key logistics and compliance considerations for the international trade and distribution of steel wheels designed for off-road vehicles. These wheels are used in construction, mining, agriculture, and heavy-duty recreational applications, and are subject to specific transportation, regulatory, and safety requirements.

Product Classification & Harmonized System (HS) Code

Accurate product classification is essential for customs clearance and duty assessment.

– Typical HS Code: 8708.70.50 (Wheels for vehicles of heading 8701 to 8705, including off-road vehicles)

– Note: Confirm with local customs authorities, as classification may vary by country based on wheel specifications (e.g., diameter, rim type, intended vehicle use).

Regulatory Compliance by Region

United States

- DOT Compliance: Off-road steel wheels are generally not required to meet FMVSS (Federal Motor Vehicle Safety Standards) unless used on vehicles operating on public roads. However, manufacturers may follow SAE J267 standards for performance and durability.

- EPA Regulations: No direct emissions compliance for wheels, but related equipment (e.g., trucks) must meet EPA standards.

- Customs: ISF (Importer Security Filing) required 24 hours prior to shipment departure.

European Union

- ECE Regulations: Steel wheels used on vehicles intended for on-road use must comply with UN Regulation No. 124.

- Off-Road Exemption: Pure off-road wheels (e.g., for construction or agricultural machinery) may be exempt but should be clearly labeled and documented.

- REACH & RoHS: Ensure materials comply with restrictions on hazardous substances. Steel wheels typically meet these unless coated with restricted materials.

Canada

- CMVSS: Similar to U.S., off-road wheels are not subject to CMVSS unless used on road-legal vehicles.

- Transport Canada: Import documentation must specify intended use to avoid misclassification.

Australia & New Zealand

- ADR Compliance: Not required for dedicated off-road wheels.

- Import Requirements: Clear declaration of use (off-road only) to prevent rejection at customs.

Packaging & Marking Requirements

Proper packaging ensures product integrity and regulatory compliance.

– Packaging: Use steel strapping, wooden pallets, or containers to prevent deformation during transit.

– Marking: Each wheel must be permanently marked with:

– Manufacturer name or trademark

– Size designation (e.g., 16×7)

– Load rating

– “OFF-ROAD USE ONLY” if not certified for on-road use

– Country of origin

Shipping & Freight Logistics

Transport Modes

- Sea Freight (FCL/LCL): Most cost-effective for bulk shipments. Use containerized shipping with moisture protection.

- Air Freight: Suitable for urgent, small-volume orders. Higher cost; ensure structural integrity for air pressure changes.

- Overland (Truck/Rail): Common for regional distribution within North America, EU, or Asia.

Load Securing

- Follow the CTU (Cargo Transport Unit) Code for securing wheels in containers or trucks.

- Use dunnage and straps to prevent shifting. Stacked wheels should be interlocked or separated with spacers.

Incoterms®

Commonly used terms:

– FOB (Free On Board): Common for sea shipments; risk transfers at port of origin.

– CIF (Cost, Insurance, Freight): Seller covers freight and insurance to destination port.

– DDP (Delivered Duty Paid): Seller manages full logistics and customs clearance (recommended for inexperienced importers).

Documentation Requirements

Ensure all documentation is accurate and complete to avoid delays.

– Commercial Invoice

– Packing List

– Bill of Lading (or Air Waybill)

– Certificate of Origin

– Test Reports (e.g., load testing, material certification)

– Import Declaration (completed by importer or agent)

Safety & Quality Standards

Key Industry Standards

- SAE J267: Performance requirements for off-road wheels.

- ISO 4003: Dimensions for earth-moving machinery wheels.

- EN 455: European standard for wheels on industrial trucks.

- ASTM A108: Standard specification for steel bars, including those used in wheel manufacturing.

Testing & Certification

- Conduct load, impact, and fatigue testing during manufacturing.

- Maintain test records for compliance audits.

- Third-party certification (e.g., TÜV, SGS) may be required by certain markets or customers.

Environmental & Sustainability Considerations

- Recyclability: Steel wheels are 100% recyclable; highlight this in sustainability reporting.

- Coating Processes: Use environmentally compliant paints and coatings (e.g., powder coating with low VOCs).

- Waste Management: Ensure manufacturing waste (metal shavings, packaging) is disposed of according to local regulations.

Risk Management & Insurance

- Cargo Insurance: Cover for damage, theft, or loss during transit (all-risk coverage recommended).

- Product Liability Insurance: Essential due to safety-critical nature of wheels.

- Force Majeure Clauses: Include in contracts to address supply chain disruptions.

Summary & Best Practices

- Clearly document intended use (off-road only) to avoid regulatory issues.

- Verify HS codes and import requirements for each destination country.

- Partner with experienced freight forwarders familiar with heavy industrial goods.

- Maintain detailed compliance records for traceability and audits.

- Label products correctly and provide technical documentation to distributors.

By following this logistics and compliance guide, manufacturers and distributors can ensure smooth international shipments, regulatory adherence, and customer satisfaction for steel off-road wheels.

Conclusion: Sourcing Steel Wheels for Off-Road Applications

Sourcing steel wheels for off-road use requires a careful evaluation of durability, load capacity, terrain compatibility, and long-term value. Steel wheels remain the preferred choice for serious off-road vehicles due to their superior strength, resistance to impact damage, and ability to withstand harsh environments where alloy wheels might crack or fail. When sourcing, it is essential to prioritize wheels manufactured from high-tensile steel, with reinforced rims and bead locks where extreme conditions demand added security.

Key considerations include matching bolt patterns, offset, and diameter to the vehicle specifications, ensuring compatibility with tires designed for mud, rock crawling, or overland travel. Sourcing from reputable manufacturers or suppliers who adhere to international quality standards (such as ISO or DOT certifications) helps guarantee reliability and safety. Additionally, evaluating warranty terms, availability of spare parts, and after-sales support can significantly impact operational uptime, especially in remote or demanding environments.

While steel wheels are heavier than alloy alternatives, their longevity, repairability, and lower cost make them a cost-effective solution over time—particularly for expedition vehicles, overlanding rigs, and industrial off-road applications. In conclusion, investing in high-quality steel wheels from trusted sources ensures enhanced performance, safety, and resilience, making them an indispensable component in any serious off-road setup.