The global steel rectangular tube market is witnessing robust expansion, driven by rising construction activities, infrastructure development, and increasing demand from industrial and automotive sectors. According to Grand View Research, the global steel tubes and pipes market was valued at USD 137.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Steel rectangular tubes, in particular, are favored for their structural strength, cost-efficiency, and versatility in applications ranging from building frameworks to mechanical manufacturing. Mordor Intelligence further projects that growing urbanization and investments in renewable energy infrastructure will continue to propel demand, especially in Asia-Pacific and emerging economies. As competition intensifies, a select group of manufacturers has risen to prominence through innovation, scale, and consistent quality. Here, we spotlight the top 10 steel rectangular tube manufacturers shaping the industry landscape in 2024.

Top 10 Steel Rectangular Tube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Atlas Tube

Domain Est. 1995

Website: atlastube.com

Key Highlights: As the leading manufacturer of structural steel tube, we’re here to help you. From conceptual design through project completion, our engineering team, design ……

#2 Structural Tubing Supplier

Domain Est. 1997

Website: sss-steel.com

Key Highlights: Triple-S Steel® offers a range of high-quality structural steel square and rectangular tube designed to meet industrial and structural needs. Learn more!…

#3 Industrial Tube and Steel Corporation: Steel Tubing & Dura

Domain Est. 1997 | Founded: 1956

Website: industrialtube.com

Key Highlights: Since 1956, Industrial Tube and Steel has been servicing the steel tubing and continuous cast iron needs of businesses across the Midwest. Contact us!…

#4 Structural Steel Rectangular Tubing

Domain Est. 1996

Website: nssco.com

Key Highlights: As a rectangular steel tubing supplier, North Shore Steel stocks rectangular tubing in many common sizes, and also in black and galvanized finish….

#5 Chicago Tube & Iron

Domain Est. 1997 | Founded: 1914

Website: chicagotube.com

Key Highlights: Founded in 1914, CTI is one of the largest specialty steel service centers in the United States, with nine locations throughout the Midwest and in Monterrey, ……

#6 Rectangular and Square Tubing

Domain Est. 1997

Website: metalsusa.com

Key Highlights: Metals USA is a leading steel distributor offering a wide variety of structural steel tubing in rectangular and square shapes and numerous sizes….

#7 Rectangular & Square Tubing

Domain Est. 1997

Website: chathamsteel.com

Key Highlights: Chatham Steel is a leading steel distributor offering a wide variety of structural steel tubing in rectangular and square shapes and numerous sizes….

#8 Rectangular Steel Tubing Supplier

Domain Est. 1998

Website: tbtube.com

Key Highlights: T&B Tube manufactures a variety of rectangular steel tubing with the ability to easily locate the weld seam. Sizes range from .5×1 to 2×3. Contact us today!…

#9 Rectangular Steel Tubing Supplier

Domain Est. 2000

Website: tottentubes.com

Key Highlights: At Totten Tubes, we offer rectangular steel tubing made from a variety of materials in both mechanical and structural grades….

#10 Steel Rectangular Tube

Domain Est. 2001

Website: madar.com

Key Highlights: Our steel rectangular tubes are strong, durable, and resistant to corrosion, making them ideal for use in harsh environments. Choose from a range of sizes and ……

Expert Sourcing Insights for Steel Rectangular Tube

2026 Market Trends for Steel Rectangular Tube

The global steel rectangular tube market is poised for steady growth and transformation by 2026, driven by evolving construction practices, industrial demands, and sustainability initiatives. Key trends shaping the market include:

Urbanization and Infrastructure Development Driving Demand

Rapid urbanization, particularly in Asia-Pacific and emerging economies, continues to fuel demand for steel rectangular tubes. Governments are investing heavily in infrastructure projects such as bridges, stadiums, and public transit systems, where steel tubes offer structural efficiency and design flexibility. The preference for prefabricated and modular construction methods further boosts adoption due to the ease of integration and faster assembly times.

Sustainability and Green Building Standards Influencing Material Choice

Environmental regulations and green building certifications (e.g., LEED, BREEAM) are pushing the construction sector toward sustainable materials. Steel rectangular tubes, especially those made from recycled content or produced using low-carbon methods, are gaining favor. Manufacturers are investing in electric arc furnaces (EAF) and energy-efficient production techniques to reduce carbon footprints, aligning with net-zero goals and enhancing market competitiveness.

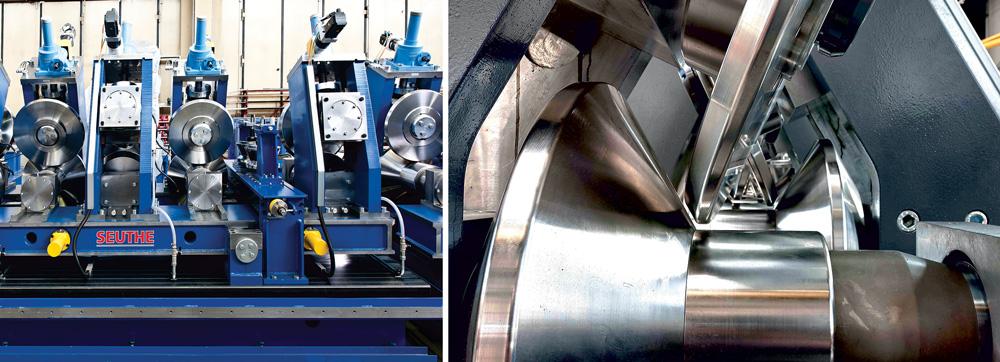

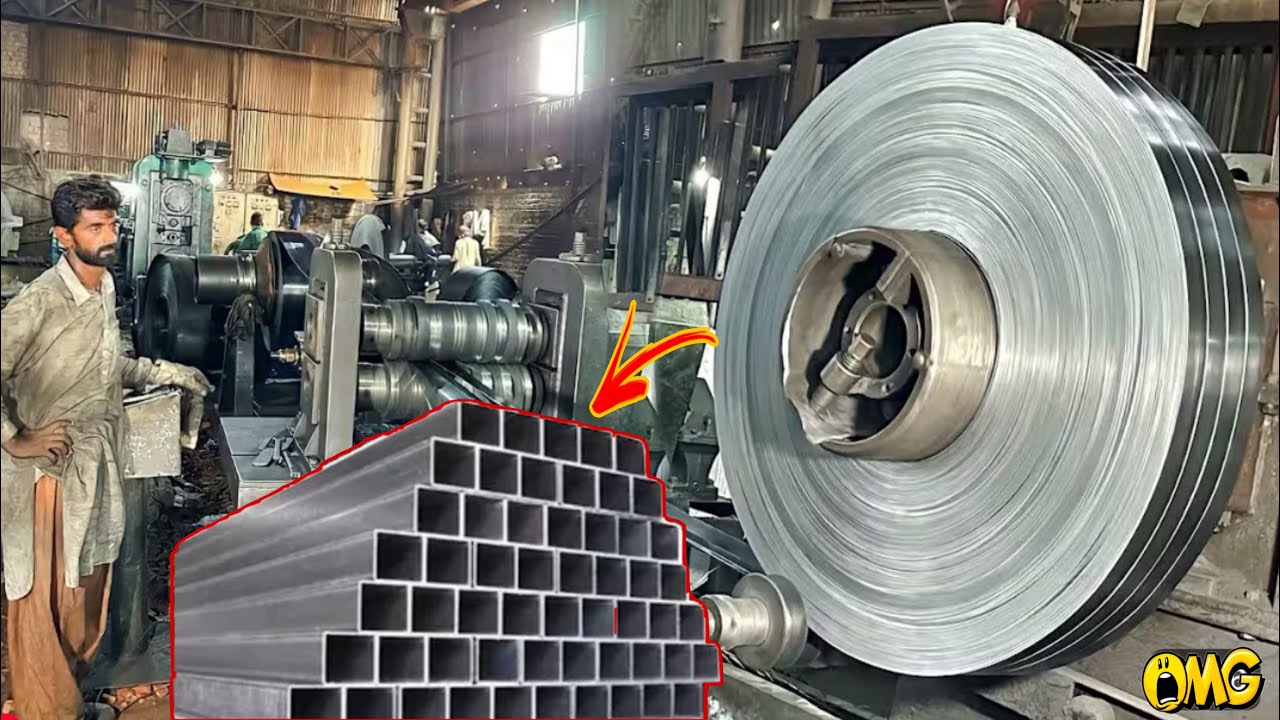

Technological Advancements in Manufacturing and Coatings

Innovations in roll-forming, laser welding, and automated production lines are improving the precision, strength, and consistency of steel rectangular tubes. Advanced coatings such as zinc-aluminum-magnesium (ZAM) alloys offer superior corrosion resistance, expanding applications in harsh environments. Digitalization and Industry 4.0 integration enable real-time quality control and supply chain optimization, reducing waste and improving delivery timelines.

Shift Toward High-Strength and Lightweight Solutions

Demand is rising for high-strength low-alloy (HSLA) steel rectangular tubes that offer improved strength-to-weight ratios. These materials are increasingly used in automotive frames, renewable energy structures (e.g., solar panel supports), and aerospace applications. Lightweight yet durable tubes support energy efficiency and reduce transportation and installation costs.

Regional Market Dynamics and Supply Chain Resilience

While Asia-Pacific remains the largest producer and consumer, North America and Europe are seeing renewed growth due to infrastructure revitalization programs (e.g., U.S. Infrastructure Investment and Jobs Act). Geopolitical factors and trade policies are prompting companies to regionalize supply chains, reducing dependency on single sources and enhancing resilience. Localized production hubs are expected to rise, shortening lead times and mitigating risks.

Increasing Competition and Price Volatility

The market faces challenges from fluctuating raw material prices, particularly iron ore and scrap steel, influenced by global economic conditions and energy costs. Intense competition among manufacturers is driving innovation but also pressuring profit margins. Strategic partnerships and vertical integration are becoming essential for maintaining cost efficiency and securing raw material supplies.

In summary, the 2026 steel rectangular tube market will be defined by sustainability, technological innovation, and resilient supply chains. Companies that adapt to regulatory changes, invest in green manufacturing, and meet evolving customer needs across construction, automotive, and renewable energy sectors will be best positioned for long-term success.

Common Pitfalls When Sourcing Steel Rectangular Tube (Quality and Intellectual Property)

Sourcing steel rectangular tubing involves navigating various challenges that can impact both the quality of the final product and exposure to intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable supply, structural integrity, and legal compliance.

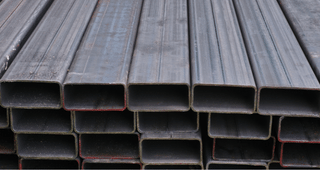

Poor Material Quality and Non-Compliance

One of the most frequent issues is receiving steel rectangular tubes that fail to meet specified standards. This includes deviations in chemical composition, inadequate tensile strength, or inconsistent wall thickness. Suppliers—especially those offering unusually low prices—may cut corners by using substandard raw materials or outdated manufacturing processes. Additionally, failure to comply with recognized standards such as ASTM A500, ASTM A513, or EN 10219 can result in structural weaknesses, safety hazards, and rejection during inspection.

Inadequate or Falsified Certifications

Many suppliers provide mill test certificates (e.g., MTRs or 3.1/3.2 certificates) that purport to verify material compliance. However, counterfeit or inaccurate documentation is a known risk, particularly when sourcing from regions with less stringent regulatory oversight. Without independent verification, buyers may unknowingly accept non-conforming material, leading to project delays, rework, or liability in case of failure.

Dimensional Inaccuracies and Tolerances

Steel rectangular tubes must adhere to strict dimensional tolerances for proper fit and structural performance. Pitfalls arise when tubes exhibit warping, twisting, or out-of-tolerance cross-sections due to poor rolling or handling practices. These inconsistencies can complicate fabrication, increase labor costs, and compromise the integrity of welded or bolted assemblies.

Surface Defects and Corrosion Issues

Visible defects such as scale, cracks, seams, or pitting can significantly reduce the performance and lifespan of steel tubing. Poor surface finish not only affects aesthetics but can also inhibit proper coating adhesion, accelerating corrosion. Buyers may overlook surface quality during initial inspection, leading to premature degradation in service environments, especially in outdoor or high-moisture applications.

Intellectual Property Infringement Risks

When sourcing proprietary tube profiles or custom-engineered sections, there’s a risk of inadvertently purchasing products that infringe on patented designs or manufacturing processes. Some suppliers may reverse-engineer branded or patented profiles and offer “compatible” versions at lower cost. Using such products can expose the buyer to legal action, product recalls, and reputational damage, even if the infringement was unintentional.

Lack of Traceability and Supply Chain Transparency

A transparent supply chain is critical for quality assurance and IP compliance. Sourcing from intermediaries or unclear supply chains can obscure the origin of materials, making it difficult to verify production methods, material traceability, or adherence to ethical and legal standards. This lack of transparency increases the risk of receiving counterfeit, stolen, or non-compliant products.

Insufficient Supplier Vetting and Due Diligence

Relying on unverified suppliers—especially through online marketplaces or new vendors without a proven track record—can result in inconsistent quality and unreliable delivery. Failure to audit manufacturing facilities, review quality management systems (e.g., ISO 9001), or conduct sample testing leaves buyers vulnerable to supply chain disruptions and subpar materials.

Overlooking Coatings and Finishes

For applications requiring corrosion resistance, the absence or inconsistency of protective coatings (e.g., galvanizing, powder coating) is a common pitfall. Poorly applied or uneven coatings can lead to premature rusting and reduced service life. Buyers may assume standard finishes are included, only to discover they must be added post-purchase, increasing costs and lead times.

Conclusion

To mitigate these risks, buyers should prioritize certified suppliers, demand verifiable documentation, conduct third-party inspections, and perform due diligence on IP rights when using specialized profiles. Establishing clear specifications and quality control protocols upfront is essential for securing reliable, compliant, and legally sound steel rectangular tubing.

Logistics & Compliance Guide for Steel Rectangular Tube

This guide outlines key considerations for the logistics and regulatory compliance involved in transporting and handling Steel Rectangular Tubes across supply chains. Adhering to these guidelines ensures safety, cost efficiency, and legal adherence.

Product Overview

Steel Rectangular Tubes are hollow structural sections (HSS) commonly used in construction, manufacturing, and infrastructure. They are typically made from carbon steel, stainless steel, or alloy steel and are available in various grades, dimensions, thicknesses, and surface finishes (e.g., galvanized, painted, or mill finish).

Packaging and Handling Requirements

Proper packaging prevents damage during transit:

– Bundling: Tubes are usually bundled using steel or nylon strapping, with protective corner boards or edge protectors to avoid deformation.

– Coating Protection: For galvanized or coated tubes, use non-abrasive padding (e.g., plastic sheathing or paper interleaving) to prevent scratching.

– Labeling: Each bundle must be clearly labeled with product details (grade, dimensions, heat number, standard, and customer order number) and handling instructions (e.g., “Do Not Stack,” “Keep Dry”).

– Loading: Use cradles or racks to prevent bending. Avoid direct contact with the ground; use wooden skids or pallets.

Transportation Guidelines

Selecting the right transport mode and method is critical:

– Mode Selection: Based on volume, distance, and urgency—options include flatbed trucks, railcars, or ocean freight containers.

– Securing Loads: Use chains, straps, or lashing to secure bundles firmly to the transport vehicle. Ensure even weight distribution to prevent shifting.

– Weather Protection: Cover loads with waterproof tarpaulins during road or sea transport to prevent moisture exposure and corrosion.

– Stacking Limits: Respect vertical load limits to avoid crushing lower bundles. Do not exceed crane or forklift lifting capacities.

International Shipping & Customs Compliance

For cross-border shipments, compliance with international regulations is essential:

– HS Code Classification: Use the appropriate Harmonized System (HS) code (e.g., 7306.61 for hollow sections of iron or steel, rectangular, of non-alloy steel) for customs declaration.

– Export Documentation: Prepare commercial invoice, packing list, bill of lading or air waybill, certificate of origin, and any required export licenses.

– Material Certification: Provide Mill Test Certificates (MTCs) or Certificates of Conformance (CoC) in accordance with standards such as ASTM A500, ASTM A1085, or EN 10219, as required by the destination country.

– Anti-Dumping & Safeguards: Be aware of trade remedies such as anti-dumping duties, especially when shipping to regions like the U.S., EU, or Canada. Verify current tariff schedules and exclusions.

Regulatory and Safety Standards

Ensure product and handling practices meet relevant standards:

– Product Standards: Confirm tubes meet applicable regional or international standards (e.g., ASTM, ISO, EN, JIS).

– REACH & RoHS Compliance: For shipments to the EU, ensure steel composition complies with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and, where applicable, RoHS restrictions on hazardous substances.

– Safety Data Sheets (SDS): While steel is generally exempt, provide SDS if coatings or treatments involve hazardous materials.

– OSHA & Local Regulations: Follow occupational safety standards for loading/unloading, including use of PPE (gloves, hard hats, safety footwear) and proper lifting equipment.

Storage and Inventory Management

Proper storage maintains product integrity:

– Environment: Store indoors or under cover in a dry, well-ventilated area to prevent rust and corrosion.

– Racking: Use horizontal racks or cradles to support full bundle length and prevent bending.

– Segregation: Separate by grade, size, and coating type to avoid mix-ups and cross-contamination.

– First-In, First-Out (FIFO): Implement FIFO to reduce the risk of prolonged storage leading to surface degradation.

Quality Assurance and Traceability

Maintain full traceability throughout the supply chain:

– Heat Traceability: Retain heat numbers and test reports for each production lot.

– Inspection Points: Conduct pre-shipment inspections to verify dimensions, surface quality, and packaging integrity.

– Non-Conformance Handling: Establish procedures for quarantining and reporting defective or non-compliant shipments.

Environmental and Sustainability Considerations

- Recyclability: Steel Rectangular Tubes are 100% recyclable—highlight this in sustainability reporting.

- Carbon Footprint: Optimize logistics routes and consolidate shipments to reduce emissions.

- Waste Minimization: Reuse packaging materials (e.g., strapping, skids) where possible.

By following this guide, stakeholders can ensure efficient, compliant, and safe handling of Steel Rectangular Tubes from production to final delivery. Regular audits and updates to procedures are recommended to stay aligned with evolving regulations and industry best practices.

Conclusion for Sourcing Steel Rectangular Tubes

In conclusion, sourcing steel rectangular tubes requires a comprehensive evaluation of material specifications, supplier reliability, cost-efficiency, and compliance with industry standards. Selecting the right grade of steel—such as ASTM A500, A513, or EN 10219—ensures structural integrity and suitability for the intended application, whether for construction, manufacturing, or infrastructure projects. Partnering with reputable suppliers who provide consistent quality, timely delivery, and full traceability helps mitigate risks and supports project continuity. Additionally, considering factors such as coating options (e.g., galvanized for corrosion resistance), dimensional accuracy, and sustainable sourcing practices contributes to long-term performance and environmental responsibility.

Ultimately, a strategic and well-informed sourcing approach not only optimizes cost and quality but also enhances supply chain resilience, ensuring that steel rectangular tubes meet both technical requirements and project timelines effectively.