The global steel beams and girders market is experiencing steady expansion, driven by rising infrastructure development, urbanization, and growth in the construction and industrial sectors. According to Grand View Research, the global structural steel market size was valued at USD 123.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 5.8% during the forecast period of 2023–2028, underpinned by increased demand for durable, sustainable, and prefabricated building solutions. This growth trajectory has intensified competition among manufacturers, elevating the importance of innovation, production capacity, and global reach. In this evolving landscape, nine leading steel beam and girder manufacturers stand out for their market influence, technological expertise, and contribution to large-scale construction projects worldwide.

Top 9 Steel Beams And Girders Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AISC Page

Domain Est. 1997

Website: aisc.org

Key Highlights: A not-for-profit structural steel technical institute, partners with the AEC community to develop safe and efficient steel specifications and codes.Missing: girders manufacturer…

#2 Steel Beams for Construction

Domain Est. 2018

Website: nucorskyline.com

Key Highlights: Nucor Skyline is North America’s premier steel foundation manufacturer and supplier, serving the construction industry with engineering solutions and an ……

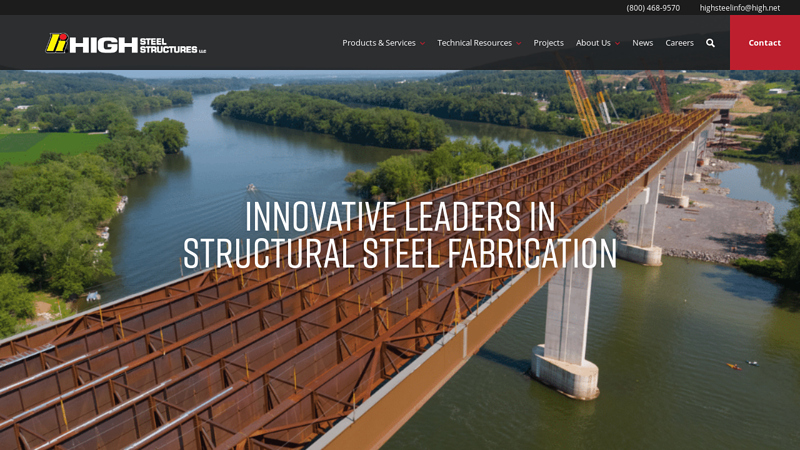

#3 High Steel Structures

Domain Est. 1997

Website: highsteel.com

Key Highlights: High Steel’s fabricators specialize in quality steel girder fabrication. High Steel supplies fabricated structural steel bridge girders, complex bridge ……

#4 Steel Beam

Domain Est. 1997

Website: nucor.com

Key Highlights: Nucor offers customers a diverse range of wide-flange steel beams, pilings, and heavy structural steel products….

#5 Structural Steel Beams

Domain Est. 1997

Website: metalsusa.com

Key Highlights: Metals USA offers a large array of structural and carbon steel shapes including beams, channels, and more….

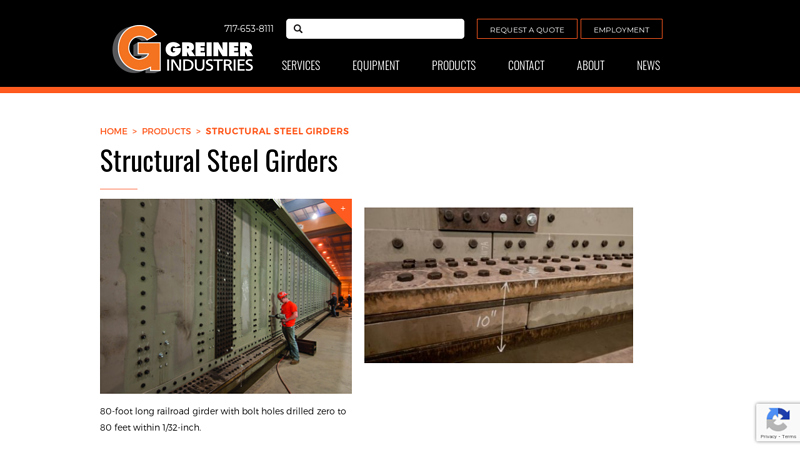

#6 Structural Steel Girders

Domain Est. 1998

Website: greinerindustries.com

Key Highlights: Greiner is highly skilled in the fabrication of heavy-duty structural steel girders. We can produce them to a customer’s exact specifications….

#7 Steel Bridge & Girder Fabrication

Domain Est. 2006

Website: wabashsteel.biz

Key Highlights: Experts in steel girder manufacturing & Bridge fabrication. Wabash Steel Company has been building steel bridges for over 100 years. We have generations of ……

#8 Steel Beams

Domain Est. 2011

Website: kloecknermetals.com

Key Highlights: Ensure structural integrity with Kloeckner Metals’ steel beams. We offer a complete inventory of structural products in various shapes/sizes….

#9 Brown Strauss Steel

Domain Est. 2014

Website: brownstrauss.com

Key Highlights: Brown Strauss is the premier structural steel service center in the United States. We have the deepest inventory for your wide flange beam, structural tube, ……

Expert Sourcing Insights for Steel Beams And Girders

H2: Projected Market Trends for Steel Beams and Girders in 2026

The global market for steel beams and girders is poised for steady growth through 2026, driven by a confluence of infrastructural development, technological advancements, and evolving regulatory landscapes. Key trends shaping the market include increased urbanization, sustainability mandates, and regional construction booms, particularly in emerging economies.

-

Infrastructure Expansion Driving Demand

Governments worldwide are prioritizing infrastructure modernization and expansion, notably in transportation networks, public buildings, and energy facilities. In North America and Europe, aging infrastructure is spurring large-scale rehabilitation projects, while in Asia-Pacific—especially India, China, and Southeast Asia—rapid urbanization is fueling high-rise construction and smart city initiatives. These activities are expected to significantly boost demand for structural steel components such as I-beams, H-beams, and plate girders. -

Green Building and Low-Carbon Steel Adoption

Environmental regulations and green building certifications (e.g., LEED, BREEAM) are pushing construction firms to adopt sustainable materials. The steel industry is responding with innovations in low-carbon and recycled steel production. By 2026, an increasing share of steel beams and girders is projected to be manufactured using electric arc furnaces (EAF) and green hydrogen-based reduction techniques. This shift aligns with net-zero goals and enhances the material’s appeal in eco-conscious construction markets. -

Technological Advancements in Fabrication

Digitalization in construction, including Building Information Modeling (BIM) and automated fabrication, is improving precision and reducing lead times in steel beam production. Prefabricated and modular construction methods are gaining traction, particularly in commercial and industrial projects. These technologies enable faster assembly on-site and reduce material waste, making steel beams a more efficient choice compared to traditional materials. -

Price Volatility and Supply Chain Resilience

Steel prices are expected to remain sensitive to global raw material costs (e.g., iron ore, scrap metal), energy prices, and geopolitical factors. However, by 2026, manufacturers are anticipated to strengthen supply chain resilience through regional sourcing, inventory optimization, and strategic partnerships. Trade policies and tariffs—especially in the U.S. and EU—will continue to influence import/export dynamics of steel products. -

Regional Market Dynamics

- Asia-Pacific will remain the largest market due to ongoing industrialization and government-led infrastructure programs.

- North America will see steady growth, supported by the U.S. Infrastructure Investment and Jobs Act.

- Europe’s market will be shaped by green transition policies and renovation waves.

- Middle East and Africa are emerging as high-growth regions, with major investments in urban development and energy projects.

In summary, the steel beams and girders market in 2026 will be characterized by resilient demand, technological innovation, and a strong push toward sustainability. Companies that invest in eco-efficient production, digital integration, and supply chain agility are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Steel Beams and Girders: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Steel Beams and Girders

Overview

Steel beams and girders are essential structural components used in construction, infrastructure, and industrial projects. Due to their weight, size, and material characteristics, transporting and handling these elements requires careful logistical planning and strict adherence to regulatory compliance standards. This guide outlines best practices, transportation considerations, safety protocols, and compliance requirements for the logistics of steel beams and girders.

Transportation Planning

Proper transportation planning ensures timely delivery while minimizing risks and costs. Key considerations include:

– Route Assessment: Evaluate road conditions, bridge weight limits, overhead clearances, and permitted routes for oversized loads. Use route survey software if necessary.

– Load Configuration: Plan load distribution across trailers to prevent overloading axles. Use spreader beams or custom cradles to secure beams and prevent shifting.

– Trailer Selection: Choose appropriate trailers—flatbeds, lowboys, or extendable multi-axle trailers—based on beam length, weight, and load height.

– Permits: Obtain oversize/overweight transport permits from relevant state or provincial authorities. Required for beams exceeding standard dimensions (typically >8.5 ft wide, >13.5 ft high, or >53 ft long).

Packaging and Handling

Appropriate packaging and handling protect materials and ensure worker safety:

– Bundling: Steel beams should be bundled securely with steel strapping or chains, separated by dunnage to prevent surface damage.

– Lifting Points: Use certified lifting lugs or slings at designated pick points. Avoid lifting by web or flange unless designed for such loads.

– Surface Protection: Apply protective coatings or wraps to prevent corrosion during transit, especially for weathering steel or painted finishes.

Safety Protocols

Safety is paramount during loading, transport, and unloading:

– Training: Ensure all personnel are trained in rigging, crane operation, and load securement (compliant with OSHA and ANSI standards).

– Personal Protective Equipment (PPE): Require hard hats, steel-toed boots, gloves, and high-visibility vests on site.

– Load Securement: Follow FMCSA (Federal Motor Carrier Safety Administration) guidelines: use tiedowns rated for load weight, with at least one tiedown for every 10 ft of cargo.

– Hazard Communication: Clearly mark loads as “Heavy Steel – Do Not Stand Under Load” and use reflective tape for visibility.

Regulatory Compliance

Adherence to legal and industry standards is critical:

– DOT Regulations (USA): Comply with FMCSA rules for vehicle weight limits, hours of service, and cargo securement (49 CFR Part 393).

– CDL Requirements: Drivers must possess a Commercial Driver’s License (CDL) with appropriate endorsements for hauling heavy or oversized loads.

– International Shipments: For cross-border transport, comply with customs documentation, NAFTA/USMCA certifications, and international load standards (e.g., ADR for Europe).

– Environmental Regulations: Manage cutting oils, rust inhibitors, and packaging waste according to EPA or local environmental codes.

Documentation and Traceability

Maintain accurate records throughout the logistics chain:

– Bill of Lading (BOL): Include detailed descriptions of beam types (e.g., W12x50), quantities, weights, and delivery instructions.

– Mill Certificates: Provide material test reports (MTRs) confirming steel grade (e.g., ASTM A36, A992) and compliance with design specifications.

– Delivery Confirmation: Require signed delivery receipts with timestamps and inspection notes upon arrival.

Risk Management and Contingency Planning

Anticipate and mitigate potential disruptions:

– Weather Delays: Monitor forecasts and adjust schedules for high winds or icy conditions that affect load stability.

– Insurance: Carry comprehensive cargo insurance covering damage, loss, and third-party liability.

– Emergency Contacts: Provide 24/7 logistics support numbers on all shipments for incident reporting.

Final Inspection and Unloading

Ensure integrity upon delivery:

– Pre-Unloading Check: Inspect beams for transport damage, deformation, or coating issues before unloading.

– Unloading Site Readiness: Confirm crane capacity, ground stability, and clear access paths at the job site.

– Stacking Guidelines: Store beams on level, well-drained surfaces with adequate support to prevent warping or corrosion.

Conclusion

Efficient and compliant logistics for steel beams and girders depend on meticulous planning, adherence to regulations, and proactive risk management. By following this guide, stakeholders can ensure safe, timely, and cost-effective delivery while maintaining structural integrity and regulatory compliance.

In conclusion, the sourcing of steel beams and girders is a critical step in the success of any structural construction project. Selecting the right supplier involves evaluating factors such as material quality, compliance with industry standards (e.g., ASTM, AISC), lead times, cost-effectiveness, and logistical capabilities. Engaging with reputable suppliers or manufacturers ensures structural integrity, reduces the risk of delays, and supports project efficiency and safety. Additionally, considering sustainable sourcing practices and local fabrication options can further enhance project sustainability and cost performance. A well-executed sourcing strategy not only meets technical and regulatory requirements but also contributes to the overall timeliness and budget adherence of the construction project.