The global portable centrifuge market, driven by rising demand for point-of-care diagnostics and compact laboratory equipment, is projected to grow at a CAGR of 7.2% from 2024 to 2030, according to a report by Grand View Research. Within this expanding landscape, the Statspin Express 4—a benchtop centrifuge widely used in clinical and research settings for rapid plasma and serum separation—has become a benchmark for efficiency and reliability. As healthcare facilities increasingly prioritize space-saving, high-performance instrumentation, a select group of manufacturers have emerged as leaders in producing compatible or alternative models tailored to meet rigorous quality and throughput standards. Driven by technological advancements and growing adoption in decentralized testing environments, these top four Statspin Express 4 manufacturers are positioned at the forefront of an evolving diagnostic equipment ecosystem.

Top 4 Statspin Express 4 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 StatSpin® Solutions

Domain Est. 1995

Website: hemocue.com

Key Highlights: With the StatSpin® Express 4, your laboratory will experience fast turnaround times and high productivity with less space. This high-speed horizontal centrifuge ……

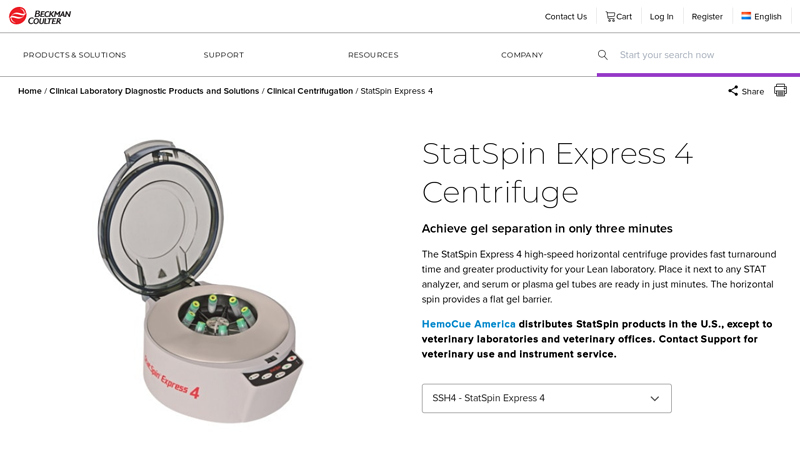

#2 StatSpin Express 4 Centrifuge

Domain Est. 1997

Website: beckmancoulter.com

Key Highlights: The StatSpin Express 4 high-speed horizontal centrifuge provides faster turnaround time and greater productivity for your Lean laboratory….

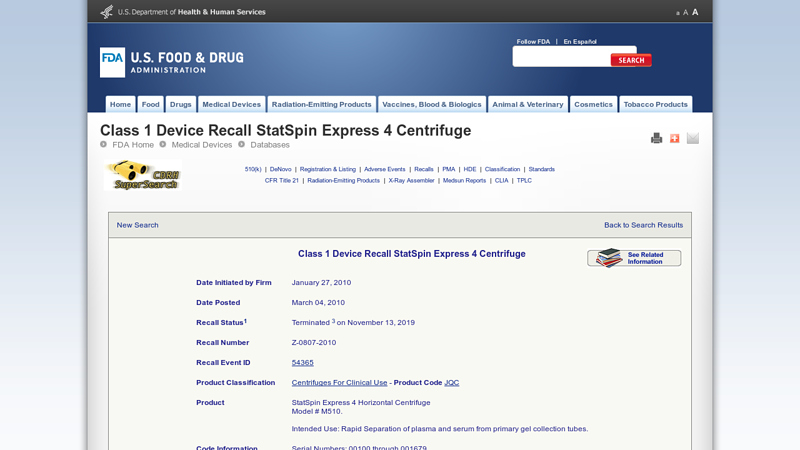

#3 Class 1 Device Recall StatSpin Express 4 Centrifuge

Domain Est. 2000

Website: accessdata.fda.gov

Key Highlights: StatSpin Express 4 Horizontal Centrifuge Model # M510. Intended Use: Rapid Separation of plasma and serum from primary gel collection tubes. Code Information ……

#4 Statspin express 4

Domain Est. 2007

Website: medwrench.com

Key Highlights: The 5 and 10 minute lights designate the instrument cannot maintain speed. The most common cause for this issues is the motor drive itself….

Expert Sourcing Insights for Statspin Express 4

H2: 2026 Market Trends for Statspin Express 4

As we approach 2026, the market landscape for diagnostic and laboratory equipment is undergoing significant transformation, driven by technological innovation, increased demand for rapid testing, and a shift toward decentralized healthcare delivery. Within this context, the Statspin Express 4 — a compact, benchtop centrifuge known for its efficiency in point-of-care and small clinical lab settings — is positioned to benefit from several key market trends.

1. Growth in Point-of-Care Testing (POCT)

The global expansion of point-of-care diagnostics is one of the primary drivers influencing the demand for compact, reliable centrifuges like the Statspin Express 4. With healthcare systems prioritizing faster turnaround times and decentralized testing — especially in rural clinics, urgent care centers, and physician offices — demand for small-footprint, easy-to-use centrifuges is rising. The Statspin Express 4’s design aligns well with POCT workflows, enabling rapid sample preparation without requiring large laboratory infrastructure.

2. Emphasis on Operational Efficiency

Healthcare providers are increasingly focused on optimizing lab throughput and minimizing operational downtime. The Statspin Express 4 offers fast spin cycles, intuitive operation, and low maintenance requirements, making it an attractive option for labs managing high sample volumes with limited staffing. As labor shortages persist into 2026, automation-adjacent devices that reduce manual handling without full-scale integration will remain in demand.

3. Integration with Digital Lab Ecosystems

While the Statspin Express 4 is not inherently a smart device, market trends point toward greater connectivity in lab equipment. In 2026, users may expect accessories or third-party solutions that enable data logging, usage tracking, or maintenance alerts for such devices. Manufacturers or integrators may leverage IoT add-ons to retrofit existing centrifuges, enhancing their value in digitally connected clinics.

4. Focus on Sustainability and Energy Efficiency

Environmental sustainability is becoming a procurement criterion in healthcare. The Statspin Express 4, with its energy-efficient motor and durable construction, supports green lab initiatives. In 2026, buyers may favor equipment with low power consumption and longer lifespans, especially in regions with strong regulatory or institutional sustainability mandates.

5. Global Expansion and Emerging Markets

In developing regions, there is growing investment in primary care infrastructure. The Statspin Express 4’s reliability, ease of maintenance, and ability to operate in variable power environments make it well-suited for deployment in emerging markets. Distributors and public health programs may increasingly include such devices in lab-in-a-box solutions or mobile clinics.

Conclusion

By 2026, the Statspin Express 4 is expected to maintain relevance in a competitive and evolving market due to its alignment with key trends: decentralization of care, demand for efficiency, and scalability across diverse healthcare settings. While newer smart centrifuges may emerge, the Statspin Express 4’s simplicity, reliability, and cost-effectiveness will continue to support its adoption — especially in resource-conscious and high-throughput environments. Strategic updates or companion technologies could further extend its lifecycle and utility in the modern diagnostic ecosystem.

Common Pitfalls When Sourcing Statspin Express 4: Quality and Intellectual Property Concerns

When sourcing a specialized medical device like the Statspin Express 4 centrifuge—whether for procurement, service, or parts—organizations often encounter significant challenges related to product quality and intellectual property (IP) rights. Being aware of these pitfalls is essential to ensure regulatory compliance, patient safety, and operational reliability.

Quality Assurance Risks

One of the primary concerns when sourcing the Statspin Express 4 is ensuring consistent quality, especially when dealing with third-party suppliers or used/refurbished units.

-

Non-OEM or Counterfeit Parts: The market may include imitation or substandard replacement parts not manufactured by the original equipment manufacturer (OEM). These components can compromise the centrifuge’s performance, leading to inaccurate test results or mechanical failure.

-

Improper Refurbishment: Refurbished units may appear functional but lack proper calibration, updated firmware, or necessary maintenance logs. Without adherence to manufacturer specifications, such devices may not meet clinical standards.

-

Lack of Traceability: Sourcing from unauthorized distributors can result in devices or parts without verifiable chain-of-custody, increasing the risk of receiving equipment exposed to improper storage or handling.

-

Outdated Firmware or Software: Older units may run on unsupported software versions, creating compatibility issues with modern lab systems and potentially violating regulatory requirements.

Intellectual Property and Regulatory Compliance Issues

Sourcing the Statspin Express 4 also presents IP-related challenges, particularly when dealing with clones, reverse-engineered components, or unauthorized reproduction of software.

-

Unauthorized Reproduction of Software: Some suppliers may illegally duplicate or distribute the device’s proprietary software. Using such software can lead to IP infringement, cybersecurity vulnerabilities, and non-compliance with FDA or CE regulations.

-

Patent and Trademark Infringement: Cloning or rebranding parts or entire units without licensing can violate patents and trademarks held by the original manufacturer, exposing the buyer to legal liability.

-

Voided Manufacturer Support and Warranties: Devices or parts sourced through unofficial channels often void OEM warranties and technical support agreements. This complicates maintenance, calibration, and regulatory audits.

-

Regulatory Non-Compliance: Using non-certified or IP-infringing components may result in non-compliance with ISO 13485, FDA 21 CFR Part 820, or EU MDR, potentially leading to audit failures or penalties.

To mitigate these risks, organizations should source the Statspin Express 4 exclusively through authorized distributors or certified refurbishers, verify documentation for authenticity, and ensure all software and components are legally licensed and traceable to the OEM.

Logistics & Compliance Guide for Statspin Express 4

This guide outlines the essential logistics and compliance procedures for the safe and effective use, transport, storage, and maintenance of the Statspin Express 4 clinical analyzer. Adherence to these guidelines ensures regulatory compliance, optimal performance, and user safety.

Device Overview and Intended Use

The Statspin Express 4 is a point-of-care centrifugal analyzer designed for rapid hematology and chemistry testing in clinical settings. It is intended for professional use in laboratories, clinics, and hospital environments to perform blood analysis using proprietary test cartridges. Always ensure the device is used strictly within the manufacturer-specified parameters.

Regulatory Compliance Requirements

The Statspin Express 4 complies with key international medical device regulations, including:

– FDA 510(k) clearance for use in the United States

– CE marking under the IVDR (In Vitro Diagnostic Regulation) in the European Union

– Compliance with ISO 13485 (quality management) and ISO 15197 (point-of-care testing)

– Adherence to IEC 61010-1 (safety requirements for electrical equipment)

Users must maintain documentation proving compliance, including device registration, calibration records, and operator training logs, as required by local health authorities.

Shipping and Transportation Guidelines

When shipping the Statspin Express 4:

– Use the original packaging or equivalent protective casing with sufficient cushioning

– Secure the device to prevent internal movement during transit

– Ensure ambient temperature is maintained between 15°C and 30°C during transport

– Avoid exposure to excessive humidity, direct sunlight, or freezing conditions

– Label the package as “Fragile” and “Medical Equipment”

– Retain shipping documentation and tracking numbers for audit purposes

Storage Conditions

Store the Statspin Express 4 in a clean, dry environment with:

– Temperature: 15°C to 30°C (59°F to 86°F)

– Relative humidity: 20% to 80%, non-condensing

– Stable, level surface free from vibration

– Protected from dust, chemicals, and electromagnetic interference

– Away from direct sunlight or heat sources

Test cartridges and reagents must be stored according to manufacturer instructions, typically refrigerated (2°C to 8°C) until use.

Installation and Site Preparation

Before installation:

– Verify the site meets power requirements (100–240 V AC, 50/60 Hz)

– Ensure a stable, grounded electrical outlet is available

– Provide adequate workspace (minimum 60 cm clearance on all sides)

– Confirm internet or network connectivity (if required for data transfer)

– Calibrate the device upon setup using certified calibration materials

– Complete user training and document competency

Operational Compliance and Quality Control

To maintain compliance during operation:

– Perform daily quality control checks using provided control materials

– Calibrate the device according to the manufacturer’s schedule (e.g., quarterly)

– Follow standard operating procedures (SOPs) for sample processing

– Use only approved, lot-validated test cartridges

– Document all QC results, maintenance, and incidents in a logbook or LIMS

– Participate in external proficiency testing programs when available

Maintenance and Service Protocol

Adhere to the following maintenance schedule:

– Weekly: Clean exterior surfaces with a lint-free cloth and 70% isopropyl alcohol

– Monthly: Inspect centrifuge chamber and cartridge slots for debris

– Annually: Schedule preventive maintenance by a certified technician

– Immediately after error codes or performance deviations: Initiate troubleshooting per manual

Keep all service records for a minimum of 5 years or as required by local regulations.

Waste Disposal and Environmental Compliance

Dispose of used test cartridges, sample tubes, and cleaning materials as biohazardous waste in accordance with:

– OSHA Bloodborne Pathogens Standard (29 CFR 1910.1030)

– Local environmental and healthcare waste regulations

– Use appropriate biohazard containers and disposal services

– Never dispose of electronic components in regular trash; follow e-waste guidelines

Data Security and HIPAA Considerations

If the Statspin Express 4 stores or transmits patient data:

– Ensure device software is updated with the latest security patches

– Use password protection and access controls

– Encrypt data during transmission (e.g., via secure network or USB)

– Comply with HIPAA or equivalent data privacy laws

– Audit data access logs regularly

Training and Personnel Certification

Only trained and authorized personnel may operate the Statspin Express 4. Required training includes:

– Device operation and sample loading

– Quality control and calibration procedures

– Troubleshooting and error resolution

– Biohazard safety and PPE use

– Documentation and reporting requirements

Maintain training records and retrain staff annually or following significant software/hardware updates.

Incident Reporting and Recalls

In the event of device malfunction, erroneous results, or safety concerns:

– Immediately cease use and isolate the device

– Report incidents to the manufacturer and relevant regulatory bodies (e.g., FDA MedWatch, EUDAMED)

– Initiate root cause analysis and corrective actions

– Monitor for recall notices and apply firmware updates promptly

By following this guide, facilities can ensure safe, compliant, and reliable operation of the Statspin Express 4 analyzer in clinical practice.

Conclusion for Sourcing a StatSpin Express 4 Centrifuge:

After a thorough evaluation of the requirements, availability, and performance specifications, sourcing a StatSpin Express 4 centrifuge is a reliable choice for laboratories requiring efficient, compact, and automated centrifugation, particularly for urinalysis and clinical sample processing. Its rapid spin-down times, ease of use, and consistent performance make it well-suited for high-throughput or point-of-care settings. While the device may be discontinued or available primarily through the secondary market, verified refurbished units from reputable suppliers with warranty and technical support ensure operational dependability. Compatibility with existing workflows, low maintenance demands, and compliance with clinical standards further justify its selection. Overall, sourcing the StatSpin Express 4 offers a cost-effective and efficient solution for laboratories seeking proven centrifugation technology.