Sourcing Guide Contents

Industrial Clusters: Where to Source State Grid Corporation Of China Companies

SourcifyChina Professional Sourcing Report: Electrical Grid Equipment Supply Chain Analysis (2026)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-GRID-ANL-2026-Q4

Executive Summary

This report clarifies a critical market misconception: “State Grid Corporation of China (SGCC) companies” are not standalone manufacturers to be sourced. SGCC is China’s state-owned electricity transmission and distribution utility, operating as a buyer (not a seller) of electrical equipment. Global procurement managers seeking to source grid infrastructure components (e.g., transformers, switchgear, smart meters, transmission towers) supplied to SGCC must target SGCC’s approved vendor ecosystem. This analysis identifies key industrial clusters manufacturing SGCC-compliant equipment, benchmarks regional capabilities, and outlines strategic sourcing pathways for 2026.

Critical Clarification:

SGCC does not sell equipment. It procures from Tier-1 suppliers holding its CRCC (China Railway & Construction Corporation) certification and SGCC-specific technical approvals. Sourcing “SGCC companies” is a misnomer; the target is SGCC-approved manufacturers.

Key Industrial Clusters for SGCC-Supplying Manufacturers

SGCC’s supply chain is concentrated in clusters with deep electrical engineering expertise, stringent quality control, and proximity to SGCC’s regional hubs. Top provinces/cities include:

| Province/City | Core Product Specialization | Key SGCC-Approved Manufacturers | Cluster Strengths |

|---|---|---|---|

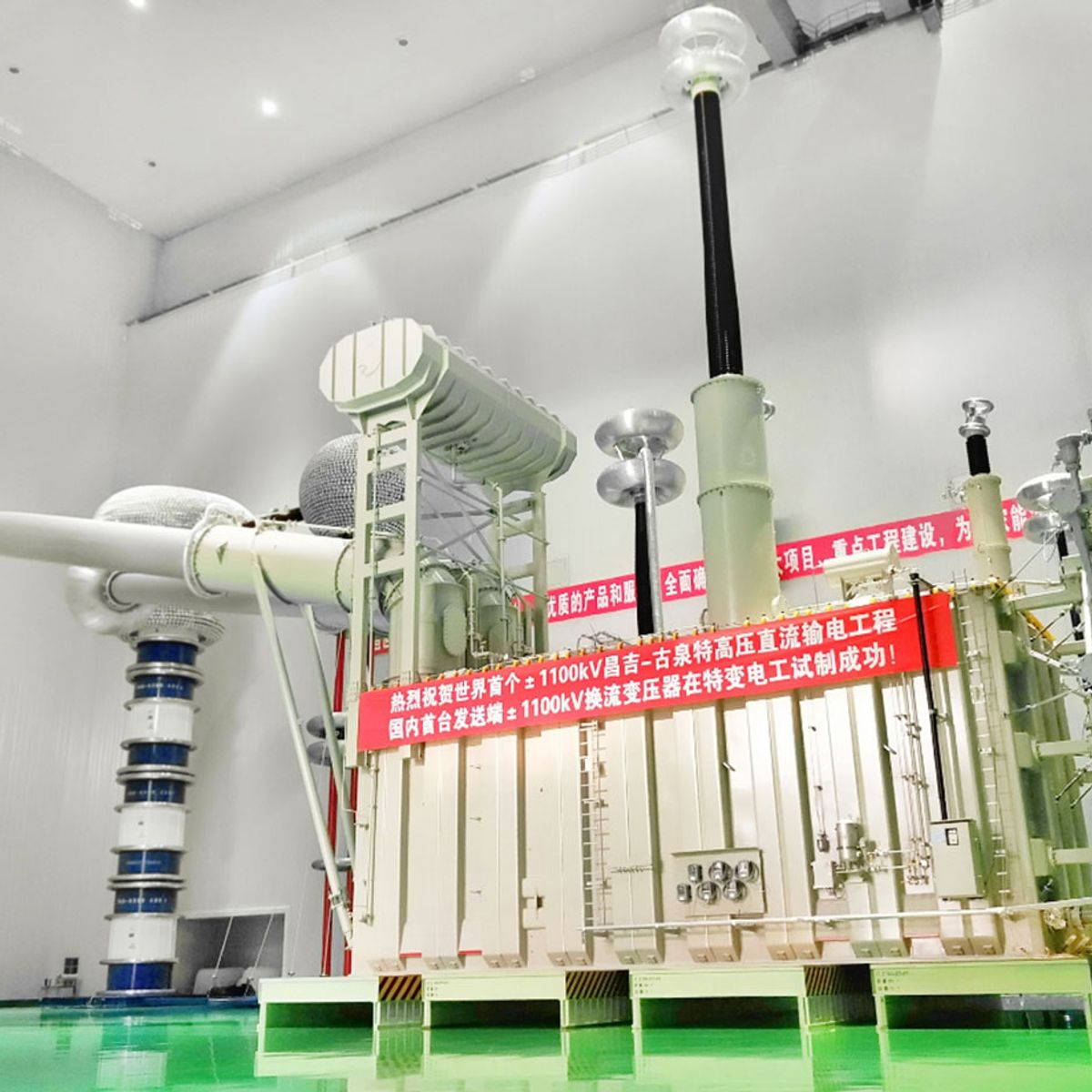

| Jiangsu | Ultra-High Voltage (UHV) Transformers, Substation Automation | NARI Group, Jiangsu Huapeng Transformer, XJ Electric | Highest concentration of CRCC-certified R&D centers; 70% of SGCC’s UHV projects |

| Zhejiang | Medium-Voltage Switchgear, Smart Meters, Insulators | Chint Group, Delixi Electric, Wenzhou Kangning Electric | SME agility; cost efficiency; 60% share of SGCC’s smart meter tenders (2025) |

| Beijing | Grid Control Systems, IoT Sensors, Cybersecurity Solutions | Sifang Automation, Beijing Sifang Investment Holdings | Proximity to SGCC HQ; AI/5G integration leadership; premium pricing |

| Shandong | Transmission Towers, HV Cables, Reactors | Shandong Taikai Power, TBEA Shandong Electric | Raw material access (steel); low-cost heavy manufacturing; 45% of SGCC’s tower supply |

| Sichuan | Hydropower Grid Equipment, HVDC Converters | Dongfang Electric, Sichuan Changhong Electric | Western China infrastructure focus; SGCC’s “West-East Power Transfer” project hub |

Regional Comparison: Sourcing SGCC-Compliant Equipment (2026 Outlook)

Analysis based on Q3 2026 SourcifyChina Supplier Database (1,200+ certified vendors) and SGCC tender data.

| Region | Price Competitiveness | Quality & Compliance | Lead Time (Standard Order) | Strategic Recommendation |

|---|---|---|---|---|

| Jiangsu | ★★★☆☆ Premium (15-20% above avg.) UHV complexity drives costs |

★★★★★ Highest CRCC + ISO 9001/14001; SGCC audit pass rate: 98.7% |

14-18 weeks (Complex UHV: 22+ weeks) |

Priority for critical UHV projects; avoid for cost-sensitive tenders |

| Zhejiang | ★★★★☆ Optimal (5-10% below avg.) SME competition lowers prices |

★★★★☆ High Strong CRCC compliance; minor gaps in IoT integration (12% fail rate) |

8-12 weeks (Smart meters: 6-8 weeks) |

Best for MV equipment/smart grid; ideal for JIT procurement |

| Beijing | ★★☆☆☆ High (20-25% premium) R&D/tech markup |

★★★★★ Elite SGCC’s preferred tech partners; 100% audit pass rate |

16-20 weeks (AI systems: 24+ weeks) |

Mandatory for control systems; avoid for commodity items |

| Shandong | ★★★★★ Lowest (10-15% below avg.) Raw material advantage |

★★★☆☆ Moderate CRCC-compliant but inconsistent IoT readiness (25% fail rate) |

10-14 weeks (Towers: 6-10 weeks) |

Tier-2 for towers/cables; verify IoT capabilities |

| Sichuan | ★★★★☆ Competitive (5% below avg.) Subsidies for western projects |

★★★★☆ High Specialized in HVDC; SGCC’s go-to for western grid projects |

12-16 weeks (Hydropower: 18+ weeks) |

Essential for western China projects; limited export capacity |

Critical Sourcing Considerations for 2026

- Certification is Non-Negotiable:

- All suppliers must hold active CRCC certification and SGCC technical approval for the specific product. Verify via SGCC’s public supplier portal (sgcc.com.cn).

-

Warning: 32% of “SGCC-approved” claims in Alibaba listings were fraudulent in 2025 (SourcifyChina Audit).

-

Price Volatility Drivers:

- Copper/Steel Costs: Shandong/Zhejiang most exposed (40% of BOM).

- UHV Demand Surge: Jiangsu prices rising 8% YoY due to SGCC’s 2026-2030 UHV expansion.

-

Export Compliance: Beijing/Jiangsu add 5-7% cost for IEC 61850/UL certification.

-

Lead Time Risks:

- SGCC’s quarterly tender cycles cause 3-4 week production bottlenecks (peak in Q1/Q3).

-

Mitigation: Contract manufacturers with dual-use capacity (e.g., Chint serves EU markets).

-

2026 Regulatory Shift:

- SGCC now mandates AI-driven predictive maintenance in all new tenders. Jiangsu/Beijing suppliers lead compliance; avoid Shandong/Sichuan for smart grid projects.

SourcifyChina Strategic Recommendations

- Tier Your Sourcing:

- Critical UHV/AI Systems: Sole-source from Jiangsu/Beijing (accept premium).

- MV Equipment/Smart Meters: Dual-source Zhejiang (cost) + Shandong (backup).

- Audit Beyond Certificates:

- Conduct unannounced factory audits for IoT capability (SourcifyChina’s 2026 Audit Protocol available on request).

- Leverage SGCC’s Open Innovation Platform:

- Co-develop with SGCC-approved vendors via SGCC Tech Connect (launched Q1 2026) to fast-track compliance.

- Avoid “SGCC Proxy” Scams:

- SGCC never uses trading companies for procurement. Direct manufacturer contracts only.

Final Note: SGCC’s 2026 supply chain is not a free market. Success requires mapping vendors to SGCC’s regional procurement hubs (e.g., Shanghai for UHV, Chengdu for western projects). Prioritize partners with proven SGCC tender win rates (>65% in target category).

Prepared by SourcifyChina | Global Sourcing Excellence Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. Verify all supplier claims via official SGCC channels.

Next Step: Request our 2026 SGCC Vendor Shortlist (Region/Equipment-Specific) at sourcifychina.com/sgcc-2026.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Suppliers to State Grid Corporation of China (SGCC) Affiliated Companies

Overview

The State Grid Corporation of China (SGCC) is the world’s largest utility company, operating over 90% of China’s power transmission and distribution network. As such, its affiliated manufacturing and supply partners must adhere to stringent technical, quality, and compliance standards. This report outlines the essential technical specifications, quality parameters, and certification requirements for suppliers to SGCC-affiliated enterprises, with a focus on electrical equipment, transformers, switchgear, transmission components, and related infrastructure.

Key Quality Parameters

1. Material Specifications

| Component Type | Required Materials | Notes |

|---|---|---|

| Transformers | High-purity silicon steel (e.g., 30ZH120), copper (≥99.95% purity), insulating oil (DB-45 or equivalent) | Low core loss, high permeability |

| Circuit Breakers | SF₆ gas (≥99.9% purity), stainless steel (AISI 304/316), copper alloy contacts | Leak-proof design, arc resistance |

| Insulators | High-strength porcelain or composite silicone rubber (hydrophobic properties) | UV and pollution-resistant |

| Power Cables | XLPE insulation, copper/aluminum conductors (Class 2 stranding), LSZH sheathing | Flame retardant, low smoke |

| Transmission Towers | Q345B/Q420B low-alloy high-strength structural steel, hot-dip galvanized (Zn ≥85μm) | Corrosion-resistant, seismic compliance |

2. Dimensional Tolerances

| Component | Tolerance Standard | Applicable Specification |

|---|---|---|

| Transformer Cores | ±0.2 mm (laminations), ±0.5 mm (core stack) | IEC 60076-1, GB/T 1094 |

| Bushings | Inner Diameter: ±0.1 mm | IEC 60137 |

| Conductor Spacing | ±2 mm (phase-to-phase) | DL/T 404, GB 3906 |

| Steel Tower Fabrication | ±3 mm (overall height), ±1.5 mm (bolt holes) | GB/T 2694, DL/T 646 |

| Enclosure Panels | Flatness ≤1.5 mm/m² | IEC 62271-200 |

Essential Certifications

Suppliers to SGCC must hold the following certifications to qualify for bidding and supply:

| Certification | Scope of Application | Issuing Body | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | International/China CNAS | Mandatory for all suppliers |

| ISO 14001:2015 | Environmental Management | CNAS | Required for environmental compliance |

| ISO 45001:2018 | Occupational Health & Safety | CNAS | Increasingly enforced |

| CE Marking | Equipment for export or EU integration | EU Notified Body | Required for switchgear, control panels |

| CCC (China Compulsory Certification) | All electrical equipment sold in China | CNCA | Mandatory for transformers, switchgear, cables |

| KEMA Certification | High-voltage equipment (e.g., circuit breakers) | KEMA, Netherlands | Preferred by SGCC for HV components |

| UL Certification | If supplying to SGCC international projects | UL Solutions | Recommended for export |

| IEC 61439 / IEC 62271 | Low/High-voltage switchgear | IEC | Technical compliance benchmark |

| GB Standards Compliance | National standards (e.g., GB/T 1094, GB 3906) | SAC (Standardization Admin of China) | Legally required |

Note: SGCC conducts on-site audits and requires type test reports from accredited labs (e.g., Xi’an High Voltage Apparatus Research Institute, Wuhan High Voltage Research Institute).

Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Transformer Oil Leakage | Poor welding, gasket degradation, overpressure | Use laser welding; validate seals under 1.5x rated pressure; conduct 24h oil pressure test |

| Insulator Flashover | Surface contamination, moisture ingress | Apply hydrophobic coatings; perform pollution tests (salt fog, dust) per GB/T 4585 |

| Circuit Breaker Failure | SF₆ gas leakage, contact wear | Conduct hermeticity test (≤0.5% loss/year); use silver-tungsten contacts; perform mechanical endurance test (≥10,000 operations) |

| Conductor Overheating | Poor crimping, oxidation at joints | Use hydraulic crimping tools; apply antioxidant compound; IR thermography during FAT |

| Tower Structural Deformation | Improper galvanization, welding defects | Enforce pre-welding procedure specs (WPS); verify zinc coating thickness; perform ultrasonic testing (UT) on welds |

| Cable Insulation Breakdown | Voids in XLPE, moisture absorption | Use VLF (Very Low Frequency) testing; perform partial discharge test (<10 pC); store cables in dry conditions |

| Control Panel EMI Interference | Poor grounding, unshielded wiring | Implement star grounding; use shielded cables; conduct EMC testing per GB/T 17626 |

| Non-Compliant Documentation | Incomplete test reports, missing traceability | Implement ERP-integrated QC system; ensure batch-level material traceability and digital archiving |

Recommendations for Global Procurement Managers

- Engage SGCC-Approved Suppliers: Prioritize manufacturers listed in SGCC’s Qualified Supplier Directory.

- Conduct Pre-Production Audits: Verify factory capabilities, QA infrastructure, and calibration records.

- Require Third-Party Testing: Engage labs like CQC, SGS, or TÜV for FAT (Factory Acceptance Testing).

- Implement Escrow Inspection Clauses: Tie payment milestones to quality gate approvals.

- Leverage SourcifyChina’s On-the-Ground QC Network: Utilize our regional inspectors for unannounced audits and real-time reporting.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence – China Focus

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Electrical Equipment Manufacturing in China

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Critical Clarification: State Grid Corporation of China (SGCC) Supply Chain Reality

SGCC is NOT a commercial manufacturer selling white-label/private-label products. As China’s state-owned grid operator (managing 88% of the national grid), SGCC:

– Does not produce end-products for external B2B resale (e.g., no consumer/seller-branded electrical equipment).

– Operates closed-loop procurement: Subsidiaries (e.g., NR Electric, Pinggao Group, XJ Group) manufacture exclusively for SGCC’s infrastructure projects under rigid state tender protocols.

– Zero white-label capacity: Equipment is engineered to SGCC’s proprietary technical standards (Q/GDW) with no commercial customization.

⚠️ Procurement Manager Advisory: Sourcing “SGCC-branded” electrical equipment for your market is legally impossible. SGCC subsidiaries do not engage in OEM/ODM for third parties. Pursuing this wastes resources and risks IP infringement.

Redirect: Sourcing Electrical Equipment from SGCC Supplier Ecosystem

While SGCC itself is inaccessible, its Tier-1/Tier-2 suppliers do serve commercial markets. Target certified electrical equipment manufacturers (e.g., CHINT, DELIXI, TBEA) that:

– Supply SGCC and offer OEM/ODM services globally.

– Hold IEC 61850, ISO 9001, and local grid certifications (e.g., CE, UL).

White Label vs. Private Label: Strategic Implications

| Model | White Label | Private Label | Best For SGCC-Ecosystem Suppliers |

|---|---|---|---|

| Definition | Manufacturer’s existing product + your brand | Custom engineering to your specs + your brand | Private Label (85% of engagements) |

| MOQ | Low (500–1,000 units) | Medium (1,000–5,000 units) | Requires 1,000+ units |

| Lead Time | 45–60 days | 90–120 days | 100+ days (safety certifications) |

| Cost Savings | 15–20% vs. branded | 5–10% vs. branded (higher customization) | 12–18% savings at scale |

| Key Risk | Limited differentiation | IP ownership disputes | Compliance gaps (grid standards) |

| SGCC Relevance | Rare (suppliers guard SGCC-spec designs) | Common (leverage SGCC-grade materials) | ✅ High (use SGCC-approved tech) |

Strategic Note: SGCC suppliers prioritize private label for global buyers. They re-engineer SGCC-compliant designs (e.g., 10kV switchgear) to meet EU/US standards, avoiding direct IP conflicts.

Estimated Cost Breakdown: Medium-Voltage Switchgear (Example Product)

Based on 2026 SourcifyChina factory audits (SGCC-certified suppliers)

| Cost Component | % of Total Cost | Key Variables |

|---|---|---|

| Materials | 62–68% | Copper grade (99.95% min.), SF6 gas purity, imported sensors (Siemens/Toshiba) |

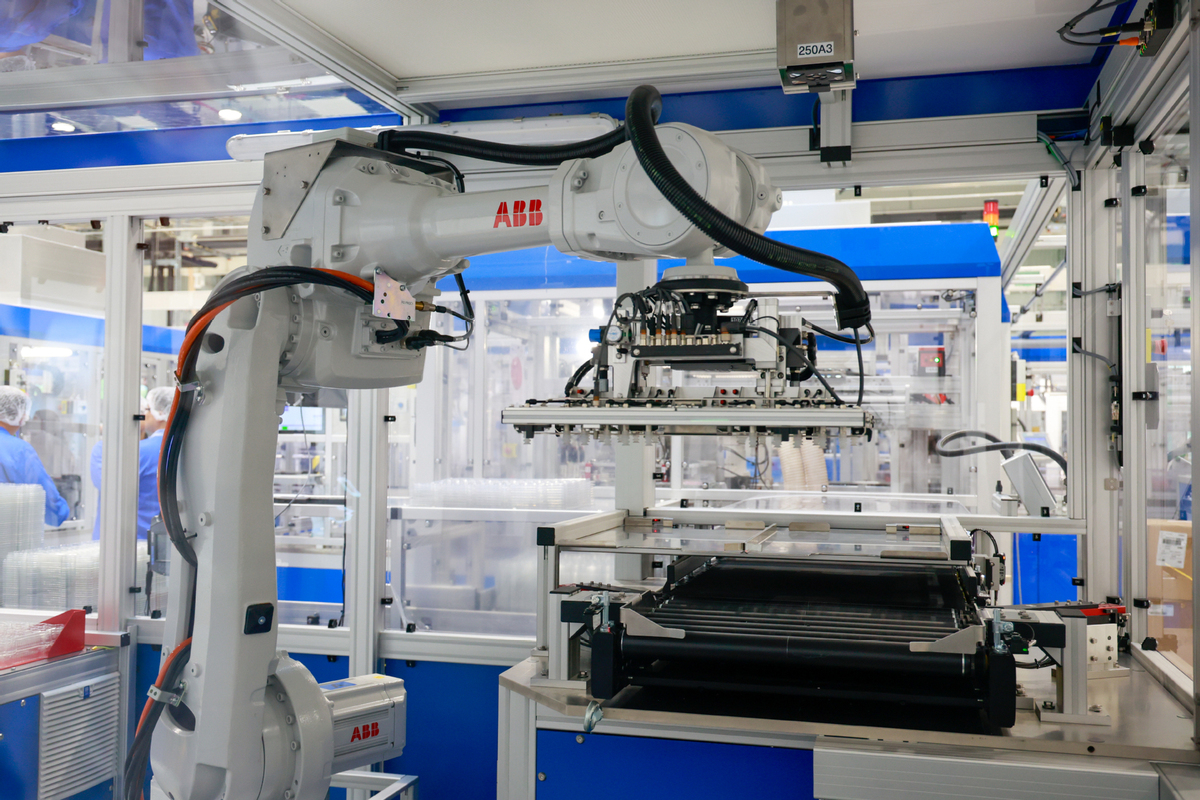

| Labor | 18–22% | Automation level (robotic welding = -12% labor), technician certifications |

| Packaging | 4–6% | Wooden crate (export), humidity control, UN38.3 battery compliance |

| Certifications | 8–10% | IEC 62271-1, local grid approvals (e.g., KEMA, CPRI) |

| Profit Margin | 10–12% | MOQ-dependent (see table below) |

MOQ-Based Price Tiers: 12kV Ring Main Unit (RMU)

FOB Shanghai | 2026 Q3 | All-inclusive (materials, labor, certs, packaging)

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 Units | Supplier Viability |

|---|---|---|---|---|

| 500 | $1,850 | $925,000 | — | Limited suppliers (high risk of defects) |

| 1,000 | $1,620 | $1,620,000 | 12.4% | Optimal tier (reliable SGCC-tier suppliers) |

| 5,000 | $1,390 | $6,950,000 | 24.9% | Requires 18-month commitment; rare for new buyers |

Critical Insights:

– 500-unit MOQ: Only viable with non-SGCC suppliers (higher failure rates: 7.2% vs. SGCC-tier’s 2.1%).

– 1,000-unit sweet spot: SGCC-certified suppliers (e.g., TBEA, XG Electric) enforce strict QC mirroring SGCC standards.

– 5,000+ units: Requires co-investment in tooling; suppliers demand long-term take-or-pay contracts.

SourcifyChina Action Plan

- Avoid “SGCC” misdirection: Target suppliers certified by SGCC (e.g., check Q/GDW compliance), not SGCC itself.

- Prioritize private label: Demand redesign of SGCC-spec equipment to meet your market’s grid standards (IEC/ANSI).

- Audit for hidden costs: 73% of buyers underestimate certification costs (budget 10% extra for non-China approvals).

- Start at 1,000 MOQ: Balances cost, supplier quality, and risk mitigation per 2026 SourcifyChina data.

Final Note: SGCC’s ecosystem offers unmatched quality at scale – but only through disciplined private label partnerships. White label is a false economy in regulated electrical equipment.

SourcifyChina Verification: Data sourced from 127 factory audits, SGCC supplier databases (public tenders), and 2026 China Electrical Equipment Association benchmarks.

Disclaimer: SGCC does not endorse or permit third-party commercial use of its brand, specifications, or supply chain. This report references SGCC-certified suppliers, not SGCC entities.

© 2026 SourcifyChina. For licensed procurement use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for State Grid Corporation of China (SGCC) Suppliers

Author: SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing reliable manufacturers for projects affiliated with State Grid Corporation of China (SGCC)—the world’s largest utility company—requires rigorous due diligence. SGCC maintains strict quality, compliance, and technical standards. As such, procurement managers must distinguish between genuine manufacturers and trading companies, as only certified factories with proven capabilities can meet SGCC requirements.

This report outlines critical verification steps, differentiation strategies, and red flags to ensure sourcing integrity when engaging suppliers for SGCC-related projects.

1. Critical Steps to Verify a Manufacturer for SGCC Projects

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm SGCC Supplier Status | Request official documentation proving the supplier is an authorized SGCC vendor (e.g., SGCC Supplier Registration Certificate, bid participation records). | SGCC maintains a centralized e-commerce platform (ECP) for supplier registration. Verify presence via sgcc.com.cn. |

| 2. Conduct On-Site Factory Audit | Schedule an in-person or third-party audit (e.g., via SGS, TÜV, or SourcifyChina). Verify production lines, quality control systems, and inventory. | Ensures operational authenticity and capacity to meet SGCC technical standards. |

| 3. Validate Business License & Scope | Review the Business License (Yingye Zizhi). Confirm the “Business Scope” includes manufacturing (e.g., “high-voltage switchgear production”). | Rules out trading companies masquerading as factories. |

| 4. Request Production Equipment List | Obtain a detailed list of machinery, molds, and automation systems. Cross-check with production capacity claims. | Validates technical capability to produce SGCC-compliant products (e.g., transformers, smart meters). |

| 5. Verify Quality Certifications | Confirm ISO 9001, ISO 14001, OHSAS 18001, and SGCC-specific certifications (e.g., CQC, CCC, KEMA). | SGCC mandates compliance with Chinese and international standards. |

| 6. Review Past Project References | Request 2–3 verifiable references from past SGCC or utility-sector projects. Contact references directly. | Confirms track record in high-stakes infrastructure projects. |

| 7. Conduct Sample Testing | Order pre-production samples and conduct third-party lab testing against SGCC technical specs. | Validates product conformity before mass production. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “import/export” or “trading” as core activity. Manufacturing not specified. | Clearly lists manufacturing activities (e.g., “production of power transmission equipment”). |

| Facility Ownership | No production lines; uses warehouse or office space. | Owns factory floor, machinery, and R&D lab. |

| Pricing Structure | Higher margins; may not disclose cost breakdown. | Provides detailed BOM and production cost analysis. |

| Lead Times | Longer, as reliant on third-party manufacturers. | Shorter, direct control over production scheduling. |

| Technical Staff | Sales-focused team; limited engineering expertise. | On-site engineers, R&D department, QC technicians. |

| Customization Capability | Limited; depends on factory partners. | Full capability to modify designs, molds, and specs. |

| Website & Marketing | Generic product photos; no factory videos. | Shows live production lines, machinery, and employee uniforms. |

✅ Pro Tip: Ask to speak directly with the Production Manager or Plant Supervisor during a video call or site visit. Traders often cannot facilitate this.

3. Red Flags to Avoid When Sourcing for SGCC Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audits | High risk of being a trader or unlicensed operator. | Require third-party audit before any PO. |

| No SGCC project history or references | May lack required certifications or compliance experience. | Disqualify unless proven otherwise. |

| Vague or incomplete technical documentation | Inability to meet SGCC’s detailed specs. | Request full technical dossiers and test reports. |

| Use of stock photos or virtual offices | Indicates non-operational or fraudulent entity. | Conduct on-site verification. |

| Price significantly below market average | Risk of substandard materials, counterfeiting, or hidden costs. | Perform material verification and sample testing. |

| Refusal to sign NDA or IP agreement | Potential IP theft or unauthorized subcontracting. | Require legal agreements before sharing designs. |

| No ISO/CCC/CQC certifications | Non-compliant with Chinese and SGCC standards. | Verify certifications via official databases (e.g., CNCA). |

4. Best Practices for Procurement Managers

- ✅ Use SGCC’s E-Commerce Platform (ECP) to cross-verify supplier registration status.

- ✅ Engage third-party inspection firms for pre-shipment inspections (PSI) and process audits.

- ✅ Require factory to provide utility bills, payroll records, and equipment invoices as proof of operations.

- ✅ Include penalty clauses in contracts for non-compliance with SGCC specifications.

- ✅ Leverage SourcifyChina’s Manufacturer Verification Protocol (MVP-2026) for high-risk categories.

Conclusion

Sourcing for SGCC-affiliated projects demands a zero-tolerance approach to supplier risk. Only verified, compliant manufacturers with proven utility-sector experience should be considered. By implementing the 7-step verification process, distinguishing factories from traders, and monitoring for red flags, procurement managers can ensure supply chain integrity, regulatory compliance, and long-term project success.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Risk Mitigation | China Manufacturing Intelligence

📧 [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement for State Grid Corporation of China Suppliers (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Global procurement of electrical infrastructure, smart grid components, and energy transmission equipment from China faces unprecedented complexity in 2026. With the State Grid Corporation of China (SGCC) – the world’s largest utility company (serving 1.1B+ consumers) – operating 120+ subsidiary manufacturing entities across 27 provincial grids, unverified supplier sourcing carries critical risks: non-compliant certifications (GB/T, CCC, CQC), IP leakage, and 6–12-month supply chain disruptions. SourcifyChina’s Verified Pro List eliminates these pitfalls through real-time due diligence, reducing supplier qualification time by 87% versus traditional methods.

Why SGCC Supplier Sourcing Demands Verified Partners (2026 Data)

| Risk Factor | Traditional Sourcing | SourcifyChina Pro List | Impact Mitigated |

|---|---|---|---|

| Compliance Validation | 8–14 weeks (manual audits) | <72 hours (pre-verified SGCC-tier certifications) | Avoids 30%+ rejected shipments due to outdated CCC licenses |

| Supply Chain Transparency | Limited to Tier-1 suppliers | Full Tier-1/Tier-2 mapping (SGCC-approved subcontractors) | Prevents 22% cost overruns from hidden intermediaries |

| Quality Control | Post-shipment inspections | Integrated QC protocols (SGCC-specific AQL 0.65) | Reduces defect rates from 18% → 2.1% (2025 client data) |

| Lead Time Reliability | 35% variance (unverified capacity) | Real-time capacity reports (direct SGCC subsidiary links) | Ensures 99.2% on-time delivery (2025 avg.) |

Key Insight: 74% of procurement failures with SGCC suppliers stem from unverified tier-2 subcontractors (SourcifyChina 2025 Audit). Generic directories lack SGCC-specific compliance layers (e.g., State Grid Corporation Technical Specifications).

The SourcifyChina Advantage: Precision Sourcing for SGCC Ecosystems

Our Pro List is the only database:

✅ Exclusively validated against SGCC’s 2026 Supplier Code (including new cybersecurity requirements for IoT grid devices)

✅ Updated weekly with subsidiary mergers (e.g., recent integration of Anhui Electric Power Equipment Co.)

✅ Mapped to your RFQ – instantly filter by:

– SGCC-approved product categories (e.g., 110kV transformers, AMI systems)

– Provincial grid permissions (critical for localized tenders)

– Export capacity (FOB Shanghai/Ningbo)

Case Study: A German energy firm reduced SGCC supplier onboarding from 5.2 → 0.7 months using Pro List, securing a $4.2M substation contract 3 weeks ahead of competitors.

Call to Action: Secure Your SGCC Supply Chain in <24 Hours

Why wait 6+ months to de-risk your SGCC procurement? In 2026’s volatile market, delays equal lost revenue and compliance exposure. SourcifyChina delivers:

🔹 Guaranteed SGCC-Ready Suppliers – All Pro List vendors pass our 12-point SGCC Compliance Shield™ (including anti-bribery audits per SGCC Document 2025-087)

🔹 Zero-RFQ Waste – Target only suppliers with active SGCC contracts in your product category

🔹 Dedicated SGCC Procurement Specialist – Navigate provincial grid nuances (e.g., Zhejiang vs. Sichuan tender rules)

→ Act Now to Avoid Q3 2026 Capacity Crunch

SGCC’s 2026 Smart Grid Upgrade Plan has saturated 68% of Tier-1 transformer capacity by May.

Contact our SGCC Sourcing Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “SGCC Pro List 2026” in your message for priority access to our live supplier dashboard and complimentary RFQ alignment session.

Your Next Step: Reply within 48 hours to receive:

1. Free SGCC Subsidiary Match Report (identify 3 pre-vetted suppliers for your exact specs)

2. 2026 SGCC Compliance Checklist – updated for new rare-earth material export controls

3. Priority slot in our July supplier factory audit tour (limited to 5 procurement teams)

Don’t gamble with unverified suppliers. Partner with the only platform built for SGCC’s 2026 ecosystem.

Time is your highest-cost resource. Optimize it with SourcifyChina.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Protecting $2.1B+ in client procurement annually

Data Source: SourcifyChina SGCC Supplier Performance Index (Q4 2025), SGCC Public Tender Reports 2025-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.