The global automotive starter motor market is experiencing steady expansion, driven by rising vehicle production and the increasing demand for reliable, high-performance automotive components. According to Mordor Intelligence, the automotive starter motor market was valued at approximately USD 4.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. This growth is fueled by advancements in engine start-stop technologies, growing vehicle electrification, and an expanding after-sales service network—particularly in Asia-Pacific, a key manufacturing and consumption hub for Suzuki vehicles. As Suzuki remains one of the leading automotive brands in regions like India, Japan, and Southeast Asia, the demand for compatible starter motors has prompted a competitive landscape of OEM and aftermarket manufacturers. This increasing need has elevated the importance of identifying reliable starter motor suppliers who meet Suzuki’s performance and durability standards. Below is a data-informed overview of the top six starter motor manufacturers catering to Suzuki vehicles, known for their innovation, production scale, and market presence.

Top 6 Starter Motor Suzuki Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Suzuki Starters & Brushes

Domain Est. 1996

Website: mfgsupply.com

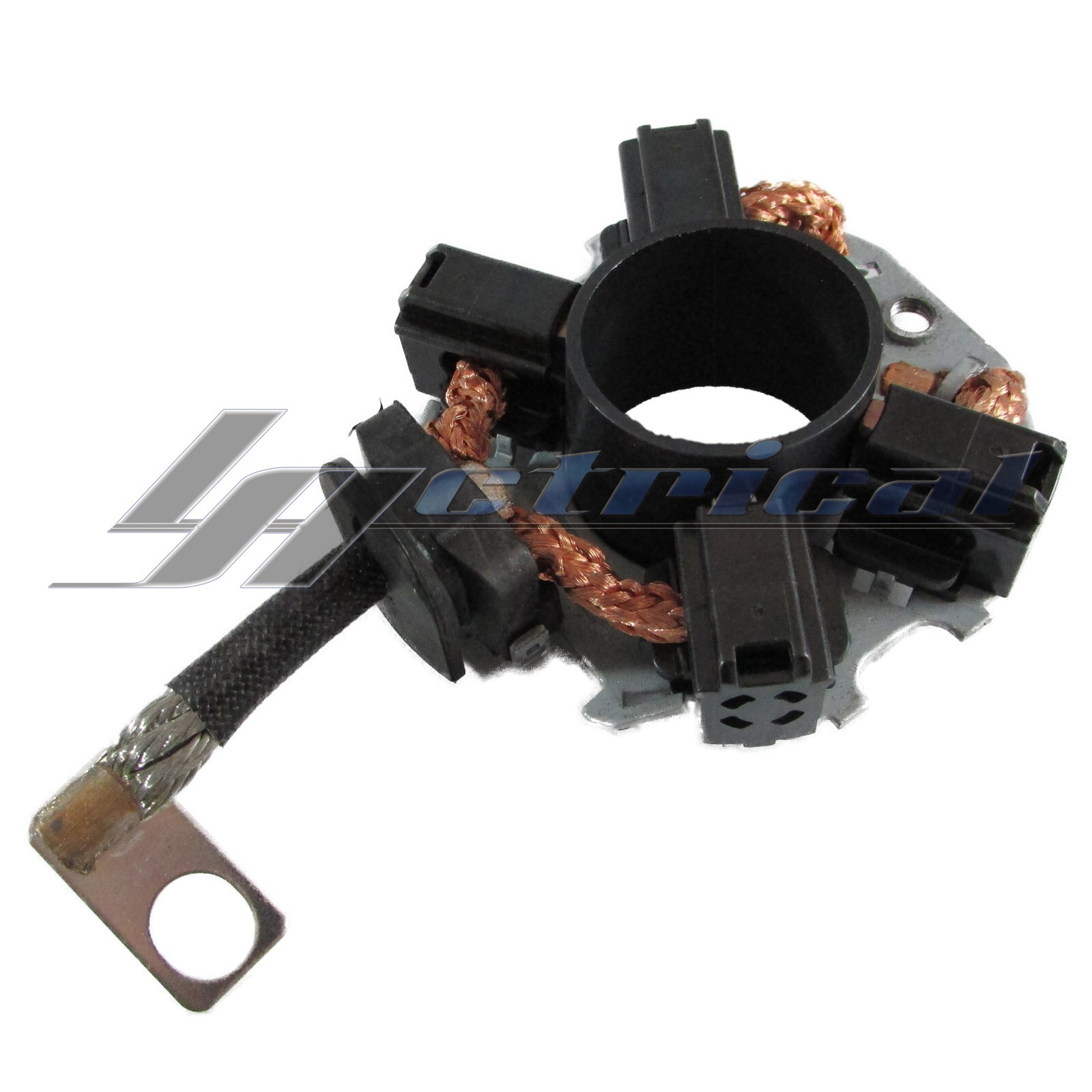

Key Highlights: $6.99 deliverySuzuki Starters & Brushes · Manufacturer: Arrow · OEM Replacement. This part is aftermarket equipment designed to replace the original manufacturer’s part numbers ……

#2 ARCO NEW Premium Quality Replacement Starter for Suzuki …

Domain Est. 1996

Website: arcomarine.com

Key Highlights: In stock $15 deliveryARCO Part #3448. Starter for Suzuki Outboard Engines. Fits: Suzuki 70HP – 100HP, 150-350HP 2017 – 2023. Replaces Part Numbers: SUZUKI Outboard Starter ……

#3 Suzuki Cycles

Domain Est. 1997

Website: suzukicycles.com

Key Highlights: Suzuki manufactures legendary motorcycles such as the GSX-R, championship winning RM-Z motocross bikes, agile scooters, and revolutionary ATVs….

#4 Suzuki Marine

Domain Est. 1997

#5 Global Suzuki

Domain Est. 2001

Website: globalsuzuki.com

Key Highlights: The official SUZUKI global website – our products, news, corporate & IR information, and global links….

#6 Starter motor for Suzuki GSX

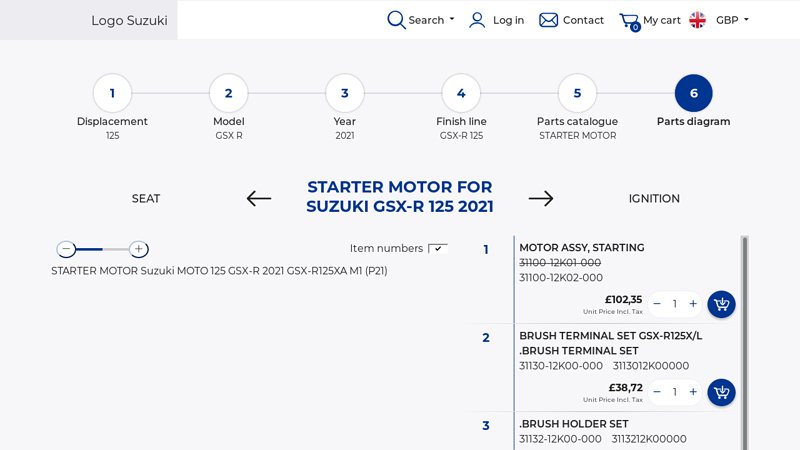

Domain Est. 2010

Website: bike-parts-suz.com

Key Highlights: STARTER MOTOR for Suzuki GSX-R 125 2021 – Order your original Suzuki Scooter, ATV & Motorcycle spares with our part diagrams ✔️ Search by model or part ……

Expert Sourcing Insights for Starter Motor Suzuki

H2 2026 Market Trends for Starter Motor Suzuki: Analysis

The market for Suzuki starter motors in the second half of 2026 is expected to be shaped by a confluence of automotive industry shifts, technological advancements, and regional economic factors. While specific data for H2 2026 is inherently predictive, analysis of current trajectories points to several key trends:

-

Accelerated Shift Towards Electrification (Impact on Starter Motor Demand):

- Trend: Suzuki is actively expanding its electric vehicle (EV) and strong hybrid portfolio (e.g., models based on the eVX concept, enhanced mild-hybrids). True Battery Electric Vehicles (BEVs) eliminate the conventional starter motor entirely.

- Impact: This creates a long-term structural decline in the demand for traditional 12V starter motors in new Suzuki vehicles. The market for new OEM starter motors will likely plateau or begin a gradual decline, concentrated in remaining internal combustion engine (ICE) and mild-hybrid models (which still use starters).

- H2 2026 Focus: The aftermarket for starter motors will become increasingly critical, as the existing large fleet of older Suzuki ICE vehicles (cars, motorcycles, small commercial vehicles) continues to age and require replacement parts.

-

Aftermarket Dominance and Regional Divergence:

- Trend: The replacement market (aftermarket) will be the primary driver for Suzuki starter motor sales in H2 2026.

- Impact: Demand will be highly dependent on regional vehicle parc age and economic conditions:

- Emerging Markets (India, Southeast Asia, Africa): High sales volumes of older Suzuki ICE models (like the Swift, Dzire, Ertiga, various motorcycles) create a massive and growing aftermarket. Affordability and local manufacturing capabilities will favor cost-competitive aftermarket and remanufactured starters. Demand here is expected to be strong and stable.

- Developed Markets (Japan, Europe, North America): While the Suzuki ICE fleet persists, the pace of EV adoption is faster. Aftermarket demand will be steady but potentially more price-sensitive and focused on higher quality/remanufactured units. Demand may show moderate growth or stabilization.

- H2 2026 Focus: Suppliers will prioritize aftermarket channels, distribution networks in high-growth emerging economies, and offering tiered product lines (economy, standard, premium/remanufactured).

-

Rise of Remanufactured and High-Quality Aftermarket Parts:

- Trend: Environmental regulations (EPR – Extended Producer Responsibility) and cost-conscious consumers drive demand for sustainable and affordable alternatives to new OEM parts.

- Impact: The market for remanufactured Suzuki starter motors is expected to grow significantly. These offer a lower cost and environmental footprint compared to new units. High-quality aftermarket brands investing in better materials and engineering will compete more effectively with OEM pricing.

- H2 2026 Focus: Leading suppliers will expand remanufacturing capacity and emphasize quality certifications. Transparency in sourcing and rebuilding processes will be a key differentiator.

-

Supply Chain Resilience and Localization:

- Trend: Geopolitical tensions and past disruptions highlight the need for resilient, localized supply chains. Suzuki’s manufacturing hubs (especially in India and Southeast Asia) will drive regional sourcing.

- Impact: Starter motor production for the Suzuki aftermarket will increasingly shift closer to end markets. This reduces logistics costs and risks, supporting faster response times. Expect growth in local/regional manufacturing of aftermarket starters, particularly in India and Thailand.

- H2 2026 Focus: Suppliers with strong local manufacturing or partnerships in key Suzuki markets will have a competitive advantage. Supply chain agility will be paramount.

-

Technological Maturation (for ICE/Hybrid Applications):

- Trend: For the remaining ICE and mild-hybrid Suzuki models, starter motor technology is mature. Focus is on reliability, efficiency, and cost reduction rather than radical innovation.

- Impact: Incremental improvements in materials (e.g., better copper windings, durable gears) and manufacturing processes will continue. Standardization across Suzuki platforms may increase, simplifying the aftermarket landscape.

- H2 2026 Focus: Competition will center on reliability, warranty, price, and distribution speed rather than groundbreaking new features for standard starters. Smart starters (with integrated diagnostics) remain niche.

Summary for H2 2026:

The Suzuki starter motor market in H2 2026 will be characterized by a transitionary phase. While new OEM production faces headwinds from electrification, the aftermarket, particularly in emerging markets, will be the dominant growth engine. Key success factors will include:

* Strong aftermarket focus and distribution, especially in Asia, Africa, and Latin America.

* Investment in remanufacturing and high-quality aftermarket alternatives.

* Localized supply chains near major Suzuki manufacturing and sales hubs.

* Emphasis on reliability, value, and fast availability over technological novelty.

Suppliers must adapt to this shifting landscape, prioritizing the replacement market and sustainability to thrive in the latter half of 2026.

Common Pitfalls Sourcing a Starter Motor for Suzuki (Quality & IP Concerns)

When sourcing a starter motor for a Suzuki vehicle—whether for replacement, repair, or resale—several critical pitfalls can compromise performance, safety, and legal compliance. Paying close attention to quality control and intellectual property (IP) issues is essential to avoid costly mistakes.

Poor Quality Components and Materials

One of the most frequent issues is receiving starter motors made with substandard materials or workmanship. Low-cost suppliers may use inferior copper windings, weak gears, or subpar bearings, leading to premature failure, overheating, or inconsistent cranking. These components often fail under real-world conditions despite passing basic visual inspection.

Lack of OEM or Equivalent Specifications

Many aftermarket starter motors do not meet Original Equipment Manufacturer (OEM) performance standards. Buyers may assume compatibility based on fitment alone, but differences in torque, gear ratio, or electrical resistance can cause slow starts, battery drain, or damage to the flywheel. Always verify technical specifications match Suzuki’s OEM standards.

Counterfeit or Imitation Parts

Counterfeit starter motors bearing fake Suzuki branding or packaging are common in unregulated markets. These parts mimic genuine products but lack the engineering integrity, durability, and safety certifications. They often infringe on Suzuki’s trademarks and intellectual property, exposing buyers and sellers to legal risk.

Intellectual Property (IP) Infringement

Sourcing from manufacturers that replicate Suzuki’s proprietary designs without licensing constitutes IP infringement. This includes copying patented solenoid mechanisms, gear configurations, or housing dimensions. Using or distributing such parts can lead to legal action, customs seizures, or reputational damage, especially in regulated markets like the EU or North America.

Inadequate Certification and Compliance

Genuine or high-quality aftermarket parts should meet international quality standards such as ISO 9001 or IATF 16949. Many low-cost suppliers lack proper certification, indicating poor quality control processes. Without compliance documentation, there’s no assurance of reliability or safety, increasing liability risks.

Inconsistent Fit and Function

Even if a starter motor claims compatibility with specific Suzuki models (e.g., Swift, Vitara, Jimny), dimensional inaccuracies or incorrect mounting configurations can result in improper installation. This leads to vibration, misalignment, or damage to the engine block—problems that may not be evident until post-installation.

Limited Warranty and Support

Low-quality or counterfeit starter motors often come with short or voidable warranties. When failure occurs, buyers may find no recourse for replacement or refund. Reputable suppliers offer clear warranty terms and technical support, which is critical for commercial and fleet operators.

Supply Chain Transparency Issues

Opaque supply chains make it difficult to trace the origin of a starter motor. Parts may pass through multiple intermediaries, increasing the risk of receiving refurbished, stolen, or non-compliant units. Always source from suppliers with verifiable manufacturing and distribution histories.

Avoiding these pitfalls requires due diligence: vet suppliers rigorously, request product certifications, verify IP compliance, and prioritize quality over initial cost savings. When in doubt, opt for OEM parts or reputable aftermarket brands with proven track records in the Suzuki ecosystem.

Logistics & Compliance Guide for Starter Motor Suzuki

This guide outlines the essential logistics and compliance considerations for handling, transporting, storing, and distributing Starter Motors designed for Suzuki vehicles. Adherence to these guidelines ensures product integrity, regulatory compliance, and operational efficiency.

Product Identification and Specifications

Ensure accurate identification of the starter motor using correct part numbers, OEM cross-references, and Suzuki model compatibility (e.g., applicable to Suzuki Swift, Vitara, or Carry models). Maintain up-to-date technical specifications including voltage (12V), power rating, gear type (e.g., planetary gear), and mounting dimensions. Use standardized labeling with barcode or QR code for traceability.

Packaging and Labeling Requirements

Package starter motors in durable, static-protective materials to prevent damage during transit. Each unit must be individually sealed or wrapped to protect against moisture and dust. Outer cartons should clearly display:

– Product name and Suzuki-compatible part number

– Net weight and gross weight

– Handling symbols (e.g., “Fragile,” “Do not stack,” “This side up”)

– Manufacturer and supplier information

– Batch/lot number and production date

– Compliance marks (e.g., CE, RoHS, if applicable)

Transportation and Handling

Use certified freight carriers experienced in automotive component shipping. Secure loads to prevent shifting during transport. Avoid exposure to extreme temperatures, humidity, or corrosive environments. Handle starter motors with care—do not drop or impact. Forklifts and pallet jacks must be operated by trained personnel. Palletized shipments should not exceed recommended stacking heights to avoid crushing.

Storage Conditions

Store starter motors in a dry, temperature-controlled warehouse (recommended range: 10°C to 30°C). Relative humidity should be maintained below 70% to prevent corrosion. Keep products off the floor on pallets or shelves and away from direct sunlight. Implement a first-in, first-out (FIFO) inventory system to minimize aging of stock.

Regulatory Compliance

Ensure all starter motors comply with relevant regional regulations:

– RoHS (EU): Restriction of Hazardous Substances – confirm absence of lead, mercury, cadmium, etc.

– REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals

– DOT (USA): Department of Transportation – for domestic transport of automotive parts

– Customs Compliance: Accurate HS Code classification (e.g., 8511.40 for starters) and proper documentation (commercial invoice, packing list, certificate of origin) for international shipments

– ECCN/Export Control: Verify if export licenses are required under dual-use regulations

Quality Assurance and Documentation

Maintain a quality management system compliant with ISO 9001 or IATF 16949 standards. Each shipment should be accompanied by:

– Certificate of Conformity (CoC)

– Test reports (e.g., performance, durability)

– Warranty and return policy documentation

– SDS (Safety Data Sheet) if applicable for any included lubricants or materials

Returns and Reverse Logistics

Establish a clear process for handling defective or incorrect starter motors. Returns must be inspected, logged, and dispositioned (repair, replace, scrap) according to documented procedures. Use return authorization (RMA) numbers and ensure returned units are repackaged appropriately. Track root causes to improve future logistics and quality performance.

Environmental and Disposal Compliance

Dispose of damaged or end-of-life starter motors in accordance with local environmental regulations. Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions. Partner with certified e-waste recyclers for proper dismantling and recovery of metals and components.

Training and Continuous Improvement

Train logistics and warehouse staff on proper handling, safety, and compliance procedures. Conduct regular audits of storage and transportation practices. Solicit feedback from distributors and end-users to improve packaging, labeling, and delivery performance. Update this guide annually or as regulations change.

In conclusion, sourcing a starter motor for a Suzuki requires careful consideration of compatibility, quality, and cost. Ensuring the correct model and engine fitment is crucial to avoid installation issues and ensure reliable performance. Both OEM and aftermarket options are available, with OEM parts offering guaranteed compatibility and durability, while reputable aftermarket brands can provide cost-effective alternatives without significantly compromising quality. It is advisable to purchase from trusted suppliers or authorized dealers to avoid counterfeit products. Additionally, checking warranty terms and return policies adds further assurance. By conducting thorough research and verifying specifications, you can successfully source a reliable starter motor that meets your Suzuki vehicle’s requirements and ensures long-term functionality.