The global stainless steel valves market is experiencing robust growth, driven by increasing demand across critical industries such as oil & gas, chemical processing, water treatment, and power generation. According to Grand View Research, the global industrial valves market was valued at USD 83.2 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030, with stainless steel variants representing a significant share due to their corrosion resistance, durability, and performance under extreme temperatures and pressures. Similarly, Mordor Intelligence forecasts a CAGR of over 5.8% for the industrial valve market through 2029, highlighting rising infrastructure investments and stringent regulatory standards as key growth catalysts. Against this backdrop, manufacturers specializing in stainless steel valves are scaling innovation and production capacity to meet evolving industry demands. Below, we present a data-driven overview of the top 10 stainless steel valve manufacturers shaping the global landscape through technological advancement, global reach, and consistent product quality.

Top 10 Stainless Steel Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Powell Valves: Industrial Valve Manufacturer

Domain Est. 1998

Website: powellvalves.com

Key Highlights: Powell Valves has been a leading industrial manufacturer, providing high-quality gate, globe, check, bellow-seal & non-return valves. Contact a valve expert ……

#2 Industrial Valve Manufacturer

Domain Est. 1998

Website: cpvmfg.com

Key Highlights: As an industrial valve manufacturer, CPV’s stainless steel fittings and superior repair kits are trusted by industries worldwide. Contact us today!…

#3 Legend Valve

Domain Est. 1996

Website: legendvalve.com

Key Highlights: Legend provides high quality valves and fittings for plumbing, industrial, commercial and residential markets….

#4 DeZURIK

Domain Est. 1996 | Founded: 1928

Website: dezurik.com

Key Highlights: Since 1928, DeZURIK is an innovative global leader as a valve manufacturer with a reputation for product innovation, reliability and service….

#5 Cooper® Valves

Domain Est. 2005

Website: coopervalves.com

Key Highlights: American original manufacturer of high alloy valves and nickel valves in a global market. We offer a large assortment of valve types….

#6 Valve Manufacturer and Supplier

Domain Est. 2009

Website: valveman.com

Key Highlights: ValveMan delivers reliable valve solutions for every industry. Find top-quality ball valves, check valves, and more with fast shipping and expert support….

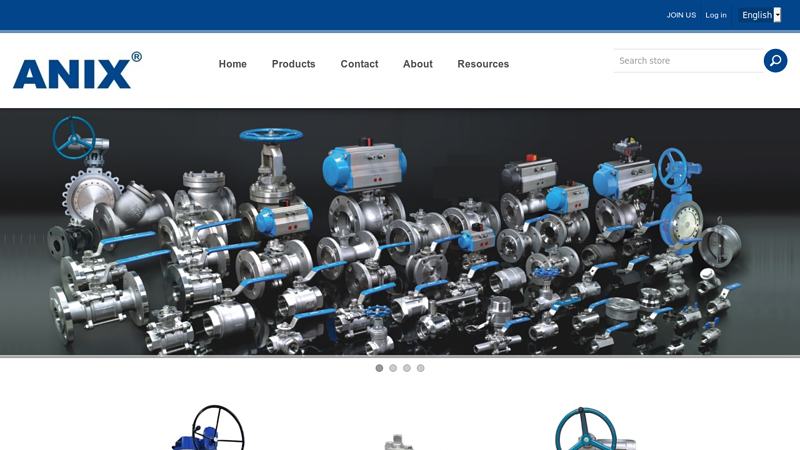

#7 ANIX Valve USA

Domain Est. 2013

Website: anixusa.com

Key Highlights: ANIX VALVE USA is a direct stocking valve manufacturer and supplier of Stainless, Cast and Carbon Steel Valves. Contact us today for your valve needs….

#8 Flomatic Valves

Domain Est. 1996 | Founded: 1933

Website: flomatic.com

Key Highlights: Since 1933, Flomatic Valves has focused on the design, development, and manufacturing of high-quality valve products for the water and wastewater industries….

#9 Magnatrol

Domain Est. 1996

Website: magnatrol.com

Key Highlights: Our Bronze & Stainless Steel 2-Way Solenoid Valves. For the Control of: water, oil, steam, air, gas, cryogenics, solvents, oxygen, corrosive fluid….

#10 Threaded End Steam Ball Valve [Series 120]

Domain Est. 2001

Website: valtorc.com

Key Highlights: Steam rated threaded ball valve in stainless steel body available in sizes 0.25″- 2″ with ISO mounting pad, 250PSI WSP, 2000PSI workingp ressure and a ……

Expert Sourcing Insights for Stainless Steel Valve

H2: 2026 Market Trends for Stainless Steel Valves

The global stainless steel valves market is poised for steady growth through 2026, driven by increasing demand across critical industries and evolving technological and regulatory landscapes. Key trends shaping the market include:

1. Rising Demand from Key End-Use Industries:

The oil & gas sector remains a dominant consumer, particularly for subsea and offshore applications requiring high corrosion resistance. Simultaneously, growth in chemical processing, power generation (including nuclear and renewable energy projects), water & wastewater treatment, and pharmaceuticals will fuel demand. The global push towards clean energy and infrastructure development will further amplify this trend.

2. Emphasis on Corrosion Resistance and Sustainability:

As industries operate in increasingly aggressive environments, the inherent corrosion resistance of stainless steel makes it a preferred material. Moreover, stainless steel’s recyclability aligns with growing environmental regulations and corporate sustainability goals, enhancing its long-term appeal over alternatives.

3. Technological Advancements and Smart Valves:

Integration of digital technologies such as IoT-enabled sensors, predictive maintenance capabilities, and smart actuators is transforming traditional stainless steel valves. These “smart valves” offer real-time monitoring, improved process control, reduced downtime, and enhanced safety—key drivers in industrial automation trends expected to accelerate by 2026.

4. Regional Market Shifts and Localization:

Asia-Pacific, led by China, India, and Southeast Asia, will continue to be the fastest-growing regional market due to rapid industrialization and infrastructure investments. However, supply chain resilience concerns post-pandemic are encouraging localization and nearshoring, prompting manufacturers to establish regional production hubs to mitigate risks and reduce lead times.

5. Regulatory Compliance and Safety Standards:

Stricter global safety and environmental regulations (e.g., emissions control, leak prevention) are pushing industries to adopt higher-specification valves. Compliance with standards such as API, ASME, ISO, and PED is becoming non-negotiable, favoring manufacturers with certified, high-quality stainless steel valve offerings.

6. Price Volatility and Material Cost Management:

Fluctuations in raw material prices (nickel, chromium) could impact profitability. Leading manufacturers are responding with improved supply chain management, alternative alloy development, and long-term supplier contracts to hedge against volatility.

In summary, the 2026 stainless steel valves market will be characterized by innovation, digital integration, sustainability focus, and resilient supply chains, positioning the sector for sustained expansion in a technologically advanced industrial environment.

Common Pitfalls When Sourcing Stainless Steel Valves (Quality, IP)

Sourcing stainless steel valves, especially for critical applications requiring specific quality standards and Ingress Protection (IP) ratings, involves several potential pitfalls. Being aware of these can help avoid costly mistakes, safety hazards, and operational failures.

1. Compromising on Material Quality and Certification

One of the most frequent issues is receiving valves made from substandard or misrepresented stainless steel. Suppliers may use lower-grade alloys (e.g., 201 instead of 304 or 316) to cut costs, leading to premature corrosion, reduced lifespan, and failure in harsh environments.

- Pitfall: Lack of Material Test Reports (MTRs) or falsified documentation.

- Risk: Reduced corrosion resistance, especially in chlorinated or acidic environments.

- Solution: Always demand certified MTRs (Mill Test Reports) conforming to ASTM or ISO standards. Conduct third-party material verification if necessary.

2. Inadequate or Misrepresented Ingress Protection (IP) Ratings

IP ratings indicate a valve’s resistance to dust and water ingress. Misleading claims about IP ratings are common, particularly for actuated or electrically operated valves.

- Pitfall: Suppliers claiming high IP ratings (e.g., IP67, IP68) without proper design, seals, or testing.

- Risk: Moisture or dust penetration leading to internal corrosion, electrical short circuits, or actuator failure.

- Solution: Request test certificates from accredited labs proving the IP rating. Inspect sealing mechanisms (gaskets, O-rings, cable glands) and ensure housings are properly rated.

3. Poor Manufacturing and Workmanship

Even with the correct materials, poor fabrication practices can compromise valve integrity.

- Pitfall: Inconsistent welding, rough internal finishes, misaligned components, or improper heat treatment.

- Risk: Leaks, flow restrictions, reduced pressure ratings, and susceptibility to stress corrosion cracking.

- Solution: Conduct factory audits or request production samples. Specify surface finish requirements (e.g., Ra < 0.8 µm for hygienic applications) and welding standards (e.g., TIG with proper purging).

4. Non-Compliance with Industry Standards

Valves may not adhere to required international or industry-specific standards (e.g., ISO, API, ASME, DIN, ATEX).

- Pitfall: Valves labeled as “API 6D compliant” without full conformance to design, testing, or marking requirements.

- Risk: Rejection during inspection, safety incidents, or non-compliance with regulatory audits.

- Solution: Clearly specify applicable standards in procurement documents and verify compliance through certification and third-party inspection.

5. Inaccurate Pressure and Temperature Ratings

Overstated performance ratings can lead to catastrophic failures under operating conditions.

- Pitfall: Suppliers inflating pressure (PSI/bar) or temperature limits beyond what the design or materials can safely handle.

- Risk: Valve rupture, leaks, or system shutdowns under normal operating stress.

- Solution: Cross-check ratings against material properties and design codes. Require pressure test certificates (e.g., shell and seat tests per API 598).

6. Lack of Traceability and Documentation

Incomplete or missing documentation hinders quality assurance and maintenance.

- Pitfall: No batch/lot traceability, missing test reports, or unclear markings on valves.

- Risk: Inability to track failures, difficulty in warranty claims, non-compliance with quality management systems (e.g., ISO 9001).

- Solution: Require full documentation packages, including material certs, test reports, and valve markings (e.g., material grade, size, pressure class, serial number).

7. Ignoring Environmental and Application-Specific Needs

Selecting a valve without considering the specific operating environment can lead to early failure.

- Pitfall: Using standard 304 stainless steel in marine or high-chloride environments where 316 or super duplex is needed.

- Risk: Pitting corrosion, stress cracking, and reduced service life.

- Solution: Conduct a thorough application review, considering fluid type, temperature, pressure, and environmental exposure. Consult with engineers or corrosion specialists when in doubt.

By addressing these common pitfalls proactively—through rigorous supplier vetting, clear specifications, and verification processes—buyers can ensure they source reliable, high-quality stainless steel valves that meet both performance and safety requirements.

Logistics & Compliance Guide for Stainless Steel Valves

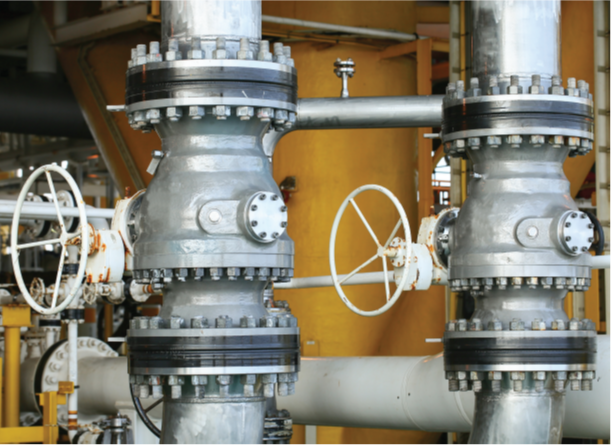

Product Overview and Classification

Stainless steel valves are essential components in fluid control systems used across industries such as oil & gas, chemical processing, water treatment, food & beverage, and pharmaceuticals. Key types include ball valves, gate valves, globe valves, check valves, and butterfly valves. These valves are valued for their corrosion resistance, durability, high-temperature tolerance, and hygienic properties. Proper logistics planning and regulatory compliance are critical to ensure product integrity, timely delivery, and adherence to international standards.

Material and Quality Specifications

Stainless steel valves are typically manufactured from grades such as 304, 316, 316L, or duplex stainless steels, each with specific chemical compositions and mechanical properties. Compliance with material standards is mandatory and includes adherence to ASTM (e.g., ASTM A182, A479), ASME (e.g., ASME B16.34), and ISO (e.g., ISO 5208) specifications. Valves must undergo quality testing such as hydrostatic testing, non-destructive testing (NDT), and material traceability via mill test reports (MTRs). Third-party inspections (e.g., by API 598 or ISO 15848) may be required for critical applications.

Packaging and Handling Requirements

Proper packaging is essential to prevent physical damage, corrosion, and contamination during transit. Valves should be protected with:

- End caps or protective covers on all ports

- Anti-corrosion paper or VCI (Vapor Corrosion Inhibitor) wrapping

- Wooden crates or reinforced cardboard boxes with internal bracing

- Desiccants to control moisture in enclosed packaging

Handling must follow safe practices: use lifting equipment for heavy valves, avoid dragging or dropping, and store in dry, clean environments. For hygienic applications (e.g., food or pharma), packaging must meet sanitary standards such as 3-A or EHEDG requirements.

Transportation and Shipping Logistics

Stainless steel valves can be shipped via air, sea, rail, or road, depending on urgency, volume, and destination. Key considerations include:

- Sea Freight: Most cost-effective for bulk shipments; use FCL (Full Container Load) or LCL (Less than Container Load). Ensure containers are sealed and moisture-controlled.

- Air Freight: Suitable for urgent or high-value orders; limited by weight and size.

- Land Transport: Ideal for regional distribution; use covered trucks with secure tie-downs.

Proper labeling with handling instructions (e.g., “Fragile,” “This Side Up”), product details, and barcodes ensures traceability and correct handling throughout the supply chain.

Regulatory Compliance and Documentation

Export and import of stainless steel valves require compliance with various international and regional regulations:

- Export Controls: Verify if valves fall under ITAR, EAR, or other export control regimes, especially if used in defense, nuclear, or strategic sectors.

- Customs Documentation: Include commercial invoice, packing list, bill of lading/airway bill, certificate of origin, and material/test certificates.

- Product Certification: Provide CE marking (for EU), CRN (Canada), ASME U-stamp, or AD2000 certification as required by destination country.

- REACH & RoHS Compliance: Confirm that materials meet EU chemical safety regulations, particularly for valves used in sensitive environments.

Accurate Harmonized System (HS) code classification (e.g., 8481.80 for valves of stainless steel) is essential for customs clearance and duty assessment.

Destination Market Requirements

Different markets have specific technical and safety standards:

- United States: Compliance with ASME, API, FM, and ANSI standards; NACE MR0175 for sour service.

- European Union: Conformity with PED (Pressure Equipment Directive 2014/68/EU), ATEX for explosive atmospheres.

- Middle East: SASO (Saudi Arabia), GSO (GCC) certification often required.

- Asia-Pacific: Compliance with JB/T (China), JIS (Japan), or AS/NZS (Australia/New Zealand) standards.

Engage local regulatory experts or certification bodies to ensure market access and avoid shipment delays.

Storage and Inventory Management

Upon arrival at destination, valves should be stored in controlled environments:

- Keep in original packaging until installation

- Store indoors on pallets, away from moisture, chemicals, and direct sunlight

- Rotate stock using FIFO (First In, First Out) to prevent obsolescence

- Monitor for signs of corrosion or packaging damage

Implement inventory tracking systems (e.g., ERP or WMS) to maintain traceability of batch numbers, certifications, and shelf life.

Environmental and Sustainability Considerations

Stainless steel is recyclable, and manufacturers should promote sustainable practices:

- Use eco-friendly packaging materials

- Optimize shipping routes to reduce carbon footprint

- Comply with WEEE (Waste Electrical and Electronic Equipment) where applicable

- Support end-of-life recycling programs

Documentation such as Environmental Product Declarations (EPDs) can enhance market competitiveness.

Conclusion

Effective logistics and compliance management for stainless steel valves ensures product quality, regulatory approval, and customer satisfaction. By adhering to standardized packaging, accurate documentation, and region-specific regulations, companies can streamline global distribution, minimize risks, and maintain a strong reputation in industrial supply chains. Regular audits and staff training further strengthen compliance and operational efficiency.

Conclusion for Sourcing Stainless Steel Valves:

In conclusion, sourcing stainless steel valves requires a comprehensive evaluation of material quality, supplier reliability, application requirements, cost-effectiveness, and compliance with industry standards. Stainless steel valves offer excellent corrosion resistance, durability, and performance under high pressure and temperature, making them ideal for demanding environments in industries such as oil and gas, chemical processing, pharmaceuticals, and water treatment.

To ensure optimal performance and longevity, it is critical to partner with reputable suppliers who adhere to international standards (such as ASTM, API, ANSI, and ISO) and provide proper certifications. Conducting thorough supplier assessments, requesting product samples, and evaluating after-sales support are essential steps in the procurement process.

Furthermore, while initial costs may be higher compared to other materials, the long-term benefits—such as reduced maintenance, extended service life, and improved system efficiency—justify the investment. By implementing a strategic sourcing approach that balances quality, cost, and reliability, organizations can secure high-performance stainless steel valves that meet operational needs and contribute to the overall efficiency and safety of their systems.

![Threaded End Steam Ball Valve [Series 120]](https://www.fobsourcify.com/wp-content/uploads/2026/01/threaded-end-steam-ball-valve-series-120-646.jpg)