The global stainless steel market, a foundational component in high-performance scope manufacturing, is projected to grow at a CAGR of 5.2% from 2023 to 2028, according to Mordor Intelligence. This expansion is driven by rising demand for corrosion-resistant, durable materials in precision optics across defense, hunting, and industrial applications. As the need for reliable, long-lasting scopes intensifies—particularly in harsh environments—stainless steel has emerged as the preferred material due to its strength, thermal stability, and resistance to wear. With the global firearm optics market also gaining momentum, especially in North America and Europe, manufacturers specializing in stainless steel scopes are well-positioned for sustained growth. This increasing demand underscores the importance of identifying industry leaders who combine engineering excellence with advanced metallurgical practices. The following list highlights the top six stainless steel scope manufacturers leading innovation, quality, and market share in this evolving landscape.

Top 6 Stainless Steel Scope Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Scope Metals

Domain Est. 1997

Website: scope-metal.com

Key Highlights: Scope markets large pipes, steel accessories, stainless steel and aluminum, screws, welding materials, profiles, sheets and plates, faucets, valves and pumps ……

#2 page

Domain Est. 1997

Website: leupold.com

Key Highlights: We’ve been making world-class optics that bear our family name for over 100 years. We honor that legacy every day as we design, machine and assemble……

#3 Our Steel

Domain Est. 2000

Website: bluescope.com

Key Highlights: BlueScope makes and supplies steel for some of the most beautiful, essential and enduring buildings and structures in the world….

#4 Riflescopes & Optics for MSR/AR & Bolt Action Firearms

Domain Est. 2001

Website: sigsauer.com

Key Highlights: SIG SAUER’s riflescopes & optics utilize advanced sighting technologies for mid to long range engagements. Explore riflescopes from SIG ……

#5 Vortex Optics

Domain Est. 2003

Website: vortexoptics.com

Key Highlights: From tagging your first buck, to hitting the range with friends, to using the right optic to get closer to nature, our team thrives on your success….

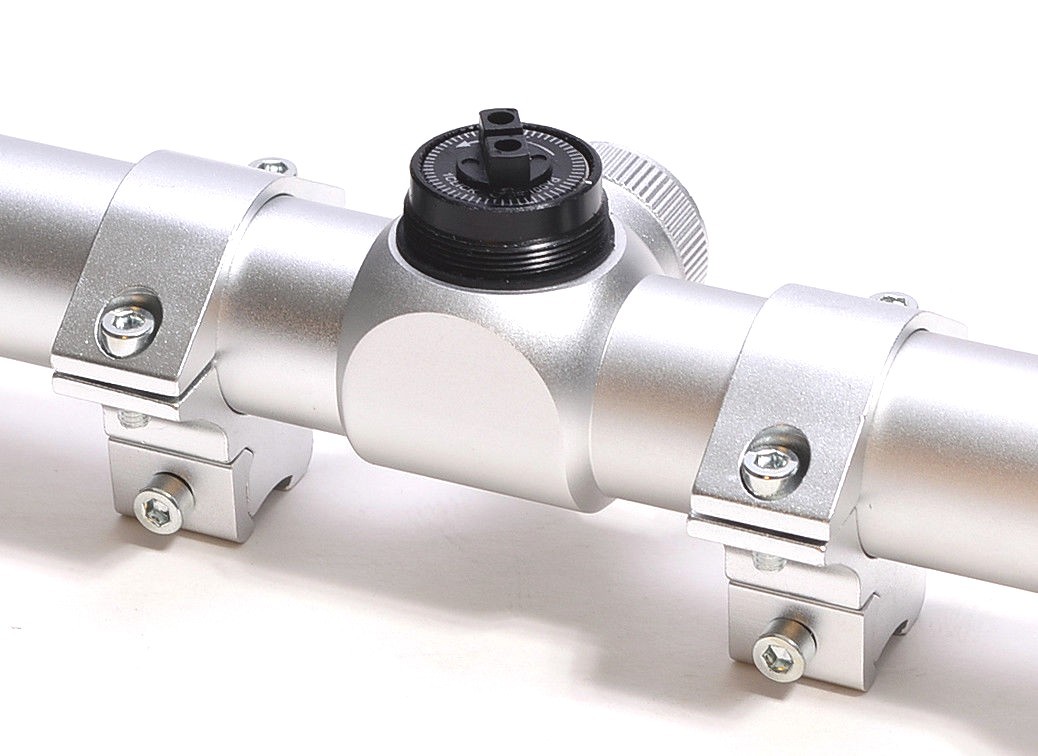

#6 Stainless Steel Rifle Scope

Domain Est. 2021

Website: 1895scopes.com

Key Highlights: Our Stainless Steel rifle scope for lever action or single shot rifles. Variable power 1.5x – 5x. 11.5 inches long. 20mm Objective Diameter….

Expert Sourcing Insights for Stainless Steel Scope

H2: Market Trends in the Stainless Steel Industry for 2026

As the global economy continues to evolve in response to technological innovation, sustainability demands, and shifting industrial needs, the stainless steel market is poised for significant transformation by 2026. The stainless steel scope—encompassing production, application sectors, regional dynamics, and material advancements—is expected to reflect several key trends shaped by macroeconomic forces, environmental policies, and emerging end-user demands.

1. Rising Demand from Infrastructure and Construction

The construction and infrastructure sectors are anticipated to remain primary drivers of stainless steel consumption in 2026. Governments worldwide are investing in urban development, public transportation, and resilient infrastructure, especially in emerging economies across Asia-Pacific and Africa. Stainless steel’s corrosion resistance, durability, and aesthetic appeal make it a preferred material for architectural facades, bridges, and water treatment facilities. The trend toward sustainable building standards (e.g., LEED and BREEAM certifications) further boosts demand for long-life, recyclable materials like stainless steel.

2. Expansion in Renewable Energy Applications

The global push toward clean energy is increasing stainless steel use in renewable energy systems. By 2026, solar panel mounting structures, wind turbine components, and hydrogen production infrastructure (particularly electrolyzers) will rely heavily on stainless steel due to its resistance to harsh environments and high temperatures. The hydrogen economy, gaining momentum in Europe, North America, and parts of Asia, will particularly benefit from austenitic and duplex stainless steel grades suited for hydrogen storage and transport.

3. Growth in Automotive and Transportation Sectors

While electric vehicles (EVs) use less stainless steel than traditional vehicles, the broader transportation sector—including rail, shipping, and EV charging infrastructure—is expected to increase stainless steel adoption. Lightweight, high-strength stainless alloys are being developed for railcars and commercial vehicles to improve fuel efficiency and safety. Additionally, EV charging stations and battery enclosures will require corrosion-resistant materials, creating new niches for stainless steel applications.

4. Technological Advancements and Material Innovation

By 2026, material science innovations will drive the development of next-generation stainless steels with enhanced properties. These include improved formability, higher temperature resistance, and greater strength-to-weight ratios. Additive manufacturing (3D printing) with stainless steel powders will expand in aerospace, medical devices, and custom industrial components, enabling complex geometries and reducing material waste.

5. Sustainability and Circular Economy Pressures

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals will intensify the focus on sustainable production. Stainless steel, being 100% recyclable with high scrap retention value, is well-positioned to benefit. By 2026, more producers are expected to adopt electric arc furnace (EAF) technologies powered by renewable energy, reducing the carbon footprint of stainless steel production. Closed-loop recycling systems and transparent supply chains will become competitive advantages.

6. Regional Shifts and Supply Chain Reconfiguration

Asia-Pacific will remain the dominant producer and consumer of stainless steel, led by China, India, and Indonesia. However, geopolitical factors and trade policies may encourage regional diversification, with increased capacity in North America and Europe to reduce dependency on imports. Nearshoring and supply chain resilience will become critical, especially for high-value sectors like medical and aerospace.

7. Price Volatility and Raw Material Constraints

Fluctuations in nickel, chromium, and molybdenum prices—key alloying elements in stainless steel—will continue to impact market dynamics in 2026. Efforts to develop low-nickel or nickel-free alternatives (e.g., nitrogen-alloyed stainless steels) may gain traction to mitigate cost risks and supply insecurity, particularly amid growing demand for battery-grade nickel in the EV sector.

Conclusion

By 2026, the stainless steel market will be shaped by a confluence of sustainability imperatives, technological innovation, and evolving industrial needs. Companies that invest in green production methods, diversify supply chains, and innovate in high-growth applications—such as clean energy and advanced manufacturing—are likely to lead the market. As global decarbonization goals accelerate, stainless steel’s role as a durable, recyclable, and versatile material will solidify its importance across critical sectors.

Common Pitfalls When Sourcing Stainless Steel: Quality and Intellectual Property Concerns

Sourcing stainless steel, especially for critical applications, involves navigating several potential pitfalls related to material quality and intellectual property (IP). Overlooking these can lead to product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

Misrepresentation of Alloy Grade and Composition

Suppliers may falsely label lower-grade or non-compliant stainless steel as premium grades (e.g., claiming 316L when delivering 201-grade). This often involves altering mill test certificates or providing falsified documentation. Without independent verification through third-party testing (e.g., Positive Material Identification or PMI), buyers risk receiving material that lacks required corrosion resistance or mechanical properties.

Inconsistent Heat Treatment and Mechanical Properties

Improper or inconsistent heat treatment processes—such as solution annealing or stress relieving—can significantly alter the microstructure and performance of stainless steel. Poorly processed material may exhibit reduced toughness, increased susceptibility to intergranular corrosion, or dimensional instability, especially in demanding environments like high temperature or pressure.

Poor Surface Finish and Contamination

Stainless steel’s corrosion resistance depends heavily on its passive chromium oxide layer. Poor handling, improper cleaning, or contamination with iron particles (e.g., from shared fabrication equipment) can compromise this layer, leading to premature rusting or pitting. Suppliers may deliver material with inadequate surface finishes (e.g., incorrect Ra values) or fail to meet required standards such as ASTM A480.

Non-Compliance with International Standards

Some suppliers provide material that does not conform to specified standards (e.g., ASTM, ASME, EN, or JIS). This includes deviations in chemical composition, mechanical strength, or dimensional tolerances. Buyers assuming compliance based on supplier claims without verification expose themselves to regulatory and safety risks.

Intellectual Property-Related Pitfalls

Unauthorized Use of Proprietary Alloys

Certain stainless steel grades are patented or trademarked (e.g., Outokumpu’s Fortrax or Acerinox’s ATI 204Cu). Sourcing material labeled as such without proper licensing constitutes IP infringement. Suppliers may falsely claim to supply proprietary alloys to win contracts, exposing the buyer to legal liability and supply chain disruption.

Counterfeit Mill Certificates and Documentation

Fraudulent or duplicated mill test reports are common in global supply chains. These forged documents may falsely attest to compliance with quality standards or specific alloy chemistry. Relying solely on paper-based certification without traceability or digital verification increases the risk of receiving substandard or misrepresented material.

Lack of Traceability and Chain of Custody

Without proper traceability (e.g., heat numbers, batch tracking), it becomes difficult to verify the origin of the material or respond to quality issues. This gap can mask IP violations, such as the illegal reproduction of specialty alloys, and complicates recalls or audits.

Insufficient Supplier Vetting and Due Diligence

Failing to audit suppliers or verify their manufacturing and sourcing practices increases exposure to both quality and IP risks. Unqualified suppliers may lack the technical capability or ethical standards to handle IP-protected materials or ensure consistent quality, especially in high-risk regions with weak enforcement of IP laws.

Addressing these pitfalls requires rigorous supplier qualification, independent material testing, clear contractual terms, and ongoing supply chain monitoring to ensure both quality integrity and IP compliance.

Logistics & Compliance Guide for Stainless Steel Scope

This guide outlines the key logistics and compliance considerations for the transportation, handling, and regulatory adherence related to stainless steel products, particularly in industrial, manufacturing, and supply chain contexts. Proper management ensures product integrity, regulatory compliance, and operational efficiency.

Product Classification and HS Code

Stainless steel products are classified under the Harmonized System (HS) for international trade. Accurate classification is essential for customs clearance, duty assessment, and regulatory compliance.

- HS Code Example: 7219 or 7220 for stainless steel flat-rolled products (e.g., sheets, strips, coils)

- HS Code Example: 7304 for stainless steel tubes and pipes

- HS Code Example: 7326 for other stainless steel fabricated articles

Note: Specific codes depend on product form (sheet, bar, pipe, fabricated), composition, and end use. Verify with local customs authorities or trade experts.

Material Specifications and Standards

Ensure all stainless steel products meet recognized international and industry standards. Compliance with material specifications is critical for quality assurance and regulatory acceptance.

- ASTM Standards: ASTM A240 (plates, sheets, strips), ASTM A312 (seamless and welded pipes), ASTM A276 (bars and shapes)

- ISO Standards: ISO 15510 (chemical composition), ISO 9445 (cold-rolled stainless steel)

- EN Standards: EN 10088 series (European standards for stainless steels)

Documentation such as Mill Test Certificates (MTCs) or Material Test Reports (MTRs) must accompany shipments to confirm compliance.

Packaging and Handling Requirements

Proper packaging prevents corrosion, mechanical damage, and contamination during transport and storage.

- Protective Measures: Use plastic or paper interleaf, VCI (Vapor Corrosion Inhibitor) wraps, and moisture-resistant packaging

- Securing Loads: Use wooden pallets, edge protectors, and steel strapping for coils and sheets; bundle bars and tubes securely

- Labeling: Clearly label with product type, grade, dimensions, heat number, and handling instructions (e.g., “Do Not Stack,” “Protect from Moisture”)

Avoid contact with carbon steel during handling to prevent contamination and rust transfer.

Transportation and Shipping

Choose appropriate transportation modes and ensure safe loading/unloading procedures.

- Modes: Ocean freight (FCL/LCL), rail, or road depending on volume, distance, and destination

- Containerization: Use dry, clean containers; desiccants may be required for long sea voyages

- Handling Equipment: Use non-magnetic lifting devices (e.g., slings, clamps) to avoid surface damage

Ensure carriers are experienced in handling metal freight and comply with safety regulations (e.g., IMDG for sea, ADR for road in Europe).

Import/Export Regulations

Compliance with trade regulations is essential to avoid delays, fines, or shipment rejection.

- Export Controls: Verify if products are subject to export restrictions (e.g., dual-use items, strategic materials)

- Import Duties and Tariffs: Check applicable tariffs, preferential trade agreements (e.g., USMCA, EU FTAs), and anti-dumping duties

- Documentation: Prepare commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and conformity certificates as required

Monitor sanctions and embargoes affecting trade with certain countries.

Environmental and Safety Compliance

Stainless steel logistics must adhere to environmental and occupational health and safety standards.

- REACH & RoHS (EU): Confirm compliance with chemical substance regulations; stainless steel generally complies, but coatings or treatments may require assessment

- OSHA (USA): Follow safe handling practices to prevent injuries from sharp edges or heavy loads

- Waste Handling: Recycle packaging materials; manage scrap metal in compliance with local regulations

Country-Specific Requirements

Different countries may impose additional requirements:

- USA: EPA and DOT regulations for domestic transport; CBP entry filing

- EU: CE marking not typically required for raw stainless steel, but traceability and documentation are critical

- China: CIQ inspection may be required; strict labeling and customs documentation

- India: BIS certification may be needed for certain stainless steel products

Always consult local legal and customs advisors for up-to-date requirements.

Recordkeeping and Traceability

Maintain complete records to support compliance audits and product traceability.

- Retention Period: Keep shipping documents, test reports, and customs filings for minimum of 5–7 years (varies by jurisdiction)

- Traceability: Track material by heat/lot number from mill to end customer

Summary and Best Practices

- Verify HS codes and customs requirements early in the process

- Use certified suppliers and demand full material documentation

- Implement protective packaging and contamination control

- Train staff on safe handling and regulatory compliance

- Conduct regular audits of logistics partners and compliance procedures

By following this guide, companies can ensure efficient, compliant, and secure movement of stainless steel products across global supply chains.

Conclusion for Sourcing Stainless Steel:

In conclusion, sourcing stainless steel requires a strategic approach that balances quality, cost, supplier reliability, and compliance with industry standards. The selection of the appropriate grade (e.g., 304, 316, 430) must align with the specific application requirements, particularly in terms of corrosion resistance, strength, and environmental conditions. Engaging with certified and audited suppliers ensures material traceability, consistent quality, and adherence to international standards such as ASTM, ISO, or EN. Additionally, factors such as lead times, MOQs (Minimum Order Quantities), logistics, and total landed cost must be evaluated to optimize the procurement process. By adopting a comprehensive sourcing strategy—leveraging market analysis, supplier diversification, and long-term partnerships—organizations can ensure a reliable supply of high-quality stainless steel that supports operational efficiency, product integrity, and cost-effectiveness.