The global stainless steel polish market is experiencing robust growth, driven by rising demand across construction, automotive, and consumer goods industries. According to Grand View Research, the global stainless steel market size was valued at USD 183.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This expansion reflects increasing urbanization, infrastructure development, and a preference for aesthetically durable finishes—factors that directly fuel demand for high-quality stainless polish. Additionally, Mordor Intelligence projects steady growth in stainless steel surface treatment applications, particularly in emerging economies where industrialization and architectural modernization are accelerating. As the need for corrosion-resistant, hygienic, and visually appealing surfaces intensifies, manufacturers specializing in stainless polish are pivotal in meeting evolving industry standards. In this competitive landscape, the following ten companies have emerged as leaders, combining innovation, scalability, and product excellence to capture significant market share.

Top 10 Stainless Polish Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

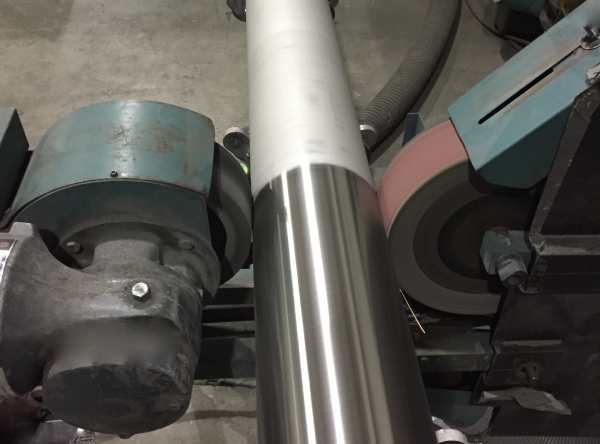

#1 Brushed Stainless Steel

Domain Est. 2023

Website: stainlesspolish.com

Key Highlights: At Stainless Steel Services, Inc., we provide honest and efficient industrial polishing with a simple mission: to be a trusted partner to your business and ……

#2 Stainless Steel Shine Polish

Domain Est. 1998

Website: blitzinc.com

Key Highlights: In stock $9.91 deliveryStainless Steel Shine Polish cleans and restores the original brilliance to stainless steel surfaces. This product contains no alcohol, no ammonia, ……

#3 Sheila Shine, Inc.

Domain Est. 2003

Website: sheilashineinc.com

Key Highlights: Sheila Shine stainless steel polish is the most effective and recognized metal polish, cleaner available. Janitorial supplies for commercial cleaners….

#4 Electropolishing Service for Stainless Steel & Other Metals

Domain Est. 1998

Website: ableelectropolishing.com

Key Highlights: Precision electropolishing and passivation for deburring, preventing corrosion for stainless steel, Nitinol, titanium, other metals: get a free sample….

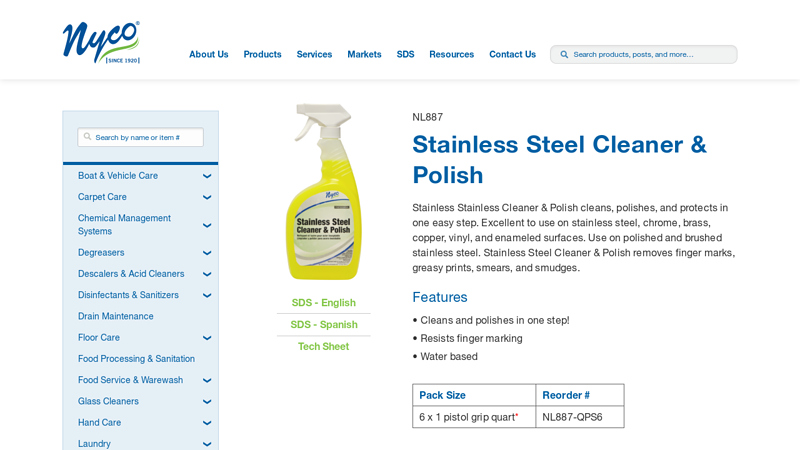

#5 Stainless Steel Cleaner & Polish

Domain Est. 1999

Website: nycoproducts.com

Key Highlights: Stainless Cleaner & Polish cleans, polishes, and protects in one easy step. Excellent to use on stainless steel, chrome, brass, copper, vinyl, and enameled ……

#6 Mirror Metals

Domain Est. 1999

Website: mirrormetals.com

Key Highlights: North America’s leading distributor of #8 mirror finish stainless steel. We offer only the highest-quality non-directional finish available in today’s market….

#7 CMPI

Domain Est. 2000

Website: cmpionline.com

Key Highlights: CMPI is a fully equipped job shop ready to take on your custom orders. Combine our stainless polishing with fabrication services….

#8 Stainless Shapes

Domain Est. 2006

Website: stainlessshapes.net

Key Highlights: Stainless Shapes is a supplier of Stainless, Titanium and Nickel Alloys. We offer beams, bars, plates, sheets, tubes and more with proven quality….

#9 Stainless International

Domain Est. 2007

Website: stainlessinternational.com

Key Highlights: Welcome to Stainless International, a leading independent Stainless Steel Supplier and Processor. Specialists in Stainless Steel Coil, Sheet, Tubular & Long ……

#10 Stainless Steel Polish

Domain Est. 2019

Website: bescomfgparts.com

Key Highlights: In stockStainless Steel Polish ; Key Features · Keep stainless steel, chrome, aluminum and a variety of other metal surfaces clean and polished to an attractive sheen….

Expert Sourcing Insights for Stainless Polish

H2: Projected 2026 Market Trends for Stainless Steel Polish

Based on current industry trajectories, technological advancements, and evolving consumer demands, the stainless steel polish market in 2026 is expected to be shaped by several key trends under the overarching theme of H2: Heightened Demand for Sustainable, High-Performance, and Smart Solutions.

-

H2.1: Sustainability & Eco-Conscious Formulations as a Primary Driver:

- Regulatory Pressure & Consumer Demand: Stricter global regulations on VOCs (Volatile Organic Compounds) and hazardous chemicals, coupled with increasing consumer preference for eco-friendly products, will push manufacturers towards water-based, biodegradable, and non-toxic formulations. “Green” certifications (e.g., EPA Safer Choice, EU Ecolabel) will become significant market differentiators.

- Natural & Plant-Based Ingredients: Expect a surge in polishes utilizing plant-derived surfactants, solvents (like citrus or soy-based), and waxes. Transparency in ingredient sourcing and biodegradability will be key marketing points.

- Reduced Packaging Waste: Growth in concentrated formulas (requiring dilution) and packaging made from recycled materials (rPET, PCR) or refill systems will address environmental concerns.

-

H2.2: Performance Enhancement & Multi-Functionality:

- Advanced Protective Coatings: Polishes will increasingly incorporate advanced polymers (e.g., silicones, fluoropolymers, ceramic nanoparticles) to provide longer-lasting protection against fingerprints, smudges, water spots, and corrosion. The focus will shift from just cleaning to “protective maintenance.”

- “One-Step” Solutions: Demand for convenience will drive innovation in multi-functional products that clean, polish, and protect in a single application, reducing labor time and effort, especially in commercial/industrial settings.

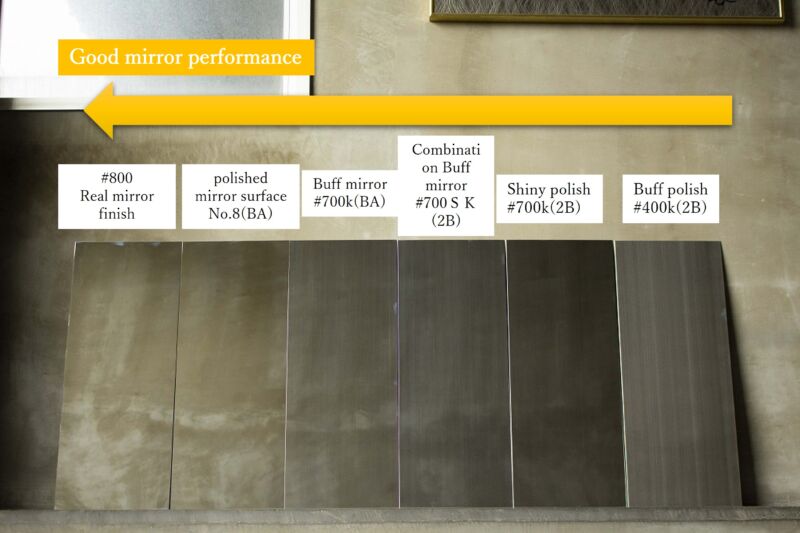

- Specialized Formulations: Growth in niche products tailored for specific stainless steel finishes (brushed, satin, mirror), harsh environments (marine, industrial kitchens), or sensitive surfaces (appliances with coatings) will continue.

-

H2.3: Digital Integration & Smart Applications:

- IoT-Enabled Maintenance: Integration with smart home/industrial systems may emerge. Sensors could detect surface condition (fingerprint density, micro-scratches) and trigger alerts or even automated dispensing systems for polish, particularly in high-traffic commercial or industrial facilities.

- Augmented Reality (AR) & AI Guidance: Apps using AR could guide users on optimal application techniques for different finishes or help identify the correct polish type. AI could personalize recommendations based on usage patterns and environmental factors.

- Enhanced Online Experience: Virtual try-on tools for visualizing polished results on different appliance finishes and sophisticated online product configurators will become more common for B2B and premium B2C segments.

-

H2.4: Supply Chain Resilience & Regionalization:

- Localized Production: To mitigate risks from global disruptions (geopolitical, logistical), manufacturers will increasingly focus on regional production hubs closer to key markets (North America, Europe, Asia-Pacific), reducing lead times and transportation emissions.

- Strategic Sourcing: Diversification of raw material suppliers and investment in more stable, traceable supply chains for key ingredients (especially specialty chemicals and packaging) will be a priority.

-

H2.5: Growth in High-Value Segments:

- Premium & Luxury Appliances: The expanding market for high-end home appliances and architectural metalwork will drive demand for premium polishes offering superior shine, protection, and ease of use.

- Industrial & Healthcare Applications: Stringent hygiene requirements in food processing, pharmaceuticals, and healthcare will sustain demand for specialized, high-efficacy, and compliant (e.g., NSF, FDA) stainless steel cleaners and polishes.

- Renewable Energy & Transportation: Growth in solar panel frames, EV battery casings, and transportation infrastructure (trains, ships) using stainless steel will create new niches for durable, specialized protective polishes.

Conclusion on H2:

By 2026, the stainless steel polish market will be significantly transformed by H2 (Heightened Demand). Success will depend on manufacturers’ ability to deliver sustainable, high-performance products that offer tangible benefits like longevity and ease of use, while embracing digital tools for enhanced customer engagement and operational efficiency. The focus will shift decisively from basic cleaning to intelligent, protective surface care within a resilient and responsible supply chain framework. Companies failing to innovate in these H2-driven areas risk significant market share loss.

Common Pitfalls When Sourcing Stainless Polish (Quality & Intellectual Property)

Sourcing stainless polish—especially for industrial, architectural, or high-end consumer applications—requires careful attention to both product quality and intellectual property (IP) considerations. Overlooking these aspects can result in subpar performance, legal risks, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inconsistent Finish and Performance

Not all stainless polishes deliver the same level of shine, corrosion resistance, or durability. Sourcing from unqualified suppliers may result in inconsistent formulations, leading to uneven finishes, premature tarnishing, or inadequate protection against environmental factors like moisture or salt exposure.

2. Lack of Standard Compliance

Reputable stainless polish should meet industry standards (e.g., ASTM, ISO, or MIL-SPEC). Failing to verify compliance can lead to products that don’t perform as expected under specific conditions, particularly in critical applications such as food processing, marine environments, or medical equipment.

3. Poor Ingredient Transparency

Some suppliers may use abrasive or corrosive chemicals that degrade stainless steel over time. Without clear documentation on chemical composition, buyers risk damaging surfaces or violating safety and environmental regulations.

4. Inadequate Testing and Validation

Suppliers may claim high performance without providing test data or third-party certifications. Relying solely on marketing materials without requesting performance reports (e.g., salt spray tests, abrasion resistance) increases the risk of product failure.

5. Counterfeit or Substandard Brands

Low-cost suppliers may offer “branded” polishes that are counterfeit or reformulated with inferior ingredients. These products may look similar but fail to deliver the expected results or long-term protection.

Intellectual Property-Related Pitfalls

1. Unauthorized Use of Branded Formulations

Some suppliers may replicate patented chemical formulations or mimic well-known brand names without licensing. Sourcing such products exposes your business to legal liability, especially if the IP owner pursues action against downstream users.

2. Misrepresentation of Patents or Trademarks

Suppliers might falsely claim that their product is patented or approved by a recognized brand. Failing to verify IP claims can lead to unintentional infringement and damage to your company’s credibility.

3. Lack of Licensing Agreements

When sourcing proprietary polish formulas (e.g., OEM-specific blends), ensure the supplier has the proper licensing rights. Using unlicensed formulations—even unknowingly—can result in costly litigation and supply chain disruptions.

4. Inadequate IP Protection in Contracts

Purchase agreements should clearly define IP ownership, especially if you’re co-developing a custom polish formulation. Without strong contractual safeguards, your innovations or specifications could be used by the supplier for other clients.

5. Grey Market Procurement Risks

Purchasing from unauthorized distributors may involve IP violations, even if the product appears authentic. These channels often bypass regional licensing agreements, exposing your business to legal and warranty issues.

Best Practices to Mitigate Risks

- Conduct thorough due diligence on suppliers, including audits and sample testing.

- Require documentation of compliance, ingredient safety data sheets (SDS), and performance testing.

- Verify IP rights through patent databases and direct confirmation with brand owners.

- Include clear IP clauses in procurement contracts.

- Source from authorized distributors or certified manufacturers whenever possible.

Avoiding these pitfalls ensures you receive a high-quality, legally compliant stainless polish that meets both performance standards and regulatory requirements.

Logistics & Compliance Guide for Stainless Polish

Product Classification & Handling

Stainless polish is typically classified as a chemical preparation used for cleaning, restoring, and protecting stainless steel surfaces. It often contains solvents, oils, and mild abrasives. Depending on formulation, it may be flammable or irritant, requiring appropriate handling and labeling under regulatory standards.

Proper handling includes storage in a cool, dry, well-ventilated area away from heat sources and direct sunlight. Always store upright in original containers with tightly sealed lids. Avoid contact with eyes and skin; use gloves and eye protection when handling large volumes or in industrial settings.

Transportation Requirements

Stainless polish must be transported in accordance with national and international hazardous materials regulations if it meets criteria for flammability, toxicity, or corrosivity. Common transport regulations include:

- DOT (U.S. Department of Transportation): Classify under 49 CFR based on flash point and health hazards. Flammable formulations may fall under Class 3 (Flammable Liquids).

- IMDG Code (Maritime): Required for sea transport; classification depends on UN number and packing group.

- IATA (Air Transport): More restrictive; many solvent-based polishes are forbidden or limited in air shipments.

Ensure packaging is UN-certified when required, and outer packaging must be durable and leak-proof. Include required hazard labels (e.g., flammable, irritant) on all shipments.

Regulatory Compliance

Compliance with safety and environmental regulations is essential:

- GHS (Globally Harmonized System): All stainless polish must have a GHS-compliant Safety Data Sheet (SDS) and product label featuring pictograms, signal words, hazard statements, and precautionary measures.

- OSHA (U.S.): Employers must maintain SDSs and provide employee training under the Hazard Communication Standard (HCS).

- REACH & CLP (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) and Classification, Labeling and Packaging (CLP) regulations apply for import and sale within the European Union.

- Proposition 65 (California): If the product contains listed chemicals (e.g., certain solvents), a clear warning label is required.

Storage & Inventory Management

Store stainless polish in a dedicated chemical storage area segregated from incompatible materials (e.g., strong oxidizers, acids). Use secondary containment to prevent spills from spreading. Implement a first-in, first-out (FIFO) inventory system to prevent product degradation over time.

Regularly inspect containers for damage or leaks. Maintain an up-to-date chemical inventory and ensure spill response supplies (e.g., absorbents, PPE) are readily available.

Environmental & Disposal Considerations

Do not dispose of stainless polish or rinse water down drains or into storm systems. Waste must be managed according to local, state, and federal regulations. Used polish, contaminated rags, and empty containers may be classified as hazardous waste depending on content.

Recycle or dispose of containers through licensed waste handlers. Follow EPA (or equivalent) guidelines for waste determination and disposal. Spills must be contained and cleaned using appropriate absorbents; dispose of cleanup materials as hazardous waste if necessary.

Documentation & Recordkeeping

Maintain the following records for compliance and traceability:

- Safety Data Sheets (SDS) for each product variant

- Shipping manifests and transport documentation

- Employee training records for chemical handling

- Spill incident reports and disposal logs

- Regulatory permits or registrations (e.g., EPA facility ID, state chemical registrations)

Retention periods vary by jurisdiction—typically 3 to 5 years. Ensure digital and physical copies are securely stored and accessible for audits.

Emergency Preparedness

Develop and communicate an emergency response plan for spills, fires, or exposure incidents. Key actions include:

- Evacuate and ventilate area in case of large spills or vapor release

- Use appropriate PPE (gloves, goggles, respirator if needed)

- Contain spill with absorbent materials; avoid ignition sources

- Flush skin or eyes with water for at least 15 minutes if contact occurs

- Contact poison control or medical professionals as needed

Post emergency numbers and SDS access points prominently in storage and usage areas.

In conclusion, sourcing stainless steel polish requires careful consideration of factors such as product quality, application requirements, supplier reliability, and cost-effectiveness. Selecting the right polish—whether it’s a cream, liquid, or wipe—ensures optimal performance in enhancing shine, providing corrosion resistance, and maintaining the longevity of stainless steel surfaces. It is essential to partner with reputable suppliers who offer consistent quality, compliance with industry standards, and technical support. Additionally, evaluating environmental and safety aspects, such as VOC content and ease of use, contributes to sustainable and efficient operations. A well-informed sourcing strategy ultimately supports superior finishing results and long-term value for industrial, commercial, or consumer applications.