The global stainless steel exhaust tubing market is experiencing significant momentum, driven by rising automotive production, stricter emission regulations, and growing demand for high-performance and corrosion-resistant materials. According to Grand View Research, the global automotive exhaust system market size was valued at USD 23.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. A key contributor to this growth is the increased adoption of stainless steel tubing, which offers superior durability, heat resistance, and longevity compared to traditional aluminized steel. Mordor Intelligence further supports this trend, noting that advancements in material engineering and the expansion of electric and hybrid vehicle platforms—which still require exhaust systems in range-extender and performance models—are reshaping demand across OEM and aftermarket segments. As competition intensifies and manufacturers prioritize lightweighting and emission compliance, the spotlight has turned to leading stainless exhaust tubing producers who combine innovation, scale, and quality. Here, we analyze the top 10 stainless exhaust tubing manufacturers shaping the future of the automotive and industrial exhaust industry.

Top 10 Stainless Exhaust Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Stainless Steel Tubes Manufacturer

Domain Est. 2005

Website: bhtubes.com

Key Highlights: USA based Stainless Steel Tubes Auto Parts Manufacturer, BHTubes Offers SS Straight & Bend Elbow Exhaust Pipes. Reliable Replacement of OEM Truck Parts….

#2 Stainless Steel Tubing Manufacturing

Domain Est. 1995

Website: plymouth.com

Key Highlights: Plymouth Tube Company is a global specialty manufacturer of carbon alloy, nickel alloy, and stainless precision steel tubing….

#3 Tubular Components :: Cleveland

Domain Est. 2004

Website: clevelandcliffs.com

Key Highlights: Cleveland-Cliffs Tubular Components specializes in technologically advanced, high-quality carbon and stainless tube for even the most demanding applications….

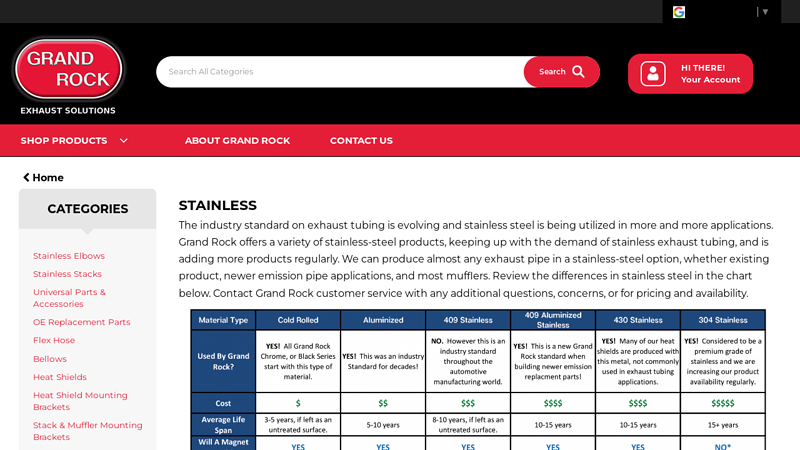

#4 Stainless

Domain Est. 1997

Website: grandrock.com

Key Highlights: Grand Rock offers a variety of stainless-steel products, keeping up with the demand of stainless exhaust tubing, and is adding more products regularly….

#5 Stainless Works

Domain Est. 2000

Website: stainlessworks.net

Key Highlights: Shop Stainless Works for premium American-made 304 stainless steel headers and exhaust systems. Build your perfect setup with header kits, muffler kits, ……

#6 Tubing and Bends

Domain Est. 2000

Website: vibrantperformance.com

Key Highlights: Our comprehensive offering of premium quality Aluminum, Stainless Steel and Titanium tubing and bends are consistent both dimensionally and in material ……

#7 Straight Tubing

Domain Est. 2003

Website: stainlessheaders.com

Key Highlights: Free delivery over $200 60-day returns…

#8 Pypes Performance Exhaust

Domain Est. 2003

Website: pypesexhaust.com

Key Highlights: Pypes Performance Exhaust supplies complete mandrel bent, performance exhaust systems for American performance vehicles ranging from the 1950’s to the present ……

#9 Heartthrob Exhaust

Domain Est. 2003

Website: heartthrobexhaust.com

Key Highlights: Mandrel Bending from 1 inch to 6 inch diameter round tube, primarily in aluminized steel, 409 and 304 stainless steel. Custom + Performance Exhaust Installation….

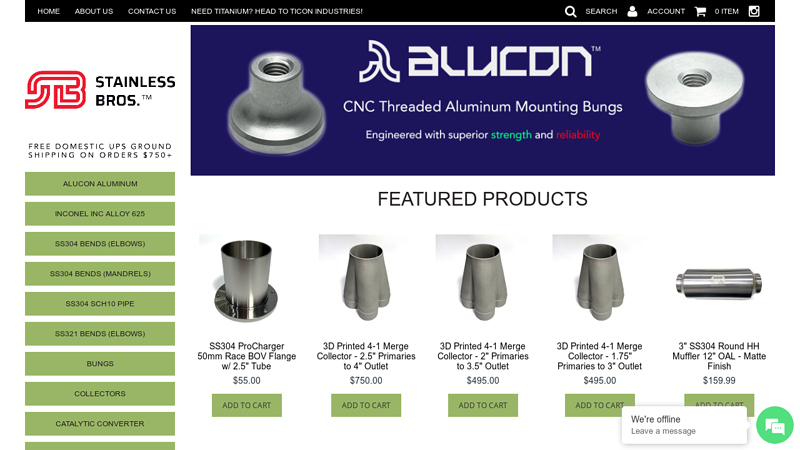

#10 Stainless Bros

Domain Est. 2016

Website: stainlessbros.com

Key Highlights: 30-day returnsShop high-quality stainless steel 304, SS321, Inconel Alloy 625 exhaust components, elbows, flanges, and tubing for race, street, and custom fabrication….

Expert Sourcing Insights for Stainless Exhaust Tubing

H2: Projected Market Trends for Stainless Exhaust Tubing in 2026

The global stainless exhaust tubing market is poised for significant transformation by 2026, driven by evolving regulatory standards, technological advancements, and shifts in end-user industries. Key trends shaping the market include:

1. Stricter Emission Regulations Driving Demand

Governments worldwide are intensifying emission control policies, particularly in the automotive and industrial sectors. Stainless steel exhaust tubing, known for its durability and resistance to high-temperature corrosion, is increasingly favored for compliance with Euro 7, China 6, and U.S. EPA standards. This regulatory pressure is expected to boost demand, especially in light-duty and heavy-duty vehicle manufacturing.

2. Growth in Electric and Hybrid Vehicle Adoption (with a caveat)

While the rise of electric vehicles (EVs) may reduce demand for traditional exhaust systems, hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) still require high-performance exhaust components during internal combustion engine (ICE) operation. Stainless exhaust tubing remains relevant in these transitional powertrains, supporting continued market demand through 2026.

3. Expansion in Non-Automotive Applications

Beyond automotive, stainless exhaust tubing is gaining traction in industrial machinery, marine propulsion systems, and power generation equipment. The need for corrosion-resistant materials in harsh environments supports steady growth in these sectors, particularly in emerging markets with expanding infrastructure.

4. Regional Shifts in Manufacturing and Demand

Asia-Pacific, led by China, India, and Southeast Asia, is expected to dominate market growth due to increasing vehicle production and urbanization. Meanwhile, North America and Europe will focus on premium and performance exhaust systems, driven by aftermarket customization and stricter environmental norms.

5. Material Innovation and Cost Optimization

Manufacturers are investing in advanced stainless steel grades (e.g., 409, 304, and 321) that offer improved heat resistance and longevity while reducing weight. Additionally, process innovations such as laser welding and automated tube forming are enhancing production efficiency and lowering costs, improving competitiveness.

6. Sustainability and Recycling Trends

With growing emphasis on circular economy principles, the recyclability of stainless steel is becoming a key selling point. Producers are highlighting the material’s long lifecycle and low environmental impact, aligning with corporate sustainability goals and influencing procurement decisions.

In summary, the stainless exhaust tubing market in 2026 will be shaped by regulatory mandates, hybrid vehicle demand, industrial diversification, and regional production shifts. While full electrification poses long-term challenges, near-term opportunities in hybrids and non-automotive sectors will sustain market growth, supported by material and manufacturing innovations.

Common Pitfalls Sourcing Stainless Exhaust Tubing (Quality, IP)

Sourcing stainless exhaust tubing requires careful consideration to avoid costly mistakes related to product quality and intellectual property (IP). Overlooking these factors can lead to performance issues, safety hazards, and legal complications.

Quality-Related Pitfalls

1. Substandard Material Grade

A major risk is receiving tubing made from inferior stainless steel grades (e.g., 201 or 304L instead of required 304 or 321). Lower grades offer reduced corrosion resistance and heat tolerance, leading to premature failure in high-temperature exhaust environments.

2. Inconsistent Wall Thickness

Poor manufacturing control can result in variable wall thickness, weakening structural integrity and reducing durability. Thin spots are prone to cracking or collapsing under stress and thermal cycling.

3. Poor Surface Finish and Weld Integrity

Low-quality tubing often features rough internal finishes or poorly fused weld seams. This increases backpressure and creates hotspots, diminishing engine performance and potentially causing leaks.

4. Inadequate Certification and Traceability

Suppliers may provide incomplete or falsified mill test reports (MTRs), making it impossible to verify material composition and compliance with standards like ASTM A269 or AMS 2700.

5. Lack of Heat Treatment Verification

Proper solution annealing is critical for optimal corrosion resistance and ductility. Without proper documentation, tubing may retain residual stresses, increasing susceptibility to cracking.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Use of Proprietary Designs

Sourcing from unverified suppliers may result in tubing that replicates patented mandrel bend profiles, flange configurations, or mounting systems, exposing the buyer to IP infringement claims.

2. Counterfeit or Misrepresented Brands

Some suppliers falsely advertise tubing as OEM-equivalent or from well-known brands without authorization. This not only violates trademarks but may also mislead buyers about performance expectations.

3. Reverse-Engineered Components Without Licensing

Tubing based on reverse engineering original equipment designs may infringe on design patents or trade secrets, especially in performance and OEM replacement markets.

4. Inadequate IP Due Diligence in Contracts

Purchase agreements that fail to include IP indemnification clauses leave buyers liable for third-party infringement claims arising from the supplied components.

Avoiding these pitfalls requires thorough vetting of suppliers, demand for full material traceability, and legal review of design rights when replicating branded or patented exhaust systems.

Logistics & Compliance Guide for Stainless Exhaust Tubing

Overview

Stainless exhaust tubing is a critical component in automotive, industrial, and marine exhaust systems, valued for its durability, corrosion resistance, and high-temperature performance. Effective logistics and compliance management are essential to ensure product quality, meet regulatory requirements, and maintain supply chain efficiency.

Product Classification & Identification

- Material Type: Austenitic (e.g., 304, 316, 321) or Ferritic (e.g., 409, 439) stainless steel

- Common Forms: Seamless or welded tubing, round, oval, or custom profiles

- Typical Sizes: 1″ to 5″ diameter, lengths up to 20 feet; may be supplied in coils or cut-to-length

- HS Code: 7304.41.00 (Stainless steel tubes, seamless, circular, of specified dimensions) or 7304.49.00 (other)

- UN Number (if applicable): Not typically hazardous; no UN number required unless coated with flammable substances

Regulatory Compliance

1. International Standards

- ASTM A269/A269M: Standard specification for seamless and welded austenitic stainless steel tubing for general service

- ASTM A554: Standard for welded decorative stainless steel tubing (may apply to polished finishes)

- SAE J2408: Performance standard for stainless steel exhaust tubing

- EN 10216-5: European standard for seamless stainless steel tubes for pressure purposes

2. Environmental & Safety Regulations

- REACH (EU): Ensure compliance with SVHC (Substances of Very High Concern) restrictions; provide Safety Data Sheets (SDS) if requested

- RoHS (EU): Not typically applicable to raw tubing unless coated with restricted substances

- EPA (USA): No specific restrictions for bare stainless steel; ensure no lead-based coatings

- Conflict Minerals (Dodd-Frank Act): Traceability of tantalum, tin, tungsten, and gold (rare in stainless tubing but verify supply chain if applicable)

3. Country-Specific Requirements

- USA: Compliance with DOT/NHTSA standards may be required if tubing is part of a certified exhaust system

- EU: CE marking not required for raw tubing; must comply with construction product regulations if used in vehicles

- Canada: Meets CSA standards if used in certified systems; check Transport Canada for automotive applications

- China (CCC Mark): Not required for raw tubing, but may apply to finished exhaust systems

Packaging & Handling Requirements

- Protection: Use end caps or plastic plugs to prevent deformation and contamination

- Bundling: Secure with non-corrosive strapping; avoid carbon steel bands that may cause rust staining

- Palletization: Use wooden or recyclable plastic pallets; ensure load stability for transport

- Labeling: Include product specification, grade, size, heat number, manufacturer, and handling instructions

- Storage: Store indoors, dry, and off the ground to prevent water contact and galvanic corrosion

Transportation & Logistics

1. Mode of Transport

- Ocean Freight: Most cost-effective for bulk shipments; use moisture-resistant packaging; consider desiccants in containers

- Air Freight: For urgent orders; ensure proper documentation and packaging to avoid damage

- Ground Transport (Truck/Rail): Ideal for regional distribution; secure loads to prevent shifting

2. Incoterms

- Recommended: FOB (Free On Board) or CIF (Cost, Insurance, Freight) for international shipments

- Clarify responsibility for customs clearance, insurance, and risk transfer

3. Customs Documentation

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin (preferably Form A for GSP eligibility)

- Mill Test Certificate (EN 10204 3.1 or 3.2) to verify material compliance

Quality Assurance & Documentation

- Mill Test Reports (MTRs): Required for traceability; include chemical composition and mechanical properties

- ISO 9001 Certification: Ensure supplier compliance with quality management systems

- Third-Party Inspection: Recommended for large orders; consider SGS, Bureau Veritas, or TÜV

Sustainability & End-of-Life

- Recyclability: Stainless steel is 100% recyclable; promote circular economy practices

- Waste Management: Recycle production scrap; partner with certified metal recyclers

- Carbon Footprint: Optimize logistics routes and use low-emission transport where possible

Risk Mitigation

- Supply Chain Diversification: Avoid reliance on single-source suppliers

- Inventory Buffering: Maintain safety stock for critical dimensions/grades

- Compliance Audits: Conduct regular audits of suppliers and logistics partners

Conclusion

Managing the logistics and compliance of stainless exhaust tubing requires a proactive approach to classification, regulatory adherence, and supply chain coordination. By following this guide, stakeholders can ensure timely delivery, regulatory conformity, and product integrity across global markets.

Conclusion for Sourcing Stainless Steel Exhaust Tubing

Sourcing stainless steel exhaust tubing requires a careful evaluation of material quality, supplier reliability, cost-efficiency, and compliance with industry standards. After thorough research and comparison of potential suppliers, it is evident that selecting a reputable vendor offering high-grade stainless steel (such as 304 or 409 grade) ensures durability, corrosion resistance, and optimal performance in high-temperature environments. Factors such as wall thickness, dimensional accuracy, certifications (e.g., ASTM, ISO), and consistent lead times are critical to maintaining production efficiency and product integrity.

While initial costs may vary between domestic and international suppliers, prioritizing quality and long-term reliability over short-term savings minimizes risks related to warranty claims, rework, or premature failure. Establishing strong relationships with vetted suppliers, coupled with regular quality audits and material testing, supports sustainable procurement practices.

In conclusion, a strategic sourcing approach that balances cost, quality, and supply chain resilience will ensure a reliable supply of stainless steel exhaust tubing, ultimately contributing to enhanced product performance and customer satisfaction in demanding automotive or industrial applications.