The global plastic crates market is experiencing steady growth, driven by rising demand for durable, lightweight, and cost-effective logistics solutions across retail, agriculture, and food & beverage industries. According to Grand View Research, the global plastic packaging market—under which stacking crates fall—was valued at USD 417.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. A key contributor to this growth is the increasing shift toward reusable and stackable plastic containers, with the logistics and supply chain sectors prioritizing space efficiency and sustainability. Mordor Intelligence further highlights that the Asia-Pacific region accounts for a significant share of market expansion, fueled by industrialization and modernization of cold chain infrastructure. As demand surges, the landscape of plastic stacking crate manufacturing has evolved, with innovation in design, material quality, and recycling capabilities becoming critical differentiators. Below are the top 8 manufacturers shaping this dynamic market.

Top 8 Stacking Crates Plastic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

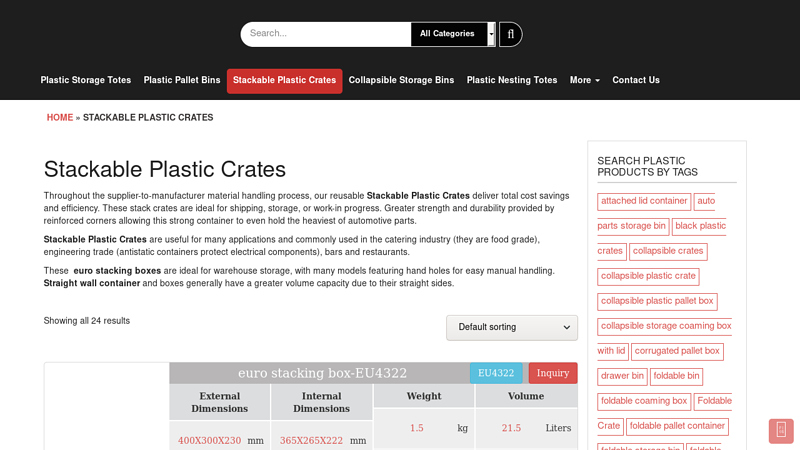

#1 Stackable Plastic Crates

Domain Est. 2019

Website: storage-totes.com

Key Highlights: Wholesale stackable storage crates and Stackable Plastic Crates directly from Chinese Stackable crates manufacturer at lowest price!…

#2 Plastic Crates Manufacturer

Domain Est. 2023

Website: veplastics.com

Key Highlights: VE PLASTICS is a leading manufacturer and supplier of high-quality plastic storage solutions, including stackable, nestable, and collapsible crates, containers ……

#3 Sterilite Corporation

Domain Est. 1996

Website: sterilite.com

Key Highlights: Sterilite’s broad line of plastic housewares feature some of the most innovative and distinctive products available on the market today….

#4 Plastic Containers Category

Domain Est. 1996

Website: usplastic.com

Key Highlights: We have cases, small boxes, dividable grid containers, and cabinets to organize and store smaller items. Our trays, pans, and tubs are perfect for the food and ……

#5 Heavy

Domain Est. 1997

Website: quantumstorage.com

Key Highlights: From rugged stack and hang bins to durable shelf bins and containers, our injection molded plastic bins are strong and versatile….

#6 Stackable containers

Domain Est. 2008

Website: utzgroup.com

Key Highlights: Stackable containers offer efficient storage and transport, customizable features, high load capacity, and compatibility with automated systems for various ……

#7 Heavy Duty Plastic Pallet ,plastic stackable crates,plastic stacking …

Domain Est. 2015

Website: cnxsplastic.com

Key Highlights: Our company is professional for the global market to provide heavy Duty Plastic Pallet ,plastic stackable crates,plastic stacking baskets,and so on….

#8 Plastic Crates, Plastic Storage Crates, Cheap Stackable Plastic …

Domain Est. 2019

Expert Sourcing Insights for Stacking Crates Plastic

H2: 2026 Market Trends for Stacking Crates Plastic

The global market for plastic stacking crates is poised for significant evolution by 2026, driven by sustainability mandates, technological innovation, and shifting supply chain dynamics. Here is a detailed analysis of the key trends expected to shape this sector:

1. Accelerated Shift Toward Sustainable Materials

Environmental regulations and consumer demand will push manufacturers to adopt recycled and bio-based plastics. By 2026, over 40% of new stacking crates are projected to contain at least 50% post-consumer recycled (PCR) content, particularly in Europe and North America. Bioplastics derived from renewable sources (e.g., sugarcane-based polyethylene) will gain traction in premium and eco-conscious supply chains, especially in food and retail logistics.

2. Smart Crate Integration via IoT

A growing trend will be the embedding of passive RFID tags and QR codes into crate designs. By 2026, smart plastic crates capable of tracking location, temperature, and handling conditions are expected to capture 15–20% of the industrial logistics market. This digital integration supports real-time inventory management, reduces loss, and enhances circular economy models through improved return and reuse tracking.

3. Dominance of Circular Economy Models

Reusable plastic crates (RPCs) will continue displacing single-use alternatives, particularly in agriculture, retail, and automotive sectors. Closed-loop systems, where crates are returned, cleaned, and reused hundreds of times, will be standard in major supply chains. Rental and pooling services—such as those offered by IFCO and CHEP—are expected to expand by 8–10% CAGR through 2026, reducing total cost of ownership and environmental impact.

4. Regional Market Diversification

While Europe leads in sustainability adoption, Asia-Pacific will be the fastest-growing market due to urbanization, cold chain expansion, and e-commerce growth. Countries like India and Vietnam will see increased investment in durable plastic crate infrastructure for fresh produce and manufacturing. Regulatory harmonization in ASEAN may further standardize crate dimensions and materials, boosting interoperability.

5. Lightweighting and Design Optimization

Innovation in structural design and high-density polyethylene (HDPE) or polypropylene (PP) formulations will enable lighter yet stronger crates. This trend reduces transportation costs and carbon emissions. By 2026, modular, stackable designs with enhanced load distribution will dominate, particularly in last-mile delivery and automated warehouses.

6. Impact of E-commerce and Cold Chain Expansion

The rise of online grocery and pharmaceutical delivery will drive demand for stackable, insulated plastic crates. Temperature-controlled variants with improved stacking efficiency will be critical for maintaining product integrity. The cold chain logistics segment is expected to account for over 25% of new stacking crate demand by 2026.

Conclusion

By 2026, the plastic stacking crate market will be defined by sustainability, digitization, and efficiency. Companies that invest in recyclable materials, smart technologies, and circular logistics models will lead the market, while regulatory pressures and environmental expectations reshape product design and usage globally.

Common Pitfalls When Sourcing Stacking Crates in Plastic (Quality and IP)

Logistics & Compliance Guide for Stacking Crates (Plastic)

This guide outlines best practices and regulatory considerations for the logistics and compliance management of plastic stacking crates used in storage, transportation, and distribution.

Material Specifications & Durability

Ensure all plastic stacking crates are constructed from high-density polyethylene (HDPE) or polypropylene (PP) to guarantee resistance to impact, moisture, and common chemicals. Crates must meet industry standards for load-bearing capacity (both static and dynamic) and be suitable for stacking under real-world warehouse and transport conditions without deformation.

Load Capacity & Stacking Limits

Clearly label each crate with its maximum load capacity (in kilograms or pounds) and safe stacking height. Never exceed the manufacturer’s recommended stacking limit, especially during transport. Account for dynamic forces during transit—stacked crates should remain stable under vertical and lateral stress.

Cleanliness & Sanitation Requirements

Plastic stacking crates must be cleaned and sanitized regularly, especially when used in food, pharmaceutical, or healthcare supply chains. Follow HACCP, FDA, or EU Regulation 1935/2004 (if applicable) for food contact surfaces. Use non-toxic cleaning agents and allow crates to dry fully before reuse to prevent microbial growth.

Traceability & Asset Management

Implement a traceability system using barcodes, QR codes, or RFID tags on each crate to monitor location, usage history, and maintenance. This supports compliance with inventory control standards and facilitates recalls or audits if contamination or damage is identified.

Environmental & Regulatory Compliance

Ensure plastic crates comply with relevant environmental regulations, including REACH (EU), RoHS (for electronics handling), and local plastic waste directives. Where applicable, use recyclable or recycled-content crates and maintain documentation for sustainability reporting. Avoid crates containing restricted substances.

Transportation & Handling Protocols

Secure stacked crates on pallets or in containers using stretch wrap, straps, or interlocking designs to prevent shifting during transit. Use appropriate handling equipment (e.g., forklifts, pallet jacks) to minimize manual lifting and reduce injury risk. Follow OSHA or local occupational safety guidelines for material handling.

Inspection & Maintenance Schedule

Conduct routine inspections for cracks, warping, broken handles, or structural weaknesses. Remove damaged crates from service immediately. Establish a maintenance log and replacement schedule based on usage cycles to ensure ongoing compliance and safety.

Returnable Packaging & Reverse Logistics

If using crates in a closed-loop or returnable system, define clear reverse logistics procedures. Establish return timelines, cleaning protocols at collection points, and quality checks before reissuing. Comply with contractual agreements regarding crate accountability and loss prevention.

Documentation & Audit Readiness

Maintain records of crate specifications, cleaning logs, inspection reports, and compliance certifications. These documents should be readily available for internal audits or external regulatory inspections (e.g., FDA, BRCGS, IFS).

Training & Staff Awareness

Train warehouse and logistics staff on proper stacking techniques, hygiene practices, and compliance requirements related to plastic crate usage. Reinforce the importance of reporting damaged equipment and following standardized operating procedures.

In conclusion, sourcing plastic stacking crates requires careful consideration of several key factors to ensure cost-effectiveness, durability, and suitability for specific applications. Evaluating material quality, load capacity, stackability, and compatibility with existing storage or transportation systems is essential. Additionally, assessing supplier reliability, pricing, lead times, and sustainability practices contributes to a successful procurement strategy. By prioritizing these elements, businesses can secure high-quality, long-lasting plastic stacking crates that enhance operational efficiency, protect stored goods, and support supply chain sustainability goals.