The global hoses and fittings market is experiencing steady expansion, driven by rising demand across industrial, automotive, construction, and agricultural sectors. According to Grand View Research, the global industrial hose market was valued at USD 28.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing infrastructure development, technological advancements in material durability, and the need for efficient fluid transfer systems in harsh environments. Stainless steel (SS) hose fittings, in particular, are gaining traction due to their corrosion resistance, high-pressure tolerance, and longevity in demanding applications. As industries prioritize reliability and compliance with international standards, the demand for high-quality SS hose fittings continues to rise. With Asia Pacific emerging as a key manufacturing and consumption hub, and North America maintaining strong demand in oil & gas and chemical processing, the competitive landscape among manufacturers is intensifying. Against this backdrop, identifying the top performers in the SS hose fittings space is critical for sourcing professionals and engineering teams seeking reliable, scalable supply partnerships.

Top 9 Ss Hose Fittings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Omega One

Domain Est. 1998

Website: omega1.com

Key Highlights: OmegaOne is a stainless steel fittings and adapters manufacturer for tubing, pipe, hose, and AMFM Braid Bands for the fabrication of industrial metal hose….

#2 Industrial Fittings, Tube Fittings and Pressure Fittings

Domain Est. 1996

Website: products.swagelok.com

Key Highlights: We offer a complete portfolio of fittings available in a variety of alloy materials for a wide range of industrial applications….

#3 Stainless Steel Fittings & Hydraulic hoses

Domain Est. 1999

Website: dicsaes.com

Key Highlights: Stainless Steel AISI 316L Fittings manufacturers and an international reference for the Hydraulic and Pneumatic Connectors and Components….

#4 Stainless Steel Tube Fittings

Domain Est. 2011

Website: myssp.com

Key Highlights: We offer stainless steel tube fittings for both instrumentation and industrial applications. Find more information here….

#5 Stainless Steel Crimp Hose Fittings

Domain Est. 2014

Website: titanfittings.com

Key Highlights: Free delivery over $10K · 30-day returnsTitan Fittings manufacturers multiple series of stainless hose fittings. Sort by: Select, Min to max, Max to min. Braided Hoses – Stainless…

#6 SHF, Inc.: Stainless Steel Fittings Supplier

Domain Est. 2016

Website: shfinc.com

Key Highlights: As a hydraulic hose fittings company, we are proud to have the largest stainless inventory of crimp fittings and adapters in North America….

#7 Stainless Steel Fittings

Domain Est. 2001

Website: stainlesssteelfittings.com

Key Highlights: Stainless Steel Fittings manufactures thousands of hydraulics products including stainless adapters, hose end fittings, valves and ……

#8 Midland Industries

Domain Est. 2011

Website: midlandindustries.com

Key Highlights: NOW IN STOCK · Mid-Lok Stainless Steel Instrumentation Fittings · Steel Hydraulic Adapters · DIN Metric Steel Compression Fittings ……

#9 Pipe Fittings

Domain Est. 2020

Website: asc-es.com

Key Highlights: ASC offers the broadest line of malleable iron fitting sizes in both black and galvanized finishes. Every fitting is manufactured and tested to ……

Expert Sourcing Insights for Ss Hose Fittings

H2: Analysis of 2026 Market Trends for Stainless Steel Hose Fittings

The global market for stainless steel (SS) hose fittings is poised for significant transformation by 2026, driven by industrial modernization, increasing demand for corrosion-resistant components, and advancements in manufacturing technologies. This analysis explores key market trends expected to shape the SS hose fittings sector in 2026, focusing on demand drivers, regional dynamics, technological innovations, and competitive landscape shifts.

1. Rising Industrial Demand Across Key Sectors

By 2026, sectors such as oil & gas, chemical processing, food & beverage, pharmaceuticals, and semiconductor manufacturing are expected to remain primary consumers of stainless steel hose fittings. Stringent hygiene and safety regulations in these industries will continue to fuel demand for high-purity, leak-proof fittings. The expansion of LNG (liquefied natural gas) infrastructure and offshore drilling operations will further boost adoption, particularly in high-pressure and high-temperature applications where SS fittings offer superior reliability.

2. Growth in Asia-Pacific and Emerging Markets

The Asia-Pacific region, especially China, India, and Southeast Asia, is projected to lead market growth by 2026 due to rapid industrialization, urban development, and government investments in infrastructure and manufacturing. Local production capabilities are expanding, reducing dependence on imports and enabling faster supply chain responses. Meanwhile, increased industrial activity in the Middle East and Africa will create new opportunities for SS hose fitting suppliers.

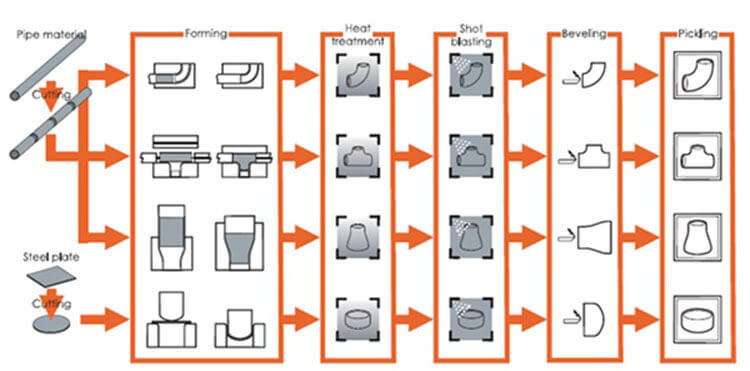

3. Sustainability and Material Efficiency Trends

Environmental regulations and corporate sustainability goals will influence material selection and manufacturing processes. Stainless steel, being recyclable and durable, aligns well with green manufacturing principles. By 2026, manufacturers are expected to emphasize eco-friendly production methods, such as energy-efficient forging and reduced waste machining techniques. Additionally, lightweight yet robust SS alloys may gain traction to improve fuel efficiency in transportation and mobile hydraulics applications.

4. Technological Advancements and Smart Integration

Innovation in smart fluid systems will begin to impact the hose fittings market. While not yet mainstream, the integration of sensors into fittings for real-time pressure, temperature, and leak monitoring is anticipated to grow. By 2026, early adopters in industries like pharmaceuticals and aerospace may begin utilizing “smart” SS fittings as part of predictive maintenance systems, enhancing system reliability and reducing downtime.

5. Supply Chain Resilience and Localization

Following disruptions in global supply chains in recent years, companies are prioritizing resilience. By 2026, a trend toward regionalization and nearshoring of production is expected to continue. This will benefit local SS hose fitting manufacturers and encourage investment in automation and digital inventory management to improve responsiveness and reduce lead times.

6. Competitive Landscape and Consolidation

The market is likely to see increased consolidation as larger players acquire niche manufacturers to expand product portfolios and geographic reach. Differentiation will come through customization, quality certifications (e.g., ISO, ASME, FDA), and value-added services such as engineering support and rapid prototyping. Smaller firms will focus on specialized applications or high-margin sectors to remain competitive.

Conclusion

By 2026, the stainless steel hose fittings market will be shaped by a confluence of regulatory, technological, and economic forces. Growth will be strongest in emerging economies and high-performance industries, with innovation centered on durability, sustainability, and digital integration. Companies that adapt to these evolving demands—through agile manufacturing, strategic partnerships, and product innovation—will be well-positioned to capture market share in this resilient and essential component sector.

Common Pitfalls When Sourcing SS Hose Fittings (Quality and IP)

Sourcing stainless steel (SS) hose fittings involves several critical considerations, particularly around quality assurance and intellectual property (IP) protection. Failing to address these areas can lead to supply chain disruptions, product failures, or legal complications. Below are common pitfalls to avoid:

Poor Material Quality and Certification

One of the most frequent issues is receiving SS hose fittings made from substandard or misrepresented materials. Some suppliers may claim compliance with ASTM or ISO standards but deliver fittings made from lower-grade stainless steel (e.g., non-316L or non-304), leading to premature corrosion or failure in critical environments.

- Pitfall: Lack of mill test certificates (MTCs) or falsified documentation.

- Solution: Require certified material test reports and consider third-party material verification (e.g., PMI testing).

Inadequate Dimensional and Thread Accuracy

Improper thread fit, incorrect hose tail dimensions, or inconsistent tolerances can result in leaks, system failures, or difficulty during assembly.

- Pitfall: Offshore suppliers using non-standard gauges or outdated tooling.

- Solution: Enforce strict dimensional inspection protocols and request first-article inspection (FAI) reports.

Insufficient Pressure and Leak Testing

Not all suppliers conduct rigorous performance testing under real-world conditions.

- Pitfall: Assumption that all fittings are tested to rated pressure; some may skip batch testing.

- Solution: Specify required test pressures, durations, and sampling rates in procurement contracts.

Counterfeit or IP-Infringing Products

High-demand SS hose fittings, especially those designed by reputable brands (e.g., Parker, Swagelok), are often counterfeited. These copies may infringe on patented designs and fail to meet performance standards.

- Pitfall: Purchasing “compatible” or “equivalent” fittings that copy protected designs without licensing.

- Solution: Source only from authorized distributors or suppliers with IP compliance guarantees. Conduct design freedom-to-operate (FTO) assessments if developing custom fittings.

Lack of Traceability and Batch Control

In regulated industries (e.g., pharmaceuticals, food & beverage, aerospace), full traceability is essential.

- Pitfall: Inability to track material heat numbers, production batches, or inspection records.

- Solution: Require lot traceability documentation and ensure suppliers maintain proper quality management systems (e.g., ISO 9001).

Inconsistent Surface Finish and Passivation

Improper surface finish or inadequate passivation can compromise corrosion resistance, especially in sanitary or high-purity applications.

- Pitfall: Fittings with rough finishes or residual iron contamination.

- Solution: Specify surface roughness (Ra value) and passivation process (e.g., ASTM A967) in technical requirements.

Hidden Costs from Non-Compliance

Low initial pricing may hide future costs due to rework, downtime, or regulatory non-compliance.

- Pitfall: Selecting suppliers based solely on price without evaluating total cost of ownership.

- Solution: Conduct supplier audits and lifecycle cost analysis before finalizing procurement.

Avoiding these pitfalls requires due diligence, clear specifications, and ongoing supplier qualification. Partnering with reputable manufacturers and insisting on transparent quality and IP practices ensures reliable and legally compliant SS hose fitting supply.

Logistics & Compliance Guide for SS Hose Fittings

This guide provides essential information for the safe, efficient, and compliant handling, transportation, and documentation of stainless steel (SS) hose fittings throughout the supply chain.

Product Classification and Handling

Stainless steel hose fittings are precision-engineered components used in fluid transfer systems across industries such as food & beverage, pharmaceuticals, petrochemicals, and industrial manufacturing. Proper classification ensures appropriate handling:

- Material Type: Typically made from 304, 316, or 316L stainless steel; verify grade per purchase order or certification.

- Form Factor: Includes adapters, elbows, tees, unions, and quick-connect fittings; handle with care to avoid thread damage.

- Storage Requirements: Store in a dry, climate-controlled environment to prevent corrosion or contamination. Use original packaging where possible.

- Handling Precautions: Wear gloves to prevent oil transfer from skin; use non-abrasive tools during inspection or packaging.

Packaging and Labeling Standards

Proper packaging and labeling ensure product integrity and compliance with shipping regulations:

- Internal Packaging: Use anti-static or VCI (Vapor Corrosion Inhibitor) bags for individual or batch packaging to prevent oxidation.

- Outer Packaging: Employ sturdy corrugated boxes or crates with internal dividers to prevent movement during transit.

- Labeling Requirements:

- Include part number, material grade (e.g., SS 316L), quantity, batch/lot number, and date of packaging.

- Mark with handling icons (e.g., “Fragile,” “This Side Up”) as applicable.

- For export shipments, ensure bilingual labeling if required by destination country.

Transportation and Shipping Logistics

Efficient and compliant transport minimizes damage and delays:

- Mode of Transport: Choose between air, sea, or ground freight based on urgency, volume, and destination.

- Temperature and Humidity Control: Avoid exposure to extreme conditions; use climate-controlled containers if shipping sensitive batches.

- Securement in Transit: Palletize loads and use stretch wrap or banding to prevent shifting.

- Hazardous Materials Classification: SS hose fittings are generally non-hazardous (UN3082, environmentally hazardous substance, solid, n.o.s., may apply only if lubricants or coatings are present—verify MSDS).

- Carrier Documentation: Provide accurate commercial invoices, packing lists, and bills of lading.

Regulatory and Compliance Requirements

Adherence to international and industry-specific regulations is mandatory:

- REACH & RoHS Compliance: Confirm that fittings are free from restricted substances (e.g., lead, cadmium, phthalates). Request supplier compliance certificates.

- FDA & 3-A Sanitary Standards: For food, beverage, or pharmaceutical applications, ensure fittings meet FDA 21 CFR or 3-A Sanitary Standards. Certifications must accompany shipments.

- PED & CE Marking (EU): Pressure Equipment Directive (PED 2014/68/EU) applies to fittings used in pressurized systems. CE-marked products must include Declaration of Conformity.

- Customs Compliance: Accurately classify under HS Code 7307.29 (Stainless steel pipe/fittings) or relevant subcategory. Include country of origin on all export documentation.

Import/Export Documentation

Ensure complete and accurate paperwork for cross-border shipments:

- Commercial Invoice: Must include buyer/seller details, item description, quantity, unit price, total value, Incoterms (e.g., FOB, DDP), and currency.

- Packing List: Detail gross/net weight, dimensions, and number of packages.

- Certificate of Origin: Required by many countries for tariff determination.

- Material Test Reports (MTRs): Provide mill test reports (e.g., EN 10204 3.1 or 3.2) confirming chemical composition and mechanical properties.

- Export Licenses: Not typically required for standard SS fittings, but verify based on destination and end-use (e.g., military or nuclear applications).

Quality Assurance and Traceability

Maintain full traceability from manufacturer to end-user:

- Batch/Lot Tracking: Assign unique identifiers to each production batch; record in internal systems and on packaging.

- Inspection Records: Conduct pre-shipment visual and dimensional inspections; retain records for a minimum of 5 years.

- Non-Conformance Procedures: Document and quarantine defective items; notify suppliers and customers as required.

Sustainability and Environmental Considerations

Promote environmentally responsible logistics practices:

- Recyclable Packaging: Use minimal, recyclable materials (e.g., corrugated cardboard, paper fillers).

- Carbon Footprint Reduction: Optimize shipping routes and consolidate shipments to reduce emissions.

- End-of-Life Recycling: Inform customers that SS fittings are 100% recyclable; encourage proper disposal through certified metal recyclers.

Conclusion

Effective logistics and compliance management for SS hose fittings ensures product integrity, regulatory adherence, and customer satisfaction. By following this guide, stakeholders can minimize risks, avoid customs delays, and maintain quality standards across the supply chain. Always consult local regulations and customer-specific requirements before shipment.

Conclusion for Sourcing SS Hose Fittings

In conclusion, sourcing stainless steel (SS) hose fittings requires a comprehensive evaluation of quality, compatibility, supplier reliability, and cost-effectiveness. Stainless steel fittings offer superior durability, corrosion resistance, and performance in demanding environments, making them ideal for industries such as food and beverage, pharmaceuticals, chemicals, and marine applications.

To ensure optimal performance and longevity, it is essential to partner with reputable suppliers who provide certified materials (e.g., SS304, SS316), adhere to international standards (such as ISO, DIN, or ANSI), and offer consistent product traceability. Additionally, considering factors like delivery timelines, after-sales support, and total cost of ownership—not just unit price—will contribute to long-term operational efficiency.

By prioritizing quality assurance, technical compatibility, and strong supplier relationships, organizations can secure reliable SS hose fittings that enhance system integrity, reduce maintenance costs, and support seamless operations across critical applications.