The global engineered wood products market, including spruce wood variants, is on a robust growth trajectory, driven by rising demand in construction, furniture, and interior design sectors. According to a 2023 report by Grand View Research, the global engineered wood market size was valued at USD 165.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Spruce, known for its strength-to-weight ratio, workability, and sustainability, plays a key role in this expansion—particularly in North America and Europe, where sustainable building practices are accelerating the adoption of renewable softwood resources. Mordor Intelligence further projects the softwood lumber market to grow at a CAGR of over 4.5% through 2028, citing increased residential construction and cross-laminated timber (CLT) applications as primary drivers. As demand for high-quality, eco-friendly spruce wood rises, a select group of manufacturers have emerged as industry leaders—combining advanced production techniques, sustainable sourcing, and global supply chain reach to meet evolving market needs. Here are the top 8 spruce wood manufacturers shaping the future of timber-based industries.

Top 8 Spruse Wood Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Spruce Products Limited

Domain Est. 2000

Website: spl.mb.ca

Key Highlights: Spruce Products Limited (SPL) is a manufacturer of premium lumber and wood products for the construction industry and the integrated wood products industry….

#2 Canfor

Domain Est. 1996

Website: canfor.com

Key Highlights: Canfor is a global leader in the manufacturing of low-carbon forest products, delivering sustainable, high-quality wood solutions to markets worldwide….

#3 Spruce sawn timber

Domain Est. 1998

Website: metsagroup.com

Key Highlights: Metsä Fibre produces Nordic spruce sawn timber that is particularly known for its light colour, providing a beautiful, consistent look for interior ……

#4 Airplane Wood

Domain Est. 1999

Website: aircraftspruce.com

Key Highlights: Aircraft Grade Wood & Structural Materials. Aircraft Spruce is a leading supplier of aircraft-grade Sitka spruce, birch plywood, capstrips, ribs, veneers ……

#5 About Sitka spruce

Domain Est. 2000

Website: naturallywood.com

Key Highlights: Sitka spruce is a large tree that grows to a height of 70 metres and a diameter of two metres when mature with an estimated lifespan of 700 to 800 years….

#6 Touchwood BV

Domain Est. 2003

Website: sitkaspruce.nl

Key Highlights: We deliver the very best Sitka spruce, the wood of choice for yacht spars, wooden aircraft, musical instruments, archery and more……

#7 Blue Spruce Building Materials

Domain Est. 2004

Website: bluesprucelc.com

Key Highlights: Local hardware store and lumber yard serving Lake City, Hinsdale County. Hardware, lumber, paint, windows, roofing and more….

#8 Spruce Wood Loggers

Domain Est. 2020

Website: sprucewoodloggers.ca

Key Highlights: Spruce Wood Loggers works closely with Manitoba Sustainable Development in ensuring that Manitoba’s forest is here today and generations to come….

Expert Sourcing Insights for Spruse Wood

H2: 2026 Market Trends for Spruce Wood

As global construction, manufacturing, and sustainable development priorities evolve, the spruce wood market is poised for notable shifts by 2026. Driven by environmental regulations, supply chain dynamics, and fluctuating demand across key industries, the following trends are expected to shape the spruce wood sector in the coming years.

-

Increased Demand in Sustainable Construction

Spruce wood, known for its strength-to-weight ratio, workability, and availability, is increasingly favored in sustainable and low-carbon building projects. By 2026, rising adoption of mass timber technologies—such as cross-laminated timber (CLT) and glued laminated timber (glulam)—will boost demand for spruce, especially in Europe and North America. Governments promoting green building certifications (e.g., LEED, BREEAM) are expected to accelerate this trend. -

Supply Chain Resilience and Sourcing Shifts

Climate change and forest management policies are affecting spruce yields in traditional producing regions like Scandinavia, Canada, and Central Europe. By 2026, supply chain diversification will become critical. Increased investments in reforestation, precision forestry, and alternative harvesting zones (e.g., Eastern Europe and Russia, under stable regulatory frameworks) are likely to emerge as key strategies to ensure supply stability. -

Price Volatility and Market Competition

While spruce remains cost-effective compared to hardwoods and engineered alternatives, price volatility due to extreme weather, pest infestations (e.g., bark beetles), and geopolitical factors may persist through 2026. Competition from substitute materials such as bamboo composites and recycled steel could pressure pricing, but spruce’s biodegradability and carbon sequestration benefits will support its market position. -

Digitalization and Traceability in Forestry

By 2026, digital tools—including blockchain for supply chain transparency, AI-driven forest inventory systems, and IoT-based monitoring—will become standard in the spruce wood industry. These technologies will enhance traceability, ensure compliance with sustainability standards (e.g., FSC, PEFC), and meet growing consumer and regulatory demands for ethically sourced timber. -

Growth in Packaging and Renewable Material Applications

Beyond construction, spruce wood pulp continues to gain traction in eco-friendly packaging solutions. As plastic bans expand globally, demand for spruce-based paperboard and molded fiber packaging is projected to rise. Additionally, research into nanocellulose and lignin extraction from spruce could open new high-value markets in bioplastics and biochemicals by 2026. -

Policy and Carbon Market Influence

Carbon pricing mechanisms and incentives for carbon-storing materials are expected to benefit spruce wood producers. Countries integrating forestry into national carbon offset programs may offer financial advantages to sustainably managed spruce forests, further incentivizing long-term investment in responsible harvesting and afforestation.

Conclusion:

By 2026, the spruce wood market will be shaped by a confluence of sustainability imperatives, technological innovation, and evolving regulatory landscapes. Stakeholders who prioritize environmental stewardship, supply chain resilience, and value-added product development will be best positioned to capitalize on emerging opportunities in this dynamic sector.

Common Pitfalls Sourcing Spruce Wood (Quality, IP)

Sourcing spruce wood can present several challenges, particularly concerning material quality and intellectual property (IP) considerations. Being aware of these pitfalls helps ensure reliable supply and legal compliance.

Quality-Related Pitfalls

Inconsistent Grain and Knot Structure

Spruce is naturally prone to variations in grain pattern and knot occurrence. Sourcing from unverified suppliers may result in inconsistent appearance and structural integrity, especially problematic for visible or load-bearing applications.

Moisture Content Fluctuations

Improperly dried spruce wood can lead to warping, cracking, or shrinkage after installation. Purchasing without verifying kiln-drying certification or moisture content (typically 8–12% for indoor use) increases the risk of performance issues.

Susceptibility to Defects and Decay

Lower-grade spruce may contain hidden defects such as splits, checks, or fungal staining. Without proper grading standards (e.g., NHLA or European EN standards), buyers risk receiving subpar material unsuitable for intended use.

Lack of Species Verification

“Spruce” is a broad term covering several species (e.g., Sitka, Engelmann, Norway). These vary in density, color, and strength. Mislabeling or substitution with inferior softwoods can compromise project outcomes if not properly verified through documentation or testing.

Intellectual Property and Compliance Pitfalls

Unauthorized Use of Certified Designs or Trademarks

When spruce is used in finished products (e.g., musical instruments, furniture), using branded or patented designs without permission can lead to IP infringement. For example, replicating a trademarked guitar body shape using spruce violates design IP rights.

Misrepresentation of Sustainability Claims

Falsely claiming FSC (Forest Stewardship Council) or PEFC certification to enhance market appeal constitutes IP and regulatory fraud. Sourcing without valid chain-of-custody documentation risks legal penalties and reputational damage.

Failure to Respect Technical IP in Engineered Wood Products

Spruce is often used in glued laminated timber (glulam) or cross-laminated timber (CLT). Using proprietary lamination techniques or performance data without licensing may infringe on patented manufacturing processes.

Inadequate Due Diligence in Supply Chain

Relying on intermediaries without verifying the origin and legal harvesting of spruce increases exposure to illegal logging allegations and violations of international trade laws (e.g., Lacey Act in the U.S.). This not only poses legal risks but can also affect brand integrity.

Mitigating these pitfalls requires sourcing from reputable suppliers, demanding certification documentation, conducting quality inspections, and consulting legal experts when using spruce in IP-sensitive applications.

Logistics & Compliance Guide for Spruce Wood

Overview of Spruce Wood Characteristics

Spruce wood is a lightweight, straight-grained softwood commonly used in construction, musical instruments, and packaging. Its low density and uniform texture make it easy to work with, but also require careful handling during transport and storage to prevent warping, splitting, or moisture damage.

Harvesting and Sourcing Compliance

Harvesting of spruce wood must comply with local forestry regulations and sustainable management practices. Ensure all suppliers adhere to recognized certification standards such as FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification). Proper documentation, including chain-of-custody certificates, must accompany each shipment to verify legal and sustainable sourcing.

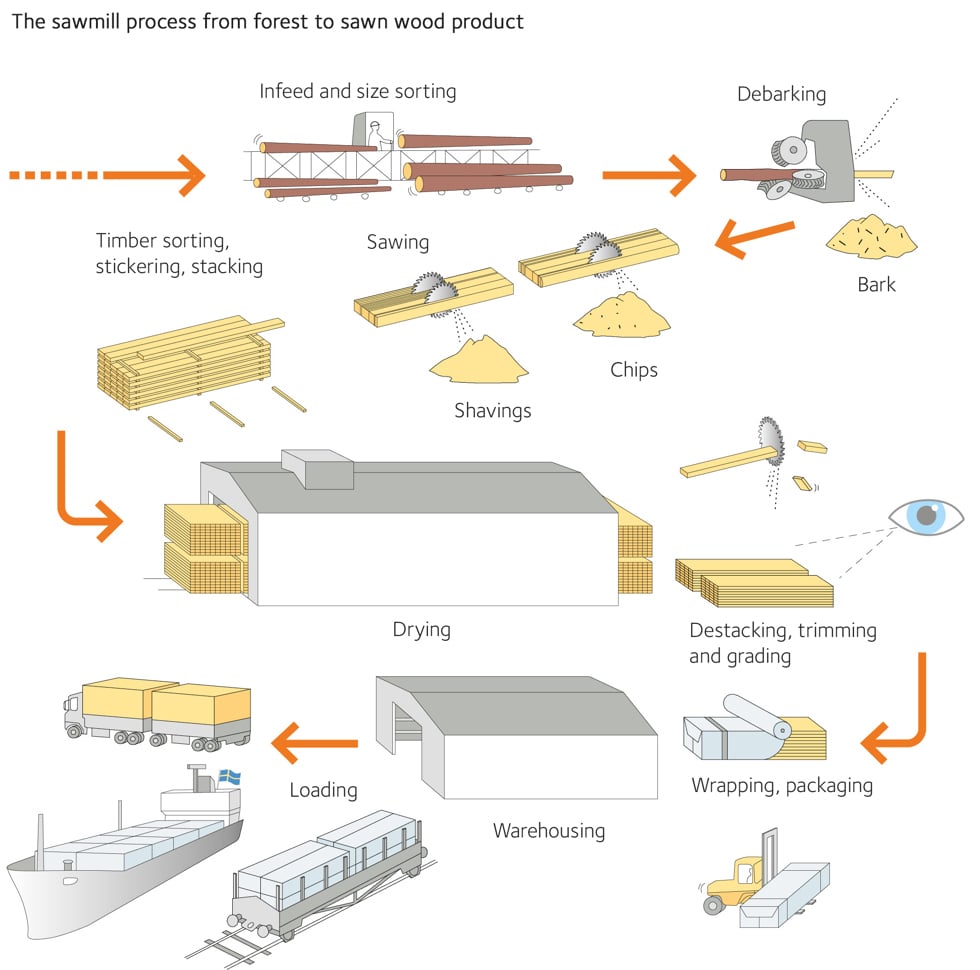

Transportation and Handling Guidelines

Spruce wood should be transported in covered vehicles to protect it from rain, snow, and direct sunlight. Lumber must be securely stacked and braced to prevent shifting during transit. Use dunnage to elevate loads off truck beds and allow airflow. Avoid dragging or dropping bundles to minimize surface damage and end splits.

Moisture Content and Storage Requirements

Before shipment, spruce wood should be kiln-dried or air-dried to a moisture content of 12–19%, depending on end use. Store in a dry, well-ventilated area off the ground and covered with waterproof tarpaulins. Avoid prolonged exposure to humidity or temperature fluctuations to reduce the risk of mold, warping, or fungal growth.

International Trade and Export Regulations

Exporting spruce wood may require phytosanitary certificates issued by national plant protection organizations to confirm the wood is pest-free. Check destination country regulations for restrictions on wood packaging materials (e.g., ISPM 15 compliance for pallets and crates). Accurate customs declarations detailing species, volume, and origin are mandatory.

Environmental and Safety Compliance

Handle spruce wood dust with care—use PPE such as masks and goggles to prevent respiratory and eye irritation. Comply with OSHA or local workplace safety standards in processing and handling facilities. Dispose of wood waste according to environmental regulations, prioritizing recycling or approved disposal methods.

Documentation and Traceability

Maintain comprehensive records for each batch, including harvest location, date, supplier details, milling data, and certification documents. Digital traceability systems are recommended to streamline audits and ensure compliance throughout the supply chain.

Quality Control and Inspection Protocols

Inspect spruce wood upon receipt and before dispatch for defects such as knots, resin pockets, or insect damage. Use standardized grading rules (e.g., NHLA or regional standards) to classify lumber quality. Regular third-party audits help ensure ongoing compliance with industry and regulatory requirements.

In conclusion, sourcing spruce wood presents a viable and sustainable option for various applications, including construction, furniture making, musical instruments, and paper production. Its favorable strength-to-weight ratio, workability, and availability make it a popular choice among builders and craftsmen. When sourced responsibly—preferably from certified sustainable forests such as those under FSC or PEFC certification—spruce offers an environmentally conscious material choice. Furthermore, its relatively fast growth and widespread distribution, particularly in northern temperate regions, contribute to its renewability and economic accessibility. To ensure long-term sustainability and ethical sourcing, stakeholders should prioritize suppliers with transparent supply chains and commitment to environmental stewardship. Overall, spruce wood stands out as a reliable, versatile, and eco-friendly resource when sourced thoughtfully and responsibly.