The global motorcycle spare parts market is witnessing robust growth, driven by increasing vehicle ownership, rising demand for aftermarket components, and a growing culture of customization—particularly in emerging markets like India. According to Mordor Intelligence, the global motorcycle spare parts market was valued at USD 28.6 billion in 2023 and is projected to grow at a CAGR of over 5.8% during the forecast period (2024–2029). With Royal Enfield accounting for a dominant share of the middleweight motorcycle segment in India—consistently selling over 600,000 units annually—the demand for genuine and aftermarket spare parts has surged. This sustained market presence, combined with a loyal rider base that frequently upgrades or replaces components, has elevated specific spare parts to high-demand status. Based on sales trends, replacement frequency, and service data from authorized dealers and e-commerce platforms, here are the top 5 spare parts by Royal Enfield manufacturers that are most sought after in the current aftermarket landscape.

Top 5 Spare Parts Of Royal Enfield Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

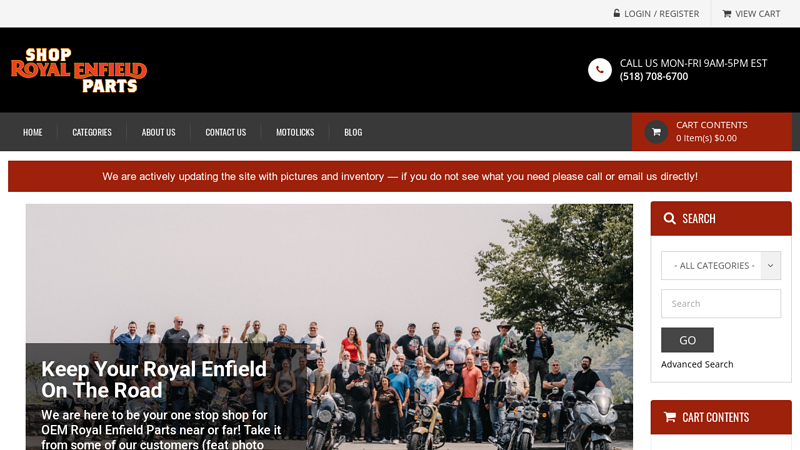

#1 Shop Royal Enfield Parts

Domain Est. 2022

Website: shoproyalenfieldparts.com

Key Highlights: Shop Royal Enfield Parts offers official OEM parts & accessories for Royal Enfield Motorcycles. We have factory trained technicians in-house who have the ……

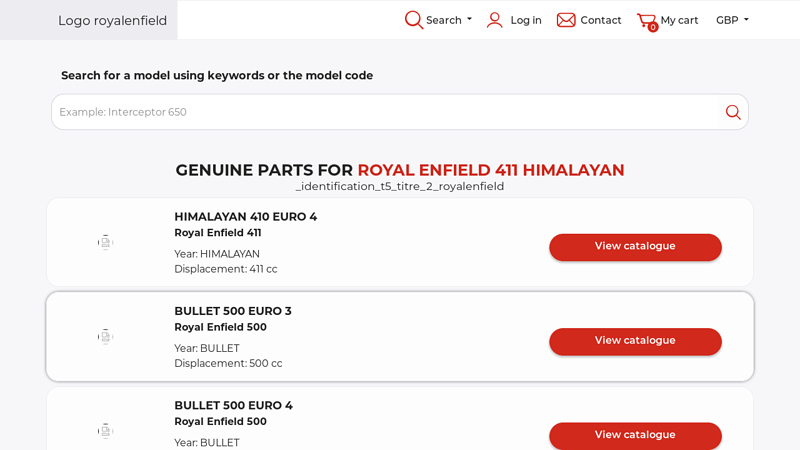

#2 Search models

Domain Est. 2019

Website: bike-parts-royalenfield.com

Key Highlights: Order your original Royal Enfield spares with our part diagrams ✔️ Search by model or part number ✔️ Manufacturer warranty – Secure payment….

#3 Genuine Motorcycle Accessories

Domain Est. 1997

#4 Royal Enfield 350 Classic Reborn Accessories

Domain Est. 2002

Website: accessories.hitchcocksmotorcycles.com

Key Highlights: 5.0 33 Royal Enfield 350 Classic Reborn Accessories. Including Frame and Chassis, luggage, servicing, upgrades, electrical and tools….

#5 Royal Enfield genuine spare parts at best price available online

Domain Est. 2016

Website: thesparescompany.com

Key Highlights: 7–15 day deliveryRoyal Enfield genuine parts available online at thesparecompany that delivers genuine motorcycle parts at lowest price available in the market via online….

Expert Sourcing Insights for Spare Parts Of Royal Enfield

H2: Market Trends for Royal Enfield Spare Parts (2026 Outlook)

As the global motorcycle industry evolves through 2026, the market for spare parts of Royal Enfield — one of the most iconic and enduring motorcycle brands — is poised for significant transformation. Driven by shifting consumer preferences, digitalization, sustainability concerns, and expansion into emerging markets, the spare parts ecosystem for Royal Enfield is expected to witness robust growth and innovation by the mid-decade. This analysis explores key trends shaping the Royal Enfield spare parts market in 2026 under the H2 framework, focusing on Hybrid Supply Chains, High-Demand Components, Hassle-Free Customer Experience, and Hydrogen/Eco-Driven Adaptations.

Hybrid Supply Chains

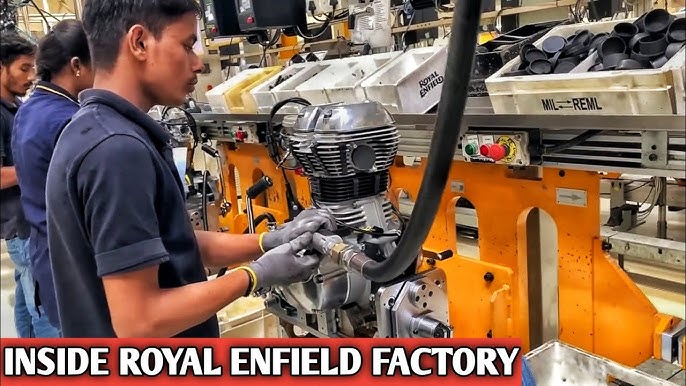

By 2026, Royal Enfield is expected to adopt a hybrid supply chain model that blends centralized manufacturing with localized spare parts distribution hubs. This approach enhances responsiveness to regional demands and reduces lead times.

- Localized Warehousing: Royal Enfield has been expanding its network of spare parts depots across India, Southeast Asia, Europe, and Latin America. By 2026, these localized hubs will allow quicker access to high-turnover parts such as brake pads, clutch plates, and electrical components.

- Digital Inventory Management: Integration with AI-powered inventory systems will enable real-time tracking of spare part demand, reducing overstocking and minimizing shortages.

- 3D Printing Adoption: Select high-cost or low-volume parts (e.g., vintage motorcycle fittings) may leverage additive manufacturing, enabling on-demand production and reducing warehousing costs.

This hybrid model ensures greater resilience against supply chain disruptions and supports Royal Enfield’s global aftermarket growth strategy.

High-Demand Components

Consumer behavior and usage patterns will drive demand for specific spare parts categories in 2026.

- Performance & Wear Parts: Components such as clutch assemblies, brake systems, and suspension units will remain in high demand due to the rugged usage of Royal Enfield bikes in diverse terrains (especially in India and Southeast Asia).

- Electrical & Digital Components: With the introduction of more tech-enabled models like the Meteor and Himalayan 450, demand for ECU units, sensors, LED lighting, and wiring harnesses is rising.

- Aesthetic & Customization Parts: The growing trend of motorcycle customization will fuel demand for aftermarket accessories — handlebars, exhaust systems, tank emblems, and seat covers — often sourced as OEM or OEM-compatible spare parts.

- Vintage & Heritage Restoration: Royal Enfield’s classic appeal continues to attract collectors. By 2026, spare parts for older models like the Bullet 350 and Electra will see sustained demand, supported by dedicated restoration programs.

Hassle-Free Customer Experience

Customer expectations around convenience, authenticity, and speed are reshaping how spare parts are accessed.

- E-Commerce Expansion: Royal Enfield’s official spare parts portal and partnerships with platforms like Amazon, Flipkart, and regional e-commerce players will dominate distribution. Mobile apps with AR-based part identification (e.g., scanning a damaged part) will enhance user experience.

- Genuine vs. Aftermarket Clarity: Increased consumer awareness will drive demand for genuine parts. Royal Enfield will likely strengthen anti-counterfeit measures using blockchain-based part authentication.

- Subscription & Maintenance Plans: Bundled service and spare parts packages (e.g., annual maintenance kits) will gain popularity, especially among fleet operators and tour operators using Royal Enfield bikes.

- Service Network Integration: Spare parts availability at authorized service centers will be tightly synchronized with service bookings, reducing downtime for riders.

Hydrogen/Eco-Driven Adaptations

While Royal Enfield has not yet launched hydrogen-powered bikes, the broader industry shift toward sustainability will influence spare parts design and materials.

- Eco-Friendly Materials: By 2026, Royal Enfield may begin incorporating bio-based plastics and recycled metals in non-critical spare parts to align with ESG goals.

- Electric Transition Preparedness: As Royal Enfield explores electric mobility (following parent company Eicher’s investments in electric vehicles), spare parts for electric drivetrains — such as battery connectors, motor controllers, and charging ports — may enter the ecosystem.

- Circular Economy Initiatives: Refurbishment and remanufacturing of parts (e.g., reconditioned engines or carburetors) could gain traction, supported by take-back programs and green certifications.

Though full electrification may still be limited in 2026, the spare parts market will begin adapting to future mobility trends.

Conclusion

By 2026, the Royal Enfield spare parts market will be characterized by greater digitization, regional customization, and sustainability consciousness. The H2 framework — Hybrid Supply Chains, High-Demand Components, Hassle-Free Customer Experience, and Hydrogen/Eco-Driven Adaptations — captures the multidimensional evolution of this niche yet vital segment. As Royal Enfield strengthens its global footprint and embraces innovation, its spare parts ecosystem will play a crucial role in enhancing customer loyalty, ensuring long-term vehicle usability, and supporting the brand’s legacy in the modern mobility era.

Common Pitfalls When Sourcing Spare Parts for Royal Enfield (Quality and Intellectual Property Issues)

Sourcing spare parts for Royal Enfield motorcycles—especially outside authorized channels—can lead to several challenges, particularly concerning part quality and intellectual property (IP) risks. Being aware of these pitfalls helps ensure vehicle performance, rider safety, and legal compliance.

Poor Quality and Performance Risks

One of the most prevalent issues when sourcing Royal Enfield spare parts is encountering substandard components. Aftermarket or third-party suppliers often offer parts at lower prices, but these may compromise on materials, tolerances, or durability.

- Inferior Materials: Counterfeit or low-quality parts may use cheaper alloys or plastics that degrade faster, leading to premature failure.

- Improper Fit and Function: Non-genuine parts might not align with Royal Enfield’s engineering specifications, causing fitment issues or affecting bike performance.

- Lack of Testing and Certification: Genuine Royal Enfield parts undergo rigorous testing for safety and reliability. Many aftermarket parts lack such validation, increasing the risk of mechanical failure.

Intellectual Property (IP) Infringement

Royal Enfield holds trademarks, design patents, and technical copyrights on many of its components. Sourcing imitation or counterfeit parts can expose buyers and resellers to legal risks.

- Trademark Violations: Using Royal Enfield logos, branding, or part numbers on unauthorized parts constitutes trademark infringement.

- Patented Designs: Certain components—such as fuel tanks, fenders, or engine covers—may be protected by design patents. Replicating them without authorization is illegal.

- Supply Chain Liability: Businesses distributing non-genuine parts may face legal action from Royal Enfield or its authorized distributors, especially if the parts are mislabeled as genuine.

Voided Warranties and Service Issues

Using non-OEM (Original Equipment Manufacturer) spare parts can void warranties on Royal Enfield motorcycles.

- Service Rejection: Authorized service centers may refuse maintenance or repairs if non-genuine parts are detected, arguing they could compromise bike integrity.

- Diagnostic Incompatibility: Some electronic components (e.g., sensors, ECUs) may not integrate properly with the bike’s systems if not sourced from genuine channels.

Supply Chain and Traceability Challenges

Lack of transparency in the spare parts supply chain increases the risk of receiving counterfeit or stolen components.

- Unclear Origins: Parts from gray-market suppliers may have dubious origins, with no reliable documentation or traceability.

- No Recall Support: In the event of a product recall, owners of counterfeit or third-party parts may not be notified, posing safety risks.

Conclusion

To avoid these pitfalls, it is advisable to source spare parts through Royal Enfield-authorized dealers or trusted OEM suppliers. While genuine parts may come at a higher cost, they ensure compatibility, reliability, and compliance with intellectual property laws—protecting both the rider and the business.

Logistics & Compliance Guide for Spare Parts of Royal Enfield

Overview

This guide outlines the essential logistics and compliance procedures for handling, storing, transporting, and distributing spare parts for Royal Enfield motorcycles. It ensures adherence to international and local regulations, maintains part authenticity, and supports efficient supply chain operations across dealerships, warehouses, and service centers.

Part Classification and Identification

Each Royal Enfield spare part is assigned a unique part number (OE number) and categorized based on function (e.g., engine, chassis, electrical). Proper classification ensures accurate inventory management and traceability. Always refer to the official Royal Enfield Parts Catalogue for correct identification.

Packaging and Labeling Standards

Spare parts must be packaged in Royal Enfield-approved materials to prevent damage during transit. All packages must include:

– Legible part number and description

– Quantity

– Batch/lot number (where applicable)

– Date of packaging

– “Royal Enfield Genuine Parts” logo

– Barcodes for inventory scanning

– Handling symbols (e.g., fragile, keep dry)

Storage Requirements

Store spare parts in dry, temperature-controlled environments (15–30°C) with low humidity (<60%). Implement FIFO (First In, First Out) and FEFO (First Expiry, First Out) inventory practices. Segregate parts by category and sensitivity (e.g., electronics, rubber components). Ensure warehouse facilities are pest-free and secure.

Inventory Management

Use an ERP or inventory management system compatible with Royal Enfield’s global supply chain standards. Conduct regular cycle counts and annual audits. Report stock discrepancies promptly. Maintain digital records of receipts, issues, returns, and serial numbers (for high-value items).

Transportation and Distribution

Use authorized logistics partners compliant with Royal Enfield’s transportation protocols. Vehicles must be enclosed, clean, and equipped with shock-absorbing features. Temperature-sensitive parts (e.g., batteries, adhesives) require climate-controlled transport. Shipments must be tracked in real-time using GPS and barcoding systems.

Import and Export Compliance

For cross-border movement of spare parts:

– Obtain necessary import/export licenses

– Comply with local customs regulations (e.g., GST, VAT, duties)

– Provide accurate commercial invoices, packing lists, and certificates of origin

– Adhere to HS codes specific to automotive parts (typically 8708 series)

– Follow REACH, RoHS, and WEEE directives (for EU markets)

– Comply with country-specific homologation requirements

Regulatory and Environmental Compliance

Ensure all spare parts meet:

– BIS (Bureau of Indian Standards) certification for domestic Indian operations

– CE marking (for European markets)

– E-Mark certification for vehicle components (ECE Regulations)

– Proper disposal of packaging in line with local environmental laws

– Documentation for hazardous materials (e.g., batteries, oils)

Anti-Counterfeiting and Authentication

Only distribute Royal Enfield Genuine Parts sourced through authorized channels. Train staff to identify counterfeit parts. Use holographic labels and QR codes for part verification. Report suspected counterfeit activities to Royal Enfield’s central compliance team immediately.

Returns and Reverse Logistics

Establish a clear returns policy for defective or excess parts. Use authorized return material authorization (RMA) forms. Inspect returned parts for authenticity and damage. Segregate and quarantine non-conforming items. Follow environmentally responsible recycling or disposal procedures.

Training and Documentation

Ensure all logistics and warehouse personnel receive regular training on:

– Handling procedures

– Safety standards

– Compliance requirements

– Use of inventory systems

Maintain up-to-date records including:

– Inventory logs

– Transport manifests

– Compliance certifications

– Audit reports

– Training records

Audit and Continuous Improvement

Undergo scheduled internal and external audits to verify compliance. Address non-conformities promptly. Implement corrective and preventive actions (CAPA). Leverage feedback from dealers and service centers to optimize logistics performance.

Contact and Support

For compliance or logistics-related queries, contact:

Royal Enfield Global Supply Chain Support

Email: [email protected]

Phone: +91-XXXX-XXXXXXX (India) / +44-XXXX-XXXXXXX (UK)

Refer to the Royal Enfield Dealer Portal for updated guidelines, forms, and bulletins.

Conclusion for Sourcing Spare Parts of Royal Enfield:

Sourcing spare parts for Royal Enfield motorcycles requires a strategic approach that balances authenticity, cost, availability, and reliability. Original Equipment Manufacturer (OEM) parts from authorized Royal Enfield dealers ensure compatibility, quality, and warranty support, making them the preferred choice for critical components and long-term reliability. However, the growing aftermarket sector offers cost-effective alternatives, especially for commonly replaced parts, provided buyers exercise caution in assessing quality and supplier credibility.

With the expansion of Royal Enfield’s global service network and the availability of online platforms—both official and third-party—access to genuine and compatible parts has improved significantly. Additionally, advancements in supply chain logistics and digital inventories have reduced lead times and enhanced service efficiency.

In conclusion, a hybrid sourcing strategy—prioritizing genuine parts for essential components while selectively using certified aftermarket alternatives for non-critical parts—can optimize vehicle performance, reduce downtime, and manage maintenance costs effectively. Building relationships with trusted suppliers and staying informed about part authenticity will ensure the longevity and authentic riding experience that Royal Enfield owners value.