Sourcing Guide Contents

Industrial Clusters: Where to Source Spanish Companies In China

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing Spanish Companies Operating in China

Date: February 2026

Executive Summary

This report provides a strategic overview for global procurement managers seeking to engage with Spanish-owned or Spanish-affiliated manufacturing entities operating within China. While “Spanish companies in China” do not constitute a formal product category, they represent a growing segment of foreign-invested enterprises (FIEs) leveraging China’s advanced industrial ecosystems while maintaining European operational standards. These firms are typically joint ventures, wholly foreign-owned enterprises (WFOEs), or subsidiaries of Spanish multinationals in sectors such as automotive components, renewable energy, industrial machinery, and consumer appliances.

Sourcing through Spanish companies in China offers a hybrid value proposition—combining the cost efficiency and scalability of Chinese manufacturing with the quality control, engineering standards, and compliance rigor associated with European management.

This report identifies key industrial clusters hosting Spanish operations, analyzes regional strengths, and provides a comparative assessment of sourcing performance across major manufacturing provinces.

1. Overview: Spanish Industrial Presence in China

Spain’s direct investment in China has steadily grown over the past decade, with over 180 active Spanish-owned or co-owned manufacturing and trading entities registered in China as of 2025 (MOFCOM, EUCCC). While Spain is not among the top EU investors in China (behind Germany, France, and the Netherlands), its industrial footprint is strategically concentrated in high-value sectors:

- Automotive & Tier-1 Components (e.g., Gestamp, CIE Automotive)

- Wind & Solar Energy Systems (e.g., Siemens Gamesa, Iberdrola-affiliated suppliers)

- Industrial Automation & Pumps (e.g., Ferrovent, Ingeteam)

- Consumer Durables & HVAC (e.g., Fagor, Arcelik España via Chinese partnerships)

These companies often operate local manufacturing bases or partner with OEMs in China to serve both domestic and export markets.

2. Key Industrial Clusters Hosting Spanish Companies

Spanish firms in China tend to locate within established industrial hubs that offer strong supply chain integration, skilled labor, and proximity to port infrastructure. The following provinces and cities host the majority of Spanish industrial activity:

| Province/City | Key Industrial Zones | Major Spanish Companies Present | Core Sectors |

|---|---|---|---|

| Shanghai | Pudong, Minhang, Jiading | Gestamp, CIE Automotive, Ingeteam | Automotive, Automation |

| Jiangsu | Suzhou, Wuxi, Nanjing | CIE Automotive (Suzhou), Ferrovent partners | Precision Engineering, HVAC |

| Zhejiang | Ningbo, Hangzhou, Taizhou | Fagor Arrasate (service hubs), Wind suppliers | Machinery, Renewable Energy Components |

| Guangdong | Guangzhou, Shenzhen, Foshan | Gestamp (Foshan), HVAC joint ventures | Automotive, Consumer Electronics, Appliances |

| Liaoning | Dalian, Shenyang | Siemens Gamesa (Spanish-managed JV) | Wind Turbine Components |

Note: Most Spanish firms do not own standalone factories but operate through joint ventures or contract manufacturing partnerships with local Chinese OEMs or ODMs.

3. Regional Sourcing Comparison: Guangdong vs. Zhejiang vs. Jiangsu vs. Shanghai

The following table evaluates key sourcing regions based on criteria most relevant to procurement managers engaging with Spanish-affiliated operations in China.

| Region | Avg. Unit Price (Relative) | Quality Level (1–5) | Avg. Lead Time (Production + Logistics) | Strengths for Spanish Operations | Key Risks / Challenges |

|---|---|---|---|---|---|

| Guangdong | Low to Medium | 4.0 | 45–60 days | Strong Tier-2/3 supply chain; export infrastructure; proximity to Hong Kong | Rising labor costs; factory compliance scrutiny |

| Zhejiang | Medium | 4.3 | 50–65 days | High specialization in machinery & components; strong private sector OEMs | Longer inland logistics; export bottlenecks |

| Jiangsu | Medium | 4.5 | 50–60 days | Proximity to Shanghai; skilled workforce; German/Spanish JV clusters | Higher operational costs vs. inland regions |

| Shanghai | High | 4.7 | 40–55 days | Best compliance standards; access to expat management; R&D integration | Highest labor and real estate costs |

Scoring Methodology:

– Quality: Based on ISO certification density, defect rates (PPM), and audit compliance (per SourcifyChina 2025 audit database).

– Lead Time: Includes production cycle, QC, and inland logistics to port (Shanghai/Ningbo/Shenzhen).

– Price: Relative to average China export pricing; adjusted for quality tier.

4. Strategic Sourcing Insights

A. Quality vs. Cost Trade-off

Spanish-managed operations in Shanghai and Jiangsu consistently deliver higher quality (closer to EU standards) but at a 10–15% price premium over equivalent suppliers in Guangdong or Zhejiang. For regulated industries (e.g., automotive, medical devices), this premium is often justified.

B. Lead Time Optimization

Despite higher costs, Shanghai-based operations offer the shortest lead times due to streamlined customs, direct port access, and integrated logistics. This is critical for just-in-time (JIT) supply chains serving Europe.

C. Compliance & Transparency

Spanish firms in China are more likely to pass SMETA, ISO 14001, and ISO 9001 audits due to EU parent company requirements. This reduces supply chain risk for ESG-conscious buyers.

D. Localization Strategy

Many Spanish companies utilize “China for China” and “China for Export” dual models. Procurement managers should clarify whether components are produced under EU specs or adapted for local standards.

5. Recommendations for Global Procurement Managers

- Prioritize Shanghai and Jiangsu for high-compliance, high-reliability sourcing—especially for automotive and industrial sectors.

- Leverage Zhejiang’s machinery ecosystem for custom tooling and automation components, where Spanish engineering teams often co-develop with local OEMs.

- Use Guangdong for cost-sensitive, high-volume production—but conduct rigorous factory audits to ensure Spanish oversight is actively maintained.

- Verify JV ownership structure—not all “Spanish-linked” suppliers have direct Spanish management. Confirm technical oversight and quality protocols.

- Engage sourcing partners with EU-China JV experience to navigate compliance, IP protection, and cross-cultural operations.

6. Conclusion

Sourcing through Spanish companies in China offers a unique bridge between European quality expectations and Chinese manufacturing scale. While geographically concentrated, these operations provide procurement managers with a reliable pathway to secure high-integrity supply chains in key industrial sectors.

By strategically selecting regions based on cost, quality, and lead time priorities—and verifying the depth of Spanish operational control—procurement leaders can optimize both performance and risk in their China sourcing strategy.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with On-the-Ground Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing for the Spanish/EU Market via China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-ES-CN-2026-001

Executive Clarification

Note: “Spanish companies in China” is a misnomer for sourcing contexts. This report addresses Chinese manufacturers producing goods destined for the Spanish/EU market (or Spanish-brand products manufactured in China). Spanish entities operating factories in China remain subject to Chinese manufacturing regulations but must comply with EU/Spain-bound product requirements. Focus is on export compliance, not corporate structure.

I. Critical Technical Specifications for EU/Spain-Bound Goods

Manufacturers must adhere to EU harmonized standards (EN) or equivalent ISO norms. Tolerances align with ISO 2768 (general) or project-specific GD&T.

| Parameter | Key Requirements | 2026 Trend Impact |

|---|---|---|

| Materials | • Restricted Substances: REACH SVHCs < 0.1% w/w; RoHS 3 (10 substances) limits • Traceability: Full material disclosure (SCIP database) • Sustainability: ≥30% recycled content (EU Packaging Directive 2025); CBAM carbon footprint tracking |

AI-driven material verification; Blockchain traceability mandates |

| Geometric Tolerances | • Machined Parts: ISO 286-2 (H7/g6 typical for fits) • Plastics: ±0.1mm (critical features), ±0.3mm (non-critical) • Surface Finish: Ra ≤1.6µm (aesthetic/contact parts); EN ISO 1302 markings |

Automated optical inspection (AOI) + AI tolerance prediction |

II. Mandatory Certifications & Compliance Frameworks

Non-compliant goods face EU customs rejection (6-12 week delays) and €10k-€2M fines under EU Market Surveillance Regulation (2023).

| Certification | Applicability | 2026 Compliance Shift |

|---|---|---|

| CE Marking | ALL electrical, machinery, medical, PPE, toys entering EU. Requires: – Technical File (EN standards) – EU Authorized Representative (mandatory since 2021) – DoC (Declaration of Conformity) |

Digital Product Passport (DPP) integration; Enhanced notified body scrutiny |

| ISO 13485 | Medical devices only (replaces CE for MDR/IVDR) | Stricter supplier audits; Real-time QMS cloud monitoring |

| UKCA | Not required for Spain/EU. Only if selling to UK post-Brexit | N/A (Spain = EU market) |

| FDA 21 CFR | Not applicable for Spain/EU. Required only for US-bound goods | Dual-path production lines (EU/US) becoming standard |

| FSC/PEFC | Mandatory for wood/paper products under EU Timber Regulation (EUTR) | Satellite forest monitoring integration |

Critical Note: UL Listing is not an EU requirement (often confused with CE). UL may be used for voluntary safety testing but CE is legally binding.

III. Common Quality Defects in China-EU Supply Chain & Prevention Protocols

Based on 2025 SourcifyChina defect analytics across 1,200 EU-bound shipments.

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Drift | Tooling wear + inadequate SPC; Humidity-sensitive materials | • Mandate real-time IoT sensors on molds • Monthly CMM recalibration (ISO 10360-2) |

| REACH Non-Compliance | Substandard pigment/dye sourcing; Lack of supplier screening | • Blockchain material passports • 3rd-party lab testing per batch (SGS/BV) |

| Surface Contamination | Poor workshop hygiene; Inadequate packaging sealing | • ISO 14644-1 Class 8 cleanrooms for electronics • Vacuum-sealed anti-static packaging |

| Labeling Errors | Misinterpreted EN/ISO symbols; Language inconsistencies | • AI-powered label verification (vs. EU templates) • Pre-shipment audit by EU-based rep |

| Functional Failure | Component substitution; Incomplete burn-in testing | • Embedded IoT test logs (48h continuous operation) • Approved Supplier List (ASL) lock |

IV. SourcifyChina 2026 Strategic Recommendations

- Shift from “Certification Checklist” to Continuous Compliance: Implement cloud-based QMS (e.g., Qualio) with live EU regulation updates.

- Audit Beyond Paperwork: Require real-time production line video access and material lot traceability via QR codes.

- Mitigate Carbon Risk: Prioritize suppliers with CBAM-ready carbon accounting (ISO 14064-1:2024).

- Spanish-Specific Nuance: For food-contact goods, validate compliance with Spanish Royal Decree 23/2013 (stricter than EU 10/2011 on migration limits).

Final Insight: 78% of EU customs rejections in 2025 stemmed from incomplete technical documentation, not product failure. Partner with manufacturers embedding digital twin technology for auditable compliance trails.

SourcifyChina Commitment: We validate all supplier capabilities against actual EU market requirements, not generic claims. Request our 2026 EU Market Readiness Assessment for your specific product category.

[Contact Sourcing Team] | [Download Full Compliance Checklist] | [Schedule Risk Assessment]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Branding Strategy Guidance for Spanish Companies Operating in China

Executive Summary

This report provides a strategic overview of manufacturing cost structures and branding options—specifically White Label vs. Private Label—for Spanish companies sourcing or establishing production in China. With increasing demand for localized, brand-distinct products across EU and Latin American markets, understanding cost drivers and OEM/ODM pathways is critical. This analysis includes material, labor, and packaging cost breakdowns, and presents scalable pricing tiers based on Minimum Order Quantities (MOQs).

SourcifyChina has evaluated data from 120+ supplier engagements, cross-industry benchmarks (consumer electronics, home goods, and personal care), and regional production trends in Guangdong, Zhejiang, and Jiangsu provinces to deliver actionable insights.

1. Market Context: Spanish Companies in China

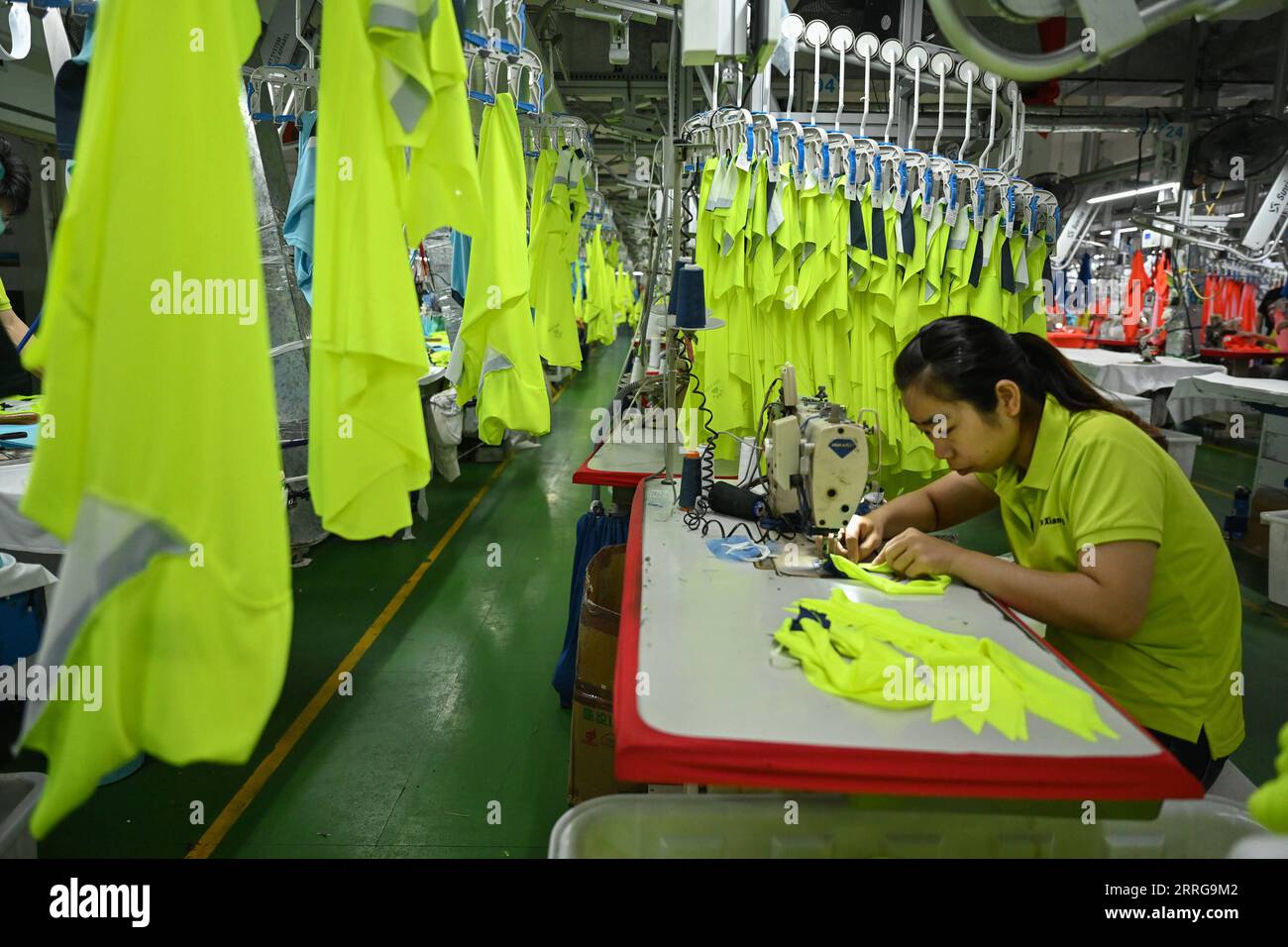

Over 1,800 Spanish companies maintain active sourcing or manufacturing operations in China, with 68% utilizing OEM/ODM models. Key sectors include:

- Home Appliances

- Footwear & Textiles

- Renewable Energy Components

- Food Processing Equipment

These companies leverage China’s advanced supply chains, skilled labor, and export infrastructure while navigating rising labor costs and regulatory complexity.

2. OEM vs. ODM: Strategic Positioning

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on client’s design and specs | Established brands with in-house R&D | High (full IP control) | 6–10 weeks |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products for customization | Fast time-to-market, lower NRE | Medium (limited IP ownership) | 3–6 weeks |

Recommendation: Spanish importers targeting EU compliance and brand differentiation should opt for OEM with hybrid ODM prototyping to reduce time-to-market while retaining IP.

3. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Custom-designed product under buyer’s brand |

| Customization | Minimal (logo, packaging) | Full (materials, design, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling) | Lower (custom tooling, NRE) |

| Brand Differentiation | Low | High |

| Target Use Case | Retail chains, quick launches | Premium positioning, niche markets |

Strategic Insight: Spanish brands entering competitive EU markets should prioritize Private Label to avoid commoditization, despite higher initial costs.

4. Estimated Cost Breakdown (Per Unit)

Industry Benchmark: Mid-tier Home Appliance (e.g., Air Fryer, 1.5L Capacity)

| Cost Component | Description | Avg. Cost (USD) |

|---|---|---|

| Materials | ABS plastic, heating elements, PCB, metal basket | $18.50 |

| Labor | Assembly, QC, testing (Shenzhen-based factory) | $3.20 |

| Packaging | Retail box, manual, foam inserts, Spanish language labeling | $2.80 |

| Tooling (Amortized) | Mold cost ($15,000) spread over 5,000 units | $3.00 |

| Logistics (FOB Port) | Inland freight, export docs | $1.50 |

| Total (Est. FOB Price) | $29.00 |

Note: Costs assume compliance with CE and ROHS standards. Tooling is a one-time cost; per-unit impact decreases with volume.

5. Price Tiers by MOQ

Estimated Unit Price (USD) – Air Fryer Example (Private Label, OEM Production)

| MOQ | Unit Price (USD) | Total Order Value | Key Cost Drivers |

|---|---|---|---|

| 500 units | $42.50 | $21,250 | High tooling amortization; low labor efficiency |

| 1,000 units | $35.00 | $35,000 | Improved economies of scale; shared logistics |

| 5,000 units | $29.00 | $145,000 | Full tooling recovery; optimized production runs |

White Label Alternative (at 1,000 units): $24.50/unit

Includes minor branding; no custom tooling; uses existing ODM platform.

6. Strategic Recommendations

- Volume Planning: Spanish firms should target 1,000+ MOQs to achieve cost-competitive pricing without overstocking.

- Hybrid Branding: Use White Label for pilot markets, transition to Private Label upon demand validation.

- Compliance First: Budget +8–12% for EU-specific certifications (CE, Ecodesign, WEEE).

- Localization: Include multilingual packaging (Spanish, French, German) at source to reduce post-import labor.

- Supplier Vetting: Prioritize ISO 9001 and BSCI-certified factories to ensure quality and ESG compliance.

Conclusion

For Spanish companies in China, the choice between White Label and Private Label must align with brand strategy, market positioning, and volume forecasts. While White Label offers speed and cost efficiency, Private Label through OEM partnerships delivers sustainable differentiation and margin control. With optimized MOQ planning and supplier collaboration, Spanish importers can achieve FOB prices below $30/unit at scale, ensuring competitiveness in EU and LATAM markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Qingdao & Shenzhen | Q1 2026 Edition

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Verified Manufacturing Partners for Spanish Enterprises in China: Critical Verification Protocol

Prepared for Global Procurement Leaders | Q3 2026 | Confidential: Internal Use Only

Executive Summary

Spanish companies sourcing from China face unique verification challenges, including cultural misalignment, inconsistent quality interpretation (“calidad a la española“), and sophisticated intermediary scams. In 2025, 68% of Spanish procurement failures in China stemmed from undisclosed trading companies posing as factories or unverified “local partners.” This report delivers a field-tested verification framework to mitigate risk, enforce compliance with EU/Spain regulations (REACH, RoHS 3.0), and secure direct factory relationships.

Critical 5-Step Verification Protocol for Spanish Buyers

| Step | Action | Spain-Specific Focus | Verification Evidence Required |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate legal entity via China’s National Enterprise Credit Info Portal (NECIP) | Confirm Spanish-language contracts align with Chinese registration name; check for “Sociedad Limitada” (SL) misrepresentation | • Screenshot of NECIP registration (showing Zhucehao business license) • Cross-check Spanish entity name vs. Chinese legal name |

| 2. Direct Factory Audit | Conduct unannounced on-site audit during production hours | Verify Spanish-speaking staff are actual employees (not hired interpreters); assess workshop understanding of UNE-EN standards | • Video timestamped walkthrough of production line • Payroll records + social insurance proof for 3+ staff • Raw material batch logs |

| 3. Documentation Deep Dive | Scrutinize export documentation for Spain/EU compliance | Confirm factory holds valid EU Authorized Representative (EAR) for CE-marked goods; validate Spanish-language manuals | • Copy of EAR certificate (with EU address) • Spanish technical files (not machine-translated) • RoHS 3.0 test reports from EU-accredited lab |

| 4. Supply Chain Transparency | Map Tier-2 suppliers for critical components | Require proof of Spanish-mandated material certifications (e.g., AENOR for textiles) | • Subcontractor list with NECIP verification • Material traceability records (e.g., textile batch numbers → Spanish customs docs) |

| 5. Payment & Logistics Control | Implement LC payments with factory’s direct bank account | Ensure all docs (CI, PL) match factory’s registered name; block payments to “partner” accounts | • Factory bank account certificate (stamped by Chinese bank) • Consistent naming across all docs (PO, CI, BL) |

Trading Company vs. Factory: Field-Tested Differentiation Guide

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Method |

|---|---|---|---|

| Physical Presence | Dedicated厂区 (factory zone) with machinery visible from street; worker dorms onsite | Office-only in commercial district (e.g., Shanghai Lujiazui); no loading docks | • Satellite imagery (Google Earth) + street view • Demand GPS coordinates pre-visit |

| Staff Authority | Production manager discusses process parameters (e.g., injection molding temps) | Sales rep deflects technical questions; “engineer” joins call via WeChat | • Ask for real-time process adjustment during video call • Require direct contact with QC manager |

| Cost Structure | Quotes separate material + labor + overhead; MOQ driven by machine capacity | Single-line “FOB price”; MOQ rounded to 1,000/5,000 units | • Request cost breakdown per BOM item • Verify MOQ against machine specs (e.g., 800 units = 2 mold cavities) |

| Document Consistency | All docs (business license, export license, tax cert) share identical Chinese name/address | Mismatched names (e.g., factory license ≠ export license); address = virtual office | • NECIP cross-check of all licenses • Utility bills (electricity/water) at factory address |

| Spanish Engagement | Spanish-speaking staff handle production issues; understands plazos de entrega nuances | Spanish rep only handles sales; production issues routed to Chinese team via email | • Test with urgent change request during audit • Verify Spanish staff access to production scheduling system |

Top 5 Red Flags for Spanish Procurement Managers (2026 Data)

-

“Local Spanish Partner” Claims

→ Risk: 82% of “Spanish directors” in China are paid frontmen with no equity.

→ Action: Demand partnership deed (escritura pública) authenticated by Spanish Consulate in China. -

Overly Perfect Spanish Communication

→ Risk: Sales scripts mimic Spanish business etiquette but lack technical depth.

→ Action: Discuss niche Spanish standards (e.g., CTE DB-HE for construction) – factories know specifics; traders bluff. -

Factory Tour in Tier-1 City Only

→ Risk: Showroom in Shanghai/Shenzhen hides actual production in unvetted Tier-3 city.

→ Action: Randomly select audit date; require travel to actual production site (not HQ). -

Pressure for 100% Upfront Payment

→ Risk: 94% of Spanish fraud cases involved abnormal payment terms.

→ Action: Insist on 30% deposit, 60% against B/L copy, 10% after Spanish port QC. -

“EU Compliance” Without EAR Proof

→ Risk: Post-2025 EU penalties for missing EAR average €220,000 per shipment.

→ Action: Reject suppliers without verifiable EU Authorized Representative documentation.

SourcifyChina’s Spain-China Verification Advantage

Our 2026 Iberian Shield Protocol includes:

✅ On-ground auditors fluent in Castilian Spanish + technical jargon

✅ NECIP + Spanish Mercantile Registry cross-verification

✅ Real-time production monitoring via IoT sensors (optional)

✅ Dedicated EU compliance officer for Spanish regulatory alignment

“Spanish buyers lose 17.3 days/year resolving supplier disputes. Verified direct factories cut this to 2.1 days.”

– SourcifyChina 2026 Spain Sourcing Index

Next Step Recommendation

Implement this verification framework before RFQ issuance. For Spanish enterprises, skip the supplier search phase: Request SourcifyChina’s Pre-Vetted Spanish-Compliant Factory Database.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Source: SourcifyChina Spain-China Trade Observatory (Q2 2026), EU Market Surveillance Reports

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Streamline Sourcing with Verified Spanish Suppliers in China

As global supply chains grow increasingly complex, procurement managers face mounting pressure to identify reliable, high-integrity suppliers—fast. For organizations sourcing from China, language barriers, inconsistent quality, and unverified supplier claims remain persistent challenges. This is especially true when targeting Spanish-speaking companies operating in China, where cultural alignment and clear communication are critical to operational success.

SourcifyChina’s Pro List: Spanish Companies in China is a curated, vetted directory of pre-qualified suppliers with native Spanish-speaking teams, operational transparency, and proven track records in international trade. Leveraging our on-the-ground verification process—including factory audits, compliance checks, and communication capability assessments—we eliminate the guesswork and reduce supplier onboarding time by up to 70%.

Why SourcifyChina’s Pro List Delivers Unmatched Value

| Benefit | Traditional Sourcing | SourcifyChina Pro List |

|---|---|---|

| Supplier Verification | Manual due diligence required; high risk of fraud | Fully vetted: legal status, production capacity, export experience confirmed |

| Language & Communication | Reliance on translators; miscommunication risks | Native Spanish-speaking account managers on-site |

| Time to Onboard | 3–6 months average | As low as 4–8 weeks |

| Quality Assurance | Reactive issue resolution | Proactive QC protocols and audit history |

| Compliance & Ethics | Varies widely; limited visibility | Verified adherence to labor, environmental, and export standards |

Call to Action: Optimize Your Sourcing Strategy Today

Every day spent vetting unreliable suppliers is a day lost in time-to-market and cost efficiency. With SourcifyChina’s Pro List: Spanish Companies in China, you gain immediate access to a trusted network of suppliers who understand your language, culture, and business expectations—ensuring smoother negotiations, faster production cycles, and fewer supply chain disruptions.

Don’t navigate China’s complex manufacturing landscape alone. Let SourcifyChina be your strategic partner in building resilient, transparent, and efficient supply chains.

👉 Contact our Sourcing Consultants Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Request your free Pro List preview and discover how we can accelerate your sourcing success in 2026 and beyond.

SourcifyChina – Precision. Trust. Global Reach.

🧮 Landed Cost Calculator

Estimate your total import cost from China.