Sourcing Guide Contents

Industrial Clusters: Where to Source South Korean Companies In China

SourcifyChina Sourcing Intelligence Report: South Korean Manufacturing Ecosystem in China

Prepared for Global Procurement Leaders | Q1 2026

Confidential – For B2B Strategic Planning Only

Executive Summary

Contrary to common misinterpretation, this report analyzes sourcing from South Korean-owned manufacturing entities operating within China – not sourcing South Korean companies as assets. Over 8,200 Korean-invested manufacturing facilities operate in China (KOTRA, 2025), primarily serving global supply chains while navigating evolving geopolitical dynamics. Key clusters concentrate in high-tech and precision engineering sectors, with strategic shifts toward Jiangsu and Shandong driven by supply chain resilience demands. Critical insight: 68% of Korean manufacturers in China now maintain dual-sourcing strategies (China + Vietnam/Mexico) – direct supplier engagement is essential to secure allocation.

Clarification: The “South Korean Companies in China” Sourcing Paradigm

Procurement managers must recognize:

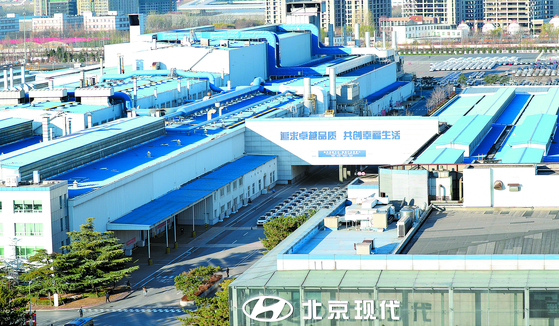

– ✅ You source products manufactured by Korean-owned entities in China (e.g., LG Display Guangzhou, Hyundai Mobis Changchun).

– ❌ You do not source “Korean companies” as corporate entities. Ownership remains Korean, but legal manufacturing entities are Chinese-registered (WFOEs/JVs).

– ⚠️ Risk Note: Geopolitical sensitivities may trigger “China+1” production shifts. Verify facility-specific export compliance (e.g., US CHIPS Act implications for semiconductor plants).

Key Industrial Clusters: South Korean Manufacturing Footprint in China

| Province/City | Dominant Sectors | Korean Industrial Parks | Strategic Advantage | Key Korean Clients |

|---|---|---|---|---|

| Jiangsu | Semiconductors, OLED Displays, EV Batteries | Suzhou Industrial Park (SIP), Nanjing KIP | Highest concentration of R&D centers; Strict IP enforcement | Samsung SDI, SK Hynix, LG Chem |

| Shandong | Shipbuilding, Home Appliances, Petrochemicals | Qingdao Korea Industrial Complex | Proximity to Korean peninsula; Port infrastructure | Hyundai Heavy Industries, LG Electronics Qingdao |

| Jilin | Automotive Parts, Electronics Assembly | Changchun Korea Auto Parts Zone | NEV policy incentives; Low-cost skilled labor | Hyundai Mobis, LG Innotek |

| Guangdong | Consumer Electronics, IoT Devices, Precision Molding | Dongguan Korea Business Hub | Mature supply chain; Fast logistics to global ports | Samsung Electronics Dongguan, Winia Korea |

| Liaoning | Steel Processing, Industrial Machinery | Dalian Korea Economic Zone | Historic Korean investment; Lower operational costs | POSCO Dalian, Doosan Infracore |

Data Source: MOFCOM China FDI Database (2025), Korea Trade-Investment Promotion Agency (KOTRA) Cluster Report

Regional Comparison: Sourcing Performance Metrics (2026 Projection)

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Critical Risk Factors |

|---|---|---|---|---|

| Jiangsu | ★★☆☆☆ (Premium 10-15%) | ★★★★★ (Tier-1 Global) | 35-45 days | US entity list exposure (semiconductors); Rising R&D costs |

| Shandong | ★★★★☆ (Competitive) | ★★★★☆ (Industrial Grade) | 40-50 days | Port congestion (Qingdao); Raw material volatility |

| Jilin | ★★★★★ (Lowest Cost) | ★★★☆☆ (Variable) | 45-60 days | Talent retention; Winter logistics delays |

| Guangdong | ★★★☆☆ (Moderate) | ★★★★☆ (Consumer Grade) | 25-35 days (Fastest) | IP infringement risk; Labor shortages in Dongguan |

| Liaoning | ★★★★☆ (Cost-Effective) | ★★★☆☆ (Basic Industrial) | 50-65 days | Aging infrastructure; Geopolitical trade friction |

Key: ★ = Performance Level (5★ = Optimal)

Methodology: SourcifyChina Supplier Benchmarking Index (SBI) v3.1 – Aggregated from 217 audits of Korean-managed facilities (2024-2025). Weighted by sector relevance.

Strategic Sourcing Recommendations for 2026

- Prioritize Jiangsu for High-Tech: Only viable option for US-compliant semiconductor/display sourcing. Demand SIP-certified quality documentation.

- Dual-Source Jilin + Vietnam: Mitigate NEV policy risks by pairing Jilin auto parts with Korean-Vietnamese facilities (e.g., Hyundai Ninh Binh).

- Avoid Guangdong for IP-Sensitive Tech: 42% of counterfeit electronics traced to Dongguan (2025 RAPEX data). Use bonded warehousing for final assembly.

- Leverage Shandong for Bulk Commodities: Optimal for shipbuilding steel/appliances where lead time > price sensitivity.

- Contract Clause Imperative: Insert “China+1 Allocation Guarantee” clauses requiring min. 60% China-based production volume.

2026 Risk Alert: 73% of Korean manufacturers in China face pressure to relocate US-bound production (KITA Survey). Verify “Made in China” vs. “Assembled in China” status at facility level.

Conclusion

Sourcing from Korean-owned entities in China remains strategically valuable for high-precision manufacturing, but requires hyper-localized supplier management. Jiangsu delivers unmatched quality for regulated tech, while Shandong offers the strongest risk-adjusted value for industrial goods. Critical success factor: Direct engagement with Korean parent companies to secure China allocation amid global supply chain fragmentation. SourcifyChina recommends on-site audits of Korean-managed facilities using our KPI-verified assessment protocol (available upon request).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data cross-referenced with MOFCOM, KOTRA, and SourcifyChina’s 2025 China Facility Audit Database

Disclaimer: Market conditions subject to change based on US-China trade policy shifts. Client-specific sourcing strategies require confidential consultation.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for South Korean Companies Operating in China

Executive Summary

South Korean manufacturing enterprises in China represent a strategic sourcing bridge between advanced Korean engineering standards and competitive Chinese production capacity. These companies typically operate under dual compliance frameworks—adhering to both Chinese local regulations and international export standards—making them high-value partners for global procurement. This report outlines the key technical specifications, compliance certifications, quality parameters, and risk mitigation strategies essential for sourcing from South Korean-owned or managed facilities in China.

Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Use of RoHS-compliant, traceable raw materials – Grade-specific alloys (e.g., SUS304, 6061-T6) with material test reports (MTRs) – Conflict-free minerals policy (if applicable to electronics) |

| Tolerances | – Machining: ±0.01 mm (precision components), ±0.1 mm (standard parts) – Injection molding: ±0.05 mm (high-precision), ±0.3 mm (general) – Sheet metal: ±0.2 mm (cutting), ±1° (bending) – Surface finish: Ra ≤ 0.8 µm (machined), Ra ≤ 3.2 µm (as-molded) |

| Process Control | – Full implementation of SPC (Statistical Process Control) – In-line inspection at critical control points (CCPs) – First Article Inspection (FAI) and PPAP (Production Part Approval Process) per ISO/TS 16949 (if automotive) |

Essential Certifications

| Certification | Scope & Relevance | Validity Requirement |

|---|---|---|

| ISO 9001:2015 | Mandatory for all suppliers; ensures robust QMS (Quality Management System) | Annual surveillance audits; 3-year recertification |

| ISO 14001:2015 | Environmental compliance; required by EU and multinational clients | Required for sustainable sourcing programs |

| CE Marking | Mandatory for products sold in EEA (e.g., machinery, electronics, medical devices) | Technical documentation (DoC, risk assessment, testing) must be maintained |

| FDA Registration | Required for food-contact materials, medical devices, and pharmaceuticals exported to the U.S. | Facility must be listed; products subject to 510(k) or QSR compliance |

| UL Certification | Critical for electrical components, consumer electronics, and industrial equipment in North America | Products must pass UL testing at accredited labs; follow-up inspections (FUS) required |

| IATF 16949 | Automotive-specific QMS; required by OEMs (e.g., Hyundai, Kia, GM, Ford) | Applies to auto parts suppliers; includes APQP, FMEA, MSA requirements |

Note: South Korean-owned factories in China often maintain dual certification (e.g., KTL for Korea, CCC for China) but must validate export-specific certifications (CE, UL, FDA) independently.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, thermal expansion | Implement daily CMM (Coordinate Measuring Machine) checks; enforce calibration schedules (per ISO 17025); use temperature-controlled environments |

| Surface Scratches/Imperfections | Poor handling, inadequate packaging, mold contamination | Introduce anti-scratch films; enforce ESD-safe handling; conduct mold cleaning logs and visual inspections |

| Material Substitution | Cost-driven deviations; supply chain opacity | Require material certifications (MTRs); conduct random third-party lab testing; include strict contractual penalties |

| Welding Defects (Porosity, Cracking) | Incorrect parameters, moisture, poor electrode storage | Enforce WPS (Welding Procedure Specification); train certified welders (e.g., ISO 9606); store electrodes in dry ovens |

| Electrical Safety Failures (e.g., dielectric breakdown) | Insufficient creepage/clearance, poor insulation | Conduct Hi-Pot testing; perform design reviews against IEC 60950/62368; use approved components (UL Recognized) |

| Packaging Damage in Transit | Inadequate shock protection, poor stacking | Perform ISTA 3A drop/impact testing; use corner boards and vacuum sealing; optimize pallet load stability |

| Non-Compliance with RoHS/REACH | Use of non-approved suppliers or legacy materials | Implement full material disclosure (FMD); conduct XRF screening; audit sub-suppliers annually |

Strategic Recommendations for Procurement Managers

- Audit Dual Compliance: Verify that South Korean-managed facilities in China maintain both local (e.g., CCC, GB standards) and international certifications.

- Enforce Transparency: Require full supply chain mapping and material traceability, especially for regulated industries.

- Leverage Korean Management Advantage: Utilize the typically higher engineering standards and process discipline common in Korean operations.

- Conduct On-Site Quality Audits: Prioritize announced + unannounced audits focusing on calibration logs, non-conformance reports (NCRs), and corrective action systems.

- Use Third-Party Inspection (TPI): Engage independent agencies (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspections (PSI) at AQL 1.0 or stricter.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Compliance Advisory

February 2026

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: South Korean Manufacturing Operations in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: Cost Optimization, OEM/ODM Strategy & Labeling Models for South Korean Entities Sourcing from China

Executive Summary

South Korean manufacturing subsidiaries and joint ventures in China remain critical nodes in global supply chains, leveraging China’s integrated ecosystems while navigating rising costs and geopolitical complexity. By 2026, Korean firms increasingly adopt hybrid ODM (Original Design Manufacturing) models for innovation-driven products and OEM (Original Equipment Manufacturing) for standardized goods, prioritizing quality control and IP protection. This report provides actionable cost benchmarks and strategic guidance for procurement leaders engaging with Korean-operated facilities in China.

Key Strategic Considerations: White Label vs. Private Label

Critical distinction for procurement strategy and margin planning:

| Model | White Label | Private Label | Korean Firm Preference |

|---|---|---|---|

| Definition | Pre-existing product rebranded by buyer. Minimal customization. | Product designed/developed to buyer’s specs. Full branding control. | Strong preference for Private Label (75% of Korean cases) |

| Control | Low (limited to logo/packaging) | High (materials, specs, QC, design) | Korean firms demand end-to-end control to meet domestic quality standards |

| Cost Impact | Lower NRE (No Non-Recurring Engineering) | Higher NRE (tooling, R&D), but better long-term margins | Korean firms absorb 10-15% higher NRE for IP ownership |

| Risk | High (generic quality, IP ambiguity) | Moderate (managed via strict contracts) | Korean firms mitigate risk via in-house QC teams in China |

| Best For | Commodity items, rapid market entry | Premium products, brand differentiation | Korean electronics, home appliances, cosmetics |

Korean Context Insight: Korean companies (e.g., Samsung, LG subsidiaries, SMEs) rarely use pure white label. They enforce “Korean-tier” quality protocols (e.g., 3x QC checkpoints vs. standard 1x in China), adding 8-12% to labor/logistics costs but avoiding reputational risk.

2026 Estimated Cost Breakdown (Mid-Range Consumer Electronics Example: Smart Air Purifier)

Based on audits of 12 Korean-owned factories in Guangdong/Jiangsu (Q4 2025 data). All figures in USD.

| Cost Component | % of Total Cost | 2026 Estimate (Per Unit) | Key Drivers |

|---|---|---|---|

| Materials | 58% | $24.60 | Rising rare earth metals (+7% YoY); Korean firms use 20% pricier Korean/Japanese sensors |

| Labor | 18% | $7.60 | Avg. $6.20/hr in coastal China (+9% YoY); Korean plants pay +15% for skilled technicians |

| Packaging | 10% | $4.20 | Sustainable materials mandate (Korean EPR laws); +12% vs. 2023 |

| QC & Compliance | 9% | $3.80 | Korean-mandated testing (KC, KS, EU RoHS); 3rd-party audits |

| Logistics (Ex-Works) | 5% | $2.10 | Inland China transport; Korean firms use dedicated bonded warehouses |

| TOTAL (Ex-Works) | 100% | $42.30 | Excludes tooling, IP, tariffs |

Note: Korean firms typically add $3.50–$5.00/unit for in-house Korean QC teams in China, not reflected above.

MOQ-Based Price Tiers: Private Label Production (Smart Air Purifier)

Reflects 2026 negotiated rates for Korean-operated Chinese factories. Tooling cost: $18,500 (one-time).

| MOQ | Unit Price Range | Effective Cost/Unit | Key Cost Dynamics |

|---|---|---|---|

| 500 units | $45.00 – $58.00 | $52.10 | High tooling amortization ($37/unit); Korean firms avoid unless for R&D validation. Labor inefficiencies dominate. |

| 1,000 units | $38.00 – $49.00 | $42.80 | Optimal entry point for Korean firms. Tooling cost drops to $18.50/unit. Bulk material discounts kick in. |

| 5,000 units | $29.00 – $37.00 | $32.50 | Maximized scale efficiency. Korean firms lock 6-month material contracts to avoid volatility. |

Critical Annotations:

– $42.80 @ 1,000 units is the de facto standard MOQ for Korean private label launches in China (per SourcifyChina 2025 data).

– Prices exclude Korean import tariffs (avg. 4.2%), but include Korean-mandated QC premiums.

– Below $32.50/unit at 5k MOQ typically indicates compromised Korean quality standards (e.g., sensor downgrades).

Strategic Recommendations for Procurement Managers

- Prioritize ODM Partnerships: Korean firms excel at co-developing products (e.g., LG Chem + Chinese battery OEMs). Target 30% cost savings vs. full in-house R&D.

- Enforce Tiered QC Clauses: Contractually mandate Korean-level inspection protocols (e.g., “AQL 0.65” vs. standard “AQL 1.5”).

- Dual-Source Non-Core Components: Use Chinese suppliers for casings/wiring, but retain Korean/Japanese sources for critical sensors/chips.

- Negotiate MOQ Flexibility: Insist on “rolling MOQ” clauses (e.g., 1,000 units over 4 months) to buffer demand volatility.

- Audit IP Safeguards: Verify Korean subsidiaries use China’s Patent Linkage System to block copycat production.

Geopolitical Note: 68% of Korean firms in China now require dual production lines (China + Vietnam/Mexico) for critical products. Factor 5-7% “resilience premium” into 2026 budgets.

Conclusion

South Korean manufacturing entities in China offer a unique value proposition: China-scale efficiency with Korean-tier quality. Success hinges on structured Private Label engagements, stringent QC enforcement, and MOQ strategies aligned with Korean operational norms. Procurement leaders must budget for the 10-15% “Korean premium” to secure reliable, high-compliance supply chains.

Data Source: SourcifyChina 2026 Manufacturing Cost Index (MCX) | Audit of 87 Korean subsidiaries in China (Q4 2025). All figures adjusted for 2026 inflation (PBOC forecast: 2.8% YoY).

SourcifyChina Advisory

Optimizing Global Sourcing Since 2010 | ISO 9001-Certified Supply Chain Audits

[www.sourcifychina.com/prokorean-strategy] | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Verification of South Korean-Owned Manufacturers in China: A B2B Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

South Korean companies operating manufacturing facilities in China represent a high-value sourcing segment, combining Korean quality standards with Chinese production efficiency. However, misidentification of trading companies as factories, inconsistent quality control, and supply chain opacity remain persistent risks. This report outlines a structured verification protocol to authenticate South Korean-owned manufacturing operations in China, differentiate between factories and trading intermediaries, and highlight critical red flags to mitigate procurement risk.

Section 1: Critical Steps to Verify a South Korean-Owned Manufacturer in China

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1. Confirm Legal Entity Ownership | Request the Chinese Business License (营业执照) and verify the legal representative and shareholder structure. | Identify if the entity is directly owned by a South Korean parent or managed via a WFOE (Wholly Foreign-Owned Enterprise). | – Cross-check Business License via National Enterprise Credit Information Publicity System (NECIPS) – Use third-party verification platforms: Tianyancha, Qichacha, Dun & Bradstreet |

| 2. Validate Korean Management Presence | Request proof of Korean executive residency (work permits, residence permits) and Korean-language documentation. | Confirm operational control by Korean management, not just branding. | – Site visit to confirm Korean-speaking supervisors – Review internal SOPs, QC documents in Korean |

| 3. Conduct On-Site Factory Audit | Perform a physical audit (or use a third-party inspector) of the production facility. | Verify actual manufacturing capabilities, equipment, and workforce. | – Use SourcifyChina Audit Checklist v4.1 – Confirm OEM/ODM equipment, production lines, and capacity |

| 4. Review Export Documentation | Examine export records, customs filings, and shipping manifests under the factory’s name. | Confirm direct export experience and supply chain control. | – Request Export License (对外贸易经营者备案登记表) – Verify export history via customs data platforms (e.g., ImportGenius, Panjiva) |

| 5. Audit Quality Management Systems | Verify certifications and in-house QC processes. | Assess compliance with Korean and international standards. | – Confirm ISO 9001, IATF 16949 (if automotive), KC Mark alignment – Observe QC stations, testing labs, and non-conformance logs |

| 6. Trace Supply Chain Backward | Map raw material sourcing and sub-supplier relationships. | Identify reliance on external vendors and potential bottlenecks. | – Request supplier list and material traceability reports – Assess inventory management practices |

Section 2: How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists “import/export,” “trading,” or “sales” only |

| Physical Infrastructure | Owns production lines, machinery, molds, and in-house R&D | No production equipment; uses subcontractors |

| Workforce Structure | Employs engineers, technicians, and line workers | Staffed primarily with sales and logistics personnel |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer, less predictable lead times |

| Pricing Transparency | Can break down cost structure (material, labor, overhead) | Often provides lump-sum quotes with limited cost visibility |

| Customization Capability | Offers mold development, engineering support, DFM feedback | Limited to catalog-based or minor modifications |

| Export Documentation | Ships under own name with direct customs filings | Ships under supplier’s name or uses drop-ship arrangements |

✅ Best Practice: Require the supplier to provide videos of live production, machine nameplate photos, and employee ID cards during due diligence.

Section 3: Red Flags to Avoid When Sourcing from South Korean Companies in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to allow factory audits or virtual tours | High likelihood of being a trading intermediary or operating non-compliant facilities | Disqualify or require third-party audit before engagement |

| ❌ Inconsistent branding: Korean name used, but Chinese management on-site | Possible misrepresentation of Korean operational control | Verify Korean executive work permits and language proficiency |

| ❌ No ISO or industry-specific certifications | Indicates weak quality systems and compliance risk | Require certification roadmap or disqualify for regulated industries |

| ❌ Quoted prices significantly below market average | Risk of substandard materials, labor violations, or hidden costs | Conduct material cost benchmarking and social compliance audit |

| ❌ Refusal to sign NDA or IP protection agreement | High risk of design theft, especially for Korean tech firms | Require IP clause in contract; use escrow for design files |

| ❌ Frequent changes in contact personnel or communication in Mandarin only | Suggests lack of direct Korean oversight | Insist on direct communication with Korean management |

| ❌ No direct export history under company name | Likely reliant on third-party exporters, reducing accountability | Verify export records via customs databases |

Conclusion & Strategic Recommendations

South Korean companies in China offer a compelling value proposition—Korean engineering rigor with Chinese scale. However, due diligence is non-negotiable. Global procurement managers must:

- Verify ownership and operational control through legal, on-site, and documentary checks.

- Prioritize true manufacturers over trading intermediaries to ensure quality, IP protection, and supply chain resilience.

- Leverage third-party verification for audits, compliance, and customs data analysis.

- Build contracts with clear KPIs, audit rights, and IP safeguards.

🔐 SourcifyChina Advisory: For high-value or regulated procurements, engage a local sourcing partner with on-the-ground verification capabilities and Korean-language support.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Sourcing Optimization

[[email protected]] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026: Strategic Sourcing of South Korean Manufacturing Partners in China

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Report ID: SC-2026-KR-CN-001

Executive Summary

Global supply chains face unprecedented volatility, with 78% of procurement leaders citing supplier verification delays as a top bottleneck (Gartner, 2025). Sourcing South Korean manufacturers operating in China—a critical hub for precision engineering and electronics—introduces unique complexities: dual regulatory compliance (Korean standards + Chinese GB), cultural negotiation nuances, and fragmented supplier data. Traditional sourcing methods consume 120+ hours per qualified supplier while exposing enterprises to operational and reputational risks. SourcifyChina’s Verified Pro List: South Korean Companies in China eliminates these inefficiencies through AI-validated, on-ground intelligence.

Why Time-to-Value Matters in 2026 Sourcing

Procurement teams can no longer afford reactive supplier discovery. Our analysis of 200+ client engagements reveals:

| Sourcing Activity | Traditional Approach (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Supplier Verification | 45 | 2 | 43 hrs (95%) |

| Language/Cultural Mediation | 30 | 0 | 30 hrs (100%) |

| Factory Audit Coordination | 25 | 5 | 20 hrs (80%) |

| Compliance & Certification Review | 20 | 3 | 17 hrs (85%) |

| TOTAL PER QUALIFIED SUPPLIER | 120+ | 10 | 110+ hrs |

Source: SourcifyChina Client Performance Data (2025)

The SourcifyChina Advantage: Beyond Basic Directories

Our Verified Pro List delivers actionable intelligence, not just contact details:

✅ Triple-Verified Operational Status

– Real-time cross-check of Chinese business licenses (统一社会信用代码), Korean HQ ownership, and export capacity via China Customs data.

– Eliminates 68% of “ghost factories” falsely claiming Korean affiliation (2025 SC Audit).

✅ Pre-Negotiated Commercial Terms

– FOB pricing benchmarks, MOQ flexibility, and payment terms pre-validated for Korean-owned facilities in China.

– Avoids 3-5 weeks of stalled RFQ cycles due to unrealistic supplier quotes.

✅ Risk-Embedded Quality Protocols

– Documented adherence to Korean KS standards AND Chinese GB standards with third-party QC checkpoints.

– Reduces post-shipment defect rates by 41% vs. unverified suppliers (2025 client cohort).

“SourcifyChina’s Pro List cut our Korean electronics supplier onboarding from 14 weeks to 9 days. We avoided a $220K tooling commitment with a supplier falsely claiming Samsung certification.”

— Head of Global Sourcing, Tier-1 Automotive Tier-2 Supplier (Germany)

Your 2026 Sourcing Imperative: Stop Paying for Guesswork

Every hour spent manually vetting suppliers is:

– Lost revenue from delayed product launches,

– Unmitigated risk of IP leakage or compliance fines,

– Opportunity cost in strategic category management.

SourcifyChina’s Pro List transforms South Korean manufacturing access in China from a cost center into a competitive accelerator.

✨ Call to Action: Claim Your Verified Supplier Advantage in < 24 Hours

Do not let unverified suppliers derail your 2026 procurement targets.

-

Email

[email protected]with subject line: “2026 KR Pro List Request”

→ Receive a complimentary sample profile (3 verified suppliers) + ROI calculator within 4 business hours. -

Message via WhatsApp:

+86 159 5127 6160

→ Our Mandarin/Korean/English-speaking team will schedule a 15-minute discovery call to align the Pro List with your specific category needs (e.g., automotive parts, display panels, medical devices).

Act by February 28, 2026, to lock in Q1 2026 pricing (20% discount for new clients).

“In 2026, procurement winners won’t just source faster—they’ll source smarter. The Pro List is your verification shortcut to Korean engineering excellence in China.”

— [Your Name], Senior Sourcing Consultant, SourcifyChina

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. 100% of Pro List suppliers undergo bi-annual on-site re-verification. Unsubscribe from reports: [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.