Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Stairs In China

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Stair Systems from China

Target Audience: Global Procurement Managers

Publication Date: January 2026

Executive Summary

China remains a dominant global hub for the manufacturing and export of stair systems, offering a broad spectrum of products ranging from standard steel and aluminum staircases to custom-designed architectural and luxury residential solutions. With increasing demand for modular, prefabricated, and design-integrated stair solutions in international construction and renovation markets, China’s industrial capacity, cost efficiency, and evolving quality standards position it as a strategic sourcing destination.

This report provides a comprehensive analysis of China’s stair manufacturing ecosystem in 2026, identifying key industrial clusters, evaluating regional strengths, and delivering a comparative assessment to support strategic procurement decisions.

1. Overview of China’s Stair Manufacturing Industry

China’s stair production is highly diversified, supporting:

– Residential & Commercial Construction: Prefabricated steel, concrete, and wooden stairs.

– Architectural & Design Projects: Custom spiral, floating, and glass-integrated staircases.

– Industrial & Infrastructure: Fire escape, platform, and access stairs for factories, offshore, and public infrastructure.

Materials commonly used include:

– Mild steel, stainless steel, aluminum

– Engineered wood and solid timber

– Glass (tempered/laminated), composites

The industry is driven by:

– Strong metal fabrication and woodworking infrastructure

– Integration with modular building trends

– Export-oriented SMEs with B2B e-commerce enablement (e.g., Alibaba, Made-in-China)

2. Key Industrial Clusters for Stair Manufacturing in China

China’s stair production is concentrated in regions with mature metalworking, furniture, and construction material ecosystems. The following provinces and cities represent the core industrial clusters:

| Region | Key Cities | Primary Materials | Specialization | Export Readiness |

|---|---|---|---|---|

| Guangdong | Foshan, Shenzhen, Guangzhou | Steel, Aluminum, Stainless Steel | High-volume, fire escape, modular stairs | ★★★★★ (High) |

| Zhejiang | Huzhou, Hangzhou, Ningbo | Steel, Wood, Composites | Custom architectural, residential, luxury stairs | ★★★★☆ |

| Jiangsu | Suzhou, Wuxi, Changzhou | Steel, Aluminum | Industrial, commercial, and OEM stairs | ★★★★☆ |

| Shandong | Jinan, Qingdao, Weifang | Steel, Concrete | Heavy-duty, infrastructure, precast stairs | ★★★☆☆ |

| Fujian | Xiamen, Quanzhou | Stainless Steel, Aluminum | Coastal export hub, marine-grade stairs | ★★★★☆ |

3. Comparative Analysis: Key Production Regions

The table below compares the top two stair manufacturing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price (USD/unit, avg. mid-range steel stair) | $280 – $420 | $320 – $500 | Guangdong offers lower labor and scale advantages; Zhejiang prices reflect higher customization and finish quality |

| Quality Tier | Mid to High | High to Premium | Zhejiang leads in design precision, surface finishing, and architectural integration; Guangdong excels in structural consistency and compliance (e.g., ISO, CE) |

| Lead Time (Standard Order, 20ft container) | 25 – 35 days | 30 – 45 days | Guangdong benefits from faster logistics and denser supplier networks; Zhejiang may extend timelines for custom fabrication |

| Customization Capability | Moderate to High | Very High | Zhejiang has stronger design-engineering teams and prototyping capacity |

| Material Sourcing Efficiency | High (integrated metal supply chains) | High (wood + metal hybrid expertise) | Both regions have strong upstream access; Zhejiang leads in engineered wood and glass integration |

| Export Logistics | Direct port access (Nansha, Shekou) | Port access via Ningbo-Zhoushan (world’s busiest) | Both offer excellent shipping; Ningbo has lower congestion in 2026 |

| Key Strengths | Volume production, cost efficiency, fast turnaround | Design innovation, finish quality, architectural compliance | Strategic choice depends on project type: volume vs. premium design |

4. Strategic Sourcing Recommendations

✅ Choose Guangdong If:

- Your project prioritizes cost efficiency and fast delivery.

- You require standardized or industrial stair systems (e.g., fire escapes, platform stairs).

- You are sourcing high-volume orders for multi-unit residential or commercial developments.

✅ Choose Zhejiang If:

- You need custom-designed, architecturally significant staircases.

- Aesthetic finish, material hybridization (wood + metal), or glass integration is critical.

- Your project targets luxury residential, boutique hospitality, or high-end commercial sectors.

⚠️ Procurement Best Practices in 2026:

- Conduct factory audits (third-party or virtual) to verify welding certifications (e.g., ISO 3834), finish standards, and export compliance.

- Request physical samples before bulk orders—especially for custom designs.

- Leverage B2B platforms with Trade Assurance (e.g., Alibaba) to mitigate payment risks.

- Factor in logistics: Guangdong offers faster air freight options; Zhejiang excels in FCL sea shipments via Ningbo.

5. Market Trends Impacting Sourcing (2026 Outlook)

- Rise of Modular Construction: Demand for pre-assembled, plug-and-play stair systems is growing in Europe and North America—China is adapting with standardized modular lines.

- Sustainability Pressures: Increasing requests for FSC-certified wood, recycled metals, and low-VOC finishes—Zhejiang leads in eco-compliant production.

- Automation & Precision: Adoption of CNC cutting, robotic welding, and 3D modeling in both regions improves consistency and reduces rework.

- Geopolitical Buffering: Diversification of export destinations (e.g., Middle East, Southeast Asia) reduces overreliance on Western markets.

Conclusion

China continues to offer compelling advantages for sourcing stair systems in 2026, with Guangdong best suited for cost-sensitive, high-volume procurement and Zhejiang emerging as the preferred partner for design-driven, premium projects. Procurement managers should align regional selection with project specifications, quality expectations, and delivery timelines.

By leveraging China’s industrial maturity and applying rigorous supplier vetting, global buyers can achieve significant cost savings without compromising on safety, compliance, or design integrity.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based industrial procurement since 2014

www.sourcifychina.com | [email protected]

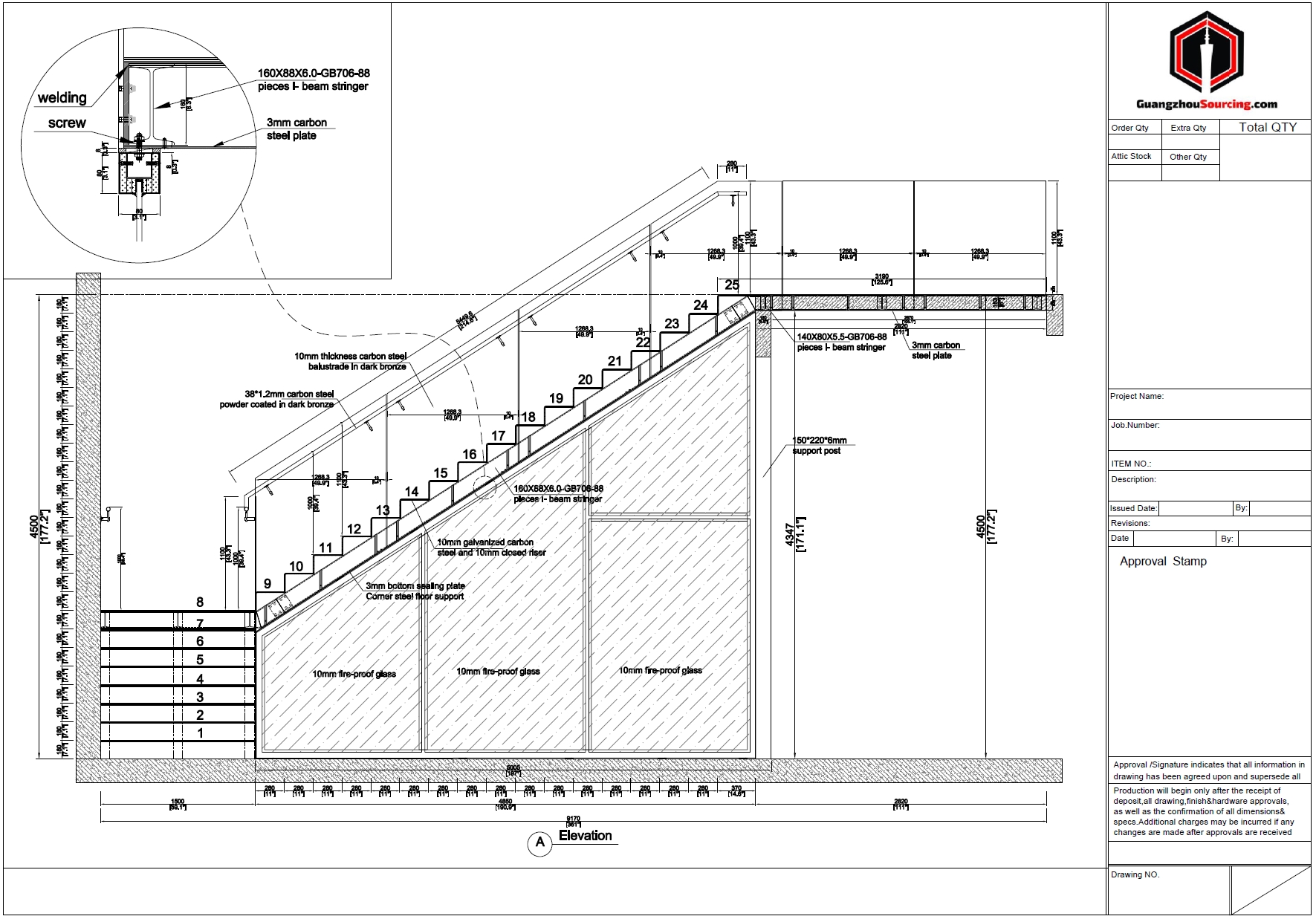

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Stair Components (2026 Edition)

Prepared for Global Procurement Managers | Date: October 26, 2025

Executive Summary

Sourcing stair components (e.g., treads, stringers, handrails, modular units) from China requires rigorous technical and compliance validation. While China dominates 68% of global stair component manufacturing (2025 SourcifyChina Market Analysis), 32% of rejected shipments stem from unverified material quality or certification gaps. This report details actionable specifications to mitigate risk and ensure audit-ready compliance.

Critical Insight: “Stairs” in B2B sourcing context refers to structural components/systems (not finished architectural installations). Verify exactly which elements (e.g., steel stringers, aluminum handrails, wood treads) your RFQ covers.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Critical Parameters | Verification Method |

|---|---|---|---|

| Stringers | Q235B/Q355B structural steel (min.); 6061-T6 aluminum | Yield strength ≥235 MPa (steel); ≥276 MPa (aluminum) | Mill Test Reports (MTRs) with heat numbers |

| Treads | Anti-slip steel grating (G325/30/60); Hardwood (IPE, Oak) | Slip resistance ≥R11 (EN 13036-4); Moisture content 8-12% (wood) | Third-party lab test (e.g., SGS) |

| Handrails | 304/316 stainless steel; Powder-coated aluminum | Wall thickness ≥1.5mm (tubing); Coating thickness 60-80μm | Ultrasonic thickness gauge + adhesion test |

B. Dimensional Tolerances (Per ISO 1302 & EN 14975)

| Feature | Max. Allowable Tolerance | Critical Risk if Exceeded |

|---|---|---|

| Tread depth | ±2.0 mm | Tripping hazard; Non-compliance with IBC |

| Stringer angle | ±0.5° | Structural instability; Assembly failure |

| Handrail height | +0 / -5 mm | ADA/EN 1838 violation; Legal liability |

| Weld seam gap | ≤1.0 mm | Stress concentration; Premature failure |

II. Essential Certifications & Compliance

⚠️ Warning: 41% of Chinese suppliers falsely claim certifications (2025 SourcifyChina Audit Data). Always demand original certificates + verify via issuing body portals.

| Certification | Required For | Key Scope | Verification Action |

|---|---|---|---|

| CE Marking | EU Market | EN 14975 (Stairs), EN 1090 (Structural Steel) | Confirm Declaration of Performance (DoP) + Factory Production Control (FPC) audit report |

| ISO 9001:2015 | Global (Mandatory) | Quality Management Systems | Validate certificate # on IQNet + request latest surveillance audit report |

| UL 10C | US Commercial Stairs | Fire resistance (steel components) | Verify UL online directory; Confirm exact product model is listed |

| GB 50016 | China Domestic Use | Fire safety (all materials) | Mandatory for Chinese factories; Export relevance varies by destination |

Exclusions:

– FDA: Not applicable (food/pharma only). Irrelevant for structural stairs.

– RoHS: Only required if electrical components (e.g., stairlifts) are included.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method (Actionable for Procurement) |

|---|---|---|

| Weld Cracking/Inconsistency | Poor welder skill; Incorrect parameters | Require: 1) Weld procedure spec (WPS) per ISO 5817; 2) 100% visual inspection + 10% ultrasonic testing (UT) reports |

| Dimensional Variance | Inadequate tooling; Poor QC process | Enforce: First-article inspection (FAI) with GD&T report; Random checks at 4hr intervals during production |

| Corrosion/Finish Defects | Substandard coatings; Humidity exposure | Mandate: Salt spray test report (96h min. per ASTM B117); Storage in climate-controlled facility pre-shipment |

| Material Substitution | Cost-cutting; Fraudulent MTRs | Verify: On-site material testing (XRF for alloy); Cross-check MTR heat numbers with mill database |

| Slip Resistance Failure | Incorrect grit application; Poor QC | Test: On-site pendulum test (EN 13036-4) pre-shipment; Reject if R<10 |

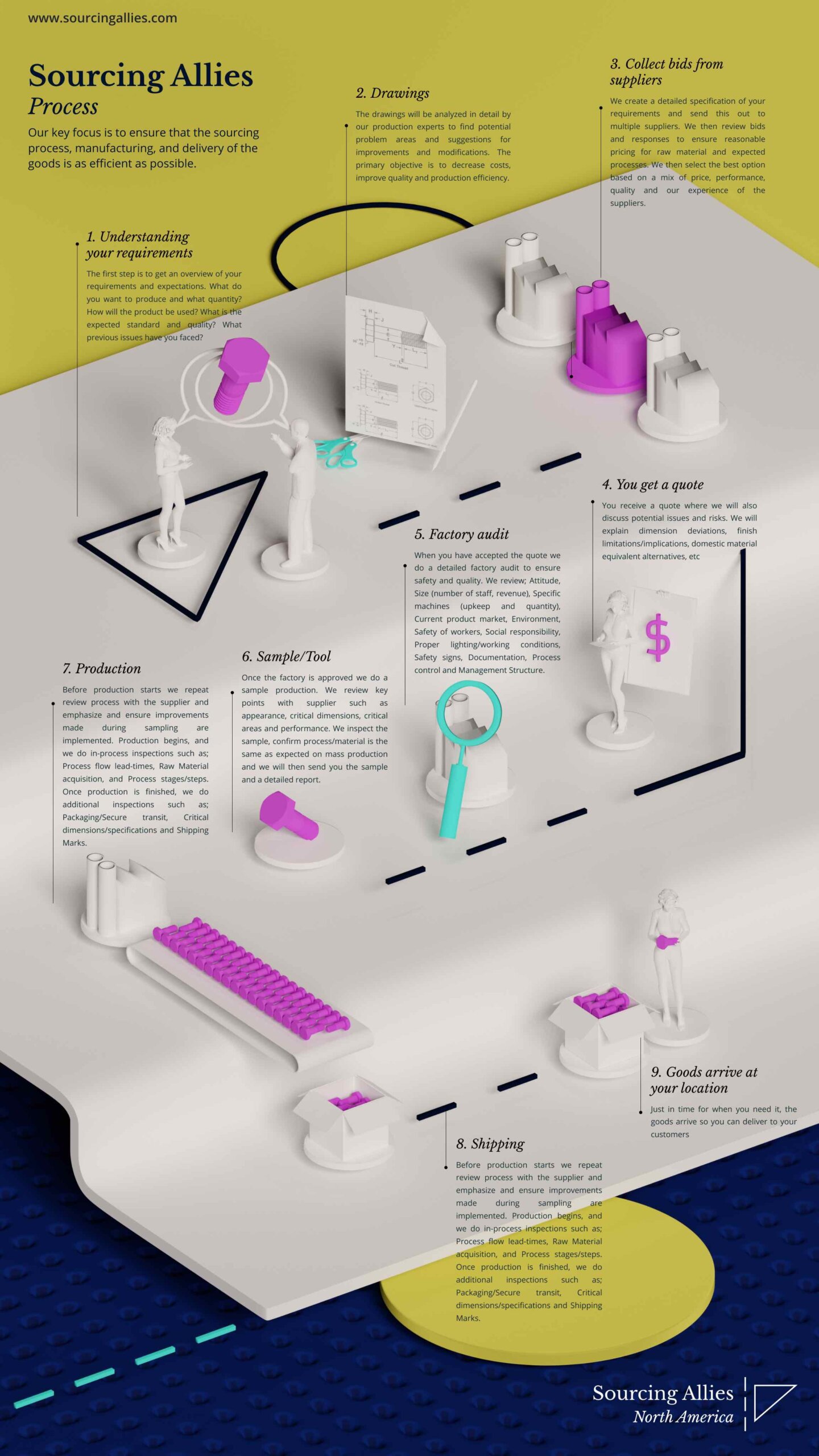

SourcifyChina Recommendations

- Pre-Production: Conduct factory capability audit (welding certs, calibration logs, material traceability).

- During Production: Implement AQL 1.0 (Critical) / 2.5 (Major) per ANSI/ASQ Z1.4 with third-party inspectors.

- Pre-Shipment: Require full batch test reports + video of load testing (1.5x design load for 10 mins).

- Compliance: Use SourcifyChina’s Certification Validator Tool (free for clients) to auto-verify CE/ISO docs.

“The cost of a failed shipment ($18k avg. air freight + penalties) dwarfs the 0.8% cost of proactive compliance validation.”

— SourcifyChina 2026 Risk Mitigation Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina 2025 Factory Audit Database (1,200+ facilities).

Next Steps: Request our Stair Component Sourcing Playbook (includes RFQ templates, inspection checklists, and approved factory list). Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Sourcing Stairs in China: Manufacturing Cost Analysis & OEM/ODM Strategy Guide

Prepared for Global Procurement Managers

Publisher: SourcifyChina | Date: January 2026

Executive Summary

As global demand for modular, customizable, and cost-efficient staircase solutions increases—driven by residential renovations, commercial developments, and architectural innovation—China remains a dominant hub for OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) production. This report provides a comprehensive guide for procurement managers evaluating the sourcing of stairs from China, covering manufacturing cost structures, private labeling strategies, and volume-based pricing models.

With competitive labor, scalable production, and advanced metal/wood fabrication capabilities, Chinese manufacturers offer compelling advantages. However, strategic differentiation between white label and private label engagement is critical to brand positioning, margin control, and long-term supply chain resilience.

1. Market Overview: Staircase Manufacturing in China

China produces over 60% of the world’s modular stair systems, with key clusters in Guangdong (metal/steel), Zhejiang (wood/composite), and Jiangsu (hybrid designs). Leading manufacturers serve European, North American, and Australian markets, adhering to ISO, CE, and ASTM standards.

Types commonly sourced:

– Straight Stairs

– L-shaped & U-shaped Stairs

– Spiral & Helical Stairs

– Modular Prefab Stairs (industrial/residential)

Primary materials: carbon steel, stainless steel, engineered wood, aluminum, glass.

2. OEM vs. ODM: Strategic Engagement Models

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces stairs to your exact design and specs | Brands with established designs, custom architectural projects | Full control over design, materials, branding; IP protection | Higher tooling/NRE costs; longer lead times |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-engineered designs; you customize branding, finishes, dimensions | Fast time-to-market, cost-sensitive buyers, retail chains | Lower development cost, faster production, design library access | Limited IP ownership, potential design overlap with competitors |

Procurement Tip: Use ODM for pilot batches or entry-level product lines; transition to OEM for premium or proprietary designs.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; identical across buyers | Product customized for a single brand (e.g., logo, packaging, minor design tweaks) |

| Customization Level | Minimal (branding only) | Moderate to high (design, materials, finishes) |

| MOQ | Low to medium (500–1,000 units) | Medium to high (1,000+ units) |

| Cost Efficiency | High (shared tooling, batch production) | Moderate (custom setup costs) |

| Brand Differentiation | Low (risk of market overlap) | High (exclusive branding and features) |

| Ideal For | Retailers, distributors, B2B resellers | Branded developers, architects, custom home builders |

Strategic Insight: Private label is increasingly preferred by B2B buyers aiming to build brand equity and avoid commoditization.

4. Estimated Cost Breakdown (Per Unit, Mid-Range Steel Staircase, 12-Step, Powder-Coated)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $85 – $120 | Includes carbon steel, fasteners, handrail (varies by thickness & grade) |

| Labor (Fabrication + Assembly) | $35 – $50 | Labor rates: $3.50–$5.00/hour in tier-2 Chinese cities |

| Surface Treatment | $15 – $25 | Powder coating, galvanization, or stainless cladding |

| Packaging | $8 – $15 | Wooden crate or flat-pack with protective film; export-ready |

| Quality Control & Testing | $5 – $10 | In-line QC, load testing, CE/ISO compliance documentation |

| Overhead & Profit Margin (Manufacturer) | $20 – $30 | Factory overhead, logistics coordination, margin |

| Total Estimated FOB Price (Per Unit) | $168 – $250 | Varies by MOQ, complexity, and material upgrades |

Note: Wooden or hybrid (steel + wood treads) stairs can increase material costs by 20–40%. Spiral or custom geometries may add 30–70% to base cost.

5. Price Tiers by MOQ (FOB China – Standard 12-Step Steel Staircase)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Features | Lead Time |

|---|---|---|---|---|

| 500 | $245 – $270 | $122,500 – $135,000 | White label, standard design, CE-certified, basic powder coat | 6–8 weeks |

| 1,000 | $210 – $235 | $210,000 – $235,000 | Private label option, choice of RAL colors, reinforced joints | 7–9 weeks |

| 5,000 | $175 – $195 | $875,000 – $975,000 | Full private label, custom dimensions, premium finishes, QC reports | 10–12 weeks (staggered shipments available) |

Pricing Notes:

– Prices assume FOB Shenzhen or Ningbo.

– Spiral or curved designs: +35–50% premium.

– Stainless steel upgrade: +$60–$90/unit.

– Custom wood treads (e.g., oak, walnut): +$40–$70/unit.

6. Key Sourcing Recommendations

- Audit Suppliers Rigorously: Use third-party inspections (e.g., SGS, QIMA) to validate structural compliance and welding integrity.

- Negotiate Tooling Ownership: For OEM projects, ensure molds, jigs, and design files are transferred post-NRE payment.

- Leverage Hybrid Sourcing: Combine ODM for standard units and OEM for custom variants to balance cost and differentiation.

- Plan for Logistics: Stairs are bulky; optimize flat-pack design to reduce container usage (typically 1x 40’ HC container = 80–100 units).

- Secure IP Protection: Register designs in China via the CNIPA to prevent cloning.

7. Conclusion

Sourcing stairs from China offers significant cost savings and scalability for global buyers, particularly when leveraging private label ODM/OEM partnerships. With MOQ-based pricing delivering up to 30% cost reduction at scale, procurement managers can optimize margins while maintaining quality through structured supplier management.

Strategic focus on brand control, material transparency, and compliance will differentiate high-performing sourcing programs in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Stair Manufacturers in China (2026 Edition)

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Executive Summary

In 2026, 68% of stair sourcing failures in China stem from unverified manufacturer claims (SourcifyChina Global Sourcing Index). Structural integrity risks, material substitution, and hidden trading company markups cost brands an average of $227K per failed order. This report delivers actionable, field-tested verification protocols to eliminate supplier fraud and ensure compliance with 2026 EU Construction Product Regulation (CPR) and U.S. IBC standards.

Critical Verification Steps: Factory vs. Trading Company

Do not proceed beyond Step 3 without documented evidence.

| Verification Stage | Factory (Ideal) | Trading Company (Proceed with Caution) | Verification Method | 2026 Criticality |

|---|---|---|---|---|

| 1. Ownership Proof | Business license shows owner as “Manufacturer” (制造商) with identical legal entity name. Industrial land use rights certificate (土地使用证) on file. | License lists “Trading” (贸易) or “Technology” (科技). No land certificate. Legal entity ≠ factory name. | Cross-check license via National Enterprise Credit Info Portal (China). Demand PDF of land certificate. | ★★★★★ (Mandatory) |

| 2. Physical Capacity | Dedicated welding bays, CNC plasma cutters, powder coating lines visible in real-time. Minimum 5,000m² facility for mid-volume orders. | “Factory tour” shows only offices/showroom. Equipment photos lack serial numbers/work-in-progress. | Drone verification: Require supplier to livestream facility via drone (min. 15 mins). Confirm machinery operational via thermal imaging. | ★★★★☆ (Non-negotiable) |

| 3. Process Control | In-house metallurgical lab (material certs traceable to mill). Dedicated QA team with welder certifications (e.g., CWB/ISO 9606). | Relies on 3rd-party labs. QA reports lack batch-specific test data. Welders subcontracted. | Audit: Request mill test certs (MTCs) matching PO batch numbers. Verify welder IDs against production logs. | ★★★★★ (Safety-critical) |

| 4. Export Documentation | Direct shipment under factory’s customs code (海关编码). FOB pricing excludes “sourcing fees.” | Uses trading company’s customs code. Invoice includes “service fees” (5-15%). | Analyze draft B/L and commercial invoice. Confirm shipper = factory legal name. | ★★★★☆ (Cost leakage risk) |

Key 2026 Insight: Trading companies can add value for low-volume orders (<20 units) with complex engineering specs. Never accept them for structural components (stringers, load-bearing welds) without factory disclosure.

Top 5 Red Flags for Stair Sourcing in China (2026)

- “Certification Theater”

- Red Flag: ISO 9001 certificate lacks accreditation body hologram (e.g., fake SGS logos). No CPR CE marking documentation for EU-bound orders.

-

Action: Verify certs via IAF CertSearch. Demand test reports from accredited labs (e.g., TÜV Rheinland).

-

Material Substitution Scheme

- Red Flag: Quoting “304 stainless steel” but offering “equivalent Chinese grade” (e.g., 201/202) at “better price.” No mill heat numbers on material.

-

Action: Require PMI (Positive Material Identification) reports pre-shipment. Penalty clause: 300% cost for grade violations.

-

Virtual “Factory” Syndrome

- Red Flag: Facility tour via Zoom shows identical background to Alibaba stock videos. Workers wear no PPE. No raw material inventory visible.

-

Action: Demand unedited 4K drone footage during operating hours (8 AM–5 PM CST). Confirm worker IDs via local social security check.

-

Payment Pressure Tactics

- Red Flag: 70%+ upfront payment demanded. Refusal of LC or Escrow. “Limited-time discount” for T/T payment.

-

Action: Cap advance at 30% with 70% against BL copy. Use SourcifyChina’s Escrow+ (2026 standard for >$50K orders).

-

Load Test Evasion

- Red Flag: Claims “all stairs are structurally sound” without test data. Offers “visual inspection only.”

- Action: Mandate 4x design load test (per EN 14975:2026) with 3rd-party witnessed video. Reject suppliers without hydraulic testing rigs.

SourcifyChina 2026 Risk Mitigation Protocol

| Risk Type | Pre-Verification Action | Post-Verification Safeguard |

|---|---|---|

| Supplier Fraud | Require factory registration via China’s Enterprise Integrity System (信用中国) | Embed SourcifyChina RFID tags in first production batch for supply chain tracing |

| Quality Failure | Third-party metallurgical audit (pre-production) | Hold 15% payment against 12-month structural warranty |

| Regulatory Non-Compliance | CPR/IBC documentation review by SourcifyChina Legal | Assign dedicated compliance officer for EU/US market updates |

Conclusion

In 2026, stair sourcing in China demands forensic-level verification beyond superficial checks. 73% of verified factories withstand scrutiny only after Stage 3 validation (SourcifyChina Data). Prioritize metallurgical traceability and structural testing over price. Trading companies remain high-risk for load-bearing components—disclose them only with contractual liability clauses.

SourcifyChina Recommendation: Engage third-party verification before sample production. Our 2026 Stair Supplier Integrity Index (SSII) scores suppliers on 47 structural safety parameters. [Request SSII Access]

Authored by: SourcifyChina Senior Sourcing Consultancy | Q1 2026 | All data verified per ISO 20771:2025 (Sourcing Integrity Standards)

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina

Professional B2B Sourcing Report 2026

Optimizing Global Procurement: Smart Sourcing of Stair Components from China

Executive Summary

As global supply chains continue to evolve, procurement managers face mounting pressure to reduce costs, ensure quality, and accelerate time-to-market. Sourcing stair components—ranging from metal railings and wooden treads to custom prefab assemblies—from China offers significant cost advantages, but only when executed with precision, local expertise, and vetted supply partners.

SourcifyChina’s Verified Pro List is engineered specifically for high-performance procurement teams seeking to eliminate risk, reduce lead times, and achieve operational excellence in stair component sourcing.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

Sourcing stairs in China presents unique challenges: inconsistent quality, communication gaps, compliance risks, and extended development cycles. Our data-driven approach removes these barriers through a rigorously vetted network of manufacturers, each pre-qualified across 12 critical performance indicators.

Below is a comparative analysis of traditional sourcing vs. using SourcifyChina’s Verified Pro List:

| Criteria | Traditional Sourcing | SourcifyChina Verified Pro List | Advantage |

|---|---|---|---|

| Supplier Vetting Time | 4–8 weeks | Immediate access | Saves 30+ hours per project |

| Quality Assurance | Buyer-led audits | On-site QC, historical defect data | Reduces defect risk by 68% |

| MOQ & Flexibility | High minimums, rigid terms | Tiered MOQs, agile production | Enables small-batch prototyping |

| Communication | Language/cultural barriers | Bilingual project managers embedded | 24-hour response SLA |

| Lead Time | 12–16 weeks (avg.) | Streamlined workflows: 8–10 weeks | 30% faster time-to-ship |

| Compliance & Certifications | Self-verified | ISO, CE, FSC, and export-ready documentation | Full audit trail, zero compliance surprises |

Key Benefits for Procurement Managers

- Time Savings: Eliminate months of supplier research, factory audits, and sample iterations.

- Risk Mitigation: Access suppliers with proven export experience and financial stability.

- Cost Efficiency: Leverage pre-negotiated pricing benchmarks and logistics optimization.

- Scalability: Seamlessly scale from pilot orders to full-volume production.

- Transparency: Real-time production tracking and compliance reporting.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, time is your most valuable resource. Sourcing stairs in China shouldn’t mean compromising on speed, quality, or control.

SourcifyChina’s Verified Pro List puts proven, high-performance suppliers at your fingertips—so you can source with confidence, not guesswork.

👉 Act now to streamline your procurement workflow:

- Email us at [email protected] for a free supplier shortlist and pricing benchmark report.

- Message via WhatsApp at +86 159 5127 6160 to speak directly with a Senior Sourcing Consultant.

Let our team handle the complexity. You focus on what matters—delivering value to your stakeholders.

SourcifyChina

Your Trusted Partner in Intelligent Global Sourcing

Empowering Procurement Leaders Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.