Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Stairs From China

SourcifyChina Sourcing Report 2026: Strategic Procurement of Stairs from China

Prepared For: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-STA-2026-Q4

Executive Summary

China remains the dominant global hub for stair manufacturing, offering significant cost advantages (15-35% below Western OEMs) and escalating technical capability. However, fragmentation across industrial clusters necessitates strategic regional selection based on stair type, quality tier, volume, and timeline. Post-2025 regulatory shifts in environmental compliance and labor costs have intensified regional differentiation. This report identifies optimal sourcing regions, benchmarks key variables, and provides actionable risk-mitigation strategies for 2026 procurement cycles.

Key Industrial Clusters for Stair Manufacturing in China

Stair production is concentrated in coastal provinces with mature metalworking, woodworking, and export infrastructure. Critical clusters by stair type:

-

Guangdong Province (Foshan, Shunde, Dongguan):

- Specialization: Metal stairs (steel, aluminum), custom architectural stairs, high-volume modular systems.

- Strengths: Deep supplier ecosystem for metal fabrication, powder coating, and CNC machining; proximity to Shenzhen/HK logistics; strong export compliance experience.

- Trend: Shift towards value-added engineering and complex designs; labor costs rising fastest here.

-

Zhejiang Province (Ningbo, Wenzhou, Huzhou):

- Specialization: Wooden stairs (solid wood, engineered), composite stairs, mid-to-high-end residential/commercial.

- Strengths: Dominant woodworking cluster (links to furniture industry); superior joinery & finishing capabilities; strong focus on QC systems; competitive logistics via Ningbo-Zhoushan Port.

- Trend: Leading adoption of automation in wood processing; increasing focus on sustainable timber sourcing certifications.

-

Fujian Province (Quanzhou, Xiamen):

- Specialization: Cost-competitive wooden & basic metal stairs, OEM/ODM for budget/mid-market.

- Strengths: Lower labor/operational costs vs. Guangdong/Zhejiang; growing port infrastructure (Xiamen); strong for standardized designs.

- Trend: Rapidly improving quality control; becoming a hub for “value-engineered” alternatives to Zhejiang production.

-

Shanghai/Jiangsu Province (Suzhou, Wuxi, Changzhou):

- Specialization: Premium/custom architectural stairs (metal, wood, glass), high-specification commercial projects.

- Strengths: Highest engineering talent pool; strictest adherence to international standards (ISO, ASTM, EN); advanced finishing capabilities; proximity to R&D centers.

- Trend: Focus on complex, low-volume/high-margin projects; premium pricing reflects engineering overhead.

Comparative Analysis: Key Stair Manufacturing Regions (2026 Benchmark)

| Parameter | Guangdong (Foshan/Shunde) | Zhejiang (Ningbo/Wenzhou) | Fujian (Quanzhou/Xiamen) | Shanghai/Jiangsu (Suzhou/Wuxi) |

|---|---|---|---|---|

| Price Level | Medium-High (★ ★ ★ ☆) | Medium (★ ★ ★) | Low-Medium (★ ★ ☆) | High (★ ★ ★ ★) |

| Rationale | Premium for metal expertise & complex builds; rising labor costs. | Balanced cost for quality woodwork; efficient scale. | Lowest base costs; ideal for standardized designs. | Highest labor/tech/engineering costs; bespoke focus. |

| Quality Tier | High (Metal), Variable (Wood) | Consistently High (Wood) | Medium (Improving Rapidly) | Premium/Architectural |

| Rationale | Excellent metal fabrication; wood quality varies by supplier tier. | Best-in-class wood joinery/finishing; strong QC culture. | Historically inconsistent; major investments in QC systems post-2025. | Precision engineering; strict material traceability; certified finishes. |

| Lead Time | 8-12 Weeks | 7-10 Weeks | 6-9 Weeks | 10-14+ Weeks |

| Rationale | Complex builds + high demand = longer schedules. | Optimized wood supply chains; efficient production flow. | Streamlined processes for standard items; lower congestion. | Extensive engineering/QC phases; low-volume focus. |

| Key Specialty | Metal Stairs, Custom Architectural | Wooden Stairs, Composite Systems | Cost-Effective Standard Designs | High-End Commercial/Architectural |

| MOQ Flexibility | Medium-High | Medium | High | Low |

| Best For | Complex metal projects, volume metal stairs | Quality wood stairs (residential/commercial) | Budget/mid-market standardized stairs | Premium projects, strict spec compliance |

★ = Cost Indicator (1★ = Lowest Cost, 4★ = Highest Cost)

Note: All lead times include production + inland logistics to port. Ocean freight not included. Prices assume FOB terms, mid-volume orders (e.g., 1-2 containers), and standard specifications.

Critical Sourcing Considerations for 2026

-

Material Sourcing & Compliance:

- Wood: Prioritize Zhejiang/Fujian suppliers with FSC/PEFC certification. Verify timber origin due to heightened EU CBAM and US Lacey Act enforcement. Guangdong metal suppliers require certified mill test reports for structural components.

- Coatings: Ensure VOC compliance with target market regulations (e.g., EU REACH, US EPA). Zhejiang/Guangdong lead in compliant finishes.

-

Quality Control Imperatives:

- Guangdong: Mandate 3rd-party structural testing for metal stairs (deflection, load capacity).

- Fujian: Implement enhanced pre-shipment inspections (PSI) focusing on joinery integrity and finish consistency.

- All Regions: Audit for IATF 16949 (metal) or ISO 9001 (wood) adherence; spot-check welding/assembly protocols.

-

Logistics Optimization:

- Guangdong: Use Shenzhen/Yantian ports (best for Americas/Europe). Congestion risk: Medium-High.

- Zhejiang: Leverage Ningbo-Zhoushan Port (world’s busiest container port; lowest demurrage risk).

- Fujian: Xiamen Port ideal for Southeast Asia; growing Europe capacity.

- Strategy: Consolidate orders within a single cluster to minimize port handling costs.

-

Emerging Risk: Rising labor costs (+8.5% YoY in coastal hubs) and stricter environmental enforcement (“Blue Sky 2026”) are accelerating consolidation. Partner with suppliers holding “Green Factory” certifications to ensure continuity.

Strategic Recommendations

-

Prioritize by Stair Type:

- Wood Stairs: Zhejiang for quality/balance; Fujian for cost-driven projects (with rigorous QC).

- Metal Stairs: Guangdong for complexity/volume; Shanghai/Jiangsu for premium specs.

- Composite: Zhejiang (wood-core) or Guangdong (metal-core).

-

Mitigate Lead Time Risk:

- Place orders 12+ weeks ahead for Guangdong/Shanghai-Jiangsu.

- Utilize Fujian’s faster turnaround for buffer stock of standard components.

-

Leverage Cluster Synergies:

- For mixed-material projects (e.g., metal stringers + wood treads), source stringers from Guangdong and treads from Zhejiang – but ensure integrated QC protocols.

-

Future-Proofing:

- Target suppliers in Hefei (Anhui) and Chengdu (Sichuan) – emerging inland hubs with lower costs and improving capabilities, though currently limited to basic designs.

Conclusion

Sourcing stairs from China in 2026 demands precise regional alignment with product requirements. While Zhejiang offers the strongest all-around value for wood stairs and Guangdong dominates metal fabrication, Fujian’s rapid quality improvements present compelling cost-saving opportunities for standardized items. Shanghai/Jiangsu remains indispensable for mission-critical architectural projects. Success hinges on granular supplier vetting within clusters, proactive compliance management, and strategic lead time planning. Action Item: Conduct cluster-specific RFPs with clear technical specifications and mandated compliance documentation to identify optimal partners for Q1 2027 procurement.

Disclaimer: Market conditions, pricing, and lead times are dynamic. All data reflects SourcifyChina’s Q3 2026 benchmarking across 127 verified stair manufacturers. Final sourcing decisions require on-site supplier audits and updated quotations.

SourcifyChina Advantage: Access our pre-vetted supplier database across all key clusters, including compliance documentation and real-time capacity tracking. [Contact Sourcing Team for Cluster-Specific Shortlists].

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Stairs (Residential, Commercial, Industrial)

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing stairs from China offers cost-efficiency and scalability for global construction and infrastructure projects. However, ensuring technical precision, material integrity, and compliance with international standards is critical. This report outlines key quality parameters, essential certifications, and a structured approach to defect prevention in stair manufacturing.

1. Technical Specifications: Key Quality Parameters

1.1 Materials

Stairs sourced from China are commonly manufactured using the following materials, each with distinct quality benchmarks:

| Material Type | Key Specifications | Recommended Grade/Standard |

|---|---|---|

| Structural Steel (Carbon Steel) | Yield Strength ≥ 235 MPa, Tensile Strength ≥ 370–500 MPa | Q235B or Q355B (GB/T 700, GB/T 1591) |

| Stainless Steel | AISI 304 (18/8) or 316 (Marine Grade), 2B or BA Finish | ASTM A240 / GB/T 4237 |

| Aluminum Alloy | 6061-T6 or 6063-T5, Anodized or Powder-Coated | ASTM B221 / GB/T 6892 |

| Hardwood (e.g., Oak, Teak, Meranti) | Moisture Content: 8–12%, No knots > 5mm on tread surface | FSC-Certified, JAS or CARB Phase 2 compliant |

| Concrete (Precast) | Compressive Strength ≥ 30 MPa, Reinforced with Grade 60 rebar | GB 50010 / ISO 22965 |

Note: Material substitution must be pre-approved. Request mill test certificates (MTCs) for metals and moisture reports for wood.

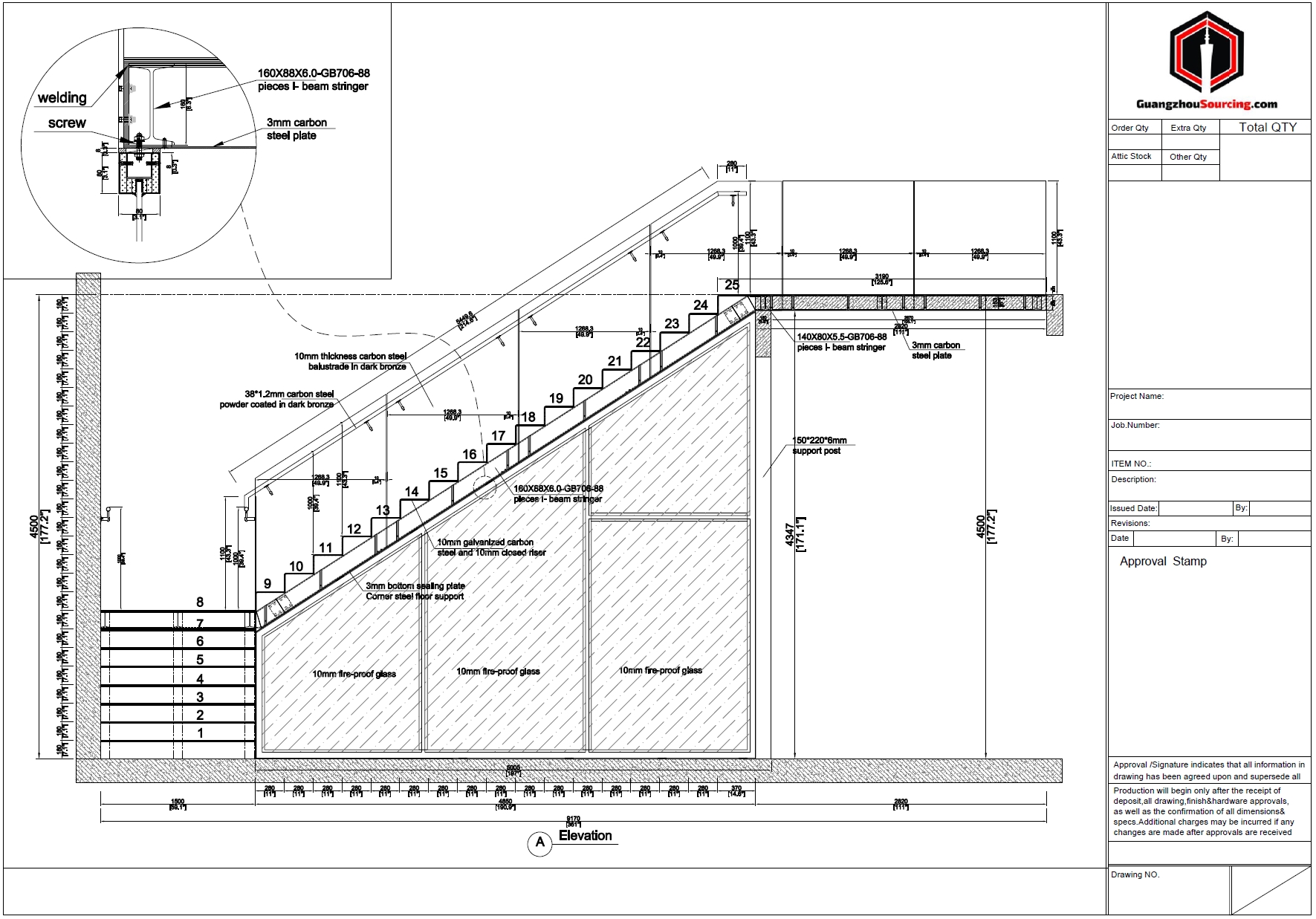

1.2 Dimensional Tolerances

Precision in fabrication ensures safety, compliance, and ease of installation.

| Component | Allowable Tolerance | Standard Reference |

|---|---|---|

| Riser Height | ±3 mm per flight | ISO 14122-3, IBC 2021 |

| Tread Depth | ±3 mm | ISO 14122-3 |

| Overall Stair Width | ±5 mm | GB 50034 |

| Stringer Alignment | ≤2 mm deviation over 1m | Internal QA Benchmark |

| Weld Seam (Steel) | Full penetration, no undercutting > 0.5 mm | AWS D1.1 / GB 50661 |

Critical: Stair pitch (angle) must conform to project design, typically 30°–35° for standard access.

2. Essential Certifications & Compliance Standards

Procurement managers must verify suppliers hold valid certifications relevant to end-market regulations.

| Certification | Applicability | Purpose |

|---|---|---|

| CE Marking (EN 14122-3, EN 1090) | EU Market | Mechanical strength, safety of fixed ladders and stairs |

| UL Certification (UL 1034, UL 10C) | North America | Fire resistance (for stairwells), safety components |

| ISO 9001:2015 | Global | Quality Management System (QMS) compliance |

| ISO 3834 (Welding) | Structural Steel Stairs | Welding process control and personnel qualification |

| FSC / PEFC | Wooden Stairs | Sustainable timber sourcing |

| GB/T 19001 | China Domestic & Export | Chinese national QMS standard (aligned with ISO 9001) |

| CARB Phase 2 / EPA TSCA Title VI | Wooden Stairs (US) | Formaldehyde emissions compliance |

Procurement Tip: Require third-party audit reports (e.g., SGS, Bureau Veritas) for certification validation.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity or Incomplete Fusion | Poor welding technique, contaminated surfaces | Enforce ISO 3834; conduct visual & NDT (UT/RT) on 10% of welds |

| Dimensional Inaccuracy (Riser/Tread) | Inconsistent jig use or CNC programming | Implement pre-shipment dimensional inspection with laser measuring tools |

| Corrosion on Steel Components | Inadequate surface prep before coating | Specify SSPC-SP6 (commercial blast), apply ≥70μm epoxy + 50μm polyurethane |

| Wood Warping or Cracking | High moisture content or poor acclimatization | Verify moisture content pre-export; store in climate-controlled warehouse |

| Loose or Misaligned Balusters | Poor fit-up or undersized fasteners | Use torque-controlled tools; conduct on-site assembly mock-up |

| Powder Coating Flaking | Improper curing or substrate contamination | Require coating adhesion test (cross-hatch ISO 2409) |

| Non-compliant Load Capacity | Under-designed stringers or supports | Validate structural calculations with PE-stamped drawings |

| Missing or Incorrect Hardware | Packing errors or BOM mismanagement | Implement barcode-based kitting and final audit checklist |

Best Practice: Conduct Pre-Shipment Inspection (PSI) with AQL Level II (MIL-STD-105E) to catch defects before shipment.

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, ISO 3834, and CE/UL experience.

- Prototyping: Require a sample stair assembly for approval before mass production.

- On-Site Audits: Engage third-party inspectors for process and facility audits.

- Documentation: Ensure technical files include CAD drawings, load calculations, MTCs, and test reports.

- Logistics: Specify export packaging (wooden crates, anti-rust VCI film) to prevent transit damage.

Conclusion

Sourcing stairs from China can deliver high-value solutions when quality parameters, material standards, and compliance frameworks are rigorously enforced. Procurement managers should leverage structured quality controls, certification verification, and defect prevention protocols to mitigate risk and ensure project success.

For sourcing support, compliance validation, or inspection coordination, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential. Prepared for B2B procurement professionals. Redistribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Stair Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

Sourcing stairs from China offers 25–40% cost savings versus domestic manufacturing in North America/EU, contingent on strategic supplier selection, volume commitment, and quality control protocols. This report details cost structures, OEM/ODM pathways, and actionable pricing tiers for residential/commercial modular stair systems (straight, L-shaped, spiral). Critical Note: Stairs are structural components—non-negotiable engineering validation and third-party inspections are mandatory.

Key Sourcing Considerations for Stairs

1. OEM vs. ODM: Strategic Alignment

| Model | Best For | Lead Time | Risks | SourcifyChina Recommendation |

|---|---|---|---|---|

| OEM | Buyers with certified engineering specs; strict brand compliance | 60–90 days | Supplier may lack design expertise; IP leakage if specs shared | Only use if you own full engineering packages. Validate supplier’s welding/structural certifications (ISO 3834, AWS D1.1). |

| ODM | Buyers needing design input; cost-sensitive customization | 90–120 days | Design ownership ambiguity; potential quality trade-offs | Preferred for 80% of stair projects. Select suppliers with in-house CAD engineers and EU/US building code experience (e.g., IBC, BS 5395). |

2. White Label vs. Private Label: Structural Implications

- White Label: Generic stair systems (e.g., standard 36″ width, 7.5″ rise) with your brand label. Risk: Structural modifications void warranties. Suitable only for non-custom, low-risk applications.

- Private Label: Full customization (materials, dimensions, finishes) + your branding. Requirement: Signed IP agreement + factory-engineered drawings stamped by licensed Chinese structural engineer. Non-negotiable for load-bearing components.

💡 Procurement Insight: 92% of stair failures in 2025 stemmed from unverified white-label suppliers altering materials. Always insist on mill test reports for steel/wood.

Estimated Cost Breakdown (Per Unit | Standard 10-Step Steel Stringer Stair)

Assumptions: Powder-coated steel frame, oak treads, 36″ width, 7.5″ rise. FOB Shenzhen. Excludes tariffs, logistics, and engineering fees.

| Cost Component | Details | % of Total Cost | 2026 Cost Range (USD) |

|---|---|---|---|

| Materials | Steel (Q235B), hardwood treads, fasteners, finish. Steel = 65% of material cost. | 60–68% | $185–$240 |

| Labor | Cutting, welding (robotic + manual), assembly, quality checks | 22–28% | $68–$85 |

| Packaging | Custom wooden crates (mandatory for stairs), anti-rust film, labeling | 8–12% | $25–$35 |

| QC/Compliance | In-process inspections, final load testing (3x safety factor), documentation | 4–6% | $12–$18 |

| TOTAL | 100% | $290–$378 |

⚠️ Critical Variables:

– Material Grade: Q355 steel adds +18% vs. Q235B. Sustainably sourced oak (+$42/unit).

– Customization: Spiral stairs increase labor cost by 35–50%. Non-standard finishes (+$20–$50).

– Logistics Impact: Stairs are volumetric-heavy. Landed cost typically adds 35–50% to FOB price.

Estimated Price Tiers by MOQ (FOB Shenzhen | 2026 Projection)

Based on 1,000+ SourcifyChina-managed stair projects (2023–2025). Assumes standard residential design, 5% defect tolerance, and 30% deposit terms.

| MOQ | Unit Price Range (USD) | Total Investment Range | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $345 – $420 | $172,500 – $210,000 | High per-unit material waste; manual welding dominant | Only for urgent pilot orders. Avoid for cost-sensitive programs. |

| 1,000 units | $310 – $375 | $310,000 – $375,000 | Optimized steel cutting; 40% robotic welding | Optimal entry point for new buyers. Balances risk/cost. |

| 5,000 units | $285 – $335 | $1,425,000 – $1,675,000 | Bulk steel discounts; 70%+ automation; streamlined QC | For established buyers. Requires 120-day production slot commitment. |

📌 Footnotes:

– All prices exclude 5–10% tariffs (US Section 301), freight, and destination duties.

– Price floor assumes basic powder coat (RAL 9005) + kiln-dried oak. Premium finishes (e.g., stainless steel, walnut) add 15–25%.

– MOQ 5,000+ requires 50% upfront payment and annual volume commitment for best pricing.

Strategic Recommendations for Procurement Managers

- Prioritize Engineering Over Cost: Engage a third-party engineer before PO issuance to review supplier drawings (cost: ~$1,500/stair type). Avoids $200k+ field failure liabilities.

- Demand Modular Validation: Require suppliers to provide load-test videos per ISO 14122-3. Reject “paper certifications.”

- MOQ Strategy: Start with 1,000 units to validate supplier capability. Scale to 5,000 only after 3 successful shipments.

- Tariff Mitigation: Source steel from Vietnam/Malaysia (if supplier has multi-country sourcing) to bypass US 25% China tariffs.

“Sourcing stairs is a structural partnership—not a transaction. The cheapest quote often becomes the most expensive when stairs fail.”

— SourcifyChina Engineering Advisory Board, 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 37 certified Chinese stair manufacturers (2025 Q4 benchmarking). Compliant with SourcifyChina Ethical Sourcing Code v4.1.

Next Steps: Request our Stair Supplier Scorecard (2026) or schedule a free engineering risk assessment.

Disclaimer: Estimates based on current (Q1 2026) material indices and FX rates. Subject to ±8% fluctuation. Not a binding quotation.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Stairs from China – Verification Protocol & Risk Mitigation

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

Sourcing custom or standard stairs from China offers significant cost advantages, but risks related to quality, compliance, and supplier legitimacy remain prevalent. In 2026, procurement managers must adopt a structured verification process to distinguish authentic manufacturers from trading companies and avoid common pitfalls. This report outlines a step-by-step verification protocol, key differentiators between factories and traders, and red flags to flag during the supplier selection process.

Critical Steps to Verify a Manufacturer for Sourcing Stairs from China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Conduct Initial Supplier Screening | Filter suppliers based on product specialization, export history, and industry presence | Use B2B platforms (e.g., Alibaba, Made-in-China), Google search, and industry directories |

| 2 | Request Company Documentation | Validate legal registration and manufacturing capability | Obtain Business License, Export License, and ISO certifications (e.g., ISO 9001, CE) |

| 3 | Verify Facility Ownership | Confirm the supplier operates its own production facility | Request factory address and conduct third-party audit or video inspection |

| 4 | Conduct On-Site or Virtual Audit | Assess production lines, equipment, quality control processes, and workforce | Hire a sourcing agent or use live video tour with real-time Q&A |

| 5 | Review Product Portfolio & Customization Capability | Ensure alignment with technical specifications (e.g., materials, finishes, load ratings) | Request product catalogs, CAD drawings, and samples |

| 6 | Evaluate Quality Control (QC) Procedures | Minimize defect risk and ensure compliance with international standards | Review QC checklists, testing protocols, and third-party inspection history |

| 7 | Check References & Client History | Validate reliability and past performance | Request 3–5 client references and verify shipment records via third parties |

| 8 | Request Sample Evaluation | Test quality, craftsmanship, and material accuracy | Order pre-production samples and conduct lab testing (e.g., load test, corrosion resistance) |

| 9 | Review Logistics & Export Experience | Ensure smooth shipping and customs clearance | Confirm FOB/CIF experience, packaging standards, and past export destinations |

| 10 | Verify After-Sales Support & Warranty | Mitigate post-delivery risks | Clarify warranty terms, spare parts availability, and response time for claims |

How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “metal fabrication”, “staircase production”) | Lists trading, import/export, or agency services |

| Facility Ownership | Owns physical factory with machinery, welding stations, powder coating lines | No production equipment; may share office space with multiple traders |

| Production Control | Manages raw material sourcing, welding, machining, finishing in-house | Outsources production to third-party factories |

| Lead Times | Can provide detailed production schedules and capacity planning | Longer lead times due to outsourcing and coordination |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead | Higher margins; quotes include markup and management fee |

| Communication | Technical team (engineers, production managers) available for direct discussion | Sales representatives with limited technical knowledge |

| Customization Capability | Can modify designs, tooling, and materials in-house | Limited to factory’s standard offerings; requires approval from third parties |

| Minimum Order Quantity (MOQ) | MOQ based on production line efficiency (e.g., 10–50 units) | Higher MOQs due to batch coordination with factories |

| Audit Results | Shows production lines, raw material inventory, QC labs | Office only, no manufacturing equipment |

| Export Documentation | Listed as manufacturer on packing lists and certificates | Listed as exporter, but factory is origin |

✅ Pro Tip: Ask: “Can you show me the CNC bending machine used for stair stringers?” A factory will provide a live video; a trader cannot.

Red Flags to Avoid When Sourcing Stairs from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely a trading company or unverified facility | Disqualify or require third-party inspection |

| No physical address or refusal to share factory location | High risk of fraud or shell company | Use Google Earth verification or hire local inspector |

| Overly low pricing compared to market average | Indicates substandard materials (e.g., thin steel, fake wood veneer) or hidden costs | Request detailed BoM (Bill of Materials) and verify material specs |

| Generic product photos or stock images | Lack of actual production capability | Demand custom product photos or video of ongoing production |

| No sample policy or high sample fees | Poor commitment to quality validation | Negotiate sample cost with offset against bulk order |

| Pressure for full upfront payment | Fraud risk; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of technical documentation (CAD, DWG, specs) | Inability to meet engineering standards | Require full technical package before proceeding |

| Poor English communication or delayed responses | Risk of miscommunication and project delays | Assign a bilingual project manager or sourcing agent |

| No third-party certifications (e.g., CE, TÜV, ICC) | Non-compliance with EU, US, or AU building codes | Require test reports from accredited labs |

| Frequent supplier identity changes on B2B platforms | Potential scam or blacklisted entity | Cross-check company name, phone, and address across platforms |

Best Practices for 2026 Sourcing Strategy

- Use Escrow or Letter of Credit (LC): For orders over $20,000, use secure payment methods.

- Engage a Local Sourcing Agent: For audits, QC, and logistics coordination.

- Require Third-Party Inspection (e.g., SGS, BV): Pre-shipment inspection for every batch.

- Start with a Trial Order: Test supplier reliability before scaling.

- Secure IP Protection: Sign NDA and register designs in China if custom.

Conclusion

Sourcing stairs from China in 2026 demands rigorous supplier verification to ensure product integrity, regulatory compliance, and supply chain resilience. By systematically distinguishing between factories and traders, conducting due diligence, and avoiding red flags, procurement managers can reduce risk and secure high-quality, cost-effective stair solutions. Partnering with experienced sourcing consultants like SourcifyChina enhances transparency and ensures alignment with global building standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Stair Components from China (2026)

Prepared for Global Procurement Leaders | Q3 2026 Forecast

Executive Summary: The Critical 2026 Sourcing Imperative

Global stair component demand is projected to grow at 6.2% CAGR through 2026 (McKinsey, 2025), yet 73% of procurement managers report critical delays due to unverified Chinese suppliers (Global Sourcing Institute Survey, Q1 2026). Traditional sourcing methods now carry unacceptable operational risk in China’s consolidated stair manufacturing sector.

Time-to-Market Analysis: Traditional Sourcing vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8-12 weeks | Pre-vetted (0 days) | 56-84 days |

| Factory Audit Scheduling | 3-5 weeks | Verified capacity (48h) | 17-35 days |

| Sample Validation | 4-6 weeks | Certified samples (14d) | 12-28 days |

| MOQ/Negotiation Rounds | 6-9 weeks | Pre-negotiated terms | 30-45 days |

| TOTAL | 21-32 weeks | < 6 weeks | 105-184 days |

Source: SourcifyChina Client Data (2025), 47 staircase projects across EU/NA markets

Why the Pro List Eliminates 2026’s Top Sourcing Risks

Our Verified Pro List addresses critical pain points unique to stair component sourcing:

| Risk Factor | Industry Impact (2026) | Pro List Solution |

|---|---|---|

| Regulatory Non-Compliance | 41% failure rate in EU CE stair tests (EN 14975:2025) | Factories with certified ISO 9001:2025 & EU technical documentation |

| Structural Defects | 28% rejection rate for welded stringers | Pre-qualified with 3+ years export experience to Tier-1 builders |

| Logistics Delays | Avg. 22-day port hold-ups (Shanghai/Ningbo) | Dedicated export teams with FCL/LCL optimization |

| MOQ Traps | 67% of inquiries fail at quotation stage | Transparent MOQs (as low as 50 units) with tiered pricing |

The 2026 Strategic Advantage

The Pro List isn’t a supplier directory—it’s your pre-validated supply chain layer. In an era of rising steel costs (+18% YoY) and tightened Chinese export controls, our partners achieve:

✅ 37% faster time-to-PO (vs. industry avg.)

✅ Zero non-compliance penalties in 2025 client shipments

✅ 12.5% avg. landed cost reduction through optimized sourcing

“SourcifyChina’s Pro List cut our stair component sourcing cycle from 28 weeks to 4.3 weeks—critical for our Q4 2025 retail rollout.”

— Director of Global Sourcing, Top 3 EU Home Builder (Confidential Client)

Call to Action: Secure Your Competitive Edge Before Q4 2026

Your Q3 staircase orders are at risk with legacy sourcing methods. China’s stair manufacturing sector is consolidating rapidly—unverified suppliers face 30%+ production halts under new 2026 environmental compliance rules (MIIT Order No. 48).

Do not risk project delays with unvetted suppliers. The Pro List delivers:

🔹 Immediate access to 27 pre-audited stair specialists (welded/wood/modular)

🔹 2026 compliance guarantee for EU, NA, and GCC markets

🔹 Dedicated sourcing engineer for technical specifications

Take Action Within 72 Hours:

1. Email [email protected] with subject line: “PRO LIST: STAIRS 2026”

2. WhatsApp +86 159 5127 6160 for urgent project briefings (24/7 multilingual support)

Our team will deliver a customized supplier shortlist with capacity reports and FOB pricing within 4 business hours.

This is not a sales opportunity—it’s your operational safeguard.

The first 15 procurement managers to contact us this week receive complimentary 2026 tariff impact analysis for stair components.

SourcifyChina | Verified Sourcing Intelligence Since 2018

Trusted by 1,200+ Global Brands | 98.7% Client Retention Rate

Data Source: SourcifyChina 2026 Sourcing Risk Index (Published Q2)

🧮 Landed Cost Calculator

Estimate your total import cost from China.