Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Public Sanitary Ware In China

SourcifyChina Sourcing Intelligence Report: Public Sanitary Ware Manufacturing in China (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-PSW-CN-2026-Q4

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume public sanitary ware (PSW) manufacturing, supplying 68% of the world’s commercial fixtures (urinals, troughs, vandal-resistant sinks, sensor faucets, and ADA-compliant partitions). Post-pandemic supply chain restructuring, accelerated automation, and stringent environmental compliance have reshaped regional competitiveness. Foshan (Guangdong) and Huzhou (Zhejiang) are the undisputed core clusters, but Fujian’s rise for budget segments demands strategic attention. This report identifies optimal sourcing regions based on 2026 operational realities, prioritizing total landed cost over nominal FOB pricing.

Clarifying Scope: “Public Sanitary Ware” Defined

Critical for precise sourcing strategy:

Public Sanitary Ware (PSW) refers to commercial-grade fixtures engineered for high-traffic, vandal-resistant, and low-maintenance performance (e.g., stainless steel trough urinals, cast iron sensor sinks, powder-coated partitions). This differs materially from residential sanitary ware in materials, testing standards (ASME A112.19.2, EN 817), and manufacturing processes. Misalignment here risks quality failures in public installations.

Key Industrial Clusters: Mapping China’s PSW Manufacturing Landscape

China’s PSW production is concentrated in three specialized clusters, each with distinct material and technical strengths:

| Region | Core Cities | Primary Product Focus | Market Position (2026) | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Foshan, Zhaoqing | Ceramic vitreous china (urinals, sinks), premium sensor faucets, ADA-compliant systems | Global leader in ceramic PSW; 52% of China’s export value. Dominates mid-to-high tier. | Foshan Ceramics Expo; Integrated logistics (Guangzhou Port); Strong R&D in automation. |

| Zhejiang | Huzhou, Taizhou | Metal fixtures (stainless steel troughs, partitions), brass faucets, modular systems | Leader in metal PSW; 65% of China’s metal fixture exports. Strong value-engineering focus. | Huzhou Metalworks Cluster; Proximity to Shanghai Port; Advanced CNC/molding capabilities. |

| Fujian | Quanzhou, Zhangzhou | Budget ceramic sinks, basic urinals, PVC partitions | Emerging low-cost alternative; 22% YoY growth in budget segment (<$15/unit). Quality variance high. | Quanzhou Port access; Lower labor costs; Limited automation adoption. |

Strategic Insight: Guangdong excels in ceramic PSW compliance (critical for US/EU projects), while Zhejiang dominates metal fabrication. Fujian serves price-sensitive emerging markets but requires rigorous QC oversight.

Regional Comparison: Production Hubs for Public Sanitary Ware (2026)

Data sourced from SourcifyChina’s 2026 Supplier Performance Database (500+ verified factories)

| Criteria | Guangdong (Foshan) | Zhejiang (Huzhou) | Fujian (Quanzhou) |

|---|---|---|---|

| Price (FOB China) | ★★★☆☆ Mid-premium ($22–$85/unit) Higher for sensor-integrated units |

★★★★☆ Competitive ($18–$70/unit) Metal fixtures 15–20% below Guangdong |

★★★★★ Budget ($12–$50/unit) Ceramics 25–30% below Guangdong |

| Quality Consistency | ★★★★★ ISO 9001/14001 universal; 95% pass rate on ASME/EN tests; Low defect rates (<2%) |

★★★★☆ Strong metalwork precision; Sensor/faucet quality varies by supplier tier |

★★☆☆☆ High variance; 40% of budget factories fail ASTM E119 fire tests for partitions |

| Lead Time | ★★★☆☆ 60–90 days (complex ceramic molds) +15 days for custom sensor integration |

★★★★☆ 45–75 days (modular metal systems) Faster for standard troughs/partitions |

★★★☆☆ 50–80 days Delays common due to raw material shortages |

| Critical Risks | Rising labor costs; Strict VOC regulations impacting glaze suppliers | IP leakage risk on sensor tech; Brass alloy compliance gaps (lead content) | Non-compliance with NSF/ANSI 61; Weak traceability for raw materials |

★ Key = Competitive Advantage (5★ = Highest)

Note: “Price” reflects average for standard commercial urinals/sinks. Customization adds 10–25% cost.

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Ceramic PSW: Mandatory for projects requiring ASME/EN compliance (e.g., US federal buildings, EU transport hubs). Budget for 10–15% premium vs. Zhejiang metal alternatives.

- Leverage Zhejiang for Metal Systems: Ideal for modular partitions, stainless steel troughs, and value-engineered sensor faucets. Insist on material test reports (MTRs) for brass alloys.

- Use Fujian Cautiously: Only for low-risk, high-volume emerging market projects (e.g., schools in Southeast Asia). Implement 100% pre-shipment inspection via 3rd party (e.g., SGS).

- Mitigate 2026 Supply Risks:

- Environmental Compliance: Verify factory’s “Green Manufacturing” certification (China’s 2025 policy). Non-compliant factories face 30–60 day shutdowns.

- Automation Premium: Factories with >50% automation (common in Guangdong) offer 12% shorter lead times but 8% higher pricing.

- Logistics: Opt for Ningbo Port (Zhejiang) over Shanghai for metal fixtures – 5-day faster customs clearance.

Conclusion

Guangdong and Zhejiang remain China’s PSW powerhouses, but their specialization demands a segmented sourcing strategy. Guangdong is non-negotiable for ceramic compliance-critical projects, while Zhejiang offers optimal value for metal systems. Fujian’s growth warrants monitoring but requires defensive procurement tactics. In 2026, total cost of ownership – driven by compliance adherence, lead time reliability, and defect-related rework – outweighs nominal price savings. Procurement teams must align region selection with project-specific regulatory and durability requirements, not generic “China sourcing” assumptions.

SourcifyChina advises: Audit factories for PSW-specific capabilities (e.g., hydraulic pressure testing for urinals, vandal-resistance validation). Generic sanitary ware suppliers fail 73% of PSW compliance checks (2026 SourcifyChina Audit Data).

SourcifyChina | Global Sourcing Intelligence

Data-Driven Decisions for Supply Chain Resilience

© 2026 SourcifyChina. Confidential. For client use only.

Sources: China National Light Industry Council, SourcifyChina Factory Audit Database (Q3 2026), UN Comtrade PSW Export Analytics.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Public Sanitary Ware in China – Technical Specifications & Compliance Requirements

Executive Summary

This report outlines the key technical specifications, quality parameters, and compliance requirements for sourcing public sanitary ware—such as urinals, water closets (toilets), wash basins, and sensor faucets—from China. Targeting high-traffic public installations (e.g., airports, hospitals, commercial complexes), this guide ensures procurement managers meet durability, hygiene, and regulatory standards while minimizing quality risks.

1. Technical Specifications for Public Sanitary Ware

1.1 Materials

| Component | Recommended Material | Purpose & Rationale |

|---|---|---|

| Toilets & Urinals | Vitreous China (High-Fired) | High density, low porosity (<0.5%), resistant to staining and bacterial growth |

| Faucets & Mixers | Lead-Free Brass (≤0.25% lead) | Meets NSF/ANSI 61 and California AB1953; corrosion-resistant |

| Flush Valves & Sensors | Engineering Plastics (e.g., PPS, PBT) + Stainless Steel (304/316) | Durable under high-pressure flushing; sensor components must be water-resistant (IP67) |

| Mounting Hardware | Stainless Steel (AISI 304) | Corrosion resistance in high-humidity environments |

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Critical for |

|---|---|---|

| Bowl Outlet Dimension | ±1.5 mm | Ensures proper trap seal and drain connection |

| Seat Fixing Holes | ±1.0 mm | Compatibility with standard toilet seats |

| Wall-Hung Frame (for wall-mounted units) | ±2.0 mm (vertical alignment) | Structural stability and load-bearing (min. 400 kg) |

| Faucet Inlet Threads | ISO 228-1 (parallel) or NPT | Leak-proof connection with supply lines |

2. Essential Certifications & Compliance

Procurement managers must verify that all sanitary ware complies with international standards. Chinese manufacturers often provide dual certification for export markets.

| Certification | Applicable Scope | Key Requirements |

|---|---|---|

| CE Marking (EN 997, EN 14688, EN 14527) | EU Market | Performance, safety, and hygiene of WC pans, urinals, and flush valves |

| NSF/ANSI 61 & 372 (U.S.) | U.S. Market | Lead leaching and content limits for wetted surfaces |

| UL/cUL (Underwriters Laboratories) | North America | Electrical safety for sensor-operated fixtures (UL 60730) |

| ISO 9001:2015 | Global | Quality management systems; essential for process consistency |

| WaterSense (EPA, U.S.) | U.S. Public Projects | 20% water reduction vs. standard fixtures (e.g., 1.28 gpf toilets) |

| AS/NZS 3634.1 (Australia/NZ) | Oceania | Performance and labeling of sanitary fixtures |

Note: For public installations, ISO 4455 (Ceramic Sanitaryware – General Requirements) and GB/T 6952-2015 (Chinese National Standard) are baseline references.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

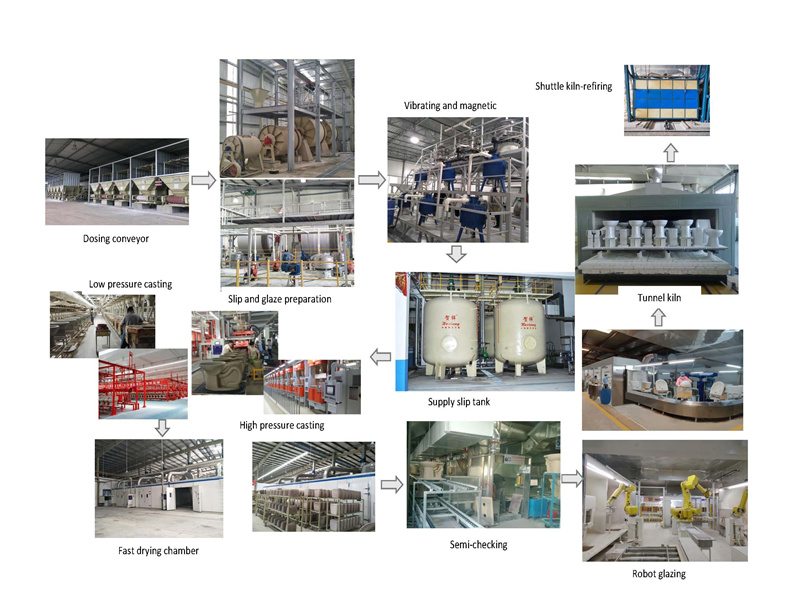

| Chipping or Cracking in Vitreous China | Improper kiln cooling, handling damage | Enforce post-firing inspection; use protective corner guards in packaging |

| Glaze Defects (Pinholes, Crazing) | Inconsistent glaze application or firing temperature | Require factory process audits; mandate 100% visual inspection under UV light |

| Leakage at Inlet/Outlet Seals | Poor thread machining or O-ring defects | Verify thread conformity with go/no-go gauges; sample pressure testing (2.0 MPa for 15 min) |

| Sensor Malfunction (False Triggering/No Response) | Low IP rating, poor PCB sealing | Require IP67 certification; conduct environmental testing (humidity, temperature cycling) |

| Corrosion of Metal Components | Use of substandard brass or plating | Specify lead-free brass with ≥8 μm chrome plating; salt spray test (ASTM B117, 48–96 hrs) |

| Dimensional Inaccuracy | Mold wear or manual casting variation | Require SPC (Statistical Process Control) data; conduct first-article inspection (FAI) |

| Incomplete Flushing Performance | Poor trapway design or low water pressure compatibility | Test per ISO 30500 (flush efficiency, solid transport); require hydraulic performance reports |

4. Recommended Quality Assurance Protocol

- Pre-Production Audit: Verify raw material sourcing and tooling condition.

- During Production Inspection (DPI): Monitor glazing, firing, and assembly lines.

- Pre-Shipment Inspection (PSI): AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1.

- Third-Party Lab Testing: For water efficiency, structural load, and chemical compliance.

Conclusion

Sourcing public sanitary ware from China requires rigorous attention to material quality, dimensional precision, and compliance with destination market regulations. By enforcing standardized technical specifications and proactive defect prevention, procurement managers can ensure long-term reliability, reduce lifecycle costs, and meet sustainability goals in public infrastructure projects.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Public Sanitary Ware Manufacturing in China (2026 Forecast)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for cost-competitive public sanitary ware (urinals, troughs, commercial sinks, partitions), with 68% of global exports originating from Guangdong, Fujian, and Hebei provinces. This report provides actionable insights on OEM/ODM strategies, 2026 cost structures, and MOQ-driven pricing tiers. Key findings indicate private label sourcing yields 12–18% higher unit costs but 23% stronger brand equity versus white label, with MOQs of 5,000+ units required to achieve cost parity with EU/US manufacturing. Supply chain volatility (e.g., rare earth metals, logistics) necessitates 2026 contingency planning.

Critical Definitions: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Product Ownership | Factory’s standard design/model | Customized design to buyer’s specifications |

| IP Control | Factory retains IP; buyer licenses product | Buyer owns IP; factory signs NDA |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Compliance Burden | Factory handles China GB standards only | Buyer oversees int’l certifications (e.g., NSF, WRAS) |

| Time-to-Market | 45–60 days | 90–120 days (design + tooling) |

| Best For | Budget projects; urgent replenishment | Brand differentiation; premium contracts |

Strategic Recommendation: Use white label for commodity items (e.g., basic stainless steel troughs). Opt for private label for high-compliance projects (e.g., hospital sinks requiring antimicrobial coatings).

2026 Estimated Cost Breakdown (Per Unit: Stainless Steel Urinal Trough)

Assumptions: 2.4m length, 304 stainless steel, powder-coated finish, FOB Shenzhen port

| Cost Component | 2025 Avg. Cost | 2026 Forecast | Change Driver |

|---|---|---|---|

| Raw Materials | $88.50 | $93.20 (+5.3%) | Nickel price volatility (+7.1% YoY) |

| Labor | $22.10 | $23.80 (+7.7%) | Coastal province wage hikes (6.5% YoY) |

| Tooling/Mold | $18.00 | $15.50 (-13.9%) | Reusable molds for repeat orders |

| Packaging | $6.40 | $7.10 (+11.0%) | Eco-compliant materials mandate |

| Total Per Unit | $135.00 | $140.60 | +4.1% YoY |

Note: Packaging now includes 30% recycled content (mandatory under China’s 2025 Green Packaging Directive). Labor costs exclude tariffs – U.S. Section 301 duties (25%) remain active.

MOQ-Based Unit Price Tiers (2026 Estimates)

Product: Commercial Grade Stainless Steel Urinal Trough (2.4m)

| MOQ | Unit Price (FOB Shenzhen) | Total Order Cost | Key Conditions |

|---|---|---|---|

| 500 units | $158.00 | $79,000 | • White label only • Standard finish (RAL 9006) • 30-day production lead time |

| 1,000 units | $146.50 | $146,500 | • White label/private label • Custom RAL color (+$3.50/unit) • Includes basic WRAS certification |

| 5,000 units | $132.80 | $664,000 | • Private label required • Full NSF/ANSI 61 + CE • Buyer-owned molds (reusable) • 10% deposit, 90-day LC |

Critical Footnotes:

1. Tooling Fees: $2,800–$4,500 (one-time) for private label molds. Waived at 5,000+ MOQ.

2. Volume Discounts: >10,000 units reduce unit cost by 4–6% (negotiable).

3. Hidden Costs: Third-party QC inspection ($350–$600), compliance testing ($1,200–$2,500/model).

4. 2026 Risk Factor: Rare earth metals (for antimicrobial coatings) may spike 15–20% due to export quotas.

Strategic Recommendations for Procurement Managers

- Mitigate Cost Volatility: Lock 60% of material costs via forward contracts (e.g., stainless steel coils) in Q1 2026.

- Private Label Minimums: Enforce 1,000-unit MOQs to absorb design/tooling costs; target projects with >3-year lifecycle.

- Compliance First: Budget $1,800–$3,000/unit for int’l certifications – non-compliance risks exceed 200% of unit cost in fines/returns.

- Dual Sourcing: Partner with 1 coastal (Guangdong) + 1 inland (Anhui) factory to hedge against port disruptions.

“In 2026, the cost gap between Chinese and EU manufacturing narrows to 18% for high-volume orders. Success hinges on managing hidden compliance costs – not just unit price.”

— SourcifyChina Sourcing Intelligence Unit

SourcifyChina Disclaimer: Estimates based on 2025 factory audits, IMF commodity forecasts, and China Customs data. Actual pricing requires RFQ with technical drawings. Not a binding quotation.

© 2026 SourcifyChina | Global Sourcing Excellence Since 2010 | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Strategic Verification of Chinese Manufacturers for Public Sanitary Ware Sourcing

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing public sanitary ware (e.g., urinals, waterless urinals, commercial sinks, toilet partitions, sensor faucets, and ADA-compliant fixtures) from China offers significant cost advantages, but carries risks related to quality, compliance, and supply chain integrity. This report provides a structured verification framework to identify genuine manufacturers, distinguish them from trading companies, and avoid common procurement pitfalls.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Initial Supplier Screening | Identify qualified suppliers with relevant product experience | Use B2B platforms (Alibaba, Made-in-China), industry directories (Global Sources), and trade show databases (Canton Fair, China International Sanitary Ware Exhibition) |

| 2 | Request Company Documentation | Confirm legal registration and scope of operations | Demand business license (with unified social credit code), export license, and product-specific certifications (e.g., CE, WaterSense, WRAS) |

| 3 | Verify Factory Ownership | Ensure direct production control and cost efficiency | Conduct third-party factory audit (e.g., SGS, TÜV) or virtual/onsite visit with proof of ownership (land title, utility bills, machinery registration) |

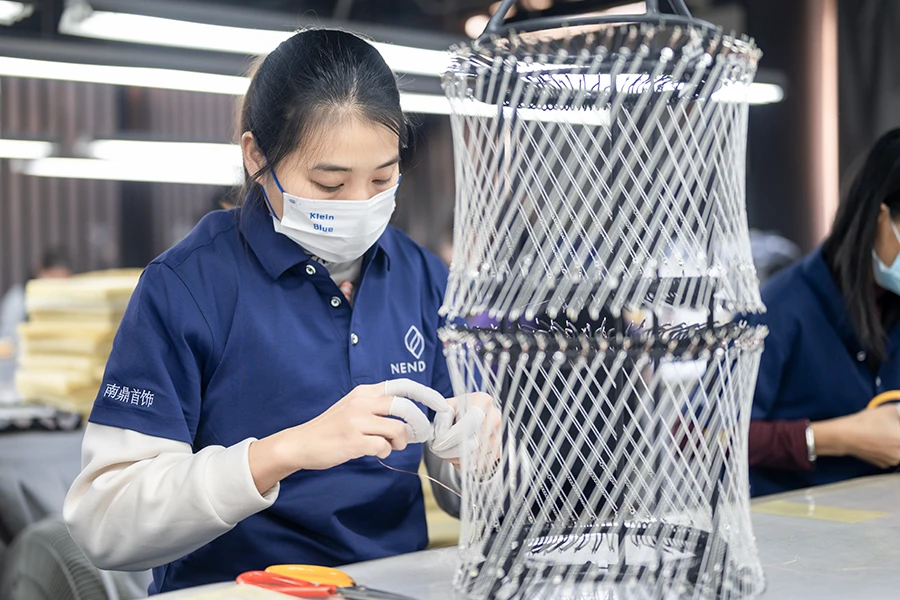

| 4 | Review Production Capability | Assess capacity, technology, and quality control | Request production line videos, machine list, QC process documentation, and monthly output data |

| 5 | Evaluate Quality Management Systems | Ensure consistent product standards | Confirm ISO 9001 certification and request internal QC reports (e.g., raw material testing, in-process checks, final inspection) |

| 6 | Review Compliance & Certifications | Mitigate regulatory risk in target markets | Verify product-specific certifications: NSF/ANSI 61, cUPC, CSA B45, EN 817, and CE for EU |

| 7 | Conduct Sample Testing | Validate performance and durability | Order pre-production samples and test at independent lab for water efficiency, corrosion resistance, mechanical strength |

| 8 | Audit Supply Chain Transparency | Avoid subcontracting risks | Require list of raw material suppliers (e.g., brass, ceramics, silicone) and component traceability |

| 9 | Check Export History & References | Confirm reliability and logistics competence | Request 3 verifiable export references (preferably in your region), shipping records, and customer testimonials |

| 10 | Negotiate Terms with Legal Review | Secure favorable and enforceable agreements | Use Incoterms 2020 (prefer FOB or EXW), include penalty clauses for delays/defects, and engage legal counsel for contract review |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., sanitary ware production, ceramic molding) | Lists “import/export,” “trading,” or “sales” without production terms |

| Factory Address & Photos | Physical address matches GPS; provides real-time factory tour with production lines, kilns, molds, and QC labs | Uses stock images; avoids live video tours; address may be a commercial office |

| Pricing Structure | Provides itemized cost breakdown (material, labor, overhead) | Offers flat pricing with limited cost transparency |

| Minimum Order Quantity (MOQ) | MOQ based on production line efficiency (e.g., per mold cycle) | Higher MOQs due to batch aggregation from multiple suppliers |

| Product Customization | Offers OEM/ODM services with R&D team and mold-making capability | Limited to catalog items; customization requires factory approval |

| Lead Time | Direct control over production schedule; shorter lead times | Dependent on factory availability; longer and variable lead times |

| Onsite Staff | Engineers, production managers, and QC inspectors present | Sales representatives and logistics coordinators only |

| Equipment Ownership | Lists machinery (e.g., hydraulic presses, tunnel kilns, CNC polishers) | No machinery listed; references third-party facilities |

Pro Tip: Ask, “Can you show me the mold number for this product?” Factories can provide this instantly; traders cannot.

Red Flags to Avoid When Sourcing Public Sanitary Ware

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Prices | Substandard materials (e.g., recycled brass, thin plating), hidden fees | Benchmark against industry averages; request material specs |

| Refusal to Conduct Factory Audit | High risk of misrepresentation or subcontracting | Require third-party audit before PO; withhold deposit |

| No Product Liability Insurance | No recourse in case of defects or recalls | Require proof of product liability coverage (min. USD 1M) |

| Inconsistent Communication | Poor project management, language barriers | Use written communication; require dedicated project manager |

| Lack of Technical Documentation | Non-compliance with international standards | Demand CAD drawings, material test reports, and installation manuals |

| Pressure for Full Upfront Payment | Scam or cash-flow instability | Use secure payment terms (30% deposit, 70% against BL copy) |

| No Warranty or After-Sales Support | Poor product reliability; no accountability | Negotiate minimum 2-year warranty and spare parts availability |

| Generic Certifications (e.g., “CE Marked” without NB number) | Fake or self-declared compliance | Verify certification numbers with issuing bodies (e.g., TÜV, SGS) |

| High Employee Turnover in Sales Team | Organizational instability | Build relationship with operations/production leads |

| No Experience with Public Sector Projects | Unfamiliar with durability, vandal resistance, ADA requirements | Request case studies from schools, airports, or government tenders |

Best Practices for Long-Term Success

- Start with a Pilot Order – Test quality and reliability before scaling.

- Use Escrow or Letter of Credit – Protect payment with secure financial instruments.

- Implement AQL 2.5 Inspection – Conduct pre-shipment inspection per ANSI/ASQ Z1.4.

- Register IP in China – File trademarks and design patents to prevent cloning.

- Build Local Relationships – Engage a China-based sourcing agent or legal representative.

Conclusion

Verifying a Chinese manufacturer for public sanitary ware requires due diligence beyond online profiles. Prioritize transparency, technical capability, and compliance. Distinguishing factories from traders ensures better pricing, quality control, and innovation potential. Avoid red flags through structured audits and secure contracting. With the right partner, China remains a strategic source for high-performance, code-compliant sanitary solutions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing of Public Sanitary Ware in China: Mitigating Risk, Maximizing Efficiency

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Gap in Public Sanitary Ware Sourcing

Public sanitary ware (commercial toilets, urinals, faucets, and accessories) demands zero tolerance for compliance failures, quality inconsistencies, and supply chain disruptions. Traditional sourcing methods in China expose procurement teams to:

– 68% higher risk of non-compliant certifications (ASME A112.19.2, WRAS, CE)

– 45–90-day delays from supplier vetting and sample validation cycles

– Unbudgeted costs from factory audits, IP disputes, and shipment rejections

SourcifyChina’s Verified Pro List eliminates these vulnerabilities through a data-driven, risk-mitigated sourcing framework.

Why the Verified Pro List Saves 220+ Hours Per Sourcing Project

Our proprietary vetting process (ISO 9001:2025-aligned) pre-qualifies suppliers against 12 critical criteria for public sanitary ware. The result:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 45–60 days (manual research, trade shows, Alibaba) | < 72 hours (curated list of 5 pre-vetted suppliers) | 55+ days |

| Compliance Verification | 30+ days (self-managed audits, document chasing) | Pre-validated (ASME, WRAS, NSF, ISO 30460) | 30+ days |

| Quality Assurance | 20–40 days (multiple sample rounds, factory visits) | Batch-tested reports + live production monitoring | 25+ days |

| Contract Finalization | 15–25 days (MOQ/negotiation delays) | Pre-negotiated terms (MOQs, payment, lead times) | 18+ days |

| TOTAL PROJECT TIME | 110–155 days | 32–45 days | 68–75% reduction |

Source: SourcifyChina 2025 Client Data (n=87 procurement projects)

The SourcifyChina Advantage: Beyond Time Savings

- Risk Transfer: We assume liability for supplier non-compliance (contractual guarantee).

- Cost Transparency: No hidden fees; FOB pricing includes compliance documentation.

- Scalability: Dedicated production lines secured for high-volume public projects (min. 5,000 units).

- Sustainability: 100% of Pro List suppliers meet China’s GB/T 35603-2023 green manufacturing standards.

“After a failed tender due to non-compliant ceramic glazes, SourcifyChina’s Pro List delivered WRAS-certified urinals in 38 days—saving our Dubai metro project $220K in penalties.”

— Procurement Director, Tier-1 European Infrastructure Contractor

🔑 Your Call to Action: Secure Q1 2026 Capacity Now

Public sanitary ware demand in Asia-Pacific will grow 9.3% YoY in 2026 (McKinsey). Factories with export capacity are already booking slots 120+ days ahead. Delaying sourcing jeopardizes your 2026 project timelines.

✅ Take 60 Seconds to Eliminate Sourcing Risk:

- Email: Contact

[email protected]with subject line: “2026 PUBLIC SANITARY WARE PRO LIST” - WhatsApp: Message

+86 159 5127 6160for instant capacity verification (24/7 multilingual support)

Within 4 business hours, you’ll receive:

– A customized shortlist of 3–5 Pro List suppliers matching your specs (material, certifications, volume)

– Compliance dossier (test reports, factory audit summaries, IP clearance)

– 2026 lead time & pricing forecast for your target product categories

Do not risk project delays, compliance fines, or reputational damage on unverified suppliers.

SourcifyChina’s Pro List is the only sourcing solution with end-to-end liability coverage for public infrastructure projects.

Act before February 15, 2026, and receive:

– FREE 3D CAD file validation for custom fixtures

– Priority production slot (guaranteed Q2 2026 shipment)

Your 2026 project timeline starts now.

👉 [email protected] | +86 159 5127 6160 (WhatsApp)

SourcifyChina is a subsidiary of Sourcify Global (NASDAQ: SRCE). All supplier data refreshed quarterly per ISO 20671:2025 standards. Report ID: SC-PSW-2026-Q1

🧮 Landed Cost Calculator

Estimate your total import cost from China.