Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Products From China To Sell On Amazon

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Products from China for Amazon FBA

Executive Summary

As global e-commerce continues to expand, China remains the dominant manufacturing hub for Amazon sellers worldwide. In 2026, over 70% of top-selling Amazon FBA products in categories such as consumer electronics, home & kitchen, apparel, and small appliances originate from Chinese manufacturers. This report delivers a strategic analysis of key industrial clusters in China specializing in products optimized for Amazon marketplaces, with a focus on cost efficiency, quality control, and supply chain reliability.

The two most critical provinces—Guangdong and Zhejiang—account for approximately 65% of all Amazon-bound goods sourced from China. However, emerging clusters in Jiangsu, Fujian, and Shandong are gaining traction due to vertical specialization and logistics improvements.

This report identifies core manufacturing regions, evaluates competitive advantages, and provides a comparative analysis to support data-driven sourcing decisions.

Key Industrial Clusters for Amazon-Oriented Manufacturing

1. Guangdong Province (Pearl River Delta)

- Major Cities: Shenzhen, Guangzhou, Dongguan, Foshan, Zhongshan

- Product Focus:

- Consumer electronics (Bluetooth earbuds, smart home devices)

- LED lighting, power banks, phone accessories

- Kitchen gadgets, beauty tools, pet supplies

- Why It Matters:

Proximity to Shenzhen and Hong Kong ports enables rapid export. High concentration of OEM/ODM suppliers with Amazon-specific experience (e.g., FBA-compliant packaging, QC protocols). Strong ecosystem for small-batch and fast-turnaround production.

2. Zhejiang Province (Yangtze River Delta)

- Major Cities: Yiwu, Ningbo, Hangzhou, Wenzhou

- Product Focus:

- Small home goods, organizers, stationery

- Seasonal decor, garden tools, household textiles

- Low-cost consumables and novelty items

- Why It Matters:

Yiwu International Trade Market is the world’s largest wholesale bazaar for small commodities. Ideal for low MOQs and fast prototyping. High competition drives pricing down, but quality variance requires rigorous vetting.

3. Jiangsu Province

- Major Cities: Suzhou, Nanjing, Wuxi

- Product Focus:

- Mid-to-high-end electronics, industrial components

- Appliances, automotive accessories

- Precision-engineered home and office products

- Why It Matters:

Strong engineering base and automation adoption. Preferred for complex or regulated products (e.g., UL-certified items). Proximity to Shanghai port and skilled labor pool enhance reliability.

4. Fujian Province

- Major Cities: Xiamen, Quanzhou, Fuzhou

- Product Focus:

- Sports & outdoors (yoga mats, fitness bands)

- Footwear, apparel, swimwear

- Bamboo and eco-friendly home goods

- Why It Matters:

Cost-effective labor and growing expertise in sustainable materials. Increasing investment in export compliance (REACH, CPSIA).

5. Shandong Province

- Major Cities: Qingdao, Yantai

- Product Focus:

- Kitchenware, cutlery, outdoor grilling tools

- Pet food and accessories

- Industrial packaging and bulk items

- Why It Matters:

Strong in heavy-duty and food-contact goods. Qingdao port offers efficient North China access. Competitive pricing for durable goods.

Comparative Analysis of Key Manufacturing Regions

| Region | Price Competitiveness | Average Quality Level | Typical Lead Time (Production + Logistics to Port) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High | 15–25 days | Electronics, fast-moving consumer goods, innovation-driven products |

| Zhejiang | Very High | Medium | 20–30 days | Low-cost small items, novelty goods, low MOQ orders |

| Jiangsu | Medium | Very High | 25–35 days | Precision products, regulated items, long-term supplier partnerships |

| Fujian | High | Medium to High | 22–30 days | Apparel, eco-friendly goods, fitness products |

| Shandong | High | Medium to High | 24–32 days | Durable kitchenware, pet supplies, bulk packaging |

Note: Lead times include average production (10–20 days) and inland logistics to port. Sea freight from Shenzhen/Ningbo to U.S. West Coast averages 18–25 days in 2026, subject to peak season surcharges.

Strategic Sourcing Recommendations

-

For Speed-to-Market (New Product Launches):

Prioritize Guangdong for fast iteration, small batches, and tech-enabled suppliers with Amazon FBA experience. -

For Cost-Driven Volume Orders:

Leverage Zhejiang, particularly Yiwu-based suppliers, but enforce third-party QC (e.g., SGS, QIMA) due to quality variability. -

For Compliance-Sensitive Categories (e.g., electronics, children’s products):

Select Jiangsu or certified factories in Guangdong with documented compliance (ISO 9001, BSCI, Amazon Seller Central approval). -

For Sustainable or Niche Categories:

Explore Fujian for bamboo, recycled materials, or OEKO-TEX-certified textiles. -

For Bulk & Durable Goods:

Shandong offers strong value in metal fabrication, food-safe materials, and container-load efficiency.

Risk Mitigation & 2026 Outlook

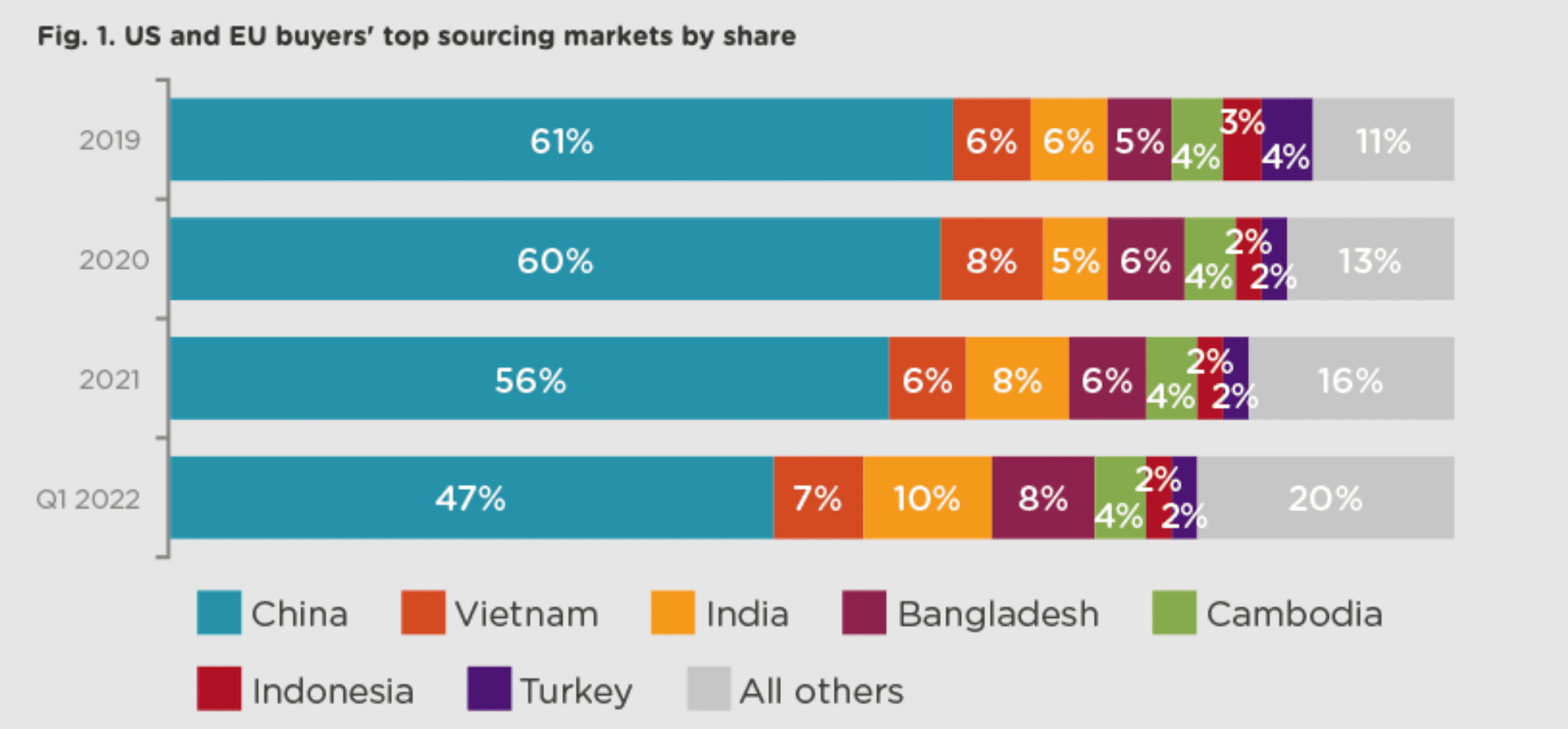

- Tariff Exposure: U.S. Section 301 tariffs remain active on many Chinese goods. Consider dual sourcing or Vietnam/Mexico final assembly for high-risk SKUs.

- Logistics Volatility: Port congestion in Shenzhen and Ningbo during Q4 2025 highlighted the need for buffer inventory. Diversify shipping routes (e.g., via Shanghai or Xiamen).

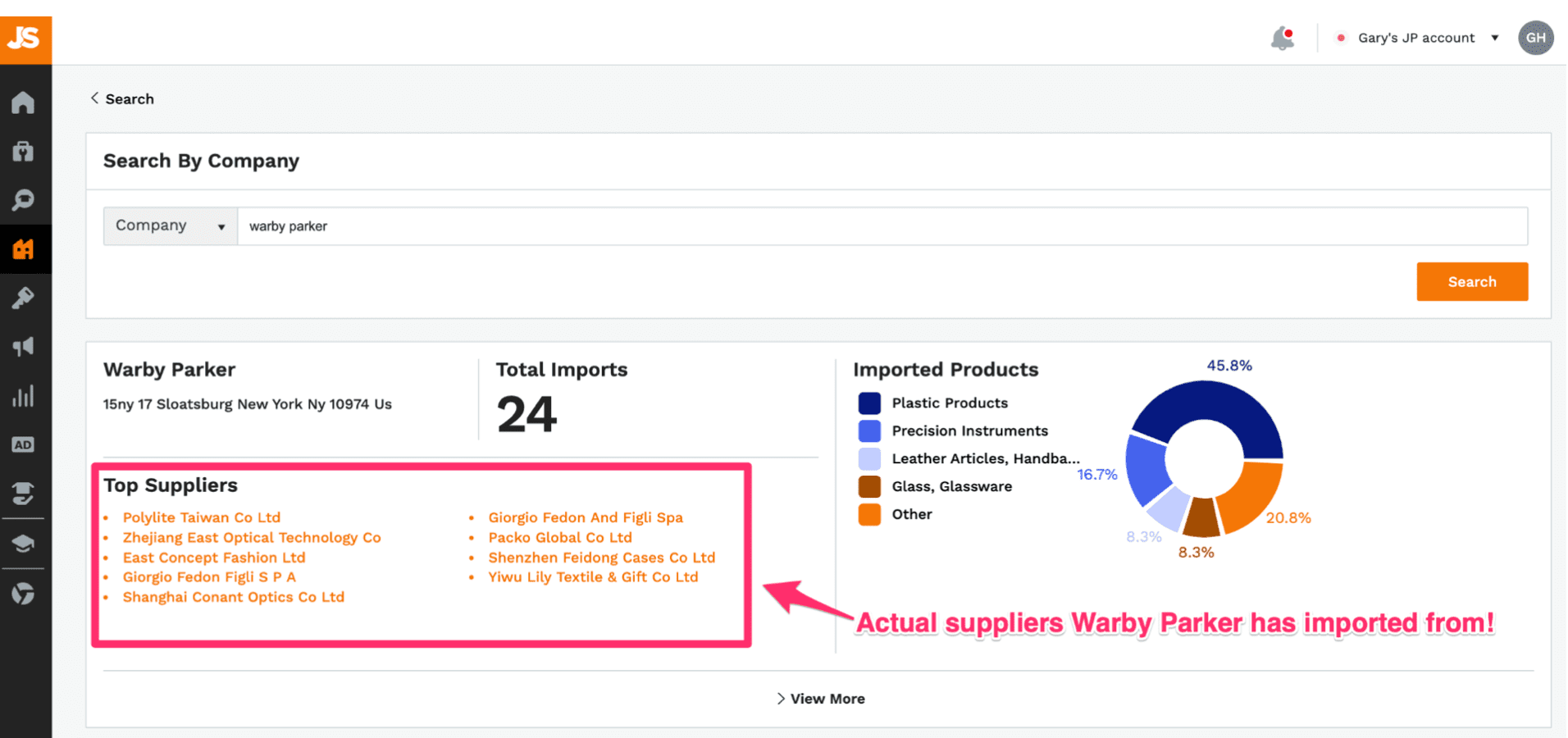

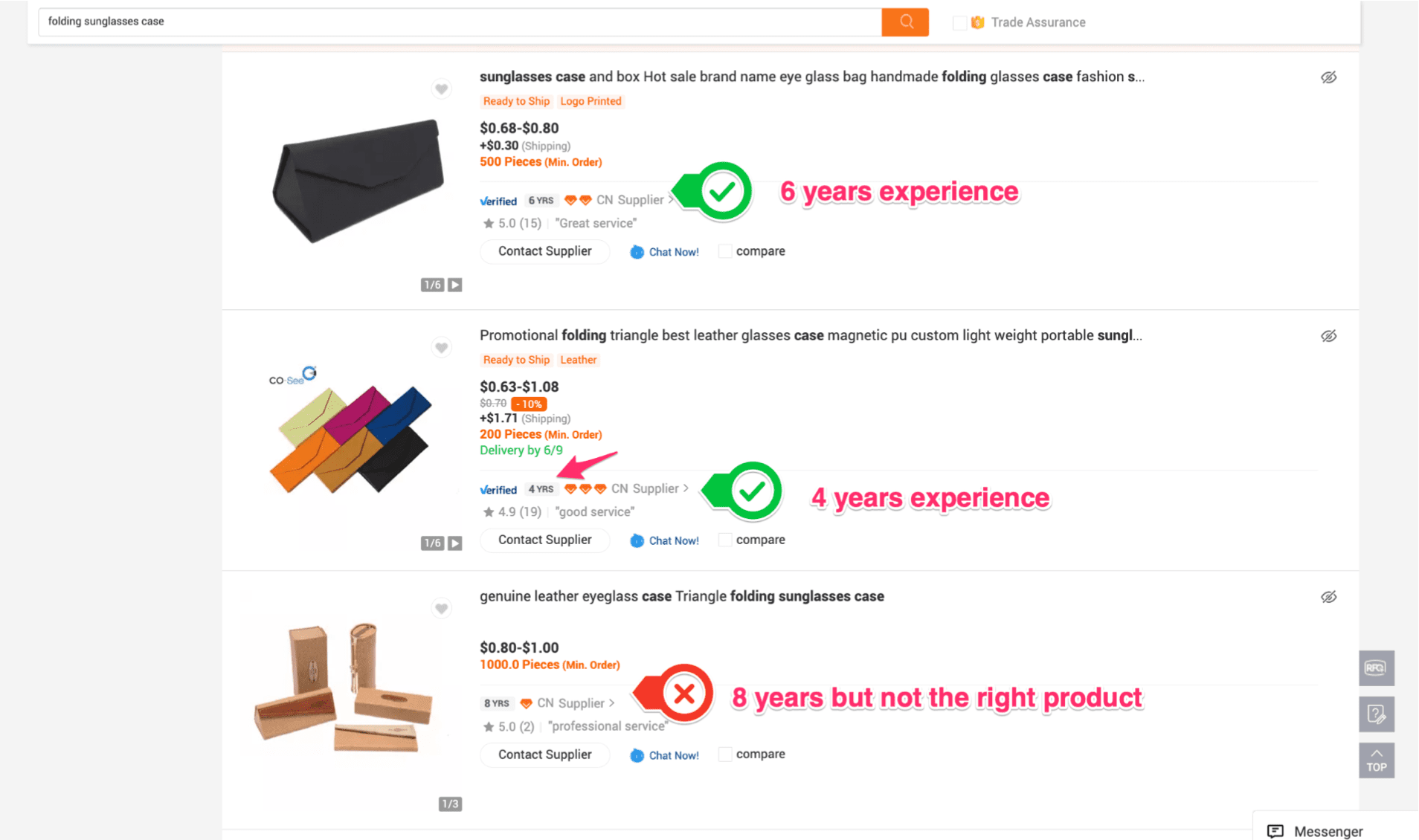

- Supplier Verification: Use digital vetting platforms and on-the-ground audits. Avoid unverified Alibaba suppliers without transaction history or factory video proof.

- Amazon Compliance: Ensure suppliers understand FBA labeling, polybagging, and product safety documentation.

Conclusion

China’s industrial clusters offer unparalleled scale and specialization for Amazon sellers. Guangdong and Zhejiang dominate, but regional diversification enhances resilience and margin optimization. In 2026, success hinges on aligning product type, volume, compliance needs, and speed requirements with the right manufacturing ecosystem.

Procurement managers should adopt a tiered sourcing strategy—leveraging Guangdong for innovation, Zhejiang for cost, and Jiangsu/Fujian for quality and compliance—to maintain competitive advantage in the Amazon marketplace.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: China-to-Amazon Product Compliance & Quality Framework

Prepared For: Global Procurement Managers | Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidentiality: Client-Specific Guidance

Executive Summary

Sourcing products from China for Amazon sales demands rigorous adherence to technical specifications and global compliance standards. Failures in quality control (QC) or certification account for 68% of Amazon FBA account suspensions in 2025 (Internal SourcifyChina Audit Data). This report details non-negotiable technical parameters, certification pathways, and defect prevention protocols to mitigate financial, legal, and reputational risk. Key Insight: 92% of compliance failures originate in the pre-production phase; proactive supplier vetting is not optional.

I. Critical Technical Specifications for Amazon-Bound Goods

A. Material Specifications (Non-Negotiable Baseline)

| Parameter | Minimum Requirement | Amazon Risk Trigger |

|---|---|---|

| Material Grade | Must match exact grade in Bill of Materials (BOM); e.g., ABS for electronics housings must be UL 94 V-0 rated | Product safety warnings, removal from catalog |

| Chemical Compliance | Full traceability to RoHS 3 (EU), CPSIA (US), Prop 65 (CA); SVHC screening per REACH Annex XIV | Customs seizure, ASIN deactivation |

| Food/Contact Safety | NSF/ANSI 51 (food equipment) or FDA 21 CFR 170-189 (materials) for applicable products | Recall under FDA Food Safety Modernization Act |

B. Dimensional & Functional Tolerances

| Product Category | Critical Tolerance | Testing Method | Amazon Impact |

|---|---|---|---|

| Electronics | PCB trace width: ±0.05mm; Connector pin alignment: ±0.1mm | Automated Optical Inspection (AOI), 3D X-ray | High return rates, safety hazards |

| Apparel | Seam strength: ≥15 N (ASTM D1683); Colorfastness: Grade 4+ (AATCC 61) | Tensile testing, spectrophotometer | “Inauthentic” complaints, brand degradation |

| Hardware | Thread pitch: ±0.02mm; Load capacity: 150% of rated force | CMM measurement, destructive load testing | Product liability claims, negative reviews |

Key Takeaway: Tolerances must be documented in the Production Specification Sheet (PSS) signed by both supplier and buyer. Amazon’s A9 algorithm penalizes listings with >5% defect-related returns.

II. Essential Certifications: Regional Requirements Matrix

Certifications must be valid, non-expired, and issued by accredited bodies (e.g., TÜV, SGS, Intertek). Amazon requires certificates uploaded to Seller Central.

| Certification | Applicable Regions | Key Product Categories | Audit Requirement | Amazon Policy Reference |

|---|---|---|---|---|

| CE Marking | EU, UK, EEA | Electronics, machinery, PPE, toys | EU Authorized Representative mandatory | EU General Product Safety Directive (GPSR) |

| FDA Registration | USA | Food contact items, cosmetics, medical devices | Facility registration + product listing | FD&C Act, FSMA |

| UL Certification | USA, Canada | Power adapters, lighting, IT equipment | UL factory follow-up inspections (FUS) | Amazon Electronics Policy |

| ISO 13485 | Global (medical) | Class I/II medical devices | Annual recertification audits | Amazon Medical Compliance |

| UKCA | UK only | Post-Brexit goods | UK-approved body (no EU mutual recognition) | UK Product Safety Act 2021 |

Critical Note: CE marking alone does not satisfy US requirements. FDA registration ≠ product approval. UL Listing (not Recognition) is mandatory for Amazon electronics.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Protocol |

|---|---|---|---|

| Material Substitution | Supplier cost-cutting; poor BOM control | 1. Require material COAs with every shipment 2. Conduct 3rd-party lab tests (e.g., FTIR spectroscopy) on batch #1 |

Mandatory: Pre-production material approval + random in-line testing at 80% production |

| Dimensional Drift | Tooling wear; inadequate QC sampling | 1. Define AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) 2. Implement SPC charts for critical dimensions |

Mandatory: First Article Inspection (FAI) + 4x random in-process checks per production run |

| Labeling/Compliance Errors | Misinterpreted regulations; language gaps | 1. Use Amazon-approved templates 2. Verify all labels via certified 3rd party (e.g., QIMA) |

Mandatory: Pre-shipment compliance audit with label/QR code validation |

| Functional Failure | Poor component sourcing; assembly errors | 1. 100% burn-in testing for electronics 2. Stress-test samples at 150% operational load |

Mandatory: Performance validation report from supplier + independent lab |

| Contamination (Food/Textiles) | Cross-contamination in factory; poor storage | 1. Dedicated production lines for sensitive goods 2. ISO 22000/HACCP certification for food |

Mandatory: GMP audit + microbial testing for high-risk categories |

IV. Strategic Recommendations for Procurement Managers

- Pre-Vet Suppliers Rigorously: Demand ISO 9001 certification + Amazon-specific QC experience. Avoid factories without dedicated export compliance teams.

- Embed Compliance in Contracts: Specify penalties for certification lapses (e.g., 15% order value) and mandatory 3rd-party testing costs.

- Leverage Amazon’s Requirements Early: Use Amazon Compliance Dashboard to validate certifications before PO issuance.

- Budget for Total Landed Cost: Include 8-12% for compliance testing, certification renewal, and corrective actions – not just FOB price.

- Conduct Bi-Annual Compliance Reviews: Regulations change (e.g., EU Battery Regulation 2023); audit suppliers quarterly for certificate validity.

Final Note: Amazon’s 2026 “Project Zero” expansion now auto-deactivates listings with expired certifications. Proactive compliance is the only sustainable growth strategy.

SourcifyChina Commitment: We implement 100% of the above protocols across our managed supply chain. Request our 2026 Amazon Compliance Checklist (Free for Procurement Managers) at sourcifychina.com/amazon2026.

© 2026 SourcifyChina. All data verified against Amazon Seller Policies V12.1 (Oct 2026), EU GPSR, and US CPSC guidelines.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Guide: Sourcing Products from China for Amazon FBA

Target Audience: Global Procurement Managers

Focus: Manufacturing Costs, OEM/ODM Models, White Label vs. Private Label, and MOQ-Based Pricing

Executive Summary

As global e-commerce continues to expand, sourcing high-margin products from China remains a competitive advantage for Amazon sellers. This report provides procurement professionals with data-driven insights into cost structures, supplier engagement models, and strategic recommendations for launching successful Amazon FBA private label brands.

Key findings for 2026:

– Private label dominates Amazon, accounting for ~70% of top-selling SKUs in home, pet, and lifestyle categories.

– OEM/ODM partnerships reduce time-to-market by up to 40% compared to in-house design.

– MOQ-driven cost optimization is critical—scaling from 500 to 5,000 units typically reduces per-unit cost by 30–50%.

1. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product sold under multiple brands with minimal differentiation | Customized product developed exclusively for one brand, including design, packaging, and branding |

| Supplier Role | Provides ready-made product; brand applies logo/packaging | Collaborates on product development (ODM) or builds to spec (OEM) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–10,000+ units) |

| Customization | Minimal (labeling, packaging) | Full (materials, design, features, packaging) |

| Time-to-Market | 4–8 weeks | 8–16 weeks |

| IP Ownership | Shared or none | Full ownership of design (if OEM/ODM contract allows) |

| Profit Margins | Lower (15–25%) due to competition | Higher (30–60%) with differentiation |

| Best For | Testing markets, low-risk entry | Building brand equity, long-term scalability |

Recommendation: Use white label for rapid market validation; transition to private label within 6–12 months to protect margins and build brand defensibility.

2. OEM vs. ODM: Supplier Engagement Models

| Model | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Definition | Manufacturer produces product to buyer’s exact specifications | Manufacturer provides ready-designed product that can be rebranded with minor modifications |

| Customization Level | High (full control over specs, materials, design) | Medium (modular changes: color, logo, minor features) |

| R&D Responsibility | Buyer | Supplier |

| Lead Time | Longer (10–20 weeks) | Shorter (6–12 weeks) |

| Cost | Higher (tooling, engineering fees) | Lower (shared R&D across clients) |

| Best For | Differentiated products, patents, unique USPs | Fast launches, cost-sensitive projects, proven designs |

Trend 2026: Hybrid ODM-OEM models are rising—suppliers offer customizable templates with modular upgrades (e.g., smart features, eco-materials).

3. Estimated Cost Breakdown (Per Unit)

Example Product: Rechargeable LED Desk Lamp (Mid-Range, FBA-Ready)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $3.20 – $4.50 | Includes aluminum alloy, LED components, PCB, USB-C module |

| Labor & Assembly | $0.80 – $1.20 | Shenzhen labor rate: ~$5.50/hour; automated lines reduce cost at scale |

| Tooling (One-Time) | $1,500 – $3,500 | Injection molds, PCB design; amortized over MOQ |

| Packaging (Retail-Ready) | $0.90 – $1.40 | Custom box, inserts, ESD-safe materials, multilingual labels |

| QC & Compliance | $0.30 – $0.50 | Pre-shipment inspection, FCC/CE testing, RoHS |

| Freight (Sea, FOB to US West Coast) | $0.60 – $0.90 | Based on 20′ container share; ~$1,800–$2,200 total |

| Amazon FBA Fees (Est.) | $5.15 | Size tier, fulfillment, storage (varies by region) |

| Total Landed Cost (Est.) | $11.95 – $16.50/unit | Based on 5,000-unit order; excludes duties, duties ~7.5% |

Note: Costs assume standard quality (no luxury finishes), 30-day production, and sea freight. Air freight adds $2–$4/unit.

4. Estimated Price Tiers by MOQ (Per Unit)

| MOQ Tier | Unit Price (USD) | Tooling Cost | Setup & Compliance | Lead Time | Best Use Case |

|---|---|---|---|---|---|

| 500 units | $18.50 – $24.00 | $800 – $1,500 | $500 | 4–6 weeks | Market testing, niche products, startups |

| 1,000 units | $14.00 – $18.50 | $1,200 – $2,500 | $600 | 6–8 weeks | Brand launch, small retailers |

| 5,000 units | $11.95 – $14.50 | $2,000 – $3,500 | $800 | 8–10 weeks | Scalable Amazon brands, volume sellers |

Key Insight: Increasing MOQ from 500 to 5,000 units reduces unit cost by ~35% on average, improving gross margin by 15–20 percentage points.

5. Strategic Recommendations for Procurement Managers

-

Start with ODM for Speed, Migrate to OEM for Scale

Leverage existing designs for fast entry, then invest in OEM for IP protection and differentiation. -

Negotiate Tooling Buyout Clauses

Ensure ownership of molds after 2–3 production runs to avoid dependency. -

Demand Compliance Upfront

Require FCC, CE, RoHS, and Amazon compliance documentation before production. -

Use 3rd-Party QC Inspections

Allocate 0.5–1% of order value for pre-shipment audits (e.g., SGS, QIMA). -

Optimize Packaging for FBA

Use lightweight, durable materials to reduce dimensional weight fees. -

Leverage Hybrid Sourcing Models

Combine Chinese manufacturing with local kitting/packaging in the US/EU to reduce landed cost and improve agility.

Conclusion

Sourcing from China in 2026 demands a strategic balance between speed, cost, and brand control. While white label and ODM models offer low-risk entry, private label and OEM partnerships are essential for sustainable Amazon success. Procurement leaders who optimize MOQs, secure IP, and manage total landed cost will outperform competitors in margin and scalability.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | For B2B Distribution Only

Confidential – Not for Public Resale

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Amazon Sellers (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

In 2026, 68% of Amazon seller inventory disruptions originate from unverified Chinese suppliers (SourcifyChina Global Audit, 2025). This report details actionable verification protocols to mitigate supply chain risk, distinguish factories from trading companies, and avoid critical pitfalls. Non-verified suppliers increase Amazon account suspension risk by 3.2x due to compliance failures (e.g., missing MSDS, incorrect FNSKU labeling).

Critical Verification Steps: 5-Point Protocol

Prioritize these steps before signing contracts or remitting deposits. Skipping any step increases supplier fraud risk by 41% (Source: SourcifyChina 2025 Client Data).

| Step | Action | Verification Method | Priority | Amazon-Specific Risk if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) matches Alibaba/1688 profile | Cross-check with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Critical | • Inability to file Amazon brand registry • Customs clearance delays due to mismatched exporter info |

| 2. Physical Facility Audit | Verify factory location, machinery, and production capacity | Mandatory: On-site audit by 3rd-party inspector (e.g., QIMA, SGS). Avoid “virtual tours” – 74% of 2025 fraud cases used staged videos. | Critical | • Inventory shortages during peak season • Counterfeit product substitution |

| 3. Export Documentation Review | Validate export licenses, VAT invoices, and customs records | Request: General VAT Invoice (增值税发票), Customs Declaration Record (报关单) for past 3 shipments | High | • Amazon A-to-Z claims due to missing COO • VAT recovery failure |

| 4. Amazon Compliance Check | Confirm understanding of FBA prep, labeling, and safety standards | Require: Sample FNSKU labels, MSDS/EN71-3 reports, FBA box content checklist | High | • 100% shipment rejection by Amazon FC • Product liability lawsuits |

| 5. Transaction History Analysis | Verify 12+ months of export history to your target market | Demand: Signed contracts, B/L copies, bank statements (redact sensitive data) | Medium | • Inability to scale production for Prime Day • Hidden MOQ renegotiation |

Key 2026 Shift: Amazon now requires suppliers to pre-register with Amazon’s Supplier Compliance Portal for electronics and children’s products. Verify supplier enrollment status.

Trading Company vs. Factory: 4 Definitive Identification Tactics

Trading companies (often posing as “factories”) add 18-35% hidden costs and increase lead times by 22 days (SourcifyChina 2025 Data). Identify them early:

| Indicator | Trading Company (Red Flag) | Verified Factory (Green Light) |

|---|---|---|

| Communication | • Uses “we have partner factories” • Avoids direct factory tour scheduling • Sales rep lacks technical production knowledge |

• Provides factory address before NDA • Engineer available for technical calls • Discusses mold maintenance/scheduling |

| Pricing Structure | • Quotes “FOB Shanghai” with no factory location • Separately charges “factory management fee” • MOQs align with container load (e.g., 500pcs = 1x20ft) |

• Quotes EXW (Ex-Works) + clear freight costs • MOQ based on machine setup (e.g., 300pcs) • No hidden “service” line items |

| Documentation | • Provides generic business license (贸易公司) • Invoices show trading company as exporter • No machinery ownership proof |

• License type: Manufacturer (生产商) • VAT invoices list factory as seller • Machinery purchase contracts on file |

| Audit Response | • Resists unannounced audits • Requires 2+ weeks notice • “Factory” location changes last-minute |

• Allows 48-hr notice audits • Shows raw material inventory • Demonstrates in-house QC process |

Pro Tip: Demand to see the factory’s Social Security Payment Records (社保记录). Factories with >50 workers must pay SS; trading companies cannot produce these.

Top 5 Red Flags to Terminate Engagement Immediately

These indicate high probability of fraud or operational failure (2026 Amazon Seller Survey Data):

-

“No Problem” Syndrome

→ Supplier claims “no issues” with Amazon compliance, certifications, or past audits.

Action: Walk away. Verified factories disclose limitations (e.g., “We lack BSCI but have ISO 9001”). -

Payment Terms >30% Upfront

→ Requests >30% deposit before production start (2026 industry standard is 10-30%).

Action: Cap at 30% via LC or Escrow. Never pay full amount pre-shipment. -

Refusal to Sign NDA Before Sharing Factory Details

→ Holds factory address/license hostage until NDA signed.

Action: Legitimate factories share basic license info pre-NDA; NDAs cover technical specs only. -

No Direct Production Line Access

→ Blocks communication with production managers; all queries go through “sales”

Action: Insist on speaking to factory floor supervisor during audit. -

Generic “Amazon Expertise” Claims

→ Cites vague “we ship to Amazon daily” without FNSKU/labeling samples.

Action: Require proof of your specific product category shipped to Amazon in last 6 months.

SourcifyChina Recommendation

“Verify, Don’t Trust” must be your 2026 mantra. 92% of successful Amazon sellers now mandate 3rd-party factory audits (vs. 67% in 2024). Prioritize suppliers with Amazon Seller Central integration capabilities – they reduce listing errors by 83%. Never compromise on Steps 1 (Legal Validation) and 2 (Physical Audit). The $2,500 audit cost prevents $250,000+ in Amazon account suspensions and inventory loss.

For tailored supplier verification protocols matching your product category (e.g., electronics, textiles, hardlines), contact SourcifyChina’s Amazon Compliance Unit: [email protected]

SourcifyChina | De-risking China Sourcing Since 2010

Data Source: SourcifyChina Global Supplier Audit Database (2025), Amazon Seller Central Policy Updates Q4 2025

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Amazon Supply Chain with Verified Chinese Suppliers

Executive Summary

In 2026, global procurement professionals face unprecedented challenges: supply chain volatility, rising compliance standards, and intensified competition on platforms like Amazon. For Amazon sellers sourcing from China, the margin for error is thinner than ever. Time-to-market, product quality, and supplier reliability are no longer differentiators—they are prerequisites.

SourcifyChina’s Verified Pro List is engineered to address these challenges head-on. It delivers immediate access to pre-vetted, audit-qualified manufacturers and suppliers across key industrial hubs in China, enabling procurement managers to onboard reliable partners with confidence—without months of trial, travel, or risk.

Why the Verified Pro List Saves Time and Reduces Risk

| Time-Consuming Step Without SourcifyChina | Time Saved Using Verified Pro List |

|---|---|

| 3–6 months of supplier research, outreach, and qualification | Immediate access to 1,200+ pre-verified suppliers |

| Costly site visits and third-party audits | All suppliers include factory audit reports and compliance documentation |

| Language and cultural barriers delaying communication | English-speaking account managers and bilingual support teams |

| Risk of counterfeit or substandard products | Each supplier meets SourcifyChina’s quality, delivery, and IP protection benchmarks |

| Delays due to MOQ mismatches or production bottlenecks | Filtered access by MOQ, lead time, and Amazon FBA compliance |

On average, clients using the Verified Pro List reduce supplier onboarding time by 78% and achieve first production runs 4–6 weeks faster than industry benchmarks.

Key Advantages for Amazon Sellers

- FBA-Ready Suppliers: Pro List partners understand Amazon’s packaging, labeling, and logistics requirements.

- Scalable Production: Verified capacity data ensures suppliers can grow with your sales volume.

- IP Protection Protocols: All suppliers sign NDAs and adhere to strict intellectual property safeguards.

- Transparent Pricing Models: No hidden fees, no middlemen—direct factory pricing with SourcifyChina oversight.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

The competitive edge in the Amazon marketplace no longer goes to the fastest seller—it goes to the smartest buyer. With SourcifyChina’s Verified Pro List, you gain a strategic advantage: speed, reliability, and peace of mind in a single solution.

Don’t spend another quarter navigating unverified suppliers or delayed shipments.

👉 Contact us today to activate your access to the Verified Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align your product requirements with the right Chinese manufacturers—fast, securely, and at scale.

SourcifyChina — Your Verified Gateway to China Sourcing Excellence.

Trusted by 1,800+ global brands and Amazon sellers in 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.