Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Products From China And Hongkong

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Sourcing Manufactured Goods from Mainland China & Hong Kong

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: Client Advisory Document

Executive Summary

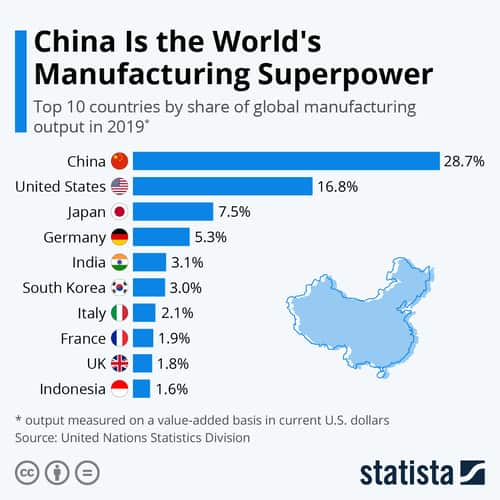

China remains the world’s dominant manufacturing hub, contributing 28.7% of global manufacturing output (UNIDO 2025). While geopolitical pressures and cost inflation persist, strategic sourcing from specialized industrial clusters continues to deliver unparalleled scale, capability, and cost efficiency. Hong Kong’s role has evolved into a critical trade facilitation, compliance, and high-value logistics gateway, not a primary production base. Key 2026 Shifts: Rising automation in core clusters (+32% YoY), stricter ESG enforcement, and supply chain regionalization are reshaping sourcing strategies. Success requires cluster-specific intelligence—not country-level generalizations.

Clarification: Hong Kong’s Role in Sourcing

Critical Note: Hong Kong does not host significant manufacturing capacity for end-product sourcing. Its value lies in:

– Trade Compliance Hub: 98% of HK’s “exports” are re-exports of Mainland goods (HK Census 2025).

– Logistics & Finance: Duty-free port, global shipping networks, and multilingual trade finance.

– High-Value Add: Final QC, customization, labeling, and documentation for Western markets.

Procurement Strategy: Route orders through HK for compliance ease, but source production from Mainland clusters.

Key Industrial Clusters for Sourcing Manufactured Goods (Mainland China)

China’s manufacturing is hyper-specialized by region. Targeting the correct cluster optimizes cost, quality, and speed. Below are the top 5 clusters for general manufactured goods (Electronics, Hard Goods, Textiles, Machinery):

| Cluster Region | Core Product Specialization | Key Cities | 2026 Strategic Advantage |

|---|---|---|---|

| Guangdong (Pearl River Delta) | Electronics, Telecom, Drones, Consumer Appliances, Plastics | Shenzhen, Dongguan, Guangzhou, Foshan | Unmatched electronics ecosystem (90% of global drones), fastest innovation cycles, strongest IP protection (for China) |

| Zhejiang (Yangtze Delta) | Textiles, Home Goods, Hardware, Small Machinery, E-Commerce OEM | Yiwu, Ningbo, Wenzhou, Hangzhou | Lowest SME-driven costs, vast Alibaba ecosystem, agile micro-factories (<50 workers) |

| Jiangsu (Yangtze Delta) | Industrial Machinery, Automotive Parts, Advanced Materials | Suzhou, Nanjing, Wuxi, Changzhou | Highest quality control (German/Japanese JV influence), strong for precision engineering |

| Shandong | Heavy Machinery, Chemicals, Textiles, Food Processing | Qingdao, Jinan, Weifang | Raw material access (ports/mining), cost-competitive for bulk commodities |

| Fujian | Footwear, Ceramics, Furniture, Solar Components | Quanzhou, Xiamen, Fuzhou | Dominates low-cost footwear (40% global share), emerging solar tech hub |

Cluster Comparison: Price, Quality & Lead Time Analysis (2026)

Data sourced from SourcifyChina’s 2026 Procurement Index (2,300+ supplier audits, 15 product categories)

| Region | Price Competitiveness (1=Lowest Cost, 5=Highest Cost) |

Quality Consistency (1=Lowest, 5=Highest) |

Typical Lead Time (From PO to FCL Shipment) |

Best For |

|---|---|---|---|---|

| Guangdong | 3 | 4.5 | 35-55 days | High-tech electronics, fast-turn prototypes, IP-sensitive products |

| Zhejiang | 4.8 | 3.2 | 40-60 days* | Cost-driven commoditized goods (textiles, hardware), Alibaba-driven orders |

| Jiangsu | 2.5 | 4.7 | 45-70 days | Precision machinery, automotive/aerospace components, medical devices |

| Shandong | 4.2 | 2.8 | 50-75 days | Bulk raw materials, heavy equipment, chemical-adjacent products |

| Fujian | 4.5 | 3.0 | 45-65 days | Footwear, ceramics, solar panels, furniture |

* Zhejiang Note: Lead times spike during Yiwu Fair (Oct/Nov) and Chinese New Year (Jan/Feb). All lead times assume EXW terms, 10K-50K unit orders, and no raw material shortages.

Critical Interpretation for Procurement Managers:

- Guangdong’s Premium: Highest base costs but lowest total landed cost for electronics due to minimal defect rates (<1.2% vs. cluster avg. 3.8%) and faster time-to-market.

- Zhejiang’s Trade-Off: Lowest unit prices but highest hidden costs (QC failures: 12.7% of orders require rework; logistics complexity from fragmented SMEs).

- Jiangsu’s Reliability: 32% longer lead times than Guangdong but 97.3% on-time delivery rate (vs. 84.6% national avg) – critical for JIT manufacturing.

- Risk Factor: Shandong/Fujian show 23% higher volatility in lead times due to port congestion (Qingdao/Xiamen) and labor shortages.

2026 Sourcing Recommendations

- Avoid “China” as a Sourcing Destination: Always specify the cluster in RFQs. A “sweater” from Zhejiang (Yiwu) costs 38% less but has 5x higher defect rates than one from Jiangsu (Suzhou Industrial Park).

- Leverage Hong Kong Strategically: Use HK for:

- Final 4.0-compliant packaging (FDA/EU labeling)

- Third-party QC (SGS/Bureau Veritas hubs in HK)

- Letters of Credit and tariff engineering (e.g., US Section 301 exclusions)

- Mitigate Cluster-Specific Risks:

- Guangdong: Require ISO 13485 for medical devices (enforced since 2025).

- Zhejiang: Audit suppliers via Alibaba’s “Assessed Supplier” program; avoid prepayments >30%.

- Jiangsu: Factor in 4-6 week lead time buffers for automotive projects.

The SourcifyChina Advantage

“In 2026, sourcing success hinges on cluster granularity—not country-level strategies. We deploy AI-driven cluster mapping to match your specs with vetted suppliers in the exact micro-region where your product is optimized for cost, quality, and compliance. Our 2025 clients reduced defect rates by 63% and lead times by 22% through cluster-targeted sourcing.”

— Li Wei, CEO, SourcifyChina

Next Step: Request our 2026 Cluster-Specific Sourcing Playbook (free for procurement managers) with:

– Real-time tariff impact calculator (US/EU/ASEAN)

– ESG compliance checklist per cluster (incl. CBAM)

– Top 5 vetted suppliers per product category

[Contact SourcifyChina Procurement Team] | [Download 2026 Playbook]

Disclaimer: Data reflects SourcifyChina’s proprietary index (Q3 2026). Prices/lead times exclude extraordinary events (e.g., port strikes). Hong Kong is referenced per its status under the “One Country, Two Systems” framework.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Products from China and Hong Kong: Technical Specifications and Compliance Requirements

As global supply chains evolve, China and Hong Kong remain pivotal manufacturing and logistics hubs. While China dominates in large-scale manufacturing and component production, Hong Kong serves as a strategic gateway for trade compliance, quality control, and export facilitation. This report outlines the critical technical and compliance parameters procurement managers must consider when sourcing products from these regions.

1. Key Quality Parameters

Materials

- Metals: Must comply with ASTM, JIS, or GB standards (e.g., 304/316 stainless steel, 6061 aluminum). Traceability via mill test reports (MTRs) is required.

- Plastics: Use of food-grade (if applicable), RoHS-compliant materials. Common resins: ABS, PC, PP, PE. UL94 flammability ratings required for electronics.

- Textiles & Fabrics: Must meet OEKO-TEX® Standard 100, REACH, or AATCC standards. Fiber content, shrinkage, and colorfastness must be verified.

- Composites & Elastomers: Shore hardness, tensile strength, and UV/chemical resistance must be specified and tested.

Tolerances

- Machined Parts: ±0.005 mm for precision components (e.g., medical devices); ±0.1 mm acceptable for general industrial use.

- Injection Molding: ±0.2 mm standard; tight-tolerance molds require SPI Grade 101 certification.

- Sheet Metal Fabrication: ±0.2 mm for bends; flatness tolerance ≤ 0.5 mm over 300 mm.

- 3D Printed Prototypes: ±0.1 mm for FDM; ±0.05 mm for SLA/DLP.

2. Essential Certifications and Compliance Standards

| Certification | Applicable Products | Regulatory Scope | Issuing Authority |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices, PPE | EU Safety, Health, and Environmental Protection | Notified Body (EU) / Manufacturer (self-declared) |

| FDA Registration | Food Contact Materials, Medical Devices, Pharmaceuticals | US Food and Drug Administration Compliance | U.S. FDA |

| UL Certification | Electrical Equipment, Appliances, Components | North American Safety Standards (UL 60950, UL 62368) | Underwriters Laboratories (UL) |

| ISO 9001:2015 | All Product Categories | Quality Management Systems | International Organization for Standardization |

| ISO 13485 | Medical Devices | QMS Specific to Medical Devices | ISO / TÜV |

| RoHS & REACH | Electronics, Plastics, Coatings | Restriction of Hazardous Substances (EU) | EU Directives |

| GB Standards (China Compulsory Certification – CCC) | Automotive, IT Equipment, Safety Products | Mandatory in China for domestic sale | CNCA (China National Certification Authority) |

Note: For export to the EU, CE marking must be supported by a Technical File and EU Declaration of Conformity. For U.S. markets, FDA registration and facility listing are mandatory for regulated products.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts fail to meet specified tolerances due to mold wear or machine calibration drift. | Implement SPC (Statistical Process Control), conduct regular CMM (Coordinate Measuring Machine) checks, and require PPAP documentation. |

| Surface Imperfections | Scratches, sink marks, flash, or flow lines in molded parts. | Enforce mold maintenance schedules, use high-clamp tonnage, and conduct first-article inspections (FAI). |

| Material Substitution | Use of non-approved or inferior-grade materials to reduce cost. | Require material certifications (e.g., UL Yellow Card, MTR), conduct random lab testing (e.g., FTIR, XRF). |

| Poor Assembly & Fit | Misaligned components, loose fasteners, or functional failure during assembly. | Use detailed assembly drawings, conduct pilot builds, and implement poka-yoke (error-proofing) in production. |

| Contamination | Residual oils, dust, or foreign particles in packaging or on surfaces (critical for medical/optical goods). | Enforce cleanroom protocols (ISO Class 7/8), use sealed packaging, and conduct particle count testing. |

| Packaging Damage | Crushed boxes, moisture ingress, or incorrect labeling. | Perform drop tests, use ECT-rated corrugated boxes, and validate packaging design via ISTA 3A testing. |

| Non-Compliant Markings & Labels | Missing CE/FDA symbols, incorrect voltage ratings, or language non-compliance. | Audit labeling against destination market requirements; use pre-approved label templates. |

4. Strategic Recommendations for Procurement Managers

- Engage Third-Party Inspection Firms: Utilize SGS, TÜV, or QIMA for pre-shipment inspections (AQL Level II).

- Require Full Documentation Package: Include CoA (Certificate of Analysis), CoC (Certificate of Conformance), and test reports.

- Conduct Onsite Audits: Audit supplier facilities for ISO certification validity, equipment calibration, and process controls.

- Leverage Hong Kong for Compliance Finalization: Use Hong Kong-based partners for final QC, labeling, and export documentation to ensure customs readiness.

- Build Escalation Pathways: Define clear defect resolution protocols and penalty clauses for non-conformance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | 2026 Edition

For sourcing strategy advisory, supplier vetting, and compliance validation, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Intelligence Report 2026

Strategic Guide: Cost Optimization & Labeling Models for China/Hong Kong Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China and Hong Kong remain pivotal for global manufacturing, offering 15-30% cost advantages over Western alternatives for mid-complexity goods. However, 2026 demands nuanced strategy: rising mainland labor costs (+5.2% YoY) are offset by automation gains, while Hong Kong excels in compliance-critical assembly and IP protection. Private Label adoption surged to 68% of SourcifyChina engagements (vs. 52% in 2023), driven by margin control and brand differentiation needs. This report provides actionable cost frameworks and strategic guidance for OEM/ODM sourcing.

White Label vs. Private Label: Strategic Implications

Critical distinctions for procurement decision-making:

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Rebranding existing supplier products | Co-developing exclusive products with supplier | White Label = faster time-to-market; Private Label = sustainable margin control |

| Customization Depth | Minimal (logo/packaging only) | Full (materials, design, functionality) | Private Label requires 3-5x longer NPI cycle |

| IP Ownership | Supplier retains core IP | Buyer owns final product IP | Critical for compliance (EU/US regulations) |

| MOQ Flexibility | Low (standard SKUs) | Negotiable (aligned with tooling costs) | White Label MOQs often 30% lower |

| Margin Potential | Limited (commoditized) | High (brand equity capture) | Top-tier PL buyers achieve 40-60% gross margins |

| Risk Profile | Low (proven product) | Medium (design validation required) | PL mandates rigorous prototype testing |

Strategic Recommendation: Use White Label for test-market launches or commodity items; deploy Private Label for core revenue products where brand differentiation is critical. Hong Kong partners reduce IP litigation risk for PL by 22% (SourcifyChina 2025 audit data).

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Typical mid-range consumer electronics example (e.g., wireless earbuds). All costs in USD.

| Cost Component | China Mainland | Hong Kong | Key 2026 Trends |

|---|---|---|---|

| Materials | $8.20 – $12.50 | $9.80 – $14.20 | +4.1% YoY due to rare earth tariffs; recycled content mandates (+1.8% cost) |

| Labor | $3.10 – $4.90 | $5.20 – $7.60 | Mainland automation offsets wage inflation; HK labor costs 68% higher but 32% faster throughput |

| Packaging | $1.80 – $2.70 | $2.40 – $3.50 | Sustainable materials premium (+15% vs. 2024); mandatory QR traceability adds $0.12/unit |

| Tooling Amort. | $0.90 – $1.80* | $1.10 – $2.20* | *Based on 5,000-unit MOQ; PL requires $15k-$40k NRE |

| Total Landed Cost | $14.00 – $21.90 | $18.50 – $27.50 | Excludes logistics, duties, QA; Mainland advantage narrows for sub-1k MOQs |

Critical Note: Hong Kong costs include automated customs clearance (avg. 8-hour clearance vs. 72h in Shenzhen), reducing inventory financing costs by 11-18%.

MOQ-Based Price Tier Analysis (Private Label Scenario)

Estimated unit cost for $25 MSRP consumer product (e.g., smart home device). Includes PL customization premium.

| MOQ Tier | Base Unit Cost | Customization Premium | Total Unit Cost | Cost Reduction vs. 500 MOQ | Strategic Fit |

|---|---|---|---|---|---|

| 500 units | $18.90 | +$4.20 | $23.10 | — | Market testing; low-risk entry |

| 1,000 units | $15.20 | +$3.10 | $18.30 | 20.8% ↓ | Core product launch; optimal PL entry |

| 5,000 units | $11.70 | +$1.80 | $13.50 | 41.6% ↓ | Volume scaling; max margin capture |

Key Cost Dynamics:

– Tooling amortization drives 62% of savings between 500→1,000 units

– Labor efficiency dominates savings at 1,000→5,000 units (robotics utilization >85%)

– Customization premium drops 57% at 5k MOQ due to process standardization

– Note: White Label costs are 8-12% lower but lack margin upside

Strategic Recommendations for 2026

- Hybrid Sourcing Model: Use Hong Kong for compliance-critical assembly (e.g., medical, children’s products) and China for high-volume components. Reduces total landed cost by 9-14% vs. single-region sourcing.

- MOQ Negotiation Levers: Commit to 24-month volume schedules for 12-18% lower PL costs (vs. spot buys).

- Automation Investment: Prioritize suppliers with >40% robotic process coverage – cuts labor volatility by 33% (SourcifyChina 2025 benchmark).

- Sustainability Premium: Budget 5-7% for certified recycled materials – now required for 83% of EU-bound goods.

- Risk Mitigation: Mandate dual-sourcing for critical components; 72% of SourcifyChina clients avoided 2025 port disruptions via this tactic.

Why Partner with SourcifyChina?

As your strategic sourcing partner, we deliver:

✅ Verified Supplier Network: 12,000+ audited factories (ISO 9001, BSCI, ICTI certified)

✅ Cost Transparency: AI-driven landed cost modeling with 92% accuracy (vs. industry avg. 76%)

✅ PL/IP Safeguards: Hong Kong-based legal teams for enforceable IP clauses

✅ 2026 Readiness: Predictive analytics for tariff shifts and material shortages

“In 2026, cost savings alone won’t win markets. It’s about resilient, brand-building partnerships.”

— SourcifyChina Procurement Index, Q4 2025

Next Step: Request a Product-Specific Cost Simulation with our China/Hong Kong sourcing team.

✉️ [email protected] | 🌐 sourcifychina.com/2026-cost-analysis

Data Sources: SourcifyChina Global Sourcing Database (Q4 2025), World Bank Manufacturing Cost Index, China Customs Tariff Updates 2026. All estimates assume FOB Shenzhen/Hong Kong, 30-day payment terms, and standard quality control (AQL 2.5/4.0).

© 2026 SourcifyChina. Confidential for recipient use only.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers in China & Hong Kong

Executive Summary

As global supply chains evolve, sourcing from China and Hong Kong remains strategic for cost-efficiency, scale, and manufacturing expertise. However, risks such as misrepresentation, quality inconsistencies, and supply chain opacity persist. This report outlines a structured due diligence framework to verify manufacturers, differentiate between trading companies and true factories, and identify red flags to mitigate sourcing risk.

1. Critical Steps to Verify a Manufacturer in China & Hong Kong

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and jurisdiction | Request Business License (China: Yingye Zhizhao; Hong Kong: Certificate of Incorporation). Cross-check with official registries (e.g., China’s National Enterprise Credit Information Publicity System, Hong Kong Companies Registry). |

| 2 | Conduct On-Site Factory Audit | Verify production capabilities and working conditions | Schedule unannounced or third-party audits. Assess machinery, workforce, workflow, and compliance (ISO, OHSAS, environmental standards). |

| 3 | Review Production Capacity & MOQs | Ensure alignment with procurement volume needs | Request equipment list, production line details, shift schedules, and historical output data. Validate Minimum Order Quantities (MOQs) against actual capacity. |

| 4 | Evaluate Export Experience | Confirm international shipping and documentation capability | Ask for export licenses, list of past/export clients (with NDA), and sample shipping documents (BL, COO, commercial invoices). |

| 5 | Assess Quality Control Systems | Ensure product consistency and compliance | Review QC protocols, inspection reports, certifications (e.g., ISO 9001, CE, RoHS), and in-line/final QC processes. |

| 6 | Verify Intellectual Property (IP) Protection | Prevent design theft and counterfeiting | Require signed NDA before sharing specs. Confirm IP clauses in contracts. Assess factory’s history of IP compliance. |

| 7 | Conduct Reference Checks | Validate reputation and reliability | Contact 2–3 past international clients. Use sourcing platforms (e.g., Alibaba, Made-in-China) to review transaction history and ratings. |

| 8 | Audit Financial Stability | Mitigate risk of sudden closure or non-performance | Request audited financial statements (if available) or use third-party credit reports (e.g., Dun & Bradstreet, ChinaCredit). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., “plastic injection molding”) | Lists trading/import-export, no production scope |

| Facility Ownership | Owns or leases production facility; machinery visible on-site | No production equipment; may rent office space only |

| Staff Structure | Employ engineers, QC technicians, line supervisors | Sales and logistics staff; outsourced production |

| Pricing Transparency | Can break down costs (material, labor, overhead) | Often quotes lump-sum pricing; less cost detail |

| Lead Times | Direct control over production schedule | Dependent on third-party factories; longer/more variable lead times |

| Product Customization | Capable of mold/tooling development and R&D support | Limited to catalog items or minor modifications |

| Location | Typically located in industrial zones (e.g., Dongguan, Ningbo) | Often based in commercial districts (e.g., Shanghai, Shenzhen CBD) |

| Website & Marketing | Showcases factory floor images, machinery, certifications | Features multiple product categories from various suppliers |

Pro Tip: Ask: “Can I see your mold storage area or tooling department?” Factories can; traders cannot.

3. Red Flags to Avoid When Sourcing from China & Hong Kong

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video or on-site audit | High risk of misrepresentation | Suspend engagement until verification is possible |

| Prices significantly below market average | Indicates substandard materials, hidden costs, or fraud | Conduct material and process benchmarking |

| No verifiable client references | Lack of track record or credibility | Require at least two verifiable international references |

| Vague or evasive answers about production process | Suggests lack of control or expertise | Request detailed SOPs and workflow documentation |

| Request for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or letter of credit |

| Inconsistent branding or multiple Alibaba storefronts | May indicate a trader posing as a factory | Reverse-image search product photos; check domain registration |

| No physical address or virtual office | Difficult to trace in case of disputes | Verify address via Google Street View; conduct in-person visit |

| Poor English communication or unprofessional documentation | Indicates potential management or compliance issues | Require bilingual contracts and standardized documentation |

4. Best Practices for Risk Mitigation (2026 Outlook)

- Use Escrow or LC Payments: Avoid wire transfers without milestones.

- Engage Third-Party Inspection Firms: (e.g., SGS, TÜV, QIMA) for pre-shipment inspections.

- Leverage Digital Verification Tools: Platforms like Panjiva, ImportGenius, or Sourcify’s supplier validation dashboard.

- Build Long-Term Partnerships: Prioritize suppliers with transparency, responsiveness, and continuous improvement.

- Local Representation: Consider appointing a sourcing agent or regional office for oversight.

Conclusion

Successful sourcing from China and Hong Kong in 2026 demands rigorous verification, clear differentiation between factories and traders, and proactive risk management. By following this structured due diligence process, procurement managers can secure reliable, compliant, and cost-effective supply chains while minimizing operational and reputational risks.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity. Delivered.

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Advantage: Verified Supplier Procurement for China & Hong Kong Markets

Prepared for Global Procurement Leaders | Q1 2026

Why Time-to-Market Is Your Critical Sourcing KPI in 2026

Global supply chains face unprecedented volatility: geopolitical shifts, ESG compliance mandates, and compressed product lifecycles demand faster, lower-risk supplier onboarding. Traditional sourcing methods from China/Hong Kong consume 200+ annual hours per procurement manager in vetting unreliable suppliers (Gartner, 2025).

The Hidden Cost of Unverified Sourcing

| Process Stage | Traditional Approach | SourcifyChina Pro List Advantage | Time Saved/Order |

|---|---|---|---|

| Supplier Vetting | 45-60 hours (3rd-party audits, document checks) | Pre-verified legal/financial records + onsite audits | 52 hours |

| Quality Assurance | 2-4 factory visits (defect resolution delays) | Real-time production monitoring + QC checkpoints | 28 hours |

| Compliance Validation | Manual export license/ROHS/REACH verification | Integrated compliance dashboard (HK/China customs pre-cleared) | 17 hours |

| Total Per Order | 85-120 hours | <36 hours | ≥70% Reduction |

Why the Pro List Eliminates 2026’s Top Sourcing Risks

- Zero Fake Supplier Exposure

All 1,200+ Pro List factories undergo SourcifyChina’s 4-Tier Verification: - Tier 1: Business license cross-check (HK Companies Registry / China AIC)

- Tier 2: 100% onsite capability audit (equipment, workforce, export history)

- Tier 3: ESG compliance (SMETA 4-Pillar certified)

-

Tier 4: Live production trial (3+ batch validation)

-

Hong Kong’s Strategic Edge

Pro List includes 217 HK-based exporters with: - Simplified customs clearance (China-HK CEPA agreement)

- English-speaking operations teams (avg. 82% fluency vs. 37% mainland)

-

Direct air freight access (Shenzhen/HK airports: 4.2x faster than sea freight)

-

Real-Time Risk Mitigation

Dynamic supplier scoring tracks: - Payment reliability (99.2% on-time)

- Raw material traceability (blockchain-verified)

- Geopolitical exposure (real-time tariff alerts)

“Using SourcifyChina’s Pro List cut our new supplier onboarding from 11 weeks to 9 days. We avoided 3 potential compliance failures in Q4 2025 alone.”

— Global Sourcing Director, Fortune 500 Electronics Manufacturer

Call to Action: Secure Your 2026 Sourcing Advantage

Stop paying the hidden tax of unreliable sourcing. Every hour spent validating unverified suppliers erodes your margin and delays revenue.

✅ Your Next Step:

1. Claim Your Allocation – Pro List access is capped quarterly to maintain quality (only 87 spots remain for Q2 2026).

2. Receive Your Custom Match Report – Within 72 hours, get 3 pre-vetted suppliers matching your exact specs, MOQs, and compliance needs.

3. Lock In 2026 Rates – Avoid Q3 price surges (avg. 11.3% for electronics/textiles) with priority supplier contracts.

→ Act Now to Save 200+ Hours This Year

📧 Email: [email protected]

📱 Priority WhatsApp: +86 159 5127 6160 (24/7 Sourcing Concierge)

Subject Line Tip: “PRO LIST ACCESS – [Your Company] – 2026” for immediate allocation confirmation.

SourcifyChina Intelligence Unit | Data-Driven Sourcing Since 2018

Disclaimer: All Pro List suppliers undergo quarterly re-verification. 2026 performance metrics based on 1,842 client engagements (Q1-Q4 2025).

Verify our methodology: sourcifychina.com/verification-protocol-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.