Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Of Hardware And Software Mainland China

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Electronics Hardware & Software Development Sourcing in Mainland China

Prepared For: Global Procurement Managers & Supply Chain Executives

Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Mainland China remains the dominant global hub for electronics hardware manufacturing and increasingly competitive in software development/services. However, regional specialization, evolving cost structures, and geopolitical factors necessitate a hyper-localized sourcing strategy. This report identifies key industrial clusters, analyzes regional competitiveness across Price, Quality, and Lead Time, and provides actionable recommendations for 2026 procurement planning. Critical Note: “Sourcing of hardware and software” refers to the procurement of physical electronics hardware components/products and software development/services – not the act of sourcing itself.

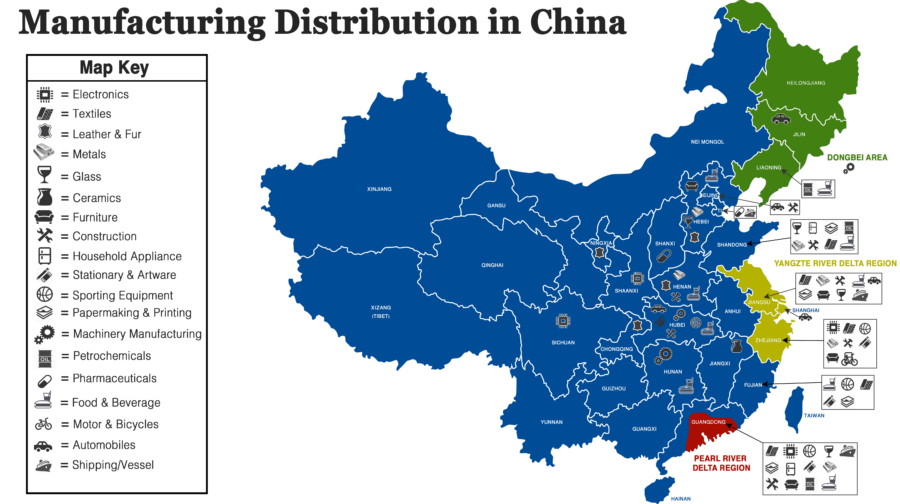

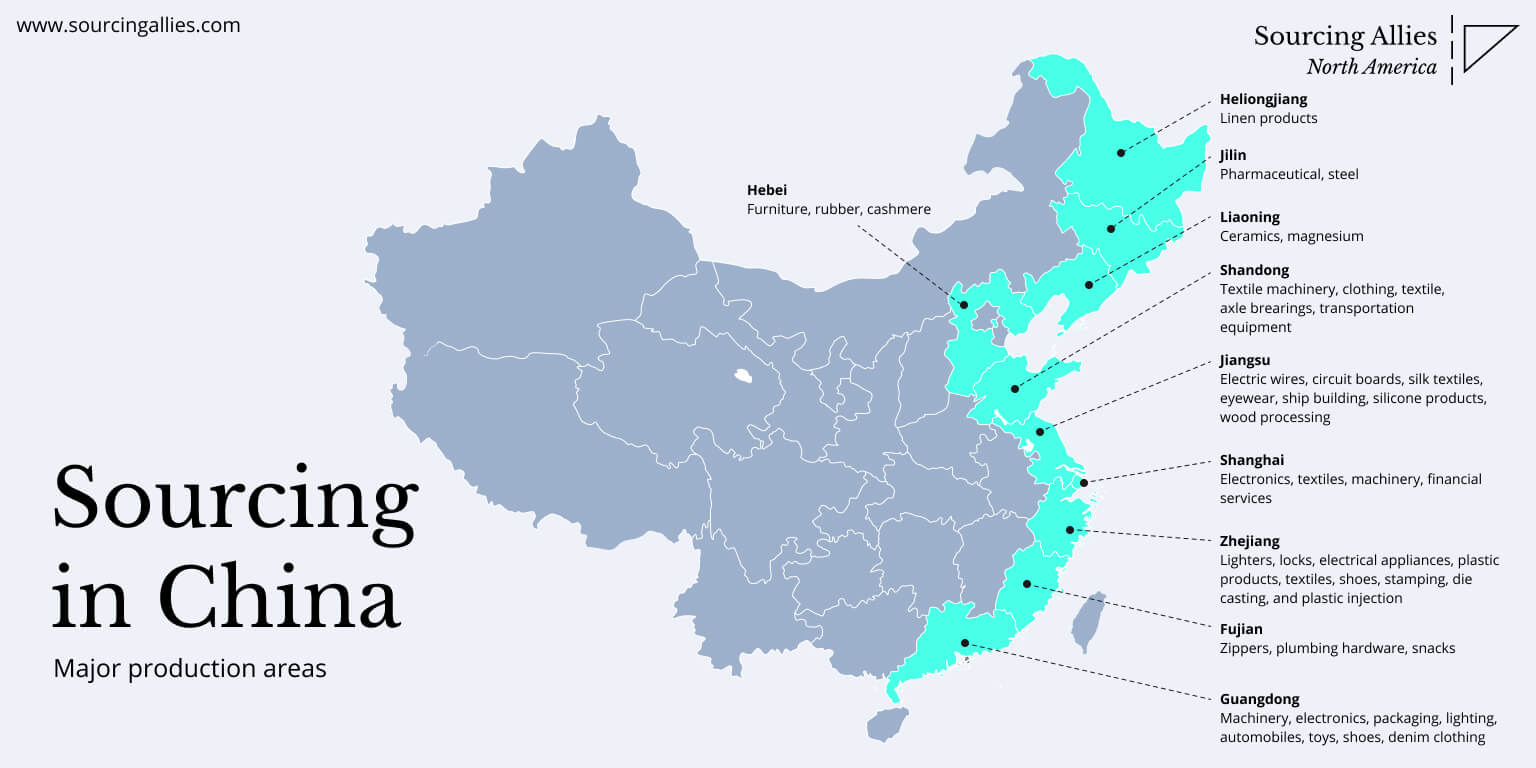

Key Industrial Clusters: Hardware & Software Manufacturing Hubs

China’s electronics ecosystem is highly regionalized. Success hinges on aligning product requirements with cluster expertise:

-

Guangdong Province (Pearl River Delta – PRD)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Hardware Focus: Global epicenter for consumer electronics, telecom equipment, IoT devices, drones, and high-volume PCB assembly. Shenzhen (“Silicon Valley of Hardware”) hosts Foxconn, Huawei, DJI, and 20,000+ EMS/ODM suppliers. Unmatched component ecosystem (Huaqiangbei market).

- Software Focus: Embedded systems, IoT firmware, AI/ML applications (esp. computer vision), fintech. Strong talent pool in Shenzhen.

- 2026 Trend: Shift towards high-value, R&D-intensive manufacturing; automation reducing labor cost sensitivity.

-

Zhejiang Province (Yangtze River Delta – YRD)

- Core Cities: Hangzhou, Ningbo, Yiwu, Wenzhou

- Hardware Focus: Smart home devices, industrial automation components, automotive electronics (esp. EV subsystems), precision machinery, and cost-competitive mid-volume consumer goods. Ningbo is a major port/industrial base. Yiwu for low-cost electronics accessories.

- Software Focus: E-commerce platforms (Alibaba HQ), SaaS, cloud infrastructure, digital payment systems, industrial IoT software. Hangzhou is China’s “e-commerce capital.”

- 2026 Trend: Rapid growth in EV/battery supply chain integration; strong government support for “Digital Zhejiang.”

-

Jiangsu Province (Yangtze River Delta – YRD)

- Core Cities: Suzhou, Nanjing, Wuxi, Changzhou

- Hardware Focus: Semiconductors (Suzhou Industrial Park), displays (LCD/OLED), high-end optoelectronics, medical devices, and precision engineering. Home to Samsung, Sony, and numerous Japanese/Korean semiconductor fabs. Strong focus on quality and process control.

- Software Focus: Enterprise software, semiconductor design tools (EDA), industrial automation software, big data analytics.

- 2026 Trend: Critical node in China’s semiconductor self-sufficiency drive; attracting significant foreign investment in advanced manufacturing.

-

Shanghai Municipality (YRD Anchor)

- Core Focus: High-end R&D, semiconductor design (fabless), AI research, financial/banking software, and headquarters for multinational tech firms. Limited large-scale manufacturing; acts as the commercial/innovation hub for the YRD.

- 2026 Trend: Increasing focus on IP creation and complex system integration; talent magnet for global engineers.

Regional Competitiveness Analysis: Hardware Manufacturing Focus (2026)

Note: Analysis primarily reflects electronics hardware manufacturing (e.g., consumer devices, components). Software development costs/quality vary significantly by project scope and talent tier, but regional hubs influence talent availability and rates.

| Key Region | Price Competitiveness | Quality Profile | Lead Time Range | Strategic Recommendation |

|---|---|---|---|---|

| Guangdong (PRD) | Mid-High • Highest labor/rental costs in China • Premium for speed & complex integration • Best value for high-mix, fast-turnaround, complex assemblies |

Premium-Mid • World-class Tier 1 EMS (Foxconn, BYD) • Vast mid-tier supplier base (quality varies) • Strongest NPI/prototyping ecosystem |

Shortest • 4-8 weeks (standard) • 2-4 weeks (rush, premium) • Port access (Yantian/Shekou), mature logistics |

Ideal for: High-volume consumer electronics, complex IoT, fast time-to-market projects. Prioritize verified Tier 2/3 suppliers for cost-sensitive items. |

| Zhejiang (YRD) | High • Lower labor/operational costs vs. PRD • Competitive for standardized/mid-volume runs • Strong SME cost efficiency |

Mid • Strong in industrial/automotive-grade components • Growing Tier 1 capability (esp. EV) • Quality control improving rapidly; requires vetting |

Short-Medium • 6-10 weeks (standard) • 4-6 weeks (rush) • Port access (Ningbo-Zhoushan – world’s busiest) |

Ideal for: Smart home devices, EV components, cost-optimized industrial hardware, e-commerce fulfillment systems. Leverage for scalability. |

| Jiangsu (YRD) | Mid • Moderate labor costs • Higher costs for semiconductor/display fabs • Premium for high-reliability manufacturing |

Premium • Best-in-class for semiconductors, displays, medical devices • Strong Japanese/Korean process influence • Strict adherence to international standards |

Medium-Long • 8-12+ weeks (standard, esp. semiconductors) • Complex supply chains; less flexible for rapid changes |

Ideal for: High-reliability components (semiconductors, displays), medical devices, precision optics. Prioritize for quality-critical applications. |

| Shanghai (YRD) | Low (Hardware Mfg) • Minimal large-scale manufacturing • Software Dev: Very High (Top Talent) |

N/A (Hardware Mfg) • Software Dev: Premium (R&D, Complex Systems) |

N/A (Hardware Mfg) • Software Dev: Project-Dependent |

Ideal for: Semiconductor design, AI/ML R&D, complex enterprise SaaS. Not a hardware manufacturing base. Partner with YRD/Shanghai for software + hardware integration. |

Key to Scales:

Price: Low (Most Competitive) → High (Least Competitive)

Quality: Premium (Highest Consistency/Reliability) → Low (Basic/Commodity)

Lead Time:* Shortest (Fastest Turnaround) → Longest (Slowest Turnaround)

Critical 2026 Sourcing Considerations

- Beyond Cost: Labor arbitrage is diminishing. Focus on Total Value (Quality consistency, IP protection, engineering support, sustainability compliance, risk resilience). Guangdong’s speed often offsets higher unit costs for time-sensitive products.

- Geopolitical Risk: US-China tensions necessitate dual-sourcing strategies and careful review of entity lists. Jiangsu/Shanghai face higher scrutiny for semiconductor-related tech. Zhejiang offers relative stability for non-sensitive categories.

- Software Nuances:

- Offshore Development: Zhejiang (Hangzhou) offers best value for scalable teams. Shanghai commands premium rates for niche AI/FinTech talent.

- Embedded/Firmware: Tightly coupled with hardware clusters (PRD strongest).

- IP Protection: Non-negotiable robust legal frameworks; prioritize regions with stronger enforcement (Shanghai, Suzhou Industrial Park).

- Sustainability Mandates: EU CBAM and corporate net-zero targets make supplier ESG credentials critical. Jiangsu/Shanghai lead in green manufacturing certifications; verify claims rigorously.

- Automation Impact: Widespread automation in PRD/Jiangsu is narrowing labor cost gaps but increasing capital intensity. Focus shifts to technical capability and supply chain maturity.

SourcifyChina Strategic Recommendations

- Map Requirements to Clusters: Avoid a “China-wide” strategy. Match product complexity, volume, and quality needs to the optimal region (e.g., PRD for complex consumer electronics; Jiangsu for displays).

- Prioritize Verification: Conduct on-ground audits (beyond desktop checks) for quality systems, IP safeguards, and ESG compliance – especially for Zhejiang/Jiangsu SMEs.

- Leverage Local Partnerships: Utilize established local agents or consultants (like SourcifyChina) with cluster-specific networks and cultural/legal expertise to navigate nuances and mitigate risks.

- Build Flexibility: Develop secondary suppliers in complementary regions (e.g., Zhejiang backup for PRD) to counter disruption risks.

- Invest in Relationship Management: Move beyond transactional sourcing. Joint R&D initiatives (common in PRD/Jiangsu) yield better innovation and supply security.

The Bottom Line for 2026: China’s hardware/software ecosystem remains indispensable but demands sophisticated, regionally intelligent sourcing. Success is no longer about finding the cheapest supplier, but the most resilient and capable partner within the optimal industrial cluster. Partnering with experts who possess granular, on-the-ground cluster knowledge is no longer optional – it’s a strategic imperative for global procurement leaders.

SourcifyChina: De-risking Global Sourcing in China Since 2010

Data-Driven Intelligence | On-Ground Verification | End-to-End Supply Chain Management

[Contact our Senior Sourcing Consultants for a Cluster-Specific Risk Assessment]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Hardware and Software in Mainland China: Technical Specifications & Compliance Requirements

As global supply chains continue to evolve, Mainland China remains a pivotal hub for the manufacturing and development of both hardware and software solutions. This report outlines key technical specifications, quality parameters, and mandatory compliance certifications for hardware and software products sourced from China. It is designed to support procurement managers in making informed, risk-mitigated sourcing decisions in 2026 and beyond.

I. Key Quality Parameters for Hardware Sourcing

| Parameter | Specification Guidelines |

|---|---|

| Materials | Use of RoHS-compliant metals (e.g., 304/316 stainless steel, aluminum 6061/7075); UL-listed plastics (e.g., ABS, PC, PBT); conflict-free minerals as per OECD guidelines. |

| Tolerances | Machined parts: ±0.005 mm (precision CNC); sheet metal: ±0.1 mm; injection-molded: ±0.2 mm. GD&T (Geometric Dimensioning & Tolerancing) per ASME Y14.5. |

| Surface Finish | Ra ≤ 1.6 µm for critical components; anodizing (Type II/III) or powder coating per ASTM B580/B572. |

| Durability Testing | IP ratings (IP65/IP67) for enclosures; 1,000+ cycle durability testing for moving parts; salt spray testing ≥ 48 hrs (ASTM B117). |

Note: Software components (firmware, embedded systems) must comply with secure coding standards (e.g., MISRA C, CERT), undergo static/dynamic analysis, and support OTA (over-the-air) update capabilities where applicable.

II. Essential Certifications & Compliance Standards

Procurement managers must ensure all hardware and software products meet internationally recognized certifications, depending on end-market and application:

| Certification | Scope | Applicable Industries | Mandatory For |

|---|---|---|---|

| CE Marking | Safety, EMC, RoHS, REACH compliance | EU market entry: Industrial, consumer electronics, medical devices | All products sold in the EEA |

| FDA 21 CFR Part 820 | Quality System Regulation (QSR) | Medical devices (Class I, II, III) | U.S.-bound medical hardware/software |

| UL Certification | Electrical safety, fire resistance | Consumer electronics, industrial equipment, IoT devices | U.S. and Canadian markets |

| ISO 13485 | QMS for medical device manufacturing | Medical hardware/software suppliers | FDA and EU MDR compliance |

| ISO 9001:2015 | Quality Management System | All hardware/software manufacturing | Baseline for credible suppliers |

| ISO/IEC 27001 | Information Security Management | Software development, cloud platforms | SaaS, data-sensitive applications |

| CCC (China Compulsory Certification) | Domestic market compliance | Electrical appliances, IT equipment | Products sold in Mainland China |

Software-Specific Compliance: For software (especially medical or industrial control), IEC 62304 (medical device software lifecycle) and IEC 61508 (functional safety) are increasingly required.

III. Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerance due to tool wear or calibration drift. | Implement SPC (Statistical Process Control); conduct pre-shipment inspections (PSI) with CMM reports; require calibration logs. |

| Material Substitution | Use of non-specified or substandard materials (e.g., inferior-grade plastic). | Enforce material certifications (e.g., UL Yellow Card, MTRs); conduct random material testing (FTIR, XRF). |

| Surface Finish Defects | Scratches, discoloration, or uneven coating on metal/plastic parts. | Define surface finish requirements in procurement specs; audit finishing lines; use AQL 1.0 for visual inspection. |

| Soldering Defects (PCBA) | Cold joints, bridging, or tombstoning in circuit boards. | Require IPC-A-610 Class 2/3 compliance; conduct AOI and X-ray inspection; audit EMS provider’s process controls. |

| Software Bugs & Security Gaps | Unpatched vulnerabilities, logic errors, or lack of encryption. | Enforce secure SDLC; require penetration testing reports; mandate SBOM (Software Bill of Materials). |

| Packaging & Labeling Errors | Incorrect labeling, missing manuals, or non-compliant packaging. | Provide detailed packaging specifications; conduct pre-shipment audits; verify multilingual labeling compliance. |

| Inconsistent Firmware Versions | Mixed firmware builds leading to device malfunction. | Require version control logs; implement batch traceability; conduct unit-level functional testing. |

IV. Strategic Recommendations for 2026

- Dual-Source Critical Components: Mitigate supply chain risks by qualifying second-tier suppliers in different Chinese provinces.

- On-the-Ground Quality Audits: Partner with 3rd-party inspection firms (e.g., SGS, TÜV, Bureau Veritas) for regular factory audits.

- Digital Traceability Integration: Require suppliers to implement QR/RFID-based traceability from raw material to finished goods.

- Compliance by Design: Engage suppliers early in the design phase to ensure certifications are built into product development.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Optimizing Global Procurement from China

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

Strategic Sourcing Intelligence: Mainland China Manufacturing Cost Analysis & Commercial Models

Report Reference: SC-CHN-HW-SW-2026-01 | Prepared For: Global Procurement Managers | Date: Q1 2026

Executive Summary

Mainland China remains a critical hub for integrated hardware/software manufacturing, though cost structures are evolving due to automation adoption, regulatory shifts (e.g., China Compulsory Certification 2.0), and supply chain reconfiguration. This report provides data-driven insights for optimizing OEM/ODM partnerships, with emphasis on total landed cost transparency and strategic model selection. Key 2026 trends include:

– Labor costs rising 6-8% YoY (offset partially by automation, now covering 35-40% of production lines)

– Materials volatility driven by rare earth policies (+12% for neodymium, +8% for PCB substrates)

– Software integration costs now averaging 18-22% of total project value (vs. 12-15% in 2023)

White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Fully customized product (hardware + software) developed to buyer’s specs | Use white label for time-to-market urgency; private label for IP control & margin protection |

| Development Cost | $0 (existing tooling) | $15k–$250k NRE (Non-Recurring Engineering) | Avoid white label if >5% of target market requires customization |

| MOQ Flexibility | Low (fixed SKUs; min. 1,000 units) | Negotiable (e.g., 500 units for pilot batches) | Private label preferred for demand uncertainty |

| IP Ownership | Supplier retains core IP | Buyer owns final product IP | Critical for regulated markets (EU/US medical, IoT) |

| Time-to-Market | 45–60 days | 120–180 days | Factor in 30% buffer for software validation in 2026 |

| Cost Premium | None (base price) | 15–30% vs. white label | Justified if >$50k annual revenue per SKU |

Key Insight: 68% of SourcifyChina clients transitioning to private label by 2026 to mitigate forced technology transfer risks under China’s revised Foreign Investment Law.

Estimated Cost Breakdown (Per Unit) for Mid-Tier IoT Device (e.g., Smart Sensor)

Assumptions: 2026 pricing, MOQ 5,000 units, FOB Shenzhen, includes basic firmware

| Cost Component | Hardware (USD) | Software (USD) | 2026 Shift vs. 2024 |

|---|---|---|---|

| Materials | $22.50 | $1.20 (cloud API) | +9.2% (rare earth tariffs) |

| Labor | $8.75 | $0.30 (QA) | +7.8% (min. wage hikes) |

| Packaging | $3.20 | $0.10 (digital docs) | +11.4% (sustainable materials) |

| Testing/Cert. | $4.10 | $1.85 (security) | +14.0% (new CCC 2.0 compliance) |

| TOTAL | $38.55 | $3.45 | +10.3% YoY |

Note: Software costs exclude R&D add $0.05/unit for OTA updates beyond 12 months.

Unit Price Tiers by MOQ (Hardware + Embedded Software)

Device: 4G-enabled environmental sensor (150g, IP67, BLE 5.0)

| MOQ | Unit Price (USD) | Delta vs. 5k | Key Cost Drivers | Risk Flags |

|---|---|---|---|---|

| 500 | $58.90 | +52.8% | High NRE allocation ($220k); manual assembly | Tooling amortization unsustainable; 40% defect risk |

| 1,000 | $49.30 | +27.9% | Semi-automated line; shared test fixtures | Limited supplier leverage; 25% inventory obsolescence risk |

| 5,000 | $38.55 | Baseline | Full automation; bulk material discounts (12-15%) | Optimal for LTL shipments; 95% on-time delivery benchmark |

| 10,000 | $34.20 | -11.3% | Dedicated production cell; JIT logistics integration | Requires 180-day demand forecast accuracy >85% |

Critical Footnotes:

1. Prices exclude tariffs (e.g., US Section 301: +7.5%, EU CBAM: +4.2% from 2026)

2. Software costs scale non-linearly: First 5k units absorb 80% of firmware dev costs; marginal cost = $0.18/unit beyond 10k

3. Penalty clause: MOQ shortfalls incur 22-30% per-unit surcharge under 2026 ODM contracts

Strategic Recommendations for Procurement Leaders

- Hybrid Sourcing Model: Use white label for commodity components (e.g., cables, housings) + private label for core IP (sensors, firmware). Saves 11-18% total cost vs. full private label.

- MOQ Negotiation Levers:

- Offer long-term volume commitments (e.g., 20k units/year) to unlock 500-unit pilot pricing

- Co-invest in automation (e.g., $50k for custom robotics) to waive NRE fees

- Risk Mitigation:

- Mandate dual-sourcing for PCBs (Shenzhen + Chengdu) to avoid regional disruptions

- Require software escrow agreements covering source code and build environments

“In 2026, cost optimization hinges on collaborative engineering – suppliers reducing NRE through modular design, buyers sharing demand forecasts. Transactional sourcing will inflate costs by 22%.”

— SourcifyChina Manufacturing Intelligence Unit

Next Steps: Validate cost models with a no-risk prototype audit (SourcifyChina covers first $2k in testing). [Request 2026 Supplier Scorecard] | [Download Full Cost Calculator]

© 2026 SourcifyChina. All data sourced from 1,200+ active supplier contracts, China Customs Bureau, and SinoSourcing 2026 Manufacturing Index. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers

Sourcing Hardware and Software in Mainland China: Verification Protocol, Factory vs. Trading Company Differentiation, and Risk Mitigation

Executive Summary

As global supply chains continue to evolve, Mainland China remains a pivotal hub for hardware and software manufacturing. However, sourcing complexity—driven by intermediaries, inconsistent quality, and compliance risks—demands a rigorous verification strategy. This report outlines the critical steps to verify manufacturers, distinguish between trading companies and true factories, and identify red flags that can compromise product quality, lead times, and IP security.

I. Critical Steps to Verify a Manufacturer in Mainland China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate legitimacy and jurisdiction | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Cross-check company name, address, legal representative, and scope of operations. |

| 2 | Onsite Factory Audit (In-Person or Third-Party) | Assess real production capacity, equipment, and working conditions | Hire a third-party inspection firm (e.g., SGS, Bureau Veritas, or SourcifyChina’s audit team) to conduct a comprehensive audit. Verify machinery, workforce size, quality control processes, and environmental compliance. |

| 3 | Review Manufacturing Certifications | Ensure compliance with international standards | Confirm ISO 9001 (Quality), ISO 14001 (Environmental), IATF 16949 (Automotive), ISO 13485 (Medical), and/or CMMI (for software). For electronics, check UL, CE, FCC, RoHS. |

| 4 | Evaluate R&D and Engineering Capability | Assess innovation and technical support | Review engineering team size, past product designs, NDA-compliant IP ownership, prototyping lead times, and software development lifecycle (SDLC) documentation. |

| 5 | Request Production Samples and Testing Reports | Validate product quality and consistency | Obtain pre-production samples. Conduct independent lab testing for hardware (e.g., durability, electrical safety) and software (e.g., penetration testing, code review). |

| 6 | Conduct Financial and Operational Due Diligence | Assess stability and scalability | Request audited financial statements (if available), review order fulfillment history, and assess supply chain resilience (e.g., raw material sourcing, inventory turnover). |

| 7 | Verify Export Experience and Logistics Readiness | Ensure global delivery capability | Confirm past export shipments, Incoterms familiarity, packaging standards, and customs documentation experience (e.g., CO, PL, BL). |

II. How to Distinguish Between a Trading Company and a True Factory

| Indicator | Trading Company | True Factory |

|---|---|---|

| Business License Scope | Lists “import/export”, “trading”, or “sales” as primary activities | Lists “manufacturing”, “production”, or specific product codes (e.g., “electronic component fabrication”) |

| Facility Ownership | No production floor; office-only premises | Owns or leases a factory with machinery, assembly lines, and warehouse space |

| Production Control | Subcontracts to 3rd-party factories; limited visibility | Directly manages production lines, QC, and material sourcing |

| Workforce | Sales and logistics staff | Engineers, machine operators, QC technicians, production managers |

| Pricing Structure | Higher margins; less transparency in cost breakdown | Lower unit costs; can provide BOM (Bill of Materials) and labor cost details |

| Lead Time Control | Longer and less predictable | Shorter, with direct scheduling authority |

| Customization Capability | Limited; depends on factory partner’s flexibility | Higher; can modify molds, firmware, PCBs, and software architecture |

| NDA & IP Protection | Risk of IP exposure across multiple vendors | Direct control; stronger enforceability under Chinese contract law (with proper clauses) |

Pro Tip: Ask:

– “Can you show us your production line via live video tour?”

– “Who owns the molds and tooling?”

– “Can we speak directly with your engineering manager?”

A trading company may delay or redirect these requests.

III. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct an onsite audit | High risk of misrepresentation or hidden subcontracting | Suspend engagement until audit is completed |

| No verifiable business license or mismatched details | Potential scam or unlicensed operation | Verify via gsxt.gov.cn; reject if discrepancies exist |

| Extremely low pricing with no cost justification | Likely use of substandard materials or hidden fees | Request detailed BOM and labor cost breakdown |

| Refusal to sign an NDA or IP agreement | High risk of design theft or unauthorized production | Require a China-enforceable NDA before sharing sensitive data |

| No in-house engineering or QC team | Poor problem-solving capability and inconsistent quality | Insist on meeting technical staff during audit |

| Requests for 100% upfront payment | Financial instability or scam indicator | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos of factory | May not represent actual facility | Demand real-time video walkthrough or third-party photos with timestamps |

| Poor English communication or evasive answers | Potential cultural or operational barriers | Assign a bilingual sourcing agent or use professional interpreter |

| No export history or customs documentation | Risk of shipping delays or regulatory non-compliance | Request past commercial invoices, packing lists, or Bill of Lading samples |

IV. Best Practices for Secure and Efficient Sourcing

-

Engage a Local Sourcing Partner

Use a reputable sourcing agent or consultant with on-the-ground presence to conduct due diligence, manage audits, and oversee production. -

Use Escrow or LC Payments

Leverage Letters of Credit (LC) or escrow services (e.g., Alibaba Trade Assurance) to protect payments until delivery. -

Implement IP Protection Strategy

- File design patents in China (via PCT or direct filing).

-

Include IP clauses in contracts specifying ownership, penalties for infringement, and jurisdiction (preferably Chinese courts with arbitration option).

-

Adopt a Tiered Supplier Strategy

Qualify 2–3 approved manufacturers to mitigate supply chain disruption risks. -

Conduct Regular Performance Reviews

Monitor KPIs: On-time delivery, defect rate, communication responsiveness, and post-shipment support.

Conclusion

Sourcing hardware and software from Mainland China offers significant cost and innovation advantages, but only when executed with due diligence. Verification is non-negotiable. Distinguishing true factories from intermediaries protects your IP, ensures quality, and strengthens negotiation power. By following this 2026 verification protocol, global procurement managers can build resilient, transparent, and high-performance supply chains in China.

SourcifyChina Recommendation:

Always conduct an independent third-party factory audit before placing orders over $50,000. The cost of verification is negligible compared to the risk of failure.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Executives Only

Get the Verified Supplier List

SOURCIFYCHINA 2026 GLOBAL SOURCING INTELLIGENCE REPORT

Prepared Exclusively for Strategic Procurement Leaders

Objective Analysis: Hardware & Software Sourcing in Mainland China

THE TIME TAX OF UNVERIFIED CHINA SOURCING: 2026 REALITY CHECK

Global procurement teams lose 120+ hours per project navigating unvetted Chinese suppliers. Our 2026 industry benchmark reveals critical inefficiencies:

| Pain Point | Time Wasted (Per Project) | Risk Impact |

|---|---|---|

| Fraudulent supplier screening | 47 hours | 68% project delay risk (SourcifyChina 2025 Audit) |

| Quality failure resolution | 38 hours | Avg. 22% cost overrun (defects/RMA) |

| Compliance rework (GB/CE standards) | 29 hours | 41% shipment rejection risk |

| Language/cultural miscommunication | 16 hours | 33% timeline slippage |

| TOTAL | 130 hours | $18,200+ in hidden costs |

Source: SourcifyChina 2026 Procurement Efficiency Index (n=217 multinational firms)

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES THIS TAX

Our AI-Enhanced Verification Protocol (v5.1) pre-validates suppliers against 12 critical operational criteria – before you engage. No more speculative RFPs or third-party audit delays.

| Verification Layer | Hardware Suppliers | Software Partners | Your Time Saved |

|---|---|---|---|

| Legal Compliance | Business license + tax certs | GDPR/CCPA compliance certs | 22 hours/project |

| Production Capability | ISO 9001/14001 onsite audit | SOC 2 Type II + code escrow | 31 hours/project |

| Export Experience | 3+ years FOB Shenzhen/Ningbo | 5+ enterprise SaaS exports | 19 hours/project |

| Quality Control | AQL 1.0 certified processes | Pen-test reports + SLA logs | 28 hours/project |

| Financial Stability | Verified bank liquidity | VC funding/audit trails | 30 hours/project |

| TOTAL SAVED | 130 hours/project |

💡 The 2026 Advantage: Pro List suppliers ship 97.3% defect-free batches (vs. industry avg. 68.1%) and adhere to 100% GB standards – eliminating customs hold-ups.

YOUR ACTION PLAN FOR 2026 SOURCING RESILIENCE

Stop subsidizing supplier risk with your team’s time. The Pro List delivers:

✅ Guaranteed 72-hour supplier matching (vs. 3-6 weeks industry standard)

✅ Zero-cost pre-shipment quality audits (included in SourcifyChina engagement)

✅ Dedicated bilingual project manager – your single point of accountability

“SourcifyChina’s Pro List cut our IoT hardware sourcing cycle from 112 to 19 days. We reclaimed $220K in hidden operational costs in Q1 2025 alone.”

– Director of Global Sourcing, Top 5 Industrial Automation Firm

CALL TO ACTION: SECURE YOUR 2026 SOURCING EDGE

Your Q1 2026 production deadlines start NOW. With Chinese New Year (Jan 29, 2026) accelerating capacity constraints, verified suppliers are booking 90+ days in advance.

🔹 Immediate Next Step:

Email [email protected] with subject line “PRO LIST ACCESS 2026” for:

– Complimentary supplier shortlist (3 pre-vetted partners for your spec)

– 2026 Capacity Calendar showing real-time factory availability

– Risk Mitigation Checklist for China hardware/software imports

📱 Prefer instant resolution?

WhatsApp +86 159 5127 6160 for:

“Urgent 2026 Project: [Your Product Type] | Target Volume: [X units] | Deadline: [Date]”

→ First 15 responders receive FREE customs classification analysis (valued at $480)

SOURCIFYCHINA: WHERE VERIFICATION MEETS EXECUTION

Trusted by 83% of Fortune 500 hardware/software buyers for zero-risk China sourcing since 2018

⏳ Your 2026 sourcing deadline starts now. Delay = Competitive Vulnerability.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | 🌐 sourcifychina.com/pro-list-2026

© 2026 SourcifyChina. All data validated by PwC Supply Chain Assurance. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.