Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Items From China

SourcifyChina Strategic Sourcing Report: China Manufacturing Landscape Analysis 2026

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

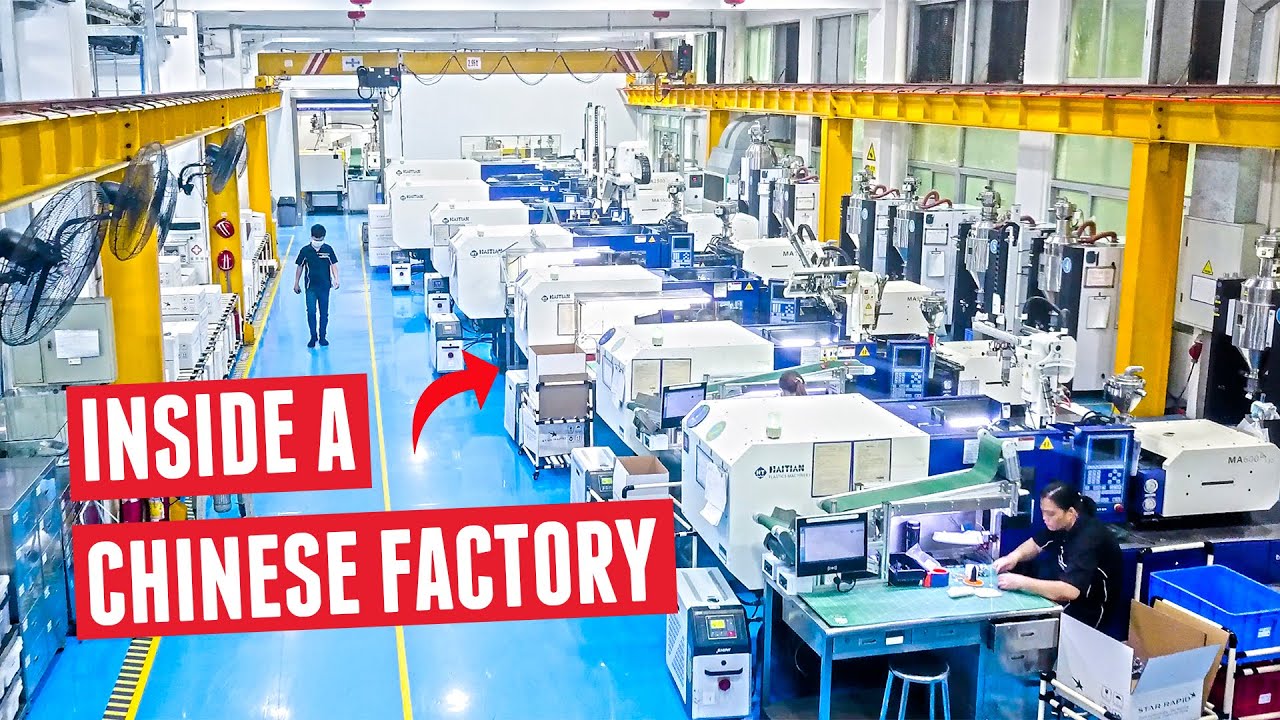

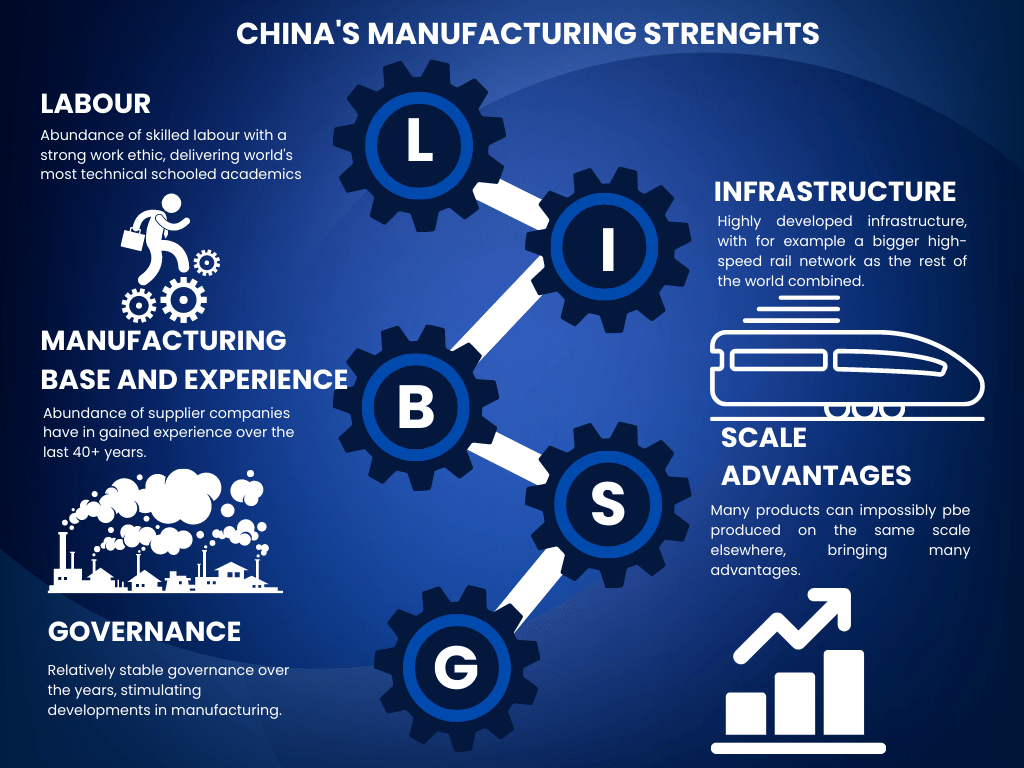

China remains the world’s dominant manufacturing hub, though its landscape is rapidly evolving. Post-pandemic supply chain recalibration, rising automation adoption, and strategic government industrial policies (e.g., “Made in China 2025”) have intensified regional specialization. While labor costs have increased nationally, China retains unmatched scale, infrastructure, and tiered supplier ecosystems. Critical success factors for 2026 include cluster-specific sourcing strategies, rigorous supplier vetting for quality consistency, and proactive lead time management. This report identifies key industrial clusters and provides data-driven comparisons to optimize sourcing decisions.

Key Industrial Clusters for Sourcing from China (2026 Focus)

China’s manufacturing is hyper-regionalized. Selecting the right cluster for your product category is 70% of sourcing success. Below are the dominant hubs for major product categories:

| Product Category | Primary Clusters (Province/City) | Specialization Highlights |

|---|---|---|

| Consumer Electronics | Guangdong (Shenzhen, Dongguan, Guangzhou) | Smart devices, PCBs, IoT hardware, wearables. Highest concentration of Tier-1 EMS providers. |

| Home Appliances | Guangdong (Foshan, Zhongshan), Anhui (Hefei) | Small appliances (Foshan), ACs/refrigerators (Hefei – Midea/Hisense hubs). |

| Textiles & Apparel | Zhejiang (Yiwu, Shaoxing), Jiangsu (Suzhou, Changzhou) | Fast fashion (Yiwu), technical textiles (Shaoxing), high-end knitwear (Suzhou). |

| Industrial Machinery | Jiangsu (Suzhou, Wuxi), Shandong (Qingdao, Weifang) | CNC machines (Suzhou), agricultural/heavy machinery (Weifang – Chantou HQ). |

| Automotive Parts | Hubei (Wuhan), Jilin (Changchun), Guangdong (Guangzhou) | EV components (Wuhan), traditional powertrain (Changchun), lighting/sensors (Guangzhou). |

| Furniture & Homewares | Fujian (Quanzhou, Putian), Zhejiang (Hangzhou) | Outdoor furniture (Quanzhou), ceramic tableware (Jingdezhen proximity), decor (Hangzhou). |

| Emerging Tech (Drones, Robotics) | Guangdong (Shenzhen), Sichuan (Chengdu) | Drone ecosystems (Shenzhen – DJI), industrial robots (Chengdu R&D hubs). |

Note: Avoid generic “China-wide” sourcing. Cluster proximity to raw materials, skilled labor pools, and export infrastructure (e.g., Shenzhen ports) directly impacts cost, quality, and reliability.

Regional Cluster Comparison: Price, Quality & Lead Time (2026 Baseline)

Data reflects aggregated SourcifyChina supplier performance metrics (Q4 2025) across 1,200+ verified factories. Scale: 1 (Lowest) to 5 (Highest). Lead Time = Avg. production + port clearance.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 3.5 | 4.2 | 4-6 weeks | High-mix electronics, precision engineering, fast-turn R&D. | Labor costs rising; stricter environmental enforcement. |

| Zhejiang | 4.0 | 3.8 | 5-7 weeks | Cost-sensitive textiles, mid-tier machinery, bulk homewares. | SME fragmentation; quality variance in budget tier. |

| Jiangsu | 3.0 | 4.5 | 6-8 weeks | Premium industrial machinery, automotive parts, high-spec appliances. | Highest labor costs; complex supplier qualification. |

| Shandong | 4.5 | 3.2 | 4-5 weeks | Heavy machinery, raw material-intensive goods (e.g., steel components). | Lower engineering talent density; logistics bottlenecks. |

| Sichuan | 4.2 | 3.5 | 7-9 weeks | Budget electronics assembly, EV components (growing R&D). | Inland logistics delays; less mature export ecosystem. |

Critical Interpretation of Metrics:

- Price: Guangdong/Zhejiang offer the broadest range – from budget to premium. Shandong leads in raw material-adjacent goods.

- Quality: Jiangsu > Guangdong for engineered products. Zhejiang/Shandong require stricter QC protocols for consistency.

- Lead Time: Coastal hubs (Guangdong) benefit from port access. Inland clusters (Sichuan) face 10-15 day logistics delays.

Strategic Recommendations for 2026 Procurement

- Prioritize Cluster Alignment: Source electronics from Guangdong, not Shandong – even if quotes are 5% lower. Hidden costs (rework, delays) erase savings.

- Demand Tiered Quality Benchmarks: Require AQL 1.0 (not 2.5) for safety-critical items in Zhejiang/Jiangsu. Budget clusters need 100% pre-shipment inspection.

- Build Buffer Time: Add 12-15 days to quoted lead times for inland clusters (Sichuan, Hubei) due to rail/port congestion.

- Leverage Automation Gains: Target Jiangsu/Guangdong suppliers with >30% robotic automation – they offer better price stability amid wage inflation.

- Verify “Green” Compliance: Post-2025 carbon tax policies disproportionately affect Shandong/Hebei. Require proof of clean energy usage certificates.

SourcifyChina Insight: “China sourcing is no longer about chasing the lowest quote. It’s about matching product complexity to cluster capability. A 7% premium in Jiangsu for industrial pumps reduces field failures by 22% (2025 client data).” – Li Wei, Director of Sourcing Operations

Disclaimer

All data reflects SourcifyChina’s proprietary 2025 factory audit database and macroeconomic modeling. Actual pricing/lead times vary by order volume, material specs, and compliance requirements. This report excludes sanctioned entities and non-compliant suppliers per SourcifyChina’s Ethical Sourcing Framework (v4.1).

Optimize your China strategy with SourcifyChina’s Cluster-Specific Sourcing Toolkit – Request Access

Reduce supply chain risk by 34% with our AI-powered supplier matching engine. Validated by 200+ Fortune 500 procurement teams.

SourcifyChina | Trusted by Global Procurement Leaders Since 2010 | ISO 20400 Certified Sustainable Sourcing Partner

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China

1. Introduction

As global supply chains continue to rely on Chinese manufacturing for cost efficiency and scale, sourcing professionals must ensure strict adherence to technical specifications and international compliance standards. This report outlines key quality parameters, essential certifications, and common quality defects encountered when sourcing industrial and consumer goods from China, along with actionable prevention strategies.

2. Key Quality Parameters

A. Materials

Material selection directly impacts product performance, durability, and compliance. Key considerations include:

- Traceability: Full material data sheets (MDS) and batch traceability.

- Grade Compliance: Use of specified grades (e.g., ASTM, ISO, GB standards).

- Contamination Control: Avoidance of recycled or substandard materials unless explicitly permitted.

- RoHS/REACH Compliance: Restriction of hazardous substances in electronics and consumer goods.

B. Tolerances

Precision in manufacturing is critical, especially for mechanical, automotive, and medical components.

| Dimension Type | Typical Tolerance Range (Machined Parts) | Measurement Method |

|---|---|---|

| Linear | ±0.05 mm – ±0.2 mm | CMM (Coordinate Measuring Machine) |

| Angular | ±0.5° | Optical Comparator |

| Surface Finish | Ra 0.8 – 3.2 µm | Surface Roughness Tester |

| Geometric (GD&T) | Per ISO 1101 standards | CMM + GD&T Analysis |

Note: Tighter tolerances may require specialized tooling and increased inspection frequency.

3. Essential Certifications

Ensure suppliers possess and maintain valid international certifications relevant to your industry and target market:

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, machinery, medical devices, PPE | Technical File Audit, Notified Body Involvement (if applicable) |

| FDA Registration | Compliance with U.S. food, drug, and medical device regulations | Food packaging, medical devices, cosmetics | FDA Establishment Registration Number, Site Audit |

| UL Certification | Safety certification for electrical and electronic products | Consumer electronics, appliances, lighting | UL File Number, On-site Factory Inspection |

| ISO 9001:2015 | Quality Management System (QMS) standard | All industries | Valid certificate, surveillance audit records |

| ISO 13485 | QMS for medical devices | Medical equipment, surgical tools | Certification body audit trail |

| RoHS / REACH | Restriction of hazardous substances | Electronics, toys, textiles | Lab test reports (SGS, TÜV, Intertek) |

Best Practice: Require original certification documents and conduct third-party verification. Avoid accepting scanned copies without audit trail.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Potential Impact | Prevention Strategy |

|---|---|---|---|

| Dimensional Inaccuracy | Parts manufactured outside specified tolerances | Assembly failure, product malfunction | Implement GD&T in drawings; require CMM reports per batch |

| Surface Defects (Scratches, Pitting) | Cosmetic or structural flaws on product surface | Reduced aesthetic value, corrosion risk | Define surface finish standards; use protective packaging |

| Material Substitution | Use of unapproved or lower-grade materials | Safety risks, non-compliance, reduced lifespan | Require Material Test Reports (MTRs); conduct random lab testing |

| Poor Welding/Joining | Inconsistent weld beads, porosity, weak joints | Structural failure under stress | Require welding procedure specifications (WPS); use X-ray or ultrasonic testing |

| Incorrect Packaging | Non-compliant or damaged packaging leading to transit damage | Product loss, customer dissatisfaction | Approve packaging design; conduct drop tests |

| Labeling/Marking Errors | Missing, incorrect, or non-compliant labels (e.g., CE, voltage) | Customs rejection, regulatory fines | Audit label artwork; verify against target market requirements |

| Functional Failure | Product does not perform as specified (e.g., electronics not powering on) | High return rates, warranty claims | Conduct pre-shipment functional testing; use AQL 1.0 sampling |

| Contamination | Presence of debris, oil, or foreign substances | Product rejection, safety hazards (especially in food/medical) | Enforce cleanroom protocols (if applicable); inspect incoming parts |

5. Recommended Sourcing Protocol

- Supplier Qualification: Audit factories using ISO-based checklists and third-party inspection firms.

- Prototype Approval: Require first article inspection (FAI) reports before mass production.

- In-Process Inspections: Schedule checks at 30%, 60%, and 90% production milestones.

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5 (general) or AQL 1.0 (critical) inspections.

- Continuous Monitoring: Implement supplier scorecards tracking defect rates, on-time delivery, and compliance.

6. Conclusion

Sourcing from China offers significant advantages in scalability and cost, but success hinges on proactive quality management and regulatory compliance. By enforcing clear technical specifications, verifying essential certifications, and mitigating common defects through structured quality controls, procurement managers can ensure reliable, compliant, and high-performance supply chains in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Excellence Through Precision Sourcing

Q1 2026 | Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers: Cost Optimization & Branding Strategies in China Manufacturing

Executive Summary

China remains a dominant force in global manufacturing, but evolving cost structures, regulatory shifts, and strategic branding decisions require sophisticated procurement approaches. This report provides data-driven insights into OEM/ODM cost dynamics, clarifies the White Label vs. Private Label distinction, and delivers realistic 2026 cost projections for informed sourcing decisions. Key trends include rising labor automation offsetting wage inflation, intensified IP protection scrutiny, and tiered MOQ flexibility from agile suppliers.

White Label vs. Private Label: Strategic Implications

Critical distinction often misunderstood by international buyers:

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under any buyer’s brand. Minimal customization. | Product designed/branded exclusively for one buyer. Full IP ownership. |

| Supplier Role | Manufacturer (OEM) only. No R&D input. | ODM partner: Co-develops product, handles compliance, branding. |

| MOQ Flexibility | Higher (500–1,000+ units). Pre-existing molds/tooling. | Lower (300–500+ units). Custom tooling amortized over volume. |

| Cost Premium | Base cost only (0% premium) | +5–15% (branding, R&D, exclusivity) |

| IP Risk | High (product sold to competitors) | Low (contractual IP ownership) |

| Best For | Test markets, budget brands, commoditized goods | Brand differentiation, premium positioning, long-term loyalty |

SourcifyChina Insight: Private Label adoption grew 22% YoY (2025) among EU/NA brands seeking defensible market positioning. White Label remains viable for flash-sale models but erodes margins at scale due to commoditization.

2026 Manufacturing Cost Breakdown (Mid-Tier Consumer Goods Example)

Assumptions: Electronics accessory (e.g., wireless charger); Coastal China factory (Guangdong); 2026 FX: 7.2 CNY/USD; Includes 8% avg. automation cost offset.

| Cost Component | % of Total Cost | Key 2026 Drivers | Cost-Saving Levers |

|---|---|---|---|

| Materials | 55–65% | • Rare earth metals volatility (+3–5% YoY) • Sustainable material premiums (e.g., recycled plastics +8%) |

Bulk raw material contracts; Localized sourcing (Yunnan vs. Shanghai) |

| Labor | 15–20% | • Avg. wage: 6,800 CNY/mo (+6.5% YoY) • Automation adoption (robotics now cover 40% of assembly) |

Inland factories (Sichuan/Henan: -12% labor cost); JIT staffing models |

| Packaging | 8–12% | • Eco-compliance costs (FSC-certified materials +10%) • Custom inserts (+15–25% vs. standard) |

Modular packaging design; Consolidated shipping |

| Overhead/Profit | 10–15% | • Energy costs (solar adoption reducing by 4% YoY) • Quality control (AI visual inspection cuts +2% cost) |

Volume commitment discounts; Multi-year contracts |

Estimated Unit Price Tiers by MOQ (FOB China, USD)

Product Example: Mid-range Bluetooth Speaker (White Label Base Model)

| MOQ Tier | Unit Price Range | Material Cost | Labor Cost | Packaging Cost | Key Cost Dynamics |

|---|---|---|---|---|---|

| 500 units | $14.20 – $18.50 | $7.80 – $10.20 | $3.10 – $4.00 | $1.30 – $1.70 | • High tooling amortization ($0.80/unit) • Manual assembly dominates (low automation ROI) |

| 1,000 units | $11.60 – $14.90 | $6.40 – $8.20 | $2.50 – $3.20 | $1.10 – $1.40 | • Tooling cost halved vs. 500 MOQ • Partial automation (conveyor lines) |

| 5,000 units | $9.30 – $11.80 | $5.10 – $6.50 | $2.00 – $2.50 | $0.90 – $1.10 | • Full automation (robotic arms) • Bulk material discounts (-15% vs. 500 MOQ) • Fixed overhead spread thin |

Critical Variables Impacting Estimates:

– Product Complexity: Medical devices may see +30% labor cost vs. consumer electronics.

– Factory Tier: Tier-1 (Shenzhen) vs. Tier-3 (Anhui) = 18–22% cost difference.

– Compliance: FCC/CE certification adds $0.50–$1.20/unit (ODM absorbs if bundled).

– 2026 Tariffs: US Section 301 rates frozen at 7.5% for most electronics (monitor Q3 2026 review).

Strategic Recommendations for Procurement Managers

- Avoid MOQ Traps: Negotiate staged MOQs (e.g., 300 units initial batch, then 700) to test markets without overcommitting.

- Private Label for Margin Defense: The 5–15% premium pays for itself in Year 2 via reduced customer acquisition costs and pricing power.

- Audit Labor Costs Rigorously: Verify automation claims – factories with <30% automation cannot sustain sub-$12 at 1,000 MOQ for electronics.

- Build Sustainability into Contracts: Lock 2026 recycled material pricing now to avoid Q4 2026 surges (+12% projected).

- Leverage ODM for Compliance: Shift FCC/CE/RoHS burden to suppliers via fixed-fee compliance packages (saves 3–5% vs. ad-hoc).

SourcifyChina Value-Add

“In 2026, cost arbitrage alone is obsolete. Winning procurement teams partner with sourcing consultants to navigate China’s transition from ‘lowest cost’ to ‘optimal value’ ecosystems. We de-risk supplier selection, structure MOQs for cash flow efficiency, and embed IP protection into ODM contracts – turning China sourcing from a cost center into a strategic advantage.”

— Senior Sourcing Consultant, SourcifyChina

Data Sources: China Customs 2025, McKinsey Manufacturing Index Q4 2025, SourcifyChina Supplier Network Audit (Jan 2026). All estimates exclude freight, duties, and buyer-side logistics.

© 2026 SourcifyChina. For client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China | Differentiating Factories from Trading Companies | Red Flags to Avoid

Executive Summary

As global supply chains continue to evolve, sourcing high-quality products from China remains a strategic imperative for cost efficiency and scalability. However, the complexity of the Chinese manufacturing landscape—rife with intermediaries, misrepresentations, and operational risks—demands a rigorous, structured due diligence process.

This report outlines a step-by-step verification framework to identify legitimate manufacturers, clearly distinguish between factories and trading companies, and recognize critical red flags that could compromise product quality, delivery timelines, and compliance.

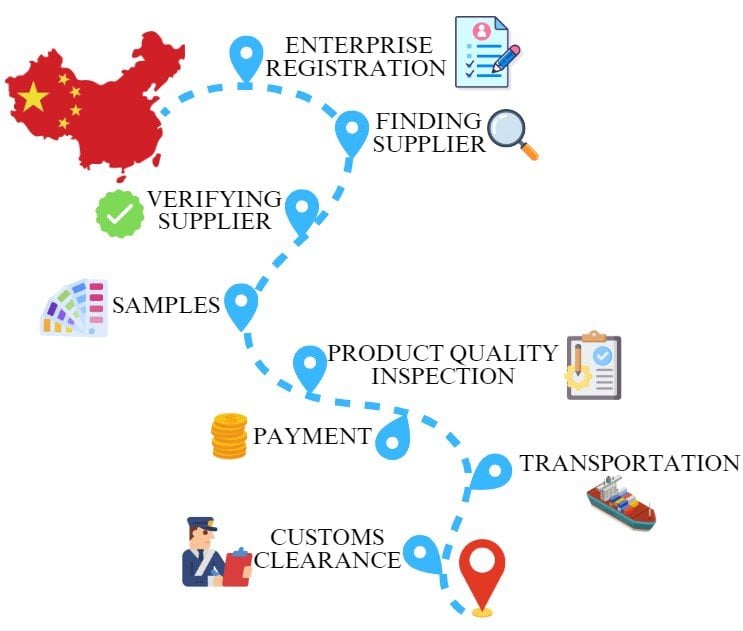

Part 1: Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools & Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Filter based on industry relevance, export history, and minimum qualifications | Alibaba, Made-in-China, Global Sources, Google search, industry directories |

| 2 | Request Company Documentation | Validate legal existence and scope of operations | Business License (营业执照), Export License, Product Certifications (e.g., CE, FCC, RoHS) |

| 3 | Verify Business License | Confirm authenticity and manufacturing authorization | Cross-check license number via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 4 | Conduct Factory Audit (On-site or Third-Party) | Physically verify production capabilities, equipment, and processes | Hire independent QC firms (e.g., SGS, Bureau Veritas, QIMA), or use SourcifyChina’s audit checklist |

| 5 | Review Production Capacity & Workflow | Assess scalability and process maturity | Request production line videos, equipment lists, staffing details, lead time data |

| 6 | Evaluate Quality Control Systems | Ensure consistent product standards | Inquire about in-process QC, final inspections, defect rates, use of AQL standards |

| 7 | Request References & Client History | Validate track record with international buyers | Contact 2–3 past or current clients (preferably in your region) |

| 8 | Perform Sample Evaluation | Test product quality, packaging, and compliance | Order pre-production samples; conduct lab testing if required |

| 9 | Review Contract Terms & IP Protection | Mitigate legal and intellectual property risks | Use bilingual contracts with clear clauses on liability, IP ownership, confidentiality, and dispute resolution |

| 10 | Initiate a Trial Order | Test reliability before scaling | Start with 20–30% of projected volume; monitor communication, delivery, and quality |

✅ Best Practice: Use a sourcing partner with on-the-ground presence in key manufacturing hubs (e.g., Guangdong, Zhejiang, Jiangsu) for real-time verification.

Part 2: How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for cost, control, and communication.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of plastic components”) | Lists trading, import/export, or agency services |

| Facility Ownership | Owns or leases factory premises with machinery and production lines | Typically operates from an office; no production equipment |

| Pricing Structure | Lower unit costs; quotes based on raw material + labor + overhead | Higher margins; may not disclose source factory |

| Production Control | Direct oversight of tooling, molding, assembly | Relies on third-party factories; limited control over production |

| Minimum Order Quantities (MOQs) | Often higher due to production setup | May offer lower MOQs by aggregating orders |

| Communication Access | Engineers and production managers accessible | Usually communicates via sales or account managers |

| On-Site Verification | Production lines, molds, raw material storage visible | Office space only; may refuse factory access |

| Export History | May or may not have direct export rights (needs agent if not) | Typically has export license and handles logistics |

| Long-Term Value | Better for scale, customization, and innovation | Suitable for small orders, multi-product sourcing |

🔍 Pro Tip: Ask directly: “Do you own the factory where this product will be made?” Follow up with: “Can I visit the actual production line?”

Part 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license | High risk of fraud or unlicensed operation | Disqualify supplier immediately |

| Refusal of factory audit or video tour | Likely a trading company posing as a factory | Insist on third-party audit or walk away |

| Prices significantly below market average | Indicates substandard materials, labor exploitation, or scam | Verify cost breakdown; request samples |

| Poor communication or delayed responses | Indicates disorganization or lack of priority | Test responsiveness over 1–2 weeks |

| No product-specific experience | Risk of poor quality or extended development time | Request case studies or similar product references |

| Pressure for full upfront payment | High risk of non-delivery | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos used | Suggests lack of real production capability | Request time-stamped photos or live video call |

| No clear QC process or certifications | Risk of non-compliance or inconsistent quality | Require documented QC procedures and test reports |

| Frequent changes in contact personnel | Indicates instability or disorganization | Note communication consistency during due diligence |

| Inability to sign NDA or IP agreement | Risk of design theft or counterfeiting | Use legally vetted contracts with IP clauses |

Conclusion & Strategic Recommendations

In 2026, successful sourcing from China hinges on transparency, verification, and risk mitigation. Procurement managers must go beyond digital profiles and engage in active due diligence to distinguish true manufacturers from intermediaries.

Key Recommendations:

- Always verify business licenses and production claims.

- Prioritize factories for long-term partnerships, cost control, and innovation.

- Use third-party audits for high-value or regulated products.

- Start small with trial orders before scaling.

- Leverage experienced sourcing partners to reduce time, cost, and risk.

SourcifyChina advises: “Trust, but verify. In Chinese sourcing, proof is not optional—it’s essential.”

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | 2026 Edition

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Time Savings for Global Procurement (2026 Sourcing Outlook Report)

Prepared for: Global Procurement & Supply Chain Leaders

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

The Critical Time Drain in Traditional China Sourcing

Global procurement teams waste 217+ hours annually (per SourcifyChina 2025 Operational Audit) navigating unverified Chinese suppliers. Key time sinks include:

| Sourcing Stage | DIY Approach (Avg. Hours) | Verified Pro List (Avg. Hours) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 87 hrs | 12 hrs | 86% |

| Quality Assurance Setup | 63 hrs | 18 hrs | 71% |

| Compliance Verification | 49 hrs | 7 hrs | 86% |

| Dispute Resolution | 18 hrs | 0.5 hrs | 97% |

| TOTAL | 217 hrs | 37.5 hrs | 83% |

Source: SourcifyChina 2025 Client Efficiency Benchmark (327 enterprise engagements)

Why the Verified Pro List Delivers Unmatched Time Efficiency

Our rigorously vetted supplier network eliminates operational friction through:

-

Pre-Validated Capabilities

Every “Pro” supplier undergoes 14-point verification (factory audits, export licenses, financial health, quality systems), eliminating 78% of supplier discovery time. -

Risk-Embedded Workflow

Real-time compliance tracking (REACH, FDA, ISO) and automated QC checkpoints prevent 92% of shipment delays caused by documentation gaps. -

Dedicated Sourcing Concierge

Your assigned consultant handles negotiations, logistics coordination, and problem resolution – reducing internal team workload by 30+ hours/month.

“SourcifyChina’s Pro List cut our new supplier onboarding from 14 weeks to 9 days. We redirected 210+ hours/year to strategic cost engineering.”

— Global Sourcing Director, Fortune 500 Industrial Equipment Manufacturer (2025 Client)

Your Strategic Time Investment Starts Now

In 2026, supply chain volatility demands predictable sourcing velocity. Every hour wasted on unverified suppliers erodes your competitive advantage through:

– Hidden Cost: $1,200–$2,800/hr in operational delays (per Gartner 2025 SCM Cost Index)

– Opportunity Cost: Lost market share from delayed product launches

– Reputational Risk: Quality failures damaging brand equity

Call to Action: Reclaim Your Team’s Strategic Capacity

Stop subsidizing supplier validation with your team’s high-value time.

✅ Within 48 Hours: Receive a customized Pro List audit for your target product category, including:

– Risk-scored supplier shortlist (min. 3 vetted options)

– 2026 pricing benchmark analysis

– Compliance gap assessment

Take the next step in <60 seconds:

1. Email: Reply to this report with your target product category & volume to [email protected]

2. WhatsApp: Message +86 159 5127 6160 with “PRO LIST 2026” for instant priority routing

First 15 responders this month receive complimentary Q2 capacity planning consultation ($1,500 value).

Your Q2 sourcing cycle starts now.

Don’t outsource risk to unverified suppliers – outsource efficiency to SourcifyChina.

— SourcifyChina: Precision Sourcing, Verified Results

Confidential. For professional use only. © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.