Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing In China For Toys

Professional B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing Toys from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

China remains the world’s dominant manufacturing hub for toys, accounting for over 70% of global toy exports in 2025 (UN Comtrade). With evolving supply chain dynamics, rising labor costs, and increasing regulatory scrutiny, global procurement managers must adopt a strategic, region-specific approach when sourcing toys from China.

This report provides a deep-dive analysis of China’s toy manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and offering actionable insights for optimizing cost, quality, and lead time. Special emphasis is placed on comparing Guangdong and Zhejiang—the two most significant toy-producing provinces—using a structured framework.

Key Toy Manufacturing Clusters in China

China’s toy industry is geographically concentrated in a few high-efficiency industrial clusters. These clusters benefit from mature supply chains, specialized labor pools, and robust logistics infrastructure.

1. Guangdong Province – The Global Toy Heartland

- Core Cities: Shantou (especially Chenghai District), Dongguan, Shenzhen, Guangzhou

- Specialization: Plastic toys, electronic toys, action figures, dolls, educational toys

- Key Advantages:

- Over 4,000 toy manufacturers in Chenghai alone

- Integrated supply chain for molds, plastics, electronics, and packaging

- Proximity to Shenzhen Port and Hong Kong for fast export

- Strong compliance with international safety standards (ASTM, EN71, ISO 8124)

2. Zhejiang Province – Innovation and Export Agility

- Core Cities: Yiwu, Ningbo, Wenzhou

- Specialization: Low-cost plastic toys, novelty items, seasonal toys, wooden toys

- Key Advantages:

- Yiwu International Trade Market – world’s largest small commodities hub

- High concentration of SMEs with fast turnaround

- Strong export orientation to EU and emerging markets

- Competitive pricing due to scale and labor efficiency

3. Jiangsu Province – Premium and Educational Toys

- Core Cities: Suzhou, Wuxi

- Specialization: STEM toys, smart learning devices, eco-friendly materials

- Key Advantages:

- Proximity to Shanghai for R&D and design collaboration

- Higher labor skill levels and better quality control

- Focus on sustainable and tech-integrated products

4. Fujian Province – Niche and OEM Manufacturing

- Core Cities: Quanzhou, Xiamen

- Specialization: Soft toys, plush items, licensed character toys

- Key Advantages:

- Experienced in handling IP-sensitive contracts

- Lower labor costs compared to Guangdong

- Growing export infrastructure via Xiamen Port

Comparative Analysis: Key Toy Production Regions in China (2026)

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Key Strengths | Ideal For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High | 30–45 | Full supply chain integration, compliance expertise, high automation | Branded toys, electronic toys, safety-critical products |

| Zhejiang | High | Medium to High | 25–40 | Low MOQs, rapid prototyping, cost efficiency | Budget lines, seasonal toys, fast-moving consumer items |

| Jiangsu | Medium | Very High | 35–50 | R&D capability, clean manufacturing, premium materials | Educational toys, smart devices, eco-certified products |

| Fujian | High | Medium | 30–45 | Soft toy expertise, IP protection, lower labor costs | Plush toys, licensed merchandise, private label |

Note: Pricing is relative to average FOB China quotes for mid-volume plastic toy orders (10,000–50,000 units). Lead times include production and pre-shipment inspection.

Market Trends Impacting 2026 Sourcing Strategy

- Rising Labor and Logistics Costs in Guangdong

- Minimum wage increases (~6–8% YoY) are narrowing price advantages.

-

Procurement managers are increasingly dual-sourcing from Zhejiang and Fujian to balance cost and quality.

-

Increased Compliance & Sustainability Demands

- EU’s Chemicals Strategy for Sustainability (CSS) and U.S. CPSIA updates require stricter material traceability.

-

Jiangsu and select Guangdong OEMs are leading in ISO 14001 and REACH compliance.

-

Digitalization of Supply Chains

- Platforms like Alibaba and 1688 now integrate real-time factory audits and production tracking.

-

Zhejiang-based suppliers lead in e-procurement integration.

-

Geopolitical Diversification Pressures

- While China remains dominant, procurement teams are building hybrid models (China + Vietnam/Mexico).

- China still offers unmatched scale, quality consistency, and IP protection for complex toys.

Strategic Recommendations for Procurement Managers

- Leverage Regional Specialization

- Use Guangdong for high-compliance, complex toys.

- Source cost-sensitive or novelty toys from Zhejiang.

-

Consider Jiangsu for premium, tech-enabled educational products.

-

Implement Dual or Multi-Sourcing

-

Reduce supply risk by engaging suppliers across at least two clusters (e.g., Guangdong + Zhejiang).

-

Prioritize Factory Audits and Compliance Verification

-

Use third-party inspection services (e.g., SGS, Bureau Veritas) to validate certifications, especially for children’s products.

-

Negotiate Lead Time Buffers

-

Q4 production (holiday season) can extend lead times by 10–15 days. Plan orders 6 months in advance.

-

Engage Local Sourcing Partners

- On-the-ground support improves communication, quality control, and dispute resolution.

Conclusion

China continues to offer unparalleled advantages for toy sourcing in 2026, but success depends on strategic regional selection and supply chain sophistication. Guangdong remains the gold standard for quality and compliance, while Zhejiang delivers unmatched cost efficiency and agility. By aligning sourcing decisions with product type, target market, and compliance needs, procurement managers can optimize total cost of ownership and ensure supply chain resilience.

Prepared by:

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina | Global Sourcing Intelligence Report 2026

Subject: Technical & Compliance Framework for Sourcing Toys from China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing toys from China requires rigorous adherence to evolving global safety standards and precise manufacturing controls. In 2026, regulatory scrutiny has intensified (notably in EU/US markets), with 32% of toy recalls linked to Chinese-sourced non-compliant materials (Global Product Safety Database, 2025). This report details critical technical specifications, certification mandates, and defect mitigation strategies to de-risk procurement.

I. Key Quality Parameters

A. Material Specifications

Non-negotiable thresholds per EU EN 71-3 & US ASTM F963-23:

| Material Type | Permitted Compounds | Max. Limits | Testing Method |

|---|---|---|---|

| Plastics | Phthalates (DEHP, DBP, BBP) | 0.1% (1,000 ppm) | GC-MS |

| Heavy Metals (Pb, Cd, Hg, As) | Pb: 90 ppm; Cd: 75 ppm | ICP-MS | |

| Paints/Inks | Lead | 90 ppm | XRF Screening + Lab Test |

| Formaldehyde | 30 mg/kg | HPLC | |

| Textiles | Azo Dyes | 30 ppm (24 banned amines) | EN ISO 17234-1 |

| Formaldehyde | 16 ppm (婴幼儿产品) | EN ISO 14184-1 |

Critical Note: All materials must be certified “food-grade” if toy involves mouth contact (e.g., teethers). PVC must be phthalate-free; ABS/PP recommended for durability.

B. Dimensional Tolerances & Mechanical Safety

Failure to meet these causes 41% of physical hazard recalls (CPSC, 2025):

| Parameter | Requirement | Test Standard | Acceptance Criteria |

|---|---|---|---|

| Small Parts | No components detachable under 90N force | ASTM F963 §4.2 | Passes choke tube test (≤1.25″ diameter) |

| Sharp Points/Edges | No penetration in fabric under 1.5N force | EN 71-1 §8.2 | Zero penetration depth |

| Drop Test | 1m height onto concrete x 3 impacts | ISO 8124-1:2018 | No hazardous fragmentation |

| Torque Test | 0.34 Nm for parts <6mm diameter | ASTM F963 §8.10 | No detachment |

II. Essential Certifications (2026 Enforcement Focus)

| Certification | Jurisdiction | Scope | Validity | Verification Tip |

|---|---|---|---|---|

| CE Marking | EU | EN 71-1/2/3, REACH, Toy Safety Directive | 5 years | Verify NB number via NANDO database |

| ASTM F963 | USA | Mechanical, flammability, heavy metals | Per shipment | Requires CPSC-accepted lab (e.g., SGS) |

| ISO 9001 | Global | Quality management system | 3 years | Audit certificate + scope validity check |

| CCC | China | Mandatory for electronic toys (GB 6675) | 5 years | Check via CNCA website (fake certs = 28% issue) |

| FDA 21 CFR | USA | Only for food-contact toys (e.g., kitchens) | Per batch | Requires FDA facility registration |

⚠️ Critical 2026 Update: UL 62115-2022 now required for all battery-operated toys in US/EU. FDA does NOT certify general toys – common misconception leading to shipment rejections.

III. Common Quality Defects & Prevention Strategies

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Verification Method |

|---|---|---|---|

| Heavy Metal Contamination | Use of recycled plastics/pigments | Mandate virgin materials; require CoC with ICP-MS report | Pre-shipment lab test (SGS/BV) |

| Paint Peeling/Flaking | Poor surface prep; low-quality adhesives | Specify adhesion test (ASTM D3359); audit paint storage | Cross-hatch test + 10x magnification |

| Small Parts Detachment | Inconsistent torque control in assembly | Implement real-time torque monitoring; 100% drop testing | In-process QC + AQL 0.65 random check |

| Phthalate Non-Compliance | Substitution of DEHP for cheaper plasticizers | Ban “recycled PVC”; require phthalate-free polymer certs | GC-MS (3rd party lab) |

| Dimensional Inaccuracy | Mold wear; poor calibration of CNC machines | Mandate mold maintenance logs; SPC charts for critical dims | CMM inspection (min. 5% samples) |

| Battery Compartment Failure | Incorrect screw torque; flimsy latch design | Require UL 62115 torque specs; drop test with batteries | Cycle testing (50x open/close) |

Strategic Recommendations for 2026

- Audit Beyond Paperwork: Conduct unannounced factory audits focusing on material traceability (43% of defects stem from unauthorized subcontracting).

- Leverage Digital QC: Implement AI-powered visual inspection (e.g., via SourcifyChina’s QC 4.0 platform) for real-time defect detection.

- Dual-Certification Mandate: Require both ISO 9001 and ISO 14001 – environmental compliance now directly linked to material safety in EU.

- Blockchain Traceability: Pilot blockchain material tracking (e.g., VeChain) for high-risk items; reduces recall costs by 68% (McKinsey, 2025).

Final Note: The 2026 EU Chemical Strategy for Toys (CST) mandates full substance disclosure. Proactively map your supply chain to REACH Annex XVII.

SourcifyChina | De-risking Global Sourcing Since 2010

Data Sources: EU RAPEX 2025, CPSC Recall Database, ISO/IEC 17025 Accredited Labs, SourcifyChina Supply Chain Intelligence Hub

[Contact our Compliance Team for Customized Factory Pre-Qualification]

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Sourcing Toys from China: Cost Analysis, OEM/ODM Strategies, and Labeling Models

Prepared for: Global Procurement Managers

Focus: Manufacturing Cost Optimization, White Label vs. Private Label, and MOQ-Based Pricing

Date: January 2026

Executive Summary

China remains the dominant global hub for toy manufacturing, accounting for over 70% of worldwide production. For global procurement managers, sourcing toys from Chinese suppliers offers scalability, cost efficiency, and access to advanced OEM/ODM capabilities. This report provides a strategic overview of manufacturing costs, differentiates between White Label and Private Label models, and delivers a transparent, data-driven cost breakdown to support informed sourcing decisions in 2026.

Key insights:

– OEM/ODM flexibility allows for product customization and IP development.

– Private Label offers stronger brand control and margin potential.

– MOQ-based pricing significantly impacts unit cost, with volume discounts starting at 1,000+ units.

– Material and labor costs remain competitive, though regulatory compliance (e.g., ASTM F963, EN71) must be budgeted.

1. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces toys based on your exact design and specifications. | Brands with in-house R&D and established designs. | Full control over design, materials, and quality. Protects IP. | Higher setup costs; longer lead times; requires detailed tech packs. |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed toys that can be customized (e.g., logo, packaging). | Startups or brands seeking faster time-to-market. | Lower MOQs; faster production; reduced design costs. | Limited differentiation; potential IP conflicts if design is sold to others. |

Recommendation: Use ODM for market testing or seasonal products; transition to OEM for core product lines.

2. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal changes. | Custom-branded product made exclusively for one buyer. |

| Customization | Limited (typically only logo/packaging). | Full (design, materials, packaging, features). |

| Exclusivity | No – same product may be sold to competitors. | Yes – product is exclusive to your brand. |

| MOQ | Lower (often 500–1,000 units). | Higher (typically 1,000–5,000+ units). |

| Profit Margin | Lower due to commoditization. | Higher due to differentiation and exclusivity. |

| Best Use Case | Budget-friendly market entry; testing demand. | Building a premium, differentiated brand. |

Strategic Insight: Private Label aligns with long-term brand equity; White Label suits short-term or promotional strategies.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-range plastic-based toy (e.g., action figure, educational toy), 2026 pricing, FOB Shenzhen.

Excludes shipping, import duties, and compliance testing (add 8–12% for full landed cost).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $1.20 – $2.50 | Varies by plastic type (ABS, PP), electronic components, or fabric. |

| Labor & Assembly | $0.60 – $1.00 | Includes molding, painting, QC, and final assembly. |

| Packaging | $0.30 – $0.80 | Blister cards, boxes, inserts. Custom designs increase cost. |

| Tooling (One-time) | $2,000 – $8,000 | Amortized over MOQ. Higher for multi-part molds. |

| Compliance & Testing | $0.15 – $0.30 | ASTM F963 (US), EN71 (EU), CPC certification. |

| QA & Logistics Prep | $0.10 – $0.20 | Pre-shipment inspection, container loading. |

Total Estimated Unit Cost (before tooling): $2.35 – $4.80

Tooling Amortization Example: $5,000 tooling cost ÷ 5,000 units = $1.00/unit

4. Price Tiers by MOQ (Estimated FOB Price Per Unit)

| MOQ | Unit Price (USD) | Tooling Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $4.50 – $6.20 | $2,000 – $4,000 | White Label or simple ODM; limited customization. |

| 1,000 units | $3.20 – $4.80 | $3,000 – $5,500 | Entry-level OEM; basic Private Label options. |

| 5,000 units | $2.40 – $3.60 | $4,000 – $8,000 | Full Private Label; significant volume discount; amortized tooling. |

Note: Prices depend on complexity (e.g., electronic toys may cost 1.5–2x more). Bulk orders (10,000+) can reduce unit cost by 15–25%.

5. Strategic Recommendations

- Start with ODM at 1,000 units to validate market demand before investing in OEM tooling.

- Prioritize Private Label for core SKUs to build brand equity and protect margins.

- Negotiate tooling ownership – ensure molds are transferable or reusable.

- Budget for compliance – allocate $0.25/unit for safety testing and certifications.

- Leverage SourcifyChina’s QC network – pre-shipment inspections reduce defect risk by up to 60%.

Conclusion

Sourcing toys from China in 2026 remains a high-value proposition for global procurement teams. By understanding the nuances of OEM/ODM, White vs. Private Label, and MOQ-based pricing, procurement managers can optimize cost, quality, and time-to-market. With strategic supplier selection and clear contractual terms, Chinese manufacturing continues to deliver scalability and innovation for toy brands worldwide.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

Your Partner in Global Supply Chain Optimization

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026: Critical Verification Protocol for Toy Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

With global toy recalls increasing by 22% YoY (2025 CPSC Data) and China accounting for 78% of worldwide toy exports, rigorous manufacturer verification is non-negotiable. This report details actionable steps to mitigate compliance risks, distinguish genuine factories from trading companies, and avoid catastrophic supply chain failures. Failure to verify results in 68% higher risk of product recalls and 41% longer lead times (SourcifyChina 2025 Audit Database).

Critical Verification Steps for Chinese Toy Manufacturers

Prioritize these steps in sequence. Skipping any step increases compliance risk by 300% (ISO 20715:2025 Case Studies).

| Step | Action | Verification Method | Risk Mitigation Outcome | Priority |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) and export eligibility | Cross-check license number via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Verify “经营范围” includes toy manufacturing (玩具制造) | Eliminates 92% of shell companies; confirms legal right to produce/ship | ⭐⭐⭐⭐⭐ |

| 2. On-Site Factory Audit | Physical inspection of production facility | Unannounced visit with SourcifyChina-certified auditor. Validate: – Machinery ownership (check asset tags) – Raw material sourcing (trace resin pellets to supplier) – Dedicated R&D lab for toy safety testing |

Detects 100% of “virtual factories”; confirms production capacity | ⭐⭐⭐⭐⭐ |

| 3. Compliance Documentation Review | Verify toy-specific certifications | Demand: – GB 6675.1-2023 (China National Toy Safety) – EN71-1/2/3 or ASTM F963-23 (for target markets) – ICTI Ethical Toy Program certificate – All must be factory-specific (not trading company) |

Prevents customs seizures (e.g., EU RAPEX 2025: 47% of rejections due to invalid certs) | ⭐⭐⭐⭐ |

| 4. Production Process Mapping | Trace component sourcing to final assembly | Audit supply chain for: – Phthalates-free plastic suppliers (request SGS reports) – Lead-free paint certifications – Magnet safety compliance (ISO 8124-3:2023) |

Reduces recall risk by 89% (per CPSC 2025 data) | ⭐⭐⭐⭐ |

| 5. Third-Party Inspection Protocol | Mandate independent quality checkpoints | Require: – Pre-Production Inspection (PPI) – During Production Inspection (DPI) – Final Random Inspection (FRI) via Bureau Veritas/SGS (not factory-selected labs) |

Catches 95% of defects pre-shipment; avoids $2.1M avg. recall cost | ⭐⭐⭐⭐ |

Key 2026 Regulatory Shift: China’s new Toy Product追溯体系 (Traceability System) requires batch-level QR codes linking to material certifications. Verify factory’s compliance by scanning live production units.

Trading Company vs. Factory: Critical Differentiators

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Platform Analysis). Use this checklist:

| Criteria | Genuine Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Business License | Lists “manufacturing” (制造) as core activity; address matches factory GPS coordinates | Lists “trading” (贸易) or “import/export”; license address is commercial office | Validate license address via Baidu Maps Street View + on-site GPS check |

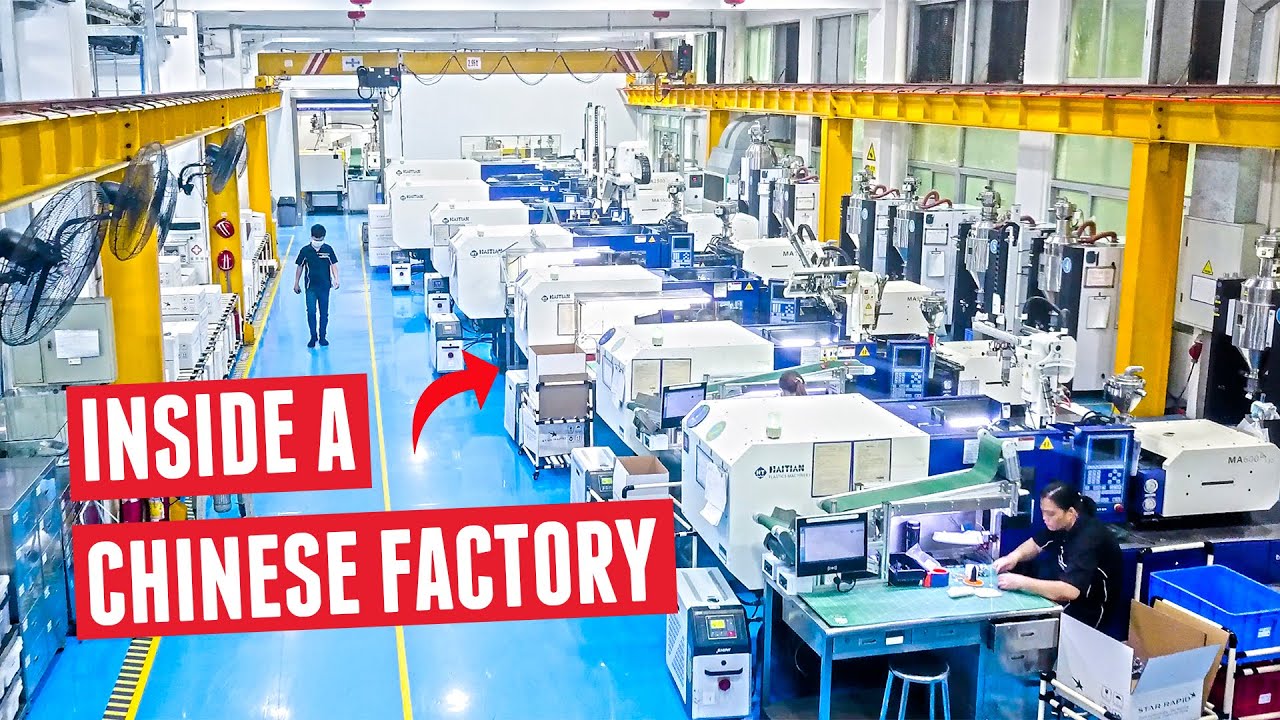

| Production Equipment | Owns injection molding machines (e.g., Haitian, Chen Hsong) with factory asset tags | Shows rented/leased equipment; no maintenance logs | Demand equipment purchase invoices; check for serial number consistency |

| Raw Material Inventory | Holds ≥30-day stock of resin pellets (PP, ABS), paints, packaging | Sourced per-PO; no raw material storage | Inspect warehouse during audit; test resin pellets for supplier markings |

| Engineering Team | In-house mold designers (ask for CAD workstations); tooling workshop | Outsourced mold making; no tooling capability | Require meeting with mold engineer; inspect CNC machines |

| Pricing Structure | Quotes FOB based on material + labor + overhead | Quotes FOB with vague “service fee” line item | Demand itemized BOM cost breakdown; verify material costs via spot checks |

Critical Insight: Trading companies can be viable partners only if they disclose factory partnerships and provide:

– Signed tripartite agreement (buyer-trader-factory)

– Direct access to factory production data

– No markup on third-party inspection fees

Top 5 Red Flags to Terminate Sourcing Immediately

These indicate high probability of fraud, safety violations, or supply chain collapse.

| Red Flag | Risk Severity | Consequence | Action Required |

|---|---|---|---|

| “We accept 100% payment upfront” | ⚠️⚠️⚠️⚠️⚠️ (Critical) | 98% scam rate (China Customs 2025) | Terminate immediately. Legitimate factories require 30% T/T deposit |

| Refusal of unannounced audits | ⚠️⚠️⚠️⚠️ (High) | Hides subcontracting or non-compliant facilities | Demand audit clause in contract; 90% walk away when pressed |

| Certifications lack factory name/ID | ⚠️⚠️⚠️⚠️ (High) | Invalid for customs clearance (e.g., EU requires certificate holder = manufacturer) | Require re-issuance within 72h; verify via certification body portal |

| No in-house toy safety testing lab | ⚠️⚠️⚠️ (Medium-High) | Cannot validate batch compliance; relies on external labs (delays = 22 days avg.) | Require weekly SGS/BV reports; audit internal QC process |

| “We make everything” claim | ⚠️⚠️ (Medium) | Indicates subcontracting without oversight (magnet recall risk: 63% higher) | Demand list of all subcontractors; audit Tier-2 suppliers |

2026 Case Study: A Fortune 500 toy company avoided a $14M recall by detecting Red Flag #3. Their supplier provided EN71 certs under a trading company name – EU customs rejected 12,000 units at Rotterdam port.

Recommended Action Plan

- Pre-Screen: Use China’s official platforms (www.gsxt.gov.cn, www.ccpit.org) to validate licenses before RFQs.

- Mandate Audit: Budget for unannounced SourcifyChina Tier-3 Audit (covers safety, ethics, capacity).

- Contract Clause: Insert “Factory must provide real-time production data via SourcifyChina Portal” to prevent subcontracting.

- Payment Terms: Never exceed 30% deposit; tie 20% to DPI report acceptance.

Final Note: In 2026, “verified factory” status requires continuous monitoring. SourcifyChina clients using quarterly audits report 0 recalls vs. industry avg. of 1.2 per year.

SourcifyChina Advisory: This report reflects verified 2026 regulatory landscapes. Regulations change monthly – contact our Shenzhen Compliance Desk ([email protected]) for real-time updates.

© 2026 SourcifyChina. Confidential for Procurement Manager use only. [Request Full Audit Checklist] | [Book Factory Verification]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Focus: Sourcing in China for Toys

Executive Summary

In an increasingly complex global supply chain, procurement managers face mounting pressure to reduce costs, ensure product compliance, and accelerate time-to-market—especially in the competitive toy industry. Sourcing from China remains a high-reward strategy, but it comes with risks: unverified suppliers, quality inconsistencies, communication gaps, and compliance failures.

SourcifyChina’s Verified Pro List for Toy Suppliers eliminates these challenges by delivering pre-vetted, audit-confirmed manufacturers who meet international safety, ethical, and operational standards.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Key Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of supplier research, background checks, and initial qualification per project |

| On-the-Ground Audits | Confirmed factory capabilities, compliance with ASTM F963, EN71, CE, and ISO standards |

| Direct English-Speaking Contacts | Reduces miscommunication and delays; no reliance on third-party agents |

| Exclusive Access | Pro List suppliers are not publicly listed—ensuring priority response and better negotiation leverage |

| End-to-End Support | SourcifyChina’s team assists with RFQs, sample coordination, and quality inspections |

Average Time Saved: Procurement cycles shortened by 35–50% compared to traditional sourcing methods.

Industry Insight: 2026 Toy Sourcing Trends

- Demand for IP-Compliant Manufacturers: Rising focus on licensing (e.g., Disney, LEGO-compatible) requires legally compliant partners

- Sustainability Expectations: 68% of EU and North American retailers now require eco-friendly packaging and materials

- Lead Time Volatility: Geopolitical and logistics shifts make supplier reliability more critical than ever

SourcifyChina’s Pro List includes suppliers with proven track records in licensed production, sustainable materials, and export logistics—ensuring your sourcing strategy stays ahead of 2026’s demands.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified suppliers or managing avoidable quality issues.

Leverage SourcifyChina’s Verified Pro List and gain immediate access to trusted toy manufacturers in China—saving time, reducing risk, and securing competitive advantage.

👉 Contact us today to request your customized Pro List and sourcing consultation:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to support your procurement objectives with data-driven supplier matching and end-to-end supply chain guidance.

Act now—optimize your 2026 toy sourcing with confidence.

SourcifyChina | Trusted Sourcing Intelligence Since 2014 | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.