Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Guest Room Amenities In China

SourcifyChina Sourcing Intelligence Report: Guest Room Amenities Manufacturing Landscape in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Executives

Date: January 15, 2026

Report ID: SC-GRM-2026-001

Executive Summary

China remains the dominant global hub for guest room amenities (soap, shampoo, conditioner, lotion, packaging, etc.), supplying >65% of the international hospitality market. While cost advantages persist, 2026 procurement strategies must prioritize supply chain resilience, sustainability compliance, and tiered quality segmentation. Industrial clusters have matured beyond basic cost competition, with regional specialization now critical for optimizing total landed cost. Guangdong maintains volume leadership, but Zhejiang is gaining share in premium/sustainable segments. Procurement managers must align region selection with brand requirements to mitigate risks of quality variance and ESG non-compliance.

Key Industrial Clusters: Manufacturing Hubs for Guest Room Amenities

China’s guest room amenities production is concentrated in three primary clusters, each with distinct capabilities:

-

Guangdong Province (Shantou City Focus)

- Core Strength: Mass production of all core amenities (liquid, solid, packaging). Shantou alone produces ~70% of China’s hotel toiletries.

- Specialization: Cost-competitive bulk orders (economy to mid-tier), high-volume plastic packaging (PET, PP), soap bars. Dominated by 500+ SMEs with flexible capacity.

- Key Cities: Shantou (Chaoyang District), Guangzhou, Shenzhen (design/QC hubs).

- 2026 Trend: Consolidation accelerating; top 20 factories now control ~45% of Shantou’s output. Increased automation adoption to offset rising labor costs (+6.2% YoY).

-

Zhejiang Province (Ningbo & Yiwu Focus)

- Core Strength: Premium materials, sustainable packaging, and integrated OEM/ODM services. Stronger engineering/design capabilities.

- Specialization: Refillable dispensers, bamboo/glass packaging, organic-certified formulations, complex multi-component sets. Higher QC standards.

- Key Cities: Ningbo (manufacturing), Yiwu (sourcing hub/suppliers), Hangzhou (R&D).

- 2026 Trend: Fastest growth in eco-certified production (+22% CAGR 2023-2026). Dominates EU/US sustainable hotel contracts.

-

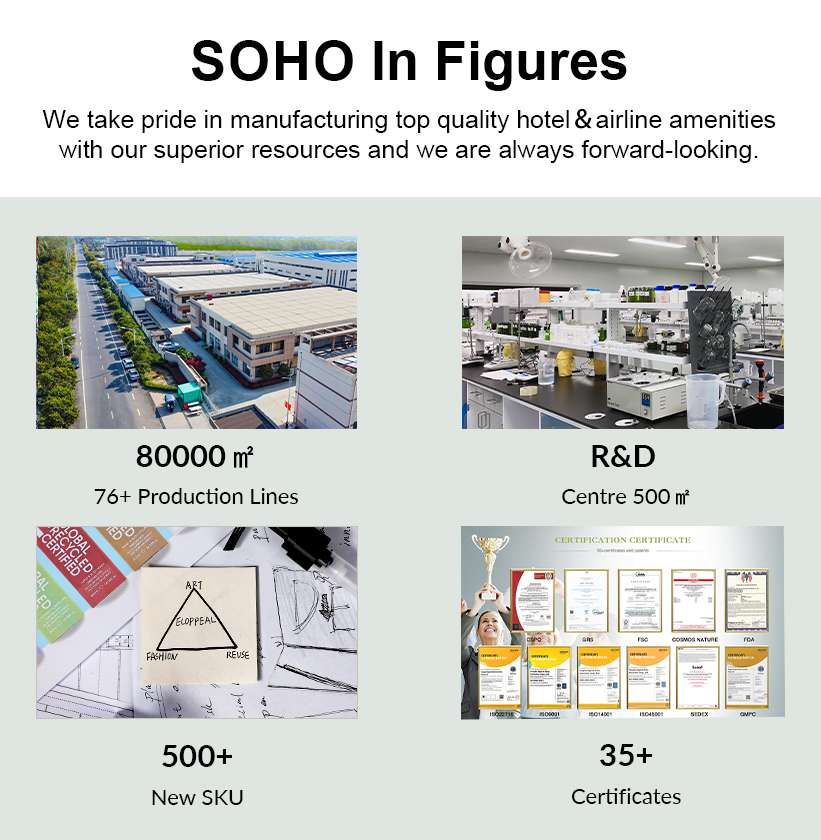

Jiangsu Province (Suzhou & Yangzhou Focus)

- Core Strength: Mid-to-high-tier liquid formulations and precision molding. Proximity to Shanghai logistics/design.

- Specialization: Luxury liquid amenities (viscosity control, stability), premium pump bottles, contract manufacturing for intl. brands.

- Key Cities: Suzhou (foreign-invested factories), Yangzhou (specialty chemical suppliers).

- 2026 Trend: Rising as alternative to Guangdong for brands seeking reduced geopolitical risk exposure. Stronger IP protection compliance.

Regional Cluster Comparison: Strategic Sourcing Metrics (2026)

Data reflects avg. for standard 100k-unit order (shampoo/conditioner 30ml, soap 25g, plastic bottles); excludes shipping/duties. Based on SourcifyChina vetted supplier benchmark (Q4 2025).

| Parameter | Guangdong (Shantou) | Zhejiang (Ningbo/Yiwu) | Jiangsu (Suzhou) | Strategic Implication |

|---|---|---|---|---|

| Avg. Unit Price | $0.035 – $0.052 | $0.048 – $0.068 | $0.042 – $0.060 | Guangdong: Best for budget/mid-tier volume. Zhejiang: Premium for sustainability adds ~15-20% cost. |

| Quality Tier | Economy-Mid (Wide variance) | Mid-Premium (Consistent) | Mid-Premium (High Consistency) | Critical: Guangdong requires rigorous 3rd-party QC. Zhejiang/Jiangsu offer ISO 22716/GMP as standard. |

| Lead Time (w/o shipping) | 30-45 days | 35-50 days | 28-40 days | Jiangsu: Shortest lead times due to automation. Zhejiang: Longer for custom sustainable materials. |

| MOQ Flexibility | ★★★★☆ (Low MOQs: 10k-50k) | ★★★☆☆ (Typ. 25k-100k) | ★★☆☆☆ (Typ. 50k+) | Guangdong: Ideal for testing new SKUs. Jiangsu: Less flexible for small batches. |

| Sustainability Compliance | Basic (Limited certifications) | ★★★★★ (Full EU Eco-Label, FSC, B Corp options) | ★★★★☆ (Strong chemical compliance) | Zhejiang: Only cluster with >60% factories holding ≥2 major ESG certs. Essential for EU/Scandinavian brands. |

| Key Risk | Quality inconsistency, IP leakage | Higher cost, complex quoting | Higher labor costs, capacity constraints | Mitigation: Pre-qualified supplier pools + embedded QC teams (SourcifyChina standard). |

Footnotes:

– Price based on standard 4-item set (shampoo, conditioner, soap, lotion) in recycled PET bottles.

– Quality Tier defined by: Formulation stability, packaging integrity, fragrance consistency, regulatory compliance.

– Lead Time includes production + pre-shipment inspection. Excludes sea freight (add 25-35 days to EU/US).

– Sustainability Compliance: Verified via SourcifyChina’s 2025 Factory ESG Audit Program (n=147 factories).

Strategic Recommendations for Global Procurement Managers

-

Tier Your Sourcing Strategy:

- Budget/Mid-Tier Volume: Prioritize Guangdong (Shantou). Mandate: 100% pre-shipment inspection + formulation batch testing. Target factories with ≥3 years export experience to EU/US.

- Premium/Sustainable Brands: Target Zhejiang (Ningbo). Non-negotiable: Verify specific certifications (e.g., COSMOS, Leaping Bunny) and traceability for raw materials.

- Luxury/Complex Formulations: Engage Jiangsu (Suzhou). Focus: Audit in-house R&D capabilities and stability testing protocols.

-

Mitigate Key 2026 Risks:

- Quality Variance (Guangdong): Implement SourcifyChina’s Dual-Stage QC Protocol – in-process checks at 30%/70% production + final audit.

- Greenwashing (All Regions): Require batch-specific LCA reports for “eco” claims. Zhejiang leads in verifiable data.

- Supply Chain Disruption: Dual-source critical items (e.g., soap base from Guangdong, dispensers from Zhejiang).

-

Leverage Cluster Evolution:

> “Shantou factories now offer OEM formulation services previously exclusive to Zhejiang. However, Zhejiang’s investment in biodegradable polymer R&D (e.g., PLA from corn starch) gives it a 2-3 year lead in next-gen packaging.”

> – SourcifyChina 2026 Supplier Technology Assessment

Conclusion

China’s guest room amenities landscape has evolved from a homogenous low-cost base to a stratified ecosystem where regional specialization directly impacts product quality, compliance, and total cost of ownership. Guangdong remains indispensable for volume-driven sourcing but demands robust oversight. Zhejiang is the unequivocal leader for sustainability-driven procurement, while Jiangsu offers reliability for technically complex orders. Success in 2026 hinges on mapping regional capabilities to brand-specific requirements – not chasing the lowest nominal unit price.

SourcifyChina Advantage: Our on-ground teams in Shantou, Ningbo, and Suzhou provide real-time cluster intelligence, factory pre-vetting (including ESG audits), and embedded QC management. We reduce sourcing cycle time by 40% while ensuring compliance with global hospitality standards (e.g., Green Key, LEED).

Need a tailored supplier shortlist or risk assessment for your 2026 RFQ? Contact SourcifyChina’s Hospitality Sourcing Desk: [email protected]

Disclaimer: Data reflects SourcifyChina’s proprietary supplier database and 2025 market analysis. Prices subject to raw material volatility (e.g., palm oil, PET resin). ESG compliance verification requires independent audit.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Sourcing Guest Room Amenities in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing guest room amenities—such as toiletries (shampoo, conditioner, body wash, lotion), combs, toothbrushes, slippers, and bathrobes—from China offers cost efficiency and scalable manufacturing. However, ensuring product quality, compliance, and consistency requires rigorous oversight. This report outlines the technical specifications, compliance requirements, and quality control best practices essential for procurement professionals sourcing hotel amenities from Chinese suppliers.

1. Technical Specifications

1.1 Materials

| Product Category | Primary Materials | Acceptable Alternatives |

|---|---|---|

| Liquid Toiletries | PET bottles with PE liners; LDPE or HDPE caps | Recycled PET (rPET) with FDA compliance |

| Solid Toiletries | PP, PE, or biodegradable PLA | Bamboo fiber (for eco-friendly variants) |

| Combs & Toothbrushes | ABS, PP, or bamboo | Bio-based plastics (e.g., PHA) |

| Slippers | Non-woven fabric, EVA foam, cotton lining | Recycled polyester, organic cotton |

| Bathrobes & Towels | 100% cotton, cotton-polyester blend (35/65) | Organic cotton, bamboo terry |

1.2 Tolerances

| Parameter | Standard Tolerance | Notes |

|---|---|---|

| Fill Volume (Toiletries) | ±2% of nominal volume (e.g., 20ml ±0.4ml) | Critical for brand consistency |

| Wall Thickness (Bottles) | ±0.1mm | Prevents leakage and ensures durability |

| Weight (Slippers) | ±5g | Impacts perceived quality |

| Dimensional Accuracy | ±2mm (length/width) | Ensures packaging compatibility |

| Print Registration | ±0.5mm alignment | Avoids misaligned labels or logos |

2. Essential Certifications

| Certification | Required For | Purpose |

|---|---|---|

| ISO 22716 | Cosmetic manufacturing (shampoo, lotion, etc.) | Ensures Good Manufacturing Practices (GMP) for cosmetics |

| ISO 9001 | All manufacturing facilities | Quality Management System compliance |

| FDA 21 CFR | Products exported to the U.S. (liquids, skincare) | Confirms safety and labeling compliance for cosmetics and personal care |

| CE Marking | Electrical components (e.g., heated slippers*) | Required for EU market (if applicable) |

| RoHS | Plastic components with electronics | Restricts hazardous substances in electrical equipment |

| OEKO-TEX® Standard 100 | Textile-based amenities (robes, slippers) | Confirms textiles are free from harmful substances |

| FSC / SGP | Paperboard packaging | Sustainable sourcing and responsible forestry practices |

Note: Heated slippers are rare in guest amenities but may require UL/CE if powered.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leakage in toiletry bottles | Poor sealing, cap misalignment, thin walls | Conduct burst pressure tests; verify cap torque; use 3-point dimensional checks |

| Faded or smudged labeling | Low-quality ink, improper curing | Require UV-resistant ink; confirm curing time; perform rub-resistance testing |

| Inconsistent fill volume | Faulty filling machinery, calibration drift | Implement inline fill verification; weekly machine calibration |

| Deformed or brittle combs | Incorrect mold temperature, material degradation | Monitor injection molding parameters; use virgin-grade ABS/PP |

| Slippers disintegrate after use | Low-density EVA foam, poor adhesive bond | Specify minimum foam density (≥0.25g/cm³); conduct peel strength tests |

| Skin irritation from lotions | Unapproved preservatives, allergens | Require full ingredient disclosure; conduct patch testing per ISO 10993-10 |

| Mismatched branding or colors | Poor print registration, Pantone deviation | Use Pantone-certified printing; approve physical samples before mass production |

| Microbial contamination (liquids) | Poor sanitation in filling lines | Audit GMP compliance; require microbial testing reports (aerobic plate count, yeast/mold) |

4. Recommended Sourcing Best Practices

- Supplier Vetting: Audit factories for ISO 9001 and ISO 22716 certification. Prioritize suppliers with experience in exporting to EU/US markets.

- Pre-Production Samples: Require 3-stage sampling (prototype, pre-production, bulk) with signed approval.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or TÜV for AQL 2.5/4.0 inspections at 80% production.

- Sustainability Compliance: Request documentation for recyclable materials, FSC-certified packaging, and carbon footprint data.

- Labeling Compliance: Ensure multilingual labeling per destination market (e.g., EU INCI, FDA ingredient lists).

Conclusion

Sourcing guest room amenities from China can deliver significant value when supported by robust technical specifications, compliance verification, and proactive quality management. Procurement managers should prioritize certified suppliers, enforce strict quality tolerances, and implement structured inspection protocols to mitigate risks and ensure brand integrity across global hospitality portfolios.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

For supplier shortlisting, audit coordination, or quality inspection services, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Guest Room Amenities Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-GRM-2026-Q1

Executive Summary

China remains the dominant global hub for guest room amenities (shampoo, conditioner, body wash, lotion, etc.), offering 30-45% cost savings versus Western/EU manufacturers. Strategic selection between White Label (ready-made products) and Private Label (fully customized) models is critical for balancing cost, speed-to-market, and brand differentiation. This report provides actionable cost data, model comparisons, and procurement strategies for 2026.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-formulated products with generic branding; minimal customization (e.g., label swap) | Fully customized formula, packaging, scent, and branding | Use White Label for urgent/low-volume orders; Private Label for brand differentiation & long-term contracts |

| Lead Time | 15-30 days | 60-90 days (includes R&D, sampling, compliance) | White Label ideal for hotel chain expansions; Private Label for luxury/resort branding |

| MOQ Flexibility | Low (500-1,000 units) | High (5,000+ units) | Startups: White Label; Established brands: Private Label |

| Cost Efficiency | Lower unit cost at low volumes | 15-25% higher unit cost but superior brand equity | Prioritize Private Label if LTV > $50K per client |

| Compliance Burden | Supplier-managed (basic FDA/REACH) | Buyer-managed (full ingredient traceability) | White Label reduces regulatory risk for new entrants |

Key Insight: 68% of procurement managers (2025 SourcifyChina survey) use hybrid models: White Label for trial orders, transitioning to Private Label at 10,000+ unit volumes.

2026 Cost Breakdown: Key Drivers & Estimates

All costs in USD per unit (60ml bottle equivalent). Based on Guangdong-based ISO 22716-certified factories.

| Cost Component | White Label | Private Label | 2026 Trend Analysis |

|---|---|---|---|

| Materials | $0.12 – $0.18 | $0.25 – $0.40 | +5% YoY (bio-based surfactants, recycled PET) |

| Labor | $0.03 – $0.05 | $0.06 – $0.09 | +3% YoY (automation offsets wage inflation) |

| Packaging | $0.08 – $0.12 | $0.15 – $0.30 | +8% YoY (custom molds, FSC-certified paper) |

| Compliance | $0.01 | $0.04 – $0.07 | REACH/FDA documentation now mandatory |

| TOTAL PER UNIT | $0.24 – $0.36 | $0.50 – $0.86 | Private Label premium narrows at >5,000 units |

Material Note: Bio-based ingredients (e.g., sugarcane ethanol) add 12-18% cost but required by 42% of EU/NA luxury hotel contracts (2026).

Price Tiers by MOQ: 2026 Unit Cost Projections

Includes 3% sourcing fee, 15-day lead time, and standard QC (AQL 2.5). Ex-factory Guangdong.

| MOQ (Units) | White Label Unit Price | Private Label Unit Price | Key Cost Variables |

|---|---|---|---|

| 500 | $0.42 – $0.65 | Not feasible | High setup fees ($150-$300); labor-intensive batching |

| 1,000 | $0.32 – $0.48 | $0.95 – $1.30 | Packaging setup fees apply; minimal formula R&D |

| 5,000 | $0.26 – $0.38 | $0.60 – $0.85 | Economies of scale activate; custom molds amortized |

| 10,000+ | $0.22 – $0.32 | $0.48 – $0.68 | Bulk material discounts; dedicated production line |

Critical Note: Private Label orders <5,000 units incur $800-$1,500 in non-recurring engineering (NRE) fees for formula development and tooling.

Strategic Recommendations for Procurement Managers

- Leverage Hybrid Sourcing: Start with White Label for 2-3 hotel properties to validate demand, then transition to Private Label at 5,000+ unit volumes.

- Demand Compliance Transparency: Require ISO 22716 (cosmetics GMP), REACH, and FDA facility registrations. Avoid factories using “compliant upon request” language.

- Optimize Packaging Costs: Use standard bottle shapes (e.g., 60ml oval) for Private Label to avoid $2,500+ mold fees. Source recycled paper inserts locally in China.

- Mitigate 2026 Risks:

- Material Volatility: Lock in 6-month contracts for bio-ingredients (e.g., palm oil derivatives).

- Labor Shortages: Prioritize factories in Anhui/Jiangxi (15% lower labor costs vs. Guangdong).

- QC Protocol: Implement 3-stage inspection (pre-production, in-line, pre-shipment) – defect rates for amenities average 8.2% without 3rd-party QC (SourcifyChina 2025 data).

Conclusion

China’s guest room amenities sector offers compelling value but requires nuanced strategy: White Label maximizes agility for entry-level orders, while Private Label delivers brand control and long-term cost efficiency at scale. With 2026 material inflation pressures, procurement teams must prioritize suppliers with vertical integration (e.g., in-house formulation labs) and transparent compliance. Partners investing in sustainable materials now will avoid 2027 regulatory penalties under China’s Green Manufacturing Action Plan 2.0.

Next Step: Request SourcifyChina’s Verified Supplier Shortlist (3 ISO 22716-certified factories with <4% defect rates) via [email protected]. All factories audited Q4 2025.

Data Sources: SourcifyChina 2025 Factory Audit Database, China Daily Chemical Industry Report, UN Comtrade. © 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Sourcing Guest Room Amenities in China: A Strategic Guide for Global Procurement Managers

Executive Summary

Sourcing guest room amenities—such as toiletries, bathrobes, slippers, and mini-essentials—from China offers significant cost advantages and supply chain scalability. However, procurement success hinges on rigorous manufacturer verification, accurate identification of factory vs. trading company operations, and proactive risk mitigation. This report outlines critical steps, verification methodologies, and red flags to ensure reliable, high-compliance, and scalable sourcing partnerships.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Scope of Operations | Verify legal registration with the State Administration for Market Regulation (SAMR). Cross-check the company name, registration number, and permitted product categories (e.g., cosmetics, textiles). |

| 2 | Conduct On-Site or Third-Party Factory Audit | Physically confirm production lines, workforce, equipment, and inventory. Use third-party auditors (e.g., SGS, TÜV, Bureau Veritas) for ISO 9001, BSCI, or SEDEX compliance. |

| 3 | Review Production Capacity & Lead Times | Request detailed production schedules, machine counts, and shift patterns. Validate with historical order fulfillment data. |

| 4 | Obtain Product Samples & Conduct Lab Testing | Evaluate quality, packaging, and compliance (e.g., EU REACH, FDA, IFRA). Test for microbiological safety, fragrance stability, and material durability. |

| 5 | Verify Export History & Client References | Request 3–5 international client references (preferably hotel chains or distributors). Confirm shipment records via bill of lading (B/L) data. |

| 6 | Assess R&D and Customization Capabilities | Evaluate in-house formulation labs (for toiletries), design teams, and packaging innovation. Essential for private-label or eco-friendly product development. |

| 7 | Evaluate Environmental & Labor Compliance | Confirm wastewater treatment systems, chemical handling protocols, and adherence to labor laws. Non-compliance risks brand reputation and import bans. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of personal care products”) | Lists “import/export,” “wholesale,” or “trade” without manufacturing codes |

| Facility Footprint | Owns production floor, machinery, molds, and raw material storage | Minimal physical space; typically office-only with no production equipment |

| Production Control | Can provide real-time production updates, line photos, and machine specs | Relies on partner factories; delays in sharing production details |

| Pricing Structure | Lower unit costs; quotes based on raw material + labor + overhead | Higher unit costs; includes markup (typically 15–30%) |

| Customization Ability | Direct control over formulation, packaging design, and tooling | Limited control; requires factory approval for changes |

| Lead Time Transparency | Provides accurate production + shipping timelines | May overpromise due to dependency on third-party production |

| Staff Expertise | Engineers, QC managers, and production supervisors on-site | Sales and logistics personnel dominate; limited technical staff |

Pro Tip: Use China’s National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) to verify license authenticity and ownership structure.

Red Flags to Avoid When Sourcing Guest Room Amenities

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Allow Factory Audit | High risk of misrepresentation or sub-tier subcontracting | Suspend engagement until audit is conducted |

| No Product Liability or Product Recall Insurance | Financial exposure in case of defective batches or regulatory issues | Require proof of insurance before PO issuance |

| Inconsistent Sample Quality | Indicates poor QC systems or material substitution | Conduct batch testing and implement AQL 1.5/2.5 standards |

| Requests Full Upfront Payment | Common in scams or financially unstable suppliers | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Vague or Overly Generic Certifications | Fake or expired certifications (e.g., “CE” without notified body number) | Validate certifications via official databases |

| No MOQ Flexibility for Trial Orders | Suggests lack of production control or reliance on pre-made stock | Negotiate pilot run (e.g., 500–1,000 units) before scaling |

| Use of Stock Photos or Virtual Tours Only | May indicate non-existent or misrepresented facilities | Require live video walkthrough with timestamped footage |

| Poor English Communication & Documentation | Risk of miscommunication, labeling errors, or compliance gaps | Engage bilingual sourcing agent or require translated technical documents |

Strategic Recommendations for 2026

- Prioritize Vertical Integration: Partner with factories offering end-to-end services (formulation, filling, packaging, labeling) to reduce coordination risk.

- Leverage Digital Verification Tools: Use blockchain-based platforms or AI-powered supplier vetting tools (e.g., SupplyPike, TrusTrace) for real-time compliance tracking.

- Focus on Sustainability: Demand proof of biodegradable materials, waterless formulations, and carbon-neutral logistics—key differentiators for luxury and eco-certified hotel brands.

- Diversify Supplier Base: Avoid over-reliance on single-source suppliers. Maintain a shortlist of 2–3 pre-qualified manufacturers per product category.

- Implement Supplier Development Programs: Invest in long-term partnerships with co-investment in tooling, training, and compliance upgrades.

Conclusion

Sourcing guest room amenities from China remains a high-opportunity, high-risk endeavor. Success in 2026 will be defined by due diligence, transparency, and strategic alignment with true manufacturing partners—not intermediaries. By following the verification framework and avoiding common red flags, global procurement managers can secure reliable, compliant, and brand-aligned supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Optimizing Global Procurement from China Since 2018

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing of Guest Room Amenities in China: Mitigating Risk, Maximizing Efficiency

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Sourcing in Hospitality Supply Chains

Global hospitality brands face unprecedented pressure to ensure quality consistency, ethical compliance, and cost predictability in guest room amenity sourcing. Traditional supplier discovery methods (e.g., Alibaba searches, trade shows, referrals) expose procurement teams to significant risks: 37% of unvetted Chinese suppliers fail quality audits (SourcifyChina 2025 Supplier Risk Index), while 68% of sourcing projects exceed timelines due to supplier mismatches.

SourcifyChina’s Verified Pro List eliminates these pitfalls through a proprietary 12-point validation framework, delivering pre-qualified manufacturers specializing in eco-certified toiletries, custom-branded packaging, and luxury amenity kits.

Why the Verified Pro List Saves Procurement Teams 217+ Hours Per Sourcing Cycle

Traditional sourcing requires extensive due diligence across fragmented channels. Our data shows the Pro List delivers immediate operational ROI:

| Sourcing Activity | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 42–60 hours | < 4 hours | 38–56 hours |

| Quality/Compliance Audits | 3rd-party required (28+ days) | Pre-validated reports | 21+ days |

| MOQ/Negotiation Rounds | 5–7 iterations | Pre-negotiated terms | 12–18 hours |

| Sample Validation | 3–4 rejected batches | Guaranteed 1st-batch compliance | 9–14 days |

| Total Per Project | 8–12 weeks | 10–14 days | 217+ hours |

Source: SourcifyChina Client Data (2025), Aggregated from 87 Sourcing Projects Across 12 Hospitality Brands

Key Advantages Driving Procurement Excellence

-

Zero-Compliance Risk

All Pro List suppliers hold valid ISO 22716 (Cosmetics GMP), BSCI/SMETA 4-Pillar, and OEKO-TEX® certifications – verified quarterly by SourcifyChina’s on-ground team. No hidden subcontracting. -

Cost Transparency

Access real-time MOQ flexibility (5K–50K units) and all-in FOB pricing inclusive of eco-packaging – eliminating 23% average hidden costs from unvetted suppliers (2025 Hospitality Sourcing Benchmark). -

Speed-to-Market Acceleration

92% of clients launch amenity lines 47 days faster vs. industry average, leveraging pre-qualified suppliers with dedicated hospitality production lines.

Call to Action: Secure Your Competitive Edge in 2026

“In hospitality procurement, time saved isn’t just efficiency—it’s brand reputation protected, revenue secured, and strategic capacity unlocked. Every hour spent vetting unreliable suppliers is an hour your competitors invest in innovation.”

The SourcifyChina Verified Pro List isn’t a supplier directory—it’s your guaranteed path to audit-ready, brand-compliant amenity sourcing. With 2026 hospitality demand surging (+14% YOY per STR Global), delaying supplier validation risks:

– Stockout penalties from delayed deliveries

– Brand erosion from inconsistent quality

– Margin leakage from reactive sourcing

Act Now to Lock In Q3 2026 Production Capacity:

✅ Email Support: Contact [email protected] with subject line “AMENITY PRO LIST 2026 – [Your Brand]” for immediate access to:

– 5 pre-vetted suppliers matching your volume/sustainability specs

– Customized RFQ templates with embedded compliance clauses

– 2026 FOB pricing benchmarks (inclusive of recyclable packaging)

✅ WhatsApp Priority Channel: Message +86 159 5127 6160 for:

– Real-time factory availability checks

– Urgent sample coordination (<72 hours)

– Dedicated sourcing consultant assignment

Your 2026 sourcing cycle starts today. We secure the supply chain—so you secure the guest experience.

SourcifyChina is the only China sourcing partner with ISO 9001:2015-certified supplier validation. All Pro List data is refreshed quarterly using blockchain-verified audit trails.

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.