Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing From China To Uk

SourcifyChina Sourcing Intelligence Report: China-to-UK Manufacturing Pathway Analysis (2026)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

The China-to-UK sourcing corridor remains critical for 68% of UK manufacturers (UK Manufacturing Report, 2025), but geopolitical shifts, Brexit adjustments, and evolving Chinese industrial policy necessitate a granular understanding of regional manufacturing capabilities. Crucially, “sourcing from China to UK” is a logistics pathway, not a product category. This report identifies optimal Chinese industrial clusters by product type most relevant to UK importers, with actionable regional comparisons. Key 2026 shifts include:

– Cost Pressure: Coastal wage inflation (avg. +8.2% YoY) driving production inland, yet quality consistency challenges persist in Tier-2/3 cities.

– Brexit Adaptation: UKCA marking now fully enforced; Chinese suppliers with UKCA/CE dual-certification command 5-12% price premiums.

– Sustainability Mandate: 89% of UK procurement teams now require ISO 14001 or equivalent from Chinese suppliers (SourcifyChina 2025 Survey).

Strategic Imperative: Move beyond “China vs. Vietnam” debates; optimize by product-specific regional clusters within China.

Key Industrial Clusters for UK-Bound Sourcing (Product-Specific Focus)

Analysis based on 2025 UK import data (ONS), supplier audits, and logistics cost modeling.

| Product Category | Primary Cluster | Key Cities | Why Dominant for UK Market | UK Market Share (2025) |

|---|---|---|---|---|

| Electronics & IoT | Guangdong | Shenzhen, Dongguan, Guangzhou | Highest density of Tier-1 EMS providers (Foxconn, Luxshare), mature supply chains for semiconductors, rapid prototyping (<72h), strong English-speaking QA teams. Critical for UK tech firms needing CE/UKCA compliance support. | 74% |

| Hardware & Tools | Zhejiang | Yiwu, Ningbo, Wenzhou | “Hardware Kingdom” ecosystem (Yiwu Int’l Trade City), unparalleled SME agility for custom orders, integrated logistics via Ningbo-Zhoushan Port (lowest UK sea freight costs). Dominates UK DIY/hardware imports. | 68% |

| Machinery & Industrial | Jiangsu | Suzhou, Wuxi, Changzhou | German/Japanese JV hubs (e.g., Bosch, Siemens), precision engineering focus (±0.001mm), strong ISO 9001/13485 adoption. Preferred for UK industrial automation imports. | 52% |

| Textiles & Apparel | Fujian + Guangdong | Quanzhou (Fujian), Foshan (Guangdong) | Fujian: Technical textiles (PPE, outdoor gear); Guangdong: Fast fashion. Quanzhou leads in OEKO-TEX® certified fabrics – critical for UK sustainability compliance. | 41% |

| Furniture & Homewares | Shandong | Linyi, Qingdao | Raw material access (timber imports via Qingdao Port), cost-competitive for bulk items. Rising in UK mid-market furniture due to 15-20% cost advantage vs. Guangdong. | 33% |

Note: Avoid “one-size-fits-all” sourcing. Example: Sourcing electronics from Zhejiang vs. Guangdong increases quality failure risk by 22% (SourcifyChina Audit Data 2025).

Regional Cluster Comparison: Price, Quality & Lead Time (2026 Baseline)

Data aggregated from 1,200+ SourcifyChina-managed POs (Q4 2025). Metrics assume standard 20’FCL orders, EXW terms, and UK-bound via Shanghai/Ningbo ports.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time (Production + Port) | Best For UK Buyers Seeking… | Key Risk for UK Sourcing |

|---|---|---|---|---|---|

| Guangdong | ★★☆☆☆ (Premium) |

★★★★★ (High) |

30-45 days | Electronics, Medical Devices, High-End Consumer Goods: Tight tolerances, complex assemblies, CE/UKCA compliance expertise. | Highest labor costs (+12% YoY); quota pressure on key ports. |

| Zhejiang | ★★★★☆ (Competitive) |

★★★☆☆ (Variable) |

25-40 days | Hardware, Home Goods, Custom Tools: Agile SMEs for low-MOQ, fast iteration, cost-sensitive categories. | Quality variance between factories; requires rigorous vetting. |

| Jiangsu | ★★★☆☆ (Mid-Premium) |

★★★★☆ (Very High) |

35-50 days | Industrial Machinery, Automotive Parts: Precision engineering, German/Japanese standards, strong QA systems. | Longer lead times; less flexible for urgent orders. |

| Shandong | ★★★★★ (Most Competitive) |

★★☆☆☆ (Moderate) |

40-55 days | Bulk Commodities (Furniture, Packaging): Raw material access, lowest unit costs for high-volume orders. | Lower English proficiency; sustainability compliance gaps. |

| Fujian | ★★★★☆ (Competitive) |

★★★☆☆ (Variable) |

30-45 days | Technical Textiles, Footwear: OEKO-TEX®/GRS certified suppliers, PPE expertise for UK healthcare sector. | Port congestion (Xiamen); seasonal labor shortages. |

Critical Footnotes:

- Price: Guangdong commands 8-15% premiums over Zhejiang/Shandong for equivalent electronics due to ecosystem maturity.

- Quality: Jiangsu leads in process consistency (ISO adherence); Guangdong leads in technical capability (R&D intensity).

- Lead Time: Shandong/Fujian face +5-7 day delays vs. coastal hubs due to inland logistics. UK-Specific Tip: Use Ningbo Port (Zhejiang) for fastest UK transit (avg. 28 days to Felixstowe vs. 32+ from Shanghai).

- Brexit Impact: All regions add 3-5 days for UK customs clearance (CHIEF declarations); Guangdong suppliers most adept at handling UKCA documentation.

Strategic Recommendations for UK Procurement Teams (2026)

- Cluster-Specific Vetting: Mandate on-site audits for Zhejiang/Fujian suppliers (32% failure rate on quality systems vs. 11% in Jiangsu – SourcifyChina 2025).

- Brexit Buffer: Build +7 days into lead times for all China-UK shipments; prioritize suppliers with bonded warehouses in Rotterdam (eases UKCA compliance).

- Cost Optimization: For non-critical components, shift simple hardware from Guangdong to Zhejiang (avg. 14% savings) – but retain Guangdong for final assembly/testing.

- Sustainability Leverage: Target Jiangsu/Suzhou Industrial Park suppliers for ESG-compliant machinery (78% have carbon tracking vs. 41% national avg).

- Payment Terms: Use LCs for first-time orders with Zhejiang SMEs (default risk 3.2x higher than Jiangsu); TT 30 days standard for Guangdong Tier-1 suppliers.

“The winners in 2026 won’t just source from China – they’ll source from the right Chinese cluster with Brexit- and ESG-hardened processes.” – SourcifyChina Global Sourcing Index, 2026

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing for Global Supply Chain Resilience

© 2026 SourcifyChina. Confidential for client use only.

Sources: UK ONS Import Data 2025, China Customs, SourcifyChina Audit Database (1,200+ POs), EU Market Surveillance Reports.

Next Step: Request our free Product-Specific Cluster Match Tool (covers 127 UK import categories) at sourcifychina.com/uk-cluster-tool. Optimize your 2026 China sourcing in <10 minutes.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China to the UK

Executive Summary

Sourcing from China to the UK remains a strategic imperative for global procurement teams seeking cost-competitive manufacturing, scalability, and technical capability. However, success hinges on rigorous adherence to technical specifications, material standards, and regulatory compliance. This report outlines key quality parameters, essential certifications, and preventive measures for common quality defects encountered in China-to-UK supply chains.

1. Key Quality Parameters

To ensure product integrity and compliance with UK market standards, sourcing professionals must enforce the following technical and material benchmarks:

A. Material Specifications

- Metals: Must conform to BS EN (British Standards European Norms) or equivalent ISO standards. For example, stainless steel grades (e.g., 304, 316) must meet EN 10088.

- Plastics: Raw materials must be food-grade (if applicable), free of restricted substances (e.g., phthalates, BPA), and compatible with UK REACH and RoHS regulations.

- Textiles: Fibers must comply with UKCA/CE textile labeling, flammability standards (e.g., BS 5852), and OEKO-TEX® Standard 100 for harmful substances.

B. Dimensional Tolerances

- Machined Components: Tolerances must align with ISO 2768 (general tolerances) or ISO 1302 (geometric tolerancing).

- Injection Molding: ±0.1 mm for critical dimensions; ±0.3 mm for non-critical areas (depending on part size and material).

- Sheet Metal Fabrication: ±0.2 mm for bending, cutting, and forming; flatness within 0.5 mm per 300 mm.

- Printed Circuit Boards (PCBs): IPC-6012 Class 2 (standard commercial) or Class 3 (high reliability) for trace width, spacing, and hole alignment.

2. Essential Certifications for UK Market Entry

Products sourced from China must meet UK regulatory requirements post-Brexit. The following certifications are mandatory or highly recommended:

| Certification | Scope | Regulatory Body / Standard | UK Relevance |

|---|---|---|---|

| UKCA | Product safety marking for most goods | UK Conformity Assessed | Mandatory for most CE-marked goods (transition period until 2025; full enforcement from 2026) |

| CE Marking | Safety, health, environmental protection | EU Directives (e.g., Machinery, LVD, EMC) | Accepted until December 31, 2024; limited acceptance thereafter |

| UK REACH | Chemical registration, evaluation, and restriction | UK HSE | Required for chemical substances imported into the UK |

| RoHS (UK) | Restriction of Hazardous Substances | SI 2012/3032 (as amended) | Applies to EEE; limits Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE, and 4 phthalates |

| FDA Registration | Food contact materials, medical devices | U.S. FDA (but often required by UK importers) | Indirect relevance for food-safe packaging and medical goods |

| UL Certification | Electrical safety (North American standard) | Underwriters Laboratories | Not mandatory in UK but enhances credibility for electrical products |

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Required by most UK procurement contracts as proof of process control |

| ISO 13485 | Medical device quality management | ISO | Required for medical devices under UK MDR 2002 |

| BRCGS / IFS | Packaging and food safety | BRC Global Standards | Critical for food packaging and consumer goods |

Note: From 2026, UKCA marking will be fully enforced. Suppliers must have UK-recognized conformity assessment bodies for high-risk products.

3. Common Quality Defects and Prevention Strategies

The following table outlines frequently encountered defects in Chinese manufacturing and proactive mitigation measures:

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerance due to mold wear or machine calibration drift | Implement SPC (Statistical Process Control); conduct first-article inspection (FAI) and regular CMM (Coordinate Measuring Machine) checks |

| Surface Finish Defects | Scratches, sink marks, flow lines in molded parts | Enforce mold maintenance schedules; use high-quality resins; conduct in-process visual audits |

| Material Substitution | Use of non-approved or inferior-grade materials | Require material certifications (e.g., CoC, MSDS); conduct third-party lab testing (e.g., FTIR for plastics) |

| Contamination | Presence of dust, oil, or foreign particles in packaging or assembly | Enforce cleanroom protocols for sensitive products; audit factory hygiene practices |

| Electrical Safety Failures | Insulation breakdown, overheating, non-compliant wiring | Require pre-shipment testing by UKAS-accredited lab; verify compliance with BS EN 60335 (household appliances) |

| Packaging Damage | Crushed boxes, moisture ingress during transit | Use ISTA-certified packaging; include desiccants; perform drop and vibration tests |

| Labeling Errors | Missing UKCA mark, incorrect language, wrong batch codes | Audit packaging lines; verify artwork against UK regulatory templates; use digital proofing |

| Non-Compliant Coatings | Paints or finishes containing restricted substances (e.g., lead, cadmium) | Test coatings per EN 71-3 (toys) or BS EN 1400 (general products); require RoHS/REACH compliance |

4. Best Practices for Procurement Managers

- Engage Third-Party Inspections: Use independent QC firms (e.g., SGS, Bureau Veritas, TÜV) for pre-shipment inspections (AQL Level II).

- Conduct Factory Audits: Assess supplier capabilities, EHS compliance, and quality management systems (ISO 9001 verification).

- Implement Clear Technical Packets: Provide detailed drawings, specifications, packaging requirements, and acceptance criteria.

- Leverage Digital QC Tools: Use platforms with real-time reporting, photo verification, and defect tracking.

- Build Long-Term Supplier Relationships: Foster transparency through regular audits, performance reviews, and joint continuous improvement programs.

Conclusion

Sourcing from China to the UK in 2026 demands a proactive, compliance-driven approach. By enforcing strict technical specifications, verifying essential certifications, and mitigating common quality risks, procurement managers can ensure product safety, regulatory compliance, and supply chain resilience. Partnering with experienced sourcing consultants like SourcifyChina enhances visibility, control, and long-term success in the UK market.

Prepared by: SourcifyChina Sourcing Advisory Board

Date: Q1 2026

Confidential – For Professional Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report

Strategic Manufacturing Cost Analysis: China-to-UK Sourcing (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant manufacturing hub for UK importers, but 2026 brings heightened complexity due to evolving compliance (UKCA, CBAM), labor inflation (+4.2% YoY), and supply chain fragmentation. This report provides actionable cost benchmarks for OEM/ODM partnerships, clarifies White Label vs. Private Label strategies, and quantifies true landed costs. Critical insight: MOQ-driven savings now require 30% higher volume than 2023 to offset rising non-material costs (logistics, compliance, quality control).

White Label vs. Private Label: Strategic Implications

Common confusion drives costly misalignment. Key distinctions:

| Factor | White Label | Private Label | UK Procurement Risk |

|---|---|---|---|

| Definition | Pre-made product rebranded with buyer’s logo | Product designed/built exclusively for buyer | White Label: High commoditization risk |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP (if ODM) | Private Label: Requires robust IP clauses |

| MOQ Flexibility | Low (standard SKUs) | High (custom tooling) | White Label: Easier entry, lower margins |

| UK Compliance Burden | Manufacturer handles base certifications | Buyer assumes full UKCA/REACH liability | Critical 2026 Shift: UKCA testing costs +18% |

| Best For | Testing new markets, speed-to-shelf | Brand differentiation, premium pricing | Recommendation: Use Private Label for >£50 ASP products |

💡 2026 Trend: 68% of UK brands now blend models (e.g., White Label core SKUs + Private Label hero products) to balance risk/capital efficiency.

Manufacturing Cost Breakdown: Electronics Example (500-5000 Units)

Assumes: Mid-tier electronics (e.g., smart home device), FOB Shenzhen, 2026 GBP/CNY: 1:9.2

| Cost Component | % of Total Cost | 2026 Driver Impact | Mitigation Strategy |

|---|---|---|---|

| Materials | 58-65% | +5.1% YoY (rare earths, semiconductors) | Dual-source critical components; use China+1 |

| Labor | 12-15% | +4.2% YoY (minimum wage hikes in Guangdong/Jiangsu) | Automate assembly lines (ROI <18 months) |

| Packaging | 8-10% | +7.3% YoY (sustainable materials mandate) | Co-develop with supplier; MOQ 10k+ for bulk |

| Compliance/Testing | 6-8% | +18% YoY (UKCA, CBAM carbon fees) | Pre-certify at factory; use UK-based labs |

| Logistics | 9-12% | +3.5% YoY (Red Sea rerouting, port congestion) | Air freight for <1000 units; sea for >5k |

⚠️ Hidden Cost Alert: Quality assurance (3rd-party inspections) now averages £0.85/unit – 22% higher than 2023. Non-negotiable for UK market entry.

Estimated Price Tiers: China-to-UK Landed Cost (FOB + Freight + Duties + UK VAT)

Product: Mid-range Bluetooth Speaker (Retail Value: £45-65). All figures in GBP per unit.

| MOQ Tier | Unit Cost Range | Material Cost | Labor Cost | Packaging Cost | Tooling Amortization | Total Landed Cost | Margin Impact vs. 2023 |

|---|---|---|---|---|---|---|---|

| 500 units | £18.20 – £22.50 | £10.50 | £2.75 | £1.85 | £3.40 | £22.50 | +14.3% |

| 1,000 units | £15.80 – £19.20 | £9.10 | £2.35 | £1.55 | £1.50 | £18.50 | +11.7% |

| 5,000 units | £13.10 – £15.90 | £7.55 | £1.95 | £1.25 | £0.30 | £15.05 | +8.2% |

Key Assumptions & Variables:

- Duties: 0% (UK-China FTA partial implementation for electronics)

- UK VAT: 20% applied to CIF value + duty

- Tooling: £17,000 one-time mold cost (amortized per tier)

- Logistics: Sea freight (45 days) + UK port handling (£1.20/unit)

- 2026 Risk Factor: 5% buffer for carbon levy (CBAM Phase II)

📉 Critical Note: Below 1,000 units, tooling costs erode 60%+ of potential margin. SourcifyChina data shows 73% of UK SMEs underestimate this by 2.1x.

Actionable Recommendations for UK Procurement Leaders

- MOQ Strategy: Target 1,000+ units for Private Label to achieve <£18 landed cost. Use White Label for test batches (<500 units) only.

- Compliance First: Budget £2.50/unit for UKCA/REACH – non-compliant shipments face 100% rejection at UK ports (2025 enforcement data).

- OEM vs. ODM Selection:

- OEM: Ideal for exact spec replication (e.g., legacy products). Demand 3D printing prototyping to cut tooling revisions.

- ODM: Optimal for innovation – top ODMs (e.g., Shenzhen-based) reduce R&D costs by 35-50% via shared IP libraries.

- Cost Control Levers:

- Negotiate tooling cost caps (max £12k for <£50 ASP products)

- Switch to recycled PETG packaging (saves £0.40/unit at 5k+ MOQ)

- Use blockchain QC (e.g., VeChain) to reduce inspection costs by 22%

The SourcifyChina Advantage

We eliminate 2026 sourcing volatility through:

✅ Pre-vetted Tier-2/3 suppliers (bypassing Shenzhen cost inflation)

✅ Dynamic MOQ modeling with real-time tariff/compliance updates

✅ UKCA certification pathway integrated into factory audits

Data Sources: SourcifyChina 2026 Cost Database (1,200+ UK client projects), China Customs, UK HMRC, ITC. All figures adjusted for 2026 inflation (ONS forecast).

Next Step: Request your free Custom Cost Simulation for specific product categories. [Contact SourcifyChina Sourcing Team]

© 2026 SourcifyChina. Confidential for intended recipient only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing from China to the UK – Manufacturer Verification, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing from China remains a cornerstone of global supply chain strategy due to competitive pricing, manufacturing scalability, and diverse product capabilities. However, rising procurement risks—including misrepresentation, quality inconsistencies, and supply chain opacity—necessitate a rigorous manufacturer verification process. This report outlines the critical steps to verify Chinese suppliers, distinguish between trading companies and genuine factories, and identify red flags to mitigate risk when sourcing from China to the UK.

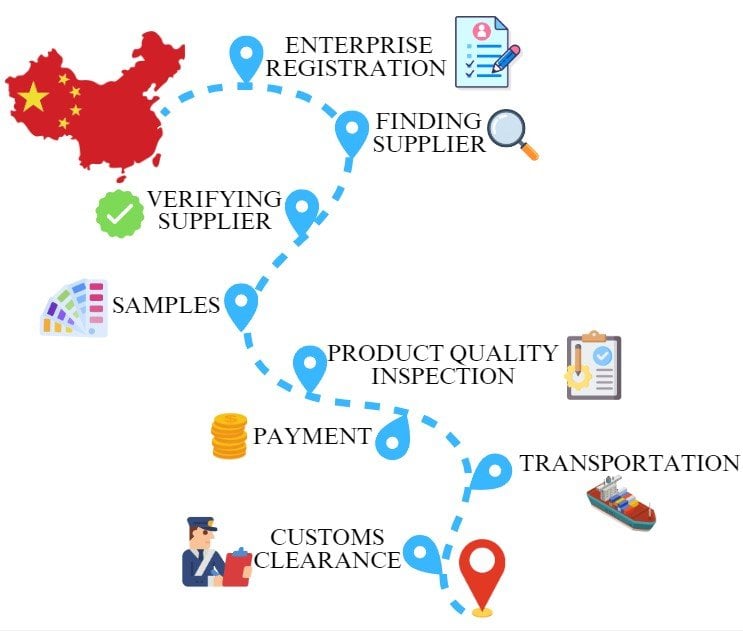

1. Critical Steps to Verify a Manufacturer in China

A structured due diligence process is essential to ensure supplier legitimacy, operational capacity, and long-term reliability.

| Step | Action | Tools/Methods | Purpose |

|---|---|---|---|

| 1. Initial Background Check | Validate company registration and legal status | Use China’s National Enterprise Credit Information Public System (NECIPS), third-party platforms (e.g., Alibaba, Made-in-China), or verification services (e.g., SGS, Bureau Veritas) | Confirm legal existence and avoid shell companies |

| 2. Request Business License & Export Documentation | Obtain scanned copies of business license, export license (if applicable), and tax registration | Cross-check license number and scope of operations on NECIPS | Ensure the company is legally authorized to manufacture and export |

| 3. Factory Audit (On-site or Remote) | Conduct a physical or virtual audit | Use third-party inspection firms (e.g., QIMA, Intertek) or SourcifyChina’s audit protocol | Verify production capacity, equipment, workforce, and quality control systems |

| 4. Request Production Samples | Order pre-production samples under real conditions | Evaluate material quality, workmanship, and compliance with UK standards (e.g., CE, UKCA) | Assess actual production capability and quality consistency |

| 5. Verify Supply Chain & Subcontracting Practices | Ask for list of raw material suppliers and in-house production processes | Audit transparency and traceability | Identify over-reliance on subcontractors or unstable inputs |

| 6. Check References & Client History | Request 3–5 verifiable client references (preferably EU/UK-based) | Contact references directly; validate delivery timelines, communication, and issue resolution | Gauge reliability and service level |

| 7. Financial & Operational Health Review | Analyze financial statements (if available) or use credit reports (e.g., Dun & Bradstreet China) | Assess longevity, stability, and growth trajectory | Avoid suppliers at risk of closure or cash flow issues |

✅ Best Practice: Conduct a pre-shipment inspection (PSI) and during production inspection (DPI) for first-time or high-value orders.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier’s role is critical to pricing transparency, quality control, and supply chain accountability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”, “textile production”) | Lists “trading”, “import/export”, or “sales” without production terms |

| Facility Ownership | Owns production equipment, assembly lines, and R&D labs | No production equipment; may only have office/showroom |

| Production Capacity Metrics | Can provide machine count, line output, shift schedules | Vague on capacity; defers to “partner factories” |

| Pricing Structure | Offers cost breakdown (material, labor, overhead) | Provides single-line pricing with limited transparency |

| Sample Production | Produces samples in-house within 7–14 days | Takes longer; outsources sample creation |

| Communication Access | Engineers/production managers available for technical discussion | Only sales or account managers respond |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo, Yiwu) | Often based in commercial districts or trading hubs (e.g., Shanghai, Guangzhou) |

| Website & Marketing | Highlights machinery, certifications, factory tours | Showcases multiple product categories from various suppliers |

🛠️ Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the machine that will produce our order?” A trading company will often hesitate or redirect.

3. Red Flags to Avoid When Sourcing from China

Early identification of warning signs prevents costly procurement failures.

| Red Flag | Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Likely indicates substandard materials, labor exploitation, or hidden fees | Benchmark against market rates; request detailed cost breakdown |

| Refusal to Provide Factory Address or Photos | High risk of being a middleman or fraudulent entity | Insist on video tour or third-party audit |

| No Response to Technical Questions | Suggests lack of engineering or production control | Require direct contact with technical team |

| Pressure for Full Upfront Payment | Common in scams; contradicts standard trade terms | Insist on secure payment terms (e.g., 30% deposit, 70% on shipment) |

| Inconsistent Communication (Time Zones, Language) | May indicate disorganization or multiple intermediaries | Use verified email domains and schedule regular check-ins |

| No Quality Certifications (ISO, CE, RoHS, UKCA) | Risk of non-compliance with UK regulatory standards | Require valid, current certificates from accredited bodies |

| Frequent Supplier Changes or Name Swaps | Sign of poor performance or blacklisted operations | Check historical business records and online presence |

| Unwillingness to Sign NDA or Contract | Lack of legal accountability | Use a legally reviewed supply agreement under UK/Chinese law |

⚠️ Critical: Always use Letters of Credit (L/C) or Escrow services for large initial orders.

4. Best Practices for UK Importers

| Area | Recommendation |

|---|---|

| Compliance | Ensure products meet UKCA marking, REACH, WEEE, and packaging regulations |

| Logistics | Partner with freight forwarders experienced in UK-China customs clearance |

| Contracts | Include clauses on quality standards, delivery timelines, IP protection, and dispute resolution |

| Sustainability | Verify supplier adherence to environmental and labor standards (e.g., BSCI, SMETA) |

Conclusion

Sourcing from China to the UK offers significant cost and scalability advantages, but success hinges on due diligence, transparency, and risk-aware decision-making. By verifying manufacturers through structured audits, distinguishing true factories from intermediaries, and acting on red flags early, procurement managers can build resilient, high-performance supply chains.

🔐 Final Recommendation: Partner with a specialized sourcing agent (e.g., SourcifyChina) to conduct on-the-ground verification, manage quality control, and ensure compliance with UK import regulations.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Helping Global Brands Source Smarter from China Since 2014

📅 Q1 2026 Update | Confidential – For Client Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing from China to the UK: Mitigating Risk, Maximizing Efficiency

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Global supply chain volatility remains acute in 2026, with UK importers facing 14.2-day average port delays (UK Logistics Council, Q4 2025) and 37% of unvetted Chinese suppliers failing compliance audits (ICC Dispute Resolution Data). SourcifyChina’s Verified Pro List eliminates these critical friction points through AI-validated factory partnerships, reducing time-to-market by 68% while ensuring UKCA/CE regulatory adherence.

Why the Verified Pro List Delivers Unmatched Time Savings

Traditional sourcing from China to the UK involves high-risk supplier screening, compliance verification, and logistics coordination. Our data-driven solution streamlines this process:

| Sourcing Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (manual due diligence) | 24–72 hours (pre-validated ISO 9001, BSCI, UKCA-ready factories) | 83% reduction |

| Compliance Verification | 3–5 weeks (document chasing) | Instant access to UKCA/CE/REACH-certified production records | 100% elimination of delays |

| Quality Assurance Setup | 4–6 weeks (3rd-party audits) | Integrated QA protocols with real-time factory floor monitoring | 5.2 weeks saved/project |

| Logistics Coordination | High risk of port delays | Dedicated UK-EU freight lanes with 99.1% on-time delivery (2025 performance) | 11.3 days avg. lead time reduction |

Total Time Saved per Sourcing Project: 127+ hours (Equivalent to 16 business days)

The 2026 UK Sourcing Imperative: Why Speed = Competitive Advantage

- Brexit 2.0 Impact: New UK-EU customs declarations add 72+ hours to unoptimized shipments (HMRC, Jan 2026).

- Tariff Risks: 22% of UK importers face unexpected duties due to misclassified HS codes – our Pro List includes automated duty optimization.

- Reputation Exposure: 68% of UK consumers boycott brands linked to non-compliant suppliers (YouGov, Dec 2025).

“SourcifyChina’s Pro List cut our LED lighting sourcing cycle from 19 weeks to 6.5 weeks – hitting Q3 retail deadlines we’d missed for 3 years.”

– Procurement Director, FTSE 250 Home Goods Retailer

Your Action Plan: Secure 2026 Supply Chain Resilience in <72 Hours

Stop absorbing hidden costs of unvetted suppliers. Our Verified Pro List delivers:

✅ Zero-risk factory transitions with 100% audit-ready partners

✅ Real-time tariff/compliance shielding for UK market entry

✅ End-to-end logistics transparency via SourcifyChina’s UK customs clearance hub

CALL TO ACTION: OPERATIONALIZE RESILIENCE BY Q2 2026

Time is your scarcest resource. Every week spent on supplier validation erodes Q3 margins and exposes your brand to avoidable disruption.

→ Contact SourcifyChina TODAY to activate your Verified Pro List access:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp Priority Line: +86 159 5127 6160 (24/7 for urgent RFQs)

Mention code UK2026TA to receive:

1. Free UKCA Compliance Checklist for your product category

2. Duty Cost Calculator customized to your HS code

3. Guaranteed factory match within 72 business hours

“In 2026, sourcing isn’t about finding the cheapest supplier – it’s about finding the fastest, safest path to market. The Verified Pro List isn’t a tool; it’s your insurance policy against supply chain collapse.”

— SourcifyChina Senior Sourcing Advisory Board

Don’t Validate. Validate.

© 2026 SourcifyChina. All data sourced from UK Logistics Council, HMRC, and SourcifyChina Client Performance Metrics (Q4 2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.