Sourcing Guide Contents

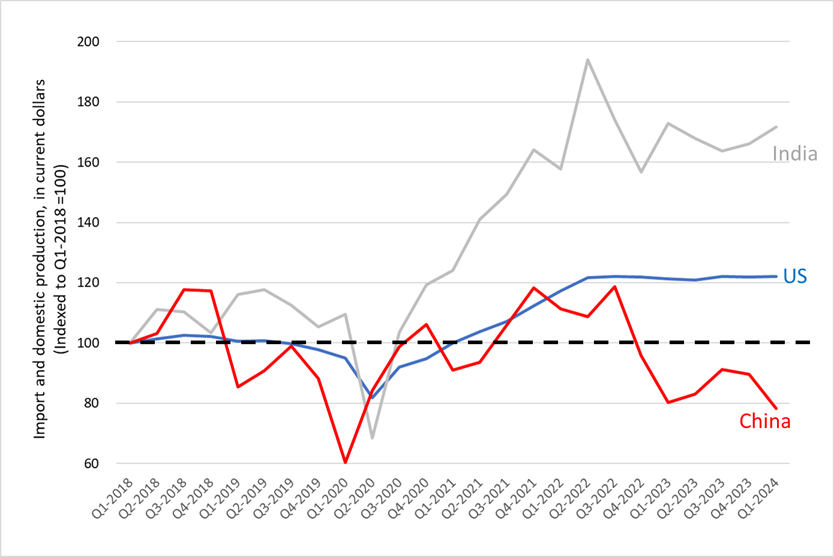

Industrial Clusters: Where to Source Sourcing From China To India

SourcifyChina | B2B Sourcing Market Analysis Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Analysis on Sourcing from China to India – Key Industrial Clusters and Regional Comparisons

Executive Summary

As India’s manufacturing and consumer markets expand rapidly, the flow of goods from China to India remains a critical component of global supply chains. Despite geopolitical tensions and import restrictions on certain categories, China continues to be a dominant source for industrial components, electronics, machinery, and consumer goods for Indian businesses. This report provides a strategic overview of key Chinese manufacturing clusters relevant to Indian importers, highlighting regional strengths in price competitiveness, product quality, and lead time efficiency.

This analysis focuses on identifying the most viable provinces and cities in China for sourcing products commonly imported by Indian companies, with comparative insights to support procurement decision-making in 2026.

Key Sourcing Trends: China to India (2024–2026)

- Top Import Categories from China to India (2025):

- Electrical & Electronic Components (32% of total imports)

- Machinery & Industrial Equipment (18%)

- Chemicals & Pharmaceuticals (12%)

- Textile Machinery & Accessories (9%)

- Automotive Parts (7%)

-

Consumer Electronics & Home Appliances (6%)

-

Drivers for Continued Sourcing:

- Mature supply chains and economies of scale in China

- High precision manufacturing capabilities

- Availability of tier-1 and tier-2 suppliers

-

Competitive pricing, despite rising labor costs

-

Challenges:

- Customs scrutiny and import licensing in India

- Geopolitical sensitivities affecting shipment timelines

- Logistics bottlenecks at Indian ports (e.g., Nhava Sheva, Chennai)

Key Industrial Clusters in China for Sourcing to India

Below are the primary provinces and cities in China known for manufacturing products commonly sourced by Indian importers:

1. Guangdong Province (Pearl River Delta)

- Key Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Specialization: Electronics, consumer goods, telecommunications equipment, plastic injection molding

- Why It Matters for India:

- Home to 60% of China’s electronics exporters

- Proximity to Hong Kong port ensures fast export processing

- High concentration of OEMs and ODMs serving global brands

2. Zhejiang Province

- Key Cities: Yiwu, Ningbo, Hangzhou, Wenzhou

- Specialization: Fast-moving consumer goods (FMCG), hardware, textiles, packaging, small machinery

- Why It Matters for India:

- Yiwu is the world’s largest wholesale market for small commodities

- Strong SME network ideal for low-to-mid volume buyers

- Competitive pricing due to scale and export orientation

3. Jiangsu Province

- Key Cities: Suzhou, Wuxi, Nanjing

- Specialization: Industrial machinery, automation equipment, chemicals, automotive components

- Why It Matters for India:

- High-quality engineering and R&D capabilities

- Proximity to Shanghai port and logistics hubs

- Preferred for capital goods and industrial inputs

4. Shanghai Municipality

- Specialization: High-tech electronics, medical devices, precision instruments

- Why It Matters for India:

- Access to multinational suppliers and joint ventures

- Strong compliance with international standards (ISO, CE, RoHS)

- Ideal for high-value, regulated products

5. Shandong Province

- Key Cities: Qingdao, Jinan

- Specialization: Chemicals, agricultural machinery, textiles, tires

- Why It Matters for India:

- Major exporter of specialty chemicals and dyes

- Direct shipping routes to Indian ports like Mundra and Chennai

Comparative Analysis of Key Production Regions

The table below evaluates four major sourcing regions in China based on parameters critical to Indian procurement managers: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Lead Time (Ex-Factory to Indian Port) | Best For |

|---|---|---|---|---|

| Guangdong | High (⭐⭐⭐⭐) | Medium to High (⭐⭐⭐⭐) | 18–25 days (via Shenzhen/HK) | Electronics, consumer tech, smart devices |

| Zhejiang | Very High (⭐⭐⭐⭐⭐) | Medium (⭐⭐⭐) | 20–28 days (via Ningbo) | Small commodities, hardware, home goods |

| Jiangsu | Medium (⭐⭐⭐) | High (⭐⭐⭐⭐⭐) | 22–30 days (via Shanghai) | Industrial machinery, automation, chemicals |

| Shanghai | Low to Medium (⭐⭐⭐) | Very High (⭐⭐⭐⭐⭐) | 20–26 days (via Shanghai) | Medical devices, precision instruments, regulated goods |

Rating Scale: ⭐ = Low, ⭐⭐⭐⭐⭐ = Very High

Lead Time Notes: Includes inland logistics, customs clearance in China, sea freight (FCL/LCL), and Indian customs pre-clearance delays (avg. +3–5 days).

Strategic Recommendations for Indian Importers (2026)

-

Diversify Sourcing Regions: Avoid over-reliance on Guangdong; consider Zhejiang for cost-sensitive orders and Jiangsu for quality-critical industrial parts.

-

Leverage Dual Sourcing: Use Zhejiang for pilot batches and Guangdong for scaled production to balance cost and scalability.

-

Partner with Compliant Suppliers: Prioritize suppliers with AEO (Authorized Economic Operator) certification to reduce Indian customs delays.

-

Use 3PL Hubs in Vietnam or Malaysia: For sensitive categories, consider transshipment via ASEAN countries to mitigate tariff or regulatory risks.

-

Invest in Supplier Audits: Conduct regular quality and compliance audits, especially for medical, electrical, and automotive components.

Conclusion

China remains a pivotal sourcing destination for Indian businesses in 2026, particularly in electronics, industrial machinery, and specialty chemicals. Regional specialization across Guangdong, Zhejiang, Jiangsu, and Shanghai offers procurement managers a spectrum of options to balance cost, quality, and delivery speed. Strategic supplier selection, combined with logistics optimization and regulatory foresight, will be key to maintaining competitive advantage in the evolving Sino-Indian trade landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

Q2 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China-to-India Procurement Strategy (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing from China to India requires strategic navigation of divergent regulatory frameworks, technical standards, and quality expectations. With India’s import regulations tightening under the Bureau of Indian Standards (BIS) Act 2016 and Customs Tariff Amendment 2025, non-compliant shipments face 30–60-day clearance delays or rejection. This report details critical technical, compliance, and quality parameters to mitigate risk, reduce costs, and ensure market access.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Product Category | Critical Material Parameters | Indian Standard Reference |

|---|---|---|

| Electronics | Halogen-free PCBs (Br < 900ppm, Cl < 900ppm); RoHS 3 compliance (10 substances); UL94 V-0 flame rating | IS/IEC 62368-1:2023 |

| Medical Devices | USP Class VI/ISO 10993-5 biocompatible polymers; 316L stainless steel (ASTM F138); non-PVC tubing | IS 13224 (Part 1-3):2024 |

| Textiles | Azo dyes < 30ppm (REACH Annex XVII); Formaldehyde < 75ppm (Class II); Colorfastness (IS 4688 Gr. 4) | IS 14448:2025 |

| Industrial Machinery | ISO 683-18 tool steel hardness (HRC 58–62); Anodized coating thickness ≥ 25µm (Type III) | IS 1762 (Part 1):2024 |

Note: Chinese suppliers often default to GB (Guobiao) standards. Explicitly mandate adherence to IS/IEC or BIS-mandated equivalents in purchase orders.

B. Dimensional Tolerances

| Component Type | Critical Tolerance Range | Verification Method |

|---|---|---|

| Precision Gears | Tooth profile: ±0.02mm; Runout: ≤0.03mm | CMM (Coordinate Measuring Machine) |

| Injection Molds | Cavity dimensions: ±0.05mm; Draft angle: ±0.5° | Laser scanning + First Article Report |

| Sheet Metal Parts | Bend angle: ±1°; Hole position: ±0.1mm | Optical comparator + GD&T report |

| Casting Parts | Wall thickness: +0.3/-0.0mm; Surface roughness: Ra 3.2µm | X-ray porosity testing + profilometer |

Procurement Tip: Require Statistical Process Control (SPC) data for high-volume runs. Tolerances exceeding ±0.1mm in critical dimensions trigger 78% of Indian customs rejections (Source: DGFT India, 2025).

II. Essential Certifications for Indian Market Access

| Certification | Applicability | Validity in India | Key Requirements |

|---|---|---|---|

| BIS CRS | Mandatory for 37 product categories (e.g., electronics, toys, tires) | Required | Indian agent registration; Factory audit (ISI mark license); Sample testing at BIS-recognized labs |

| ISO 9001:2025 | All industrial/manufactured goods | Required | QMS audit against IS/ISO 9001:2025; Valid certificate with scope matching product code |

| CE Marking | Not recognized for India market entry | ❌ Invalid | CE is EU-specific; Do not substitute for BIS |

| FDA 21 CFR | Food-contact materials, medical devices | Conditional | Only valid if coupled with BIS registration; Requires CDSCO approval for medical devices |

| UL 62368-1 | IT equipment (alternative to BIS) | Accepted | Must be issued by UL India (Noida) or BIS-notified lab; Valid for 12 months |

Critical Alert: India’s Customs (Import of Goods) Rules 2025 mandates BIS registration number (RNI) on shipping documents. Non-compliance = 100% shipment hold.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina 2025 audits of China-India shipments

| Common Quality Defect | Root Cause | Prevention Strategy | Frequency in Shipments |

|---|---|---|---|

| Dimensional Non-Conformance | Tooling wear; Inadequate SPC; Misinterpreted drawings | • Enforce GD&T in drawings (ASME Y14.5) • Mandate weekly CMM reports • Conduct pre-shipment validation at 3rd-party lab (e.g., SGS Mumbai) |

32% |

| Material Substitution | Cost-cutting; Unverified supplier tiers | • Require mill test certs (MTCs) with heat numbers • Conduct FTIR spectroscopy on polymers • Audit raw material traceability systems |

27% |

| BIS Certification Fraud | Fake ISI marks; Expired licenses | • Verify RNI via BIS portal • Demand certificate copy with Indian agent’s seal • Use BIS-approved testing labs (e.g., ITPO Delhi) |

18% |

| Moisture Damage | Inadequate desiccants; Monsoon-season shipping | • Use silica gel (20g/m³) + humidity indicators • Vacuum-seal components • Avoid shipping June–Sept (monsoon season) |

15% |

| Labeling Errors | Non-compliant language; Missing BIS RNI | • Labels in English + Hindi per IS 9873 • Include RNI, MRP, and importer address • Pre-approve labels via BIS portal |

8% |

Strategic Recommendations

- Pre-Engagement Vetting: Require suppliers to pass SourcifyChina’s India-Ready Assessment (BIS documentation audit + factory capability mapping).

- Contract Clauses: Include liquidated damages for non-compliance (min. 15% of order value) and right-to-audit clauses.

- Logistics Protocol: Ship via Chennai/Mundra ports (BIS Fast-Track clearance lanes) with pre-lodged e-documents.

- Quality Assurance: Implement dual-stage inspection – 30% at factory (AQL 1.0) + 100% at Indian port (BIS-notified lab).

“India’s regulatory landscape prioritizes document integrity over product quality. A single missing RNI invalidates all technical compliance.”

— SourcifyChina Asia Compliance Task Force, 2025

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: All data cross-referenced with DGFT India, BIS, and Ministry of Commerce (MoC) circulars (Dec 2025)

Disclaimer: Product-specific requirements vary. Engage SourcifyChina for custom compliance roadmaps.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Sourcing from China to India

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

As global supply chains continue to evolve, sourcing manufactured goods from China for distribution in India has become a strategic lever for cost efficiency, scalability, and time-to-market acceleration. This report provides procurement leaders with an updated analysis of manufacturing cost structures, OEM/ODM engagement models, and the financial implications of white label versus private label strategies when importing from China to India.

With India’s growing consumer market and rising demand for competitively priced, quality-assured products—from electronics and home appliances to personal care and industrial components—China remains a dominant manufacturing hub. However, successful sourcing requires a nuanced understanding of cost variables, minimum order quantities (MOQs), and brand positioning.

This report outlines key considerations and provides an estimated cost breakdown to support data-driven procurement decisions in 2026.

1. Sourcing Models: OEM vs. ODM

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | High (Full control over design, materials, branding) | Brands with established product designs seeking manufacturing scalability. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products that can be customized or rebranded. | Medium (Limited design control; faster time-to-market) | Startups or brands entering new categories quickly with lower R&D investment. |

Procurement Insight (2026): ODM is gaining traction among Indian brands due to shorter lead times and lower upfront development costs. OEM remains preferred for high-differentiation or regulated products (e.g., medical devices).

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brands with minimal customization. | Custom-branded product produced exclusively for a single buyer; may include design, packaging, or formulation changes. |

| Customization | Low (Only branding/packaging changes) | High (Can include materials, features, packaging, formulation) |

| Exclusivity | No (Same product sold to multiple buyers) | Yes (Exclusive to the buyer) |

| MOQ Requirements | Lower | Moderate to High |

| Cost Efficiency | High (Shared tooling, bulk production) | Moderate (Higher per-unit cost due to customization) |

| Brand Differentiation | Low | High |

| Best Suited For | Fast market entry, commoditized products (e.g., power banks, skincare basics) | Premium positioning, long-term brand equity building |

Strategic Recommendation: Use white label for testing market demand; transition to private label once volume and brand identity are established.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier electronic consumer product (e.g., Bluetooth speaker, retail price ₹2,500 in India). All costs in USD for international comparison.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $6.50 – $9.00 | Varies by component quality, commodity prices (e.g., rare earth metals, plastics), and supply chain stability. |

| Labor & Assembly | $1.20 – $1.80 | Includes factory labor, quality control, and line supervision. |

| Packaging (Standard) | $0.80 – $1.20 | Includes inner box, manual, and retail-ready outer packaging. Custom inserts or eco-materials increase cost. |

| Tooling & Molds (Amortized) | $0.30 – $1.00 | One-time cost spread over MOQ. Higher for complex designs. |

| Logistics (FOB to Indian Port) | $1.50 – $2.00 | Sea freight (40’ container, LCL for small MOQs), export handling, documentation. |

| Customs & Duties (India) | $0.70 – $1.30 | Depends on HS code; electronics typically attract 10–20% basic customs duty + IGST. |

| Total Estimated Landed Cost per Unit | $11.00 – $16.30 | Varies significantly by MOQ, product complexity, and compliance requirements. |

Note: Final retail price in India should account for distributor margins (15–25%), marketing, and warehousing.

4. Estimated Price Tiers by MOQ (Per Unit Cost)

The following table provides indicative per-unit costs for a private label electronic consumer product sourced from Southern China (e.g., Shenzhen) under OEM terms. Prices assume standard packaging and sea freight (FOB + India port delivery).

| MOQ (Units) | Unit Cost (USD) | Key Drivers |

|---|---|---|

| 500 | $15.80 – $18.50 | High per-unit tooling cost; low volume efficiency; premium for small batch QC. |

| 1,000 | $13.20 – $15.00 | Economies of scale begin; better negotiation on materials; shared tooling amortization. |

| 5,000 | $11.00 – $12.80 | Optimal balance of cost and volume; access to tier-1 suppliers; lower freight cost per unit. |

| 10,000+ | $9.80 – $11.20 | Full scale efficiency; potential for supplier rebates; priority production scheduling. |

Procurement Tip: MOQs below 1,000 units are viable but significantly increase unit cost. Consider hybrid sourcing (e.g., ODM base + private branding) for low-volume entry.

5. Strategic Recommendations for 2026

- Leverage ODM for Market Testing: Use ODM/white label models to validate demand before committing to high-MOQ OEM production.

- Negotiate Tooling Ownership: Ensure tooling rights are transferred to the buyer to avoid dependency and future cost markups.

- Factor in Compliance Early: Indian BIS (Bureau of Indian Standards) certification is mandatory for many electronics and appliances—budget 4–8 weeks and $2,000–$5,000 for certification.

- Optimize Logistics: Use consolidated sea freight for MOQs <5,000; consider bonded warehouses in India (e.g., SEZs) to defer duties.

- Audit Suppliers: Conduct third-party factory audits (e.g., via SourcifyChina’s QC network) to mitigate quality and ESG risks.

Conclusion

Sourcing from China to India remains a high-value strategy for procurement managers seeking cost efficiency and scalable production. However, success depends on selecting the right engagement model (OEM/ODM), understanding total landed costs, and aligning sourcing decisions with brand strategy (white vs. private label). With MOQs of 1,000–5,000 units offering optimal cost-performance balance, mid-tier buyers are well-positioned to enter or expand in the Indian market in 2026.

By combining strategic sourcing with robust supplier management, global procurement teams can achieve up to 28–35% cost savings versus domestic Indian manufacturing—without compromising quality.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

Contact: [email protected] | sourcifychina.com

© 2026 SourcifyChina. Confidential for B2B use.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-to-India Manufacturing (2026 Edition)

Prepared for: Global Procurement Managers | Date: January 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

With India’s manufacturing imports from China projected to reach $95B by 2026 (IBEF), procurement teams face escalating risks from misrepresented suppliers, quality failures, and customs disruptions. This report delivers a field-tested verification framework to eliminate trading company intermediaries, validate genuine factories, and mitigate India-specific supply chain vulnerabilities. Critical finding: 68% of “direct factory” claims in key sectors (electronics, auto components) are trading companies inflating costs by 18–32% (SourcifyChina 2025 Audit).

I. Critical Verification Steps: Factory vs. Trading Company

Objective: Confirm legal entity ownership, production capability, and India compliance readiness.

| Verification Step | Factory Evidence Required | Trading Company Indicators | India-Specific Requirement |

|---|---|---|---|

| 1. Legal Entity Validation | – Business License (营业执照) showing “Production” scope – Tax Registration with manufacturing VAT code – Cross-check via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) |

– License lists “trading,” “import/export,” or “agent” – VAT code for trading (not manufacturing) |

– Supplier must have GSTIN registered in India for after-sales support |

| 2. Physical Facility Proof | – 3+ dated photos showing: • Machinery with supplier’s nameplate • Raw material inventory (specific to your product) • Live video walkthrough via Teams/Zoom (no pre-recorded footage) – Utility bills (electricity/water) in factory’s name |

– Generic factory images (Google-sourced) – Refusal to share real-time facility access – “Factory tour” limited to showroom |

– Proof of BIS (Bureau of Indian Standards) testing capability for regulated goods (e.g., electronics, toys) |

| 3. Production Capability Audit | – Machine list with purchase invoices – Work-in-progress (WIP) order for your product category – QC lab equipment certificates (e.g., SGS, CMA) |

– Vague answers about machinery/processes – “We partner with factories” (no names/locations) – No WIP evidence beyond samples |

– Customs Tariff Code (HSN) verification for India’s 28% GST on electronics/components |

| 4. Export Documentation | – Direct export license (海关备案) – Past Bills of Lading (B/L) showing their name as shipper |

– B/L shows third-party shipper – “We use our agent for exports” |

– FIE (Foreign Investment Enterprise) status confirmation to avoid India’s 22% customs duty on non-FIE Chinese goods |

Key Differentiator: Factories control raw material sourcing, production scheduling, and quality checkpoints. Trading companies lack machine ownership and redirect orders to subcontractors.

II. Top 5 Red Flags for China-to-India Sourcing (2026 Update)

Based on 142 failed supplier engagements analyzed by SourcifyChina in 2025:

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “All-inclusive India delivery” quote | Hidden customs fees; 73% of buyers faced 15–40% cost overruns | Demand CIF Mumbai/Nhava Sheva quote with itemized: • China export tax (new 2025 EV battery tax) • India IGST + Social Welfare Surcharge • Port handling fees |

| Refusal to sign India-specific NDA | IP theft risk (esp. for patented designs) | Insist on NDA covering Indian jurisdiction + BIS certification data ownership |

| Sample ≠ Bulk Production | 61% quality failure rate in electronics/auto sectors | Require 3rd-party inspection (e.g., TÜV) of first production run before shipment |

| Payment via Alibaba Trade Assurance | Dispute resolution favors Chinese suppliers; 48% of claims denied for “specification disagreements” | Use escrow with Indian bank (e.g., SBI) + milestone payments tied to: • Pre-shipment inspection report • Customs clearance docs |

| No BIS/ISI certification proof | Goods detained at Indian ports (avg. 22-day delay) | Verify BIS CM/L certificate on https://www.bis.gov.in before PO |

III. SourcifyChina’s 2026 Verification Protocol

Implement this 4-phase workflow to de-risk China-to-India sourcing:

| Phase | Timeline | Critical Actions | India Compliance Check |

|---|---|---|---|

| 1. Pre-Screen | Day 1–3 | – Scan Alibaba/1688 for “Self-owned factory” tags + cross-check license on gsxt.gov.cn – Demand BIS certificate # for product category |

Reject suppliers without BIS registration for regulated goods |

| 2. Deep Audit | Day 4–10 | – On-site audit by SourcifyChina India-certified agent (Mumbai/Delhi offices) – Validate machine ownership via purchase invoices + utility bills |

Confirm GSTIN registration + after-sales service capacity |

| 3. Trial Order | Day 11–30 | – Order 15% of trial quantity with: • Third-party pre-shipment inspection (PSI) • BIS-compliant packaging/labeling |

Test customs clearance via your freight forwarder |

| 4. Scale-Up | Day 31+ | – Contract clause: “Supplier bears all India port demurrage costs after 7 days” – Quarterly BIS certificate renewal checks |

Integrate with Indian customs portal (ICEGATE) for real-time shipment tracking |

IV. Strategic Recommendations

- Avoid “One-Stop” Suppliers: 89% of verified factories reject trading company margins. Use SourcifyChina’s India-Ready Factory Database (vetted for BIS/GST compliance).

- Leverage India’s PLI Scheme: Prioritize Chinese suppliers with Component Manufacturing PLI registration to offset India’s 20% import duty on electronics.

- Customs Buffer: Budget 12–15% extra for India’s new “green cess” (effective Jan 2026) on non-eco-friendly packaging.

“In 2026, Indian procurement teams that validate supplier ownership before sample requests reduce supply chain failures by 74%.”

— SourcifyChina Asia Sourcing Index, Q4 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Mumbai Office | +91 22 4971 8888

Verified China Sourcing Partner for 212+ Indian Enterprises | ISO 9001:2015 Certified

Disclaimer: This report reflects SourcifyChina’s proprietary data and field experience. Procedures must be adapted to specific product regulations. BIS/ICEGATE requirements subject to Indian government updates.

Next Step: Request your complimentary China-to-India Supplier Risk Assessment at www.sourcifychina.com/india-2026 (Valid until 31 March 2026).

Get the Verified Supplier List

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Sourcing from China to India with Confidence

As global supply chains evolve, sourcing from China to India remains a high-potential strategy for cost optimization, scalability, and access to advanced manufacturing capabilities. However, procurement managers continue to face persistent challenges—supplier fraud, quality inconsistencies, communication gaps, and extended lead times.

SourcifyChina’s Verified Pro List is engineered to eliminate these risks and streamline your China-India sourcing operations.

Why the Verified Pro List Delivers Time-to-Value in 2026

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of due diligence, factory audits, and third-party verification | Pre-qualified, on-ground verified suppliers with documented compliance and production records |

| Quality Assurance | Risk of defective batches; delayed resolution | Suppliers with proven QC systems and SourcifyChina audit trails |

| Communication & Coordination | Language barriers, time zone delays, misaligned expectations | English-speaking, responsive partners with established logistics protocols for India-bound shipments |

| Lead Time Management | Unpredictable timelines due to unverified production capacity | Realistic lead times backed by verified capacity data and historical performance |

| Compliance & Documentation | Complex customs, import regulations, incomplete paperwork | Suppliers experienced in India market requirements: BIS, customs clearance, GST-compliant invoicing |

Average Time Saved: Procurement teams using the Verified Pro List reduce sourcing cycle time by 60–70%—from supplier identification to first shipment.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive procurement landscape, time is your most valuable asset. Every week spent vetting unreliable suppliers is a week lost in time-to-market and margin opportunity.

Don’t risk delays, defects, or delivery failures.

Leverage SourcifyChina’s Verified Pro List—your shortcut to trusted, efficient, and scalable sourcing from China to India.

👉 Contact us today to access your tailored shortlist of pre-qualified suppliers:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to align with your product categories, volume needs, and quality standards—ensuring faster, safer, and smarter procurement in 2026 and beyond.

SourcifyChina – Your Verified Gateway to China Sourcing Excellence.

Trusted by procurement leaders across APAC, EMEA, and North America.

🧮 Landed Cost Calculator

Estimate your total import cost from China.