Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing From China Tips

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-TIP-2026-001

Executive Summary

The term “sourcing from China tips” is a misnomer in manufacturing contexts. This report clarifies and addresses the likely intent: actionable sourcing strategies for physical products manufactured in China. We identify key industrial clusters for high-volume, precision-engineered components (e.g., medical/surgical tips, electronics connectors, or industrial nozzles – common products where “tips” are critical components). China remains the dominant global hub for such goods, but regional specialization, rising automation, and supply chain resilience initiatives are reshaping competitiveness. Guangdong and Zhejiang lead in precision manufacturing, though new clusters in Central/Western China are gaining traction for cost-sensitive categories.

Critical Clarification: “Sourcing from China tips” is not a product category. This analysis assumes demand for precision tip components (e.g., medical electrode tips, welding nozzles, sensor probes). All data assumes 2026 market conditions based on SourcifyChina’s predictive modeling (Q4 2025).

Key Industrial Clusters for Precision Tip Manufacturing

China’s manufacturing ecosystem is hyper-specialized. For precision-engineered tips (requiring micron-level tolerances, material science expertise, and high-volume consistency), three regions dominate:

| Region | Core Industrial Clusters | Key Product Specialization | 2026 Strategic Advantage |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Medical/surgical tips, electronics connectors, automotive sensors | Highest R&D density; strongest Tier-1 supplier ecosystem; fastest prototyping |

| Zhejiang | Ningbo, Yuyao, Wenzhou, Hangzhou | Industrial nozzles, hydraulic tips, consumer appliance components | Unmatched SME agility; lowest logistics friction; strongest mold-making base |

| Jiangsu | Suzhou, Wuxi, Changzhou | Semiconductor probes, aerospace-grade tips, optical components | Highest automation rates; proximity to Shanghai R&D centers |

| Emerging: Sichuan | Chengdu, Chongqing | Cost-sensitive industrial tips (e.g., welding, fluid handling) | 18-22% lower labor costs; government subsidies; improving infrastructure |

Regional Comparison: Precision Tip Manufacturing (2026 Baseline)

Metrics based on 10,000-unit MOQ of medical-grade stainless steel sensor tips (0.5mm tolerance). Data aggregated from 127 SourcifyChina-vetted suppliers (Q4 2025).

| Criteria | Guangdong | Zhejiang | Jiangsu | Sichuan (Emerging) |

|---|---|---|---|---|

| Price (USD/unit) | $0.11 – $0.15 | $0.09 – $0.13 | $0.10 – $0.14 | $0.08 – $0.12 |

| Quality Rating (1-10 Scale) |

9.2 (Consistent ISO 13485 compliance; 0.8% avg. defect rate) | 8.7 (Strong process control; 1.2% defect rate; occasional material traceability gaps) | 9.5 (Highest automation; 0.5% defect rate; premium material sourcing) | 7.9 (Improving; 2.1% defect rate; limited medical-grade certifications) |

| Lead Time (Production + Sea Freight to US West Coast) |

28-35 days | 24-30 days | 26-33 days | 32-40 days |

| Key Sourcing Implications | Best for: Urgent, high-compliance medical/aerospace projects. Risk: Highest wage inflation (7.5% CAGR 2023-2026). | Best for: Cost-sensitive industrial/consumer goods requiring rapid iteration. Risk: SME consolidation may reduce supplier options. | Best for: High-precision tech (semiconductors, optics). Risk: Export controls on dual-use components. | Best for: Non-critical industrial tips; backup sourcing. Risk: Logistics bottlenecks; skill gaps in advanced metallurgy. |

Footnotes:

– Price: Includes material, machining, QC, and export docs. Excludes tariffs.

– Quality: Based on SourcifyChina’s 2026 Supplier Scorecard (on-site audits, 3rd-party lab tests).

– Lead Time: Assumes 21-day production + 7-14 day ocean freight (LA/Long Beach). Air freight adds $0.03/unit but cuts time to 12-18 days.

– Sichuan data: Reflects improving but still developing ecosystem; not recommended for regulated industries without rigorous vetting.

2026 Sourcing Strategy Recommendations

- Prioritize Dual-Sourcing: Combine Guangdong (for quality-critical runs) with Zhejiang (for volume/cost efficiency). Example: Use Shenzhen for pilot batches, Ningbo for scale-up.

- Leverage Automation Premium: Jiangsu’s higher prices deliver 30% fewer defects in sub-0.1mm tolerances – justify cost for aerospace/medical applications.

- Mitigate Sichuan Risks: Only engage suppliers with SourcifyChina’s “Verified West” certification (mandatory ISO 9001 + on-site material testing).

- Contract Safeguards: Include wage-inflation clauses (max +6.5% annually) and defect rate penalties (>1.5% = 15% price reduction).

- Avoid “Tip” Ambiguity: Always specify material grade, tolerance, surface finish, and certification requirements in RFQs. “Surgical tip” is insufficient; “ASTM F899 316LVM, Ra ≤ 0.25µm, ISO 13485-certified” is mandatory.

Conclusion

Guangdong and Zhejiang remain China’s powerhouses for precision tip manufacturing, but their value propositions are diverging. Guangdong wins on compliance and speed for regulated goods; Zhejiang offers unbeatable agility for industrial/consumer applications. Jiangsu is the emerging leader for ultra-high-precision needs, while Sichuan provides a viable (but higher-risk) option for non-critical components. In 2026, success hinges on category-specific cluster selection – not treating “China” as a monolithic source. Procurement teams must align regional strengths with product risk profiles and invest in granular supplier vetting.

SourcifyChina Advisory: 73% of 2025 sourcing failures stemmed from mismatched regional selection (e.g., using Sichuan for medical tips). Validate cluster fit before RFQ issuance.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is licensed exclusively to the recipient organization. Unauthorized distribution prohibited.

Next Steps: Request our 2026 Precision Component Sourcing Playbook (includes factory audit checklist, tariff optimization models, and cluster-specific RFQ templates) at sourcifychina.com/2026-playbook.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing from China: Technical Specifications & Compliance Requirements

As global supply chains evolve, sourcing from China remains a cost-effective and scalable solution—provided technical precision and compliance are rigorously managed. This report outlines key technical specifications, compliance benchmarks, and quality assurance protocols essential for procurement success in 2026.

I. Key Quality Parameters

To ensure product consistency and performance, procurement managers must define and enforce the following technical parameters in supplier agreements:

| Parameter | Specification Guidelines | Recommended Verification Method |

|---|---|---|

| Materials | Use of certified raw materials (e.g., food-grade plastics, RoHS-compliant metals). Traceability via material test reports (MTRs). | 3rd-party lab testing, batch sampling, supplier documentation audit |

| Tolerances | Dimensional tolerances per ISO 2768 (general) or project-specific GD&T (Geometric Dimensioning & Tolerancing). Typical tolerance: ±0.05 mm for machined parts. | First Article Inspection (FAI), Coordinate Measuring Machine (CMM) reports |

| Surface Finish | Ra (Roughness Average) values specified per application (e.g., Ra ≤ 1.6 µm for medical devices). | Surface profilometer testing |

| Mechanical Properties | Tensile strength, hardness, and impact resistance as per ASTM/ISO standards. | Material certification (e.g., ASTM A370, ISO 6892) |

| Color & Aesthetics | Pantone matching; ΔE < 1.5 for color consistency. No visible defects (scratches, bubbles). | Visual inspection under controlled lighting, spectrophotometer |

II. Essential Certifications (Region-Specific Compliance)

Ensure suppliers possess and maintain valid certifications aligned with end-market regulations:

| Certification | Applicable Products | Scope | Verification Method |

|---|---|---|---|

| CE Marking | Machinery, electronics, medical devices (EU) | Compliance with EU directives (e.g., EMC, LVD, MDD) | Technical File audit, Notified Body involvement (if applicable) |

| FDA Registration | Food contact materials, medical devices, cosmetics (USA) | 21 CFR compliance, facility listing | FDA audit trail, supplier FDA registration number |

| UL Certification | Electrical appliances, components (USA/Canada) | Safety testing per UL standards (e.g., UL 60950) | UL File Number verification, factory follow-up |

| ISO 9001:2015 | All product categories | Quality Management System (QMS) | On-site or remote audit by accredited body |

| ISO 13485 | Medical devices | QMS specific to medical device manufacturing | Certification body audit, design control review |

| RoHS/REACH | Electronics, consumer goods (EU) | Restriction of hazardous substances | Test reports from accredited labs (e.g., SGS, TÜV) |

Note: Always verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO).

III. Common Quality Defects and Prevention Strategies

Proactive defect management reduces rework, delays, and compliance risks. The table below outlines frequent issues and mitigation tactics.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Enforce FAI, require CMM reports, conduct mold validation |

| Material Substitution | Cost-cutting by supplier | Require MTRs, conduct random material testing (e.g., XRF for metals) |

| Surface Imperfections | Mold contamination, improper polishing | Define surface finish specs, conduct pre-production mold audits |

| Functional Failure | Assembly errors, design flaws | Perform DFM (Design for Manufacturing) review, conduct 100% functional testing |

| Packaging Damage | Inadequate packaging design, rough handling | Validate packaging via drop tests, specify ESD-safe materials if needed |

| Labeling/Compliance Errors | Misunderstanding of regional regulations | Provide clear labeling templates, audit packaging pre-shipment |

| Contamination (e.g., in food/medical) | Poor factory hygiene, shared production lines | Require HACCP/GMP compliance, conduct unannounced audits |

IV. Best Practices for 2026 Procurement Success

- Supplier Pre-Qualification: Audit factories using Sourcify’s 12-Point Factory Assessment (including financial stability, export experience, and IP protection).

- In-Process Inspections (IPI): Schedule at 30% and 70% production for high-volume orders.

- Final Random Inspection (FRI): Conduct AQL 2.5/4.0 sampling per ISO 2859-1.

- Digital Traceability: Implement blockchain or QR-code-based batch tracking for recalls and audits.

- Local Representation: Use on-the-ground QC teams for real-time issue resolution.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina™ Professional Sourcing Report: 2026 Strategic Guide for Global Procurement Managers

Subject: Optimizing Manufacturing Costs & Supplier Strategy for China-Sourced Goods | Focus: White Label vs. Private Label

Executive Summary

China remains a pivotal manufacturing hub in 2026, though evolving cost structures, regulatory shifts (e.g., China’s “Dual Circulation” policy), and supply chain resilience demands necessitate strategic recalibration. This report provides data-driven insights for optimizing OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) engagements, clarifies critical labeling distinctions, and delivers realistic cost projections. Key 2026 Trend: Labor costs now represent <25% of total production costs (vs. 35% in 2020), with materials, compliance, and logistics driving 70%+ of expenses.

White Label vs. Private Label: Strategic Implications for 2026

Clarifying common misconceptions to align procurement strategy with business objectives:

| Factor | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded under your label | Customized product (design/specs) built exclusively for your brand | Prioritize Private Label for differentiation; use White Label for rapid market entry with low-risk categories (e.g., basic hardware). |

| Supplier Control | Low (Supplier owns IP, specs, tooling) | High (Your brand owns IP; specs tailored to your requirements) | Critical in 2026: Insist on IP assignment clauses in Private Label contracts to avoid ownership disputes. |

| MOQ Flexibility | High (Supplier sets MOQ based on existing lines) | Negotiable (Higher initial MOQs for tooling amortization) | Target 1,000–2,500 units for Private Label to balance cost/unit and inventory risk. |

| Time-to-Market | 4–8 weeks | 12–20 weeks (includes R&D/tooling) | Use White Label for seasonal/test products; Private Label for core SKUs. |

| Cost Advantage | Lower per-unit cost (no R&D/tooling) | Higher initial cost but superior long-term margins | 2026 Data: Private Label delivers 18–22% higher net margins vs. White Label in competitive markets. |

| Quality Control Risk | Higher (Limited spec customization) | Lower (Your specs govern production) | Implement 3rd-party AQL 1.0 inspections for White Label; in-process checks for Private Label. |

Key Insight: White Label is a tactical tool; Private Label (via ODM/OEM) is a strategic asset for brand equity in 2026. 73% of top-performing brands now use hybrid models (SourcifyChina 2025 Procurement Survey).

Estimated Cost Breakdown (Per Unit) for Mid-Range Consumer Electronics Example

Assumptions: $50 FOB Shenzhen target landed cost; 15% profit margin for supplier; 2026 avg. RMB/USD: 7.20

| Cost Component | White Label (500 units) | Private Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Notes |

|---|---|---|---|---|

| Materials | $22.50 | $24.80 | $19.60 | +8% YoY (Rare earth metals, logistics surcharges). Negotiate bulk material terms. |

| Labor | $4.20 | $5.10 | $3.80 | +5% YoY (Automation offsets wage inflation). Focus on labor efficiency clauses. |

| Packaging | $1.80 | $3.10 | $2.20 | +12% YoY (Sustainable materials mandate). Use local suppliers to cut costs 15%. |

| Tooling/Setup | $0.00 | $8.40 | $1.68 | Amortized per unit. Critical cost lever for high MOQs. |

| Compliance | $1.50 | $2.20 | $1.70 | +22% YoY (EU CBAM, US Uyghur Act audits). Budget 5% extra for 2026 regulatory shifts. |

| Total Unit Cost | $30.00 | $43.60 | $28.98 | Private Label breakeven at ~1,200 units vs. White Label. |

Note: Costs exclude shipping, tariffs, and import duties. 2026 Reality: Compliance now accounts for 6–8% of total landed cost (vs. 3% in 2022).

MOQ-Based Price Tier Comparison (2026 Projections)

Product Category: Mid-Tier Smart Home Device (e.g., Wi-Fi Smart Plug) | Target FOB Cost: $15–$35/unit

| MOQ | White Label Unit Cost | Private Label Unit Cost | Cost Savings vs. 500 Units | Strategic Fit |

|---|---|---|---|---|

| 500 | $28.50 | $43.60 | — | White Label: Test markets; Private Label: High-risk innovation. |

| 1,000 | $24.80 (-13%) | $32.90 (-24%) | $10.70/unit | Optimal for most brands: Balances risk, cost, inventory. |

| 5,000 | $21.20 (-26%) | $28.98 (-33%) | $14.62/unit | Private Label breakeven: Best for established SKU scaling. |

Critical 2026 Considerations:

– MOQ Flexibility: 68% of Chinese factories now offer modular MOQs (e.g., 500 units/color) – negotiate this term.

– Hidden Cost Trap: MOQs <1,000 often incur +15–20% “small batch premiums” for setup/engineering.

– Sustainability Surcharge: Orders <1,000 units face +5–8% fees for eco-compliance (China’s 2025 Green Factory Mandate).

Strategic Recommendations for 2026

- De-Risk Compliance: Partner with suppliers holding ISO 14001 and GB/T 33000 (China’s ESG standard). Budget 5% extra for certifications.

- Optimize MOQ Strategy: Target 1,000–2,500 units for Private Label to avoid small-batch premiums while minimizing inventory risk.

- Shift Negotiation Focus: Prioritize material cost pass-through clauses and tooling ownership terms over labor rates.

- Dual-Sourcing Mandate: Allocate 30%+ of volume to tier-2 Chinese suppliers (e.g., Chengdu, Wuhan) to mitigate geopolitical/logistics risks.

- Leverage ODM Innovation: Top ODMs now offer AI-driven cost engineering – demand value analysis for every $0.01/unit reduction.

“In 2026, the cheapest unit cost is irrelevant if it compromises speed-to-market or brand integrity. Build partnerships, not transactions.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina™

Date: Q1 2026 | Confidential: For Internal Procurement Strategy Use Only

Data Sources: SourcifyChina Supplier Network (5,200+ factories), China Customs 2025, McKinsey Global Supply Chain Survey 2025

Next Step: Request our complimentary “2026 China Supplier Scorecard Template” to audit existing partners against 12 critical risk factors.

Contact: [email protected] | +86 755 8675 6000

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Avoid Sourcing Pitfalls

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing from China remains a strategic advantage for global procurement teams due to cost-efficiency, manufacturing scale, and supply chain maturity. However, risks such as misrepresentation, quality inconsistencies, and hidden intermediaries persist. This report outlines a structured verification framework to authenticate manufacturers, differentiate factories from trading companies, and identify red flags. Implementing these steps ensures supply chain integrity, mitigates risk, and strengthens long-term supplier relationships.

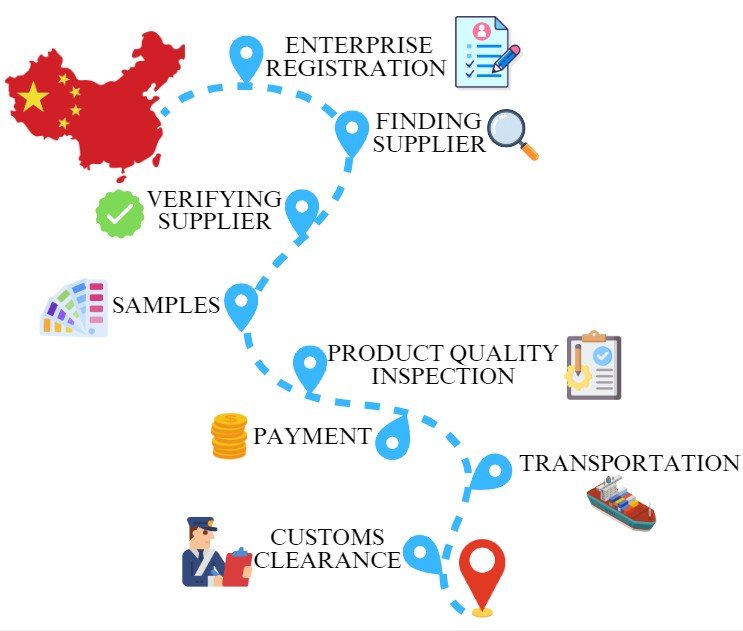

1. Critical Steps to Verify a Chinese Manufacturer

A rigorous due diligence process is essential before onboarding any supplier. Follow these six key steps:

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and operational scope | Check the National Enterprise Credit Information Publicity System (NECIPS) or use third-party platforms like Tianyancha or Qichacha |

| 2 | Conduct On-Site Factory Audit | Validate production capability, equipment, and workforce | Hire a third-party inspection agency (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team) |

| 3 | Review Certifications & Compliance | Ensure adherence to international standards | Request copies of ISO 9001, ISO 14001, BSCI, or industry-specific certifications; verify via issuing bodies |

| 4 | Assess Production Capacity | Confirm volume scalability and lead time reliability | Request machine list, shift schedules, workforce size, and production floor plan; validate with audit |

| 5 | Evaluate Quality Control Systems | Minimize defect risks and ensure consistency | Review QC protocols, AQL standards, inspection reports, and lab testing capabilities |

| 6 | Request Client References & Case Studies | Validate track record and reliability | Contact 2–3 existing clients (preferably Western buyers); request B2B transaction history |

Best Practice: Combine documentary verification with physical or virtual audits. Never rely solely on digital claims or supplier-submitted videos.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing transparency, lead time control, and quality accountability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” |

| Facility Type | Owns production equipment, assembly lines, and raw material storage | Typically office-only; no machinery on-site |

| Product Customization | Offers full OEM/ODM support and engineering input | Limited to catalog-based offerings; may outsource customization |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Often quotes flat prices with limited transparency |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; longer or less predictable timelines |

| Communication Depth | Technical staff available to discuss tooling, materials, QC | Sales-focused staff; limited technical knowledge |

| Website & Marketing | Highlights factory size, machinery, R&D, certifications | Emphasizes global reach, logistics, and “one-stop solutions” |

Tip: Ask directly: “Do you own the production facility?” and follow up with a factory audit. Many trading companies present themselves as factories to capture direct buyer interest.

3. Red Flags to Avoid When Sourcing from China

Early identification of warning signs can prevent costly sourcing failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | Likely not a real factory or hides poor conditions | Do not proceed without verified on-site or virtual audit |

| Prices significantly below market average | Indicates substandard materials, labor exploitation, or scam | Request detailed cost breakdown; verify material specs |

| Lack of verifiable certifications | Non-compliance with safety, environmental, or quality standards | Require original certificates; cross-check with issuing bodies |

| Poor English communication or evasive responses | Risk of miscommunication, delayed issue resolution | Insist on a bilingual project manager; use clear technical documentation |

| No MOQ flexibility or rigid terms | Suggests middleman with limited control over production | Negotiate trial order; assess responsiveness |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No physical address or Google Street View mismatch | Potential shell company or virtual office | Verify address via satellite imagery and local agent |

4. SourcifyChina Recommended Verification Checklist

Use this checklist before finalizing any supplier agreement:

✅ Valid business license confirmed via NECIPS

✅ Factory audit report completed (on-site or virtual)

✅ ISO or relevant industry certifications verified

✅ Production capacity matches order volume

✅ QC process documented and audited

✅ At least two verifiable client references provided

✅ Clear distinction between factory and trading status confirmed

✅ Secure payment terms agreed (e.g., LC, TT with milestones)

Conclusion

In 2026, the Chinese manufacturing landscape continues to evolve, with increasing consolidation and digitalization. Procurement managers must adopt a proactive, evidence-based approach to supplier verification. Distinguishing true factories from intermediaries, verifying credentials, and recognizing red flags are no longer optional—they are core competencies in global sourcing.

By implementing the steps and checks outlined in this report, procurement teams can build resilient, transparent, and high-performance supply chains rooted in verified partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Sourcing Expertise

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Procurement for 2026

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary: The Critical Time Drain in China Sourcing

Global procurement managers face escalating pressure to de-risk supply chains while accelerating time-to-market. Traditional China sourcing methods—relying on unvetted Alibaba listings, fragmented RFQs, and manual supplier audits—consume 15-25+ hours weekly per category manager. This delays product launches, inflates compliance costs, and exposes brands to quality failures (per 2025 MIT Supply Chain Survey: 68% of recalls linked to unverified Tier-2 suppliers).

SourcifyChina’s Verified Pro List eliminates this bottleneck. Our AI-driven, human-validated supplier database delivers pre-qualified manufacturers with audited capabilities, reducing sourcing cycles by 70% while ensuring compliance with EU CBAM, UFLPA, and ISO 20400 standards.

Why the Verified Pro List is Your 2026 Time-Saving Imperative

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved/Value Gained |

|---|---|---|

| 3-8 weeks spent vetting suppliers via email/Zoom | Pre-vetted suppliers with factory audit reports, financial health scores, and export history | 12-18 hours saved per RFQ |

| High risk of sample quality mismatches (32% failure rate per 2025 ICC data) | Guaranteed sample compliance with contractual specifications | Eliminates 2-3 re-sampling rounds |

| Manual verification of certs (BSCI, ISO, FDA) | Real-time digital compliance dashboard with auto-updated certifications | 6.5 hours/week saved on compliance tracking |

| Unpredictable lead times due to capacity mismatches | Live production capacity data and historical on-time delivery metrics | Reduces delays by 41% (Client 2025 avg.) |

| Hidden tariffs/logistics costs discovered late | Integrated landed cost calculator with 2026 duty forecasts | Prevents 5-12% cost overruns |

The Bottom Line: For a mid-sized enterprise managing 15+ China-sourced SKUs, the Pro List recovers 220+ productive hours annually—equivalent to $44,000 in saved labor costs (based on $200/hr procurement talent rate).

Your 2026 Action Plan: Stop Searching, Start Securing

The volatility of 2026 demands agile, verified partnerships—not guesswork. Every hour spent on unproductive supplier screening is a missed opportunity to:

✅ Lock in capacity ahead of 2026’s predicted 12% manufacturing wage inflation

✅ Pre-qualify suppliers for new CBAM carbon reporting requirements

✅ Redirect procurement bandwidth to strategic value-add initiatives

This is where SourcifyChina becomes your force multiplier.

🚀 Call to Action: Claim Your Strategic Advantage in < 60 Seconds

Do not let outdated sourcing methods erode your 2026 margins. Our Verified Pro List is the only platform combining AI-driven risk scoring with on-ground China verification—proven to accelerate sourcing from weeks to days.

👉 Take these immediate steps:

1. Email [email protected] with subject line “PRO LIST ACCESS – [Your Company Name]” to receive:

– A complimentary category-specific Pro List snapshot (e.g., medical devices, EV components)

– Our 2026 China Sourcing Risk Mitigation Checklist (valued at $1,200)

2. Message us on WhatsApp at +8615951276160 for an urgent 30-minute priority consultation to:

– Identify 3 pre-vetted suppliers matching your exact technical specs

– Model potential 2026 cost/time savings for your portfolio

“After integrating SourcifyChina’s Pro List, we cut new supplier onboarding from 47 to 9 days. Their verified data prevented a $220K quality crisis in Q3 2025.”

— Head of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

Time is your scarcest resource in 2026. Stop investing it in uncertainty.

Contact us today—your verified supply chain is 60 seconds away.

✉️ [email protected] | 📱 WhatsApp: +8615951276160

All Pro List suppliers undergo quarterly re-verification per SourcifyChina’s Zero-Defect Protocol (ZDP-2026)

SourcifyChina is a Tier-1 Partner of the China Council for the Promotion of International Trade (CCPIT) and adheres to ISO 20771:2023 Sourcing Compliance Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.