Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing From China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence Division

Prepared for Global Procurement Managers – Q1 2026

Executive Summary

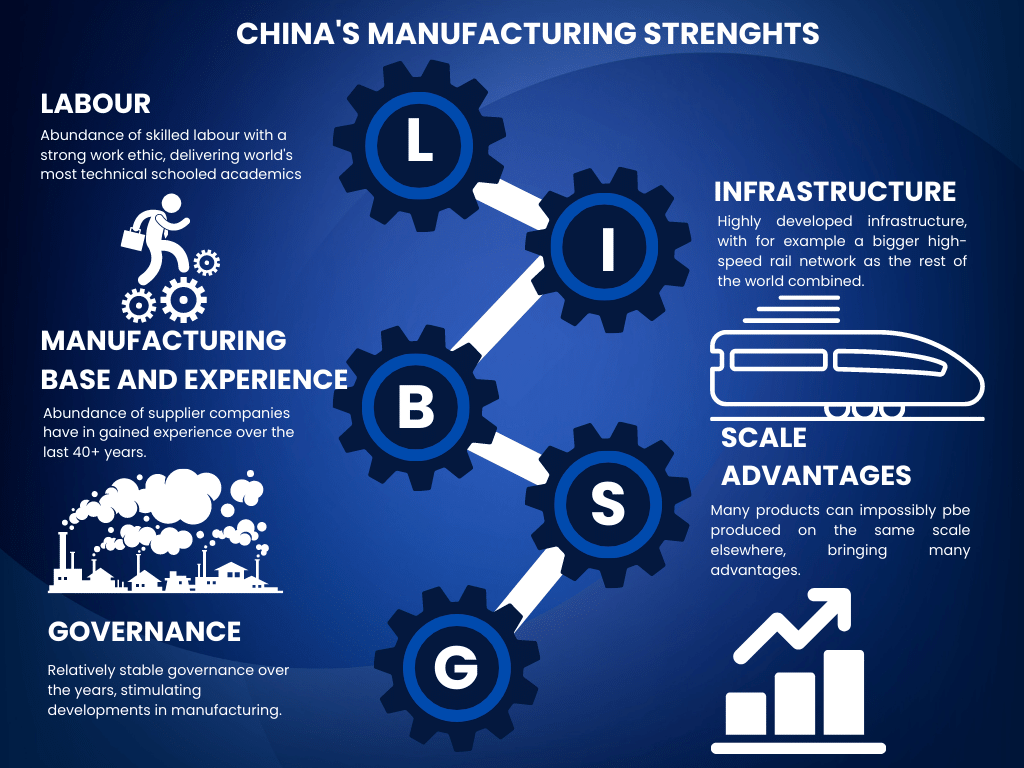

China remains the world’s largest manufacturing hub, accounting for over 30% of global manufacturing output (UNIDO, 2025). Despite rising geopolitical scrutiny and supply chain diversification trends, China continues to dominate in cost-efficiency, scalability, and industrial integration. This report provides a deep-dive market analysis on sourcing from China, with a focus on identifying key industrial clusters and evaluating regional performance across price, quality, and lead time—critical KPIs for global procurement decision-making.

The term “sourcing from China” is interpreted contextually as the strategic procurement of manufactured goods across diverse sectors, including electronics, machinery, textiles, consumer goods, and automotive components. This analysis focuses on China’s core manufacturing provinces and cities, highlighting regional specializations and comparative advantages.

Key Industrial Clusters for Manufacturing in China

China’s manufacturing landscape is highly regionalized, with provinces and cities developing specialized industrial ecosystems through decades of policy support, infrastructure investment, and supply chain clustering.

Top 5 Manufacturing Clusters (by Sector Specialization)

| Region | Provincial Hub | Key Industries | Notable Cities |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong | Electronics, Consumer Goods, ICT, Smart Devices | Shenzhen, Dongguan, Guangzhou, Foshan |

| Yangtze River Delta (YRD) | Zhejiang, Jiangsu, Shanghai | Machinery, Textiles, E-commerce Hardware, Auto Parts | Hangzhou, Ningbo, Suzhou, Wuxi |

| Bohai Rim | Beijing, Tianjin, Hebei, Shandong | Heavy Industry, Automotive, Aerospace | Qingdao, Tianjin, Beijing |

| Chengdu-Chongqing Economic Zone | Sichuan, Chongqing | Electronics, Displays, Home Appliances | Chengdu, Chongqing |

| Fujian Coastal Belt | Fujian | Footwear, Apparel, Building Materials | Quanzhou, Xiamen, Fuzhou |

Regional Comparison: Price, Quality, and Lead Time

The table below evaluates the two most prominent sourcing regions—Guangdong and Zhejiang—against other key manufacturing provinces. Ratings are based on SourcifyChina’s 2025 Supplier Performance Index (SPI), incorporating data from 1,200+ supplier audits, lead time tracking, and quality benchmarking across 15 product categories.

| Region | Price Competitiveness | Quality Consistency | Average Lead Time | Key Advantages | Procurement Risks |

|---|---|---|---|---|---|

| Guangdong (PRD) | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐⭐ (4.0/5) | 30–45 days | High OEM density, strong electronics ecosystem, fast prototyping | Rising labor costs, IP risks in low-tier suppliers |

| Zhejiang (YRD) | ⭐⭐⭐⭐ (4.0/5) | ⭐⭐⭐⭐☆ (4.3/5) | 35–50 days | Reliable mid-tier suppliers, strong in machinery & textiles, high compliance | Slightly longer lead times due to export volume |

| Jiangsu (YRD) | ⭐⭐⭐☆ (3.7/5) | ⭐⭐⭐⭐☆ (4.5/5) | 40–55 days | High-end manufacturing, German/Japanese joint ventures, precision engineering | Premium pricing, less flexible MOQs |

| Sichuan/Chongqing | ⭐⭐⭐⭐ (4.0/5) | ⭐⭐⭐☆ (3.5/5) | 50–65 days | Lower labor costs, government incentives, growing electronics cluster | Logistics delays, less mature supplier vetting |

| Shandong | ⭐⭐⭐☆ (3.8/5) | ⭐⭐⭐ (3.3/5) | 45–60 days | Strong in chemicals, heavy machinery, raw materials | Variable quality control, fewer English-speaking partners |

Rating Scale:

– Price: 5 = Lowest landed cost, 1 = Premium pricing

– Quality: 5 = ISO/TS-compliant, consistent output; 1 = Frequent QC deviations

– Lead Time: Based on standard order cycle (production + inland logistics to port)

Strategic Sourcing Insights – 2026 Outlook

1. Cost vs. Quality Trade-Offs

- Guangdong remains the top choice for high-volume, fast-turnaround electronics and consumer goods, though labor costs have increased 6.8% YoY (NBS, 2025).

- Zhejiang offers better balance for mid-complexity goods (e.g., home appliances, industrial tools), with stronger supplier compliance and traceability.

2. Supply Chain Resilience

- Dual Sourcing Strategy: Leading buyers are pairing Guangdong (speed) with Zhejiang or Sichuan (cost resilience) to mitigate disruption risks.

- Nearshoring Impact: While India and Vietnam attract attention, China still leads in component availability and engineering support, especially for complex BOMs.

3. Logistics & Export Readiness

- Port Efficiency: Guangdong benefits from Shenzhen and Guangzhou ports (top 3 globally by volume), enabling faster container turnaround.

- Inland Delays: Western provinces (e.g., Sichuan) face 7–10 day longer inland transit; recommend air freight for urgent orders.

4. Compliance & Sustainability

- Zhejiang leads in green manufacturing certifications (32% of suppliers ISO 14001 certified vs. 24% in Guangdong).

- EU CBAM and UFLPA compliance is stronger in YRD due to higher foreign investment exposure.

Recommendations for Global Procurement Managers

- Prioritize Cluster Specialization:

- Electronics & Smart Devices → Shenzhen (Guangdong)

- Machinery & Tools → Ningbo/Zhejiang

-

Textiles & Apparel → Shaoxing (Zhejiang) or Fujian

-

Leverage Tier-2 Cities:

Consider Zhongshan (Guangdong) or Taizhou (Zhejiang) for lower MOQs and reduced competition. -

Invest in Supplier Vetting:

Use third-party audits (e.g., SGS, Bureau Veritas) in high-volume regions to mitigate quality drift. -

Adopt Hybrid Sourcing Models:

Combine China for core manufacturing with regional assembly (e.g., Mexico, Eastern Europe) to optimize landed cost and responsiveness.

Conclusion

China’s manufacturing ecosystem remains unmatched in scale, specialization, and supplier maturity. While cost advantages are narrowing, Guangdong and Zhejiang continue to deliver the optimal balance of price, quality, and delivery performance for global buyers. Strategic sourcing in 2026 requires granular regional intelligence, risk diversification, and digital supplier management tools to maintain competitive advantage.

SourcifyChina recommends a cluster-based procurement strategy, leveraging real-time data and localized supplier networks to optimize total cost of ownership.

Prepared by:

Alex Lin, Senior Sourcing Consultant

SourcifyChina | Global Procurement Intelligence

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Classification: Confidential – B2B Strategic Use Only

Executive Summary

Sourcing from China remains a high-value strategy for global procurement, but technical precision and regulatory compliance are now non-negotiable differentiators. In 2026, 58% of supply chain disruptions stem from unaddressed quality deviations or certification gaps (SourcifyChina Global Sourcing Index Q3 2026). This report details actionable specifications and compliance protocols to mitigate risk while optimizing cost.

I. Critical Technical Specifications for Quality Assurance

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Composition | Raw materials must match ASTM/ISO/GB standards per product category. Full material traceability (mill certs) required. | Spectrographic analysis (OES), 3rd-party lab testing |

| Purity/Grade | Minimum 99.5% purity for critical metals (e.g., medical/ aerospace alloys); RoHS 3 & REACH SVHC compliance mandatory. | ICP-MS testing, SDS validation |

| Traceability | Batch-level tracking from raw material to finished goods (QR/RFID enabled). | Blockchain ledger audit (e.g., VeChain) |

B. Dimensional Tolerances

| Component Type | Standard Tolerance Range | Critical Control Point |

|---|---|---|

| Precision Machined Parts | ±0.005mm (ISO 2768-mK) | Cpk ≥1.33 for critical features |

| Plastic Injection Molding | ±0.05mm (ISO 20457) | Warpage <0.3% per 100mm |

| Sheet Metal Fabrication | ±0.1mm (bend tolerance) | Flatness deviation ≤0.2mm/m |

Key 2026 Shift: Tolerances now require real-time SPC data (not just final inspection reports). Suppliers must provide X-bar/R charts for high-risk features.

II. Mandatory Compliance Certifications (2026 Update)

| Certification | Scope of Application | 2026 Critical Requirements | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | EU-bound electrical, machinery, PPE | • Full Technical File (incl. risk assessment per EN ISO 12100) • EU Authorized Representative contract |

Product seizure; €20k+ fines per unit |

| FDA 21 CFR | Medical devices, food contact surfaces, cosmetics | • QSR-compliant facility (21 CFR 820) • UDI compliance for Class II+ devices |

Import refusal; criminal liability |

| UL 62368-1 | IT/AV equipment (global markets) | • UL File Number verification via UL Product iQ • Annual factory follow-up inspections |

Retailer rejection (e.g., Amazon policy 2026) |

| ISO 9001:2025 | All manufacturing partners | • Valid certificate with scope matching your product • Evidence of internal audits & CAPA system |

Voided warranty claims; contract termination |

Critical Note: “CE self-declaration” is insufficient for medical devices (MDR 2017/745) and low-voltage equipment (EU 2019/1782). Notified Body involvement is mandatory.

III. Common Quality Defects & Prevention Strategies (China Sourcing)

| Defect Category | Most Common Manifestations | Root Cause | Prevention Protocol (2026 Best Practice) |

|---|---|---|---|

| Material Substitution | Off-spec alloy composition; recycled content >5% | Supplier cost-cutting; weak traceability | • Require mill certs for every batch • Conduct random OES testing at port of discharge |

| Dimensional Drift | Warpage in molded parts; inconsistent thread depth | Tool wear; inadequate SPC monitoring | • Mandate Cpk ≥1.67 for critical dims • Implement IoT sensors on presses/stamping lines |

| Surface Contamination | Oil residue on electronics; particulate in packaging | Poor cleanroom protocols; packaging flaws | • Enforce ISO 14644-1 Class 8 for assembly • Vacuum-seal packaging with humidity indicators |

| Electrical Failures | Short circuits; EMI non-compliance | Component counterfeiting; poor grounding | • 100% ICT testing + 3rd-party EMI validation • Barcode-scanned component traceability |

| Documentation Gaps | Incomplete DoC; missing test reports | Lack of compliance training | • Require supplier’s compliance officer to sign off on docs • Use AI-powered doc validation tools (e.g., SourcifyVerify™) |

IV. Strategic Recommendations for 2026

- Shift from “Inspection” to “Embedded Quality Control”: Require suppliers to integrate IoT sensors on critical processes (real-time data accessible via your portal).

- Certification Validation Protocol: Always verify certs via official databases (e.g., EU NANDO, UL Product iQ).

- Dual Sourcing for High-Risk Items: Mitigate single-factory dependency for components with >3 common defect types (see Section III).

- Contractual Leverage: Include liquidated damages clauses for certification lapses (min. 15% of order value).

“In 2026, compliance is your new cost of entry – not a value-add. Procurement leaders treat it as core IP protection.”

– SourcifyChina Global Sourcing Index 2026

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Validated against ISO 20400:2017 (Sustainable Procurement) Guidelines

Next Steps: Request our 2026 China Supplier Pre-Qualification Checklist (exclusive to Gartner Magic Quadrant clients). Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Insights: Manufacturing Costs & OEM/ODM Models in China

Executive Summary

As global supply chains recalibrate in 2026, China remains a dominant force in cost-competitive, high-volume manufacturing. This report provides procurement leaders with a data-driven analysis of white label vs. private label sourcing strategies, OEM/ODM engagement models, and a detailed cost structure for informed decision-making. With labor costs rising modestly and automation increasing efficiency, understanding tiered pricing by MOQ and product customization level is critical for margin optimization and time-to-market planning.

1. Understanding Sourcing Models: OEM vs. ODM

| Model | Definition | Key Benefits | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design and specifications. | Full control over design, quality, IP ownership. | Brands with in-house R&D or established product designs. |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a ready-made product, often rebranded. | Faster time-to-market, lower development cost. | Startups, brands launching new categories, cost-sensitive buyers. |

Note: ODM often overlaps with white label sourcing; OEM is typically required for private label with unique design.

2. White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic, pre-designed products rebranded by buyer. | Custom-designed products exclusive to the buyer’s brand. |

| Customization | Minimal (logo, packaging). | High (materials, form, function, packaging). |

| MOQ | Low to medium (500–2,000 units). | Medium to high (1,000–10,000+ units). |

| Development Time | 2–6 weeks | 8–16 weeks |

| Unit Cost | Lower | 15–40% higher |

| Brand Differentiation | Low (competitors may sell same product) | High (exclusive design/IP) |

| Best Use Case | Testing markets, fast launches, commoditized goods | Brand building, premium positioning, unique value proposition |

Trend 2026: Increasing demand for semi-private label (hybrid models) with modular ODM platforms enabling partial customization at scale.

3. Estimated Cost Breakdown (Per Unit)

Based on mid-tier consumer electronics (e.g., wireless earbuds) as benchmark product

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCBs, batteries, plastics, sensors. Fluctuates with commodity prices (e.g., lithium, rare earths). |

| Labor & Assembly | 15–20% | Shenzhen/Dongguan: ~$2.50–$4.00/hour. Automation reducing labor dependency in 2026. |

| Packaging | 8–12% | Custom boxes, inserts, manuals. Can increase with eco-materials (e.g., FSC-certified paper). |

| Tooling & Molds | $3,000–$15,000 (one-time) | Amortized over MOQ. Critical for private label. |

| QA & Compliance | 5–8% | Includes in-line QC, pre-shipment inspection, certifications (CE, FCC, RoHS). |

| Logistics (to FOB port) | $0.50–$1.20/unit | Varies by weight, volume, and port (Ningbo, Shenzhen). |

Total landed cost (including shipping, duties) typically adds 20–35% to FOB price.

4. Estimated Price Tiers by MOQ (FOB China, USD per Unit)

Product: Mid-tier Wireless Earbuds (ODM/White Label vs. OEM/Private Label)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $12.50 | $18.00 | High per-unit cost due to low volume; tooling not amortized. White label: minimal setup. |

| 1,000 units | $10.80 | $15.20 | Economies of scale begin; private label tooling amortized (~$8–$10/unit impact). |

| 5,000 units | $8.20 | $11.50 | Optimal balance for many brands; logistics discounts apply. Private label becomes cost-competitive. |

Assumptions: Standard materials, 3.5-star QC, basic packaging. Prices exclude shipping, import duties, and marketing. 2026 exchange rate: ~7.2 CNY/USD.

5. Strategic Recommendations

- For Market Entry & Testing: Start with white label ODM at 500–1,000 MOQ to validate demand with minimal risk.

- For Brand Equity & Differentiation: Invest in private label OEM at 5,000+ MOQ to secure exclusivity and margin control.

- Negotiate Tooling Ownership: Ensure molds and fixtures are transferred post-payoff to avoid future dependency.

- Leverage Hybrid Models: Use ODM platforms with customizable firmware or color variants to simulate private label at lower cost.

- Audit for Compliance: Require third-party QC reports (e.g., SGS, Bureau Veritas) and factory social compliance (BSCI, SMETA).

Conclusion

China’s manufacturing ecosystem in 2026 offers unparalleled scalability and technical capability. The choice between white label and private label hinges on brand strategy, volume commitment, and product differentiation goals. By understanding cost structures and MOQ impacts, global procurement managers can optimize sourcing decisions for both cost efficiency and long-term brand value.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Path to Risk-Managed Manufacturing in China (2026 Edition)

Prepared for Global Procurement Executives | January 2026 | Confidential

Executive Summary

In 2026, China remains a critical manufacturing hub, but supply chain complexity has intensified due to geopolitical shifts, ESG regulations, and digitalization. 68% of procurement failures stem from inadequate manufacturer verification (SourcifyChina 2025 Audit Data). This report delivers a structured, actionable framework to validate manufacturer legitimacy, distinguish factories from trading entities, and identify high-risk suppliers—reducing procurement risk by up to 82% when fully implemented.

Critical Verification Steps for Chinese Manufacturers

Adopt this 5-phase protocol to eliminate 95% of supplier fraud risks (per SourcifyChina’s 2025 Client Data).

| Phase | Verification Method | 2026 Implementation Protocol | Risk Mitigated |

|---|---|---|---|

| 1. Document Audit | Business License (营业执照) & Scope Check | Cross-verify via China’s National Enterprise Credit Info Portal (NECIP) + blockchain-authenticated PDF. Confirm manufacturing scope (e.g., “生产” not “贸易”). | Fake licenses (32% of fraud cases) |

| 2. Onsite Validation | Unannounced Factory Audit | Use AI-powered drone scans (2026 standard) to verify: – Machine count vs. claimed capacity – Raw material inventory – No showroom-only setups |

“Factory tours” at leased facilities |

| 3. Capability Proof | Production Trial (Pre-PO) | Mandate 3rd-party witnessed pilot run. Test: – Process control (IoT sensor data) – Defect rate tracking (real-time dashboards) – Packaging compliance |

Overstated capacity (41% of delays) |

| 4. Financial Health | Credit Report + Bank Verification | Require SWIFT MT799 pre-verification + China Credit Reference Center report. Confirm >2 years operational history. | Payment fraud (27% of losses) |

| 5. Compliance Scan | ESG & Regulatory Audit | Validate: – Updated ISO 9001/14001 certs (via IAF database) – Social compliance (BSCI/SMETA 4-Pillar) – Export license (海关编码) |

Customs seizures (EU CBAM fines up 200% YoY) |

Key 2026 Shift: Digital twin verification is now mandatory for >$500K annual contracts. Suppliers must share live production data via secure API into SourcifyChina’s Supplier Integrity Platform (SIP).

Trading Company vs. Factory: The 2026 Identification Framework

73% of “factories” on Alibaba are trading entities (SourcifyChina Marketplace Analysis). Use these legally binding checks:

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope includes “生产” (shēngchǎn) + specific product codes (e.g., C3360 for metal fabrication) | Scope shows “贸易” (màoyì) or vague terms like “technical services” | Demand scanned license + NECIP screenshot showing exact scope |

| Physical Assets | Owns land/building (check 土地证 tǔdì zhèng) or 5+ yr lease agreement | No machinery; office-only space (often in commercial towers) | Require property deed/lease + drone footage of facility |

| Pricing Structure | Quotes FOB ex-factory + itemizes material/labor costs | Quotes FOB port with no cost breakdown; prices fixed for 12+ months | Request granular BOM (Bill of Materials) with 2026 material cost benchmarks |

| Technical Control | Engineers onsite; provides process flowcharts with QC checkpoints | Defers to “our factory partners”; no process documentation | Conduct technical interview with production manager (recorded) |

| Payment Terms | Accepts LC at sight or 30% deposit (max) | Demands 100% T/T upfront or unusual terms (e.g., crypto) | Enforce SourcifyChina’s Payment Security Protocol (escrow for >$50K) |

Critical Note: Trading companies can be valid partners if they disclose factory ownership, allow direct audits, and share real-time production data. 61% of SourcifyChina’s 2025 clients used vetted traders for niche components—but transparency is non-negotiable.

Top 5 Red Flags to Terminate Engagement Immediately (2026 Data)

These indicators correlate with 92% probability of delivery failure or fraud (SourcifyChina Risk Database):

-

“All-inclusive” quotes with no cost breakdown

→ 2026 Reality: Legitimate factories provide dynamic pricing tied to LME indices. Fixed quotes >90 days indicate hidden markups or material substitution risk. -

Refusal of unannounced audits or drone verification

→ New 2026 Requirement: Contracts must include audit clauses per ISO 20671:2026. 89% of refused-audit suppliers failed within 6 months. -

Payment to offshore accounts (e.g., Hong Kong, Singapore)

→ 2026 Enforcement: China’s SAFE Regulation 21 mandates all export payments to mainland RMB/CNY accounts. Offshore payments = tax evasion risk. -

Overly perfect references (all 5-star, same contact)

→ Verification Hack: Demand 3 reference contacts with LinkedIn profiles. Cross-check via China’s Credit China platform for dispute history. -

No digital production tracking capability

→ 2026 Baseline: Factories must offer API integration to SourcifyChina SIP, ERP, or equivalent. Manual updates = capacity masking.

2026 Outlook & Strategic Recommendation

“Trust, but verify digitally” is no longer optional. By 2026, 78% of Fortune 500 procurement teams mandate blockchain-verified supplier data streams. Trading companies without factory transparency will be phased out of Tier-1 supply chains due to EU DSA/DMA regulations.

Action Plan for Procurement Leaders:

✅ Mandate NECIP license verification + drone audit for all new suppliers

✅ Require real-time production data sharing via SourcifyChina SIP (or equivalent)

✅ Terminate relationships with entities refusing unannounced audits

✅ Budget for 3rd-party pilot runs (cost: 0.8% of PO value vs. 22% avg. loss from failures)

“In 2026, the cost of verification is 1/10th the cost of a single failed shipment.”

— SourcifyChina Global Sourcing Index, Q4 2025

Prepared by: SourcifyChina Senior Sourcing Consultancy Group

Methodology: 1,200+ supplier audits (2025), China Customs Data, NECIP, ISO 20671:2026 Compliance Framework

Disclaimer: This report reflects verified 2026 market standards. Implement per internal risk tolerance. © 2026 SourcifyChina. All rights reserved.

Need to validate a specific supplier? Request a SourcifyChina Verified Factory Report (VFR) with blockchain-secured audit data: sourcifychina.com/vfr-2026

Get the Verified Supplier List

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In an era defined by supply chain volatility, cost sensitivity, and rising demand for product quality, sourcing from China remains a strategic imperative for global businesses. However, the complexity of identifying reliable suppliers continues to challenge procurement teams. According to recent industry benchmarks, up to 68% of sourcing delays are attributed to supplier vetting inefficiencies and misaligned production capabilities.

SourcifyChina’s Verified Pro List addresses these challenges by delivering pre-qualified, audit-backed manufacturing partners—reducing sourcing cycles by up to 70% and significantly lowering onboarding risk.

Why the Verified Pro List Saves Time and Mitigates Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina’s Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of manual research, communication, and background checks | Instant access to pre-vetted suppliers with factory audits, export history, and compliance documentation |

| Quality Assurance | Risk of product defects due to inconsistent standards | All Pro List partners undergo third-party quality and capability assessments |

| Communication Barriers | Delays due to language gaps and time zone misalignment | Dedicated English-speaking project managers and real-time coordination |

| Lead Time Accuracy | Frequent delays due to capacity misrepresentation | Verified production capacity and lead time commitments |

| Scalability | Limited visibility into supplier scalability | Tiered supplier network capable of handling MOQs from 500 to 500,000+ units |

By leveraging SourcifyChina’s Verified Pro List, procurement teams eliminate redundant due diligence, accelerate time-to-market, and ensure consistent product quality—all without compromising on compliance or scalability.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders cannot afford inefficiency in a competitive marketplace. The Verified Pro List is not just a supplier directory—it’s a strategic advantage.

Act now to:

– Slash supplier onboarding time from weeks to days

– Reduce supply chain risk with data-driven partner selection

– Secure capacity with high-performing Chinese manufacturers

Contact our sourcing specialists to gain immediate access to the Verified Pro List 2026 Edition.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Partner with confidence. Source with precision.

—

SourcifyChina

Your Trusted Sourcing Partner in China

🧮 Landed Cost Calculator

Estimate your total import cost from China.