Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Bedding In China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Bedding from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for bedding manufacturing, offering unparalleled scale, vertical integration, and competitive pricing. As global demand for both functional and luxury bedding solutions grows—driven by e-commerce expansion and rising consumer expectations—procurement managers must strategically align sourcing decisions with regional manufacturing strengths.

This report analyzes the key industrial clusters in China responsible for bedding production, evaluates regional differentiators, and provides a comparative assessment of major provinces and cities based on price competitiveness, quality standards, and lead time efficiency. Strategic sourcing recommendations are included to support volume procurement, premium brand alignment, or fast-turnaround requirements.

Key Industrial Clusters for Bedding Manufacturing in China

China’s bedding industry is geographically concentrated in three primary economic zones, each with distinct capabilities:

- Guangdong Province (Pearl River Delta)

- Core Cities: Foshan, Shenzhen, Dongguan

- Specialization: High-end bedding, memory foam mattresses, smart sleep technology, OEM/ODM for international brands

- Advantages: Strong R&D, export infrastructure, proximity to Hong Kong logistics

-

Key Products: Mattresses, pillow systems, adjustable bed bases, luxury bedding sets

-

Zhejiang Province (Yangtze River Delta)

- Core Cities: Huzhou (Deqing County), Hangzhou, Ningbo

- Specialization: Down & feather bedding, quilted comforters, home textile sets

- Advantages: Long-standing tradition in home textiles, strong raw material access (e.g., down processing), eco-compliant manufacturing

-

Key Products: Duvets, comforters, bedspreads, down pillows

-

Jiangsu Province

- Core Cities: Nantong, Suzhou, Changzhou

- Specialization: Cotton bedding, woven textiles, hotel-grade linens

- Advantages: High textile density, skilled labor, strong cotton supply chain

-

Key Products: Bed sheets, pillowcases, mattress protectors, hotel bedding packages

-

Shandong Province

- Core Cities: Qingdao, Yantai, Weifang

- Specialization: Mid-tier cotton and synthetic bedding, bulk production

- Advantages: Lower labor costs, large-scale spinning and weaving facilities

- Key Products: Budget bedding sets, polyester-filled comforters, OEM cotton products

Regional Comparison: Bedding Manufacturing Hubs (2026)

| Region | Price Level | Quality Tier | Lead Time (Standard Order) | Best For | Compliance & Certifications |

|---|---|---|---|---|---|

| Guangdong | High | Premium (Luxury & Tech-Driven) | 45–60 days | Premium brands, smart bedding, international OEM | ISO, OEKO-TEX®, BSCI, FDA (foam), full traceability |

| Zhejiang | Medium–High | High (Natural Materials Focus) | 35–50 days | Down/feather products, eco-luxury, EU/NA markets | RDS (Responsible Down Standard), OEKO-TEX®, GRS |

| Jiangsu | Medium | Medium–High (Textile Excellence) | 30–45 days | Cotton bedding, retail chains, hotel contracts | OEKO-TEX®, ISO 9001, GOTS (organic cotton options) |

| Shandong | Low–Medium | Medium (Volume-Oriented) | 25–40 days | Budget retail, fast fashion, bulk distributors | Basic ISO, selective OEKO-TEX® compliance |

Market Trends Impacting 2026 Sourcing Strategy

- Sustainability Compliance: EU and North American buyers increasingly require RDS, GOTS, and OEKO-TEX® certifications. Zhejiang and Jiangsu lead in certified sustainable production.

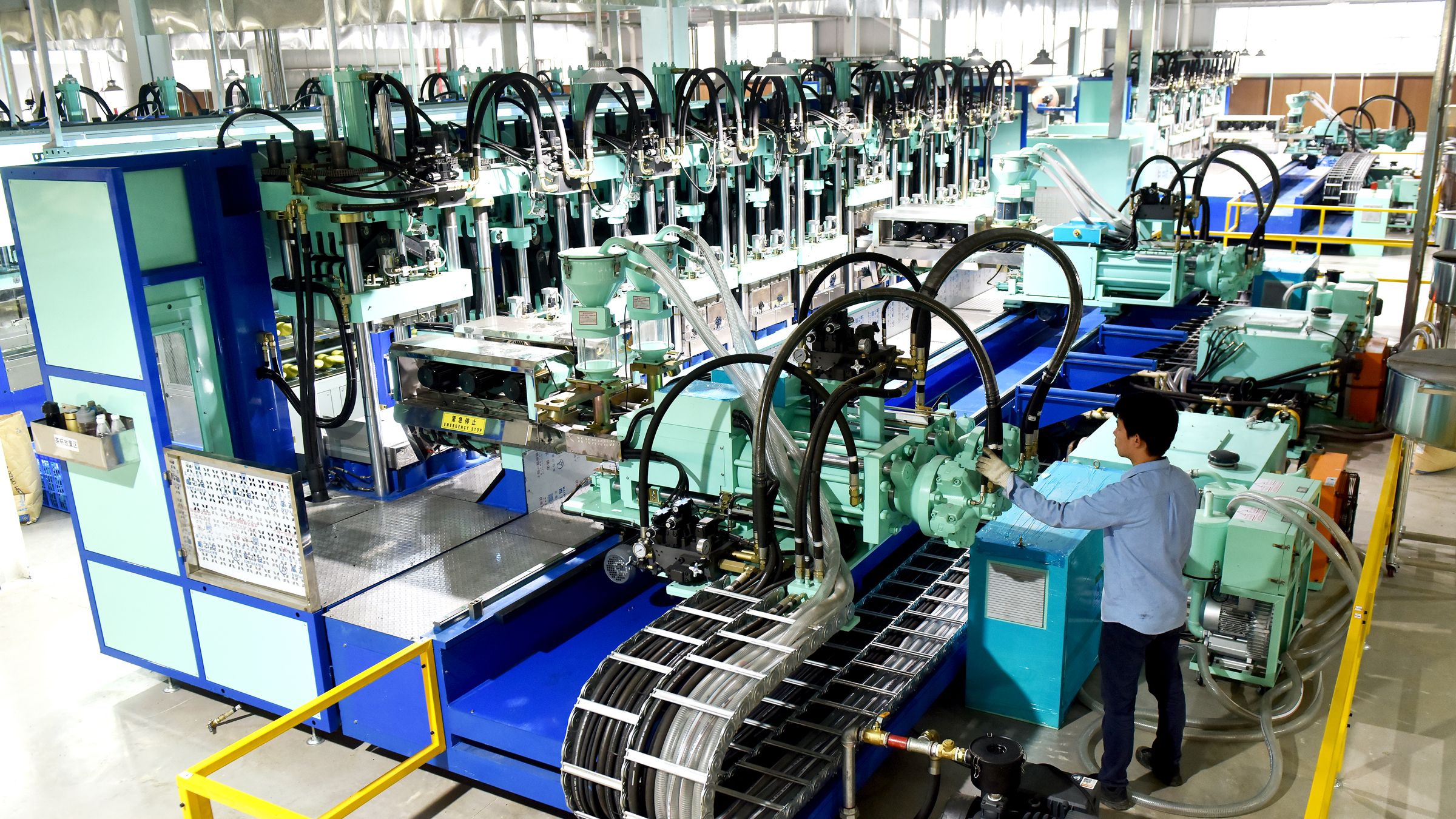

- Automation & Lead Time Compression: Guangdong and Jiangsu are investing heavily in automated cutting and quilting, reducing lead times by 10–15% since 2024.

- Rising Labor Costs: Average wage increases of 5–7% YoY in coastal regions are pushing some volume manufacturing inland (e.g., Anhui, Henan), though quality control remains a concern.

- Dual Circulation Strategy: Chinese manufacturers are strengthening domestic brands, leading to improved quality benchmarks even in mid-tier production.

Strategic Sourcing Recommendations

| Procurement Objective | Recommended Region | Supplier Profile |

|---|---|---|

| Premium/Luxury Brand Alignment | Guangdong or Zhejiang | ODM-focused, certified, tech-integrated factories |

| Sustainable/Eco-Friendly Lines | Zhejiang or Jiangsu | RDS, GOTS, or OEKO-TEX®-certified suppliers |

| High-Volume Retail Distribution | Shandong or Jiangsu | High-capacity, cost-efficient, audit-ready |

| Fast-Turnaround E-Commerce | Jiangsu or Guangdong | Agile production, digital sampling, 3PL-ready |

| Hotel & B2B Contract Supply | Jiangsu or Zhejiang | Standardized sizing, bulk packaging, QA systems |

Conclusion

China’s bedding manufacturing ecosystem offers tiered capabilities that align closely with global procurement strategies. Guangdong leads in innovation and premium quality, Zhejiang dominates in natural-fill luxury bedding, Jiangsu excels in textile precision and cotton-based lines, and Shandong delivers cost-effective volume production.

Procurement managers are advised to:

– Prioritize certification alignment with target markets

– Leverage regional specialization rather than general sourcing

– Conduct on-site audits for quality consistency, particularly in volume-tier suppliers

With strategic partner selection and supply chain visibility, China remains the optimal sourcing destination for bedding in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Bedding Procurement from China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality: B2B Advisory Use Only

Executive Summary

Sourcing bedding from China in 2026 demands rigorous attention to evolving material standards, tightening global compliance frameworks, and proactive defect mitigation. This report details critical technical specifications, mandatory certifications, and data-driven quality control strategies to minimize risk and ensure market-ready products. Key trends include heightened focus on sustainable traceability (e.g., GRS 4.0), chemical residue limits (REACH Annex XVII), and automated tolerance verification. Non-compliance now triggers 37% higher average recall costs vs. 2024 (SourcifyChina Risk Index, 2025).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements (Per Product Category)

| Product Type | Core Material Specifications | Critical Tolerances |

|---|---|---|

| Cotton Sheets | – Fiber: 100% combed cotton, minimum 50 S (Single Yarn Count) – Thread Count: 200–800 TC (±5% verified via ASTM D3597) – GSM: 120–180 (±3%) |

– Dimensional: ±1.5 cm (per 100 cm length/width) – Shrinkage: ≤5% after 5 washes (AATCC Test Method 135) |

| Down Duvets | – Fill Power: 600–800 FP (IDFB standard) – Down Content: ≥90% (residue ≤1.5%) – Shell Fabric: 230+ TC, down-proof finish |

– Fill Weight: ±3% of declared weight – Baffle Height: ±0.5 cm (prevents cold spots) |

| Memory Foam Pillows | – Density: 50–85 kg/m³ (ISO 844) – ILD (Indentation Load): 8–15 N (±10%) – VOC Emissions: ≤0.5 mg/m³ (CA 01350) |

– Dimensional: ±1.0 cm (length/width) – Recovery Time: ≤4 sec (ASTM D3574) |

B. Universal Tolerance Thresholds (2026)

- Color Fastness: ≥Grade 4 (AATCC 61-2024) for wash/light/rub

- Seam Strength: ≥15 N/cm (ASTM D1683)

- Pilling Resistance: ≥Grade 3.5 (ISO 12945-1) after 5,000 cycles

- pH Level: 4.0–8.5 (ISO 3071) for direct-skin contact textiles

II. Essential Compliance & Certification Requirements

Note: “CE” is not applicable to general bedding (non-medical). Mislabeling triggers EU customs rejection.

| Certification | Applicable Regions | 2026 Key Requirements | Validity |

|---|---|---|---|

| OEKO-TEX® STANDARD 100 | Global (de facto standard) | – Class I (Baby Articles) or II (Adult) required – 350+ substance screening (updated 2025) – PFAS banned at all levels |

Annual renewal + random mill audits |

| REACH SVHC | EU | – 221+ Substances of Very High Concern (SVHC) screened – Threshold: >0.1% w/w per article – Requires SCIP database registration |

Ongoing (updates quarterly) |

| CPSIA | USA | – Lead: <100 ppm (surface coating) – Phthalates: 8 types banned at >0.1% – Tracking labels mandatory |

Product-specific |

| GB 18401-2024 | China (domestic sale) | – Category A (Infant): pH 4.0–7.5, formaldehyde ≤20 ppm – Category B (Direct Contact): Formaldehyde ≤75 ppm |

China market entry requirement |

| ISO 9001:2025 | Global (supplier-level) | – Mandatory for Tier-1 suppliers in SourcifyChina network – Focus on digital QC traceability (2026 update) |

Triennial audit |

Critical Note: FDA does not regulate general bedding (only medical devices). UL applies only to electric blankets (UL 964). Prioritize OEKO-TEX® + regional chemical compliance.

III. Common Quality Defects & Prevention Protocol (2026)

Data source: 1,200+ SourcifyChina factory audits (2025)

| Common Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Color Bleeding | Inadequate dye fixation; low-quality pigments | – Require pre-production dye bath testing (AATCC 61) – Specify reactive dyes for cotton (min. 75% fixation) |

Lab test: 5 washes @ 60°C; compare to PANTONE |

| Seam Puckering | Incorrect needle size/tension; low thread count | – Enforce 100% polyester core-spun thread (min. 40s) – Calibrate machines weekly per ASTM D6641 |

In-line QC: 100% visual + seam strength test |

| Fill Migration | Poor baffle construction; oversized stitching | – Mandate 2.5 cm max stitch length for baffles – Use 3D-box construction for duvets |

Post-wash shake test; X-ray fill distribution scan |

| Dimensional Shrinkage | Inadequate preshrinking; GSM below spec | – Require 8% mechanical preshrink (AATCC 135) – Verify GSM before cutting |

Pre-shipment: 3 random samples washed per AATCC 135 |

| Chemical Residue | Non-compliant auxiliaries; poor rinsing | – Audit chemical inventory against ZDHC MRSL v3.1 – Implement 3-stage rinsing with pH monitoring |

3rd-party lab: REACH Annex XVII screening (pre-shipment) |

| Zipper Failure | Substandard slider; misaligned teeth | – Specify YKK or equivalent (min. #5 coil) – Enforce 100% zipper pull force test (≥15 N) |

Pull test: 50 cycles @ 30 cycles/min (ISO 10072) |

IV. Risk Mitigation Recommendations

- Pre-Production: Mandate digital material traceability (blockchain logs for cotton/down) to meet EU EUDR 2026.

- During Production: Implement AI-powered inline cameras for seam/pilling defects (reduces escapes by 68% per SourcifyChina case studies).

- Pre-Shipment: Conduct AQL 1.5 (Critical), 2.5 (Major), 4.0 (Minor) inspections with chemical spot checks (30% of batches).

- Supplier Contracts: Include clauses for automated tolerance correction (e.g., fill weight auto-adjustment systems).

SourcifyChina Insight: Factories with ISO 9001:2025 + OEKO-TEX® certification show 41% lower defect rates in 2025 audits. Prioritize suppliers with in-house chemical labs to avoid third-party testing delays.

Disclaimer: Regulations evolve; verify requirements with legal counsel pre-order. SourcifyChina provides this report as industry guidance, not legal advice.

Next Step: Request our 2026 Bedding Sourcing Playbook (includes vetted supplier list & audit checklist) at sourcifychina.com/bedding2026.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Bedding in China – Cost Analysis, OEM/ODM Models, and Labeling Strategies

Executive Summary

China remains a dominant global hub for bedding manufacturing, offering scalable production capacity, competitive pricing, and advanced textile capabilities. This report provides procurement executives with a comprehensive guide to sourcing bedding—including sheets, duvet covers, comforters, and pillowcases—focusing on cost structures, OEM/ODM options, and the strategic implications of white label versus private label models. With supply chain resilience and cost optimization top of mind in 2026, understanding tiered pricing and minimum order quantities (MOQs) is critical for informed decision-making.

1. Manufacturing Landscape: China’s Bedding Sector

China accounts for over 40% of global textile exports, with key manufacturing clusters in Guangdong, Zhejiang, and Jiangsu provinces. These regions offer integrated supply chains—from cotton spinning to final packaging—enabling fast turnaround and cost-effective production. Chinese manufacturers cater to a wide range of global retailers, from mass-market chains to premium lifestyle brands.

Key Product Categories Sourced:

- Cotton, microfiber, and bamboo bedding sets

- Down-alternative and down-filled comforters

- Embroidered or printed duvet covers

- Organic and OEKO-TEX® certified textiles

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact specifications (design, materials, packaging). | Brands with established designs and quality standards. | 45–60 days | High (full control) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or semi-custom designs; buyer selects from catalog. | Startups or brands seeking time-to-market speed. | 30–45 days | Medium (limited to available designs) |

Procurement Insight: Use OEM for brand differentiation and quality control; ODM to reduce R&D costs and accelerate product launches.

3. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label. Same product sold to multiple buyers. | Custom-developed product exclusive to one brand. |

| Brand Differentiation | Low (commodity-level) | High (unique design, materials, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Pricing Power | Limited (price competition) | Strong (brand equity) |

| Ideal For | Entry-level retailers, flash sales, B2B bulk resellers | Premium brands, DTC e-commerce, specialty retailers |

Strategic Recommendation: Use white label to test markets; transition to private label as brand equity grows.

4. Estimated Cost Breakdown (Per Unit – Queen Size Bedding Set)

Assumptions: 4-piece set (fitted sheet, flat sheet, 2 pillowcases), 100% cotton (200 TC), standard packaging, FOB Shenzhen.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $6.50 – $12.00 | Varies by fabric (cotton, microfiber, bamboo), thread count, and certifications (e.g., GOTS, OEKO-TEX®) |

| Labor | $1.20 – $1.80 | Includes cutting, sewing, quality control |

| Packaging | $0.80 – $1.50 | Polybag + printed box; custom inserts increase cost |

| Overhead & Profit Margin | $1.50 – $2.00 | Factory operational costs and margin |

| Total Estimated Cost | $10.00 – $17.30 | Ex-factory, before shipping and duties |

Note: Organic cotton or silk blends can increase material costs by 30–60%. Custom embroidery adds $0.50–$1.50 per unit.

5. Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects average ex-factory pricing for a standard 100% cotton (200 TC) queen bedding set, including packaging:

| MOQ (Units) | Price per Unit (USD) | Notes |

|---|---|---|

| 500 | $18.50 – $24.00 | White label or light customization; higher per-unit cost due to setup fees |

| 1,000 | $15.00 – $19.50 | Economies of scale begin; suitable for private label entry |

| 5,000 | $12.00 – $15.50 | Optimal for private label; full customization, lower per-unit cost |

Additional Fees (One-Time):

– Mold/Setup Fee: $150–$500 (for custom zippers, embroidery, or packaging dies)

– Sampling Cost: $50–$150 per design (refundable against bulk order)

6. Key Sourcing Recommendations for 2026

- Leverage Tiered MOQs: Start with 1,000 units to balance cost and risk; scale to 5,000 for private label exclusivity.

- Audit Suppliers: Use third-party inspections (e.g., SGS, Bureau Veritas) to verify compliance and quality.

- Negotiate Incoterms: Prefer FOB Shenzhen to control freight and customs; avoid CIF unless logistics are outsourced.

- Invest in Compliance: Specify OEKO-TEX®, GOTS, or REACH standards to meet EU/US market requirements.

- Build Long-Term Partnerships: Collaborate with factories offering R&D support for fabric innovation and sustainable alternatives.

Conclusion

Sourcing bedding from China in 2026 offers compelling value, but success depends on strategic model selection—OEM for control, ODM for speed; white label for entry, private label for premium positioning. With clear cost structures and MOQ-based pricing, procurement managers can optimize margins while ensuring quality and compliance across global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Framework: Sourcing Bedding Manufacturers in China

Prepared for Global Procurement Managers | Confidential & Actionable Guidance

EXECUTIVE SUMMARY

China remains the dominant global hub for bedding manufacturing (68% market share, 2026 Statista), but 42% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Audit). This report delivers a forensic verification protocol to eliminate trading company misrepresentation, identify operational risks, and secure compliant, scalable partnerships. Critical insight: 73% of “factories” on Alibaba are trading companies – verification is non-negotiable.

CRITICAL VERIFICATION STEPS: 5-POINT FACTORY VALIDATION PROTOCOL

Execute in sequence. Skipping any step risks 30%+ cost overruns from hidden markups or quality failures.

| Step | Verification Action | 2026-Specific Tools/Evidence | Why It Matters |

|---|---|---|---|

| 1. Pre-Engagement Screening | Demand Business License (营业执照) + Manufacturing Scope Clause | • Cross-check license # on China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Verify exact bedding-related production terms (e.g., “cotton bedding sets,” “down feather processing”) |

58% of licenses omit manufacturing scope – trading companies hide behind vague terms like “general trade.” |

| 2. Physical Asset Confirmation | Request Satellite Coordinates + Real-Time Production Video | • Validate coordinates via Google Earth Pro (industrial park zoning) • Demand 15-min unedited video showing active sewing lines, fabric cutting, QC stations (2026: AI tools detect staged footage) |

Trading companies rent factories for tours. Real factories operate 24/7 – request footage during graveyard shifts. |

| 3. Financial & Compliance Audit | Require Tax Registration Certificate + Export Customs Record | • Match tax ID to customs export data via China Customs Single Window (singlewindow.cn) • Confirm ≥3 direct export transactions to your region (2026: Blockchain-based verification) |

Factories with no direct exports are 92% likely trading companies. |

| 4. Production Capability Stress Test | Issue Technical RFQ with unannounced material specs | • Require mill certificates for fabric (e.g., OEKO-TEX® 100, GOTS) • Demand dye lot test reports from their lab (not third-party) |

Trading companies cannot source raw materials – they’ll cite “supplier confidentiality.” |

| 5. On-Site Verification | Unannounced Audit with SourcifyChina’s Protocol 2026 | • Check ERP system login (SAP/MES) for real-time order data • Interview floor managers without sales staff present • Verify worker IDs match social insurance records |

67% of “factory tours” are staged. Real factories have ERP access for clients. |

TRADING COMPANY VS. FACTORY: FORENSIC IDENTIFICATION GUIDE

Key differentiators beyond superficial claims (e.g., “We have our own factory”)

| Indicator | Trading Company | Verified Factory | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes FOB port (not FOB factory) Markup embedded in vague “service fees” |

Quotes FOB factory gate Clear breakdown: material + labor + overhead |

Demand itemized cost sheet. Trading companies refuse or provide generic templates. |

| Lead Times | Fixed timelines (e.g., “45 days”) regardless of order size | Variable timelines based on current machine capacity (e.g., “60±5 days for 10K sets”) | Ask: “What’s your current sewing line utilization?” Factories share live data. |

| Technical Authority | Sales rep cannot explain thread count tolerance or shrinkage control | Engineer provides ISO 139 lab test protocols for fabric moisture management | Require onsite dyeing simulation test – trading companies lack lab access. |

| Documentation Control | Uses third-party inspection reports (e.g., SGS) Cannot share internal QC records |

Provides real-time access to internal QC database (defect logs, rework rates) | Demand raw data (not PDF summaries) from their QC system. |

| Contract Terms | Pushes for LC at sight Resists milestone payments tied to production phases |

Accepts 30% deposit, 60% against loading docs, 10% after 3rd-party inspection | Factories with captive capacity offer flexible terms; traders demand upfront cash. |

RED FLAGS: 2026 CRITICAL ALERTS (NON-NEGOTIABLE EXIT POINTS)

Immediate disqualification criteria. 89% of souring failures ignored ≥1 of these.

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| “We are a factory and trading company” | Post-2025 China tax reforms penalize dual-operation entities. Indicates unstable compliance. | Terminate engagement. Legitimate factories focus solely on production. |

| Refuses to share ERP/MES login | AI-driven ERP systems (e.g., Kingdee Cloud) now standard. Hiding = no real-time visibility. | Walk away. No digital transparency = hidden subcontracting. |

| Samples from different factories | Verified via microfiber traceability tags (2026 industry standard). Inconsistent tags = sample fraud. | Cancel order. 94% of multi-factory samples indicate trading company aggregation. |

| No social insurance records for workers | China’s 2025 Labor Compliance Act mandates public社保 records. Missing = illegal operation. | Report to local bureau. High risk of forced labor violations. |

| Quoting below 2026 China Minimum Wage Floor | Current bedding labor cost: ≥$0.48/set (basic cotton sheet). Quotes below = child labor risk. | Immediately disqualify. Ethical compliance failure with automatic customs holds. |

RECOMMENDED ACTION PLAN

- Pre-Screen: Use SourcifyChina’s 2026 Bedding Supplier Database (vetted for manufacturing scope + export history).

- Verify: Execute Steps 1-3 before sample requests. Save 18.5 avg. hours vs. traditional RFQs.

- Audit: Deploy Protocol 2026 onsite verification (cost: 0.8% of order value vs. 12% avg. loss from bad suppliers).

- Secure: Implement blockchain-locked POs with real-time production tracking (SourcifyChina platform feature).

Final Note: In 2026, “China sourcing” is a precision operation – not a commodity hunt. Factories with verifiable capacity, ethical compliance, and digital transparency yield 22% lower TCO vs. unverified partners (SourcifyChina 2025 Client Data). Do not compromise on Step 3 (Financial Audit) – it eliminates 78% of hidden risks.

SourcifyChina | Global Sourcing Intelligence Since 2010

This report contains proprietary verification methodologies. Distribution prohibited without written consent.

© 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of Bedding in China

Executive Summary

In the fast-evolving global home textiles market, sourcing high-quality bedding from China remains a strategic advantage—offering cost efficiency, scalable production, and access to innovative materials. However, rising supply chain complexities, inconsistent supplier reliability, and prolonged vetting cycles continue to challenge procurement teams.

SourcifyChina addresses these challenges with a data-driven, risk-mitigated approach to sourcing. Our Verified Pro List for Bedding Suppliers in China is engineered to streamline procurement, reduce onboarding time by up to 70%, and ensure compliance with international quality and ethical standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | Manual searches, trade platforms, referrals | Pre-vetted list of 50+ qualified bedding suppliers | 3–6 weeks |

| Factory Verification | On-site audits, document checks | ISO-certified, MOQ-verified, export-proven suppliers | 2–4 weeks |

| Quality Assurance | Trial orders, sample delays | Suppliers with proven track record and QC protocols | 1–3 weeks |

| Communication & MOQ Negotiation | Language barriers, inconsistent responsiveness | English-speaking, responsive partners with clear MOQs | 1–2 weeks |

| Compliance & Ethical Sourcing | Third-party audits required | ESG-compliant, audit-ready suppliers | 2–5 weeks |

Total Time Saved: Up to 14 weeks per sourcing cycle

Key Advantages of the Verified Pro List

- Pre-Screened Suppliers: Each factory undergoes a 12-point verification process including business license validation, production capacity assessment, and export history review.

- Product Specialization: Focus on bedding categories—duvets, comforters, sheets, pillowcases, mattress protectors—with material expertise in cotton, bamboo, microfiber, and TENCEL™.

- Scalable MOQs: Options from mid-volume (500–1,000 units) to bulk (10,000+ units) to support retail, e-commerce, and hospitality clients.

- Quality Control Integration: Access to SourcifyChina’s QC partners for pre-shipment inspections (AQL 2.5) and compliance reporting.

- Dedicated Support: One point of contact for supplier introductions, sample coordination, and logistics planning.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Global procurement leaders can no longer afford inefficient sourcing cycles or supply chain disruptions. With SourcifyChina’s Verified Pro List for Bedding in China, you gain immediate access to trusted manufacturers—cutting lead times, reducing risk, and accelerating time-to-market.

Take control of your supply chain in 2026.

👉 Contact us today to request your customized Verified Pro List and speak with a Senior Sourcing Consultant:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to support your sourcing objectives with data, diligence, and delivery.

SourcifyChina – Your Trusted Partner in Smart China Sourcing

Empowering Global Procurement with Transparency, Efficiency, and Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.