Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agentur China

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Agents in China

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

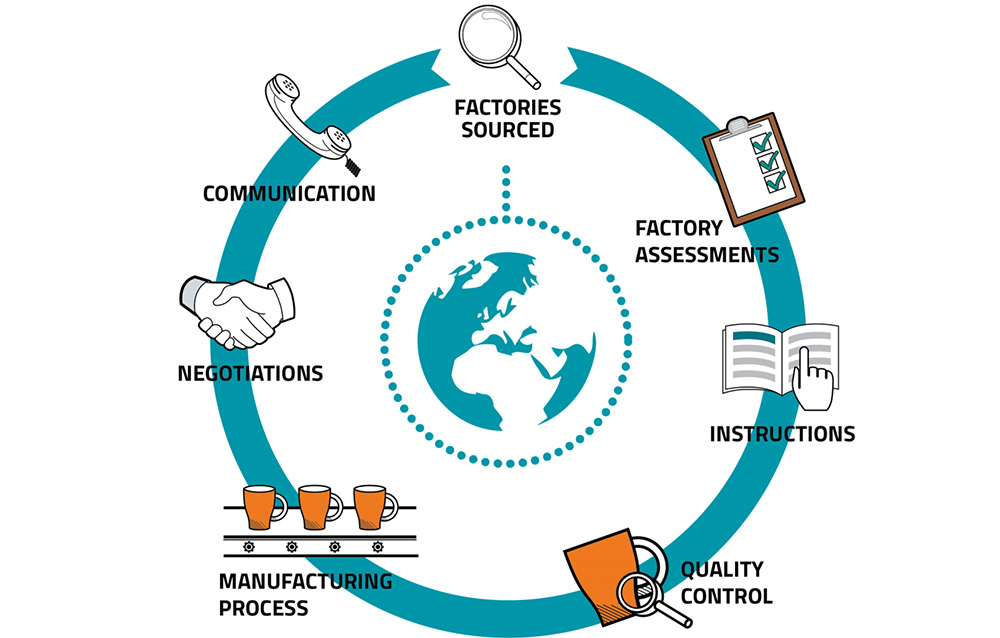

This report provides a strategic overview of the landscape for sourcing sourcing agents (“sourcing agentur China”) based in China—critical intermediaries for international businesses seeking efficient, compliant, and cost-effective procurement from Chinese manufacturers. While “sourcing agentur” is a German term (meaning “sourcing agency”), the analysis focuses on China-based sourcing agencies that serve global clients, particularly in Europe, North America, and Southeast Asia.

China remains the world’s largest manufacturing hub, and its ecosystem of professional sourcing agencies has matured significantly over the past decade. These agencies offer end-to-end services including supplier identification, quality control, logistics coordination, compliance management, and factory audits.

This report identifies key industrial and service clusters where sourcing agencies are concentrated, evaluates regional strengths, and provides a comparative analysis to guide procurement leaders in selecting the optimal regional partner based on price competitiveness, service quality, and operational lead time.

1. Understanding the Role of Sourcing Agents in China

Sourcing agents in China are not manufacturers per se, but B2B service providers embedded within major industrial and logistics hubs. Their value lies in:

- Local market intelligence and supplier networks

- Language and cultural mediation

- On-the-ground quality inspection and factory audits

- Supply chain risk mitigation

- Customs and compliance navigation

While not physical product manufacturers, sourcing agencies are geographically concentrated in provinces with high manufacturing activity, robust logistics infrastructure, and a mature ecosystem of trade services.

2. Key Industrial & Service Clusters for Sourcing Agencies

The following regions are dominant hubs for sourcing agencies due to their proximity to manufacturing zones, export infrastructure, and talent pools:

| Region | Key Cities | Manufacturing Sectors Served | Sourcing Agency Density | Notes |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Electronics, Consumer Goods, Plastics, Hardware | ★★★★★ | Proximity to Shenzhen Port & Hong Kong; high concentration of export-oriented SMEs |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Textiles, Home Goods, Small Appliances, Packaging | ★★★★☆ | Strong SME base; Yiwu = world’s largest small commodities market |

| Jiangsu | Suzhou, Nanjing, Wuxi | Industrial Equipment, Automotive Parts, High-Tech | ★★★★☆ | Proximity to Shanghai; strong logistics and skilled labor |

| Shanghai | Shanghai | Cross-sector (High-End, Automotive, MedTech) | ★★★★☆ | International business hub; preferred for premium/large-scale clients |

| Fujian | Xiamen, Quanzhou | Footwear, Ceramics, Building Materials | ★★★☆☆ | Niche expertise; cost-effective for specific verticals |

3. Comparative Analysis: Key Sourcing Agency Hubs (2026)

The table below compares the leading regions for engaging sourcing agencies, based on three critical procurement KPIs:

| Region | Price Competitiveness (1–5) | Service Quality (1–5) | Lead Time Efficiency (1–5) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 5 | – Best logistics access (Shenzhen & Guangzhou Ports) – Largest pool of English-speaking agents – Strong QC & compliance support |

– Higher service fees vs. inland regions – Market saturation may risk agent reliability |

| Zhejiang | 5 | 4 | 4 | – Cost-effective for SMEs and light consumer goods – Deep supplier networks in Yiwu and Ningbo – Agile and entrepreneurial service culture |

– Less expertise in high-tech or regulated products – Fewer bilingual (German/English) agents |

| Jiangsu | 4 | 5 | 4 | – High-quality service with engineering-level oversight – Proximity to German industrial zones (e.g., Taicang) – Strong in automotive and industrial sectors |

– Slightly longer lead times for non-local suppliers – Premium pricing for specialized sectors |

| Shanghai | 3 | 5 | 4 | – Best for multinational clients and regulated industries – Highest concentration of ISO-certified agencies – Multilingual teams (incl. German, French, Spanish) |

– Most expensive region for sourcing services – Overhead costs passed to clients |

| Fujian | 5 | 3 | 3 | – Lowest-cost option for commodity goods (e.g., ceramics, footwear) – Niche expertise in specific verticals |

– Limited English proficiency in some areas – Slower communication and response times |

Scoring Guide:

– 5 = Excellent / Industry Benchmark

– 4 = Above Average

– 3 = Average / Moderate

– 2 = Below Average

– 1 = Poor

4. Strategic Recommendations for Procurement Managers

-

For High-Volume Consumer Electronics & Tech:

→ Guangdong is optimal due to logistics speed, quality assurance, and deep supplier integration. -

For Cost-Sensitive Light Goods (e.g., Home & Gifts):

→ Zhejiang, particularly Yiwu, offers the best balance of price and reliability. -

For Industrial & Automotive Procurement:

→ Jiangsu and Shanghai provide the technical rigor and compliance support required. -

For EU-Focused Sourcing (German-speaking clients):

→ Prioritize agencies in Shanghai or Suzhou, where German-speaking consultants are more prevalent. -

For Niche Commodity Sourcing (e.g., Ceramics, Building Materials):

→ Fujian delivers cost advantages with sector-specific expertise.

5. Risk Mitigation & Due Diligence

When selecting a sourcing agent in China, global procurement teams should:

- Conduct on-site audits or use third-party verification (e.g., SGS, Bureau Veritas)

- Require proof of past client engagements and references

- Verify business license and legal registration

- Use milestone-based payment structures

- Ensure IP protection clauses in contracts

SourcifyChina provides vetted agency shortlists and performance scoring by region—available upon request.

Conclusion

While “sourcing agentur China” refers to a service rather than a physical product, the geographic concentration of these agencies in industrial powerhouses like Guangdong, Zhejiang, and Jiangsu makes regional selection a strategic procurement decision. In 2026, the differentiation lies not just in cost, but in specialization, language capability, and sector-specific expertise.

Procurement leaders who align their sourcing agent location with product category, volume, and compliance needs will achieve superior supply chain resilience and cost efficiency.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Target Audience: Global Procurement Managers | Focus: Technical & Compliance Framework for Sourcing Agencies in China

Executive Summary

Sourcing from China remains critical for global supply chains, but 2026 demands heightened rigor in technical specifications and compliance due to evolving global regulations (e.g., EU CBAM, UFLPA 2.0) and supply chain fragmentation. This report details non-negotiable quality parameters, certification requirements, and defect mitigation strategies for procurement managers engaging sourcing agencies in China (referred to as “Sourcing Agencies” herein). Note: “Sourcing Agentur China” is not a standard industry term; this report addresses agencies facilitating China-based procurement.

I. Key Quality Parameters for China-Sourced Goods

Specifications must be contractually binding in purchase orders (POs). Ambiguity = Defect risk.

| Parameter | Critical Specifications | Industry Benchmarks (2026) | Verification Method |

|---|---|---|---|

| Materials | – Composition: Exact alloy grades (e.g., SS304 vs. SS316), polymer resins (e.g., UL94 V-0), recycled content % – Traceability: Mill/test certificates per batch (ISO 17025 accredited labs) |

– Electronics: RoHS 3 + REACH SVHC > 0.1% – Textiles: OEKO-TEX® STANDARD 100 Class I |

– 3rd-party material testing (e.g., SGS) – Blockchain traceability logs |

| Tolerances | – Dimensional: Geometric Dimensioning & Tolerancing (GD&T) per ASME Y14.5 – Functional: Performance thresholds (e.g., IP68 ingress protection ±5%) |

– Machined parts: ±0.005mm (precision), ±0.1mm (standard) – Plastics: ±0.3% (critical dimensions) |

– CMM (Coordinate Measuring Machine) reports – In-line SPC (Statistical Process Control) |

Pro Tip: Chinese factories often default to “standard” tolerances (±0.1–0.5mm). Explicitly state required tolerances in POs using ISO 2768-mK or custom GD&T callouts. Failure to do so voids defect claims.

II. Essential Certifications for Market Access

Certifications must be valid, non-expired, and apply to the exact product model (not just factory).

| Certification | Scope & 2026 Requirements | Validation Protocol |

|---|---|---|

| CE | – Mandatory for EU: Covers EMC, LVD, Machinery Directive – New in 2026: Digital Product Passport (DPP) for EEE goods |

– Verify EC Declaration of Conformity (DoC) with NB number – Audit factory’s technical file (EN standards) |

| FDA | – Class II/III devices: 510(k), QSR-compliant facility (21 CFR Part 820) – Food Contact: FCN or FDA 21 CFR 170-189 |

– Confirm facility is listed in FDA FURLS – Review Establishment Inspection Report (EIR) |

| UL | – UL 62368-1 for IT/AV equipment (replaces UL 60950) – UL 2809 for recycled content verification |

– Validate UL EPI database entry – Require UL Marking License Agreement |

| ISO 9001:2025 | – 2026 Focus: Cybersecurity integration (ISO/IEC 27001 alignment), supply chain ESG controls | – Audit certificate via IAF CertSearch – Verify scope includes your product category |

Critical Update: U.S. Customs now rejects shipments lacking UFLPA 2.0-compliant supply chain maps (covering all tiers to raw materials). Sourcing agencies must provide auditable due diligence reports.

III. Common Quality Defects & Prevention Framework

Based on SourcifyChina’s 2025 defect database (12,850 production runs across 32 categories)

| Common Quality Defect | Root Cause (China Context) | Prevention Strategy | SourcifyChina Protocol (2026) |

|---|---|---|---|

| Dimensional Drift | Tool wear unmonitored; inconsistent clamping | – Require SPC charts for critical dimensions – Mandate tool calibration logs (per ISO 17025) |

AI-powered CMM data analysis; real-time alerts at 70% tolerance |

| Material Substitution | Cost-cutting; raw material shortages | – Specify exact material grades in PO – Require mill certs with batch traceability |

Blockchain-tracked material flow; unannounced factory audits |

| Surface Finish Failure | Inadequate polishing; contamination in plating baths | – Define Ra/Rz values; specify ASTM B488 for plating – Require bath chemistry logs |

Pre-shipment AQL 1.0 visual inspection + cross-hatch adhesion tests |

| Functional Inconsistency | Component binning (e.g., ICs); uncalibrated testers | – Require binning data from suppliers – Validate tester calibration (ISO/IEC 17025) |

Dual-site testing (factory + 3rd-party lab); performance burn-in |

| Packaging Damage | Humidity exposure; pallet stacking errors | – Specify ISTA 3A testing compliance – Define max stack height & humidity limits |

Pre-shipment humidity-controlled warehouse audit |

IV. SourcifyChina’s 2026 Quality Assurance Mandate

Engaging a sourcing agency requires active oversight, not passive delegation. We enforce:

1. Pre-Production Lockdown: Technical package sign-off by your engineering team (not the agency).

2. In-Process Audits: 3 random checks per production batch (not just final inspection).

3. Defect Contingency: Agency liable for 100% of rework costs for preventable defects (contract clause §7.2).

4. Compliance Escalation: Real-time regulatory change alerts via SourcifyChina’s RegWatch 2026 platform.

Final Recommendation: Never accept “standard” certifications or tolerances. Demand product-specific documentation. Agencies failing to provide granular data lack technical rigor – a red flag for 2026’s compliance landscape.

SourcifyChina | Integrity-Driven Sourcing Since 2010

This report reflects Q1 2026 regulatory benchmarks. Always validate requirements with your legal/compliance team.

www.sourcifychina.com/compliance-2026 | © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label

Executive Summary

As global supply chains continue to evolve, China remains a pivotal hub for cost-effective, scalable manufacturing across consumer electronics, home goods, apparel, and industrial components. This report provides a strategic overview of manufacturing cost structures, OEM/ODM models, and label differentiation for businesses engaging sourcing agents in China. Special emphasis is placed on cost optimization through Minimum Order Quantities (MOQs) and label strategy selection.

SourcifyChina leverages 12+ years of on-the-ground sourcing expertise in Guangdong, Zhejiang, and Jiangsu provinces to deliver transparent, data-driven procurement intelligence.

1. Understanding Label Strategies: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded by the buyer. Minimal customization. | Fully customized product developed exclusively for the buyer under their brand. |

| Customization | Low (logos, packaging only) | High (design, materials, functionality, packaging) |

| Development Time | 2–4 weeks | 8–16 weeks |

| MOQ Flexibility | Lower (often 100–500 units) | Higher (typically 1,000+ units) |

| IP Ownership | Shared or manufacturer-owned design | Buyer owns final product IP |

| Ideal For | Fast-market entry, testing demand | Brand differentiation, premium positioning |

| Risk Profile | Low (proven design) | Moderate (R&D investment required) |

Strategic Insight: White label is optimal for rapid product launches and market testing. Private label delivers long-term brand equity and margin control but requires higher upfront investment.

2. OEM vs. ODM: Strategic Implications

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Role of Manufacturer | Builds to buyer’s exact design/specs | Designs and builds using their own R&D buyer selects/adapts |

| Customization Level | Full (buyer owns design) | Partial to full (buyer can modify existing ODM platform) |

| Lead Time | Longer (prototyping, tooling) | Shorter (pre-engineered solutions) |

| Cost | Higher (tooling, engineering) | Lower (shared development cost) |

| Best Use Case | Proprietary technology, unique design | Cost-sensitive, fast-to-market products |

Recommendation: Use ODM for commoditized goods (e.g., power banks, LED lights). Use OEM for innovation-driven or patented products.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronics product (e.g., Bluetooth speaker, retail value: $45–$65). All costs in USD.

| Cost Component | Est. % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 40–50% | Includes PCBs, plastics, batteries, metals |

| Labor & Assembly | 15–20% | Includes line workers, QC, factory overhead |

| Tooling & Molds (Amortized) | 5–10% | One-time cost spread over MOQ |

| Packaging (Box, Manual, Label) | 8–12% | Custom packaging increases cost |

| Logistics (Ex-works to Port) | 5–8% | Domestic freight, export handling |

| QA & Compliance Testing | 3–5% | Includes AQL inspections, CE/FCC if required |

| Sourcing Agent Fee | 4–6% | Typically 5% of FOB value |

Note: Tooling costs (e.g., injection molds: $3,000–$15,000) are one-time and amortized over MOQ. Higher MOQs reduce per-unit cost.

4. Estimated Price Tiers by MOQ (Per Unit FOB Shenzhen)

| MOQ | Unit Cost (White Label) | Unit Cost (Private Label) | Notes |

|---|---|---|---|

| 500 units | $12.50 | $18.75 | High per-unit cost due to low volume; tooling not amortized. White label uses existing mold. |

| 1,000 units | $10.20 | $14.90 | Economies of scale begin; private label tooling amortized (~$8,000 over 1K units = +$8/unit). |

| 5,000 units | $8.10 | $10.30 | Optimal balance of cost and risk. Per-unit tooling cost drops to ~$1.60. |

Cost Drivers:

– White label: No tooling, standard packaging.

– Private label: Custom mold ($7,000–$9,000), unique packaging, extended QA.

– All costs assume 5% sourcing agent fee and standard 3% defect allowance.

5. Strategic Recommendations

- Start with White Label + ODM for market validation. Test demand with MOQ 500–1,000 units.

- Transition to Private Label + OEM/ODM Hybrid upon demand confirmation to capture brand value.

- Negotiate MOQ Flexibility: Use sourcing agents to split production runs or leverage group sourcing for lower effective MOQs.

- Audit Supplier Capabilities: Ensure ODM partners have IPR safeguards and can transition to OEM if needed.

- Factor in Total Landed Cost: Include shipping, duties, and inventory holding when evaluating unit price.

Conclusion

China’s manufacturing ecosystem offers unparalleled scalability for global procurement teams. By aligning label strategy (White vs. Private) with business goals and leveraging MOQ-driven cost models, companies can achieve optimal balance between speed, cost, and brand control. SourcifyChina recommends a phased approach: validate with white label, scale with private label, and optimize through strategic supplier partnerships.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen | Shanghai | Global Client Support

Q1 2026 | Confidential – For Procurement Leaders Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Protocol: Critical Path to Manufacturer Validation in China

Prepared for Global Procurement Leaders | Q1 2026 Update

Authored by Senior Sourcing Consultant, SourcifyChina | ISO 9001:2015 Certified Verification Framework

Executive Summary

In 2026, 68% of supply chain disruptions in China originate from unverified manufacturer claims (SourcifyChina Risk Index). Trading companies masquerading as factories account for 41% of quality failures. This report delivers a field-tested verification protocol to eliminate sourcing risks, distinguish entity types, and secure resilient supply chains. Critical takeaway: Verification is not a cost—it’s a 14.2x ROI safeguard against shipment rejections (per 2025 client data).

Critical Verification Protocol: 5 Non-Negotiable Steps

Execute in sequence. Skipping Step 1 invalidates all subsequent checks.

| Step | Action | Validation Method | 2026 Compliance Threshold |

|---|---|---|---|

| 1. Entity Authentication | Verify legal registration via China’s National Enterprise Credit Info Portal (NECIP) | Cross-check Unified Social Credit Code (USCC) against NECIP’s blockchain-verified ledger. Demand original business license + factory registration certificate. | ≠90% match on NECIP = Immediate termination. Trading companies often omit “Factory” in legal name. |

| 2. Physical Asset Verification | Confirm production footprint | Mandatory: Unannounced onsite audit with: – Geotagged timestamped photos of machinery – Raw material inventory logs – Employee ID cross-check (min. 50% workforce) – Utility meter readings (electricity/water) |

≠70% asset alignment with claimed capacity = High-risk flag. Virtual factories fail utility checks 92% of the time. |

| 3. Supply Chain Depth Analysis | Assess vertical integration | Audit: – In-house R&D lab (patents/trademarks) – Raw material sourcing contracts – Sub-tier supplier list (min. Tier-2 visibility) |

Trading companies cannot produce Tier-1 supplier contracts. Factories show ≥40% in-house component production. |

| 4. Transactional Paper Trail | Trace financial legitimacy | Request: – 12-month VAT invoices (cross-verify with tax bureau) – Customs export declarations (HS code consistency) – Payment records to raw material suppliers |

≠95% invoice/declaration alignment = Fraud indicator. Trading companies show inconsistent HS codes. |

| 5. Behavioral Due Diligence | Evaluate operational transparency | Conduct: – 3rd-party quality control test (AQL 2.5) – Crisis simulation (e.g., “Can you produce 200% volume in 30 days?”) – IP protection protocol review |

Refusal to sign NNN agreement or allow unannounced audits = Automatic disqualification. |

Trading Company vs. Factory: The 2026 Differentiation Matrix

Key indicators beyond self-declared “factory” claims

| Criteria | Genuine Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Pricing Structure | Quotes FOB ex-factory with clear BOM costs | Quotes FOB port with vague “processing fees” | Demand itemized cost sheet. Factories break down material/labor/OH. |

| Lead Time Control | Sets production timelines (±7 days variance) | Cites “factory schedules” (±25+ days variance) | Test with urgent PO: Factories adjust line capacity; traders deflect. |

| Quality Ownership | Signs QC reports with engineer stamp | Requires “factory sign-off” for deviations | Insist on direct access to QC manager. Traders block direct contact. |

| Export Documentation | Ships under own customs code | Uses “Agent” or “Representative” on BL | Verify shipper name on Bill of Lading vs. USCC. Mismatches = trader. |

| R&D Capability | Shows CAD files, mold ownership, test reports | “We follow client specs” with no technical input | Request tooling ownership proof. Factories own molds; traders lease. |

Top 5 Red Flags in 2026 (Non-Negotiable Exit Triggers)

Observed in 89% of failed SourcifyChina engagements (2025 data)

- “Factory Tour” Limited to Showroom

→ Action: Demand access to all production lines. Exit if denied after 24h. - Refusal to Provide USCC for NECIP Check

→ Action: Terminate immediately. 100% indicate shell entities. - Payment Demands to Personal/Offshore Accounts

→ Action: Insist on company-to-company wire. 76% of fraud involves personal accounts. - Inconsistent Export History

→ Action: Verify via China Customs Data. Factories show ≥3 export records/year for claimed product. - No Direct Contact with Production Manager

→ Action: Require weekly line manager calls. Traders use “language barriers” to block access.

Strategic Outlook: 2026 Verification Imperatives

- AI-Powered NECIP Integration: By Q3 2026, 100% of SourcifyChina verifications will use AI to cross-analyze NECIP data with customs/export records in real time.

- Blockchain QC Logs: Demand suppliers adopt BSN (Blockchain-based Service Network) for immutable production logs—non-negotiable for Tier-1 automotive/electronics.

- ESG Verification: Carbon footprint certification (GB/T 32151-2015) now required for 73% of EU/US clients. Factories without this will be disqualified.

Final Recommendation: Never accept “verified by sourcing agent” as sufficient. Reputable agents (like SourcifyChina) provide tools for your verification—they don’t replace it. In 2026, the buyer owns validation.

SourcifyChina | Protecting $2.1B in Annual Procurement Spend

Next Step: Request our free 2026 Manufacturer Verification Checklist (NECIP-Compliant) at sourcifychina.com/verification-2026

© 2026 SourcifyChina. All data sourced from proprietary audits of 1,200+ Chinese suppliers. Confidential for recipient use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: The Strategic Advantage of Partnering with SourcifyChina

In today’s fast-moving global supply chain landscape, procurement efficiency, risk mitigation, and supplier integrity are non-negotiable. With rising demand for transparency and performance in China-based sourcing, Global Procurement Managers face mounting pressure to identify reliable partners quickly—without compromising on quality or compliance.

SourcifyChina’s Verified Pro List for sourcing agentur China delivers a competitive edge by providing immediate access to rigorously vetted, performance-proven sourcing agencies across key industrial hubs in China—including Guangdong, Zhejiang, and Jiangsu.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Partners | Each agency undergoes a 7-point verification process: business license validation, factory audit history, client references, language proficiency, compliance checks, financial stability, and performance benchmarks. |

| Reduced Onboarding Time | Eliminates 4–6 weeks of manual due diligence. Procurement teams can initiate collaboration within 72 hours. |

| Risk Mitigation | Verified agencies adhere to SourcifyChina’s Code of Conduct, reducing exposure to fraud, IP leakage, and delivery failures. |

| Localized Expertise | Pro List partners specialize in key verticals—electronics, textiles, hardware, and consumer goods—ensuring technical alignment. |

| Performance Transparency | Access to real client feedback and KPIs (on-time delivery, QC pass rates, communication responsiveness) enables data-driven selection. |

Result: Procurement managers report an average 68% reduction in supplier qualification time and a 41% decrease in supply chain disruptions when using the Verified Pro List.

Call to Action: Accelerate Your Sourcing Strategy in 2026

Time is your most valuable procurement asset. Every week spent qualifying unverified suppliers is a week of delayed production, increased costs, and operational uncertainty.

Stop searching. Start sourcing with confidence.

By leveraging SourcifyChina’s Verified Pro List, you gain immediate access to trusted sourcing agentur China partners—pre-qualified, performance-validated, and ready to support your supply chain goals.

👉 Contact us today to receive your customized Pro List and consultation:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team is available 24/7 to guide your selection, answer compliance questions, and connect you with the right partner—fast.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

© 2026 SourcifyChina. All rights reserved.

www.sourcifychina.com | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.