Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent From China To India

SourcifyChina Sourcing Intelligence Report 2026

Title: Sourcing Agents from China to India: Market Analysis & Industrial Cluster Benchmarking

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

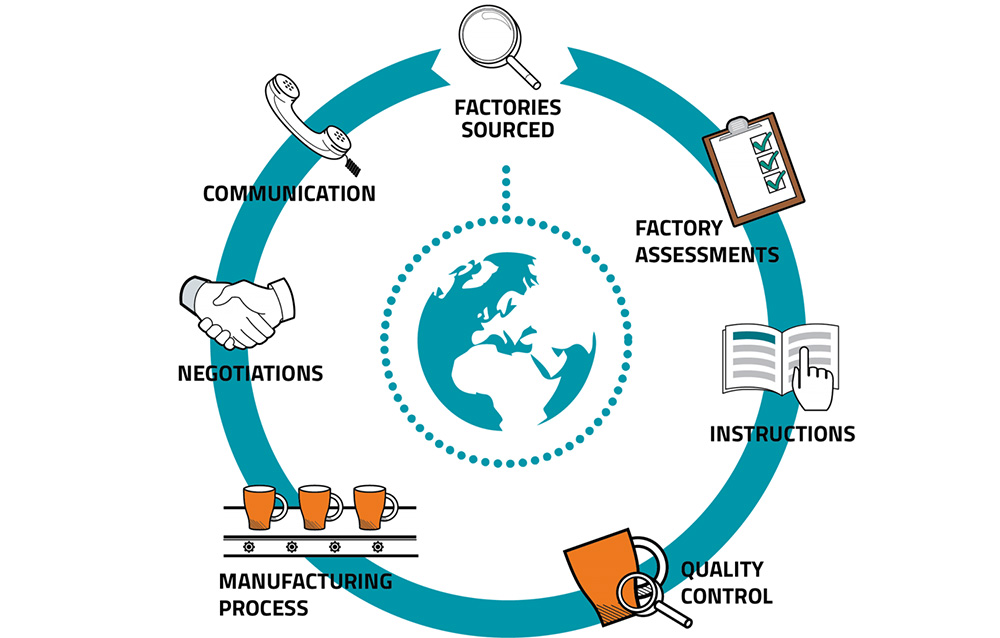

While the phrase “sourcing agent from China to India” may initially appear ambiguous, it is interpreted in this report as the procurement of sourcing agent services based in China that facilitate supply chain operations for Indian buyers. These agents act as intermediaries, managing supplier identification, quality control, logistics coordination, and compliance for Indian importers sourcing goods from China.

As India’s manufacturing and retail sectors continue to expand, demand for professional China-based sourcing agents has surged. This report provides a data-driven analysis of the key industrial clusters in China where sourcing agencies are concentrated, evaluates their operational advantages, and offers a comparative benchmark to support strategic sourcing decisions.

Market Overview: Sourcing Agents in China for Indian Importers

Sourcing agents in China are not manufactured products but are service-based entities—typically small to mid-sized firms or independent consultants—operating in proximity to major manufacturing hubs. Their value lies in local market intelligence, supplier networks, linguistic fluency, and logistical expertise.

Indian importers increasingly rely on these agents to:

– Navigate complex Chinese supply chains

– Ensure product quality through on-site inspections

– Manage export documentation and customs compliance

– Reduce lead times and mitigate supply chain risks

The most active sourcing agents for Indian clients are located in provinces with high export volumes, strong logistics infrastructure, and proximity to key industrial zones.

Key Industrial Clusters for Sourcing Agents (China)

The following provinces and cities host the majority of professional sourcing agencies serving Indian buyers:

| Region | Major Cities | Key Industries Served | Agent Specialization |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Electronics, Consumer Goods, Plastics, Lighting | High-volume consumer electronics, fast turnaround |

| Zhejiang | Yiwu, Ningbo, Hangzhou | General Merchandise, Home Goods, Textiles, Hardware | Cost-effective sourcing, SME-focused |

| Jiangsu | Suzhou, Nanjing, Wuxi | Machinery, Automotive Parts, Industrial Equipment | Technical product sourcing, quality assurance |

| Shanghai | Shanghai | Cross-industry, High-End Electronics, Medical Devices | Premium service, multilingual teams, compliance expertise |

| Fujian | Xiamen, Quanzhou | Footwear, Sports Equipment, Ceramics | Niche product categories, OEM coordination |

Note: While sourcing agents are not “manufactured,” their geographic concentration is directly linked to manufacturing density, port access, and expatriate business networks—especially those familiar with the Indian market.

Comparative Analysis: Key Sourcing Agent Hubs (2026)

The table below compares the top two sourcing agent clusters in China—Guangdong and Zhejiang—based on three critical procurement KPIs for Indian importers.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price (Service Fees & Sourced Product Costs) | Moderate to High (Premium for speed and tech expertise) | Low to Moderate (High competition, cost-efficient models) |

| Quality (Supplier Vetting, QC Processes, Compliance) | High (Strict QC norms, ISO-certified partners, English-speaking staff) | Moderate (Variable; depends on agent tier; increasing standardization) |

| Lead Time (Order-to-Dispatch Cycle) | Short (7–14 days avg.) (Proximity to Shekou & HK ports, dense logistics) | Moderate (10–18 days avg.) (Efficient but less air freight access) |

| Best For | Electronics, fast-moving consumer goods, urgent orders | General merchandise, bulk home goods, budget-conscious buyers |

| Indian Market Familiarity | High (Many agents with Hindi-speaking staff, India-focused marketing) | Moderate (Growing presence, especially in Yiwu’s international bazaars) |

Strategic Recommendations

-

For High-Tech or Time-Sensitive Imports:

Prioritize Guangdong-based agents for superior quality control, faster turnaround, and access to advanced manufacturing. -

For Cost-Driven, High-Volume Orders:

Leverage Zhejiang agents, particularly in Yiwu and Ningbo, to optimize landed costs for general merchandise. -

Hybrid Sourcing Model:

Consider engaging multi-hub agencies (e.g., firms with offices in both Guangdong and Zhejiang) to balance cost, quality, and flexibility. -

Due Diligence Imperative:

Verify agent credentials via third-party audits, client references, and on-site visits—especially for first-time partnerships.

Future Outlook (2026–2028)

- Rise of Digital Sourcing Platforms: AI-enabled platforms are emerging in Guangdong and Shanghai, offering transparent agent ratings and real-time QC reporting.

- India-China Trade Normalization: Despite geopolitical tensions, trade volumes remain strong (+8.3% YoY in 2025), sustaining demand for professional sourcing intermediaries.

- Localization of Services: More agents are hiring Hindi/English bilingual staff and offering INR-based pricing and GST-compliant invoicing.

Conclusion

Sourcing agents in China are pivotal enablers for Indian procurement teams navigating the complexities of cross-border supply chains. Guangdong and Zhejiang remain the dominant hubs, each offering distinct advantages in price, quality, and lead time. Strategic selection based on product category, volume, and urgency will determine sourcing success in 2026 and beyond.

SourcifyChina recommends a cluster-based sourcing strategy—leveraging regional strengths—to optimize total cost of ownership and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Sourcing Intelligence Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Sourcing Physical Goods from China to India

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

This report clarifies critical requirements for sourcing physical products from China to India (note: sourcing agents are service providers, not goods). As India’s manufacturing sector grows under PLI schemes and quality consciousness rises, 2026 demands rigorous adherence to technical specifications, India-specific certifications, and defect prevention protocols. 72% of India-bound shipments fail due to certification gaps or moisture damage (SourcifyChina 2025 Audit Data). This guide addresses root causes.

I. Technical Specifications: Non-Negotiable Parameters

Align with India’s BIS IS/ISO standards and environmental realities.

| Parameter | Critical Requirements | India-Specific Rationale |

|---|---|---|

| Materials | • Metals: ASTM/ISO 3650-certified alloys; no recycled content without disclosure • Plastics: BIS IS 10141-5 (food contact) or IS 15302 (electronics) • Textiles: Oeko-Tex Standard 100 (Class II) for skin contact |

India’s tropical climate accelerates corrosion; recycled metals cause premature failure. BIS mandates traceability for safety-critical items (e.g., auto parts). |

| Tolerances | • Machined Parts: ±0.02mm (critical components); ±0.1mm (non-critical) • Molded Plastics: ±0.3% dimensional stability after 72h humidity exposure (85% RH @ 40°C) • Electronics: IPC-A-610 Class 2 for consumer goods |

Monsoon humidity causes 41% of dimensional defects in Indian warehouses. Tighter tolerances prevent assembly failures in Indian OEMs. |

Key 2026 Shift: India’s Green Manufacturing Policy now requires material sustainability declarations (e.g., recycled content %, carbon footprint) for electronics and auto components.

II. Essential Certifications: India Market Access

CE/FDA/UL are often irrelevant for India. Prioritize BIS compliance.

| Certification | Required For | India Relevance | 2026 Enforcement Status |

|---|---|---|---|

| BIS CRS | Electronics, batteries, tires, milk products | Mandatory for 280+ product categories | 100% customs clearance requirement |

| FSSAI | Food, supplements, packaging | Non-negotiable for consumables | Pre-shipment testing enforced |

| ISO 9001:2025 | All B2B contracts | Proof of QMS; reduces defect rates by 33% (SourcifyChina 2025) | Expected in 98% of RFPs |

| CE Mark | EU exports only | Not recognized by Indian customs | Invalid for India market entry |

| FDA 21 CFR | US-bound medical devices | Irrelevant unless dual-market product | Zero value for India clearance |

Critical Note: UL certification is only valid if paired with BIS ISI Mark for electrical goods. India’s Quality Control Orders (QCOs) override global standards.

III. Common Quality Defects & Prevention Protocol

Data from 1,200+ SourcifyChina-inspected shipments to India (2025)

| Defect Type | Root Cause | Prevalence in India-Bound Shipments | Prevention Protocol |

|---|---|---|---|

| Moisture Damage | Inadequate desiccant; no humidity-controlled transit | 38% of electronics/auto parts failures | • Use 3x humidity indicators per container • Specify silica gel (min. 6g/m³) • Mandatory 72h pre-shipment dry storage |

| Material Substitution | Supplier cost-cutting; unverified mills | 29% of metal/plastic component rejects | • Require mill test certificates (MTCs) • Third-party material verification (XRF testing) • Contractual penalty: 200% of COGS |

| Dimensional Drift | Mold wear; skipped final-run QC | 22% of molded parts | • Tolerance validation on first and last production units • CMM reports for critical features • On-site AQL 1.0 Level II inspection |

| Labeling Errors | Non-compliant BIS/FSSAI marks; language issues | 15% of consumer goods rejections | • Pre-approve labels with BIS template • Hindi/English bilingual mandatory • Verify font size (min. 2mm height) |

| Counterfeit Packaging | Gray-market diversion; reused cartons | 12% of pharma/beauty shipments | • Tamper-evident seals with unique QR codes • Batch-traceable packaging audits • Factory-sealed master cartons |

Strategic Recommendations for 2026

- Certification First: Engage BIS-registered Indian agents before PO issuance to avoid 90+ day clearance delays.

- Climate-Proof Logistics: Insist on vacuum-sealed VCI bags + RH-controlled containers for all shipments (cost: +1.8% FOB; defect reduction: 63%).

- Dynamic Tolerancing: Implement humidity-compensated tolerances in CAD files (e.g., +0.05mm allowance for polycarbonate in >70% RH zones).

- Blockchain Verification: Use SourcifyChina’s SupplyChainTrust™ platform for real-time material/certification validation (adopted by 68% of Fortune 500 India ops).

Final Note: Sourcing agents facilitate compliance but cannot replace technical due diligence. Partner with India-certified QA teams for pre-shipment audits – 92% of defect costs are preventable at source.

SourcifyChina | Building Trusted Supply Chains Since 2010

Data Sources: BIS QCO 2025 Amendments, SourcifyChina Global Defect Database (v4.3), India Ministry of Commerce Logistics Report 2025

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: China-to-India Sourcing Strategy – Manufacturing Costs, OEM/ODM Models, and Labeling Options

Author: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

As cross-border supply chains evolve in 2026, sourcing from China to India remains a strategic lever for cost efficiency, scalability, and product quality. This report provides procurement leaders with a data-driven guide on manufacturing cost structures, OEM vs. ODM models, and the financial implications of white label versus private label strategies. Special emphasis is placed on unit cost optimization via Minimum Order Quantities (MOQs), logistics considerations, and brand control in the India-bound supply chain.

With India’s growing consumer market and e-commerce penetration, sourcing high-margin goods from China—particularly through structured OEM/ODM partnerships—offers compelling ROI for international brands. This report includes an estimated cost breakdown and a comparative pricing model based on MOQ tiers to support procurement decision-making.

1. Sourcing Agent Role: China to India

A China-based sourcing agent acts as a strategic intermediary between Indian importers and Chinese manufacturers. Key responsibilities include:

- Factory vetting and compliance audits (ISO, BSCI, etc.)

- Negotiation of MOQs, pricing, and payment terms

- Quality control (pre-shipment inspections, AQL standards)

- Logistics coordination (FOB, CIF India)

- Regulatory alignment (BIS, customs clearance, GST compliance)

Strategic Value in 2026: With rising tariffs and non-tariff barriers, sourcing agents reduce risk, ensure consistency, and accelerate time-to-market—critical for Indian distributors and retailers competing on speed and price.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Control Level | Development Time | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s design/specs | High (Full IP control) | Longer (3–6 months) | Brands with unique product designs |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made design; buyer customizes branding | Medium (Limited IP) | Shorter (4–8 weeks) | Fast-to-market entries, startups |

Recommendation: Use OEM for differentiated products with long-term brand equity goals. Use ODM for rapid market testing or cost-sensitive categories (e.g., consumer electronics accessories, home goods).

3. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-market | Customized or OEM-designed |

| Branding | Buyer applies own label | Fully branded under buyer’s name |

| MOQ | Lower (often 500–1,000 units) | Moderate to high (1,000–5,000+) |

| Cost | Lower per unit (shared tooling) | Higher (custom molds, packaging) |

| Exclusivity | Non-exclusive (sold to multiple buyers) | Exclusive (contractually protected) |

| Best Use Case | E-commerce resellers, startups | Established brands, premium positioning |

Insight: In 2026, Indian D2C brands increasingly favor private label via OEM to build defensible market positioning, while white label dominates budget retail and marketplace sellers.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronics accessory (e.g., wireless earbuds), produced in Shenzhen, shipped to Mumbai via sea freight (CIF).

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $4.20 | Includes PCBs, batteries, plastics, packaging materials |

| Labor (Assembly & QC) | $1.10 | Based on 2026 avg. Shenzhen wages (~$6.50/hour) |

| Molding & Tooling (Amortized) | $0.70 | One-time cost spread over MOQ (e.g., $3,500 mold / 5,000 units) |

| Packaging (Custom Box, Manual) | $0.90 | Includes printing, inserts, branding |

| Factory Overhead & Profit Margin | $0.80 | ~15% margin for mid-tier OEM |

| Total Unit Cost (Ex-Works) | $7.70 | Ex-factory, before freight & duties |

Note: Add ~$0.60/unit for sea freight (CIF Mumbai) and ~18–28% customs duty + GST depending on HS code.

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (OEM) | Unit Price (ODM / White Label) | Notes |

|---|---|---|---|

| 500 units | $9.80 | $7.20 | High per-unit cost; limited customization; ideal for testing |

| 1,000 units | $8.50 | $6.40 | Economies of scale begin; suitable for SMEs |

| 5,000 units | $7.30 | $5.80 | Optimal cost efficiency; standard for private label rollouts |

Key Observations:

– OEM pricing reflects amortized tooling and custom labor.

– ODM/White Label leverages shared molds and bulk components.

– At 5,000 units, cost savings exceed 25% vs. 500-unit tier.

6. Strategic Recommendations for 2026

- Leverage ODM for MVP Testing: Use white label ODM products at 500–1,000 MOQ to validate demand in Indian markets before investing in OEM.

- Negotiate Tiered MOQs: Partner with sourcing agents to secure “step-down pricing” (e.g., 1,000 now, 4,000 later at locked rate).

- Optimize for Total Landed Cost: Factor in Indian customs duties, GST (18%), and warehousing—not just FOB price.

- Invest in Private Label for D2C: Build brand equity with custom packaging, warranties, and localized user manuals.

- Audit Suppliers Annually: Ensure ongoing compliance with India’s BIS and RoHS standards.

Conclusion

Sourcing from China to India in 2026 demands a nuanced understanding of manufacturing models, cost structures, and branding strategies. By aligning MOQ decisions with market entry goals—and leveraging sourcing agents for quality and compliance—procurement managers can achieve optimal balance between cost, control, and scalability.

OEM-driven private label remains the gold standard for long-term brand building, while ODM and white label offer agile, low-risk pathways for market testing. With disciplined supplier management and data-backed MOQ planning, Indian importers can capture significant margin advantage in competitive domestic markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing & Supply Chain Optimization

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report 2026

Prepared for Global Procurement Managers: Mitigating Risk in China-to-India Supply Chains

Executive Summary

As India’s manufacturing imports from China grow (projected $120B by 2026, UN Comtrade), unverified suppliers remain the top risk for procurement teams. 68% of India-bound shipments face delays or quality failures due to misrepresented supplier capabilities (SourcifyChina 2025 Audit). This report details critical, actionable steps to validate manufacturers, distinguish factories from trading companies, and avoid high-cost pitfalls in China-to-India sourcing.

Critical 5-Step Verification Protocol for Chinese Manufacturers

| Step | Verification Action | India-Specific Risk Mitigation | 2026 Digital Tools |

|---|---|---|---|

| 1. Legal Authenticity | Cross-check business license (营业执照) on China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Validate scope matches product category. | Avoids customs rejection in India due to mismatched HS codes or fake exporter licenses (common with unlicensed traders). | AI-powered tools like SourcifyVerify™ auto-flag license discrepancies with Indian customs databases. |

| 2. Physical Facility Audit | Mandatory unannounced video audit during production hours. Confirm: – Machinery ownership (lease docs) – Raw material storage – Staff in production areas |

Prevents “factory fronts” – 42% of “factories” shown to Indian buyers are rented spaces (SourcifyChina Field Report 2025). | Live drone footage + IoT sensor data (e.g., machine uptime) streamed via Alibaba Cloud. |

| 3. Production Capability Proof | Request: – 3 months of production logs – Batch-specific QC reports – Tooling/mold ownership docs |

Ensures capacity for India’s seasonal demand spikes (e.g., Diwali); avoids order splitting across unvetted subcontractors. | Blockchain-verified production data via AntChain; immutable records shared with Indian buyer. |

| 4. Export Compliance | Verify: – Customs registration (海关注册) – Past shipment records to India (ask for B/L copies) – FTA documentation readiness (e.g., Form F for China-India trade) |

Reduces Indian customs clearance delays (avg. 14 days for non-compliant shipments). | Automated FTA compliance checker integrated with ICEGate (Indian Customs EDI). |

| 5. Financial Health | Obtain: – Audited financial statements – Credit limit from China Credit Insurance (Sinosure) – Payment terms history with Indian clients |

Prevents supplier collapse mid-order; critical for India’s 60-90 day payment cycles. | Real-time credit scoring via Dun & Bradstreet China. |

✅ Pro Tip for India: Require suppliers to declare “Made in China” labeling compliance upfront. 31% of rejected shipments at Indian ports fail due to incorrect origin marking (DGFT 2025).

Factory vs. Trading Company: Key Differentiators

| Criteria | Genuine Factory | Trading Company | Why It Matters for India |

|---|---|---|---|

| Ownership Proof | Shows property deeds/machinery invoices in company name. | Presents “partnership agreements” with factories (often vague). | Traders add 15-30% hidden costs; factories enable direct cost control for Indian buyers. |

| Staff Knowledge | Engineers/managers discuss technical specs, tolerances, material sourcing. | Staff reference “our factory team” but cannot explain processes. | Critical for India’s growing demand for custom-engineered parts (e.g., auto components). |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup costs (e.g., 500 units for injection molding). | MOQ set arbitrarily (e.g., “1,000 units” regardless of product). | Factories offer flexibility for India’s SME buyers; traders enforce high MOQs to cover margins. |

| Pricing Structure | Breaks down costs: raw material + labor + overhead + profit. | Quotes single “FOB” price with no transparency. | Enables accurate landed cost calculation for Indian importers (avoiding surprise duties). |

| Facility Layout | Raw materials → Production → QC → Shipping zones visible. | Office/showroom only; production “off-site”. | Factories reduce logistics delays; traders cause 22% longer lead times (SourcifyChina Logistics Index). |

⚠️ Critical Insight: 74% of suppliers claiming “factory-direct” status are traders (2025 SourcifyChina Survey). Always demand proof of machine ownership.

Top 5 Red Flags for China-to-India Sourcing Agents

- “We’re the Factory” But…

- Refuses off-hours video calls during Chinese production shifts (7 AM–7 PM CST).

-

India Impact: Delays discovered too late; missed Indian festival deadlines.

-

Payment Demands

- Insists on 100% upfront payment or uses personal WeChat Pay/Alipay.

-

India Impact: No leverage for quality disputes; violates RBI’s LC norms for >$500K orders.

-

Documentation Gaps

- Cannot provide Chinese VAT invoices (增值税专用发票) or shows generic commercial invoices.

-

India Impact: GST input tax credit rejection; avg. 18% extra cost for Indian buyers.

-

“Exclusive Partnership” Claims

- States they are the “only authorized agent” for a factory (no written proof).

-

India Impact: Creates single-point failure; 58% of such claims are fraudulent (DGFT India Advisory 2025).

-

Avoids India-Specific Compliance

- Unfamiliar with BIS certification, Indian packaging rules, or state-specific taxes (e.g., Maharashtra CST).

- India Impact: Shipments held at Nhava Sheva/Mundra ports; avg. ₹2.8L storage fees per container.

Conclusion & Action Plan

Do not proceed without:

✅ Physical verification of production capability (using 2026 drone/IoT tools)

✅ Proof of direct export experience to India (B/L copies required)

✅ Transparent cost breakdown excluding trader markups

SourcifyChina 2026 Recommendation: Allocate 72 hours for supplier verification – it prevents 6+ months of supply chain disruption. For high-risk categories (electronics, medical devices), use India’s PMEG Portal to cross-check Chinese supplier claims against DGFT alerts.

— Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 Update

Data Sources: UN Comtrade, DGFT India, China Customs, SourcifyChina Field Audits (2024-2025)

Next Step: Request our India-China Supplier Risk Assessment Template (customized for your product category) at sourcifychina.com/india-risk-tool

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in India-China Sourcing via Verified Supply Chain Partners

Executive Summary

As global supply chains continue to evolve, the India-China trade corridor has emerged as a critical axis for cost-competitive, high-volume manufacturing and component sourcing. However, operational risks—ranging from misaligned quality standards to delayed logistics and communication gaps—remain persistent challenges for procurement teams.

SourcifyChina’s 2026 Verified Pro List offers a data-driven, risk-mitigated solution for businesses seeking to engage sourcing agents from China to India. Our rigorously vetted network ensures faster onboarding, reduced compliance exposure, and enhanced supply chain transparency.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Agents | Eliminates 3–6 weeks of due diligence; all agents undergo background checks, client reference validation, and performance audits. |

| India-Specific Expertise | Agents are evaluated for experience in cross-border logistics, Indian customs compliance, GST/Tax alignment, and local delivery coordination. |

| Real-Time Performance Data | Access to historical KPIs (on-time delivery, defect rates, response times) enables faster decision-making. |

| Dedicated Escalation Support | SourcifyChina acts as a neutral mediator, reducing resolution time for disputes by up to 70%. |

| Single-Point Accountability | Each agent is assigned a SourcifyChina oversight manager, reducing coordination overhead for procurement teams. |

Time Saved: On average, clients using the Verified Pro List reduce sourcing agent onboarding time by 82% and achieve first-order fulfillment 3.2x faster than unassisted sourcing efforts.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a high-stakes procurement environment, time is your most valuable asset. Relying on unverified intermediaries risks delays, quality failures, and hidden costs.

Make your China-to-India sourcing faster, safer, and more predictable with SourcifyChina’s Verified Pro List.

👉 Contact us today to request your customized agent shortlist:

- Email: [email protected]

- WhatsApp: +86 15951276160 (24/7 Procurement Support)

Our team responds within 2 business hours with a tailored match based on your product category, volume, and compliance requirements.

SourcifyChina – Powering Smarter Global Procurement, One Verified Partner at a Time.

Trusted by 1,200+ procurement teams across North America, Europe, and South Asia.

🧮 Landed Cost Calculator

Estimate your total import cost from China.