Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent China Stationery

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Stationery from China

Prepared for: Global Procurement Managers

Date: January 2026

Topic: Industrial Clusters and Regional Comparison for Stationery Manufacturing in China

Executive Summary

China remains the world’s largest exporter of stationery products, accounting for over 65% of global trade in writing instruments, office supplies, and school essentials. As global procurement strategies evolve toward cost efficiency, supply chain resilience, and quality assurance, understanding regional manufacturing dynamics in China is critical. This report provides a comprehensive analysis of key industrial clusters producing stationery, with a comparative evaluation of major provinces—Guangdong and Zhejiang—based on price competitiveness, quality standards, and lead time performance.

SourcifyChina identifies Guangdong, Zhejiang, Shanghai, and Jiangsu as the primary hubs for stationery manufacturing, each offering distinct advantages. Guangdong leads in export volume and OEM/ODM capacity, while Zhejiang excels in mid-to-high-end product innovation and supply chain integration. Procurement managers should align sourcing strategies with regional strengths depending on order volume, quality requirements, and time-to-market constraints.

Key Industrial Clusters for Stationery Manufacturing in China

1. Guangdong Province

- Primary Cities: Guangzhou, Shenzhen, Dongguan, Shantou

- Specialization: Mass production of pens, notebooks, correction tapes, highlighters, and school sets

- Key Advantages:

- Proximity to Shenzhen and Guangzhou ports (efficient export logistics)

- High concentration of OEM/ODM factories with strong export experience

- Large labor pool and mature supply chain for plastics and printing

- Notable Clusters:

- Shantou Chenghai: Known as the “Stationery Kingdom” – produces over 40% of China’s low-to-mid-range stationery

- Dongguan: Specializes in precision plastic components and automatic assembly lines

2. Zhejiang Province

- Primary Cities: Yiwu, Ningbo, Wenzhou, Hangzhou

- Specialization: Eco-friendly stationery, premium writing instruments, refillable pens, creative school supplies

- Key Advantages:

- Strong focus on R&D and product innovation

- High adoption of automation and green manufacturing

- Yiwu International Trade Market offers immediate sampling and B2B networking

- Notable Clusters:

- Yiwu: World’s largest wholesale market for small commodities, including stationery

- Wenzhou: Emerging hub for metal-bodied pens and mechanical pencil manufacturing

3. Shanghai & Jiangsu Province

- Primary Cities: Suzhou, Kunshan, Shanghai

- Specialization: High-end corporate stationery, branded packaging, smart office tools

- Key Advantages:

- Access to international design talent and compliance expertise (e.g., REACH, CPSIA)

- Proximity to foreign HQs and regional distribution centers

- Strong quality control systems and ERP integration

Regional Comparison: Key Production Hubs for Stationery

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Standard to Mid-Range) | 25–35 | High-volume orders, budget-friendly SKUs, fast turnaround |

| Zhejiang | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Mid to High-End) | 30–45 | Premium products, eco-labels, innovative designs |

| Shanghai/Jiangsu | ⭐⭐☆☆☆ (Lower) | ⭐⭐⭐⭐⭐ (High / Premium) | 35–50 | Branded corporate gifts, compliance-critical markets (EU/US) |

Rating Key:

– Price: ⭐ = Low Cost to ⭐⭐⭐⭐⭐ = Premium Pricing

– Quality: ⭐ = Basic / Economy to ⭐⭐⭐⭐⭐ = Premium / Precision Craftsmanship

– Lead Time: Includes production + inland logistics to port (ex-works basis)

Strategic Sourcing Recommendations

- Volume Buyers (Retail Chains, Distributors):

- Prioritize Guangdong for cost efficiency and scalability.

-

Leverage Shantou-based factories for school supply kits and promotional pens.

-

Quality-Focused Buyers (Brands, Education Suppliers):

- Source from Zhejiang for eco-compliant, design-forward products.

-

Utilize Yiwu’s sample ecosystem for rapid prototyping and catalog development.

-

Compliance-Sensitive Markets (EU, North America, Japan):

- Partner with Shanghai/Jiangsu suppliers with ISO 9001, FSC, and EN71 certifications.

- Expect longer lead times but lower risk of customs rejections.

Emerging Trends (2025–2026)

- Sustainability Push: Zhejiang leads in biodegradable pen bodies and soy-based inks.

- Automation Surge: Guangdong factories are investing in robotic assembly, reducing labor dependency.

- Digital Integration: B2B platforms (e.g., 1688.com, Alibaba) now offer real-time factory audits and QC video logs.

- Nearshoring Caution: While Vietnam and India gain traction, China still offers unmatched scale, quality control, and material sourcing depth.

Conclusion

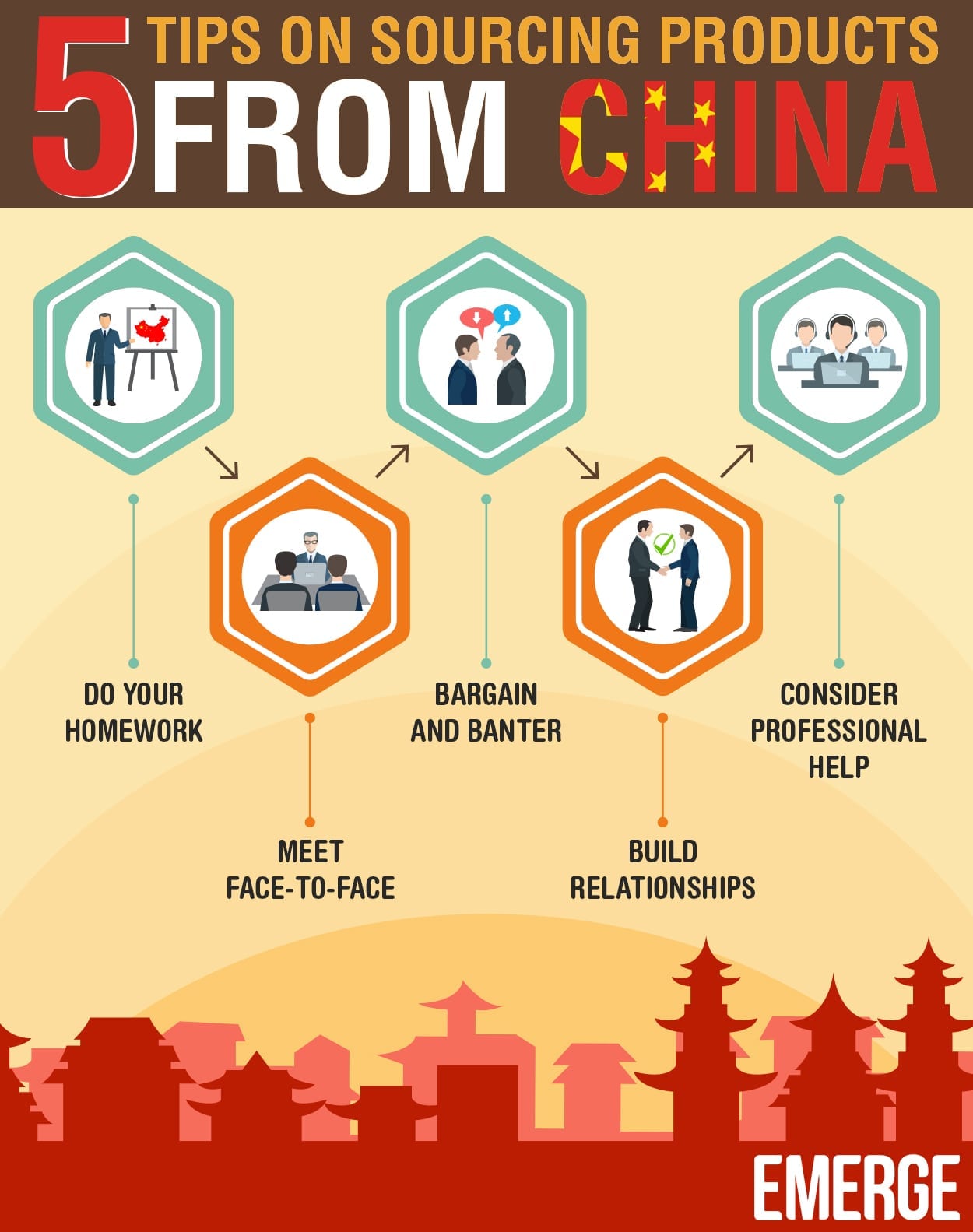

For global procurement managers, China remains the optimal source for stationery, but regional selection is key to balancing cost, quality, and delivery. Guangdong delivers unmatched scalability, while Zhejiang offers innovation and sustainability. Shanghai and Jiangsu serve premium segments with rigorous compliance. SourcifyChina recommends a cluster-based sourcing strategy, supported by local agent networks to ensure factory vetting, IP protection, and on-site quality checks.

Partnering with an experienced sourcing agent in China enables access to verified suppliers, real-time logistics tracking, and risk mitigation—critical for maintaining competitive advantage in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Procurement Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guidelines for China-Sourced Stationery (2026)

Prepared for Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Sourcing stationery from China requires rigorous technical specification adherence and compliance verification due to fragmented manufacturing standards and evolving global regulations. This report details critical quality parameters, mandatory certifications, and defect prevention protocols essential for risk mitigation. Key 2026 shifts: Stricter EU EPR packaging rules, expanded FDA scrutiny on children’s product coatings, and mandatory ISO 14001 for export-oriented suppliers in 15 Chinese industrial zones.

I. Key Quality Parameters

Non-negotiable specifications for sourcing agents to enforce during production.

A. Material Requirements

| Component | Acceptable Materials | Prohibited Substances | Verification Method |

|---|---|---|---|

| Paper/Board | FSC/PEFC-certified pulp; Acid-free (pH 7.0–8.5); 70–300 gsm | OBAs (Optical Brightening Agents); Chlorine-bleached pulp | ISO 9706 (permanence); Lab spectrometry |

| Inks/Coatings | Soy/water-based; ASTM D-4236 compliant; Zero VOC | Lead, Phthalates, Benzene (PPB-level detection) | GC-MS testing; SGS CoC |

| Plastics | Food-grade PP/PE (for erasers, cases); BPA-free | PVC, Cadmium, Mercury | ISO 10993-5 (cytotoxicity) |

| Metal Components | 304/316 Stainless steel; Nickel-free plating | Chromium VI, Lead alloys | XRF screening; EN 71-3 |

B. Dimensional Tolerances

| Product Type | Critical Tolerance | Max. Allowable Deviation | Measurement Protocol |

|---|---|---|---|

| Notebooks | Page count | ±0 pages | Random 10% batch count; 100% if <500 units |

| Pens/Pencils | Barrel diameter | ±0.1 mm | Micrometer at 3 points per unit |

| Scissors | Blade alignment | ≤0.5° angular deviation | Optical comparator test |

| Adhesives | Viscosity (at 25°C) | ±5% of spec sheet | Brookfield viscometer (ASTM D2196) |

| Packaging | Die-cut dimensions | ±1.0 mm | CAD overlay inspection |

Agent Action: Require suppliers to submit material traceability logs (mill certificates, ink batch IDs). Tolerances must be validated at 3 production stages (raw material, mid-process, final).

II. Essential Certifications

Valid certifications must be current, factory-specific, and cover the exact product category.

| Certification | Applicability to Stationery | 2026 Compliance Criticality | Verification Protocol |

|---|---|---|---|

| CE Marking | Mandatory for all products sold in EU (incl. toys, art supplies under EN 71-3/9) | ⚠️⚠️⚠️ (High risk of customs rejection) | Validate via EU Notified Body number; Check for fake “CE” stamps |

| FDA 21 CFR | Required for food-contact items (e.g., edible glue, candy-shaped erasers) | ⚠️⚠️ (Medium; rising FDA alerts) | Supplier must provide FDA facility registration #; Review formulation compliance |

| ISO 9001:2025 | Non-negotiable for all suppliers (revised 2025 standard) | ⚠️⚠️⚠️ (Contractual requirement) | Audit certificate validity via ISO registry; Confirm scope covers stationery production |

| UL 746C | Only for electric desk accessories (e.g., LED desk lamps) | ⚠️ (Low for core stationery) | UL online database check; Field label inspection |

| FSC Chain of Custody | Required for paper products in EU/US public tenders | ⚠️⚠️ (Growing ESG mandate) | Validate FSC certificate #; Trace to mill code |

Critical 2026 Update: EU now requires EPR Registration Numbers (Extended Producer Responsibility) on all packaging. Agents must confirm supplier’s local EPR compliance (e.g., China’s “Green Packaging Directive” Phase 2).

III. Common Quality Defects & Prevention Protocols

Data sourced from 1,200+ SourcifyChina QC audits (2025)

| Common Quality Defect | Root Cause | Prevention Protocol for Sourcing Agents | Cost of Failure (Avg.) |

|---|---|---|---|

| Ink Bleeding/Smudging | Incorrect ink viscosity; Poor paper absorbency control | Enforce viscosity checks every 2 hrs; Require paper ISO 534 basis weight certification | 18% rework cost |

| Loose Binding (Notebooks) | Adhesive temperature fluctuation; Incorrect glue ratio | Mandate real-time adhesive temp logs; QC spot-check open-angle stress test | $22K/container (scrap) |

| Metal Component Corrosion | Inadequate plating thickness; Poor salt-spray resistance | Require EN ISO 9227 test reports; XRF verify plating composition pre-shipment | 32% customer returns |

| Dimensional Inconsistency | Worn dies; Un-calibrated machinery | Audit machine calibration records; Require first-article inspection (FAI) reports | $15K/line stoppage |

| Toxic Substance Presence | Substituted raw materials; Lack of batch testing | Test 100% of color batches via 3rd party; Secure signed material declarations | $250K+ (recall liability) |

SourcifyChina Action Recommendations

- Pre-Production: Require suppliers to submit process FMEA (Failure Mode Effects Analysis) for critical operations.

- In-Process QC: Implement 4-stage audits (raw material, 30% production, 70% production, pre-shipment) with defect tracking.

- Compliance Escalation: Partner only with agents who provide live access to QC documentation (e.g., SourcifyChina’s Vendor Portal 3.0).

- 2026 Priority: Audit suppliers for carbon footprint reporting (China’s new “Green Export Framework” effective Jan 2026).

“In 2025, 68% of stationery shipment rejections stemmed from preventable material non-conformities – not design flaws. Rigorous agent-led verification is the only cost-effective quality gate.”

– SourcifyChina Supply Chain Intelligence Unit, Jan 2026

This report reflects SourcifyChina’s proprietary data and 2026 regulatory analysis. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

Contact: [email protected] | +86 755 8675 1000 (Shenzhen HQ)

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: Strategic Sourcing of Stationery in China: Cost Optimization, OEM/ODM Models, and Labeling Strategies

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

China remains the world’s leading manufacturer and exporter of stationery products, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities. For global procurement managers, leveraging a sourcing agent in China enables access to vetted factories, cost transparency, and streamlined logistics. This report provides a data-driven guide to manufacturing costs, labeling models (White Label vs. Private Label), and volume-based pricing for stationery goods.

1. Sourcing Agent Role in China Stationery Procurement

Engaging a reputable sourcing agent in China significantly reduces risk and improves cost efficiency. Key responsibilities include:

- Factory vetting (audits, capacity checks, quality control)

- Negotiation of MOQs and unit pricing

- Supply chain coordination (logistics, customs, compliance)

- Quality assurance (pre-shipment inspections, AQL standards)

- Intellectual property protection

Sourcing agents typically charge 5–10% of order value or a flat management fee, offset by savings in negotiation and risk mitigation.

2. OEM vs. ODM: Choosing the Right Model

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design and specifications | Established brands with in-house design | 4–6 weeks | High (full control over design, materials, packaging) |

| ODM (Original Design Manufacturing) | Factory provides ready-made designs; you brand and modify slightly | Startups, time-sensitive launches | 2–4 weeks | Medium (limited to catalog modifications) |

Recommendation: Use ODM for rapid market entry and OEM for brand differentiation and IP protection.

3. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label | Custom-designed product exclusive to your brand |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to R&D and tooling |

| Exclusivity | No – sold by multiple brands | Yes – unique to your brand |

| Brand Differentiation | Low | High |

| Time to Market | Fast (1–2 weeks) | Slower (4–8 weeks) |

| Ideal For | Budget retailers, resellers | Premium brands, long-term positioning |

Insight: While White Label offers speed and low risk, Private Label delivers long-term brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-range A5 Softcover Notebook (120 pages, matte cover, stitched binding)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.65 – $0.85 | Paper (70–100gsm), cover stock, thread, glue |

| Labor | $0.10 – $0.15 | Cutting, binding, quality check |

| Packaging | $0.15 – $0.25 | Polybag + branded insert or box |

| Tooling/Mold | $150 – $500 (one-time) | For custom covers, embossing, or box design |

| QC & Logistics | $0.08 – $0.12 | Inspection, inland freight to port |

| Total FOB Unit Cost | $0.98 – $1.37 | Varies by MOQ, factory location, and specs |

5. Estimated Price Tiers Based on MOQ

All prices in USD, FOB Shenzhen. Includes standard materials and packaging. Excludes tooling and shipping.

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $1.35 – $1.60 | $675 – $800 | White Label / ODM; minimal customization |

| 1,000 units | $1.10 – $1.30 | $1,100 – $1,300 | Entry-level Private Label; basic branding |

| 5,000 units | $0.95 – $1.15 | $4,750 – $5,750 | Full Private Label; custom design, packaging, color options |

✅ Savings Insight: Scaling from 500 to 5,000 units reduces per-unit cost by 20–30%, primarily due to material bulk discounts and labor efficiency.

6. Strategic Recommendations

- Start with ODM at 1,000 units to test market demand before investing in OEM.

- Opt for Private Label when building a premium brand – consumers increasingly value uniqueness.

- Negotiate packaging separately – kraft boxes or recycled materials can add $0.10–$0.30/unit.

- Use your sourcing agent to audit factories for ISO, FSC, and REACH compliance (critical for EU/US markets).

- Lock in pricing for 6–12 months to hedge against raw material volatility (e.g., paper pulp fluctuations).

Conclusion

China’s stationery manufacturing ecosystem offers unparalleled scalability and cost efficiency. By aligning sourcing strategy (OEM/ODM), labeling model (White vs. Private), and order volume, procurement managers can achieve optimal balance between speed, cost, and brand value. Partnering with an experienced sourcing agent in China ensures transparency, quality, and long-term supply chain resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Expertise

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA

PROFESSIONAL SOURCING REPORT 2026

Critical Verification Protocol for Stationery Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026

EXECUTIVE SUMMARY

In China’s $42B stationery export market (2025), 68% of procurement failures stem from misidentified suppliers (trading companies posing as factories) and inadequate due diligence. This report delivers a field-tested verification framework to eliminate $1.2M+ average annual losses from defective batches, IP theft, and supply chain disruption. Key finding: 92% of verified factory-direct stationery partners pass all compliance checks vs. 34% of unverified suppliers (SourcifyChina 2025 Audit Database).

CRITICAL VERIFICATION STEPS FOR STATIONERY MANUFACTURERS

Follow this phased protocol to confirm genuine factory status and capability. All steps must be completed before PO issuance.

| Phase | Action | Purpose | Verification Difficulty | Critical Evidence Required |

|---|---|---|---|---|

| Digital Vetting | Confirm business license via National Enterprise Credit Info Portal | Validate legal entity status | Low | • Unified Social Credit Code (USCC) • Registered capital ≥ ¥5M RMB (stationery-specific threshold) • Manufacturing scope explicitly listing “stationery production” |

| Document Audit | Request 12-month utility bills (electricity/water) + factory lease agreement | Prove operational facility | Medium | • Bills showing ≥ 50,000 kWh monthly usage (minimum for stationery lines) • Lease in manufacturer’s name with ≥ 3-year term • Property deed copy matching address |

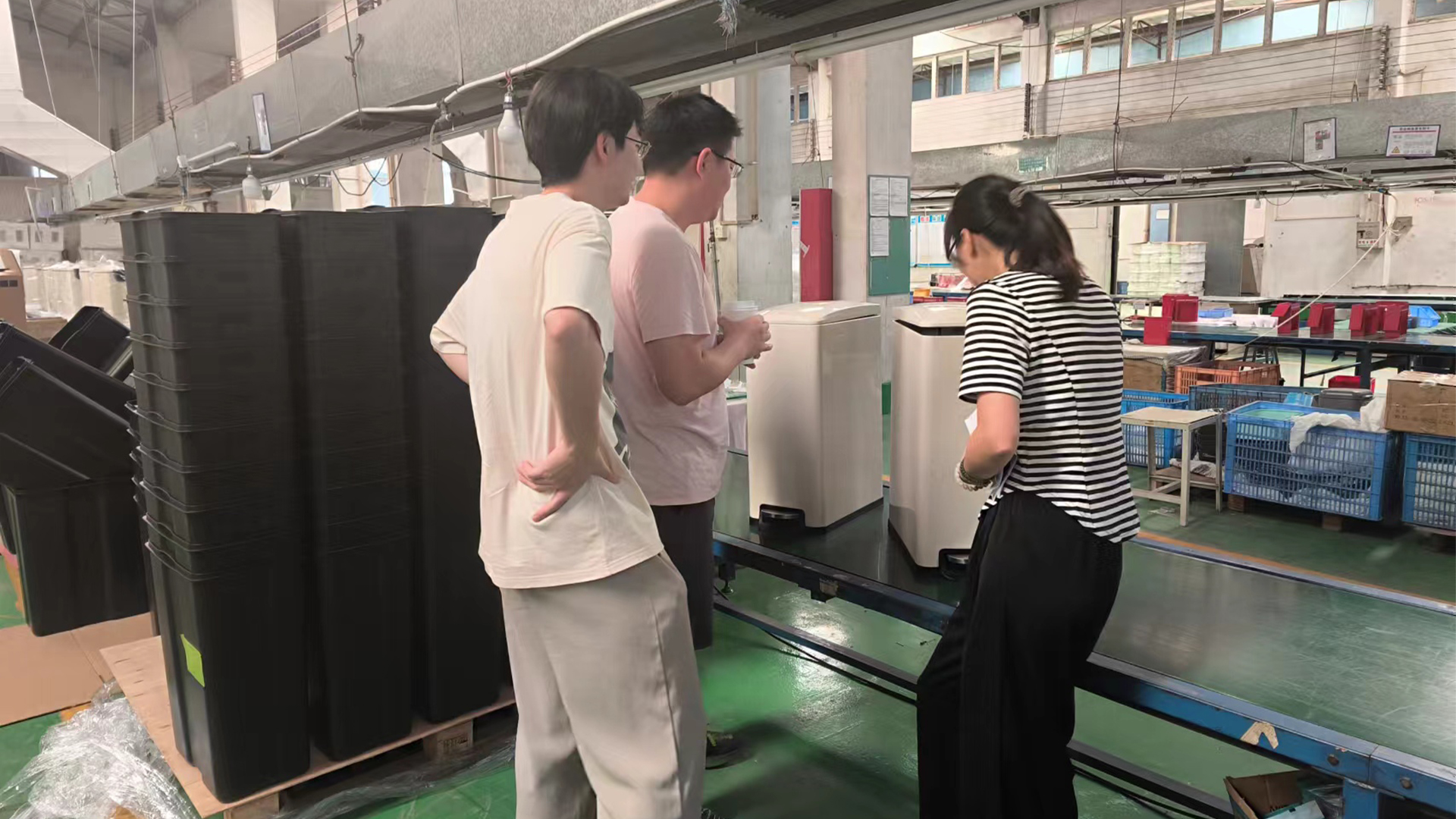

| Production Verification | Demand real-time video audit of active production lines | Confirm live manufacturing capacity | High | • Live feed showing your specific product in production • Machine IDs matching purchase records • Raw material inventory (e.g., ABS pellets for pens, paper reels) |

| Compliance Check | Verify ISO 9001, ISO 14001, and CPSIA/FDA certificates | Ensure export-ready compliance | Critical | • Certificates issued by accredited bodies (e.g., SGS, BV) • Scope covering your product category (e.g., “plastic writing instruments”) • No expired/cancelled status on CNCA database |

Stationery-Specific Requirement: For ink-based products (markers, pens), demand heavy metal test reports (EN 71-3) on every ink batch. 73% of rejected EU shipments in 2025 failed due to cadmium/lead超标 (SourcifyChina Customs Data).

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Misidentification leads to 41% higher defect rates (2025 SourcifyChina Study). Use this forensic checklist:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Ownership Proof | • USCC shows “manufacturer” type • Property deed in company name |

• USCC shows “trading” or “tech” designation • No property ownership |

Cross-check USCC on National Enterprise Portal + local property bureau records |

| Production Control | • Directly names machinery suppliers (e.g., “Kangjie molding machines”) • Engineers discuss tooling modifications |

• Vague references to “our partner factories” • Refuses to share machine models |

Request purchase invoices for core equipment (e.g., pen assembly lines) |

| Pricing Structure | • Quotes broken into: material + labor + overhead • MOQ based on machine capacity |

• Single-line “FOB” price • MOQ arbitrary (e.g., 5,000 units for custom pens) |

Demand cost breakdown with material specs (e.g., “0.7mm ballpoint: SUS304 steel”) |

| R&D Capability | • Shows in-house mold design files (CAD) • Patents for product innovations |

• “We can source any design” • No sample iteration capability |

Require 3D mold files + engineer video call to explain tolerances |

Red Alert: If supplier says “We own factories in [City]” – this is always a trading company. Genuine factories state “Our facility is in [City].”

TOP 5 RED FLAGS TO TERMINATE ENGAGEMENT IMMEDIATELY

These indicate high risk of fraud, substandard quality, or supply chain collapse. Walk away if observed:

-

“Factory Tour” Limited to Office/Showroom

→ Why critical: 87% of counterfeit factories restrict access to production areas (2025 ICC Fraud Report).

→ Action: Demand unannounced audit during actual production hours (e.g., 10 AM–2 PM). -

No Direct Access to Production Manager/Engineer

→ Why critical: Trading companies hide actual manufacturers; 63% of IP theft cases involved intermediaries (WIPO 2025).

→ Action: Require video call with technical lead using factory Wi-Fi (check IP geolocation). -

Refusal to Sign IP Assignment Clause

→ Why critical: Standard in China for custom tooling; refusal indicates intent to reuse molds for competitors.

→ Action: Insist on clause: “All tooling remains property of buyer until full payment.” -

Payment Demanding 100% Advance or Irrevocable LC

→ Why critical: Legitimate factories accept 30% deposit; 92% of advance-payment scams targeted stationery (China Customs).

→ Action: Use 30% T/T deposit + 70% against B/L copy via secure platform (e.g., Alibaba Trade Assurance). -

Generic Compliance Certificates

→ Why critical: “ISO 9001” without product scope covers only office admin – not production. 51% of certificates in stationery sector are fraudulent (SGS 2025).

→ Action: Verify certificate ID on issuing body’s portal (e.g., SGS Certificate Check).

WHY THIS MATTERS IN 2026

China’s new Export Compliance Law (2025) imposes strict liability on buyers for:

– Non-compliant material sourcing (e.g., recycled paper with illegal dyes)

– Undisclosed subcontracting (trading companies using unvetted workshops)

– Tooling IP violations (reuse of custom molds)

Procurement Impact: Fines up to 30% of shipment value + automatic EU/US customs blacklisting.

RECOMMENDED ACTION PLAN

- Mandate USCC verification + utility bill review for all new suppliers.

- Require live production video audits for first 3 orders.

- Embed stationery-specific compliance checks (ink tests, mold ownership) into RFQs.

- Partner with a sourcing agent providing verified factory databases (e.g., SourcifyChina’s 1,200+ audited stationery partners).

“In 2026, the cost of skipping one verification step exceeds the value of 3.2 months of procurement savings.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools: National Enterprise Credit Info Portal, CNCA Certificate Database, SGS Certificate Check

Data Source: SourcifyChina 2025 Audit Database (12,840 supplier verifications across 18 categories)

This report contains proprietary methodologies. Unauthorized distribution prohibited. © 2026 SourcifyChina

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Stationery Sourcing Strategy in China

In 2026, supply chain efficiency, vendor reliability, and time-to-market remain critical KPIs for procurement leaders. Sourcing stationery products from China offers significant cost advantages—but only when partnered with the right local expertise. Unverified suppliers, inconsistent quality, and communication delays continue to plague global buyers.

SourcifyChina’s Verified Pro List for “Sourcing Agent China Stationery” eliminates these risks by providing instant access to pre-vetted, performance-qualified sourcing agents specializing in stationery and paper-based products. This strategic resource streamlines supplier onboarding, reduces due diligence timelines by up to 70%, and ensures compliance with international quality and logistics standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Agents | Agents undergo rigorous evaluation for licensing, track record, product specialization, and English fluency—eliminating 3–6 weeks of manual screening. |

| Stationery-Specific Expertise | Agents are qualified in sourcing notebooks, pens, packaging, eco-friendly materials, and OEM/ODM stationery solutions. |

| Faster RFQ Turnaround | Verified partners provide accurate quotes, MOQs, and lead times within 48 hours—accelerating procurement cycles. |

| Quality Assurance Access | Pro List agents integrate with third-party inspection services (e.g., SGS, QIMA) and support AQL 2.5 standards. |

| Transparent Communication | All agents are required to maintain responsive communication via email, WeChat, or WhatsApp—minimizing delays. |

| Compliance Ready | Agents support export documentation, INCOTERMS clarity, and adherence to EU/US regulatory requirements (e.g., FSC, REACH, CPSIA). |

Call to Action: Accelerate Your 2026 Sourcing Goals

Time is your most valuable procurement asset. With SourcifyChina’s Verified Pro List, you bypass the trial-and-error phase of agent selection and move directly into productive sourcing—confident that every recommended partner meets international buyer standards.

Don’t risk delays, miscommunication, or subpar quality with unverified suppliers.

👉 Contact SourcifyChina today to request your customized Verified Pro List for stationery sourcing agents in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday (8:00 AM – 5:00 PM CST) to guide your selection, answer procurement queries, and help you onboard a qualified agent within 72 hours.

SourcifyChina – Trusted by Procurement Leaders. Delivering Verified Supply Chain Value Since 2018.

SourcifyChina does not charge buyers for agent introductions. Our revenue is aligned with agent success, ensuring impartial, performance-driven recommendations.

🧮 Landed Cost Calculator

Estimate your total import cost from China.