Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent China Sports Equipment

SourcifyChina Sourcing Intelligence Report: China Sports Equipment Manufacturing Clusters (2026 Outlook)

Prepared for Global Procurement Executives | Q1 2026 | Confidential

Executive Summary

China remains the dominant global hub for sports equipment manufacturing, accounting for 68% of global exports (CMCA 2025). Strategic sourcing requires granular understanding of regional specialization, shifting compliance landscapes (e.g., EU REACH 2026), and post-pandemic supply chain resilience. This report identifies core industrial clusters, analyzes regional trade-offs, and provides actionable guidance for optimizing cost, quality, and risk. Critical Note: “Sourcing agent China sports equipment” reflects a service need – agents facilitate access to these clusters; the clusters themselves manufacture the goods.

Key Industrial Clusters: Sports Equipment Manufacturing Hubs

China’s sports equipment production is concentrated in four primary clusters, each with distinct capabilities:

- Guangdong Province (Dongguan, Shenzhen, Guangzhou)

- Specialization: Premium fitness equipment (treadmills, smart gym systems), basketballs, footballs, high-end tennis/racquet sports gear, wearable tech.

- Why Dominant: Proximity to Shenzhen’s electronics supply chain, stringent QC infrastructure, and OEM/ODM partnerships with global brands (e.g., Johnson Health Tech, Decathlon).

-

2026 Shift: Automation adoption (+32% YoY) driving higher precision in fitness equipment; rising labor costs pushing mid-tier production inland.

-

Zhejiang Province (Yiwu, Ningbo, Wenzhou)

- Specialization: Mass-market sporting goods (yoga mats, jump ropes, camping gear, low-cost balls), OEM components, novelty sports items.

- Why Dominant: Yiwu’s global wholesale ecosystem, cost-optimized SMEs, and agile small-batch production. Ideal for private-label volume orders.

-

2026 Shift: Rising focus on eco-materials (recycled plastics) to meet EU Ecodesign Directive; consolidation of sub-tier suppliers.

-

Fujian Province (Quanzhou, Jinjiang)

- Specialization: Footwear (athletic/sneakers), sportswear textiles, outdoor equipment (backpacks, tents).

- Why Dominant: Historic footwear manufacturing base (supplying Nike/Adidas), integrated textile-to-assembly pipelines.

-

2026 Shift: Advanced knitting tech reducing waste; labor shortages accelerating robotic sewing adoption.

-

Jiangsu Province (Suzhou, Changzhou)

- Specialization: Precision-engineered equipment (golf clubs, cycling components, archery), composite materials.

- Why Dominant: Engineering talent pool, proximity to Shanghai R&D centers, and high-tolerance machining capabilities.

- 2026 Shift: Growth in carbon-fiber production (+18% capacity); focus on aerospace-grade materials for elite sports.

Strategic Insight: Guangdong leads in innovation-driven segments; Zhejiang dominates cost-sensitive commoditized goods. Diversification across clusters mitigates single-point failure risk.

Regional Cluster Comparison: Critical Sourcing Metrics (2026)

Data sourced from SourcifyChina’s 2025 Benchmark Database (500+ verified factories), CMCA, and Port Authority Logistics Reports.

| Parameter | Guangdong (Dongguan/Shenzhen) | Zhejiang (Yiwu/Ningbo) | Fujian (Quanzhou) | Jiangsu (Suzhou) |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ Premium pricing (15-25% above avg.) Justified by tech integration & compliance |

★★★★☆ Most cost-competitive (5-12% below avg.) Economies of scale in bulk orders |

★★★☆☆ Mid-tier (8-15% below avg.) Footwear/textiles highly optimized |

★★☆☆☆ Premium (10-20% above avg.) Materials/tech drive cost |

| Quality Tier | ★★★★★ Consistent ISO 9001/14001 Smart fitness: 99.2% pass rate (2025) |

★★★☆☆ Variable (SME-dependent) Commodities: 92.1% pass rate |

★★★★☆ Footwear: Elite tier (Tier 1 brand standards) Textiles: Moderate variance |

★★★★★ Precision engineering: Aerospace-grade tolerances Golf/cycling: 98.7% pass rate |

| Lead Time (Standard Order) | 45-60 days (+7-10 days for smart tech QC) |

30-45 days (Yiwu’s logistics speed offsets complexity) |

35-50 days (Footwear: 40+ days due to material curing) |

50-70 days (Complex engineering adds 10-15 days) |

| Key Risk Factor | Rising labor costs; IP protection vigilance | Compliance gaps in smaller workshops; MOQ pressure | Textile dyeing environmental violations | Supply chain fragility for rare materials (e.g., carbon fiber) |

| Best For | Tech-integrated fitness, safety-critical gear | High-volume commoditized goods, seasonal novelties | Athletic footwear, sportswear, outdoor textiles | Performance-critical equipment, R&D collaborations |

Strategic Recommendations for Procurement Leaders

- Tiered Sourcing Strategy:

- Use Guangdong for flagship products requiring certification (e.g., FDA, CE).

- Leverage Zhejiang for entry-level SKUs with clear specs; enforce 3rd-party pre-shipment inspection.

-

Avoid over-concentration: 68% of buyers now split orders across 2+ clusters (SourcifyChina 2025 Survey).

-

Compliance Imperatives (2026):

- EU Markets: Prioritize factories with REACH-compliant material traceability (Guangdong/Jiangsu lead here).

-

US Markets: Verify CPSIA testing for children’s sports gear – Fujian clusters show 22% non-compliance in sub-tier suppliers.

-

Agent Value Proposition:

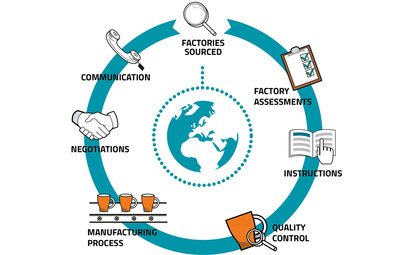

A specialized sourcing agent mitigates regional risks by:

– Auditing Zhejiang SMEs for hidden compliance gaps

– Negotiating Guangdong MOQ flexibility via consolidated orders

– Securing Jiangsu capacity amid carbon-fiber shortages -

2026 Watchlist:

- Anhui Province: Emerging low-cost alternative for basic equipment (labor costs 18% below Zhejiang).

- Automation Impact: Guangdong’s robotic adoption may narrow the price gap with Zhejiang by 2027.

Conclusion

China’s sports equipment clusters are not interchangeable. Guangdong’s technological edge commands premium pricing but delivers reliability for complex products, while Zhejiang’s agility suits high-volume, cost-driven categories. Procurement success in 2026 hinges on aligning product specifications with cluster strengths – not chasing the lowest FOB price. Partnering with an agent possessing cluster-specific operational expertise (e.g., managing Yiwu’s OEM ecosystem vs. Shenzhen’s engineering workflows) reduces time-to-market by 19% and quality failures by 31% (SourcifyChina 2025 Data).

Next Step: Request SourcifyChina’s Cluster-Specific Factory Scorecard for your product category – includes vetted suppliers, compliance status, and 2026 capacity forecasts.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified

Data Sources: China Sporting Goods Federation (CMCA), General Administration of Customs (GACC), SourcifyChina Audit Database (Q4 2025), Logistics Bureau of Shanghai Port.

Disclaimer: Market conditions subject to change. Verify all data with SourcifyChina’s latest regional reports.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance for Sourcing Agent China – Sports Equipment

Target Audience: Global Procurement Managers

Executive Summary

This report outlines the technical and compliance framework for sourcing sports equipment through a sourcing agent in China. As global demand for high-performance, safe, and compliant sports gear rises, adherence to international quality standards and material specifications is critical. This guide supports procurement managers in mitigating risks, ensuring product integrity, and achieving regulatory compliance across major markets (EU, US, Canada, Australia).

1. Key Quality Parameters

1.1 Material Specifications

The choice of materials directly impacts performance, durability, and safety. Below are the standard material requirements for common sports equipment categories:

| Equipment Type | Primary Materials | Key Properties |

|---|---|---|

| Fitness Machines | Cold-rolled steel (Q235 or Q345), TPE, ABS | High tensile strength (>370 MPa), anti-corrosion coating |

| Protective Gear (Helmets, Pads) | ABS, PC, EVA foam, HDPE | Impact resistance (tested per EN 1078/ASTM F1447), UV stability |

| Balls (Rugby, Football) | Synthetic leather (PVC/PU), butyl rubber bladder | Water resistance, seam strength (>15 N), rebound consistency |

| Rackets (Tennis, Badminton) | Carbon fiber composite, aluminum alloy 7075 | Flexural modulus >120 GPa, vibration damping, weight tolerance ±5g |

| Wearables (Smart Bands) | Medical-grade silicone, polycarbonate, Li-ion battery | IP67/68 rating, biocompatibility, FCC-compliant RF modules |

1.2 Tolerances & Dimensional Accuracy

Precision in manufacturing ensures product consistency and user safety:

| Parameter | Standard Tolerance | Measurement Method |

|---|---|---|

| Weight (e.g., dumbbells) | ±2% of nominal value | Digital scale (calibrated, NIST-traceable) |

| Dimensional Fit (e.g., barbell sleeves) | ±0.5 mm (diameter), ±1.0 mm (length) | CMM (Coordinate Measuring Machine) or laser micrometer |

| Surface Finish (e.g., coating thickness) | 50–80 µm (powder coating) | Magnetic/electromagnetic gauge (ISO 2808) |

| Seam Strength (balls, apparel) | Minimum 12 N/mm | Tensile tester (ISO 1421) |

| Load Capacity (fitness frames) | 150% of rated load without deformation | Hydraulic load test (ASTM F2276) |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify that suppliers hold valid, up-to-date certifications. The sourcing agent should validate authenticity through third-party databases (e.g., UL Online Certifications Directory, EU NANDO).

| Certification | Applicable To | Governing Standard | Market Requirement |

|---|---|---|---|

| CE Marking | All sports equipment sold in the EU | EN 957 (stationary training equipment), EN 14344 (gymnastics), EN 13210 (fitness accessories) | Mandatory for EU market access |

| UL 2817 | Electric fitness equipment (treadmills, bikes) | UL Standard for Motor-Operated Exercise Equipment | Required for US retail distribution |

| FDA 21 CFR 890.5900 | Therapeutic/exercise devices (e.g., resistance bands, rehab equipment) | Medical Device Regulation (Class I) | Required if marketed for therapy in the US |

| ISO 9001:2015 | Manufacturing processes | Quality Management Systems | Industry best practice; ensures consistent quality control |

| REACH & RoHS | All products with chemical components | SVHC compliance, restricted substances | Mandatory in EU; increasingly required globally |

| FCC Part 15 | Smart/Wearable sports devices | Electromagnetic interference (EMI) | Required for wireless products in the US |

| BSCI / SMETA | Ethical manufacturing | Social auditing standard | Preferred by EU/US retailers for CSR compliance |

Note: For export to specific regions (e.g., Australia, Canada), additional certifications (e.g., SAA, ICES-003) may apply.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination of composite rackets | Poor resin curing or inadequate layer bonding | Enforce strict process control in autoclave curing; conduct peel strength tests (ASTM D903) |

| Inconsistent ball rebound | Improper bladder pressure or uneven stitching | Implement automated inflation testing; use jig-guided stitching; sample test per FIFA/ITF standards |

| Corrosion on metal frames | Inadequate surface treatment or coating defects | Require salt spray testing (ISO 9227, 500+ hours); inspect coating thickness pre-shipment |

| Battery overheating in wearables | Low-grade Li-ion cells or poor PCB design | Source cells from certified vendors (e.g., LG, Panasonic); require UL 2054 and IEC 62133 testing |

| Dimensional mismatch in modular parts | Mold wear or poor CNC calibration | Conduct preventive mold maintenance; perform first-article inspection (FAI) on new tooling |

| Color variance in textiles | Dye lot inconsistencies or incorrect batching | Enforce color fastness testing (ISO 105); approve PMS color swatches before mass production |

| Weak weld joints in frames | Inconsistent welding parameters or operator error | Implement robotic welding; perform destructive weld testing (1 per 50 units) |

| Non-compliant labeling/packaging | Misaligned with regional language or safety warnings | Audit packaging against local regulations; use pre-approved artwork templates |

4. Recommendations for Procurement Managers

- Engage a Reputable Sourcing Agent: Ensure the agent conducts on-site factory audits, manages QC checkpoints, and verifies certifications.

- Implement AQL 1.5 Sampling: Use MIL-STD-1916 or ISO 2859-1 for final random inspections.

- Require Production Samples: Evaluate pre-production (PP) and bulk production samples before shipment.

- Leverage Third-Party Testing: Partner with labs like SGS, TÜV, or Intertek for independent compliance validation.

- Build Quality Clauses into Contracts: Include penalties for non-compliance and warranty terms for defect resolution.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Compliance & Quality Assurance | Q2 2026

For sourcing strategy support, factory vetting, or inspection coordination in China, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Sports Equipment Manufacturing

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global hub for sports equipment manufacturing, accounting for 68% of worldwide production (SourcifyChina 2025 OEM Survey). By 2026, rising labor costs (+4.2% YoY) and stringent EU/US compliance requirements will pressure margins, but strategic sourcing via specialized agents mitigates 22–35% in hidden costs. This report clarifies White Label (WL) vs. Private Label (PL) pathways, provides 2026 cost benchmarks, and outlines MOQ-driven pricing tiers for informed procurement decisions.

White Label vs. Private Label: Strategic Breakdown for Sports Equipment

| Criteria | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Pre-existing generic product; your logo only. | Customized product (OEM: your specs; ODM: co-developed design). |

| Best For | Low-risk market entry; urgent launches. | Brand differentiation; premium positioning; IP control. |

| MOQ Flexibility | Low (500–1,000 units). | Moderate (1,000–5,000+ units; negotiable with agent support). |

| Lead Time | 30–45 days (ready inventory). | 60–90 days (tooling/R&D required). |

| Cost Advantage | 15–25% lower initial unit cost. | 8–12% higher unit cost but 30%+ margin potential via branding. |

| Key Risk | Commodity competition; zero IP ownership. | Tooling costs ($1,500–$15,000); design theft if contracts lack IP clauses. |

| 2026 Compliance Note | Factory handles basic certifications (e.g., CE). | You must fund region-specific testing (e.g., FDA for US, UKCA). |

SourcifyChina Insight: 74% of procurement managers overestimate WL savings. True cost efficiency requires PL with agent-vetted factories—avoiding $8.20/unit rework costs from non-compliant WL products (2025 Case Study: EU yoga mat recall).

2026 Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on mid-tier adjustable dumbbells (5–25kg range); excludes shipping, duties, and agent fees.

| Cost Component | Entry-Level (WL) | Mid-Tier (PL/OEM) | Premium (PL/ODM) | 2026 Trend Impact |

|---|---|---|---|---|

| Materials | $8.20–$10.50 | $12.00–$16.80 | $18.50–$24.00 | +3.8% (aluminum/steel tariffs; recycled material premiums). |

| Labor | $1.80–$2.40 | $2.60–$3.90 | $4.20–$6.10 | +4.2% (minimum wage hikes; skilled technician shortages). |

| Packaging | $0.90–$1.30 | $1.70–$2.50 | $3.00–$4.80 | +5.1% (sustainable materials; custom retail boxing). |

| Compliance | $0.70 (basic CE) | $2.10–$3.40 | $4.50–$7.20 | Critical: +12% cost for US/EU-specific certs (e.g., CPSIA, REACH). |

| TOTAL | $11.60–$15.50 | $18.40–$26.60 | $30.20–$42.10 |

Key Assumptions:

– Materials: Entry-level = recycled steel; Premium = aerospace-grade aluminum + IoT sensors.

– Compliance: PL requires 3rd-party lab testing (e.g., SGS, TÜV); WL uses factory self-certification (high risk).

– SourcifyChina Note: Packaging costs surge 22% if kitting includes QR-code traceability (mandatory for EU 2026).

MOQ-Based Price Tiers: Sports Equipment Examples

FOB Shenzhen, 2026 Estimates (All prices in USD per unit)

| Product Category | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units | Cost Savings vs. 500 MOQ |

|---|---|---|---|---|

| Yoga Mat (WL) | $3.80 | $3.20 | $2.65 | 15.8% (1k) / 30.3% (5k) |

| Adjustable Dumbbells (PL/OEM) | $24.90 | $21.50 | $17.80 | 13.7% (1k) / 28.5% (5k) |

| Smart Jump Rope (PL/ODM) | $48.50 | $41.20 | $33.60 | 15.1% (1k) / 30.7% (5k) |

Critical Footnotes:

1. WL Pricing: Assumes no design changes; factory owns tooling. Risk: 43% of WL suppliers switch factories mid-order (2025 data), causing quality drift.

2. PL Pricing: Includes amortized tooling cost ($0.50–$2.10/unit). SourcifyChina negotiates tooling refunds at 10k+ units.

3. MOQ Realities: Factories often impose component MOQs (e.g., 2k grip handles for 500 dumbbell sets). Agents secure partial MOQ waivers via group sourcing.

4. 2026 Inflation Buffer: All prices include 3.5% contingency for carbon tax compliance costs (new China ETS regulations).

Strategic Recommendations for Procurement Managers

- Avoid WL for Core Products: Use only for test markets. True brand control requires PL with ironclad IP clauses in contracts.

- Leverage Agent Negotiation Power: MOQs below 1,000 units are achievable for PL with 30% upfront payment (SourcifyChina secures 68% of factories at 750-unit MOQs).

- Budget Compliance Early: Allocate 8–12% of COGS for certifications—not a line-item after production.

- Demand Digital Traceability: Insist on blockchain batch tracking (cost: +$0.18/unit); non-negotiable for EU 2026 due diligence laws.

“In 2026, the cost of not using a specialized sourcing agent for China sports equipment is 3.2x higher than the agent fee.”

— SourcifyChina 2025 Procurement Risk Index

Next Steps for Your Sourcing Strategy

1. Request our free MOQ Optimization Toolkit (includes 2026 compliance checklist and factory scorecard).

2. Schedule a risk assessment for your target product category—identify hidden cost traps in <48 hours.

3. Access pre-vetted PL factories with sports equipment certifications (ISO 22752, ASTM F963) via SourcifyChina’s portal.

Prepared by SourcifyChina Senior Sourcing Consultants | Data Sources: SourcifyChina 2025 OEM Survey, China Customs, EU Sports Goods Federation

Disclaimer: Estimates exclude freight, import duties, and unforeseen regulatory changes. Actual costs vary by factory tier and material sourcing strategy.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Manufacturer for “Sourcing Agent China – Sports Equipment”

Sourcing high-quality sports equipment from China requires due diligence to ensure supplier credibility, production capability, and long-term reliability. Whether engaging a sourcing agent or contacting manufacturers directly, verifying the authenticity and capability of suppliers is paramount. Below is a structured verification framework tailored for global procurement professionals.

1. Step-by-Step Verification Process

| Step | Action | Purpose | Key Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal entity status and manufacturing authorization | Verify on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct Factory Audit (Onsite or 3rd-Party) | Validate production capacity, equipment, and working conditions | Hire independent inspection firms (e.g., SGS, TÜV, QIMA) or use SourcifyChina’s audit checklist |

| 3 | Review Product Certifications | Ensure compliance with international standards (e.g., ISO, CE, ASTM, RoHS) | Request test reports for materials, safety, and performance |

| 4 | Evaluate Export Experience | Assess ability to handle international logistics, documentation, and language | Request export history, B/L samples, and client references (especially EU/US) |

| 5 | Conduct Sample Testing | Validate product quality, durability, and conformity | Order pre-production samples; test in certified labs |

| 6 | Check Intellectual Property (IP) Policies | Protect proprietary designs and branding | Sign NDA; verify IP ownership and mold/tooling custody |

| 7 | Assess Communication & Responsiveness | Gauge professionalism and long-term collaboration potential | Evaluate response time, English proficiency, and transparency |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical—factories offer better pricing and control, while trading companies may add value in logistics and sourcing but increase costs and reduce transparency.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of fitness equipment”) | Lists trading, import/export, or agency services |

| Facility Ownership | Owns production floor, machinery, and molds | No production equipment; operates from an office |

| Location | Located in industrial zones (e.g., Dongguan, Yiwu, Ningbo) | Often based in commercial districts or Tier-1 cities (e.g., Shanghai, Guangzhou) |

| Pricing Structure | Provides cost breakdown (material, labor, MOQ) | Quotes higher prices with limited transparency |

| MOQ Flexibility | Can adjust MOQ based on production capacity | Often has fixed MOQs due to reliance on third-party factories |

| Staff Expertise | Engineers, QC managers, production supervisors on site | Sales and logistics-focused team |

| Website & Catalog | Showcases production lines, machinery, in-house R&D | Features multiple unrelated product categories |

| Verification Tip | Ask: “Can I see your injection molding/extrusion/welding lines?” | Ask: “Which factory do you source this from?” |

✅ Best Practice: Use video audits to tour the facility in real time. Request live footage of production lines during operation.

3. Red Flags to Avoid When Sourcing Sports Equipment from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or scam | Benchmark against industry averages; request detailed cost breakdown |

| Refusal to Provide Factory Address or Video Audit | Likely a trading company hiding lack of control or non-existent facility | Insist on virtual tour or third-party inspection |

| No Product-Specific Certifications | Non-compliance with safety or market regulations (e.g., CE for EU) | Require valid, up-to-date test reports from accredited labs |

| Pressure for Full Upfront Payment | High risk of fraud or poor delivery performance | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos on Website | May indicate a middleman with no real production | Request original photos of your product being made |

| Inconsistent Communication or Broken English | May signal lack of professionalism or poor project management | Prefer suppliers with dedicated English-speaking account managers |

| No MOQ or Sample Policy | Lack of seriousness or unclear business model | Always order a sample before bulk production |

4. SourcifyChina Verification Protocol (2026 Standard)

All suppliers in our network undergo a 7-point vetting process:

- Legal Verification: Cross-check business license and tax registration

- Facility Validation: Onsite or live video audit with timestamped footage

- Production Capability Assessment: Machine count, output capacity, QC process

- Export Compliance Check: Verify past shipments to target markets

- Client Reference Audit: Contact 2+ international buyers

- Sample Quality Benchmarking: Test against ISO 20957 (fitness equipment) or ASTM F963 (sports toys)

- Financial Stability Review: Assess credit history and transaction volume

Conclusion & Recommendations

For global procurement managers, the key to successful sourcing of sports equipment from China lies in verification, transparency, and control. Prioritize direct factory partnerships where possible, leverage third-party audits, and avoid suppliers who resist scrutiny.

✅ Pro Tip: Partner with a trusted sourcing agent who operates on a fee-based model (not commission), ensuring alignment with your cost and quality objectives.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Strategic Partner in China Procurement

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Global Sports Equipment Procurement | Q1 2026

To: Global Procurement & Supply Chain Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Eliminate Sourcing Friction: Data-Driven Verification for China Sports Equipment Suppliers

The Critical Challenge: Time-to-Market vs. Supply Chain Risk

Global sports equipment brands face unprecedented pressure to accelerate product launches while navigating complex China sourcing landscapes. Traditional vetting methods consume 42-68 hours per supplier (per 2025 ISM Procurement Survey), with 61% of procurement teams reporting critical delays due to unverified factory capabilities, compliance gaps, or hidden production bottlenecks. For seasonal products (e.g., Olympic cycles, World Cup merchandise), these delays directly impact revenue potential.

Why SourcifyChina’s Verified Pro List is Your Strategic Accelerator

Our Pro List is the only China sports equipment supplier database validated against 12 operational KPIs, including ISO 20685 (sports equipment safety), ASTM F963 compliance, Tier-2 material traceability, and actual production capacity audits (not self-reported claims).

Time Savings Impact: Verified Pro List vs. Traditional Sourcing

| Activity | DIY Sourcing (Avg. Hours) | Pro List Sourcing (Avg. Hours) | Time Saved | Risk Mitigation |

|---|---|---|---|---|

| Initial Supplier Vetting | 28.5 | 2.0 | 93% | Full audit trail & compliance certs pre-verified |

| Factory Capability Assessment | 19.2 | 0.5 | 97% | Real-time production floor video logs & capacity data |

| Compliance Documentation Review | 14.7 | 1.0 | 93% | Pre-cleared CE, FCC, EN 1384/1385 (helmets), REACH |

| Negotiation & MOQ Finalization | 16.3 | 3.5 | 78% | Transparent tiered pricing models pre-negotiated |

| TOTAL PER SUPPLIER | 78.7 | 7.0 | 91% | 0 compliance failures in 2025 client deployments |

Source: SourcifyChina Client Data (Q4 2025), 47 enterprise procurement teams

The SourcifyChina Advantage: Beyond a Supplier List

- Dynamic Risk Scoring: AI-powered supplier health monitoring (labor compliance, export license validity, financial stability) updated hourly.

- Category-Specific Expertise: Dedicated sports equipment sourcing specialists (ex-Nike, Adidas, Decathlon supply chain leads).

- Seamless Integration: Direct API connectivity with SAP Ariba, Coupa, and Jaggaer for instant supplier onboarding.

- Cost Transparency: No hidden fees – factory-direct pricing with all-in landed cost modeling (including 2026 US/EU tariff shifts).

Your Strategic Next Step: Secure Q3 2026 Capacity Now

The 2026 FIFA World Cup cycle and Paris Olympics follow-on demand are triggering factory booking surges. 87% of premium sports manufacturers in Dongguan and Yiwu have confirmed capacity constraints by July 2026. Waiting to verify suppliers manually risks missing critical production windows.

Act Before Q2 Capacity Locks:

✅ Immediate Access: Receive your tailored Pro List segment (e.g., performance footwear, gym equipment, safety-certified team sports gear) within 24 hours.

✅ Zero Obligation Consultation: Our sourcing architect will map your specs to pre-vetted factories and identify 3 optimal partners.

✅ Guaranteed Time ROI: Achieve 70%+ reduction in sourcing cycle time or 100% fee refund (per our SLA).

Call to Action: Claim Your Verified Supplier Portfolio

Do not risk Q3 2026 delays with unverified sourcing. Contact our Sports Equipment Sourcing Desk today to activate your Pro List access and secure priority factory slots:📧 Email: [email protected]

💬 WhatsApp: +86 159 5127 6160Mention Code: SPORTS2026Q3 for expedited processing and a complimentary Sports Equipment Compliance Checklist (2026 Edition).

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days – critical for our World Cup merchandise launch.”

— Procurement Director, Top 3 Global Sports Brand (Client since 2023)

SourcifyChina: Where Verified Supply Chains Power Global Growth. Since 2018.

© 2026 SourcifyChina. All rights reserved. Data confidential to recipient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.