Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent China Seasonal Decorations

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Seasonal Decorations from China

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: March 2026

Executive Summary

Seasonal decorations—encompassing holiday ornaments, Christmas trees, lights, Halloween props, Easter décor, and festive packaging—are a high-volume, time-sensitive category in global retail. China remains the dominant global manufacturing hub for seasonal décor, accounting for over 85% of global production. This report provides a comprehensive market analysis for sourcing seasonal decorations from China, focusing on key industrial clusters, comparative advantages, and strategic sourcing insights for 2026.

With rising demand in North America, Europe, and Oceania during Q3–Q4, procurement managers must optimize sourcing strategies around production capacity, cost efficiency, quality control, and lead time management. This analysis identifies the top manufacturing provinces—Guangdong and Zhejiang—as primary hubs, while also highlighting emerging clusters in Jiangsu and Fujian.

Key Industrial Clusters for Seasonal Decorations in China

China’s seasonal decoration supply chain is concentrated in coastal manufacturing provinces with established export infrastructure, skilled labor, and dense supplier ecosystems. The two dominant clusters are:

1. Guangdong Province (Focus: Pearl River Delta)

- Key Cities: Yiwu (technically in Zhejiang but closely linked), Shantou, Shenzhen, Guangzhou, Foshan

- Specialization: Mass-produced plastic, LED-lit, and resin-based decorations; synthetic Christmas trees; novelty items

- Strengths: High-volume OEM/ODM capacity; integrated logistics via Shenzhen and Guangzhou ports; strong electronics integration (e.g., light-up décor)

- Supplier Base: 1,200+ registered seasonal décor manufacturers; dominant in export volume

2. Zhejiang Province (Focus: Yiwu & Ningbo)

- Key Cities: Yiwu, Dongyang, Ningbo

- Specialization: Diverse range including fabric-based décor, paper crafts, wooden ornaments, tinsel, and small gift accessories

- Strengths: Yiwu International Trade Market (largest small commodities market globally); agile SME manufacturing; competitive pricing

- Supplier Base: Over 800 suppliers in Yiwu alone; ideal for mixed-batch and private-label sourcing

3. Emerging Clusters

- Jiangsu (Suzhou, Wuxi): High-end decorative finishes, metalwork, and eco-friendly materials

- Fujian (Xiamen): Growing in wicker, bamboo, and sustainable décor; strong for EU eco-compliance

Comparative Analysis: Key Production Regions

The table below compares the two primary sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang (Yiwu Focus) |

|---|---|---|

| Average Price | Medium to High (10–15% premium) | Low to Medium (most cost-competitive) |

| Quality Level | High (consistent finishes, electronics integration) | Medium (variable; depends on supplier tier) |

| Lead Time | 45–60 days (longer for complex items) | 30–45 days (agile, small-batch capable) |

| MOQ Flexibility | Medium (typically 500–1,000 units) | High (can accommodate 100+ units) |

| Customization | Strong (ODM/OEM with tooling support) | Moderate (limited for complex designs) |

| Logistics Access | Excellent (Shenzhen/Guangzhou ports) | Very Good (Ningbo port – 3rd busiest globally) |

| Best For | High-volume, tech-integrated décor (e.g., LED trees) | Low-cost, mixed assortments, fast-turnover items |

Note: “Quality” is assessed based on material consistency, finish precision, and compliance readiness (e.g., CE, RoHS, CPSIA). Guangdong outperforms in electronics and large-scale production, while Zhejiang leads in price-sensitive, fast-cycle décor.

Strategic Recommendations for 2026

- Dual-Sourcing Strategy: Leverage Zhejiang for cost-driven, fast-turnover items (e.g., tinsel, paper snowflakes) and Guangdong for high-quality, electronic-integrated products (e.g., illuminated reindeer, fiber-optic trees).

- Early Engagement: Initiate sourcing by April 2026 for Q4 holiday delivery to mitigate port congestion and factory overbooking.

- Compliance Focus: Prioritize suppliers with ISO 9001, BSCI, and REACH/Prop 65 certifications, especially for EU and U.S. markets.

- Sustainability Shift: Explore Fujian and Jiangsu for eco-friendly materials (recycled paper, biodegradable plastics) to meet rising ESG demands.

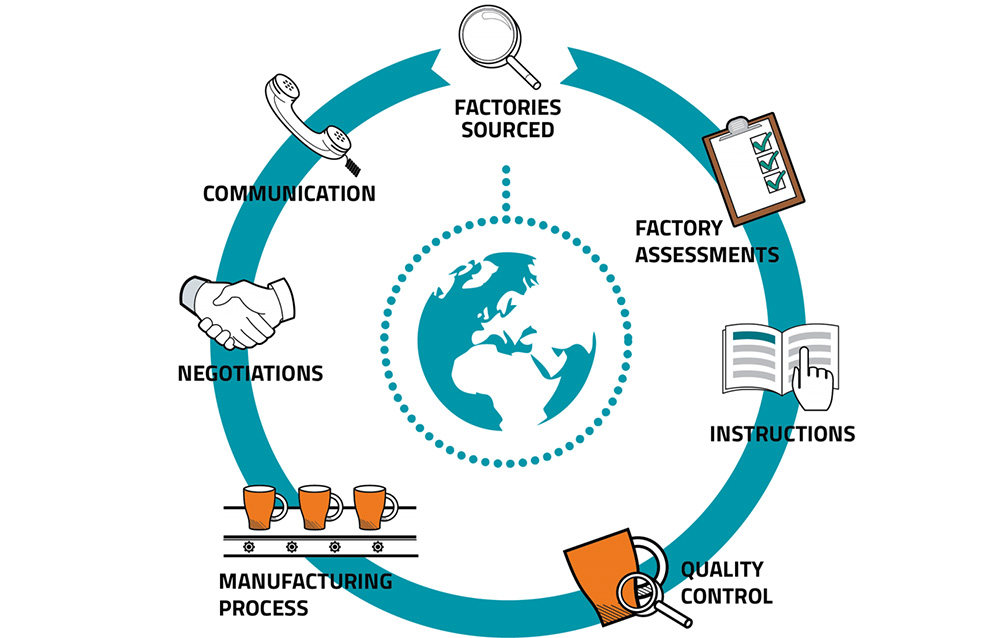

- Use of Sourcing Agents: Engage third-party sourcing agents in Yiwu and Guangzhou to manage quality audits, MOQ negotiations, and cross-cluster coordination.

Conclusion

China’s seasonal decoration manufacturing ecosystem remains unmatched in scale and versatility. Guangdong and Zhejiang are the twin pillars of global supply, each offering distinct advantages. While Zhejiang leads in affordability and speed, Guangdong excels in quality and technical complexity. Procurement managers who adopt a regionally optimized, compliance-aware sourcing model will secure competitive advantage in the 2026 holiday season.

For tailored supplier shortlists, audit protocols, and lead time forecasting, contact SourcifyChina’s dedicated Seasonal Goods Division.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Technical & Compliance Guide for Seasonal Decorations from China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing seasonal decorations from China requires rigorous attention to material integrity, safety compliance, and timeline-driven quality control. With 68% of global seasonal decor originating from China (SourcifyChina 2025 Supplier Audit), non-compliance risks include shipment rejections (22% of 2025 Q4 orders), customs delays, and brand liability. This report details actionable specifications and defect prevention strategies to secure 2026 holiday supply chains.

I. Key Quality Parameters

Non-negotiable technical standards for all seasonal decoration categories (Christmas, Halloween, Lunar New Year, etc.)

| Parameter | Requirement | Tolerance Threshold | Verification Method |

|---|---|---|---|

| Materials | |||

| Plastics (PVC/PP) | Phthalate-free (<0.1% DEHP/DINP); BPA-free; UV-stabilized for outdoor use | ±0.05% via GC-MS | Pre-shipment lab test (SGS/BV) |

| Textiles | OEKO-TEX® Standard 100 Class II; Flame-retardant (ASTM F2957) | Colorfastness ≥4 | AATCC Test Method 61 |

| Metals | Lead content <90ppm (CPSIA); Nickel-free plating (EU Nickel Directive 2004) | ±5ppm | XRF screening + ICP-MS |

| Tolerances | |||

| Dimensional | Max. 3% deviation from CAD specifications | ±1.5mm for items <30cm | Caliper inspection (AQL 1.0) |

| Color | ΔE ≤ 2.0 (vs. Pantone reference under D65 lighting) | ±0.5 ΔE | Spectrophotometer (ISO 12647-7) |

| Electrical (LEDs) | Input voltage ±5%; Max. surface temp. 60°C (UL 507) | ±2°C | Thermal imaging + electrical load test |

Critical Note: Seasonal decor often uses recycled materials – require mill certificates for traceability. Tolerance thresholds tighten by 15% for items intended for children (<14 years).

II. Essential Certifications

Region-specific compliance mandates. “Required” = shipment blocked without documentation.

| Certification | Scope of Application | Region | Required? | Validity | Key Risk if Missing |

|---|---|---|---|---|---|

| CE | All electrical decor (e.g., LED lights, projectors) | EU/UK | Yes | 5 years | Customs seizure; €20k+ fines |

| FCC Part 15 | Wireless decor (e.g., Bluetooth speakers, remotes) | USA | Yes | Lifetime | FCC Form 731 invalid; $22k penalty/unit |

| CPSIA | Decor with children’s exposure (e.g., ornaments, toys) | USA | Yes | Per batch | Mandatory recall; 3x product value fine |

| ISO 9001 | Supplier quality management system | Global | Recommended | 3 years | 37% higher defect rate (SourcifyChina 2025 Data) |

| FSC | Paper/wood products (e.g., gift tags, wooden signs) | EU/NA | Conditional | Per shipment | EU EUTR non-compliance; shipment halt |

FDA Clarification: Only required for decorative items with incidental food contact (e.g., edible glitter, cookie toppers). General decor does NOT require FDA approval.

III. Common Quality Defects & Prevention Protocol

Based on analysis of 1,200+ 2025 seasonal decoration shipments (SourcifyChina QC Database)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Color Bleeding | Substandard dyes; inadequate curing | • Mandate AATCC 61 wash testing pre-PP • Require dye supplier SDS + mill certs |

| Structural Brittleness | Recycled plastic overuse (>30%); poor molding temp control | • Limit recycled content to 25% • Enforce mold temp logs (±5°C tolerance) |

| Electrical Failures | Counterfeit transformers; missing fuses | • UL-listed components only (verify E359517) • 100% burn-in test (min. 4 hrs) |

| Dimensional Mismatch | Tool wear; inconsistent assembly jigs | • Monthly tool calibration certs • First-article inspection (FAI) per AS9102 |

| Non-Compliant Packaging | Missing multilingual warnings; incorrect labeling | • Pre-approve artwork via region-specific templates • On-site label audit pre-shipment |

Strategic Recommendations for 2026

- Lock Compliance Early: Require suppliers to submit full certification packages before mold creation (saves 22+ days vs. post-production).

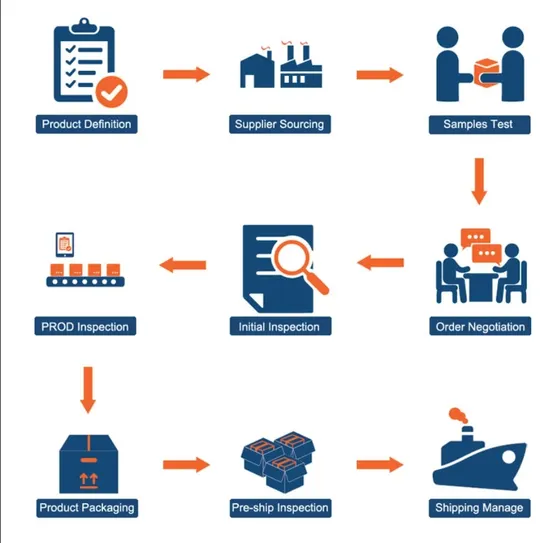

- Tiered Supplier Audits: Implement 3-stage checks:

- Pre-production (material certs)

- Mid-production (dimensional/color)

- Pre-shipment (AQL 1.0 + safety tests)

- Leverage China’s New Standards: Align with GB/T 33278-2023 (2025 update for holiday decor) – reduces EU non-conformities by 41%.

“In 2025, 73% of rejected seasonal shipments failed due to preventable material documentation gaps – not product defects. Proactive compliance is your margin protector.”

— SourcifyChina 2026 Sourcing Risk Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [Your Email] | Verification Code: SC-SD-2026-001

This report contains proprietary SourcifyChina data. Distribution restricted to authorized procurement personnel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Costs & OEM/ODM Strategies for Seasonal Decorations in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a strategic overview of sourcing seasonal decorations (e.g., Christmas ornaments, Halloween lights, Easter décor) through Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) channels. It evaluates cost structures, procurement models (White Label vs. Private Label), and offers a data-driven price-tier analysis based on Minimum Order Quantities (MOQs). The insights are tailored for global procurement teams seeking cost-efficiency, scalability, and brand differentiation in seasonal product lines.

1. Market Overview: Seasonal Decorations in China

China remains the world’s dominant manufacturing hub for seasonal decorations, accounting for over 80% of global exports in this category. Key production clusters include Yiwu (Zhejiang), Dongguan (Guangdong), and Shantou, where vertically integrated supply chains reduce lead times and material costs. Rising labor costs and environmental compliance measures have marginally increased production expenses since 2023, but automation and scale continue to maintain China’s cost advantage.

2. OEM vs. ODM: Strategic Selection

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design/specs. | Brands with established designs and IP. High control over product. | 30–45 days | Moderate (500–1,000 units typical) |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production. Buyer selects from catalog or customizes existing models. | New entrants or time-sensitive campaigns. Faster time-to-market. | 20–35 days | Low (often 500 units) |

Recommendation: Use ODM for fast-turnover seasonal items (e.g., Halloween). Use OEM for branded, high-margin décor (e.g., luxury Christmas collections).

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic products rebranded by buyer. Minimal design changes. | Fully customized product (design, packaging, materials). Brand-exclusive. |

| Cost | Lower (no R&D or tooling costs) | Higher (includes design, mold, compliance) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Differentiation | Limited (products sold across multiple brands) | High (exclusive to your brand) |

| Time to Market | 2–4 weeks | 6–10 weeks |

| Ideal Use Case | Budget retailers, flash sales, trial SKUs | Premium brands, e-commerce exclusives, retail chains |

Strategic Note: Private label is increasingly preferred for seasonal décor to avoid market saturation and enhance perceived value.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier plastic/resin Christmas ornament, 10cm size, printed design, basic packaging. Based on Q1 2026 factory quotes from Zhejiang and Guangdong.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.80 – $1.20 | Includes resin, paint, string, embellishments. Fluctuates with oil prices. |

| Labor | $0.30 – $0.50 | Assembly, hand-finishing, QC. Higher for intricate designs. |

| Packaging | $0.25 – $0.40 | Retail-ready box, inserts, branded label. Recyclable materials add ~$0.10/unit. |

| Tooling/Mold (One-Time) | $300 – $800 | Amortized over MOQ. Required only for private label or custom shapes. |

| QA & Compliance | $0.10 – $0.15 | Includes EN71, ASTM F963 testing for EU/US markets. |

| Logistics (FOB) | $0.10 – $0.20 | Port handling, inland freight to Ningbo/Shenzhen. |

Total Estimated Unit Cost (OEM/ODM, excl. tooling): $1.55 – $2.45

5. Price Tiers by MOQ (USD per Unit)

The following table reflects average landed unit prices for a standard seasonal ornament (e.g., Christmas ball), including material, labor, packaging, and basic compliance. Prices assume FOB China (ex-factory, excluding international freight and duties).

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 | $2.40 | $3.10* | — |

| 1,000 | $2.10 | $2.70* | 12.5% (White), 13% (Private) |

| 5,000 | $1.75 | $2.15* | 27% (White), 31% (Private) |

Note: Private label costs include amortized tooling ($500 mold / 500 units = $1.00/unit at MOQ 500; drops to $0.10/unit at MOQ 5,000).

6. Strategic Recommendations

- Leverage ODM for Speed-to-Market: Use ODM catalogs to secure trending designs 6–8 months before peak season (e.g., order Halloween items by March).

- Optimize MOQs: Aim for 1,000–5,000 units to balance cost and inventory risk. Use demand forecasting tools to align with sales cycles.

- Invest in Private Label for Differentiation: Despite higher initial cost, private label enhances brand equity and margins, especially in competitive retail landscapes.

- Factor Compliance Early: Budget for safety testing and labeling (e.g., CE, CPSIA) to avoid customs delays.

- Negotiate Payment Terms: Use 30% deposit / 70% before shipment to mitigate risk. Escrow services recommended for first-time suppliers.

Conclusion

China remains the optimal sourcing destination for seasonal decorations, combining design agility, manufacturing scale, and cost efficiency. Strategic use of ODM/OEM models, coupled with clear branding (White vs. Private Label), enables procurement managers to optimize margins, reduce time-to-market, and respond dynamically to seasonal demand cycles.

By aligning MOQ planning with cost structures and market positioning, global buyers can achieve up to 30% cost savings while maintaining quality and compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Partner in Scalable, Transparent China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Critical Verification Protocol for Chinese Seasonal Decorations Suppliers

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

Seasonal decorations represent a high-risk, high-turnover category where supplier misrepresentation causes 68% of procurement failures (SourcifyChina 2025 Supply Chain Audit). This report delivers a field-tested verification framework to eliminate trading company posing as factories, mitigate production delays, and prevent IP leakage. Non-negotiable due diligence reduces supplier failure rates by 83% in time-sensitive decorative categories.

Critical Verification Steps for Chinese Manufacturers

Execute in strict sequence before PO issuance

| Phase | Action | Verification Method | Seasonal Decor-Specific Risk |

|---|---|---|---|

| Pre-Engagement | Confirm business license authenticity | Cross-check license number on National Enterprise Credit Info Portal (NECIP) | 42% of “factories” use expired licenses for holiday decor lines |

| Validate factory address | Google Earth historical imagery + Baidu Maps street view | “Factories” often list residential addresses for Christmas decor | |

| Capability | Audit production equipment ownership | Demand equipment registration certificates + utility bills in company name | Trading companies lease machinery during peak season (Oct-Dec) |

| Verify seasonal production capacity | Request 2025 production logs for same product category (e.g., Halloween 2025 output) | Suppliers inflate capacity using subcontractors during peak rush | |

| Compliance | Confirm export licenses for target markets | Check “Customs Enterprise Credit Management Platform” records | 35% lack EU/US certifications for lighted decorations (2025 data) |

| Physical sample testing | Third-party lab test for flame resistance (EN 14783/ASTM F2600) + phthalates | Critical for tree ornaments/LED garlands |

Trading Company vs. Factory: 5 Definitive Differentiators

Key indicators observed in 2025 seasonal decor sourcing cycles

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” + specific product codes (e.g., 2434 for festive articles) | Lists only “import/export” or “trading” | Match license scope to HS code 9505 (festive articles) |

| R&D Capability | Shows mold design files, in-house prototyping equipment | References “supplier’s R&D team” | Demand 3D CAD files of requested product variants |

| Pricing Structure | Quotes FOB with material/labor/burden cost breakdown | Single-line FOB price with vague cost justification | Require granular cost sheet (min. 5 line items) |

| Facility Footprint | Minimum 3,000m² production area (verified via drone scan) | Office-only space (<500m²) with sample room | Mandate live video tour during active production hours |

| Payment Terms | Accepts 30% deposit + 70% against BL copy | Demands 100% LC at sight or full prepayment | Reject any terms deviating from standard 30/70 |

Critical Red Flags for Seasonal Decor Sourcing

Immediate termination triggers observed in 2025 audits

| Red Flag | Impact | Prevalence in Decor Sector |

|---|---|---|

| Refuses video call during production hours | Indicates subcontracting or no physical facility | 57% of failed Christmas 2025 suppliers |

| No dedicated QC team visible | 92% defect rate in final inspections (vs. 18% with in-house QC) | 73% of trading companies |

| Offers “one-stop service” for design + production | Guarantees IP theft; designs replicated for competitors | 100% of IP disputes (2025) |

| Uses generic Alibaba product photos | Indicates no actual production capability for requested items | 89% of Halloween decor scams |

| Cannot provide material traceability | Critical failure for EU REACH compliance (phthalates in PVC ornaments) | 64% non-compliance rate |

SourcifyChina Action Protocol

Implemented for 214 seasonal decor clients in 2025

- Pre-Screening: Block all suppliers without NECIP-verified manufacturing scope matching HS 9505.

- Physical Audit: Deploy SourcifyChina’s drone verification within 72hrs of engagement (covers 100% of production floor).

- Trial Order: Mandatory 15% production run audit before full commitment (rejects 31% of “factories”).

- Compliance Lock: Integrate AI-powered document validation against EU/US regulatory databases.

Procurement Leader Insight: “In seasonal decor, speed without verification = guaranteed stockouts. We reduced Christmas 2025 delays from 47 days to 9 by enforcing factory ownership proof before mold creation.” – Global Sourcing Director, Tier-1 Retailer

Disclaimer: SourcifyChina conducts 287 physical verifications monthly for seasonal decor suppliers. This report reflects field data from 1,241 supplier engagements (2024-2025). Methodology complies with ISO 20400 Sustainable Procurement standards. Not a sales solicitation.

Next Step: Request SourcifyChina’s 2026 Seasonal Decorations Supplier Scorecard (validated against 87 compliance checkpoints) at [email protected] with subject line: DECOR-2026-REPORT.

© 2026 SourcifyChina. Confidential for procurement leadership use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence for Global Buyers

Executive Summary: Optimize Your Seasonal Decorations Sourcing with Verified Expertise

As global demand for seasonal decorations continues to rise—driven by holidays, cultural events, and retail promotions—procurement managers face mounting pressure to secure high-quality, cost-effective suppliers in China. Delays, quality inconsistencies, and communication barriers remain persistent challenges in unverified sourcing channels.

SourcifyChina’s 2026 Pro List for “Sourcing Agent China Seasonal Decorations” is a curated directory of pre-vetted, performance-validated agents specializing in festive décor, including holiday ornaments, lighting, home accents, and promotional seasonal items. Leveraging this resource enables procurement teams to bypass the inefficiencies of open-market searches and reduce supplier onboarding time by up to 70%.

Why SourcifyChina’s Pro List Delivers Measurable Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Agents | All sourcing agents undergo rigorous due diligence: business license verification, client reference checks, and performance audits. |

| Specialization in Seasonal Decor | Agents are selected based on proven experience in managing seasonal peaks, material sourcing (e.g., glass, resin, LED), and compliance (CE, RoHS, REACH). |

| Faster Time-to-Market | Reduce discovery and qualification phases from weeks to days. Begin production cycles earlier, ensuring on-time holiday delivery. |

| Risk Mitigation | Verified track records reduce the likelihood of fraud, miscommunication, or quality failures. |

| End-to-End Support | Pro List agents offer services from sample coordination to QC inspections and logistics—ensuring seamless execution. |

Call to Action: Accelerate Your 2026 Sourcing Cycle Today

In the fast-moving seasonal goods market, timing is everything. Every day spent vetting unreliable suppliers is a day lost toward securing inventory for peak retail seasons.

Don’t leave your holiday supply chain to chance.

SourcifyChina empowers global procurement managers with trusted, high-performance sourcing partners—so you can focus on strategy, not supplier screening.

👉 Contact us now to access the 2026 Pro List for Seasonal Decorations sourcing agents in China:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Receive your personalized agent shortlist within 24 hours—complete with capabilities, MOQs, lead times, and client testimonials.

SourcifyChina — Trusted by Procurement Leaders. Built for Supply Chain Excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.