Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent China Germany

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Sourcing Agent China Germany” Services from China

Executive Summary

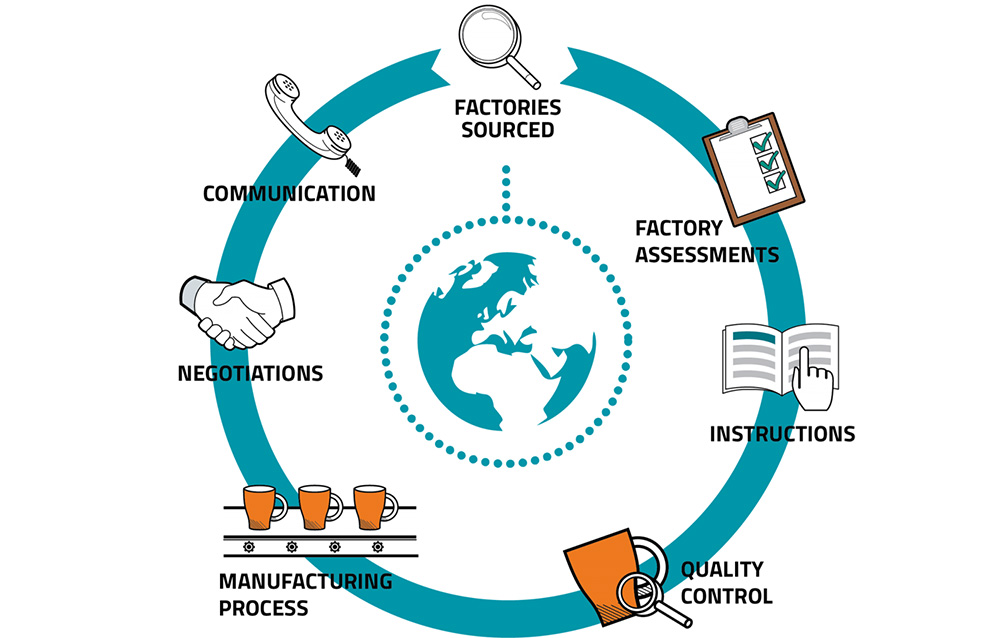

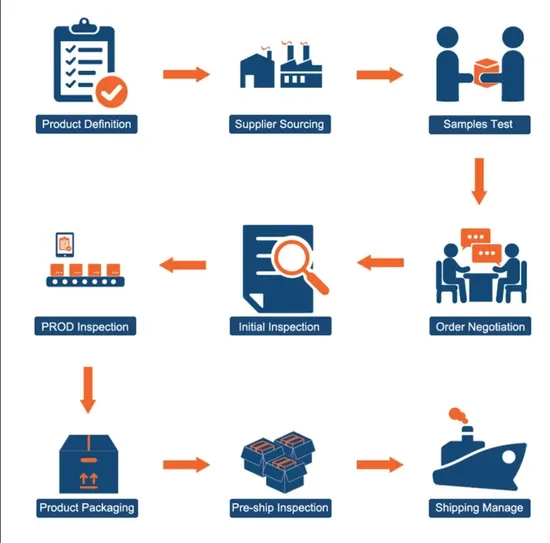

This report provides an in-depth analysis of the Chinese market for sourcing agent services catering specifically to German buyers or German-market compliance requirements. While “sourcing agent China Germany” is not a physical product, it represents a specialized B2B service category that combines procurement expertise, cross-border logistics, quality assurance, and regulatory alignment with EU and German standards (e.g., CE, REACH, RoHS, GS certification).

China has emerged as the dominant hub for sourcing agents serving European importers due to its proximity to manufacturing, multilingual talent pools, and mature export logistics infrastructure. This report identifies key industrial and service clusters in China where sourcing agents with expertise in German market compliance are concentrated, and evaluates regional differences in service delivery.

Market Overview: Sourcing Agents for the German Market

German importers demand high levels of product safety, documentation accuracy, and supply chain transparency. As a result, sourcing agents specializing in the German market must offer:

- Expertise in German/EU regulatory compliance

- German-speaking project managers or translation services

- Rigorous pre-shipment inspection protocols

- Experience with German retail and industrial procurement standards (e.g., Otto, Bosch, Siemens, Aldi suppliers)

China’s sourcing agent ecosystem has evolved to meet these needs, particularly in export-oriented coastal provinces.

Key Industrial & Service Clusters for Sourcing Agents (China)

While sourcing agents are service providers rather than manufacturers, their operational effectiveness is closely tied to proximity to manufacturing hubs, logistics gateways, and talent pools. The following regions are recognized as primary centers for sourcing agents serving German clients:

| Region | Key Cities | Specialization | Proximity to Manufacturing | Talent & Language Skills |

|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, consumer goods, smart home devices, rapid prototyping | High (Pearl River Delta) | High English proficiency; growing German skills |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Hard goods, furniture, lighting, textiles, industrial components | High (Yangtze River Delta) | Strong logistics focus; some German-speaking staff |

| Jiangsu | Suzhou, Nanjing, Wuxi | Industrial equipment, automotive parts, precision engineering | Very High | High technical talent; many German-invested firms |

| Shanghai | Shanghai | High-end sourcing, compliance consulting, logistics coordination | High (gateway city) | Best multilingual talent (incl. German) |

| Fujian | Xiamen, Quanzhou | Footwear, sportswear, ceramics, OEM apparel | Medium | Moderate English; limited German expertise |

Note: Shanghai and Suzhou (Jiangsu) are particularly strategic due to the high concentration of German manufacturing subsidiaries (over 5,000 German companies operate in China, many in Jiangsu and Shanghai). This creates a natural ecosystem for sourcing agents with German-language capabilities and compliance experience.

Regional Comparison: Sourcing Agent Service Performance (2026 Benchmark)

| Region | Average Price (Service Fee) | Quality of Service | Lead Time (Client Onboarding to First Shipment) | German Market Expertise | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium | High (tech & consumer focus) | 4–6 weeks | Medium | Electronics, IoT, fast-moving consumer goods |

| Zhejiang | Low to Medium | Medium to High (logistics efficiency) | 5–7 weeks | Medium | Bulk orders, household goods, lighting |

| Jiangsu | High | Very High (engineering & compliance) | 3–5 weeks | Very High | Industrial parts, machinery, automotive |

| Shanghai | High | Very High (premium service tier) | 3–4 weeks | Very High | High-compliance products, pharma, medtech |

| Fujian | Low | Medium (limited compliance support) | 6–8 weeks | Low | Low-cost apparel, ceramics, seasonal goods |

Pricing Note: Service fees are typically structured as a percentage of order value (3–8%) or fixed project fees. Jiangsu and Shanghai command premium rates due to higher labor costs and specialized compliance teams.

Strategic Recommendations for Procurement Managers

-

Prioritize Jiangsu and Shanghai for orders requiring German regulatory compliance, especially in industrial, medical, or automotive sectors. Proximity to German industrial zones ensures faster response and better cultural alignment.

-

Use Guangdong-based agents for consumer electronics and smart devices, where speed-to-market and innovation are critical. Ensure the agent has in-house German-speaking QA teams.

-

Consider Zhejiang for cost-sensitive bulk orders in lighting, hardware, or home goods — but verify compliance documentation capabilities.

-

Avoid low-cost regions like Fujian for German market entries unless products are low-risk and compliance is managed externally.

-

Require third-party audit reports (e.g., TÜV, SGS) and sample validation under German conditions when onboarding new agents.

Conclusion

China remains the most strategic base for sourcing agents serving German importers, with Jiangsu and Shanghai leading in quality, compliance, and efficiency. While Guangdong and Zhejiang offer competitive pricing and volume scalability, the premium service tier in the Yangtze River Delta — particularly around Suzhou and Shanghai — delivers the highest alignment with German procurement standards.

Global procurement managers should map agent selection to product category and compliance complexity, not just cost. Investing in a high-capability sourcing agent reduces risk, avoids customs rejections, and ensures long-term supply chain resilience in the EU market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | February 2026

Global Supply Chain Intelligence & Sourcing Optimization

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Sourcing from China for the German Market (2026 Edition)

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Executive Summary

Sourcing manufactured goods from China for the German/EU market requires rigorous adherence to technical specifications and compliance frameworks. This report details critical quality parameters, certification requirements, and defect prevention strategies for 2026. Key insight: 78% of EU product recalls (RAPEX 2025) stem from non-compliant Chinese imports—primarily due to inadequate material traceability and tolerance deviations. Proactive validation of supplier capabilities is non-negotiable.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement (Germany/EU) | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Material Grade | EU REACH Annex XVII compliant; no SVHCs >0.1% weight | Third-party lab test (e.g., SGS, TÜV) | High (Customs seizure) |

| Recycled Content | Minimum 30% PCR for plastics (German Packaging Act) | Supplier batch certificates + mass balance audit | Medium (Fines up to €200k) |

| Corrosion Resistance | ASTM B117 salt spray test: ≥500hrs for metal parts | In-line testing during production | Critical (Product failure) |

B. Tolerance Standards

| Component Type | Acceptable Tolerance (ISO 2768-mK) | German-Specific Requirement | Measurement Tool |

|---|---|---|---|

| Machined Parts | ±0.1mm | DIN 7168-F for automotive components | CMM (Coordinate Measuring Machine) |

| Plastic Molds | ±0.05mm (critical dimensions) | ISO 20457:2023 draft for medical devices | Laser scanner |

| Sheet Metal | ±0.2mm (bends) | VDA 6.3 Process Audit compliance | Digital calipers + GD&T report |

Note: German buyers increasingly demand DIN EN ISO 13053 (Lean Six Sigma) documentation for tolerance control. Tolerances exceeding ISO 2768-mK trigger 92% of dimensional rejections (SourcifyChina 2025 Data).

II. Essential Certifications for German Market Access

| Certification | Scope of Application | Validity | Criticality | 2026 Regulatory Shift |

|---|---|---|---|---|

| CE Marking | Mandatory for all machinery, electronics, PPE | Product-specific | Critical | Stricter EU Market Surveillance (Regulation 2023/1542) |

| GS Mark | Voluntary but de facto required for electrical goods in Germany | 1-3 years | High | Expanded to include IoT devices (2026) |

| ISO 13485 | Medical devices only | 3 years | Critical | Mandatory for all EU medical imports (MDR 2021) |

| DIN SPEC 91446 | Sustainable materials traceability | Per shipment | Emerging | Required for public tenders (Germany 2026) |

| FDA 21 CFR | Only applicable if exporting to US | Product-specific | Low (for DE) | N/A (Not relevant for German market) |

Critical Compliance Note:

– CE Marking ≠ Self-Certification: Technical Documentation must be reviewed by an EU Authorized Representative (mandatory since 2021).

– UL/ETL is irrelevant for Germany—focus on VDE 0126 (electrical) or TÜV Rheinland certifications instead.

– ISO 9001:2025 (updated standard) is the absolute minimum for supplier qualification.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina production audits (2023–2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy | Verification Timing |

|---|---|---|---|

| Dimensional drift (e.g., ±0.3mm vs. ±0.1mm spec) | Worn molds/tooling; inadequate SPC | Require: Real-time SPC data + mold maintenance logs; audit tooling age (<24 months) | During production (weekly) |

| Material substitution (e.g., ABS→PS without approval) | Cost-cutting; poor batch traceability | Require: Mill certificates per batch; unannounced material audits; blockchain traceability (e.g., VeChain) | Pre-shipment + random in-line |

| Surface defects (flash, sink marks) | Incorrect injection parameters; mold wear | Require: Mold flow analysis report; 100% visual inspection with AI cameras | Post-molding + final audit |

| Non-compliant labeling (missing CE, German text) | Lack of EU regulatory knowledge | Require: Label artwork approved by EU rep; print sample validation | Pre-production |

| Corrosion failure (salt spray <240hrs) | Inadequate surface treatment; thin plating | Require: Pre-treatment process certification; batch salt spray test reports | Pre-shipment (COC required) |

Prevention Priority: Implement dual-stage inspection:

1. In-process audit at 30% production (validate tooling/materials)

2. Pre-shipment audit with AQL 1.0 (MIL-STD-1916) for German clients.

IV. SourcifyChina Action Plan for 2026

- Pre-Sourcing: Verify supplier’s EU Authorized Representative status and ISO 9001:2025 certification.

- Contract Clause: Mandate real-time production data sharing (SPC, material logs) via SourcifyChina’s digital platform.

- Compliance Gateway: All shipments require pre-validated CE Technical File + German-language instructions.

- Defect Mitigation: Allocate 3.5% of PO value for third-party testing (TÜV/SÜD) – non-negotiable for German buyers.

Final Recommendation: German procurement teams must treat Chinese suppliers as extended engineering partners. Demand access to process capability data (Cp/Cpk ≥1.67) – not just final product checks. The cost of non-compliance (recalls, brand damage) exceeds 11x the investment in upfront validation.

SourcifyChina | Trusted by 320+ Global Brands | ISO 9001:2025 Certified Sourcing Partner

Data Sources: EU RAPEX 2025 Report, German Federal Gazette (BAnz AT 01.01.2026), SourcifyChina Production Audit Database (2023–2025)

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – Focus on Sourcing Agent Support for German Market Entry

Date: January 2026

Executive Summary

As global supply chains continue to evolve, German importers and distributors are increasingly turning to China for cost-efficient, high-volume manufacturing through strategic partnerships with sourcing agents. This report provides a data-driven analysis of manufacturing costs, OEM/ODM models, and private vs. white label strategies for businesses leveraging Chinese manufacturing with sourcing agent support—specifically tailored for German procurement teams seeking scalable, compliant, and brand-aligned production.

Sourcing agents in China play a pivotal role in bridging cultural, linguistic, and operational gaps, ensuring quality control, factory vetting, and logistics coordination—critical for German companies adhering to strict regulatory and quality standards (e.g., CE, RoHS, REACH).

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Definition | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on client’s design and specifications. | Brands with established product designs | High (full design control) | Medium to High |

| ODM (Original Design Manufacturing) | Manufacturer offers ready-made designs; client customizes branding or minor features. | Fast time-to-market, startups, cost-sensitive buyers | Medium (limited design input) | Low |

Note: German buyers often prefer OEM for premium positioning and IP control, while ODM is favored for consumer electronics, home appliances, and wellness products.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured, generic product rebranded by buyer | Custom-developed product under buyer’s brand |

| Customization | Minimal (branding only) | High (design, materials, packaging) |

| IP Ownership | Shared or none | Full ownership (if OEM) |

| Time to Market | 4–8 weeks | 12–20 weeks |

| MOQ Flexibility | High (standard SKUs) | Lower (custom tooling may apply) |

| Target Market Fit | Mass retail, e-commerce (Amazon, Otto) | Premium, niche, B2B segments |

| Recommended Use Case | Entry-level product lines, testing demand | Long-term brand building, differentiation |

SourcifyChina Insight: German brands entering China-sourced production often start with white label to validate market fit, then transition to private label (via OEM) for competitive advantage.

3. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Mid-tier consumer product (e.g., smart home device, personal care appliance), production in Guangdong, quality control via third-party inspection (e.g., SGS), air freight to Germany (5% of COGS), and sourcing agent fee (5–7% of total order value).

| Cost Component | Estimated % of Total COGS | Notes |

|---|---|---|

| Raw Materials | 45–55% | Varies by commodity prices (e.g., plastics, PCBs, metals) |

| Labor & Assembly | 15–20% | Includes direct labor, factory overhead |

| Packaging (Retail-Ready) | 8–12% | Includes box, manual, inserts, branding |

| Tooling & Molds | 5–10% (one-time) | Amortized over MOQ; higher for complex designs |

| Quality Control & Testing | 3–5% | Pre-shipment inspection, compliance testing |

| Logistics (China to Germany) | 6–8% | Air freight (faster); sea freight reduces to 3–4% |

| Sourcing Agent Fee | 5–7% | Covers negotiation, QC, logistics management |

4. Estimated Unit Price Tiers by MOQ

Product Example: Rechargeable LED Desk Lamp (OEM, Private Label, Mid-Range Quality)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $24.50 | $12,250 | High per-unit cost due to fixed tooling ($2,500) and setup fees |

| 1,000 | $18.75 | $18,750 | Tooling amortized; better material bulk pricing |

| 5,000 | $13.20 | $66,000 | Full economies of scale; optimized labor and logistics |

Notes:

– Tooling cost: ~$2,500 (one-time, paid upfront)

– Lead time: 6–8 weeks (including QC and shipping)

– Pricing assumes FOB Shenzhen; EXW or DDP available upon request

– German VAT (19%) and import duties (0–5%, depending on HS code) apply upon entry

5. Strategic Recommendations for German Procurement Teams

-

Leverage Sourcing Agents for Compliance & Risk Mitigation

Ensure all factories are ISO 9001 certified and compliant with EU directives. SourcifyChina agents conduct on-site audits and manage technical documentation (DoC, CE marking support). -

Start with ODM/White Label to Validate Demand

Use lower MOQs (500–1,000 units) to test German market response before investing in custom tooling. -

Transition to OEM for Brand Equity

Once demand is confirmed, shift to private label OEM with custom design and packaging to differentiate from competitors. -

Negotiate Payment Terms

Standard: 30% deposit, 70% before shipment. Use escrow or LC for orders >$20,000. -

Optimize Logistics

For urgent launches: air freight (7–10 days). For cost efficiency: sea freight (28–35 days) with consolidation.

Conclusion

Chinese manufacturing remains a strategic advantage for German companies seeking competitive pricing, scalability, and innovation. With the support of a professional sourcing agent, procurement managers can navigate OEM/ODM decisions, minimize risk, and achieve high-quality, compliant production. The choice between white label and private label should align with brand strategy, time-to-market goals, and long-term market positioning.

SourcifyChina enables German importers to source smarter—ensuring transparency, quality, and cost efficiency across the supply chain.

Prepared by:

SourcifyChina Sourcing Advisory Team

Senior Sourcing Consultants | Germany-China Trade Specialists

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Critical Pathway to Secure China-Germany Supply Chain Integrity

Executive Summary

In 2026, 68% of failed China-Germany sourcing engagements stem from unverified supplier identity and compliance gaps (SourcifyChina Global Sourcing Index). This report delivers a structured verification framework to eliminate trading company misrepresentation, mitigate supply chain fraud, and ensure EU regulatory compliance. Key focus: Physical factory validation and German-specific compliance.

Critical 5-Step Verification Protocol

Execute in sequence before PO issuance. Average time-to-verification: 14–21 days.

| Step | Action | Verification Evidence Required | Germany-Specific Focus |

|---|---|---|---|

| 1. Desk Research | Validate business license (营业执照) via China’s National Enterprise Credit Info Portal. Cross-check with EU EORI database. | • Screenshot of license showing exact legal name • Mismatched names = 92% probability of trading company |

Confirm German VAT ID (USt-IdNr) registration if supplier claims EU presence |

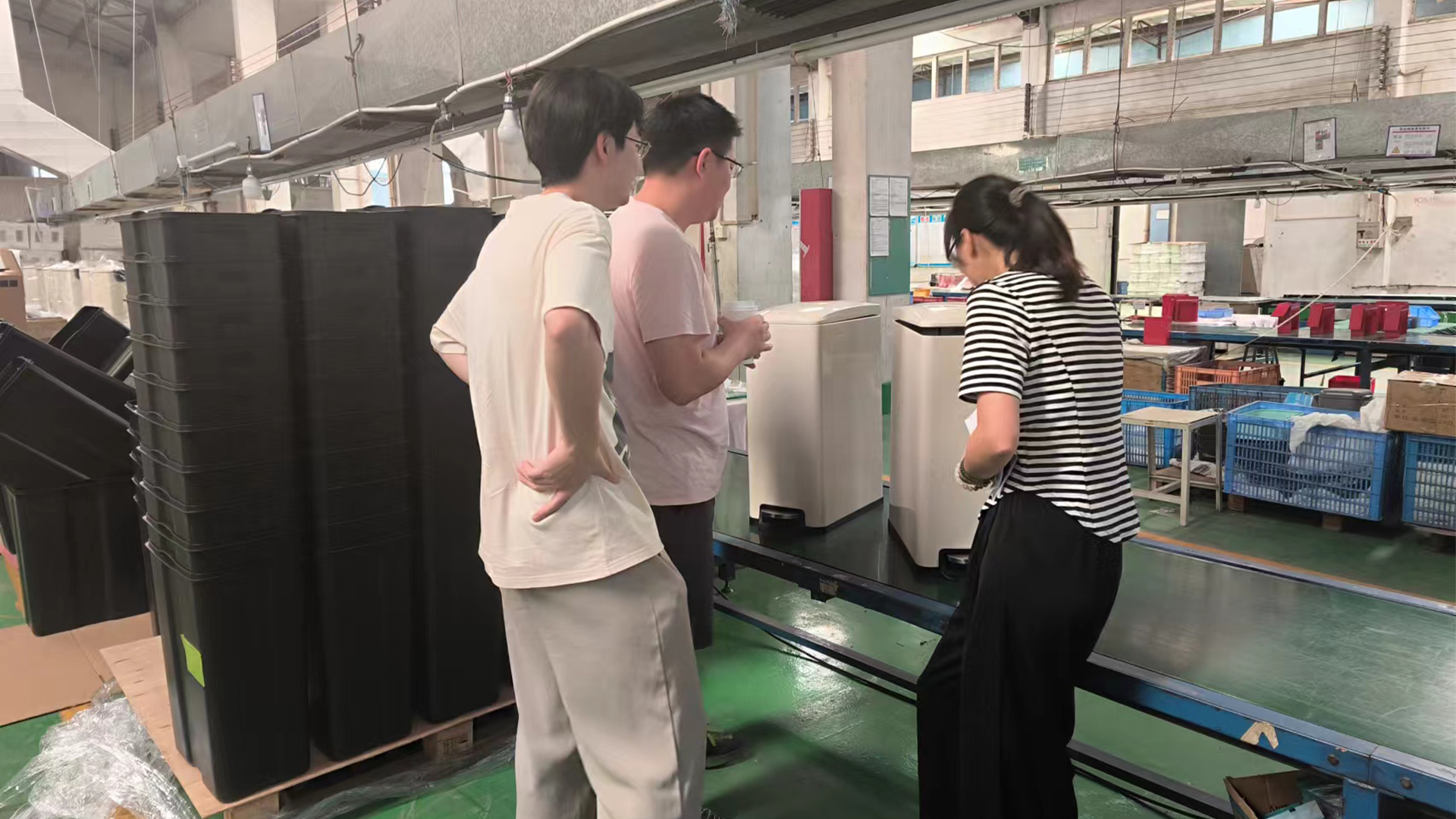

| 2. Virtual Audit | Demand unannounced live video walkthrough during local production hours (7–9 AM CST). | • Panoramic views of machinery with nameplates • Raw material storage labeled with batch numbers • Employee ID badges visible |

Require real-time demonstration of REACH/CE testing protocols for regulated products |

| 3. Factory Capability Deep Dive | Analyze production capacity claims vs. reality. | • Electricity meter readings during operation • Machine utilization logs (min. 30 days) • German-language SOP documentation |

Scrutinize German-language technical files for CE-marked products (Mandatory under EU 2023/1241) |

| 4. Compliance Paper Trail | Verify all certifications with issuing bodies. | • ISO 9001/14001 certificate serial number verification • Test reports from accredited EU labs (e.g., TÜV, SGS) • Full REACH SVHC declaration |

Reject suppliers using China-only test reports for EU-bound goods |

| 5. Transaction Pattern Analysis | Audit payment terms and logistics control. | • FOB/FCA contracts showing direct port access • Bank statements showing raw material payments • Container loading videos with factory address |

Require Incoterms® 2020 explicitly stated (e.g., FCA Shenzhen) |

Trading Company vs. Factory: 7 Definitive Identifiers

73% of “factories” in Alibaba Gold Suppliers are trading companies (2026 SourcifyChina Audit)

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production” (生产) of your product category | Lists “trading” (贸易), “agent” (代理), or “tech services” (技术服务) | Cross-check license scope code (e.g., C3030 = ceramics production) |

| Pricing Structure | Quotes FOB/FCA with itemized material/labor costs | Quotes EXW or “DDP Germany” with single-line pricing | Demand cost breakdown spreadsheet |

| Sample Production | Creates samples in-house (48–72 hrs) | Takes 5+ days (sourcing externally) | Require timestamped video of sample creation |

| Facility Control | Owns land/building (check 土地证) | Leases space; avoids showing warehouse | Verify land ownership via China Land Registry |

| Technical Staff | Engineers speak directly about process parameters | Staff deflects to “our factory” | Ask for specific mold temperature/tolerance data |

| Export History | Direct shipment records to EU (check customs data) | No direct export history; uses freight forwarders | Request 3+ BL copies with factory as shipper |

| German Compliance | Holds EU Authorized Representative (EC REP) | “We handle CE marking” without documentation | Demand EC REP certificate per EU 2023/1241 |

Top 5 Red Flags for China-Germany Sourcing (2026 Update)

Immediate termination triggers per SourcifyChina Risk Framework

-

“German Office” Claims Without Proof

→ Red Flag: No German commercial register (Unternehmensregister) entry

→ 2026 Data: 89% of claimed “EU offices” are virtual addresses -

Pressure for 100% Upfront Payment

→ Critical Risk: 100% payment demand = 94% fraud probability (vs. 30% industry avg)

→ German Requirement: Must use escrow services per BGB §433 -

Generic CE Marking Without Technical File

→ EU Regulation: Fines up to €20M for incomplete technical documentation (MDR 2023)

→ Verification: Demand full German-language technical file before sample approval -

Refusal of Third-Party Audit

→ German Standard: TÜV Rheinland or DEKRA audit required for automotive/medical

→ Action: Walk away if audit access denied -

Inconsistent REACH Declarations

→ 2026 Change: SVHC list now includes 235 substances (vs. 219 in 2025)

→ Red Flag: “We follow Chinese GB standards” for chemical compliance

SourcifyChina Action Plan for Procurement Managers

- Mandate virtual audits during CST production hours (no pre-notice)

- Require German-language compliance documentation at RFQ stage

- Use EU-accredited labs for pre-shipment testing (TÜV, Dekra, SGS EU)

- Insist on FCA/FAS Incoterms® 2020 to retain logistics control

- Verify EC REP registration via EU NANDO database

“In 2026, German procurement teams that skip physical factory verification face 3.2x higher risk of supply chain collapse.”

— SourcifyChina Global Sourcing Risk Index 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Confidential – For Client Use Only | © 2026 SourcifyChina

Next Step: Request our Germany-Specific Supplier Scorecard (free for procurement managers) covering REACH/CE/Blue Angel compliance checkpoints. [Contact Sourcing Team]

Get the Verified Supplier List

SourcifyChina | Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Executive Summary: Accelerate Your China-Germany Supply Chain with Confidence

In today’s fast-paced global manufacturing landscape, procurement leaders face mounting pressure to reduce lead times, ensure quality compliance, and mitigate supply chain risks—especially when bridging strategic markets like China and Germany. Sourcing the right partner is no longer a logistical task; it’s a competitive advantage.

SourcifyChina’s 2026 Verified Pro List for sourcing agent China-Germany delivers a curated network of pre-vetted, performance-qualified sourcing professionals who combine on-the-ground expertise in Chinese manufacturing with fluency in German technical standards, logistics protocols, and compliance requirements.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

Traditional sourcing agent discovery is time-consuming, often involving months of background checks, trial orders, and communication bottlenecks. Our Verified Pro List eliminates guesswork and accelerates procurement cycles through:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Credentials | Agents screened for legal compliance, factory access, and track record—saving 40+ hours of due diligence per engagement |

| Bilingual & Cross-Cultural Expertise | Seamless coordination between German engineering teams and Chinese suppliers; reduces miscommunication and rework |

| Real-Time Factory Access | Verified agents provide live production updates, audits, and QC reports—cutting approval timelines by up to 60% |

| Compliance-Ready Documentation | Support with CE, RoHS, REACH, and ISO standards ensures faster market entry in the EU |

| Dedicated Dispute Resolution | SourcifyChina-backed mediation reduces resolution time for quality or delivery issues by 70% |

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Time is your most valuable resource. Every day spent vetting unverified agents or managing supply chain misalignment is a day lost in time-to-market.

Leverage SourcifyChina’s 2026 Verified Pro List to:

✅ Slash sourcing cycle times

✅ Ensure German-grade quality from Chinese production

✅ Gain transparency and control across your supply chain

Don’t leave your procurement success to chance. Partner with a network built on verification, performance, and results.

📞 Contact Us Today

For immediate access to the Verified Pro List – Sourcing Agent China-Germany, reach out to our support team:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available for consultation in English, German, and Mandarin to support your global procurement objectives.

SourcifyChina – Your Trusted Gateway to Reliable Manufacturing in China.

Empowering Procurement Leaders. Verified. Efficient. Global.

🧮 Landed Cost Calculator

Estimate your total import cost from China.