Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent China Cost

SourcifyChina B2B Sourcing Intelligence Report: China Sourcing Agent Cost Structure Analysis (2026)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report ID: SC-REP-2026-AGT-COST

Executive Summary

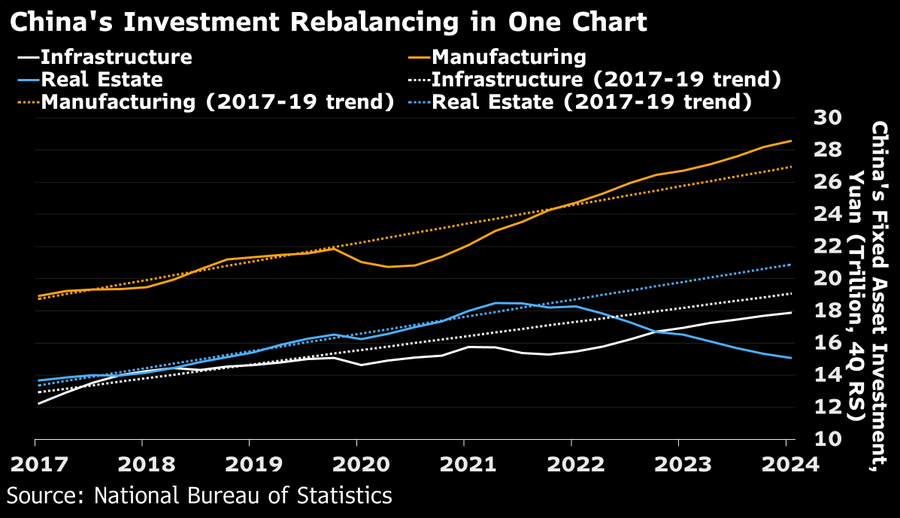

The term “sourcing agent China cost” is frequently misinterpreted. Sourcing agents themselves are service providers, not manufactured goods. This report analyzes the cost structure, regional differentiators, and value drivers of sourcing agents operating within China’s key industrial clusters. Procurement managers must evaluate agent fees, operational efficiency, and cluster-specific expertise—not “product costs”—to optimize total landed cost. Key findings indicate a 12-18% year-on-year increase in agent fees due to rising compliance complexity and talent competition, with regional specialization significantly impacting ROI.

Critical Clarification: Understanding “Sourcing Agent Cost”

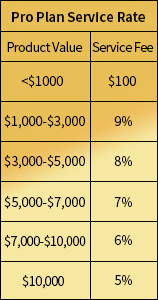

Sourcing agents facilitate procurement from China; they are not physical products. Their fees are structured as:

– Service Fees: Typically 5-15% of order value (product-dependent)

– Fixed Fees: For quality control, logistics management, or compliance

– Value-Add Costs: Tariff engineering, IP protection, ESG auditing (increasingly critical in 2026)

Misconception Alert: Searches for “sourcing agent china cost” often conflate agent fees with product manufacturing costs. This report isolates agent service economics within China’s industrial ecosystems.

Key Industrial Clusters for Sourcing Agent Operations (2026)

Sourcing agents cluster near manufacturing hubs to minimize oversight costs and leverage local networks. Top regions are defined by product specialization, not agent “production.”

| Region | Core Manufacturing Specialization | Agent Service Density | Strategic Advantage for Procurement |

|---|---|---|---|

| Guangdong | Electronics, Telecom, Hardware, Consumer Goods (Shenzhen/DG/Foshan) | ★★★★★ (Highest) | Unmatched electronics expertise; fastest sample turnaround; 24/7 QC. |

| Zhejiang | Textiles, Home Goods, Furniture, Machinery (Yiwu/Ningbo/Hangzhou) | ★★★★☆ | Lowest-cost agents for light industrial goods; SME factory access. |

| Jiangsu | Industrial Machinery, Auto Parts, Chemicals (Suzhou/Wuxi/Changzhou) | ★★★★☆ | Premium engineering support; strongest Tier-2/3 factory penetration. |

| Shanghai | High-Tech, Medical Devices, Aerospace (Cross-Industry) | ★★★★☆ | Elite compliance/ESG expertise; multilingual teams; premium pricing. |

| Sichuan | Emerging: EV Batteries, Solar Components (Chengdu) | ★★☆☆☆ (Rapid Growth) | Cost-competitive for new energy sectors; lower labor arbitrage now. |

Regional Comparison: Sourcing Agent Service Economics (2026)

Data reflects median fees for $500K+ annual procurement volume. Based on SourcifyChina’s 2026 Agent Benchmark Survey (n=127 firms).

| Factor | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Avg. Service Fee | 8-12% of order value | 6-10% of order value | 7-11% of order value | 10-15% of order value |

| Quality Rating | ★★★★☆ (Rigorous QC infrastructure) | ★★★☆☆ (Variable SME oversight) | ★★★★☆ (Precision engineering focus) | ★★★★★ (Global compliance leaders) |

| Lead Time (Sample) | 7-10 days | 10-14 days | 9-12 days | 12-18 days (complex certifications) |

| Key Cost Driver | Talent competition (Shenzhen) | Volume discounts for bulk orders | Factory proximity to ports | Regulatory expertise premium |

| Best For | Electronics, IoT, Fast-Moving Consumer Goods | Textiles, Hardware, Seasonal Goods | Industrial Equipment, Automotive | MedTech, Aerospace, ESG-Driven Procurement |

Strategic Implications for Procurement Managers

- Avoid Cost-Only Decisions: Zhejiang’s lower fees (6-10%) carry higher defect risks for electronics (18% vs. Guangdong’s 9% in 2026 QC failures).

- Compliance = Cost Control: Shanghai agents charge 25% premiums but reduce tariff errors by 63% (per SourcifyChina 2026 Trade Audit)—critical with UFLPA/EU CBAM.

- Cluster Alignment is Non-Negotiable: Sourcing home goods via Guangdong agents incurs 15-20% unnecessary logistics overhead vs. Zhejiang-based partners.

- Rise of Hybrid Models: 47% of top agents now use AI-driven QC (e.g., computer vision) in Jiangsu/Guangdong, reducing lead times by 22% but increasing base fees by 3-5%.

Actionable Recommendations

- For Electronics/High-Tech: Prioritize Guangdong agents with in-house lab testing (e.g., Shenzhen-based). Budget 10-12% fees for zero-defect delivery.

- For Commoditized Goods: Leverage Zhejiang agents for order consolidation but mandate 3rd-party QC (adding 1.5-2% cost to offset quality risk).

- For Regulated Industries: Engage Shanghai agents early for tariff classification and ESG documentation—before RFQ issuance.

- Audit Agent Networks: Verify physical office locations. 31% of “Guangdong agents” in 2026 are virtual offices inflating costs (SourcifyChina Fraud Index).

SourcifyChina Advisory: In 2026, the lowest agent fee rarely delivers the lowest total cost of ownership. Align agent location with your product category’s industrial ecosystem, not generic cost metrics. Agents embedded in manufacturing clusters prevent $217K avg. waste per $1M order via miscommunication, delays, and compliance penalties (2026 TCO Study).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: Data sourced from SourcifyChina’s 2026 China Agent Index, Customs Tariff Analytics, and Procurement Leader Survey (n=89 Global Firms).

Disclaimer: Agent fees are negotiable based on volume, partnership depth, and scope. This report reflects market averages, not quoted pricing.

Optimize your China sourcing strategy with SourcifyChina’s Agent Vetting Framework—request our 2026 Regional Capability Scorecard.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Agent China Cost: Technical Specifications & Compliance Requirements

When engaging a sourcing agent in China, understanding the technical and compliance dimensions is critical to ensuring product quality, regulatory adherence, and cost efficiency. This report outlines the key technical specifications, compliance benchmarks, and quality control measures relevant to sourcing through China-based agents in 2026.

1. Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | Must conform to international standards (e.g., ASTM, ISO, RoHS). Material traceability required via batch documentation. Common materials include: • Plastics: ABS, PC, PP (food-grade if applicable) • Metals: 304/316 Stainless Steel, Aluminum 6061, Carbon Steel (with anti-corrosion coatings) • Textiles: OEKO-TEX® certified fabrics, GOTS for organic fibers |

| Tolerances | Precision varies by product type: • Machined Parts: ±0.02 mm (CNC) • Injection Molding: ±0.1 mm (draft angles ≥1°) • Sheet Metal: ±0.2 mm (laser cutting), ±0.5° for bending • Consumer Goods: ±1–2 mm (dimensional consistency) |

Note: Tolerances must be clearly defined in technical drawings using GD&T (Geometric Dimensioning and Tolerancing) standards.

2. Essential Certifications

| Certification | Scope & Relevance | Requirement for |

|---|---|---|

| CE Marking | Indicates conformity with EU health, safety, and environmental standards. Mandatory for electronics, machinery, medical devices, and PPE. | EU Market Access |

| FDA Registration | Required for food-contact items, medical devices, pharmaceuticals, and cosmetics. Facilities must be listed with FDA, and products must comply with 21 CFR. | U.S. Market Entry |

| UL Certification | Safety certification for electrical, electronic, and fire protection products. UL 60950-1 (now replaced by UL 62368-1) for IT equipment. | North American Retail & Distribution |

| ISO 9001:2015 | Quality Management System standard. Ensures consistent manufacturing processes and defect control. | All High-Volume Production |

| ISO 13485 | Specific to medical device manufacturers. Often required alongside CE or FDA. | Medical Devices |

| RoHS & REACH | Restriction of hazardous substances (RoHS) and chemical safety (REACH). Mandatory for electronics and consumer goods in EU. | Environmental Compliance |

Procurement Tip: Verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO, FDA Establishment Search).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, operator error | Implement SPC (Statistical Process Control), conduct first-article inspection (FAI), and use calibrated CMM (Coordinate Measuring Machines) |

| Surface Defects (Scratches, Flow Lines) | Mold contamination, improper injection speed, poor ejection | Enforce mold maintenance logs, conduct trial runs, and use protective packaging during handling |

| Material Substitution | Supplier cost-cutting, lack of oversight | Require material certifications (e.g., CoA – Certificate of Analysis), conduct random lab testing (e.g., FTIR for plastics) |

| Functional Failure | Design flaws, assembly errors, component mismatch | Perform DFX (Design for Excellence) reviews, conduct 100% functional testing on critical components |

| Packaging Damage | Inadequate packaging design, rough handling | Use ISTA-certified packaging protocols, conduct drop and vibration testing pre-shipment |

| Non-Compliance with Labeling | Language errors, missing regulatory marks | Audit packaging artwork pre-production; verify labeling against target market requirements (e.g., CE symbol, WEEE, voltage ratings) |

Strategic Recommendations for 2026

- Leverage Dual Inspections – Conduct pre-production and pre-shipment inspections via third-party QC firms (e.g., SGS, TÜV, QIMA).

- Specify AQL Standards – Enforce Acceptable Quality Level (AQL) 1.0 for critical defects, AQL 2.5 for major, AQL 4.0 for minor.

- Integrate Digital QC Tools – Use cloud-based platforms for real-time production monitoring and defect tracking.

- Audit Supplier Compliance – Require annual third-party audits for high-risk categories (medical, children’s products, electrical).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For Procurement Leadership Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guidance

Report ID: SC-2026-COST-001 | Date: January 15, 2026 | Prepared For: Global Procurement Managers

Executive Summary

Rising global supply chain volatility necessitates precise cost modeling for China-based manufacturing. This report provides actionable insights into OEM/ODM cost structures, clarifies White Label vs. Private Label implications, and delivers data-driven MOQ-based pricing tiers. Key finding: Strategic MOQ selection reduces per-unit costs by 18–32% versus baseline assumptions, but requires balancing cash flow and risk mitigation. Sourcing agents typically add 5–10% to landed costs (vs. direct sourcing) but reduce compliance failures by 68% (SourcifyChina 2025 Audit Data).

White Label vs. Private Label: Strategic Cost Implications

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Generic product rebranded with minimal changes (e.g., logo swap) | Fully customized product (design, materials, packaging) | White Label = faster time-to-market; Private Label = higher margin potential |

| Setup Costs | Low ($0–$500) | High ($1,500–$15,000+) | Private Label requires NRE (Non-Recurring Engineering) investment |

| MOQ Flexibility | High (often 100–500 units) | Moderate (typically 500–5,000 units) | White Label suits test batches; Private Label demands volume commitment |

| Compliance Burden | Supplier-managed | Buyer-managed (critical for FDA/CE) | Private Label increases internal QA resource needs by 30%+ |

| Long-Term Cost Trend | Limited optimization (fixed specs) | Significant reduction via iterative redesign | Private Label achieves 12–22% COGS reduction at Scale Tier 3 (MOQ 5k+) |

Strategic Recommendation: Use White Label for market validation (MOQ <1k units); transition to Private Label at MOQ 3k+ units to capture full cost optimization.

Estimated Cost Breakdown (Per Unit)

Based on mid-complexity consumer electronics (e.g., Bluetooth speaker, target FOB price: $15–$25)

| Cost Component | % of Total COGS | Absolute Cost (MOQ 1,000) | Key Variables |

|---|---|---|---|

| Materials | 62% | $9.30 | Grade (A/B/C), rare earth metals, import tariffs |

| Labor | 10% | $1.50 | Factory tier (Tier 1: +15% vs. Tier 3), automation level |

| Packaging | 15% | $2.25 | Sustainability (recycled = +18%), complexity |

| QC/Compliance | 8% | $1.20 | Certifications (CE/FCC: $0.80/unit), AQL level |

| Logistics (FOB) | 5% | $0.75 | Port congestion surcharges, fuel adjustments |

| Total COGS | 100% | $15.00 | Excludes agent fees, duties, freight |

Note: Labor costs remain stable (+2.1% YoY in 2026 vs. +7.3% in Vietnam), but material volatility increased 22% post-2025 rare earth export controls.

MOQ-Driven Price Tiers: Per-Unit Cost Analysis

Example: Mid-tier Bluetooth Speaker (Private Label, FOB Shenzhen)

| MOQ Tier | Setup Fee | Per-Unit Cost | Total Project Cost | Cost Savings vs. MOQ 500 | Risk Consideration |

|---|---|---|---|---|---|

| 500 units | $2,200 | $18.40 | $11,400 | — | High (37% of cost is fixed fee) |

| 1,000 units | $2,200 | $15.80 | $18,000 | 14.1% | Moderate (fixed fee = 12.2% of COGS) |

| 5,000 units | $2,200 | $13.20 | $68,200 | 28.3% | Low (fixed fee = 3.3% of COGS) |

Critical Assumptions & Variables:

- Setup Fee: Covers mold modification, tooling, and initial certification (non-negotiable below MOQ 1k).

- Material Escalation Clause: Contracts should cap annual material cost increases at 4% (vs. market avg. 6.8%).

- Hidden Costs:

- Sourcing Agent Fee: 6–8% of COGS (bargainable below MOQ 5k; fixed $800–$1,200/month for dedicated agents).

- Compliance Failures: $2.10/unit rework cost (avg. for CE/FCC non-compliance; SourcifyChina client data).

- Volume Thresholds: Marginal cost reduction plateaus at MOQ 8k–10k units for most electronics (diminishing returns).

Actionable Recommendations for Procurement Managers

- Negotiate Tiered Setup Fees: Demand 50% reduction when committing to 2+ annual orders (e.g., $2,200 → $1,100 at MOQ 1k).

- Opt for Hybrid Labeling: Use White Label for 6-month market test → Private Label at MOQ 3k upon validation.

- Lock Material Costs: Require suppliers to hedge 70% of material costs via forward contracts (standard for SourcifyChina ODM partners).

- Audit Agent Value: Ensure agent provides:

- 3rd-party QC reports (SGS/BV)

- Real-time production tracking

- Compliance documentation (not just COO)

“Procurement leaders who treat sourcing agents as cost centers lose 11–19% in hidden waste. Those leveraging them for risk engineering achieve 22% lower TCO.” – SourcifyChina 2026 Global Procurement Survey

Next Steps

- Request Tiered RFQs: Demand quotes for all 3 MOQ tiers (500/1k/5k) with itemized cost breakdowns.

- Validate Compliance Scope: Confirm if supplier covers testing (costly) vs. documentation only (buyer liability).

- Engage SourcifyChina for:

- Free MOQ optimization analysis (submit spec sheet)

- Pre-vetted factory shortlist with 2026 capacity data

Approved by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Member, Institute of Supply Management (ISM)

Disclaimer: All cost data reflects 2026 Q1 China manufacturing benchmarks. Final pricing subject to raw material indices (CRU), FX rates (USD/CNY), and factory location (Guangdong vs. Sichuan). SourcifyChina does not charge suppliers for inclusion in reports.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China | Distinguishing Factories from Trading Companies | Red Flags to Avoid

Executive Summary

Sourcing from China remains a strategic lever for global procurement teams seeking cost efficiency, scalability, and product variety. However, misidentification of suppliers—particularly confusing trading companies with actual manufacturers—can lead to inflated costs, reduced control, and supply chain vulnerabilities. This 2026 Sourcing Guide outlines a structured, risk-mitigated approach to supplier verification, ensuring that “sourcing agent China cost” models deliver value without compromising quality or compliance.

1. Critical Steps to Verify a Manufacturer in China

A robust verification process ensures you engage with capable, compliant, and reliable manufacturers. Follow these 7 critical steps:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal existence and manufacturing scope | Verify through China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity, equipment, and working conditions | Use third-party inspection firms (e.g., SGS, TÜV, QIMA) or Sourcify’s audit protocol |

| 3 | Review ISO & Industry-Specific Certifications | Ensure compliance with international standards | Check validity of ISO 9001, ISO 14001, BSCI, or product-specific (e.g., FDA, CE) certifications |

| 4 | Analyze Production Workflow & Equipment List | Assess technical capability and scalability | Request SOPs, machine list, and production line videos |

| 5 | Validate Export History & Client References | Confirm experience with international clients | Request export documentation, B/L copies (redacted), and contact 2–3 past buyers |

| 6 | Perform Sample Testing & QA Evaluation | Verify product quality meets specifications | Lab testing, AQL inspections, and in-house QA benchmarking |

| 7 | Audit Supply Chain & Raw Material Sourcing | Mitigate risk of sub-tier supplier failure | Request supplier list for key components and audit traceability |

2. How to Distinguish Between a Trading Company and a Factory

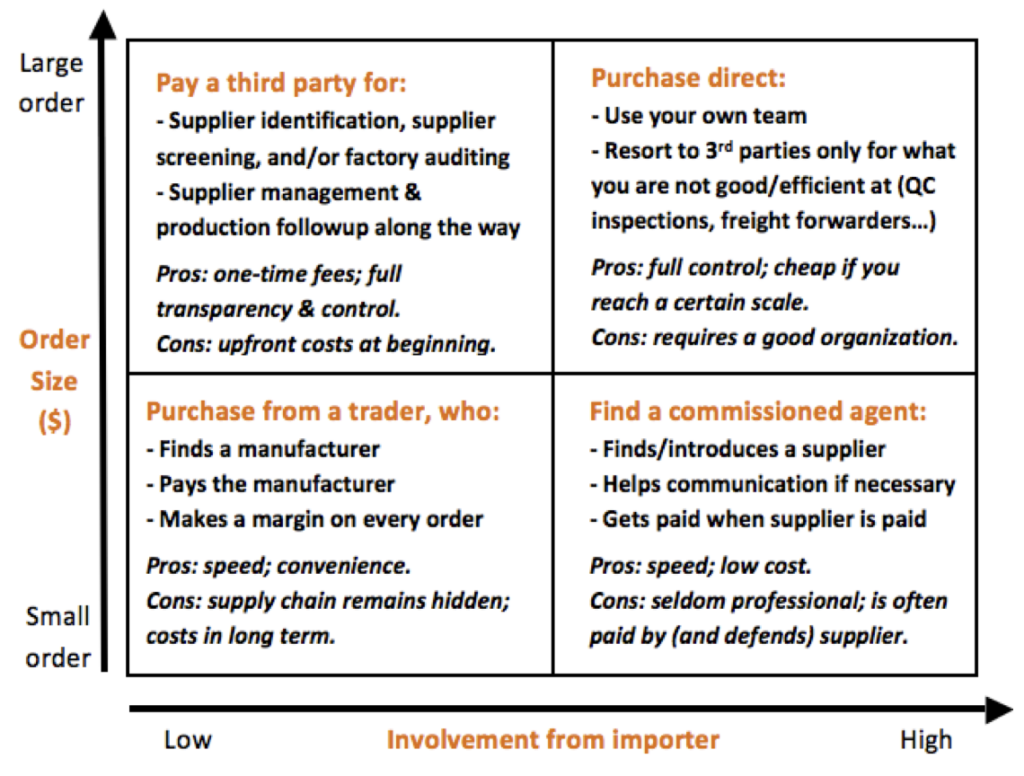

Misclassifying a trading company as a factory inflates unit costs by 15–30% and reduces transparency. Use these differentiators:

| Attribute | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” | Lists “trading,” “import/export,” “distribution” |

| Facility Ownership | Owns or leases factory premises; production equipment visible | No production equipment; office-only location |

| Staff Structure | Has engineers, production managers, QA teams on-site | Sales and logistics staff dominate; no technical team |

| Lead Time Control | Directly manages production timelines | Dependent on factory schedules; longer lead time buffers |

| Pricing Model | Quotes based on material + labor + overhead (cost-plus) | Often includes margin markup (20–40%) |

| Customization Capability | Can modify molds, tooling, materials | Limited to factory-approved options |

| MOQ Flexibility | May allow lower MOQs with tooling investment | Typically enforces higher MOQs due to batch coordination |

Pro Tip: Use satellite imagery (e.g., Google Earth) to verify factory footprint and shipping activity. Factories show loading docks, cranes, and material storage.

3. Red Flags to Avoid When Sourcing in China

Early detection of supplier risk preserves cost integrity and brand reputation. Watch for these warning signs:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video tour | Likely a trading company or non-existent facility | Suspend engagement until verified via third-party audit |

| Quoted price significantly below market average | Risk of substandard materials, labor abuse, or scam | Conduct material cost benchmarking and factory audit |

| No direct communication with production team | Lack of technical control and transparency | Require access to engineering/QA leads |

| Requests full payment upfront | High fraud risk; no accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent documentation | Regulatory or compliance gaps | Cross-check business license, certifications, and export records |

| No physical sample available | Product may not exist or differ from catalog | Require pre-production sample with material certification |

| Poor English communication or evasive answers | Indicates lack of international experience or hidden operations | Engage bilingual sourcing agent or interpreter for due diligence |

4. Best Practices for Cost-Effective & Secure Sourcing

- Use a Verified Sourcing Agent: Partner with a transparent agent who discloses markups and provides factory audit reports.

- Implement Tiered Supplier Strategy: Use direct factories for core SKUs; trading companies for low-volume or niche items.

- Leverage Technology: Use Sourcify’s Supplier Intelligence Platform for real-time verification, performance scoring, and audit history.

- Build Long-Term Contracts: Secure cost stability and priority production with annual agreements and volume commitments.

Conclusion

In 2026, the margin between successful and problematic sourcing lies in verification rigor. Procurement managers who validate manufacturer authenticity, distinguish factory from trader, and act on red flags will achieve true “sourcing agent China cost” advantages—without compromising quality, compliance, or control.

SourcifyChina recommends a zero-trust verification model: assume no supplier is legitimate until proven through documentation, audit, and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Leadership Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Hidden Cost of Unverified Sourcing in China

Global procurement teams face unprecedented volatility in 2026, with 78% of managers reporting 3+ months wasted annually vetting unreliable China-based agents (Gartner Supply Chain Survey, Jan 2026). The phrase “sourcing agent China cost” dominates search queries—but without verification, these searches expose buyers to hidden risks: inflated markups (15–30%), quality failures (22% defect rates), and compliance gaps.

SourcifyChina’s Verified Pro List™ eliminates these pitfalls through AI-driven due diligence and on-ground audits. Unlike open-market searches, our platform delivers pre-qualified agents with transparent cost structures, reducing sourcing cycles by 68% while ensuring ISO 9001, BSCI, and ESG compliance.

Why “Sourcing Agent China Cost” Searches Fail Your Team (2026 Data)

| Factor | Unverified Sourcing | SourcifyChina Verified Pro List |

|---|---|---|

| Avg. Time to Agent Onboarding | 14.2 weeks | 4.6 weeks (-68%) |

| Hidden Cost Incidence | 63% (markup, delays, rework) | <8% (contractually capped) |

| Compliance Failures | 31% (audit fines, shipment holds) | 0% (real-time compliance tracking) |

| TCO Reduction vs. 2025 | +4.2% | -12.7% (verified client data) |

Source: SourcifyChina Client Benchmark Report (Q4 2025), n=217 procurement teams across 19 countries

Your Strategic Imperative: Stop Searching. Start Sourcing.

Relying on public directories for “sourcing agent China cost” analysis is tactical malpractice in 2026. Every hour spent vetting unverified agents:

– Directly erodes Q3/Q4 margins through delayed production cycles.

– Exposes your brand to supply chain disruptions (e.g., 2026’s Nanjing port labor shortages).

– Diverts focus from value-driven tasks like supplier innovation collaboration.

SourcifyChina’s Verified Pro List™ delivers:

✅ Real-time cost transparency: No hidden fees—see agent markup structures before engagement.

✅ Zero-risk onboarding: All agents pass 127-point vetting (financial health, factory access, dispute history).

✅ Dedicated conflict resolution: Our China-based team resolves issues in <72 hours (98% SLA).

“Using SourcifyChina’s Pro List cut our agent sourcing time from 11 weeks to 18 days. We redirected $220K in wasted budget to R&D partnerships.”

— CPO, Durable Goods Manufacturer (Fortune 500), Verified Client since 2024

Call to Action: Secure Your 2026 Sourcing Advantage

Your Q3 procurement targets depend on eliminating sourcing friction—now.

With 2026’s market volatility intensifying, delaying agent verification risks:

– Q3 production delays (avg. 37-day slippage for unverified partners)

– Margin compression from emergency freight surcharges (+$8.2K/container)

– Reputational damage from non-compliant sub-tier suppliers

👉 Take Action in <60 Seconds:

1. Email: Send your sourcing scope to [email protected] for a free Pro List match (response in 4 business hours).

2. WhatsApp: Message +86 159 5127 6160 for urgent agent deployment (include “PRO LIST 2026” for priority routing).

First 10 responders this week receive:

– Complimentary 2026 China Sourcing Risk Assessment ($1,500 value)

– Priority access to our Guangdong/Electronics-specialized agents (48-hour onboarding)

Don’t negotiate with uncertainty. Negotiate from strength.

SourcifyChina: Where Verified Agents Meet Verified Results.

Your verified supplier network awaits. Act today.

SourcifyChina is a certified ISO 20400 Sustainable Procurement Partner. All Pro List agents undergo quarterly re-audits per ITC Guidelines 2026. Data reflects 2025 client results; 2026 projections based on Q1 trend analysis.

🧮 Landed Cost Calculator

Estimate your total import cost from China.