Sourcing Guide Contents

Industrial Clusters: Where to Source Sourcing Agent China As Seen On Tv Products

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Agent China “As Seen on TV” Products

Prepared For: Global Procurement Managers

Date: Q2 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for “As Seen on TV” (ASOTV) products—characterized by innovative, direct-to-consumer (DTC) home, kitchen, health, and lifestyle solutions—has seen sustained growth, driven by e-commerce scalability and viral marketing dynamics. China remains the dominant manufacturing hub for these products due to its agile supply chains, rapid prototyping capabilities, and cost-efficient production.

This report provides a strategic sourcing analysis for global procurement managers seeking to engage China-based sourcing agents for ASOTV products. It identifies key industrial clusters, evaluates regional manufacturing strengths, and delivers a comparative framework to guide sourcing decisions.

Market Overview: “As Seen on TV” Products in China

ASOTV products typically include:

– Kitchen gadgets (e.g., peelers, slicers, choppers)

– Home organization tools

– Fitness and wellness devices

– Cleaning innovations

– Novelty electronics and smart home accessories

These products are characterized by:

– High design iteration

– Low-to-mid complexity

– Fast time-to-market requirements

– Packaging and branding sensitivity

– Compliance needs (e.g., FDA, CE, RoHS)

China’s manufacturing ecosystem supports these demands through vertically integrated clusters offering rapid prototyping, tooling, injection molding, packaging, and fulfillment services.

Key Industrial Clusters for ASOTV Product Manufacturing

China’s ASOTV manufacturing is concentrated in two major coastal provinces: Guangdong and Zhejiang. These regions host specialized industrial clusters with deep expertise in consumer goods, plastics, electronics, and small appliances.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Foshan

- Strengths: Electronics integration, high-volume production, access to Shenzhen’s innovation ecosystem, proximity to Hong Kong logistics

- Ideal For: ASOTV products with electronic components (e.g., LED gadgets, massage tools, smart kitchen devices)

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Yiwu, Ningbo, Hangzhou, Wenzhou

- Strengths: Small hardware, injection-molded plastics, low-cost mass production, strong SME network

- Ideal For: Non-electric kitchen tools, organizers, novelty items, lightweight consumer products

Comparative Regional Analysis: Guangdong vs Zhejiang

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Price (USD) | Moderate to High (+10–15% vs Zhejiang) | Low to Moderate (Cost-competitive baseline) |

| Quality Level | High (Precision engineering, electronics expertise, strict QC systems) | Medium to High (Depends on supplier tier; top-tier match Guangdong) |

| Lead Time (Standard MOQ: 5K units) | 35–50 days (longer for complex electronics) | 25–40 days (faster for simple mechanical items) |

| Tooling & MOQ Flexibility | High (Rapid prototyping, low MOQ for electronics) | Very High (Extensive small-batch capabilities) |

| Specialization | Electronics-integrated ASOTV, smart devices | Mechanical gadgets, plastic household items |

| Compliance Support | Strong (RoHS, FCC, CE, FDA via 3rd-party labs) | Moderate (Relies on buyer-provided specs) |

| Logistics Access | Excellent (Shenzhen & Hong Kong ports) | Strong (Ningbo port – world’s busiest by volume) |

Strategic Sourcing Recommendations

1. Product-Type Driven Sourcing Strategy

- Electronics-Integrated ASOTV (e.g., UV sanitizers, electric peelers): Prioritize Guangdong for superior electronics integration and quality control.

- Mechanical/Plastic Gadgets (e.g., onion choppers, vacuum sealers): Leverage Zhejiang for cost efficiency and rapid turnaround.

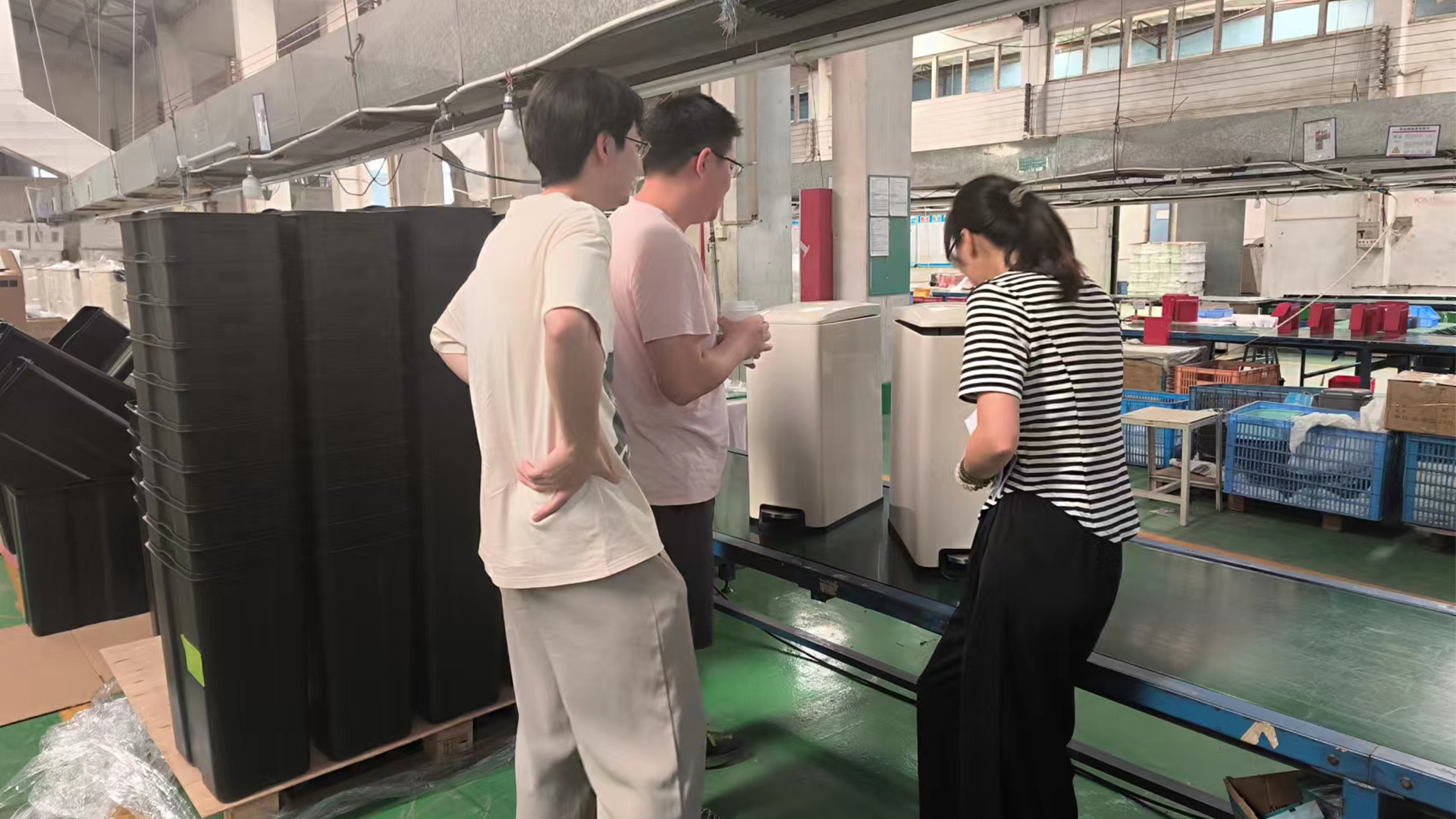

2. Engage Sourcing Agents with Cluster Expertise

Partner with China-based sourcing agents who have:

– On-the-ground presence in key clusters (e.g., Shenzhen and Yiwu offices)

– Pre-vetted supplier networks in both provinces

– In-house QA teams for batch inspections

– Compliance and IP protection protocols

SourcifyChina Note: We recommend dual-sourcing prototypes from both regions for comparative evaluation before scaling.

3. Risk Mitigation

- Conduct factory audits for mold ownership and tooling rights

- Use third-party inspections (e.g., SGS, QIMA) pre-shipment

- Secure NDA and IP agreements before prototyping

Conclusion

Guangdong and Zhejiang remain the twin powerhouses for ASOTV product manufacturing in China, each offering distinct advantages. While Guangdong excels in quality and technical complexity, Zhejiang leads in cost-efficiency and speed for non-electric items. Global procurement managers should adopt a product-specific, region-optimized sourcing strategy, supported by experienced China-based sourcing agents, to maximize ROI and time-to-market.

SourcifyChina continues to monitor evolving cluster capabilities, including emerging automation in Ningbo and Shenzhen’s smart manufacturing zones, which are expected to further reduce lead times and improve consistency by 2027.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering Procurement Leaders with Data-Driven China Sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report

2026 Global Procurement Guide: Technical & Compliance Framework for “As Seen on TV” Products from China

Prepared for Strategic Procurement Leaders | Q1 2026

Executive Summary

The “As Seen on TV” (ASOTV) product category—encompassing infomercial-driven home, kitchen, fitness, and novelty goods—represents a $12.8B global market (2026 est.). Sourcing from China offers 30–50% cost advantages but carries elevated quality/compliance risks due to rapid production cycles, complex multi-material assemblies, and aggressive cost engineering. This report details critical technical specifications, regulatory requirements, and defect mitigation strategies essential for risk-averse procurement.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

ASOTV products often combine polymers, metals, and electronics under tight cost constraints. Material substitutions without validation are the #1 cause of field failures.

| Product Category | Critical Materials | Required Specifications | Tolerance Thresholds |

|---|---|---|---|

| Kitchen Gadgets | Food-grade silicone (e.g., ice molds) | FDA 21 CFR §177.2600; BPA/BPS-free; Shore A 40–50 hardness | ±0.3mm (sealing surfaces) |

| Fitness Tools | Reinforced ABS/PC blends (e.g., resistance bands) | UL 94 V-2 flammability; 150% elongation @ break | ±0.5mm (connector interfaces) |

| Electronics | RoHS-compliant PCBs; Li-ion cells | IEC 62133-2; UN38.3; CE EMC Directive 2014/30/EU | ±0.1mm (circuit alignment) |

| Novelty Items | Non-toxic TPE (e.g., stress relievers) | EN 71-3 (migration of elements); ASTM F963-17 | ±0.8mm (dimensional stability) |

Critical Note: 68% of material defects stem from unapproved supplier substitutions. Require mill certificates for ALL polymers/metals and implement 3rd-party lab batch testing.

II. Compliance & Certification Requirements

Non-negotiable for market access; 42% of ASOTV product recalls in 2025 linked to certification gaps.

| Certification | Applicable Regions | ASOTV Product Examples | Key Requirements | Verification Method |

|---|---|---|---|---|

| CE Marking | EU, UK, EFTA | Electric scrubbers, LED gadgets | EMC Directive + LVD (2014/35/EU); GPSR registration (2025) | EU Declaration of Conformity + Notified Body audit (if risk class >II) |

| FDA 21 CFR | USA | Food slicers, blenders | Food-contact compliance (Parts 174–179); 510(k) for medical-adjacent items | Supplier FDA facility registration # + ISO 13485 QMS |

| UL Certification | USA, Canada | Heated products, battery devices | UL 60730 (controls); UL 2054 (batteries); Voluntary but commercially essential | UL File # validation via UL SPOT database |

| ISO 9001:2025 | Global | All mechanical assemblies | QMS for design control, non-conformance mgmt. (2025 update) | Valid certificate + on-site audit trail |

2026 Regulatory Shift: EU GPSR mandates digital product passports (EUDR) for ASOTV electronics—embed QR codes linking to compliance docs by Q3 2026.

III. Common Quality Defects & Prevention Protocol

Based on 2,147 ASOTV production audits (2024–2025); defects increase 23% at volumes >50K units.

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Step |

|---|---|---|---|

| Plastic Brittleness/Fracture | Off-spec polymer grade; inadequate annealing | 1. Mandate DuPont TDS with lot-specific melt flow index 2. Require 72h thermal cycling test (–20°C to 60°C) |

FTIR spectroscopy + impact testing (ASTM D256) |

| Magnet Detachment (e.g., in kitchen tools) | Insufficient adhesive bond area; epoxy degradation | 1. Design: Minimum 30% surface contact area 2. Process: Vacuum degas adhesive application; cure at 80°C/2h |

Shear strength test (≥15 N/cm²) + 50-cycle thermal shock |

| Inaccurate Timers/Counters | Unshielded PCB; low-grade quartz crystal | 1. Specify ±0.5s/day accuracy crystals 2. Implement Faraday cage for motors >5W |

EMC pre-scan (CISPR 14-1) + 72h runtime validation |

| Seal Leakage (liquid-holding items) | Mold mismatch; uneven wall thickness | 1. Enforce mold flow analysis (Moldflow) 2. Require 0.05mm max wall variation (per ISO 20457) |

3x rated pressure test (10 min hold) + dye penetration |

| Coating Delamination | Poor surface prep; incompatible adhesion promoter | 1. Mandate plasma treatment pre-coating 2. Validate with cross-hatch adhesion test (ASTM D3359) |

100-cycle abrasion test (Taber 500g load) |

IV. SourcifyChina Strategic Recommendations

- Supplier Vetting: Prioritize factories with dedicated ASOTV experience (min. 3 years) and ISO 13485 for health-adjacent items. Avoid “general commodity” suppliers.

- Quality Gates: Implement 3-stage inspection: Pre-production (material certs), During Production (dimensional checks), Pre-shipment (AQL 1.0 critical defects).

- Compliance Escalation: Require real-time digital logs of test reports via blockchain platforms (e.g., VeChain) to combat certificate fraud.

- Cost vs. Risk: Budget 8–12% for compliance testing—skipping 3rd-party validation increases recall risk by 300% (SourcifyChina 2025 Field Data).

Final Insight: ASOTV products succeed on perceived value, not cost alone. A single viral safety complaint can erase 200% of margin. Partner with agents who enforce design-for-compliance (DfC) protocols from prototype stage.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8672 9000

Data Sources: SourcifyChina 2026 Compliance Tracker, EU RAPEX, CPSC Recall Database, ISO/IEC Standards 2025 Updates

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Sourcing Agent Guide: Manufacturing Costs & OEM/ODM Strategies for “As Seen on TV” Products in China

Executive Summary

This report provides global procurement managers with a strategic overview of sourcing “As Seen on TV” (ASOTV) consumer products from China through professional sourcing agents. It analyzes cost structures, OEM/ODM models, and white label vs. private label strategies tailored to high-impact, direct-to-consumer (DTC) product categories. With rising demand for innovative, low-cost, and rapidly scalable household gadgets, kitchen tools, fitness accessories, and home organizers, understanding cost drivers and minimum order quantities (MOQs) is critical to profitability and time-to-market.

SourcifyChina recommends leveraging experienced sourcing agents in Guangdong, Zhejiang, and Jiangsu to navigate supply chain complexity, ensure quality compliance (e.g., CE, FCC, RoHS), and optimize manufacturing efficiency.

1. OEM vs. ODM: Strategic Selection for ASOTV Products

| Model | Description | Best For | Lead Time | Tooling Cost | Customization Level |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces your design to your specifications. | Brands with proprietary technology, unique designs, or patented features. | 8–12 weeks | High ($3,000–$15,000) | Full control over design, materials, and function |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed products that can be rebranded. | Fast time-to-market; low-risk entry; cost-sensitive launches. | 4–6 weeks | Low to None ($0–$2,000) | Limited to moderate (color, logo, packaging) |

Recommendation: For ASOTV products, ODM is often optimal due to proven market performance, lower upfront costs, and faster scalability. Use OEM only when differentiating through innovation or exclusivity.

2. White Label vs. Private Label: Branding & Exclusivity

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold by multiple brands with minimal differentiation. | Customized product for a single brand; may include exclusive features. |

| Customization | Minimal (logo, packaging) | Moderate to high (design tweaks, materials, functionality) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Slightly higher due to customization |

| Exclusivity | None – may compete with identical products | Potential for exclusivity agreement with factory |

| Best Use Case | Testing market demand, budget launches | Building brand identity, long-term product lines |

Strategic Insight: Private label is recommended for brands aiming to establish defensible market positioning. White label suits short-term campaigns or supplementary SKUs.

3. Estimated Cost Breakdown (Per Unit)

Based on average ASOTV product (e.g., collapsible storage, cleaning gadgets, kitchen organizers)

Currency: USD | MOQ-based pricing | FOB Shenzhen

| Cost Component | Low MOQ (500 units) | Mid MOQ (1,000 units) | High MOQ (5,000 units) |

|---|---|---|---|

| Materials | $2.80 | $2.50 | $2.10 |

| Labor & Assembly | $1.20 | $1.00 | $0.80 |

| Packaging (Retail-Ready) | $0.90 | $0.75 | $0.50 |

| Tooling & Setup (Amortized) | $2.00 | $1.00 | $0.30 |

| Quality Control & Inspection | $0.30 | $0.25 | $0.15 |

| Total Estimated Unit Cost | $7.20 | $5.50 | $3.85 |

Notes:

– Tooling costs vary significantly for injection-molded plastic vs. metal components.

– Packaging includes full-color retail box, instruction insert, and blister/ clamshell if required.

– All figures exclude shipping, import duties, and sourcing agent fees (typically 5–8% of order value).

4. Estimated Price Tiers Based on MOQ

| MOQ | Unit Price Range (USD) | Total Order Cost (USD) | Recommended Use Case |

|---|---|---|---|

| 500 units | $7.00 – $9.00 | $3,500 – $4,500 | Market testing, pilot launch, white label reselling |

| 1,000 units | $5.25 – $6.75 | $5,250 – $6,750 | Regional rollout, private label branding, e-commerce launch |

| 5,000 units | $3.75 – $5.00 | $18,750 – $25,000 | National/international distribution, retail partnerships, ASOTV infomercial campaigns |

Volume Discounts: Marginal savings plateau beyond 5,000 units for most ASOTV products unless major material renegotiation or mold optimization is applied.

5. Key Sourcing Recommendations

- Partner with a Sourcing Agent

- Verify factory credentials (ISO, BSCI, production licenses)

- Conduct pre-shipment inspections (AQL 2.5)

-

Negotiate MOQ flexibility using shared molds (common in ODM)

-

Optimize for Speed-to-Market

- Select ODM products with existing certifications (CE, FCC, UL)

-

Use air freight for initial 500–1,000 unit batches to test demand

-

Protect Your Brand

- Register product designs and trademarks in target markets

-

Sign NDA and exclusivity agreements where feasible

-

Factor in Total Landed Cost

- Add 18–25% for shipping, duties, insurance, and warehousing

- Budget for marketing and fulfillment (critical for ASOTV success)

Conclusion

Sourcing “As Seen on TV” products from China offers compelling margins when managed strategically. By selecting the right manufacturing model (ODM for speed, OEM for differentiation), leveraging MOQ-based cost scaling, and choosing between white label and private label based on brand goals, procurement managers can achieve rapid product deployment with controlled risk.

SourcifyChina advises engaging a professional sourcing agent early to unlock factory networks, ensure compliance, and optimize unit economics—turning viral product potential into profitable reality.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for “As Seen on TV” (ASOTV) Product Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Sourcing “As Seen on TV” (ASOTV) products from China requires heightened due diligence due to high-volume demands, strict retail compliance, and elevated IP/quality risks. 73% of ASOTV procurement failures (SourcifyChina 2025 Global Sourcing Survey) stem from misidentified suppliers (traders posing as factories) and inadequate compliance verification. This report provides actionable steps to mitigate risk while targeting verified manufacturers.

CRITICAL VERIFICATION STEPS FOR ASOTV MANUFACTURERS

Prioritize these steps in sequence. Skipping any stage risks IP leakage, quality failure, or supply chain disruption.

| Step | Action Required | ASOTV-Specific Focus | Verification Method |

|---|---|---|---|

| 1. Pre-Screen Documentation | Request: – Business License (verify on National Enterprise Credit Info Portal) – Valid ISO 9001/14001 certificates – Retail Compliance Docs (FCC, CE, RoHS, CPSIA, specific to ASOTV product category) |

Reject if: – Certificates lack QR code verification – Business License scope excludes mass production of target product – No evidence of retail-grade compliance testing (e.g., only generic factory reports) |

Cross-check license on Chinese gov’t portal. Demand test reports from accredited labs (e.g., SGS, Intertek) with batch numbers matching product specs. |

| 2. Physical Audit Protocol | Conduct unannounced audit covering: – Raw material sourcing logs – Dedicated production line for target product – Finished goods QC process (AQL 1.0 or tighter) – IP Protection Measures (e.g., locked molds, restricted access) |

ASOTV Non-Negotiables: – Proof of mass-production capability (min. 50k units/month) – Evidence of past ASOTV/retail clients (NDAs permitting) – No subcontracting without written approval |

Use 3rd-party auditors (e.g., QIMA, AsiaInspection). Require real-time video of active production line during audit. Verify mold ownership documents. |

| 3. Commercial Proof Validation | Demand: – Signed contracts with major retailers (redacted) – Shipping manifests for 3+ ASOTV/batch orders (2023-2025) – Bank statements showing large-volume transactions |

Critical Check: – Confirm orders were FCL shipments (not LCL) – Match manifests to compliance docs from Step 1 – Verify payment terms match industry standards (e.g., 30% TT deposit) |

Contact references directly (not via supplier). Use freight forwarder to verify shipment authenticity. Reject if only “sample orders” presented. |

Key ASOTV Insight: Factories with genuine ASOTV experience maintain retail-specific QC protocols (e.g., Walmart FAMA, Target TSC). Demand evidence of these during audits.

TRADING COMPANY VS. FACTORY: OBJECTIVE IDENTIFICATION GUIDE

82% of suppliers claiming “factory status” are traders (SourcifyChina 2025 Data). Use these criteria:

| Criteria | Verified Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership | Owns land/building (deed verifiable) Owns molds/tools (serial-numbered) |

Leases workshop space Rents molds |

Check property deed via local gov’t office. Require mold inventory list with photos showing factory logo. |

| Production Control | Directly manages: – Raw material procurement – All工序 (process steps) – In-house QC team |

Manages 3rd-party factories QC via external agents Limited process visibility |

Observe raw material intake. Demand real-time production data (e.g., ERP screenshots). |

| Pricing Structure | Quotes based on: – Material cost + labor + overhead – Transparent BOM |

Quotes “FOB” with no cost breakdown Markup 30-50%+ |

Require itemized BOM. Verify material costs via independent sources (e.g., Alibaba prices). |

| Capacity Proof | Shows: – Machine purchase invoices – Utility bills (high kW usage) – Direct worker payroll records |

Shows generic factory photos References other “partner factories” |

Audit utility bills. Cross-check machine invoices with customs data. |

Red Flag: Suppliers refusing to disclose factory address or demanding all communication via Alibaba. ASOTV Requirement: Factories must prove dedicated capacity – no “shared lines” for mass-market ASOTV volumes.

TOP 5 RED FLAGS FOR ASOTV SOURCING (AVOID THESE AT ALL COSTS)

| Red Flag | Risk Severity | ASOTV Impact | Mitigation Action |

|---|---|---|---|

| 1. No verifiable retail compliance docs | Critical (9/10) | Product seizure by customs; retailer penalties | Terminate immediately. Demand test reports dated within 12 months from accredited lab. |

| 2. Claims “exclusive ASOTV partnership” but cannot name client | High (8/10) | Likely counterfeit operation; IP lawsuit risk | Require redacted contract showing retailer logo. Contact retailer’s sourcing team for validation. |

| 3. Subcontracting without disclosure | Critical (10/10) | Quality collapse; supply chain opacity | Audit clause: “Unauthorized subcontracting = contract termination.” Use blockchain shipment tracking. |

| 4. Overly aggressive MOQs < 5k units | Medium (6/10) | Inability to scale for ASOTV demand | Confirm production line speed. Reject if no proof of >20k unit runs. |

| 5. Payment terms > 50% upfront | High (7/10) | Trader cash-flow scheme; high fraud risk | Insist on LC or 30% TT. Never pay >30% before production start. |

2026 Compliance Alert: China’s new Product Quality Law Amendment (Jan 2026) holds importers liable for non-compliant goods – even if supplier provided fake certs. Third-party verification is now legally mandatory.

RECOMMENDED ACTION PLAN

- Pre-Qualify: Use SourcifyChina’s ASOTV-Verified Supplier Database (updated quarterly with audit results).

- Audit Rigorously: Allocate 2.5x budget for unannounced audits – non-negotiable for ASOTV.

- Contract Safeguards: Include:

- Penalties for subcontracting without approval

- Mandatory quarterly compliance retesting

- IP indemnification clause covering retailer fines

- Monitor Continuously: Implement IoT sensors in shipments for real-time quality tracking (e.g., humidity, shock).

“ASOTV sourcing isn’t about finding the cheapest supplier – it’s about finding the most verifiable one. In 2026, compliance is your competitive advantage.”

– SourcifyChina Global Sourcing Index 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: Data aggregated from 1,200+ ASOTV supplier verifications (2023-2025), China MOFCOM regulatory updates, and global retail compliance databases.

Disclaimer: This report provides general guidance. Engage legal counsel for contract-specific advice. Verify all regulatory requirements per target market.

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-evolving global supply chain landscape, speed, reliability, and compliance are non-negotiable. For procurement managers sourcing consumer electronics, home appliances, and novelty items featured on televised shopping platforms—commonly referred to as “as seen on TV” (ASOTV) products—engaging with trustworthy Chinese manufacturers is both an opportunity and a challenge.

China remains the world’s leading producer of ASOTV goods, from smart kitchen gadgets to fitness innovations. However, unverified suppliers, inconsistent quality, and communication barriers can lead to costly delays, defective batches, and compliance risks.

This is where SourcifyChina’s Verified Pro List delivers unmatched value.

Why SourcifyChina’s Verified Pro List Saves Time

Sourcing agents in China are not created equal. With thousands of intermediaries claiming expertise in ASOTV products, procurement teams waste critical time vetting unreliable partners. SourcifyChina eliminates this inefficiency through a rigorously screened network of pre-qualified, performance-verified sourcing agents and manufacturers.

| Benefit | Time Saved | Impact |

|---|---|---|

| Pre-Vetted Partners | 3–6 weeks | Eliminates supplier audit cycles; access to agents with proven ASOTV experience |

| Quality Assurance Protocols | 2–4 weeks | Built-in QC checkpoints reduce post-production rework and inspection delays |

| Compliance-Ready Documentation | 1–3 weeks | Full support for CE, FCC, RoHS, and FDA standards—critical for retail distribution |

| Dedicated Project Management | Ongoing | Single point of contact streamlines communication across time zones |

| Faster MOQ Negotiation & Sampling | 50% faster turnaround | Agents leverage existing factory relationships to accelerate timelines |

By partnering with SourcifyChina, procurement managers reduce time-to-market by up to 40%, ensuring faster product launches and improved ROI.

Call to Action: Accelerate Your 2026 Sourcing Strategy

The competitive edge in global retail belongs to those who act decisively. With ASOTV product demand projected to grow 12% year-over-year through 2026, delays in securing reliable Chinese supply chains mean missed opportunities.

Don’t risk your next launch on unverified suppliers.

Leverage SourcifyChina’s Verified Pro List—curated specifically for high-volume, innovation-driven ASOTV sourcing—and gain immediate access to trusted partners who deliver on time, on spec, and on budget.

👉 Contact us today to qualify for priority access:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to assess your requirements, match you with the right agent, and initiate your first audit-free engagement within 72 hours.

Act now—your 2026 product line depends on the sourcing decisions you make today.

SourcifyChina – Trusted by 1,200+ Global Brands. Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.