Introduction: Navigating the Global Market for used meeting room chairs

Selecting the right used meeting room chairs is a strategic decision for organizations aiming to balance quality, sustainability, and budget. In markets spanning Africa, South America, the Middle East, and Europe, the demand for reliable, cost-effective office furniture is surging—driven by rapid business expansion and a renewed focus on workplace comfort and efficiency. For B2B buyers, acquiring pre-owned meeting room seating offers a unique opportunity to access premium designs and robust craftsmanship at a fraction of the cost of new products, while also contributing to environmental goals.

However, navigating the global secondary market for meeting room chairs demands a nuanced understanding of product categories, material durability, manufacturing standards, and supplier credibility. Competitive sourcing extends well beyond price, requiring thorough evaluation of ergonomic performance, compliance with international standards, and ongoing maintenance requirements. Buyers from regions like Poland, Kenya, and the UAE, for instance, must also address challenges such as logistics, import regulations, and effective supplier communication.

This comprehensive guide is designed to empower B2B professionals with actionable insights crucial for effective sourcing decisions. It delves into the full landscape of used meeting room chairs, including:

- Types and Styles: From stackable conference seating to executive ergonomic models.

- Materials and Construction: Evaluating fabrics, mesh, frames, and their durability.

- Manufacturing & Quality Control: Understanding certification processes and refurbishment standards.

- Supplier Assessment: Identifying reputable sources and assessing reliability.

- Cost Considerations: Budgeting for acquisition, shipping, and potential refurbishing.

- Market Trends: Tracking regional preferences and key demand drivers.

- FAQs: Addressing common challenges and best practices.

Armed with this expertise, international B2B buyers can confidently cross borders, mitigate risk, and secure solutions that enhance both functionality and bottom-line results.

Understanding used meeting room chairs Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Stackable Guest Chairs | Lightweight, stack vertically, often armless | Dynamic or multi-use meeting rooms, event halls | Space-saving; easy storage and transport; may lack ergonomic features for long sessions |

| Ergonomic Conference Chairs | Adjustable components, lumbar support, premium materials | Boardrooms, executive meeting spaces | High comfort; enhances productivity; typically higher price and bulkier build |

| Cantilever Base Chairs | Sleek metal frame, no rear legs, slight flex/rock | Modern offices, seminar rooms | Modern aesthetic; comfortable movement; less stackable, requires more storage space |

| Mesh-Back Chairs | Breathable mesh back, contemporary styling | Warm climates, high-usage meeting rooms | Ventilation and comfort; resistant to odors; mesh may degrade with heavy use |

| Conference Armchairs | Cushioned, fixed or swivel base, with armrests | Formal meeting rooms, client-facing spaces | Enhanced formality and comfort; less mobility, larger footprint |

Stackable Guest Chairs

Characteristics: These chairs are designed for easy stacking, making them highly portable and efficient for storage. Generally made from lightweight materials like polypropylene, metal, or basic upholstery, they are armless or feature minimal arms for compactness.

Suitability: Stackable guest chairs are ideal for organizations that frequently reconfigure meeting or training spaces, such as hotels, training centers, and corporate event venues.

Key B2B Purchasing Considerations: Evaluate stacking capacity (how many units can be safely stacked), durability across frequent moves, and whether the aesthetic aligns with corporate branding. Bulk purchases can drive down unit cost, but always inspect for structural integrity and surface wear in used inventories.

Ergonomic Conference Chairs

Characteristics: Featuring adjustable lumbar and armrests, seat height, and tilt mechanisms, these chairs prioritize user comfort. Premium models use mesh or memory foam and offer long-term support for extended meetings.

Suitability: Ergonomic conference chairs are best for executive boardrooms, high-level meetings, and environments where comfort and posture directly impact productivity and engagement.

Key B2B Purchasing Considerations: For international buyers, scrutinize adjustment mechanisms for wear when sourcing used models. Ergonomics can reduce workplace fatigue but check for missing parts or worn supports. Consider balancing comfort and cost, especially when outfitting larger conference areas.

Cantilever Base Chairs

Characteristics: Built with a tubular steel or chrome frame that forms a continuous base, these chairs offer gentle flexing for comfort and a minimalist look without rear support legs.

Suitability: Favoured in modern, collaborative office environments and seminar rooms where a sleek appearance and moderate comfort are needed. Suitable for organizations seeking to project an innovative, contemporary image.

Key B2B Purchasing Considerations: Assess the integrity of the frame and seat attachment points, as these take the brunt of user weight. While visually appealing, their non-stackable nature requires more storage space between uses.

Mesh-Back Chairs

Characteristics: Characterized by a ventilated mesh backrest, these chairs prevent heat buildup, which is especially valuable in warm or humid regions. Usually combined with padded seats for increased comfort.

Suitability: Mesh-back chairs suit meeting rooms in tropical climates (e.g., parts of Africa, South America, Middle East) or high-usage areas where prolonged sitting is common.

Key B2B Purchasing Considerations: Inspect mesh panels for tears, sagging, or discoloration in used selections. Assess if the frame and mechanisms remain solid. Mesh chairs are typically lighter, aiding logistics, but mesh quality varies—opt for commercial-grade mesh when possible.

Conference Armchairs

Characteristics: These chairs emphasize comfort and status, with plush cushioning, integrated armrests, and either fixed or swivel bases. They convey a sense of formality and are often upholstered in leather or quality fabric.

Suitability: Designed for formal boardrooms and client-facing spaces where aesthetic impact and extended comfort are priorities.

Key B2B Purchasing Considerations: Examine upholstery for wear, stains, or tears, especially if image and prestige are a concern. Armchairs can be large and less flexible in multi-purpose spaces, so ensure your venue dimensions and layout can accommodate them efficiently. They command higher prices, but strategic sourcing of used models can yield significant cost savings without compromising on quality.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of used meeting room chairs

| Industry/Sector | Specific Application of used meeting room chairs | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Corporate Offices | Boardrooms, collaborative spaces, training rooms | Cost-effective workplace upgrades; supports flexible office setups | Ergonomic standards, chair durability, bulk availability |

| Education | Classroom seating, seminar rooms, staff/meeting rooms | Budget optimization for institutions; rapid expansion possible | Easy cleaning, stackability, compliance with local safety standards |

| Hospitality & Events | Conference centers, banquet halls, event rentals | Quick scaling for large groups; enhances ROI for venues | Aesthetics, ease of transport, lightweight yet sturdy construction |

| Government & NGOs | Community meeting halls, administrative offices, training centers | Maximizes tight budgets; enables efficient use of public resources | Warranty status, condition of upholstery, suitability for heavy use |

| Healthcare Facilities | Waiting areas, multi-purpose meeting rooms, staff break rooms | Improves comfort for visitors and staff; supports expansion | Infection-control friendly surfaces, robust frames, easy maintenance |

Corporate Offices

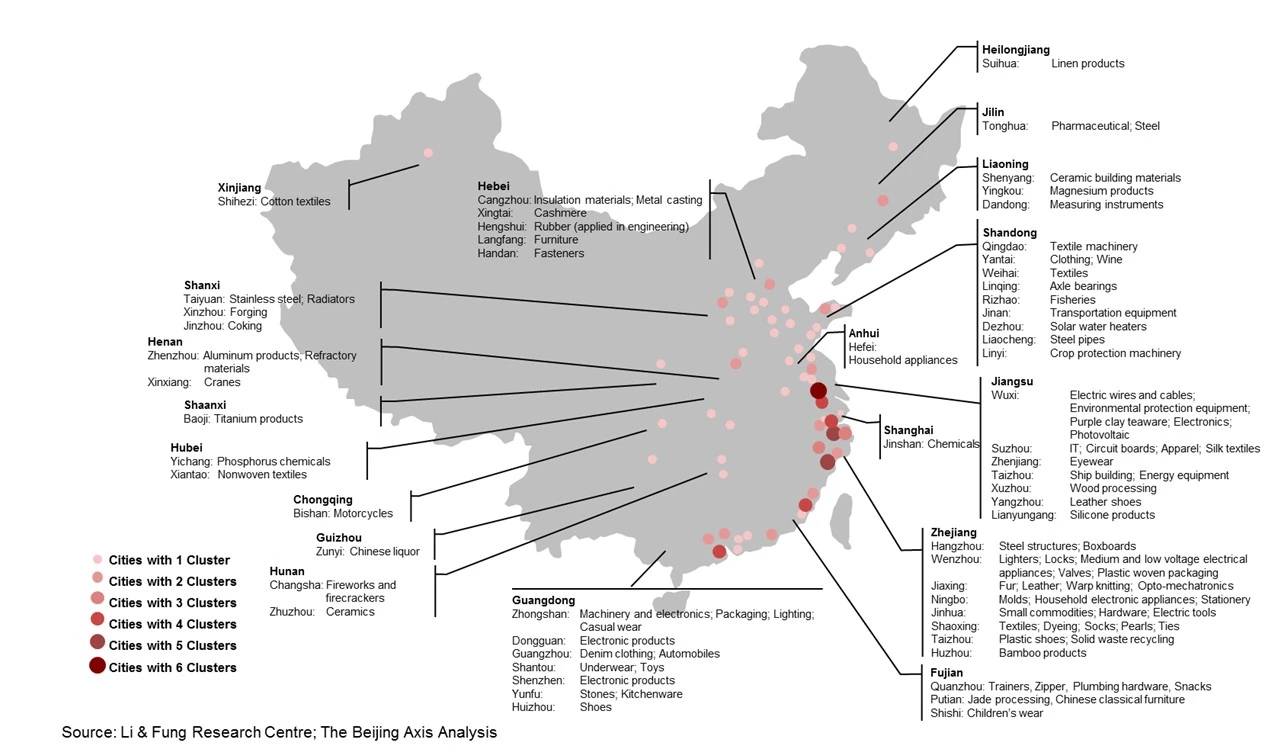

In corporate environments, used meeting room chairs serve as practical solutions for equipping boardrooms, brainstorming zones, and training areas. By sourcing quality pre-owned seating, companies in Africa, South America, and Europe can modernize workspaces or set up temporary collaboration areas while keeping costs manageable. Buyers should prioritize ergonomically designed models to ensure employee comfort and productivity, as well as assess product durability to withstand regular use. For bulk upgrades or distributed offices, confirm supplier ability to provide consistent quality and volume.

Education

Educational institutions—from universities to private training centers—use meeting room chairs in classrooms, lecture halls, and staff lounges. Second-hand options enable rapid furnishing during expansion or for project-based learning spaces, especially where budgets are constrained. Stackable and easily sanitized designs are highly valuable, given frequent turnover and intensive daily use. International buyers must verify local regulatory compliance (such as fire safety), ease of maintenance, and long-term durability to ensure a sound investment.

Hospitality & Events

Hotels, conference centers, and event rental companies benefit from used meeting room chairs for equipping versatile spaces such as conference halls and banquet rooms. Because events often require large, matched sets of seating on short notice, pre-owned chairs offer significant cost advantages and flexibility. For this sector, appearance, portability, and lightweight yet sturdy build are crucial for rapid setup and breakdown. B2B buyers, particularly in regions with seasonal peaks (e.g., Middle East or Mediterranean Europe), should focus on sourcing uniform styles and finishes for a professional look.

Government & NGOs

Public sector offices and nonprofits regularly utilize meeting chairs in community halls, training centers, and administrative spaces. Used options allow these organizations to maximize limited resources and reallocate funds to core services or outreach. Reliability and condition are essential, as the chairs often experience high-traffic use. Buyers in Africa and South America, in particular, should conduct thorough inspections for upholstery wear and seek providers offering post-purchase support or warranties when possible.

Healthcare Facilities

In healthcare, used meeting room chairs are commonly placed in waiting areas, consultation rooms, and staff lounges. They help providers quickly expand or refurbish public-facing spaces during periods of growth or redevelopment. The priority is on hygiene—surfaces must be easy to disinfect, and materials should resist moisture and staining. When purchasing for clinics or hospitals, especially in busy metropolitan areas in Europe or the Middle East, buyers should ensure the chairs meet health and safety standards and can withstand rigorous cleaning protocols.

Related Video: Video Conferencing Basic Solution for meeting room

Strategic Material Selection Guide for used meeting room chairs

Material Considerations for Used Meeting Room Chairs: A Detailed B2B Perspective

Selecting the right material for used meeting room chairs is pivotal for international buyers, as it affects product longevity, end-user satisfaction, regulatory compliance, and return on investment. In the global used furniture trade—serving regions from Europe to Africa and South America—four common materials stand out: fabric upholstery, mesh, leather/vinyl, and plastic/polypropylene. Each offers unique characteristics and poses distinct logistical and compliance considerations, especially for buyers sourcing in climates or regulatory environments divergent from the manufacturing origin.

Fabric Upholstery

Key Properties:

Fabric-upholstered chairs are typically made with synthetic blends (like polyester or nylon) or natural fibers. They offer a soft, comfortable seating experience with moderate breathability. Fabric’s thermal properties make it suitable for both warm and cool interiors but not ideal for areas with high humidity unless treated.

Pros:

– Cost-effective and widely available on the used market

– Comfortable and customizable in color/pattern

– Generally easy to repair or reupholster

Cons:

– Prone to staining and absorbing odors

– Wears faster than other materials, especially in high-use environments

– Challenging to disinfect thoroughly, which may be a concern post-pandemic

Regional Impact:

Buyers in Africa and South America should assess the potential for mold/mildew growth due to humidity. In the Middle East, where dust is common, fabric may require more frequent cleaning. Many European buyers (e.g., in Poland) may prefer fabrics that comply with flammability standards (EN 1021), so verifying these certifications is critical.

Mesh

Key Properties:

Mesh is usually constructed from tightly woven synthetic fibers (such as polyester or nylon) and is well-regarded for its breathability and flexibility. It allows air circulation, which is essential for comfort in hot climates.

Pros:

– Excellent ventilation, ideal for warm offices

– Modern appearance, fits many contemporary spaces

– Lightweight, facilitating shipping and rearrangement

Cons:

– Can sag or tear if not of high quality

– Offers less cushioning than fabric or leather

– May collect dust and require special cleaning tools

Regional Impact:

Mesh is advantageous in tropical and arid regions (e.g., Kenya, Middle East) where heat management is a priority. European buyers should confirm compliance with relevant safety and durability standards (e.g., EN 1335), and mesh sourced from reputable brands often meets these requirements. For African and South American importers, seek UV-resistant grades to counter sun exposure.

Leather (Natural and Synthetic) / Vinyl

Key Properties:

Leather (natural or faux) and vinyl present a high-end appearance and are inherently more resistant to liquid spills compared to fabric. These materials are smooth, non-porous, and generally easy to wipe clean.

Pros:

– Durable and long-lasting, even with intensive use

– Stain-resistant, easy to sanitize

– Luxurious aesthetic, suitable for executive or boardroom settings

Cons:

– Higher up-front and maintenance costs

– Uncomfortable in hot climates (sticky feel) or cold conditions (hard surface)

– Susceptible to cracking or peel if improperly maintained or stored

Regional Impact:

Buyers in the Middle East and Africa must consider the potential discomfort from heat—leather/vinyl can become hot and sticky. In humid subtropical regions (e.g., coastal Brazil), check for mildew resistance. For Europe, ensure that synthetic leather/vinyl complies with REACH or EN standards for chemical safety. Local preferences may favor real over synthetic, or vice versa, depending on price sensitivity.

Plastic / Polypropylene

Key Properties:

Plastic and polypropylene chairs are prized for their resistance to moisture, chemicals, and physical impact. Molding advances allow a variety of shapes and ergonomic designs, including stackable forms suited to multi-use or mobile spaces.

Pros:

– Highly durable and corrosion-resistant

– Lightweight, easy to transport and clean

– Typically the most affordable option on the used market

Cons:

– Aesthetically less prestigious

– Offers the least ergonomic support and comfort unless enhanced with add-ons

– Lower perceived value in executive or high-end settings

Regional Impact:

Plastic is ideal for humid or coastal environments (common in parts of Africa and South America) due to its non-corrosive properties. However, UV resistance is critical to avoid brittleness in equatorial regions. Regulatory standards (like EN 1729 for seating in the EU) may dictate suitability in institutional settings in Europe.

Summary Table: Materials for Used Meeting Room Chairs

| Material | Typical Use Case for used meeting room chairs | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Fabric Upholstery | General meeting spaces, training rooms in offices/schools | Comfortable, customizable | Prone to staining, can retain odors, less durable | Low–Medium |

| Mesh | High-use meeting rooms in warm climates, modern collaboration zones | Breathable, good for heat | Can sag/tear, less cushioning | Medium |

| Leather/Vinyl | Executive boardrooms, conference suites | Durable, easy to sanitize | Costly, hot/cold temperature sensitivity, may crack | Medium–High |

| Plastic/Polypropylene | Multipurpose and mobile venues, stackable seating, humid/coastal areas | Moisture-resistant, lightweight | Lower comfort, lower prestige, less ergonomic support | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for used meeting room chairs

The production and assurance of quality in used meeting room chairs are pivotal for international B2B buyers seeking reliability, compliance, and value. Buyers from diverse markets – including Africa, South America, the Middle East, and Europe – need to navigate unique regulatory, logistical, and functional requirements. Understanding the journey of a used meeting room chair, from material preparation to final inspection, and the layered quality control (QC) mechanisms involved, is essential to sourcing with confidence.

Key Stages in the Refurbishment and Remanufacturing Process

The transformation of a used meeting room chair into a commercially viable, export-ready product typically involves several structured stages:

Material Identification and Preparation

- Inspection & Selection: Initial evaluation screens incoming used chairs for structural integrity, material type, and refurbishing potential. This assessment classifies chairs by refurbish/repair route or for parts recovery.

- Disassembly: Chairs are methodically dismantled. Components (frames, cushions, armrests, mechanisms) are separated for specialized cleaning or replacement, maximizing reuse while ensuring hygiene and compliance with import regulations.

- Material Treatment: Upholstery is deep-cleaned, sanitized, or replaced as needed. Frames and mechanical parts may be stripped, sanded, prepped for repainting, or powder-coated for corrosion resistance.

Reconditioning and Assembly

- Component Replacement: Worn or damaged parts – such as gas lifts, wheels, or arm pads – are replaced with OEM or high-quality aftermarket components.

- Re-upholstery: Where necessary, chairs receive new upholstery materials (often in adherence to regional fire safety standards such as EN 1021 for Europe) to restore appearance and performance.

- Structural Repairs: Reinforcement or repair of frames is executed, typically applying welding, bolting, or epoxy solutions, depending on the chair’s design and original manufacturing process.

Finishing and Pre-Delivery

- Reassembly: All refurbished components are assembled, ensuring correct alignment and secure fixings to meet or exceed the original design specifications.

- Surface Treatment: Final treatments may include the application of stain, varnish, or powder coating. For fabric elements, anti-static or stain-resistant finishing can be applied to meet market preferences or legal requirements.

- Cleaning & Packaging: Thorough final cleaning is performed. Packaging is designed to protect the chair in international transit and may be customized for specific client branding or destination country compliance.

Quality Control Frameworks: Standards, Methods, and Buyer Verification

Ensuring the consistent quality and safety of used meeting room chairs is achieved through a layered QC process, mapped to international norms and responsive to the needs of global B2B buyers.

International and Industry Standards

- ISO 9001 (Quality Management Systems): Manufacturers adhering to ISO 9001 implement documented QC processes, regular audits, and continuous improvement. This is the baseline many B2B buyers demand.

- EN Standards (Europe), CE Marking: For shipments into Poland and other EU markets, compliance with EN 16139 (Strength, Durability, Safety) and the CE marking process is increasingly expected.

- Local Import Requirements: Some regions (such as Kenya, Brazil, or the GCC) have specific certification or pre-export verification requirements, such as Pre-Export Verification of Conformity (PVoC) or the Saudi SASO standards. Buyers should align with suppliers familiar with these procedures.

Quality Control Checkpoints

- Incoming Quality Control (IQC): All used chairs and replacement parts undergo IQC for material integrity and suitability. This stage often identifies and segregates components for further reconditioning or disposal.

- In-Process Quality Control (IPQC): QC inspectors monitor key refurbishment steps, verifying workmanship, structural repairs, and upholstery work. Deviations are flagged immediately for remediation.

- Final Quality Control (FQC): Thorough post-assembly inspections check mechanical operation (e.g., adjustability, wheel movement), stability, and aesthetic standards. Only units meeting the pre-agreed acceptance criteria proceed to packaging.

Product Testing and Validation Techniques

- Load and Stress Testing: Chairs are subjected to simulated use cycles (applying weights as per ISO or EN specifications) to check structural durability.

- Functionality Testing: All moving mechanisms – tilt, swivel, gas lift, and casters – are tested for smooth operation and longevity.

- Safety Assessment: Where relevant, fire retardancy testing (e.g., EN 1021, California TB117 for US buyers) and toxicity checks are executed, especially for re-upholstered elements.

Actionable Steps for B2B Buyers to Ensure Quality

1. Supplier Audits:

– Onsite Audits: Arrange for personal or third-party visits to supplier facilities to observe refurbishment practices and check QC documentation.

– Virtual Walkthroughs: For remote buyers, request live video audits or photo documentation of processes and QC checkpoints.

2. Require Comprehensive Documentation:

– QC Reports: Insist on full QC reports for each batch, including testing results and compliance certificates for critical standards (CE, EN, ISO).

– Component Traceability: Request records that detail the source and condition of replaced components, especially upholstery and safety-related elements.

3. Leverage Third-Party Inspection:

– Engage recognized third-party inspection agencies (e.g., SGS, TÜV) for pre-shipment inspection to independently verify specifications, function, and regulatory compliance.

4. Understand Import/Market-Specific Nuances:

– Africa & South America: Confirm that products meet local regulatory standards, and clarify certification or labeling needs in advance. In some regions, proof of prior sanitization is mandatory – obtain certificates where required.

– Middle East: Anticipate requests for SASO (Saudi Arabia), G-Mark (Gulf region), or other conformity markings.

– Europe (e.g., Poland): Prioritize CE-marked goods with EN-compliance, and ascertain whether environmental standards concerning recycling are addressed.

5. Request After-Sales Support and Guarantees:

– Ensure suppliers offer a remediation process for defective goods, and seek a clear warranty or service guarantee on refurbished items.

Maximizing Value and Reducing Risk

International B2B buyers face a diverse landscape of standards, customer expectations, and compliance requirements. To optimize procurement strategies:

- Build relationships with ISO 9001-certified suppliers: This increases the likelihood of consistent QC practices and responsiveness to market-specific mandates.

- Customize QC and testing protocols based on destination market: Work with suppliers to align finishing, labeling, and documentation with local requirements.

- Incorporate sample checks into your contracts: Stipulate acceptance testing of pilot shipments before scaling to large orders.

- Stay informed of regulatory updates in target markets, as fast-evolving environmental and safety regulations can impact future shipments.

By thoroughly understanding the refurbishment process and embedding quality assurance into every stage of procurement, international buyers can source used meeting room chairs that are both cost-effective and compliant, minimizing risk while maximizing operational confidence.

Related Video: Amazing factories | Manufacturing method and top 4 processes | Mass production process

Comprehensive Cost and Pricing Analysis for used meeting room chairs Sourcing

Key Cost Components in Sourcing Used Meeting Room Chairs

For international B2B buyers, understanding the overall cost structure of used meeting room chairs is fundamental to effective sourcing. The costs of these chairs go beyond the simple price tag and can be broken down as follows:

- Materials: While used chairs have already absorbed their original input material costs (metal, plastic, upholstery, etc.), the quality and type of materials still affect resale value. Chairs incorporating premium or branded materials (mesh, leather, high-grade plastics) often command higher prices even in the used market.

- Labor: Labor costs associated with cleaning, refurbishment, or minor repairs before resale are factored into the unit price. Regions with lower labor costs may offer more competitive rates for reconditioned chairs.

- Manufacturing Overhead: This includes allocated facility costs, utilities, equipment depreciation, and administration. Typically, these are lower for used chairs than new, but reputable suppliers allocate overheads to cover storage and handling.

- Tooling and Refurbishment: Some suppliers may perform mechanical repairs, repainting, or upholstery replacement. These reconditioning steps raise the overall cost, but may also increase longevity and compliance with safety standards.

- Quality Control (QC): Inspection, testing for durability, and meeting local safety standards can add to costs. Buyers should clarify what level of QC is included with suppliers.

- Logistics: International buyers from Africa, South America, the Middle East, or Europe must factor in global shipping (including containerization, freight, and insurance), as well as local delivery, duties, and import taxes.

- Supplier Margin: Suppliers include a profit margin which varies by product quality, market dynamics, supply consistency, and brand reputation.

Price Influencers B2B Buyers Must Consider

Several crucial variables can significantly influence the per-unit pricing of used meeting room chairs in the B2B context:

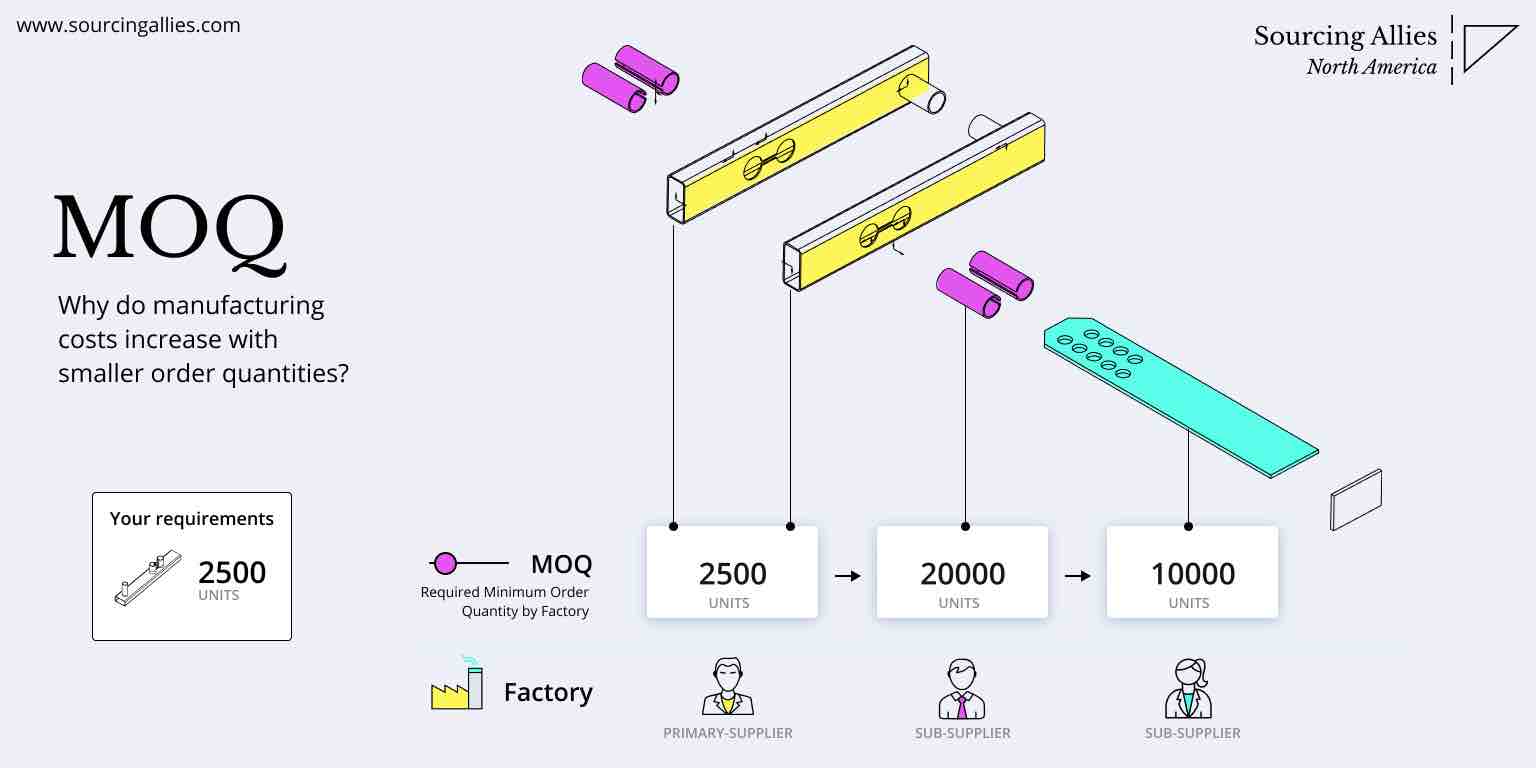

- Order Volume and Minimum Order Quantity (MOQ): Larger orders typically attract economies of scale, resulting in lower per-unit pricing. However, MOQs vary by supplier – some exporters may only quote for orders exceeding a container load, especially for international shipping.

- Specifications and Customization: Requests for additional customization—such as reupholstering in company colors or adding ergonomic features—will increase costs.

- Material and Build Quality: Used chairs with recognized durability brands (e.g., Herman Miller, Steelcase) or advanced features remain more expensive. Certifications (ISO, BIFMA) for ergonomic and safety standards also impact price.

- Supplier Selection and Reputation: Established wholesalers or refurbishers with comprehensive after-sales services, warranties, or compliance documentation may command higher prices but offer more predictable quality.

- Incoterms (International Commercial Terms): Pricing varies based on whether you purchase Ex-Works (EXW), Free On Board (FOB), Cost, Insurance and Freight (CIF), or Delivered Duty Paid (DDP). DDP pricing covers all delivery costs and customs clearance, while EXW places responsibility on the buyer from the supplier’s warehouse.

Practical Insights for Cost-Efficient and Successful Sourcing

- Negotiate Beyond Price: Leverage order volume, payment terms, and long-term partnership potential to negotiate not only price but also value-added services (warranties, logistics support, or quality guarantees).

- Optimize for Total Cost of Ownership (TCO): Factor in all secondary costs—such as durability, after-sales maintenance, and replacement cycles—not just upfront unit price. Sometimes slightly higher-priced chairs with greater durability and lower maintenance can yield better long-term ROI.

- Understand Regional Dynamics: For buyers in Africa and South America, port tariffs, shipping timelines, and last-mile delivery can add significant costs. European and Middle Eastern buyers should pay close attention to compliance with local safety and environmental regulations.

- Clarify Specifications Upfront: Provide detailed requirements (quantity, types, preferred brands, condition grade, and customization) early in negotiations to receive accurate, all-inclusive quotes and reduce costly misunderstandings.

- Assess Supplier Transparency and Credentials: Prioritize suppliers who provide clear documentation on product condition, quality checks, and sourcing provenance. Certifications and transparent grading (e.g., A/B/C refurbished) are especially important for cross-border transactions.

- Beware Market Fluctuations: Global events, currency shifts, and supply chain disruptions can affect both availability and pricing. Lock in quotes where possible, and maintain flexibility for alternative sourcing arrangements.

Disclaimer: All prices and cost factors outlined are indicative and subject to fluctuation based on global market dynamics, supplier terms, shipping routes, and local regulatory environments. Actual costs should always be confirmed directly with the supplier prior to placing orders.

By systematically evaluating each of these components and carefully managing supplier negotiations, international B2B buyers can secure optimal value and cost efficiency when sourcing used meeting room chairs.

Spotlight on Potential used meeting room chairs Manufacturers and Suppliers

- (No specific manufacturers were selected for detailed profiling in this iteration for used meeting room chairs.)*

Essential Technical Properties and Trade Terminology for used meeting room chairs

Key Technical Specifications to Evaluate

When sourcing used meeting room chairs internationally, understanding technical specifications is essential for informed purchasing and smooth cross-border transactions. Here are the primary properties to assess before committing to a bulk order:

-

Frame Material & Finish:

The chair’s frame — typically crafted from steel, aluminum, or high-grade plastics — determines durability, load tolerance, and longevity. Inspect for powder-coated or chrome finishes for enhanced corrosion resistance, especially important for humid climates (e.g., coastal Africa or the Middle East). -

Upholstery Material & Wear Grade:

Used chairs may feature fabric, mesh, leather, or vinyl upholstery. Assess for commercial-grade textiles and note the Martindale or Wyzenbeek rub count (measuring abrasion resistance). Higher counts (>30,000) indicate better suitability for heavy usage in conference environments. -

Ergonomics & Adjustability:

Confirm if chairs offer features such as adjustable height, tilt tension, armrests, and lumbar support. Even in the used market, adjustability impacts user comfort and productivity during long meetings — a critical factor in employee satisfaction. -

Load Capacity & Dimensions:

Meeting chairs should specify their weight capacity (often 100–150 kg), vital for safety and compliance with workspace regulations. Overall dimensions (seat width, depth, height) ensure compatibility with existing tables and room layouts, reducing logistical issues on delivery. -

Stackability and Mobility:

For buyers with limited storage or dynamic meeting spaces, chairs designed to stack or equipped with casters can streamline handling and optimize space, especially for businesses in urban Europe or growing SMEs across Africa and South America. -

Condition Grading and Quality Assurance:

Suppliers often classify used items as Grade A (minimal wear), Grade B (visible but functional wear), or Grade C (for refurbishment). Demand clear grading standards and quality inspection reports to avoid post-shipment disputes or hidden costs.

Common Trade Terms and B2B Jargon

Navigating supplier catalogs, contracts, and logistics in the used office furniture market involves specific terminology. Mastering these terms can reduce misunderstanding and ensure contract clarity:

-

MOQ (Minimum Order Quantity):

The smallest batch the supplier is willing to sell. Used furniture MOQs may be lower than new, but they still affect price negotiation and freight costs — relevant for buyers consolidating shipments in regions with limited warehousing. -

OEM (Original Equipment Manufacturer) & ODM (Original Design Manufacturer):

While more common in new chair procurement, some used sellers also broker OEM surplus or custom-designed lots. If brand matching or replacement parts are required, clarifying the OEM status helps maintain workplace consistency. -

RFQ (Request for Quotation):

This formal document requests a price quote and product details. International buyers should specify inspection requirements, warranty terms, and shipping conditions in their RFQs to pre-empt miscommunication. -

Incoterms (International Commercial Terms):

These standardized trade definitions (e.g., FOB, CIF, DAP) dictate where risks and logistics responsibilities transfer from seller to buyer. Choosing suitable Incoterms is critical for controlling costs, especially for long-haul deliveries (e.g., Asia to Africa or Europe). -

Lead Time:

Defines the duration from order confirmation to delivery. Used chair shipments can vary based on inspection, refurbishment, and consolidation processes. Understanding true lead time is crucial for project scheduling, especially for office relocations or new facilities. -

Container Load (FCL/LCL):

Full Container Load (FCL) and Less than Container Load (LCL) terms impact shipping cost per chair. For buyers across South America or Europe with fluctuating needs, optimizing load types can yield significant freight savings.

Action Points for B2B Buyers

- Always request detailed technical specs and grading reports for the offered chairs.

- Specify your minimum technical and visual condition requirements in all RFQs.

- Clarify Incoterms, lead times, and payment terms to avoid hidden charges.

- Seek suppliers familiar with compliance and documentation for your destination market — especially important in Africa, the Middle East, and the EU.

A solid grasp of these technical factors and trade concepts is vital for risk mitigation, optimizing value, and building reliable supplier relationships in the international market for used meeting room chairs.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the used meeting room chairs Sector

Market Overview & Key Trends

The international market for used meeting room chairs is undergoing notable transformation, largely driven by a combination of economic, technological, and sustainability imperatives. As companies worldwide increasingly embrace hybrid and flexible work models, the demand for adaptable, cost-effective, and sustainable meeting room solutions has sharply increased. In regions such as Africa, South America, the Middle East, and parts of Europe (notably Poland and Kenya), businesses are seeking quality meeting room furniture that matches global standards but at a fraction of the cost of new items.

A major market dynamic is the expansion of cross-border B2B sourcing platforms and digital marketplaces. These enable buyers to access large inventories of certified pre-owned chairs, compare supplier credentials, and negotiate directly for bulk purchases. Tech-enabled supply chain transparency, such as digital product passports and QR-based traceability, is becoming more prevalent, helping buyers verify the history, materials, and refurbishment process of used inventory. Many top-tier suppliers now offer virtual showroom tours and detailed condition reports, mitigating the geographical barriers that have traditionally hampered B2B furniture sourcing, particularly for international buyers from emerging economies.

Global supply chain pressures (including shipping costs and logistics disruptions) have further propelled the appeal of used and refurbished office furniture. B2B buyers are also responding to rising demand for ergonomic and modular designs, with a focus on chairs that support employee well-being and can be easily integrated into a variety of spaces. Customizable bulk orders, local warehousing partnerships, and OEM/ODM (original equipment/design manufacturing) services now allow buyers to align product selection with regional preferences—such as climate-adapted materials for African markets or compliance with EU workplace safety standards in Europe.

Sustainability & Ethical Sourcing in B2B

Corporate responsibility and environmental stewardship are front and center in the used meeting room chair sector. For B2B buyers, sourcing pre-owned chairs is inherently sustainable, as it extends product life cycles and reduces landfill waste associated with office refurbishments. Environmental impact is compounded by the use of recycled metals, certified low-emissions foams, and eco-friendly upholstery materials in refurbishment processes—elements that are increasingly verifiable via independent certifications such as GREENGUARD, FSC, or EU Ecolabel.

Ethical sourcing demands not only environmental compliance but also fair labor practices and transparent supply chains. Leading suppliers provide detailed sourcing and refurbishment documentation, including chain-of-custody reports and social compliance certificates, catering to the requirements of global buyers focused on ESG (environmental, social, and governance) objectives. In markets like Europe and the Middle East, regulations and buyer expectations around material origin and end-of-life recycling are more stringent, pushing suppliers to maintain rigorous standards.

For international buyers, especially those in developing regions, sustainability represents more than image; it is a meaningful differentiator and sometimes a procurement requirement in public and corporate tenders. Key decision points should include verifying whether suppliers offer take-back programs, utilize renewable energy in refurbishment processes, and minimize packaging waste. Buyers should also seek clarity on logistics partners’ green credentials, such as optimized shipping routes or carbon offset options, to ensure an end-to-end ethical supply chain.

Brief Evolution and Historical Context

The evolution of the used meeting room chair marketplace tracks broader changes in global office culture and sustainability priorities. In the past, secondary office furniture was often relegated to local resale markets with limited quality assurance and minimal transparency. However, globalization—combined with advances in refurbishment technology and greater environmental awareness—has professionalized the sector.

Today, the used office chair market is a recognized and integral segment of the global office furniture supply chain. B2B buyers now benefit from streamlined procurement channels, higher refurbishment standards, and robust documentation, making used meeting room chairs a viable and compelling option for organizations aiming to balance cost savings, functional quality, and sustainability. This maturation has opened new opportunities for buyers across Africa, South America, the Middle East, and Europe to access international-grade furniture while supporting circular economy principles.

Related Video: THINK GLOBAL CONFERENCE 2021 – The basics of international trade compliance

Frequently Asked Questions (FAQs) for B2B Buyers of used meeting room chairs

-

How can I effectively vet suppliers of used meeting room chairs for international bulk orders?

Begin by requesting documented company credentials, trade licenses, and references from recent international clients. Conduct background checks using supplier platforms, business directories, and third-party verification services. Evaluate their export history, especially to your region, and ask for samples or virtual product tours. Prioritize suppliers with transparent communication and clear return or dispute policies, and always consider site visits or third-party inspections for high-value transactions. -

What options exist for customization or branding when sourcing used meeting room chairs?

While used chairs generally have limited customization compared to new, some suppliers offer reupholstery, refinishing, or branding services such as embroidery or tagging. Ask if the condition and quantity allow for batch customization (e.g., re-covering fabrics, new armrests). Clearly communicate your branding requirements in advance, and confirm lead times and additional costs. Ensure customizations do not affect warranty or quality guarantees, and request photos or samples before approval. -

What is the typical minimum order quantity (MOQ), lead time, and payment structure for international orders?

MOQs for used meeting room chairs often start at 20–50 units, but may be negotiable depending on supplier stock and your destination. Lead times vary (2–8 weeks), factoring in customization, inspection, and shipping. Most suppliers require a deposit—commonly 30% upfront with balance due pre-shipment or upon delivery. For new trade relationships, consider using secure payment methods (escrow, letters of credit), and clarify timelines in the contract to avoid misunderstandings. -

How can I ensure the quality and condition of used meeting room chairs before shipping?

Request detailed condition reports, including high-resolution photos and/or videos of each batch. Ask about the grading system used (A, B, C grade, etc.) and request a sample unit if possible. Consider employing third-party inspection agents to validate quality, quantity, and conformity to your expectations before the shipment is released. Ensure your purchase agreement outlines acceptable conditions, post-delivery inspection windows, and recourse for discrepancies. -

Are there international certifications or quality standards I should require from suppliers?

While certifications for used furniture are less common than for new, reputable suppliers may offer documentation regarding fire safety, materials (e.g., no hazardous chemicals), and hygiene (such as antibacterial treatments). For markets in Europe or the Middle East, compliance with relevant local standards (e.g., EN 16139 for contract seating) can be a quality benchmark. Request test reports or compliance certificates where applicable, especially for large-scale or public use purchases. -

What are the key logistics considerations for shipping used meeting room chairs internationally?

Determine whether the supplier offers door-to-door (DDP), port-to-port, or FOB services, and clarify who handles export documentation, customs clearance, and insurance. Verify packaging standards to avoid damage in transit and request per-unit or palletized packing photos. Factor in destination port fees, local taxes, and import restrictions for used furniture. Engage a reliable freight forwarder or customs broker familiar with regulations in both the country of origin and your market. -

How should I handle disputes or issues with product condition, shipment delays, or missing items?

Insist on a clear written contract stipulating dispute resolution mechanisms—such as arbitration, applicable legal jurisdiction, and documented communication protocols. Keep detailed records of all orders, communications, and agreed specifications. Inspect goods immediately upon arrival, noting discrepancies. Timely notification is often crucial for claims. In case of unresolved disputes, involving trade bodies, export councils, or local chambers of commerce can sometimes expedite resolution. -

What are best practices for building long-term supplier relationships in the used office furniture market?

Foster trust by honoring agreed payment terms and providing constructive feedback post-shipment. Regularly communicate your future requirements to help suppliers plan and pre-select quality stock for your needs. Visiting suppliers, attending relevant trade fairs, or connecting via digital platforms can deepen relationships and expand your sourcing options. Establishing a track record of successful transactions can result in better prices, preferential access to premium inventory, and improved after-sales support.

Strategic Sourcing Conclusion and Outlook for used meeting room chairs

International B2B buyers seeking used meeting room chairs are uniquely positioned to create significant value through strategic sourcing. By leveraging global supply networks, assessing supplier credibility, and aligning purchases with both functional requirements and broader sustainability goals, buyers can achieve cost efficiencies while maintaining high workplace standards. The secondhand market offers not only substantial savings but also access to reputable brands and diverse chair models that might be otherwise cost-prohibitive.

Key insights for effective sourcing include thorough due diligence on suppliers, clear communication regarding specifications, and an understanding of regional logistics and import procedures—vital for markets such as Africa, South America, the Middle East, and Europe. Strategic partnerships with experienced suppliers can streamline procurement processes and foster long-term business relationships that adapt to evolving workspace needs.

Looking ahead, the market for used meeting room chairs will continue to grow, driven by the global emphasis on circular economies and eco-conscious procurement. B2B buyers who act decisively and form reliable supplier partnerships will secure the best inventory and pricing advantages. Now is the time to prioritize strategic sourcing—reach out to reputable global suppliers, evaluate your upcoming needs, and position your business for agile, sustainable growth in an increasingly competitive environment.