The global demand for solderless connectors has surged in recent years, driven by the need for faster assembly, improved reliability, and increased efficiency across industries such as automotive, industrial automation, consumer electronics, and renewable energy. According to a 2023 report by Mordor Intelligence, the global electrical connectors market—which includes solderless variants—is projected to grow at a CAGR of 5.8% from 2023 to 2028. This expansion is fueled by rising adoption of electric vehicles, advancements in Industry 4.0 technologies, and the growing emphasis on modular and maintenance-friendly electrical systems. Solderless connectors, in particular, are gaining traction due to their ease of installation, reduced labor costs, and superior performance in high-vibration environments.

With these trends accelerating innovation, a select group of manufacturers has emerged as leaders in developing robust, scalable, and high-performance solderless connection solutions. These companies are not only advancing connector design but also setting new benchmarks in compatibility, durability, and safety. Based on market presence, product portfolio diversity, and technological leadership, here are the top 9 solderless connectors manufacturers shaping the future of electrical interconnectivity.

Top 9 Solderless Connectors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Solderless Terminals Manufacturer

Domain Est. 1995

Website: hollingsworth.com

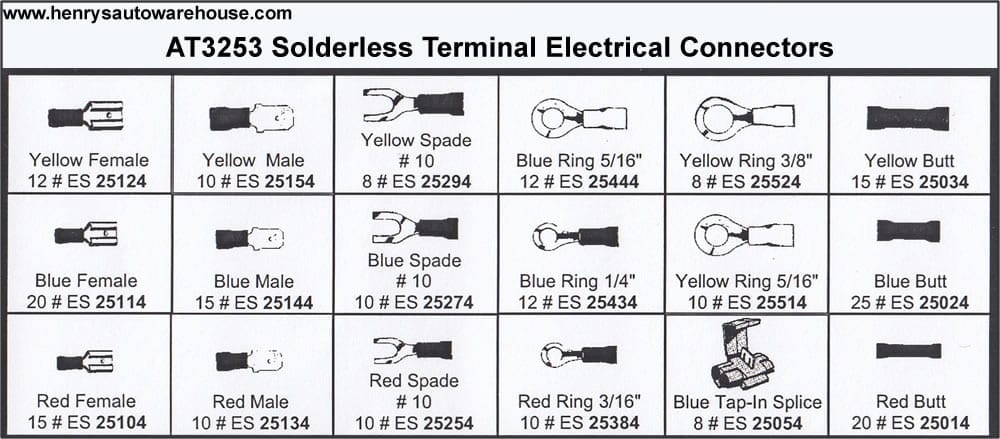

Key Highlights: Hollingsworth manufacturing solderless terminals, wire harnesses, cable assemblies, and tools to produce correct-crimp applications….

#2 J.S.T. Mfg. Co., Ltd.

Domain Est. 1997

Website: jst-mfg.com

Key Highlights: Solderless Terminals … Wire harness assembly can be conveniently performed on-site by simply inserting stripped solid wire into the connector housing….

#3 Nichifu America

Domain Est. 1997

Website: nichifu.com

Key Highlights: Nichifu is an ISO9001 certified global manufacturer for a variety of innovative electronic fastening components. We import a wide selection of solderless ……

#4 SpliceLine® In

Domain Est. 2012

Website: idealind.com

Key Highlights: 30-day returnsIDEAL SpliceLine utilizes patented push-in technology, in a unique design, to provide a crimp-free, solderless butt splice quickly and easily….

#5 Sta

Domain Est. 1990

Website: electrification.us.abb.com

Key Highlights: ABB developed the first tool-applied solderless terminals and connectors more than 70 years ago. Key benefits. Sta-Kon wire terminals feature high ……

#6 Connectors

Domain Est. 1994

Website: molex.com

Key Highlights: Solderless Terminals. A wide variety of reliable, high-quality solderless solutions that include terminals, splices, quick disconnects and wire management ……

#7 Full Product List – Connectors & Solutions

Domain Est. 1995

Website: ittcannon.com

Key Highlights: A versatile range of full plastic direct, in-line and bulkhead circular connectors that are resistant to engine, transmission, and brake fluids….

#8 JST Sales America: Cutting

Domain Est. 1998

Website: jst.com

Key Highlights: Discover how our product line of over 100000 electrical connectors provides our customers with the tools they need for endless innovation….

#9 Solderless Electrical Terminals Archives

Domain Est. 2024

Website: kingterminals.com

Key Highlights: The solderless electrical terminal and connector is a device used to connect two or more electrical conductors without the use of solder. Due to this fact, ……

Expert Sourcing Insights for Solderless Connectors

2026 Market Trends for Solderless Connectors

The global solderless connectors market is poised for significant growth and transformation by 2026, driven by technological advancements, evolving industry demands, and a heightened focus on efficiency and sustainability. Here are the key trends shaping the market:

Rising Demand in Consumer Electronics and IoT

The proliferation of smart devices, wearables, and the Internet of Things (IoT) ecosystem continues to be a major catalyst. Solderless connectors offer rapid assembly, easy repairability, and design flexibility—critical attributes for high-volume, fast-paced consumer electronics manufacturing. By 2026, demand will surge for miniaturized, high-reliability solderless solutions in smartphones, tablets, smart home devices, and edge computing hardware.

Expansion in Electric Vehicles (EVs) and Automotive Electronics

The automotive sector, particularly electric and hybrid vehicles, represents one of the fastest-growing end-use markets. Solderless connectors are increasingly adopted for battery management systems (BMS), charging infrastructure, and in-vehicle infotainment due to their vibration resistance, thermal stability, and ability to handle high currents. As EV production scales globally, solderless technologies like crimp, spring-cage, and plug-in connectors will see accelerated adoption for modular and serviceable electrical architectures.

Emphasis on Sustainability and Circular Economy

Environmental regulations and corporate sustainability goals are pushing manufacturers toward greener production methods. Solderless connections eliminate the need for lead-based soldering, reducing hazardous waste and energy consumption during assembly. This aligns with circular economy principles by simplifying disassembly for repair, upgrade, or recycling—making solderless connectors a preferred choice in eco-conscious design and manufacturing.

Advancements in Miniaturization and High-Density Designs

With electronics becoming smaller and more powerful, there is a growing need for compact, high-density interconnects. Innovations in micro-spring, press-fit, and board-to-board solderless technologies are enabling tighter pitches and greater signal integrity. By 2026, expect broader adoption of ultra-miniature solderless connectors in medical devices, aerospace systems, and advanced computing platforms.

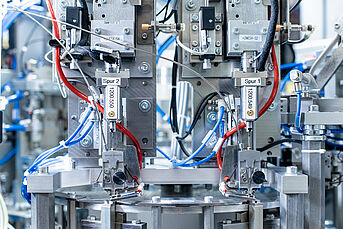

Growth in Industrial Automation and Smart Manufacturing

Industry 4.0 initiatives are increasing deployment of robotics, sensors, and programmable logic controllers (PLCs), all requiring reliable and quickly deployable connections. Solderless connectors reduce downtime during maintenance and support modular machine designs. Their plug-and-play nature makes them ideal for rapidly reconfigurable production lines, fueling demand across industrial automation sectors.

Shift Toward Standardization and Interoperability

As the ecosystem of connected devices expands, there is a growing push for standardized solderless interfaces to ensure compatibility across brands and systems. By 2026, industry alliances and regulatory bodies are expected to promote common form factors and communication protocols, particularly in sectors like EV charging (e.g., ISO 15118) and industrial IoT.

Supply Chain Resilience and Localization

Post-pandemic and geopolitical factors have prompted electronics manufacturers to diversify and localize supply chains. Solderless connectors, often easier to source and assemble domestically due to simpler manufacturing processes, support this trend. Regional production hubs in North America, Europe, and Southeast Asia are anticipated to expand, reducing dependency on traditional electronics assembly regions.

Integration with Smart Diagnostics and Monitoring

Next-generation solderless connectors are being embedded with sensors and diagnostic capabilities to monitor connection integrity, temperature, and current flow in real time. This smart connectivity trend, especially relevant in critical applications like data centers and medical equipment, will gain traction by 2026, enabling predictive maintenance and improved system reliability.

In summary, the 2026 solderless connectors market will be shaped by technological innovation, sustainability imperatives, and growing demand across high-growth industries. Manufacturers who focus on reliability, miniaturization, and smart functionality will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Solderless Connectors (Quality and IP)

Sourcing solderless connectors offers speed and convenience, but overlooking key factors can lead to significant quality issues, reliability failures, or intellectual property (IP) risks. Being aware of these common pitfalls helps ensure a successful and secure procurement process.

Poor Quality Due to Substandard Materials and Manufacturing

Many low-cost suppliers use inferior materials—such as low-grade copper alloys, plastic housings with poor thermal stability, or tin-plated contacts instead of gold—to cut corners. These materials degrade quickly under stress, leading to increased contact resistance, overheating, or mechanical failure. Inconsistent manufacturing processes can also result in dimensional inaccuracies, weak crimps, or poor spring tension in contact mechanisms, all compromising long-term reliability.

Lack of Compliance with Industry Standards

Reputable solderless connectors comply with standards like UL, IEC, RoHS, and REACH. Sourcing from suppliers who do not provide certification or test data risks using non-compliant parts that may fail safety evaluations or cause field failures. Always verify that connectors meet applicable environmental, flammability, and electrical performance standards for your application.

Inadequate Environmental and Mechanical Ratings

Solderless connectors must endure specific operational conditions, including temperature extremes, vibration, moisture, and dust. A common pitfall is selecting connectors based on nominal specs without confirming their Ingress Protection (IP) rating (e.g., IP67, IP68) or mechanical durability. Using a connector rated for indoor use in an outdoor or industrial setting can lead to premature failure due to corrosion or ingress of contaminants.

Counterfeit or Reverse-Engineered Components

The market includes counterfeit or cloned connectors that mimic well-known brands but lack performance and safety certifications. These copies often infringe on original designs and patents, exposing buyers to IP litigation and product liability. Always source from authorized distributors or directly from the manufacturer to avoid legal and performance risks.

Insufficient IP Protection and Design Infringement

When developing proprietary connector solutions or custom variants, failure to secure patents, design rights, or non-disclosure agreements (NDAs) with suppliers can result in IP theft. Suppliers may replicate your design for other customers or sell it openly. Ensure contracts include strong IP clauses and that your designs are protected before sharing technical details.

Inconsistent Performance and Interoperability

Solderless connectors from different manufacturers—even with similar specs—may not intermate reliably or maintain signal integrity, especially in high-speed or high-current applications. Poorly documented performance data or vague specifications can mislead buyers. Always request test reports, mating cycle data, and compatibility details before finalizing a supplier.

Hidden Costs from Field Failures and Rework

While low upfront pricing may seem attractive, poor-quality connectors often lead to higher lifetime costs due to field failures, product recalls, or the need for rework. Investing in higher-quality, certified components from reputable suppliers usually results in lower total cost of ownership and protects brand reputation.

By addressing these pitfalls proactively—through rigorous supplier vetting, specification validation, and IP protection—organizations can ensure they source solderless connectors that are reliable, compliant, and free from legal or performance risks.

Logistics & Compliance Guide for Solderless Connectors

Overview

Solderless connectors are electrical components designed to join wires or circuits without requiring soldering, commonly used in automotive, industrial, and consumer electronics applications. Ensuring proper logistics handling and regulatory compliance is critical for product safety, performance, and market access. This guide outlines key considerations for the transportation, storage, and compliance of solderless connectors.

Regulatory Compliance Requirements

Solderless connectors must meet various international and regional standards to ensure safety, performance, and environmental sustainability. Key compliance areas include:

– RoHS (Restriction of Hazardous Substances): Compliance with EU Directive 2011/65/EU is mandatory for connectors sold in the European Union. This restricts the use of lead, mercury, cadmium, and other hazardous materials.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Ensure that all substances in the connector materials are registered and meet exposure thresholds under EC 1907/2006.

– UL Certification: In North America, connectors should be certified by Underwriters Laboratories (e.g., UL 486A-B) for wire connectors to verify performance under electrical and thermal loads.

– CE Marking: Required for entry into the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

– IEC Standards: International Electrotechnical Commission standards such as IEC 61210 (for electrical connectors) may apply depending on the application.

– Conflict Minerals Compliance (Dodd-Frank Act Section 1502): Suppliers must disclose the use of tin, tantalum, tungsten, and gold (3TG) sourced from conflict-affected regions.

Packaging & Labeling Standards

Proper packaging and labeling ensure product integrity and regulatory compliance throughout the supply chain:

– Use static-dissipative or anti-static packaging for connectors used in sensitive electronic environments.

– Include clear labeling with part number, manufacturer, RoHS/REACH compliance status, date of manufacture, and handling instructions (e.g., “Protect from Moisture”).

– Apply GHS-compliant labels if hazardous substances are present above threshold limits.

– Ensure multilingual labeling for international shipments, especially for EU, China, and South Korea markets.

Storage & Handling Guidelines

To maintain product quality and performance:

– Store in a dry, temperature-controlled environment (15°C to 30°C recommended; max humidity 60% RH).

– Avoid direct sunlight and exposure to corrosive chemicals or solvents.

– Use original sealed packaging until ready for deployment.

– Implement FIFO (First-In, First-Out) inventory practices to prevent aging of components.

– Handle with ESD-safe tools and grounded workstations when unpacking.

Transportation & Shipping Considerations

- Classify solderless connectors appropriately under the Harmonized System (HS Code), typically under 8536.90 (other electrical connectors).

- Declare accurate weight, dimensions, and material composition for customs clearance.

- Use cushioned, shock-resistant packaging for air and ground freight to prevent mechanical damage.

- For air transport, ensure compliance with IATA regulations; no special hazardous classification is typically required unless connectors contain restricted substances above limits.

- Maintain documentation such as commercial invoices, packing lists, certificates of compliance (RoHS, REACH, UL), and material declarations.

Import/Export Documentation

Ensure the following documents are prepared for cross-border shipments:

– Certificate of Conformity (CoC) for target market standards

– Material Declaration (e.g., IMDS for automotive applications)

– Country of Origin declaration

– SDS (Safety Data Sheet) if applicable

– Export Control Classification Number (ECCN), if subject to dual-use regulations

Audit & Traceability

- Maintain batch-level traceability through serialization or barcoding.

- Keep compliance documentation for a minimum of 10 years, as required by RoHS and REACH.

- Conduct regular supplier audits to verify ongoing compliance with environmental and quality standards.

Conclusion

Adhering to logistics best practices and regulatory requirements ensures that solderless connectors are safely delivered and legally compliant across global markets. Proactive management of compliance documentation, proper storage, and accurate labeling minimizes delays, reduces risk, and supports product reliability.

Conclusion for Sourcing Solderless Connectors

Sourcing solderless connectors offers a practical, efficient, and cost-effective solution for electrical and electronic applications requiring quick assembly, reliable connections, and ease of maintenance. These connectors eliminate the need for specialized soldering equipment and skilled labor, reducing production time and minimizing the risk of heat damage to sensitive components. When selecting a supplier, it is essential to prioritize quality, compatibility, and consistency to ensure long-term performance and safety.

Key considerations in the sourcing process include material durability (e.g., copper alloys, gold or nickel plating), insulation type, current and voltage ratings, environmental resistance, and compliance with industry standards such as UL, RoHS, or IEC. Additionally, establishing relationships with reputable suppliers who offer technical support, volume pricing, and reliable lead times can significantly enhance supply chain efficiency.

In conclusion, solderless connectors are a valuable choice for modern electrical systems, and strategic sourcing—focused on quality, specifications, and supplier reliability—ensures operational efficiency, product reliability, and overall cost savings across prototyping, manufacturing, and field service applications.