The global solar power supply market is experiencing robust expansion, driven by rising energy demands, declining photovoltaic costs, and supportive government policies aimed at reducing carbon emissions. According to a report by Mordor Intelligence, the solar photovoltaic market was valued at USD 153.76 billion in 2023 and is projected to reach USD 307.53 billion by 2029, growing at a CAGR of over 12.3% during the forecast period. Similarly, Grand View Research estimates that the global solar power market size was valued at USD 187.4 billion in 2022 and is expected to expand at a CAGR of 13.5% from 2023 to 2030. With solar energy accounting for an increasing share of new electricity generation capacity worldwide, the demand for reliable and efficient solar power supply manufacturers has never been greater. In this evolving landscape, a select group of manufacturers have emerged as leaders through innovation, scale, and performance—shaping the future of renewable energy infrastructure across residential, commercial, and utility-scale applications.

Top 10 Solar Power Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SMA America

Domain Est. 2000

Website: sma-america.com

Key Highlights: Discover the global specialist for inverters, photovoltaic & solar technology from the private solar system to the megawatt PV power plant….

#2 Solar panel manufacturer, trusted since 1996

Domain Est. 2004

Website: recgroup.com

Key Highlights: REC Group is a solar panel manufacturer, trusted for almost three decades. Since its founding in 1996, REC has been a true pioneer in the solar industry….

#3 Ameresco Solar

Domain Est. 2007

Website: amerescosolar.com

Key Highlights: We are also a manufacturer and solar components distributor that supplies a network of retailers, installers, and large customers….

#4 SEG Solar

Domain Est. 2012

Website: segsolar.com

Key Highlights: We are a Leading US Solar Module Manufacturer with A Fully Integrated Supply Chain. About us. 1GW+. Global Cumulative Module Shipments. 1GW. Global PV Module ……

#5 Solar & Battery Solutions

Domain Est. 1995

Website: generac.com

Key Highlights: Use energy on your own terms. Generac Solar & Battery Solutions provide a more powerful, resilient and smart way to manage your energy needs….

#6 First Solar

Domain Est. 1999

#7 Solar Manufacturing

Domain Est. 1999

Website: energy.gov

Key Highlights: Solar manufacturing refers to the fabrication and assembly of materials across the solar value chain….

#8 Solar for , Utility, and Commercial

Domain Est. 2004

Website: trinasolar.com

Key Highlights: Trina Solar is a world leader in solar energy innovation and reliability. Power your energy future with industry-leading solar panels and solutions….

#9 SolarEdge

Domain Est. 2005

Website: solaredge.com

Key Highlights: Transform your businesses and residences into an eco-friendly energy hub using the SolarEdge inverter solution and the SolarEdge energy manager platform….

#10 Sungrow US

Domain Est. 2007

Website: us.sungrowpower.com

Key Highlights: Sungrow, a global leader in renewable energy solutions in the USA, provides innovative solar power systems for diverse programs in North America….

Expert Sourcing Insights for Solar Power Supply

H2: 2026 Market Trends for Solar Power Supply

As the global energy landscape undergoes rapid transformation, the solar power supply sector is poised for significant evolution by 2026. Driven by technological innovation, policy shifts, supply chain dynamics, and increasing demand for clean energy, several key trends are expected to define the market in the coming years.

1. Accelerated Global Deployment and Grid Integration

By 2026, solar photovoltaic (PV) is projected to remain the fastest-growing electricity source worldwide. The International Energy Agency (IEA) and BloombergNEF anticipate annual solar installations will surpass 500 GW globally, fueled by strong policy support in key markets like China, the United States, India, and the European Union. A major trend will be the integration of large-scale solar into national grids, supported by digitalization, smart inverters, and hybrid systems combining solar with storage and wind. Grid modernization and expanded transmission infrastructure will be critical to managing solar’s intermittent nature.

2. Dominance of Utility-Scale and Commercial Solar

While rooftop solar continues to grow, utility-scale solar farms will dominate new capacity additions in 2026. Falling levelized costs of electricity (LCOE)—now often below $30/MWh in optimal regions—make utility solar competitive with fossil fuels even without subsidies. Corporations are also increasingly signing corporate power purchase agreements (PPAs), driving demand in the commercial and industrial (C&I) segment. This trend is particularly strong in emerging markets and regions with high electricity costs.

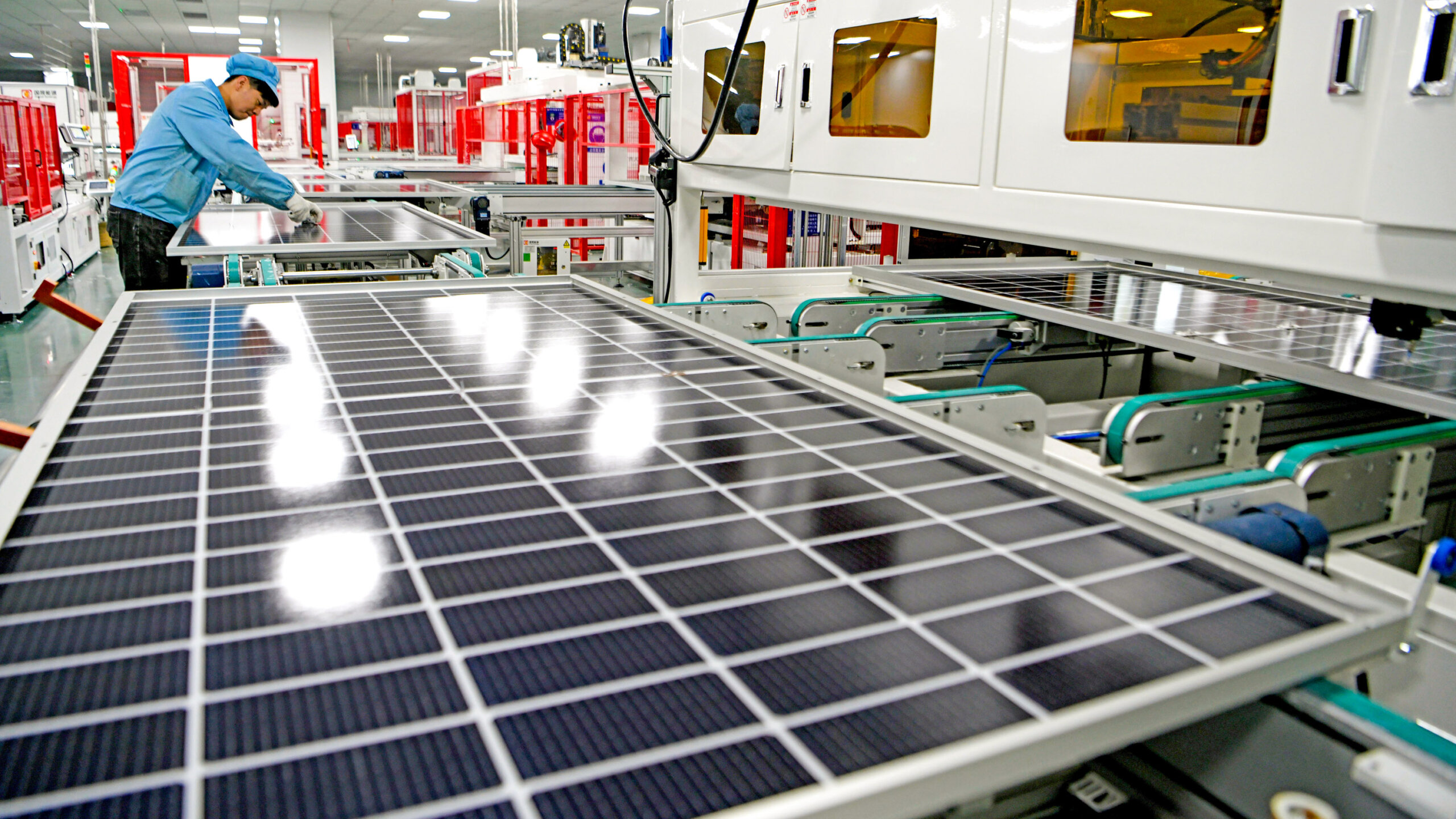

3. Advancements in Solar Technology and Efficiency

By 2026, high-efficiency solar cell technologies such as TOPCon (Tunnel Oxide Passivated Contact), HJT (Heterojunction), and perovskite-silicon tandem cells will gain substantial market share, gradually replacing traditional PERC modules. These technologies offer conversion efficiencies exceeding 25%, reducing land and balance-of-system costs. Manufacturing capacity for advanced cells, especially in China and Southeast Asia, will expand rapidly. Additionally, building-integrated photovoltaics (BIPV) and agrivoltaics (dual-use solar farming) will gain traction as niche but high-growth sectors.

4. Energy Storage Integration Becomes Standard

Solar-plus-storage systems will become the norm rather than the exception by 2026. Falling lithium-ion battery prices and improved cycle life are enabling solar projects to provide dispatchable power. In markets with time-of-use pricing or grid instability, hybrid systems enhance reliability and economic returns. Flow batteries and next-generation storage technologies may begin to see early commercial deployment, especially for long-duration storage needs.

5. Supply Chain Resilience and Regionalization

Geopolitical tensions and trade policies (e.g., U.S. Uyghur Forced Labor Prevention Act, EU’s Carbon Border Adjustment Mechanism) are pushing solar manufacturers and developers to diversify supply chains. By 2026, we expect increased solar module and component production in the U.S., India, Southeast Asia, and Europe to reduce reliance on single-source suppliers. Vertical integration and localization incentives—such as the U.S. Inflation Reduction Act (IRA)—will reshape global manufacturing footprints.

6. Focus on Sustainability and Circular Economy

Environmental, social, and governance (ESG) concerns are driving demand for sustainable solar solutions. By 2026, recycling of end-of-life solar panels will become more economically viable and regulated, with the EU leading in policy frameworks. Manufacturers will emphasize low-carbon manufacturing processes, ethical sourcing of raw materials (e.g., polysilicon, silver), and product transparency through digital product passports.

7. Emerging Markets as Growth Engines

Countries in Africa, Southeast Asia, and Latin America will see accelerated solar adoption, driven by energy access needs, falling technology costs, and international climate financing. Distributed solar solutions—such as mini-grids and solar home systems—will play a crucial role in rural electrification, supported by innovative financing models and mobile payment platforms.

Conclusion

By 2026, the solar power supply market will be characterized by technological sophistication, deeper integration with storage and grids, and a more diversified and resilient supply chain. With solar expected to account for a significant share of new electricity generation globally, the sector will continue to be a cornerstone of the clean energy transition—delivering cost-effective, scalable, and sustainable power solutions across developed and emerging economies alike.

Common Pitfalls Sourcing Solar Power Supply (Quality, IP)

Sourcing solar power supply systems, especially from international or cost-driven suppliers, carries significant risks related to product quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to performance failures, safety hazards, financial losses, and legal complications.

Quality-Related Pitfalls

Substandard Component Materials

Many low-cost suppliers use inferior materials to cut production costs. This includes low-grade solar cells with reduced efficiency and lifespan, thin or improperly tempered glass prone to cracking, and frames made from non-corrosion-resistant aluminum. These compromises result in diminished energy output, shorter operational life, and increased vulnerability to environmental stress.

Inaccurate Power Ratings and Performance Claims

A common issue is the misrepresentation of power output. Some suppliers inflate wattage ratings (e.g., labeling a 380W panel as 400W) or provide performance data under ideal lab conditions that don’t reflect real-world performance. This leads to underperforming systems that fail to meet energy generation expectations.

Poor Manufacturing and Assembly

Defects such as microcracks in solar cells, poor soldering, inadequate sealing, and inconsistent lamination are prevalent in poorly manufactured units. These flaws can cause premature failure, hotspots, and reduced efficiency. Lack of rigorous quality control processes during manufacturing increases the likelihood of receiving defective batches.

Lack of Certifications and Compliance

Reputable solar products should meet international standards such as IEC 61215 (performance), IEC 61730 (safety), and UL certifications. Sourcing from suppliers without valid, verifiable certifications increases the risk of non-compliant products that may fail inspections, void warranties, or pose safety hazards like fire or electric shock.

Insufficient or Inadequate Warranty Coverage

Some suppliers offer attractive warranties on paper but lack the financial stability or service infrastructure to honor them. Others may offer only limited product warranties without performance guarantees, leaving buyers exposed when output degrades faster than expected.

Intellectual Property (IP) Pitfalls

Counterfeit or Cloned Products

It’s increasingly common to encounter solar panels or inverters that mimic the appearance and branding of established manufacturers. These counterfeit products not only violate IP rights but often use inferior technology, posing reliability and safety risks. Buyers may unknowingly support IP theft and face legal exposure if used in commercial projects.

Unauthorized Use of Patented Technology

Many solar components incorporate patented designs or technologies (e.g., PERC cells, half-cut cell architecture, specific inverter topologies). Sourcing from suppliers who use these without licensing exposes the buyer to potential infringement claims, especially in regulated markets like the EU or North America.

Lack of Transparency in Supply Chain

Opaque supply chains make it difficult to trace the origin of components and verify IP compliance. Suppliers may subcontract production to unauthorized or unlicensed manufacturers, increasing the risk of IP violations and making it hard to enforce contractual terms.

Weak Contractual IP Protections

Purchase agreements that fail to include clear IP indemnification clauses leave buyers liable for third-party infringement claims. Without warranties stating that the products do not infringe on existing patents or trademarks, the buyer assumes all legal risk.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence: verify supplier credentials, demand test reports and certification documents, perform factory audits, and use independent third-party inspections. Legally, ensure contracts include IP warranties, indemnification clauses, and clear performance guarantees. Partnering with reputable suppliers and leveraging legal counsel familiar with renewable energy IP law can significantly reduce exposure.

Logistics & Compliance Guide for Solar Power Supply

Overview

This guide outlines key logistics and compliance considerations for the transportation, installation, and operation of solar power supply systems. Adhering to these guidelines ensures safety, regulatory compliance, and efficient project execution across supply chain stages.

Regulatory Compliance

Ensure all solar components meet local, national, and international regulations. Key requirements include:

– Electrical Safety Standards: Compliance with IEC 61215 (crystalline silicon modules), IEC 61730 (safety qualification), and local codes (e.g., NEC in the U.S.).

– Environmental Regulations: Adherence to RoHS (Restriction of Hazardous Substances) and REACH (chemical safety) in the EU.

– Certifications: Obtain necessary certifications such as UL (Underwriters Laboratories), CE marking, or INMETRO (for Brazil) based on destination market.

– Grid Interconnection Rules: Follow utility-specific requirements and national grid codes for system integration.

Import & Export Documentation

Accurate documentation is essential for international shipments:

– Commercial Invoice: Detailed description of goods, value, and terms of sale (e.g., FOB, CIF).

– Packing List: Itemized list of contents, weights, dimensions, and packaging types.

– Bill of Lading/Air Waybill: Contract of carriage and proof of shipment.

– Certificate of Origin: Required for tariff determination and trade agreements.

– Customs Declarations: Submit HS codes (e.g., 8541.40 for solar panels) to determine duties and taxes.

– Permits and Licenses: Some countries require import licenses for electrical equipment.

Packaging & Handling

Proper packaging prevents damage during transit:

– Use robust, moisture-resistant packaging with corner protectors and palletization.

– Clearly label packages with orientation arrows, fragile indicators, and handling instructions.

– Protect modules from pressure, puncture, and exposure to extreme temperatures.

– Follow manufacturer-recommended stacking limits and storage conditions.

Transportation Modes & Considerations

Select appropriate transport based on volume, distance, and urgency:

– Maritime Shipping: Cost-effective for large-scale projects; ensure containers are watertight and secured against shifting.

– Air Freight: Suitable for urgent or lightweight components; verify weight and size restrictions.

– Overland Transport: Use cushioned trucks with secure load restraints to prevent vibration and impact.

– Route Planning: Avoid regions with extreme weather or poor infrastructure that may delay delivery.

Storage & Site Management

On-site logistics must prioritize safety and efficiency:

– Store solar panels horizontally in a dry, shaded area with adequate ventilation.

– Keep components away from dust, moisture, and corrosive materials.

– Implement inventory tracking to prevent loss or damage.

– Secure equipment with fencing or surveillance to deter theft.

Installation Compliance

Ensure installation meets code requirements:

– Hire certified solar installers trained in local regulations.

– Perform structural assessments to verify roof or ground-mount integrity.

– Follow grounding, wiring, and labeling standards per NEC Article 690 (U.S.) or IEC 60364 (international).

– Submit as-built drawings and commissioning reports to authorities.

Environmental & Safety Protocols

Minimize environmental impact and ensure worker safety:

– Recycle packaging materials and dispose of damaged components responsibly.

– Provide PPE (gloves, harnesses, eye protection) for installation crews.

– Conduct risk assessments for working at heights, electrical hazards, and extreme weather.

– Plan for end-of-life recycling through certified e-waste handlers.

Recordkeeping & Audits

Maintain comprehensive documentation for compliance verification:

– Retain shipping records, customs filings, and inspection reports for at least 5–7 years.

– Document system performance, maintenance, and repairs.

– Prepare for audits by regulatory bodies or certification agencies.

Conclusion

Effective logistics and strict compliance are critical to the successful deployment of solar power supply systems. Proactive planning, adherence to standards, and clear communication across stakeholders ensure safe, legal, and sustainable operations.

In conclusion, sourcing solar power presents a sustainable, economically viable, and environmentally responsible solution for meeting current and future energy needs. As solar technology advances and costs continue to decline, the accessibility and efficiency of solar energy systems have significantly improved, making them an attractive option for individuals, businesses, and governments alike. By investing in solar power, stakeholders can reduce dependence on fossil fuels, lower greenhouse gas emissions, achieve long-term energy cost savings, and contribute to energy independence. Additionally, supportive policies, incentives, and growing public awareness further strengthen the case for solar adoption. With proper planning, site assessment, and reliable suppliers, transitioning to solar power is not only a smart financial decision but also a crucial step toward a cleaner, more resilient energy future.