The global SMD (Surface Mount Device) capacitors market is experiencing steady expansion, driven by rising demand in consumer electronics, automotive, and telecommunications sectors. According to a 2023 report by Mordor Intelligence, the global capacitor market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, with SMD capacitors accounting for a significant share due to their compact size and high efficiency in modern PCB designs. This growth is further fueled by the proliferation of miniaturized electronic devices and the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs), where reliable passive components are critical. Grand View Research also highlights that the Asia Pacific region dominates both production and consumption, supported by a dense electronics manufacturing ecosystem. As demand surges, a select group of manufacturers have emerged as industry leaders, consistently innovating in materials, capacitance density, and thermal stability to meet evolving technical requirements. Here are the top 9 SMD capacitor manufacturers shaping the future of electronic components.

Top 9 Smd Capacitors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Capacitor

Domain Est. 1994

Website: murata.com

Key Highlights: Murata offers ceramic, polymer aluminum, single-layer microchip, variable, silicon, film, and various other types of capacitors. See selection guide….

#2 Nippon Chemi

Website: chemi-con.co.jp

Key Highlights: Nippon Chemi-Con is the world’s largest manufacturer of aluminum electrolytic capacitors. Parent company of United Chemi-Con and Europe Chemi-Con….

#3 SMD Components: Capacitors, Resistors, Inductors, LEDs

Domain Est. 1995

Website: venkel.com

Key Highlights: Venkel Surface Mount Passive Components: Capacitors, Resistors, LEDs, Inductors, Thermistors, Choke Coils, Ferrite Beads. Free engineering kits to ……

#4 SMD Capacitors

Domain Est. 1996

Website: product.tdk.com

Key Highlights: The SMD Hybrid Polymer Aluminum Electrolytic Capacitors presented in this product group are designed to be mounted by a relow soldering process….

#5 Lelon Electronics Corp.

Domain Est. 1997

Website: lelon.com.tw

Key Highlights: Conductive Polymer Hybrid Capacitors · SMD Aluminum Electrolytic · Leaded Miniature Aluminum Electrolytic · Flame Retardant · More Products Product Search News ……

#6 Nichicon

Domain Est. 1997

Website: nichicon.com

Key Highlights: Nichicon is a global leader in advanced capacitor technologies. We offer a capacitor for every design need—from high temperature and high ripple current to ……

#7 yageo

Domain Est. 2004

Website: yageogroup.com

Key Highlights: YAGEO Group is dedicated to sustainability through robust governance, social responsibility, environmental stewardship, and ethical supply chain practices….

#8 SMD MLCCs

Domain Est. 2013

Website: knowlescapacitors.com

Key Highlights: Surface Mount MLCCs (Multilayer Ceramic Capacitors) from Knowles Precision Devices are designed for some of the world’s most demanding applications….

#9 Rubycon Corporation

Website: rubycon.co.jp

Key Highlights: Rubycon Corporation is a Japanese electronics company, whose main products are electrolytic capacitors, film capacitors and power supply units with a wide ……

Expert Sourcing Insights for Smd Capacitors

H2 2026 Market Trends for SMD Capacitors

The Surface Mount Device (SMD) capacitor market is poised for significant evolution in the second half of 2026 (H2 2026), shaped by technological advancements, shifting end-market demands, supply chain dynamics, and sustainability imperatives. Key trends expected to define this period include:

1. Accelerated Demand from Advanced Electronics and AI Infrastructure:

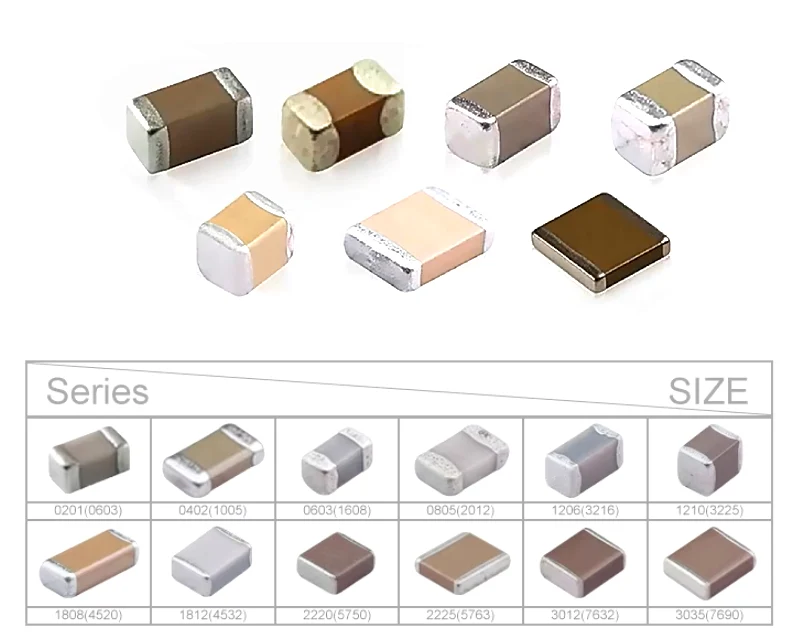

H2 2026 will see sustained and growing demand for high-performance SMD capacitors driven by the proliferation of next-generation technologies. The deployment of AI servers, data centers, and high-performance computing (HPC) infrastructure will require capacitors with exceptional stability, low Equivalent Series Resistance (ESR), and high ripple current handling. Multilayer Ceramic Capacitors (MLCCs) in miniaturized, high-capacitance packages (e.g., 01005, 0201) and specialized Tantalum and Polymer capacitors will be in high demand for power delivery networks (PDNs) in AI chips and GPUs. Similarly, the rollout of advanced 5G/6G infrastructure and IoT devices will fuel demand for reliable, small-footprint capacitors.

2. Continued Focus on Miniaturization and High-Density Packaging:

The relentless push for smaller, lighter, and more powerful electronic devices will intensify in H2 2026. This will drive innovation in SMD capacitor manufacturing, with a strong emphasis on developing capacitors in ultra-miniaturized case sizes (e.g., 008004, 0201) without sacrificing capacitance or reliability. High-density packaging techniques and advancements in dielectric materials will be critical. MLCCs will dominate this trend, but miniaturized Tantalum and Aluminum Electrolytic SMD capacitors will also see development, particularly for applications needing higher capacitance values in compact spaces.

3. Supply Chain Resilience and Strategic Sourcing:

Following ongoing geopolitical tensions and past supply disruptions, H2 2026 will likely see manufacturers and OEMs prioritizing supply chain resilience. This includes dual-sourcing strategies, increased regionalization/nearshoring of capacitor production (particularly in Southeast Asia and potentially North America/Europe for strategic components), and longer-term supply agreements. Transparency in the supply chain and efforts to mitigate risks associated with raw material sourcing (e.g., tantalum, nickel, rare earths) will be paramount. Companies with robust, diversified supply chains will have a competitive advantage.

4. Material Innovation and Performance Enhancement:

Material science will be a key differentiator. Expect advancements in:

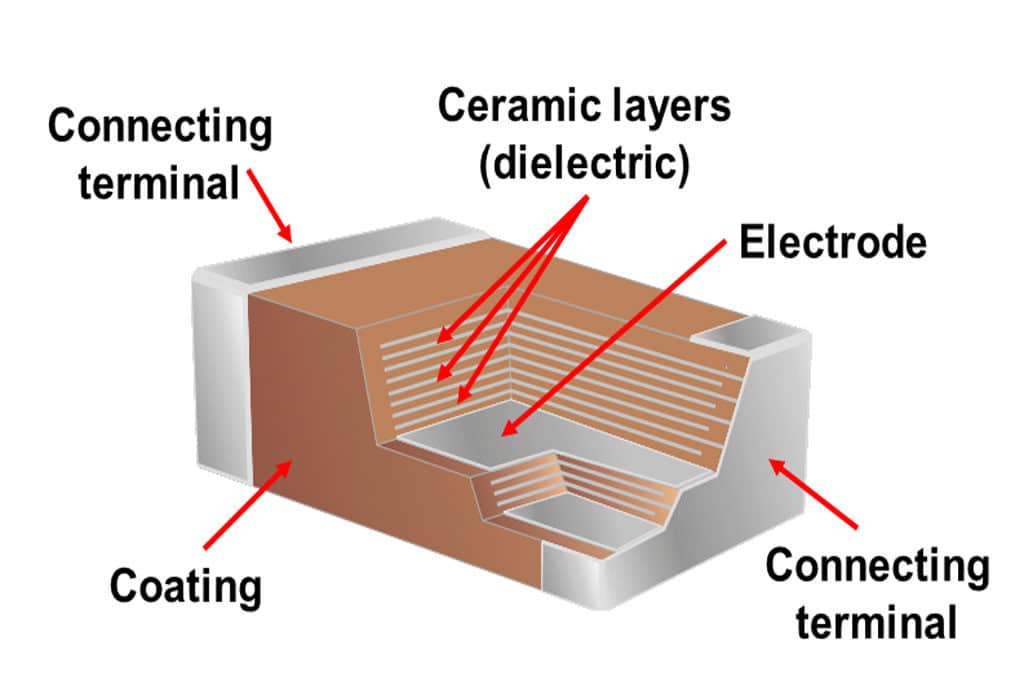

* MLCCs: Development of new dielectric formulations (e.g., relaxor ferroelectrics) to achieve higher capacitance in smaller sizes, improved temperature stability (X8R, X7S variants), and reduced DC bias effects.

* Polymer Capacitors: Wider adoption due to their superior ESR, reliability, and safety compared to traditional wet aluminum electrolytics. Innovations will focus on higher voltage ratings and further miniaturization.

* Sustainability: Increased R&D into lead-free termination finishes, reduced use of conflict minerals, and more energy-efficient manufacturing processes. Capacitors designed for longer lifespans and easier recyclability will gain traction.

5. Price Stabilization with Selective Volatility:

After the volatility of the preceding years, the SMD capacitor market is expected to see relative price stabilization in H2 2026 for standard commodity parts (e.g., common MLCC case sizes and capacitance values). However, prices for high-performance, specialized capacitors (e.g., ultra-miniaturized, high-voltage, high-reliability, automotive-grade) and those in short supply due to specific demand spikes (e.g., for AI hardware) may remain firm or experience targeted increases. Competition among major players (Murata, TDK, Samsung Electro-Mechanics, KEMET, Vishay) will keep pressure on standard component pricing.

6. Growth in Automotive and Industrial Segments:

The automotive electronics market, driven by electrification (EVs), advanced driver-assistance systems (ADAS), and in-vehicle infotainment, will be a major growth engine. H2 2026 will see high demand for AEC-Q200 qualified SMD capacitors, particularly high-reliability MLCCs and Tantalum/Polymer capacitors capable of withstanding harsh temperature and vibration environments. Similarly, industrial automation, robotics, and renewable energy systems (solar inverters, wind turbines) will require robust, long-life SMD capacitors, supporting steady market growth.

Conclusion:

H2 2026 will be a period of maturation and targeted growth for the SMD capacitor market. While the frenzy of previous shortages may ease, demand will be robust and highly specialized, driven by cutting-edge technologies like AI and 5G, alongside strong fundamentals in automotive and industrial sectors. Success will depend on manufacturers’ ability to innovate in materials and miniaturization, ensure supply chain security, meet stringent quality and reliability standards, and respond to increasing sustainability demands. The market will reward technological leadership and operational resilience.

Common Pitfalls Sourcing SMD Capacitors (Quality, IP)

Sourcing Surface Mount Device (SMD) capacitors may appear straightforward, but hidden risks related to quality and intellectual property (IP) can undermine product reliability and expose companies to legal and financial liabilities. Understanding these pitfalls is essential for procurement, engineering, and supply chain teams.

Substandard or Counterfeit Components

One of the most significant risks is receiving capacitors that fail to meet specifications or are outright counterfeits. These components may use inferior dielectric materials, incorrect capacitance values, or reduced voltage ratings, leading to premature failure in the field. Counterfeit parts are often remarked or salvaged from electronic waste and lack traceability, increasing the risk of batch inconsistencies and latent defects. This compromises product performance and can damage brand reputation.

Lack of Traceability and Data Sheet Integrity

Reputable manufacturers provide detailed, accurate datasheets and full traceability through lot numbers and certifications. However, when sourcing from unauthorized distributors or gray market suppliers, datasheets may be falsified or outdated, and traceability is often missing. Without proper documentation, verifying compliance with industry standards (e.g., AEC-Q200 for automotive) becomes impossible, raising concerns about long-term reliability and regulatory compliance.

Misrepresentation of IP and Branding

Sourcing from unreliable suppliers increases the risk of receiving capacitors that falsely claim to be from well-known brands (e.g., Murata, TDK, Samsung Electro-Mechanics). These mislabeled components infringe on intellectual property rights and may not meet the performance or reliability benchmarks associated with the authentic brand. Using such parts can expose the buyer to IP infringement claims and void warranties on end products.

Inconsistent Tolerance and Performance Under Environmental Stress

Low-quality SMD capacitors often exhibit wide parameter drift under temperature, humidity, or voltage stress. For instance, X7R or X5R dielectrics may show significant capacitance loss at elevated temperatures or bias voltages—beyond acceptable limits. Poor manufacturing controls result in inconsistent performance across batches, making design validation unreliable and increasing field failure rates.

Absence of Compliance and Certification

Genuine components are manufactured under strict quality management systems (e.g., ISO 9001, IATF 16949) and comply with environmental regulations such as RoHS and REACH. Counterfeit or substandard capacitors may lack proper certification or contain restricted substances. This not only poses environmental and health risks but can also result in shipment rejections, product recalls, or legal penalties.

Mitigation Strategies

To avoid these pitfalls, always source SMD capacitors through authorized distributors or directly from OEMs. Conduct supplier audits, require full traceability documentation, and perform incoming inspection with independent testing (e.g., X-ray, curve tracing, decapsulation). Building strong relationships with trusted suppliers and investing in supply chain visibility tools can significantly reduce the risk of quality and IP issues.

Logistics & Compliance Guide for SMD Capacitors

Overview

Surface Mount Device (SMD) capacitors are essential passive components in modern electronics, used across industries including consumer electronics, automotive, telecommunications, and medical devices. Efficient logistics and strict compliance with international regulations ensure reliable supply chains and product safety. This guide outlines key logistics considerations and compliance requirements for handling and transporting SMD capacitors.

Packaging & Handling

SMD capacitors are sensitive to electrostatic discharge (ESD), moisture, and mechanical stress. Proper packaging and handling are critical to maintain component integrity.

- ESD-Safe Packaging: Use static-shielding or conductive packaging (e.g., metallic static shielding bags, conductive foam) to prevent electrostatic damage.

- Moisture Sensitivity Level (MSL): Many SMD capacitors, especially multilayer ceramic capacitors (MLCCs), are moisture-sensitive. Follow IPC/JEDEC standards (e.g., J-STD-033) for moisture barrier packaging, including use of desiccant and moisture indicator cards.

- Tape and Reel Packaging: Most SMD capacitors are supplied on carrier tapes in reels. Ensure reels are properly sealed and labeled with lot numbers, date codes, and MSL ratings.

- Handling Environment: Store and handle in controlled environments with relative humidity between 30–60% and temperature between 15–25°C. Use ESD-safe workstations (wrist straps, grounded mats) during assembly.

Storage Conditions

Improper storage can degrade capacitor performance or lead to soldering defects.

- Temperature: Store in a dry, temperature-controlled warehouse (typically 10–30°C).

- Humidity: Maintain low humidity (≤60% RH) to prevent moisture absorption. For moisture-sensitive components, use dry cabinets or nitrogen storage.

- Shelf Life: Monitor manufacturer-defined shelf life (typically 12–24 months for sealed packages). Once opened, adhere to floor life limits based on MSL classification.

- First-In, First-Out (FIFO): Implement FIFO inventory management to prevent use of expired or out-of-spec components.

Transportation & Shipping

Shipping SMD capacitors requires protection from environmental and physical damage.

- Climate-Controlled Transport: Use temperature- and humidity-controlled containers or vehicles, especially for long-distance or international shipments.

- Shock and Vibration Protection: Secure packages to minimize movement. Use cushioning materials to protect against mechanical stress.

- Labeling: Clearly label packages with ESD warnings, MSL ratings, handling instructions, and hazardous material status (if applicable). Include barcodes for traceability.

- Export Packaging Standards: Comply with ISTA and ASTM standards for drop, vibration, and compression testing to ensure package integrity during transit.

Regulatory Compliance

SMD capacitors must meet various international standards and environmental regulations.

- RoHS (Restriction of Hazardous Substances): Ensure compliance with EU Directive 2011/65/EU, limiting lead, cadmium, mercury, and other hazardous substances. All components must be RoHS-compliant unless exempt.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Comply with EC 1907/2006. Declare SVHCs (Substances of Very High Concern) if present above threshold levels.

- Conflict Minerals (SEC Rule 13p-1): Disclose use of tin, tantalum, tungsten, and gold (3TG) sourced from conflict-affected regions, particularly the Democratic Republic of Congo.

- IPC Standards: Follow IPC-191 (generic performance standard), IPC-A-610 (acceptability of electronic assemblies), and IPC-J-STD-020 (MSL classification).

- JEDEC Standards: Adhere to JEDEC JESD47 (stress testing) and JESD51 (thermal testing) for reliability qualification.

- Country-Specific Requirements: Verify compliance with local regulations (e.g., China RoHS, Korea K-REACH, India E-Waste Management Rules).

Customs & Import/Export Documentation

Smooth international logistics require accurate documentation.

- Commercial Invoice: Include detailed descriptions, HS codes, values, and origin.

- Packing List: Specify quantities, weights, and packaging types.

- Certificates of Compliance: Provide RoHS, REACH, and conflict minerals declarations.

- Material Declarations: Submit IMDS (International Material Data System) or similar for automotive applications.

- HS Code Classification: Use appropriate Harmonized System codes (e.g., 8532.20 for fixed capacitors, ceramic dielectric, SMD type).

- Export Controls: Check if components are subject to EAR (Export Administration Regulations) or ITAR, especially for high-capacitance or military-grade variants.

Traceability & Documentation

Maintain full traceability for quality control and compliance audits.

- Lot Tracking: Record lot numbers, manufacturing dates, and supplier data.

- Date Codes: Ensure date codes are readable and match documentation.

- Quality Certificates: Retain supplier-provided certificates (e.g., COC, C of A).

- Audit Readiness: Maintain logs of storage conditions, handling procedures, and compliance records.

Conclusion

Effective logistics and compliance management for SMD capacitors reduce risks of component failure, supply chain disruptions, and regulatory penalties. By adhering to established packaging, handling, storage, transportation, and regulatory standards, companies can ensure component reliability and maintain market access across global regions. Regular training, supplier audits, and process reviews are recommended to uphold best practices.

Conclusion on Sourcing SMD Capacitors

Sourcing SMD (Surface Mount Device) capacitors requires a strategic approach that balances quality, cost, reliability, and supply chain continuity. With the increasing demand for compact and high-performance electronics, selecting the right capacitors—from reputable manufacturers such as Murata, TDK, Samsung Electro-Mechanics, and AVX—is critical to ensuring circuit stability, longevity, and compliance with industry standards.

Key considerations include capacitance value, voltage rating, temperature coefficient, package size, and tolerance, all of which must align with the specific application requirements. Partnering with authorized distributors or franchise suppliers helps avoid counterfeit components and ensures traceability and long-term availability. Additionally, evaluating lead times, minimum order quantities, and pricing structures supports efficient inventory management and project scalability.

In conclusion, a well-informed sourcing strategy—grounded in supplier reliability, technical specifications, and market trends—enables engineers and procurement teams to secure high-quality SMD capacitors that meet performance demands while minimizing risks in production and design.